The Impact of US–China Trade Tensions on Applied Materials Stock

Applied Materials (AMAT) earned 21% of its 2016 revenues and 19% of its 2017 revenues from China. Any major shift in this market could hurt AMAT.

Nov. 20 2020, Updated 1:12 p.m. ET

Applied Materials stock exposed to market risk

Applied Materials (AMAT) stock fell despite strong fundamental growth and solid business opportunities. This decline came as the company is exposed to market risk.

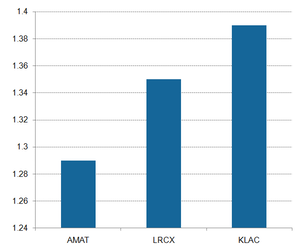

Every stock is exposed to two types of risks. The first risk is company-specific, which investors can reduce by diversifying their investments in similar stocks. The second is market risk, which arises from economic growth and geopolitical issues. When market risk rises, stocks are impacted. However, the extent of the hit is determined by each stock’s beta. Beta is a measure of volatility, and a beta greater than 1.0 indicates high volatility.

Small-cap companies have higher betas, as they have greater exposure to market risks. AMAT has a beta of ~1.3, which is lower than its smaller-cap rivals Lam Research’s (LRCX) and KLA-Tencor’s (KLAC) betas of ~1.4 and ~1.4, respectively. AMAT has a beta greater than 1.0, as it operates in the highly volatile semiconductor industry.

Although AMAT would deliver higher returns than the market during economic growth, it would also fall faster than the market during an economic downturn.

US–China trade tensions

As AMAT is a volatile stock, it reacted significantly to the market sell-off on March 22 and 23 when concerns of a potential trade war between the US and China (FXI) were floated. While the S&P 500 Index (SPY) fell 4.6%, the iShares PHLX Semiconductor ETF (SOXX) fell 5.3% during these two days.

As SME (semiconductor manufacturing equipment) suppliers have higher beta readings, they saw greater declines than SOXX’s fall. AMAT fell 8.9%, KLAC fell 8.4%, and LRCX fell 9.7% during these two days.

Applied Materials (AMAT) earned 21.0% of its 2016 revenues and 19.0% of its 2017 revenues from China. Any major shift in this market could hurt AMAT. China aims to reduce its dependence on semiconductor exports by boosting chip production in the nation. It also made chip production part of its Made in China 2025 initiative, wherein it aims to meet 40.0% of its chip requirements from local chipmakers by 2020.

Looking ahead

The US–China trade tensions could encourage China to accelerate its domestic chip production. AMAT investors are concerned that if China accelerates its domestic chip production, it could negatively impact its equipment sales worldwide.

However, some analysts believe that investors are overreacting to the noise, as the trade war hasn’t yet started. Even if China produces chips domestically, it’s far behind its multinational rivals and is unlikely to become competitive with them anytime soon.

Next, we’ll look at industry-specific and company-specific risks and how they impact AMAT’s stock price.

Check out all the data we have added to our quote pages. Now you can get a valuation snapshot, earnings and revenue estimates, and historical data as well as dividend info. Take a look!