General Motors Company

Latest General Motors Company News and Updates

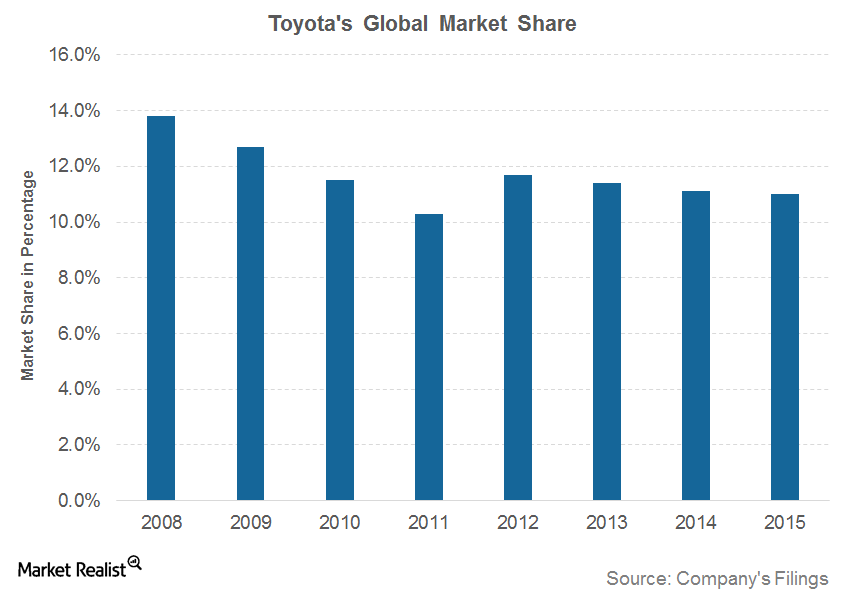

How Toyota Became the World’s Largest Automaker

Toyota established its US headquarters in 1982. It expanded into luxury cars in the 1980s, pickup trucks in the 1990s, and hybrids in the 2000s.

Overview: All You Need to Know about Toyota Motor Corporation

In 2015, Toyota ranked 11th on Forbes’s list of the world’s largest companies. This ranking was based on a composite score of the revenues, profits, assets, and market value of various companies.

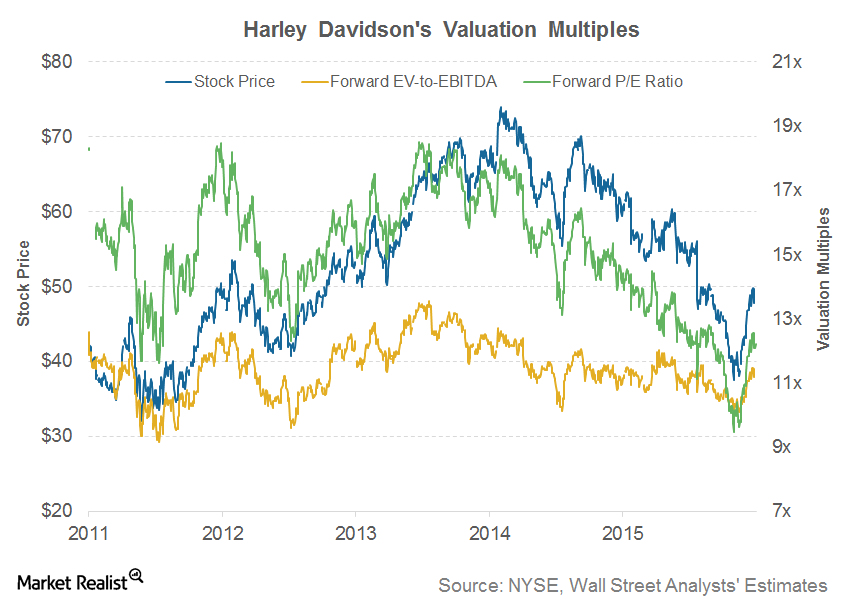

What Are Harley-Davidson’s Valuation Multiples?

As of March 29, 2016, Harley-Davidson’s forward EV/EBITDA multiple is 11x for the next 12 months.

What Is Harley-Davidson’s Marketing Strategy?

It’s important for investors to take a look at an automaker’s marketing strategy to understand how the company differentiates its strategy to market its offerings.

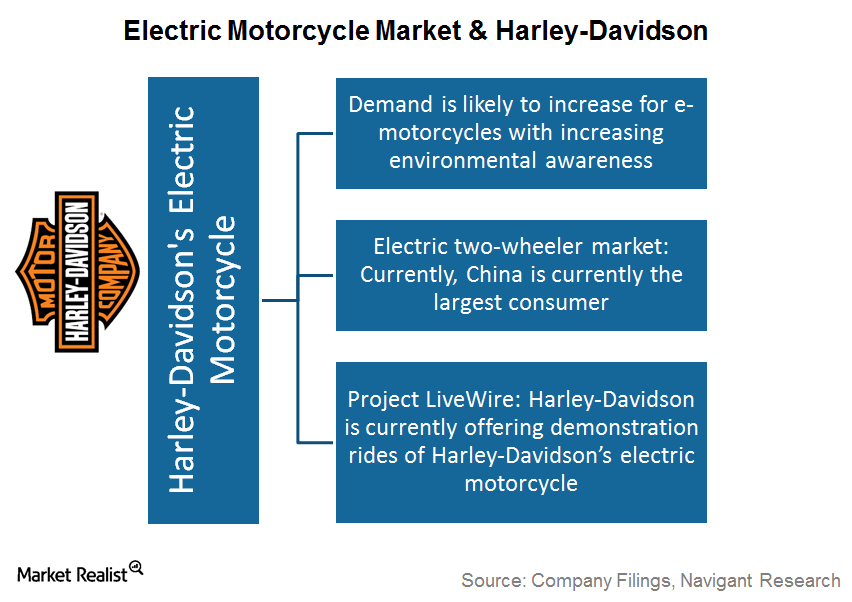

Could Harley-Davidson’s Electric Motorcycle Be a Reality Soon?

