Puja Tayal

Having joined Market Realist in 2015, Puja has been covering the intricacies of the semiconductor industry. She has 13 years of experience as a financial analyst with a particular focus on the manufacturing sector. Having graduated in commerce (accounting) and completed CFA Level 1, Puja is known for her insightful and well-researched articles. Puja is a tech enthusiast and has an interest in understanding the endless possibilities of technology as the world moves towards AI, 5G, and autonomous cars. In the early days of her career, she worked with a business intelligence firm as a quality analyst and trainer. This experience built on her analytical skills. Puja has also pursued a crash course in business analytics.

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Puja Tayal

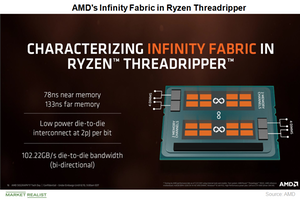

AMD’s Infinity Fabric Technology inside Ryzen Threadripper Two

Advanced Micro Devices (AMD) is using Infinity Fabric to leverage its Zen cores across low, mid, and high-end PC and server CPUs (central processing units).

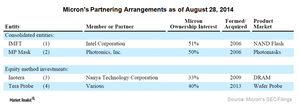

An Instructive Rundown of Micron’s Business Strategies

Two business strategies that Micron can use to beat competition include innovating processes that reduce costs and developing next-generation products.

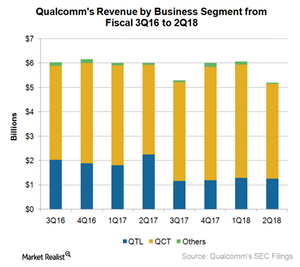

Understanding Qualcomm’s Revenue Seasonality

Qualcomm earns 60.0%–70.0% of its revenues from QCT and 30.0%–40.0% of its revenues from QTL.

How Successful Has Qualcomm’s $30 Billion Buyback Been?

Qualcomm (QCOM) is a leader in the mobile market, with its chips powering 95% of the world’s smartphones.

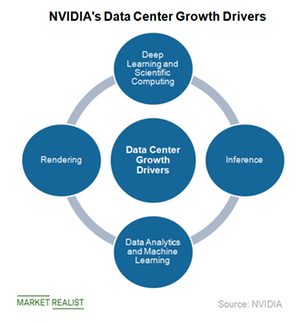

Data Center: A $50 Billion Market for NVIDIA

Revenues from NVIDIA’s Data Center segment have grown from just $340.0 million in fiscal 2016 to $1.9 billion in fiscal 2018.

NVIDIA, AMD, and Intel Expect Strong Growth

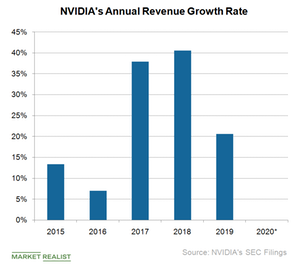

NVIDIA expects its revenues to fall 31% YoY to $2.2 billion in the first quarter of fiscal 2020. The revenues are expected to miss analysts’ estimate.

Can Operating Leverage Keep AMD Profitable despite Weak Revenue?

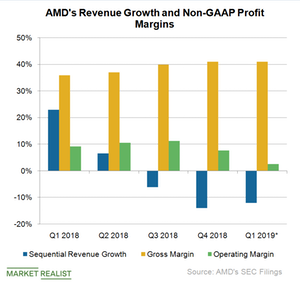

In the fourth quarter of 2018, AMD’s operating expense rose 9.5% sequentially.

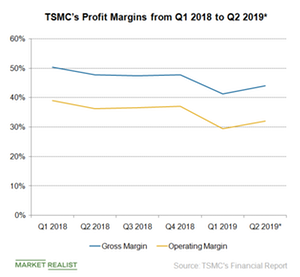

TSMC’s First-Quarter Profit Margins Fall to Seven-Year Low

TSMC (TSM) is a third-party chip manufacturer and incurs a lot of fixed cost that goes into maintaining its fabrications facilities, or fabs.

