Why AMAT’s Weak Guidance Alarmed Semiconductor Investors

Applied Materials’ (AMAT) performance is an indicator of the overall semiconductor industry’s outlook.

Nov. 20 2020, Updated 1:25 p.m. ET

What do AMAT’s earnings mean to the semiconductor industry?

Applied Materials’ (AMAT) performance is an indicator of the overall semiconductor industry’s outlook, as it supplies chipmakers manufacturing equipment to build new capacity or upgrade semiconductor manufacturing technology. Semiconductor investors were already concerned that the weakness in smartphone demand and new technologies would encourage chipmakers to reduce their equipment purchases. The decline in NAND (negative AND) prices added to these concerns.

The health of the semiconductor industry

AMAT’s weaker guidance for fiscal Q4 2018 fueled investors’ concerns that the chip industry’s two-year-long growth trend is beginning to slow. During its fiscal Q3 2018 earnings call, AMAT’s chief executive, Gary Dickerson, stated that the company expects semiconductor systems’ revenue to fall 4% in fiscal Q4 2018.

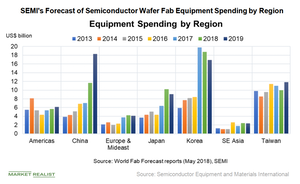

AMAT earns a major portion of its revenue from chip giants like Samsung (SSNLF), TSMC (TSM), and Intel (INTC), who order equipment ahead of production. Foundries manufacture a wide range of chips for different semiconductor companies. For instance, TSMC manufactures A-series processors for Apple iPhones, graphics cards for NVIDIA, and modems and mobile processors for Qualcomm. Foundries have invested a significant amount of capital over the last four years to build new capacity.

Gary Dickerson stated that some of its foundry customers are now reducing their equipment spending to optimize their existing capacity across the broader demand. He stated that this is a good sign, as it shows more disciplined investment than the previous cycles.

AMAT uses its diversified portfolio to its advantage

AMAT has diversified its portfolio to mitigate the impact of a downturn. Gary Dickerson stated that company earns about 40% of its products and service revenue from display and adjacent markets. AMAT’s chief financial officer, Daniel Durn, stated that the company earns 32% of its semiconductor service revenue from the maintenance of its installed machines, which means this revenue is stable. However, Gary Dickerson is still optimistic about its longer-term growth opportunity from artificial intelligence.

Check out all the data we have added to our quote pages. Now you can get a valuation snapshot, earnings and revenue estimates, and historical data as well as dividend info. Take a look!