One such innovation that could soon become large in the two wheeler segment is electric motorcycles.

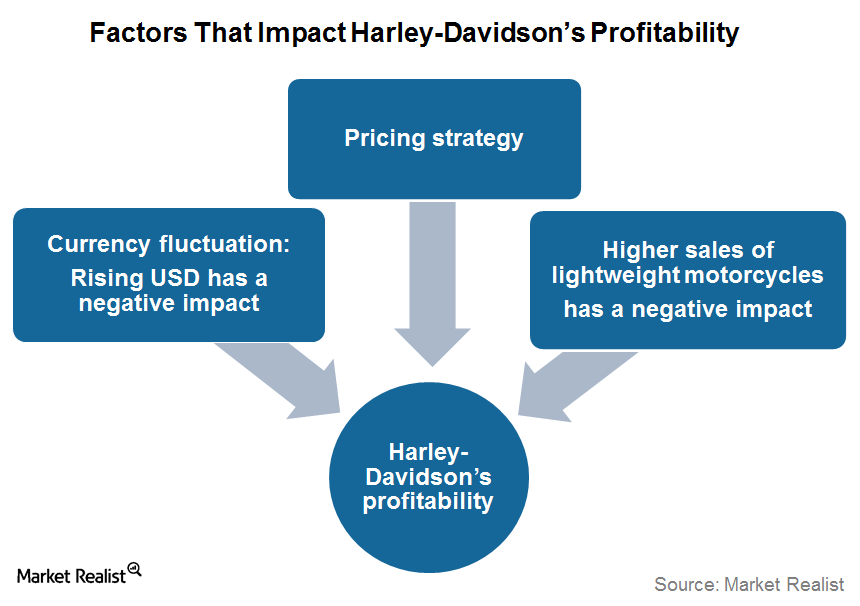

What Factors Could Affect Harley-Davidson’s Profitability?

Last year, currency headwinds stole nearly 4.4% of the company’s total revenues, which resulted in an unfavorable impact on Harley-Davidson’s profitability and margins.

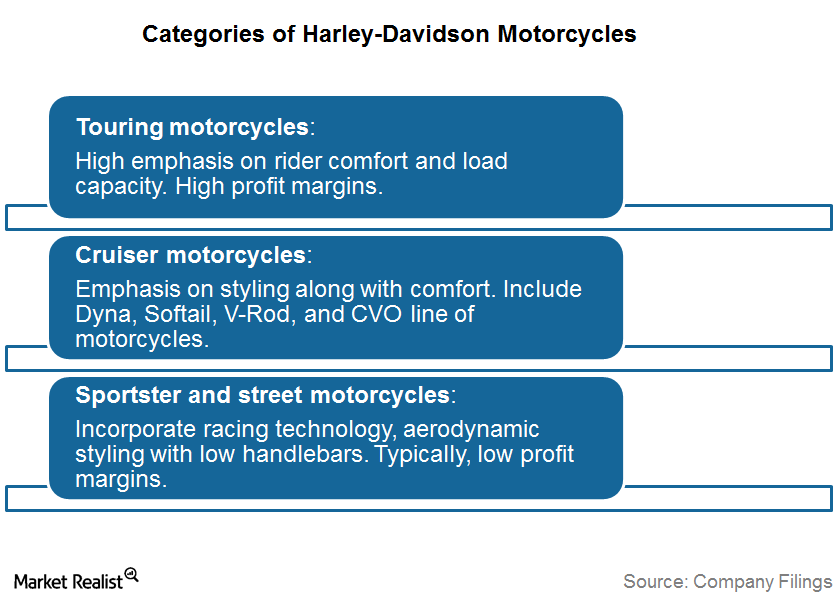

What Are the Broad Categories of Harley-Davidson Motorcycles?

Harley-Davidson (HOG) is a well-known global motorcycle brand that currently produces a variety of motorcycle models. These models range from lightweight motorcycles to large heavyweight motorcycles.

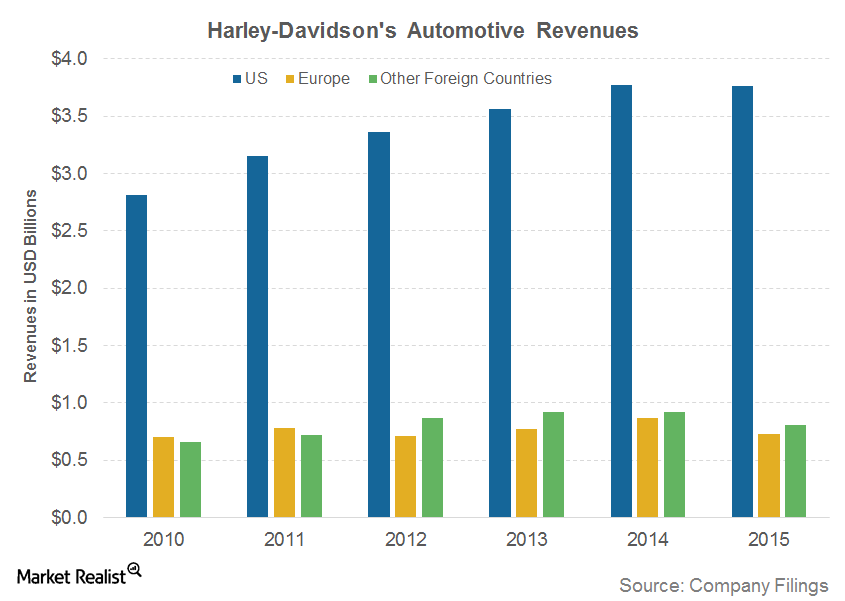

What Are the Key Geographical Markets for Harley-Davidson?