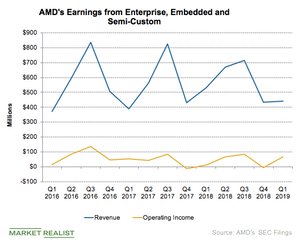

AMD’s Growth Strategy for Enterprise Business

Allied Market Research estimates global GPU revenues to grow at a compound annual rate (or CAGR) of 35.6% to $157.1 billion by 2022.

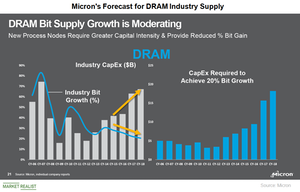

Micron Expects DRAM Supply to Exceed Demand in 2019

The DRAM market’s three major players—Samsung (SSNLF), SK Hynix, and Micron Technology (MU)—together command more than 95% of the market.

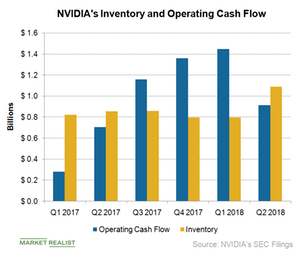

What Investors Should Know about NVIDIA’s Cash Flow and Inventory

NVIDIA’s accounts receivable fell by $795 million to $1.4 billion in fiscal 2019’s fourth quarter.

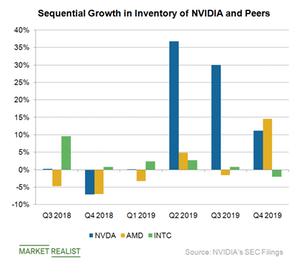

NVIDIA’s Curiously High Inventory Levels

After enjoying windfall gains from the crypto boom, NVIDIA (NVDA) has seen its profits normalize.

What Makes the GPU Market So Lucrative?

The GPU market is dominated by Intel, Nvidia, and Advanced Micro Devices, with 66.6%, 18.4%, and 14.9%, respectively, of the market share.

Why Did Tech Stocks Crash in Early October?

October started with a sharp drop in the stock markets as the Federal Reserve increased interest rates by 25 basis points to 2.25%.

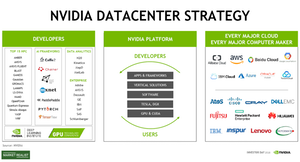

A Look at NVIDIA’s Strategy to Expand Its Data Center Business

NVIDIA supports open-source AI frameworks like Facebook’s Caffe and Google’s TensorFlow.

AMD’s Turnaround Story: From 2012 to 2019 and Beyond

The year 2017 was an important one for Advanced Micro Devices (AMD). Let’s take a look at why—and how far the company has come since then.

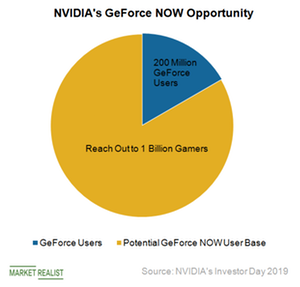

NVIDIA Reaches Low-End PC Users with GeForce NOW Services

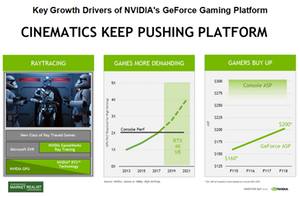

NVIDIA (NVDA) has been benefitting from the growing popularity of gaming.

Here Are AMD’s Future Growth Drivers

Advanced Micro Devices (AMD) is a small competitor in the CPU (central processing unit) and GPU (graphics processing units) space but a market leader in the game console market.

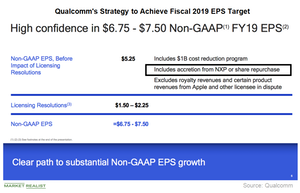

Qualcomm Set to Face Competition in the 5G Space

If Qualcomm (QCOM) loses its chance to acquire NXP Semiconductors, its strategy to grow beyond smartphones into embedded and automotive could take the back seat, and it may be pressured to settle its licensing disputes with Apple.

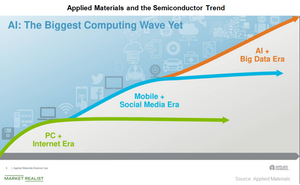

AMAT Feels the Impact of the Shift from Mobile Era to AI Era

The guidance from Apple (AAPL) and its foundry partner TSMC (TSM) show that smartphone demand should pick up in the second half of 2018.

Would Intel Consider Outsourcing Its CPU Manufacturing to TSMC?

In 2018, AMD decided to divide the production of its 7nm products between TSMC and GlobalFoundries.

What’s Unique about Micron’s Stock Buyback Program?

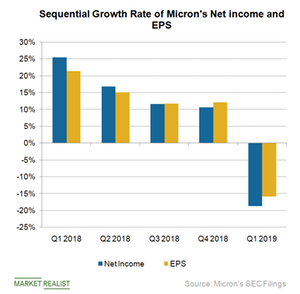

Micron, a pure-play memory chipmaker, has one of the semiconductor industry’s most cyclical stocks.

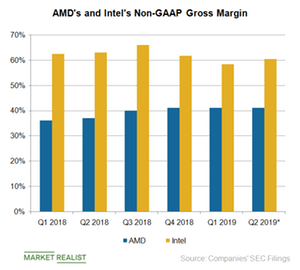

Highs and Lows in AMD’s and Intel’s Gross Margin

In the manufacturing sector, gross margin is an important fundamental, as it significantly impacts a company’s earnings per share.

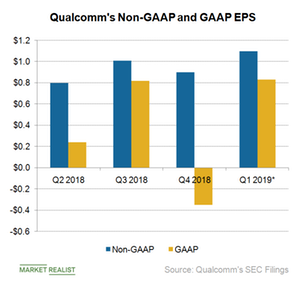

What Qualcomm Investors Should Watch For

Among semiconductor stocks, Qualcomm (QCOM) may have been hit the hardest by US-China trade tension.

NVIDIA Taps New Growth Drivers in the Data Center Market

NVIDIA’s (NVDA) Data Center segment reported its first sequential revenue decline in more than three years in the fourth quarter of fiscal 2019.

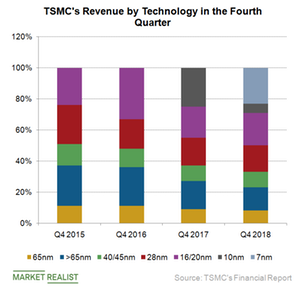

TSMC’s Process Node Strength Reflects in Its Q4 Revenue

A smaller node improves transistor density, thereby improving performance and power efficiency.

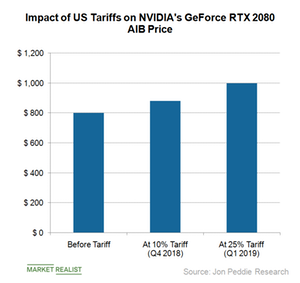

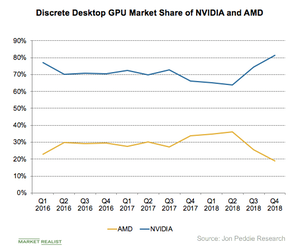

NVIDIA and AMD to See Higher GPU Prices Because of US Tariffs

According to Jon Peddie Research, NVIDIA’s new RTX 2080 AIB would cost gamers $800 in September, $880 in the fourth quarter, and $1,000 in the first quarter of 2019.

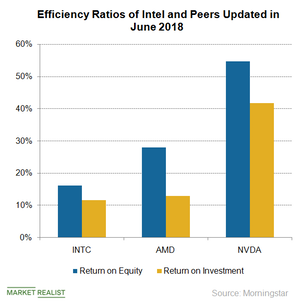

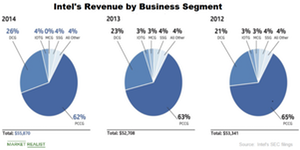

Intel’s Struggle in Emerging Markets Impacts Its Efficiency Ratio

In the first quarter, Intel had an ROE of 16.19%, which was lower than AMD’s 27.94% and NVIDIA’s 54.65%.

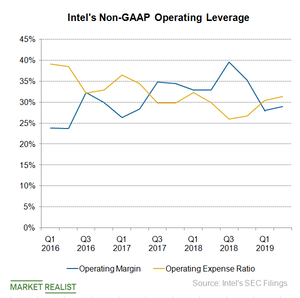

Why Intel’s Operating Leverage Reversed in the First Quarter

Intel’s (INTC) profit margins started to fall in the fourth quarter of 2018 after reaching a peak in the third quarter of 2018.