In 2015, the company shipped ~95,000 motorcycles outside the US. Australia, Mexico, and Canada are also some of the other key markets for Harley-Davidson motorcycles.

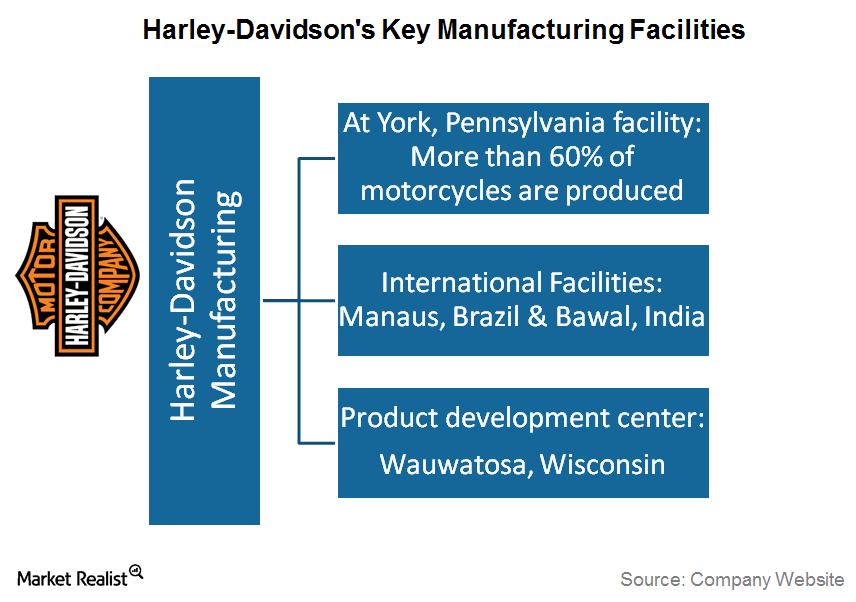

Where Are Harley-Davidson Motorcycles Manufactured?

Most of Harley-Davidson’s (HOG) manufacturing and assembly plants are located in the US.

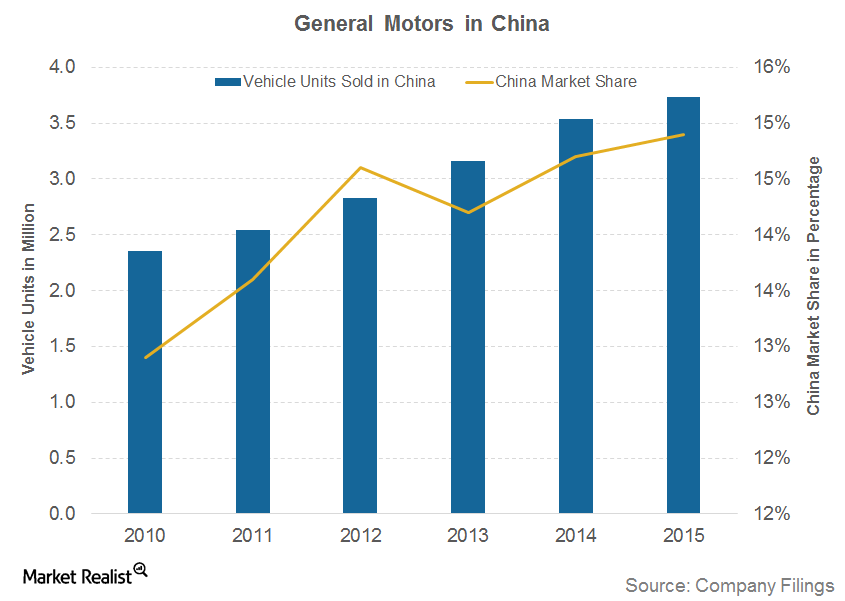

General Motors Continues to Rule the Chinese Auto Market

In 2015, GM remained at the top in the Chinese auto market, with the largest market share of 14.9%. This was higher than its share of 14.7% in 2014.

Key Brands Under General Motors’ Umbrella

Cadillac is the most popular luxury car brand in General Motors’ portfolio. It was established with the foundation of the Cadillac Automobile Company.

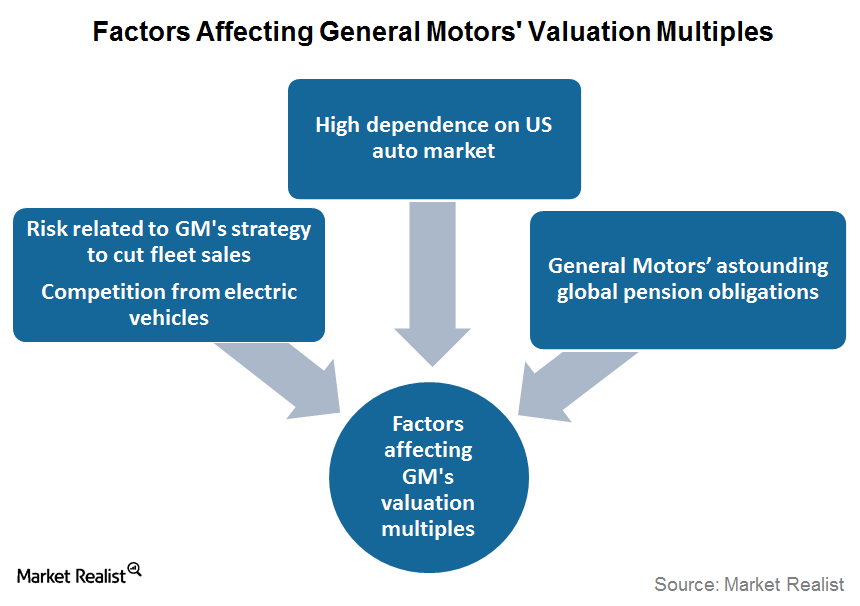

What Factors Could Affect General Motors’ Valuation Multiples?