Can AMD’s Navi GPUs Compete with NVIDIA’s Turing-Based RTX GPUs?

There had been a lot of speculation about Advanced Micro Devices (AMD) unveiling its most awaited next-generation 7-nm (nanometer) Navi GPU (graphics processing unit) at Computex 2019.

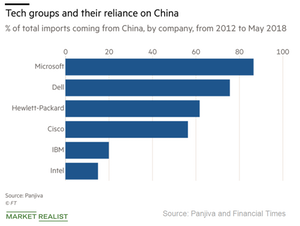

The Impact of a US–China Trade War on Intel

The trade war between the United States and China revolves around the supremacy of 5G technology, which is expected to form the basis for the data economy.

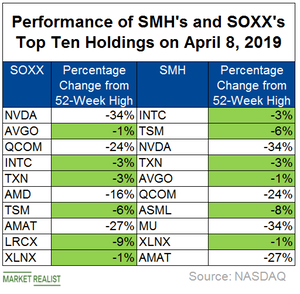

What Pushed SOXX and SMH to New Highs?

The semiconductor sector is set to report its weakest earnings in more than two years.

Why AMAT’s Weak Guidance Alarmed Semiconductor Investors

Applied Materials’ (AMAT) performance is an indicator of the overall semiconductor industry’s outlook.

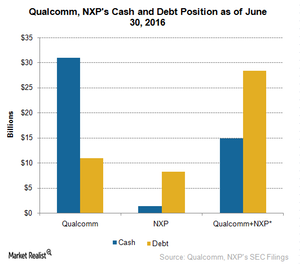

How Would Qualcomm Fund a Possible Acquisition of NXP?

If Qualcomm (QCOM) looks to buy NXP Semiconductors (NXPI), the deal could be valued at just above $30 billion or as high as $46 billion.

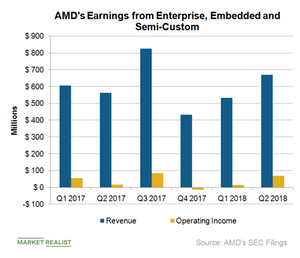

How AMD’s Enterprise, Embedded and Semi-Custom Business Has Fared

Advanced Micro Devices’ (AMD) 2018 earnings are largely being driven by its CG (Computing and Graphics) segment due to the growing adoption of Radeon and Ryzen.

The Impact of US–China Trade Tensions on Applied Materials Stock

Applied Materials (AMAT) earned 21% of its 2016 revenues and 19% of its 2017 revenues from China. Any major shift in this market could hurt AMAT.

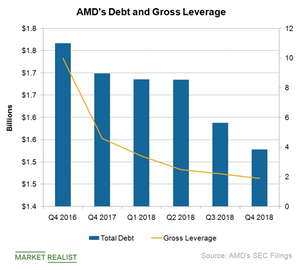

AMD Lowers Leverage Ratio and Strengthens Balance Sheet

AMD has been using its cash flow to increase and maintain its cash reserve above $1 billion.

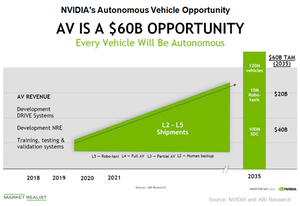

Intel and NVIDIA to Benefit from Autonomous Vehicle Trend

NVIDIA has a three-stage strategy to deliver its end-to-end self-driving system.

What Preorders Say about Apple’s iPhone Sales

Within 30 minutes of the preorder opening on September 15, the iPhone XS Max—priced between $1,099 and $1,499—was sold out.

Can AMD Compete with Intel in the Server CPU Market?

Advanced Micro Devices (AMD) and Intel (INTC) operate in an oligopoly server CPU (central processing unit) market where one’s gain is the other’s loss.

Is the Growth Cycle for Applied Materials Here to Stay?