The majority of General Motors’ revenues come from North America. The company’s high dependence on the US market alone can be seen as a big risk.

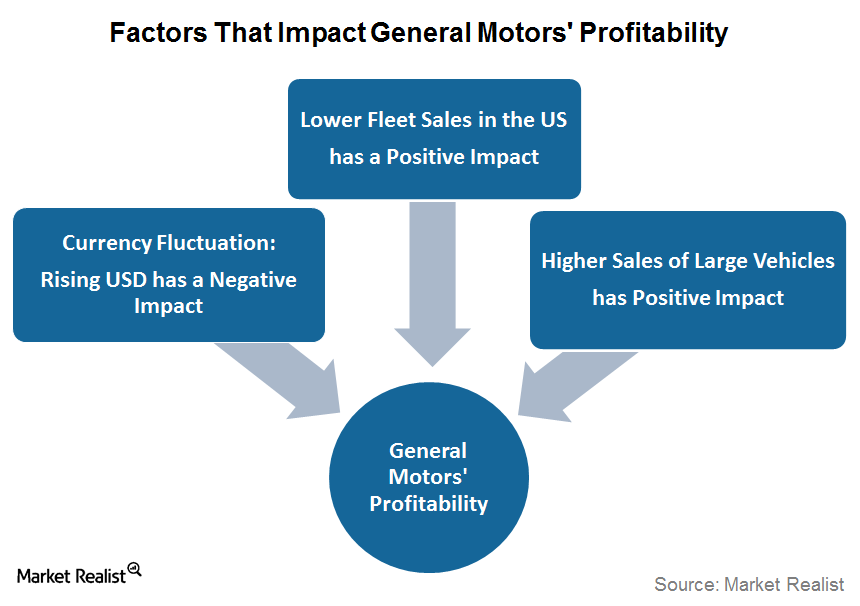

What Factors Are Affecting General Motors’ Profitability?

According to 2015 sales volume, General Motors is the largest US automaker and the third-largest automaker globally.

Why Is General Motors’ Global Market Share Falling?

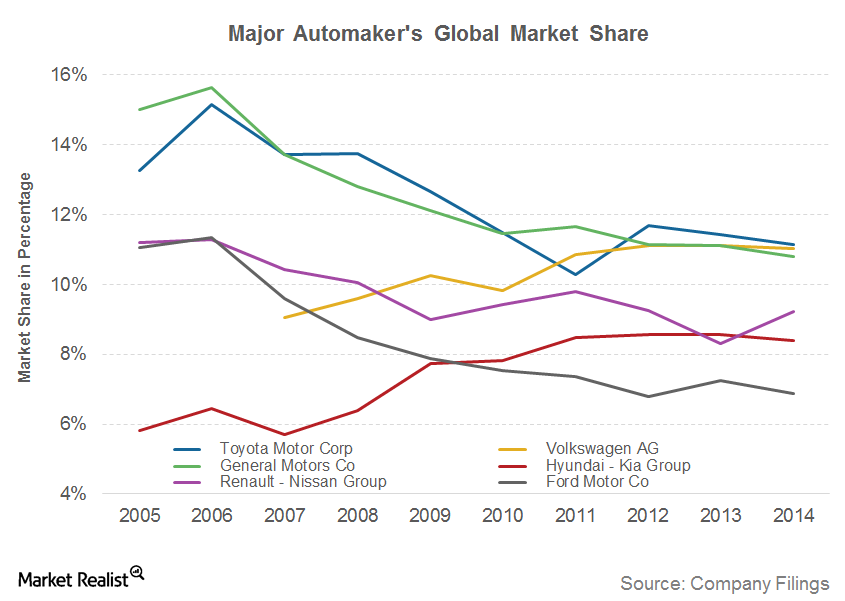

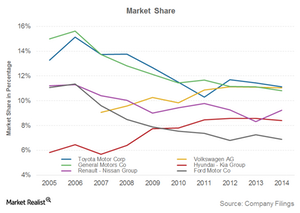

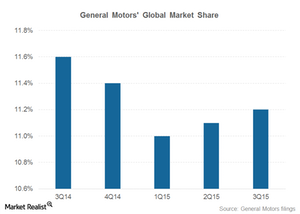

In recent years, General Motors’ global market share has been falling. In 2015, its global market share stood at 11.2% against 11.5% two years ago.

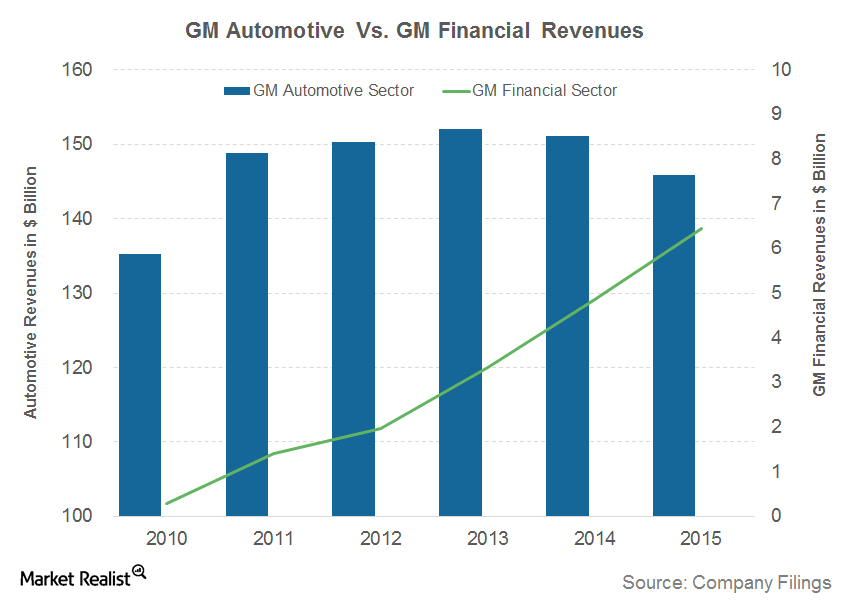

How GM Helps Customers Buy Vehicles through GM Financial

To encourage people to purchase its vehicles, General Motors provides automotive financing services through GM Financial Company.

Key Geographical Markets for General Motors

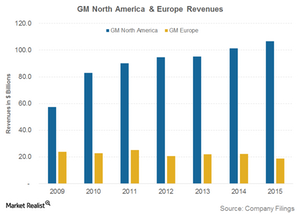

Since General Motors’ beginning, North America has been its most important market. North America alone accounted for ~70% of GM’s total revenues in 2015.

Consumerism Abroad to Drive Growth in Mexico

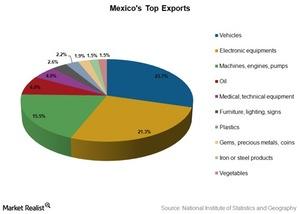

Mexico is known for its industrial base. In 2015, vehicles constituted about 23.7% of Mexican exports, followed by electronic equipment at 21.3% of exports.

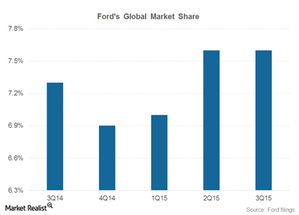

Why Has Ford’s Global Market Share Fallen in the Last Decade?

Ford’s market share fell from 11.1% in 2005 to ~7% in 2015, mostly due to competition outside North America and strength in the commercial vehicle segment.

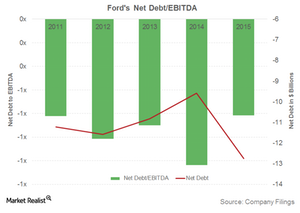

Analyzing Ford Motor Company’s Leverage Position

Ford uses a high amount of financial leverage. At the end of 2015, 70.4% of Ford’s capital structure was made up of debt, while 29.6% was made up of equity.

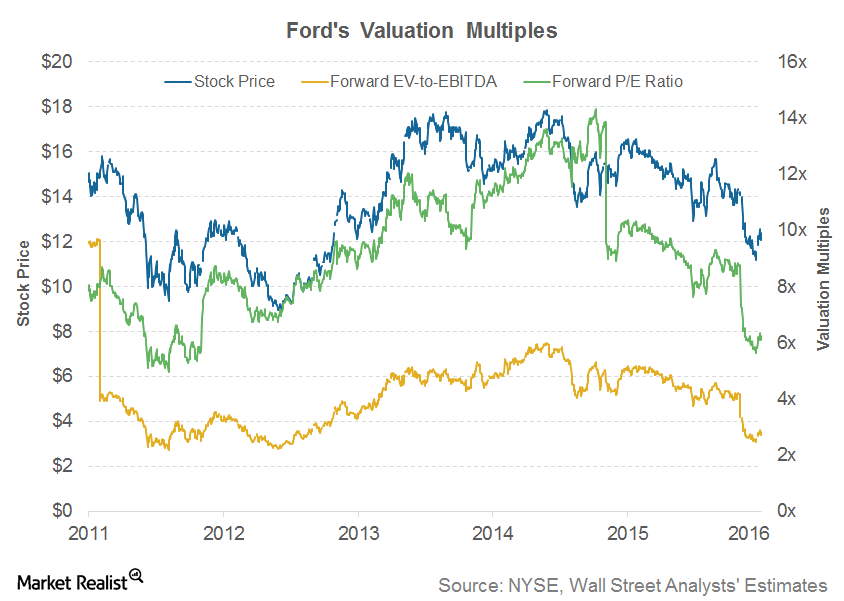

An Investor’s Guide to Ford’s Valuation

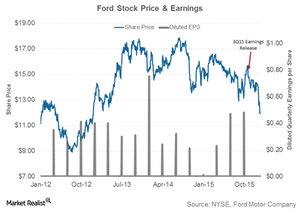

Ford’s valuation multiples are in a negative trend. This could be because of the concern that US auto sales may have already peaked last year.

How Chevrolet Was Vital for General Motors’ Success

In 1911, three years after founding General Motors, the founder William C. Durant and road racer Louis Chevrolet created the Chevrolet brand.