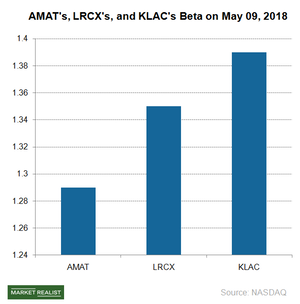

Trade war jitters between the US and China sent Applied Materials stock to $55.40 on March 23 from its 52-week high of $62.40 on March 12.

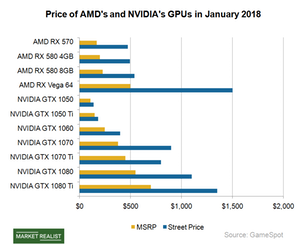

NVIDIA, AMD, and Rising Graphics Processing Unit Prices

Last year saw the cryptocurrency boom, in which many miners purchased Advanced Micro Devices’ (AMD) and NVIDIA’s (NVDA) GPUs to mine currency.

AMAT’s Weak Fiscal Q4 2018 Guidance Makes Investors Cautious

Applied Materials, the world’s largest chip manufacturing equipment vendor, reported strong fiscal Q3 2018 earnings but lowered its fiscal Q4 2018 guidance.

What Is NVIDIA’s Strategy to Expand Its Gaming Business?

NVIDIA launched the beta version of GeForce NOW, which allows gamers to play graphics-intensive games on the cloud at an hourly rate.

The Role of Intel’s Leadership in Transforming the Company

When Krzanich took over as Intel’s CEO, it was already a leader in the microprocessor technology and had strong profits and cash flows.

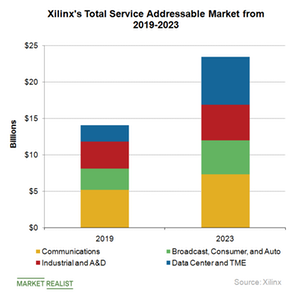

Data Center Market to Drive Xilinx’s Future Growth

Xilinx (XLNX) has started realizing the benefits of 5G (fifth generation) and AI (artificial intelligence) opportunities.

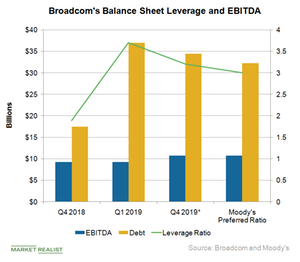

Broadcom’s Acquisitions Burden Its Balance Sheet with High Debt

At the end of fiscal 2018, Broadcom’s cash reserves stood at $4.3 billion, and long-term debt stood at $17.5 billion.

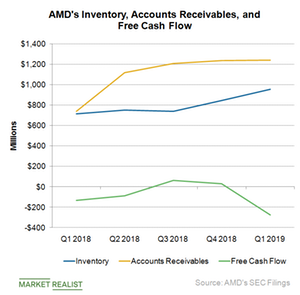

Should Investors Worry about AMD’s Negative Cash Flow?

Most semiconductor companies’ first-quarter earnings hit two-year lows as weak economic demand impacted their revenue and profit margins.

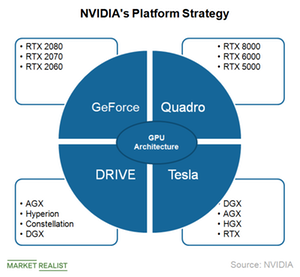

NVIDIA Broadens Product Portfolio to Tap New Computing Markets

NVIDIA (NVDA) has grown exponentially in the last three years.

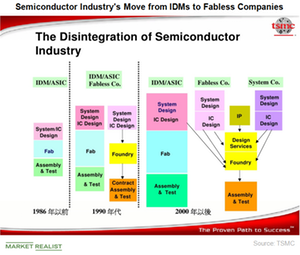

What Happened to Intel’s Foundry Business?

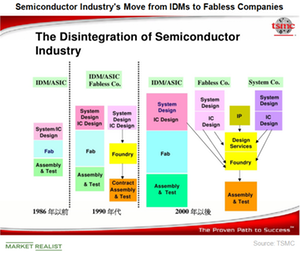

In 1986, Intel (INTC) adopted an integration model in which it invested in x86 chip designs and manufacturing nodes to attain technology leadership in the microprocessor market.