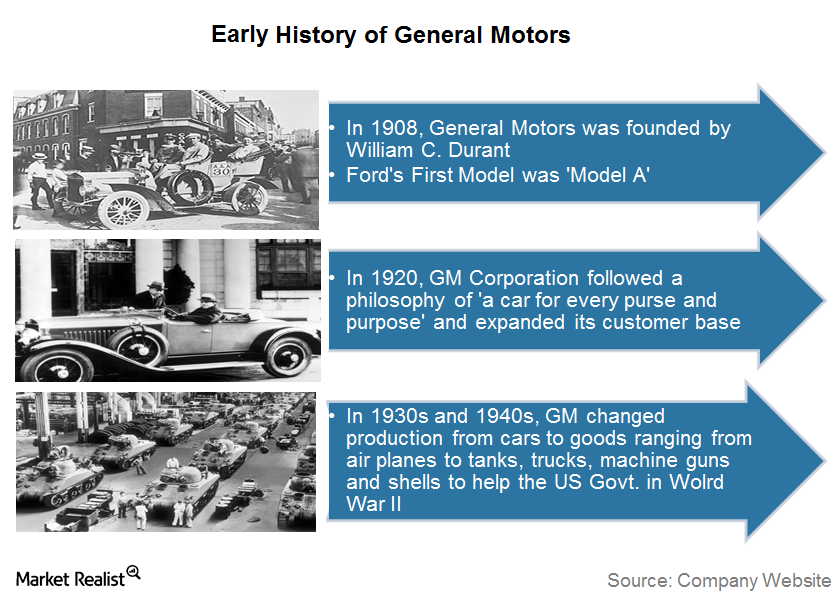

General Motors: The Beginning of the US Auto Giant

General Motors (GM) is the largest American automaker. The company was founded in the year 1908 by William C. Durant.

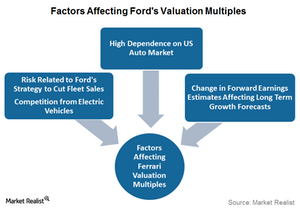

What Factors Could Affect Ford’s Valuation Multiples?

In Ford’s case, a number of risk factors may affect its future earnings estimates and could negatively affect its valuation multiples going forward.

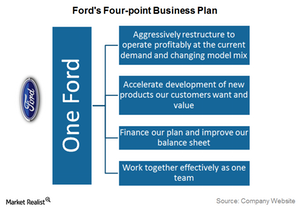

Why the One Ford Plan Is Still Critical for Ford

Global platform consolidation under the One Ford plan has helped Ford to reduce its vehicle development–related costs.

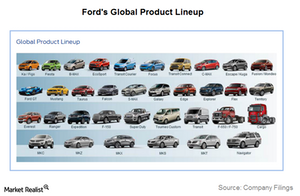

Ford’s Global Product Lineup: Product Portfolio Strengths

In 2014 and 2015, Ford Motor Company (F) launched 40 new or upgraded vehicle variants globally. This was done under the One Ford plan.

Ford Is Shifting Gears on Its Target Markets

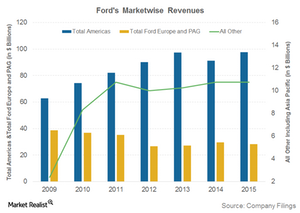

North America and Europe are two important geographic regions for Ford Motor Company. The US accounts for more than half of Ford’s total revenues.

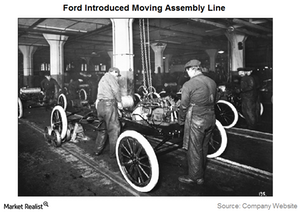

Assembly Line Innovation Helped Ford Outpace the Competition

Ford’s assembly line innovation allowed it to reduce the price of its Model T to $350 from $850 and to produce a vehicle within 90 minutes.

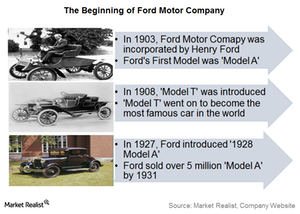

A Look at Ford Motor Company’s Humble Beginnings

Being born and raised in a farmer family, Henry Ford had the vision to produce a vehicle for the masses. This encouraged him to produce the Model T.

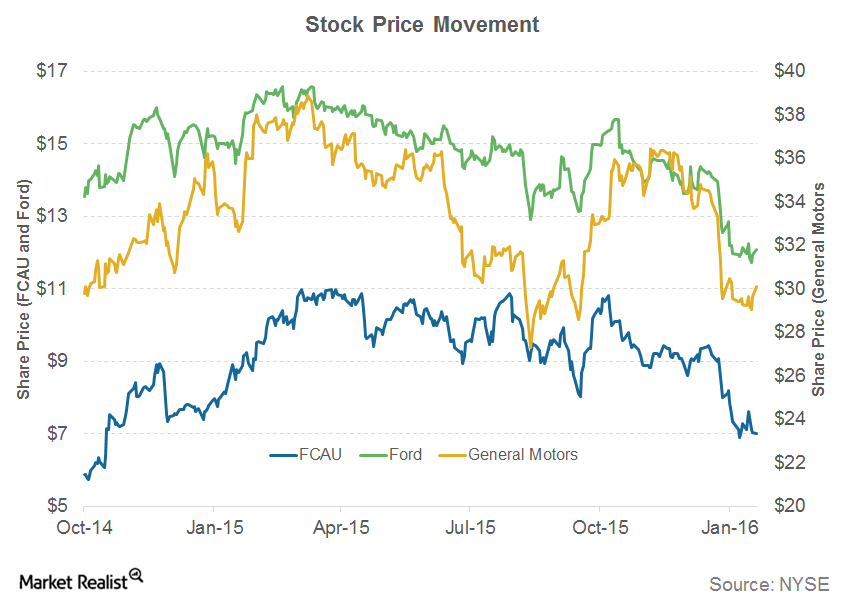

Must-Read Guide on Fiat Chrysler’s 4Q15 Earnings and Conference

Fiat Chrysler Automobiles (FCAU) released its 4Q15 earnings on January 27, 2016.

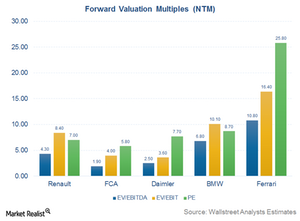

What Is Ferrari’s Current Valuation?

Ferrari is expected to witness high growth in earnings with relatively lower leverage than the industry average. This could be a reason why Ferrari has a high forward price-to-earnings multiple.

What Do Analysts Recommend for Ford ahead of 4Q15 Results?

Ford Motor Company (F) will release its 4Q15 earnings report on January 28, 2016. Nearly 43% of total analysts covering Ford have given it a “buy” recommendation.

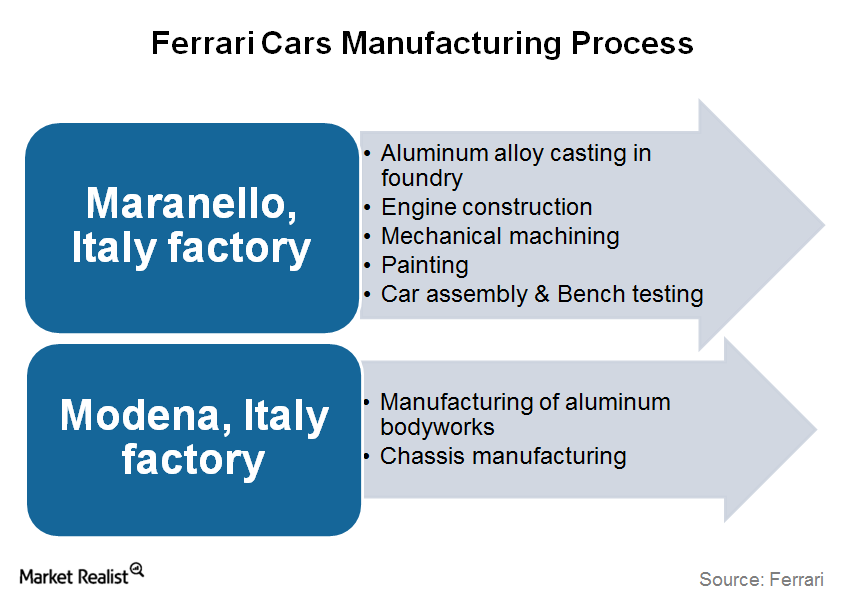

How Ferrari Manufactures Its Luxury Cars

Ferrari (RACE) owns two manufacturing units in Italy: one in Maranello and one in Modena.

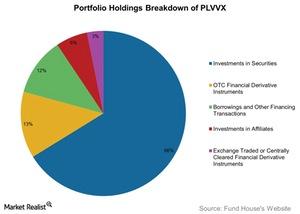

A Detailed Holdings Analysis of PLVVX

PLVVX holds fixed income securities in both long and short positions. The fund also holds derivative forward, future, and swap agreements on government securities, indexes, and currencies.

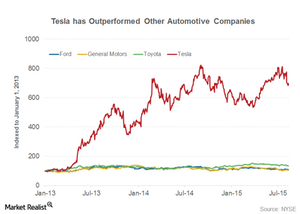

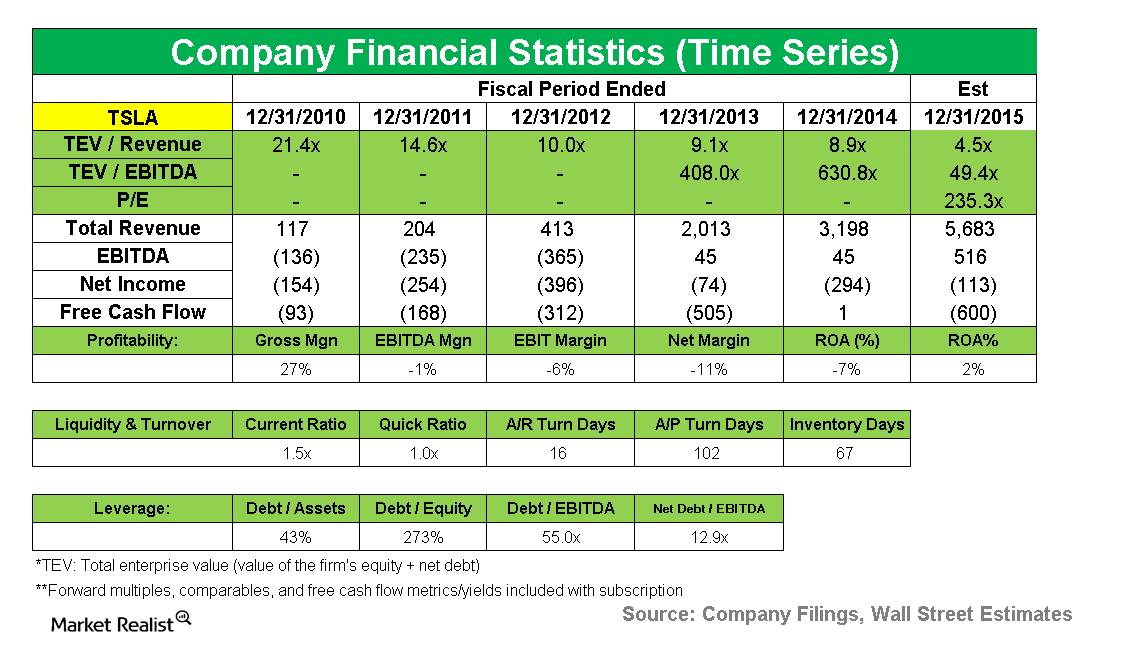

An Investor’s Guide to Tesla Motors

Tesla Motors (TSLA) was trading at $255 per share on August 20. The share price has been quite volatile over the last few trading sessions.

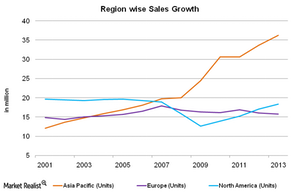

Why growth shifted in the global automotive industry

The automotive industry is geographically concentrated. The top 15 countries produce 88% of the world’s vehicles. Almost all of the G20 nations have a manufacturing unit.

What Was Ford’s Global Market Share in 3Q15?

Ford (F) commanded a global market share of 7.6% in 3Q15. In comparison, Ford had a market share of 7.3% in the corresponding quarter last year.

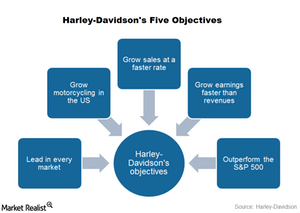

Harley-Davidson’s 5 Objectives: Investor Takeaways

In its 3Q15 earnings conference call, Harley-Davidson outlined five objectives for the company, including growing sales and outperforming the S&P 500 Index.

General Motors Loses Market Share and the Markets Don’t Care

General Motors’s global market share in 3Q15 was 11.2% as compared to 11.4% in the corresponding quarter last year.

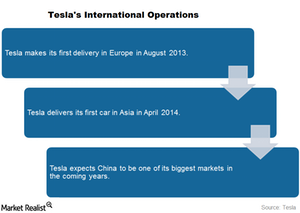

International Expansion Is Crucial for Tesla Motors

Expansion into international markets is crucial for Tesla. It will have to follow the footsteps of other US automakers to expand in overseas markets.

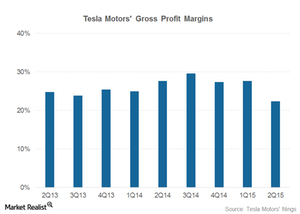

Tesla Motors Expects to Generate Profits in 2020

In 2Q15, Tesla’s gross profit margin was 22.3%—much higher than other that of established automakers. Tesla expects to post net profits on GAAP in 2020.

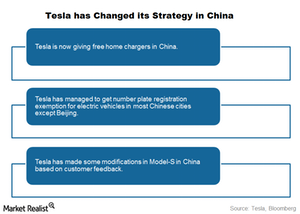

What Is Tesla Doing to Put Things Right in China?

In response to customer feedback, Tesla has made slight modifications to its Model-S in China, including an “executive rear seat” option.

Understanding Tesla Motors’ Marketing Strategy

As part of its marketing strategy, Tesla places its Superchargers in convenient, visible places such as restaurants, hotels, and shopping malls.

Is Tesla Pursuing the Correct Sales and Distribution Strategy?

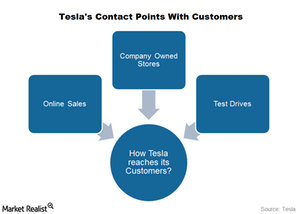

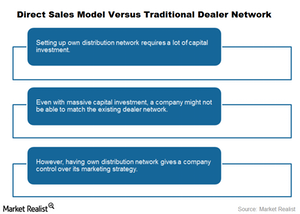

Tesla (TSLA) uses the online sales model coupled with company-owned stores to sell its cars. Selling more vehicles online reduces the company’s selling costs.

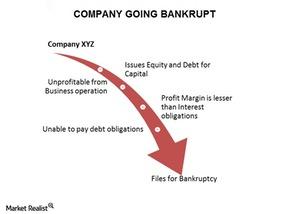

What Is Bankruptcy Investing?

Informed investors can profit from businesses that have filed for bankruptcy. A chapter 11 bankruptcy gives a company a second chance to revive its business.

What Value Proposition Does Tesla Offer Its Customers?

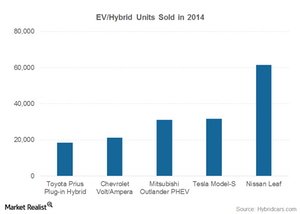

Tesla’s value proposition is centered on the electric vehicle market. However, the share of EVs in total vehicle sales is minuscule at best.

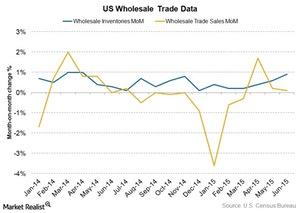

Indicators Suggest US Inventory Build-Up, SPY Falls 0.94%

August 11 saw the release of a number of key indicator around the world. Wholesale inventory data was the most eagerly awaited in the United States.

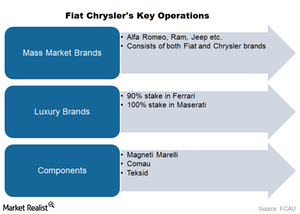

Understanding Fiat Chrysler’s Key Operations

Fiat Chrysler’s key operations include mass-market car brands such as Alfa Romeo, Chrysler, Dodge, Jeep, and Ram. Its luxury brands are Ferrari and Maserati.

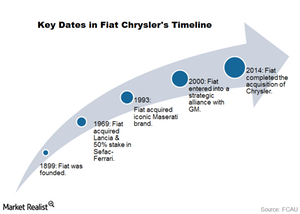

An Investor’s Guide to Fiat Chrysler’s Timeline

In this part, we’ll explore some key dates on Fiat Chrysler’s timeline. Fiat Chrysler (FCAU) debuted on the NYSE on October 14, 2014, after Fiat Motors acquired Chrysler.

Highfields Capital Initiates a Stake in Tesla Motors

Tesla Motors is involved in the design, development, manufacturing, and sales of electric vehicles and advanced powertrain components for electric vehicles.

A summary of Caxton Associates’ key 4Q14 holdings

Caxton Associates’ portfolio fell from $3.04 billion in 3Q14 to $1.29 billion in 4Q14.