BTC iShares China Large-Cap ETF

Latest BTC iShares China Large-Cap ETF News and Updates

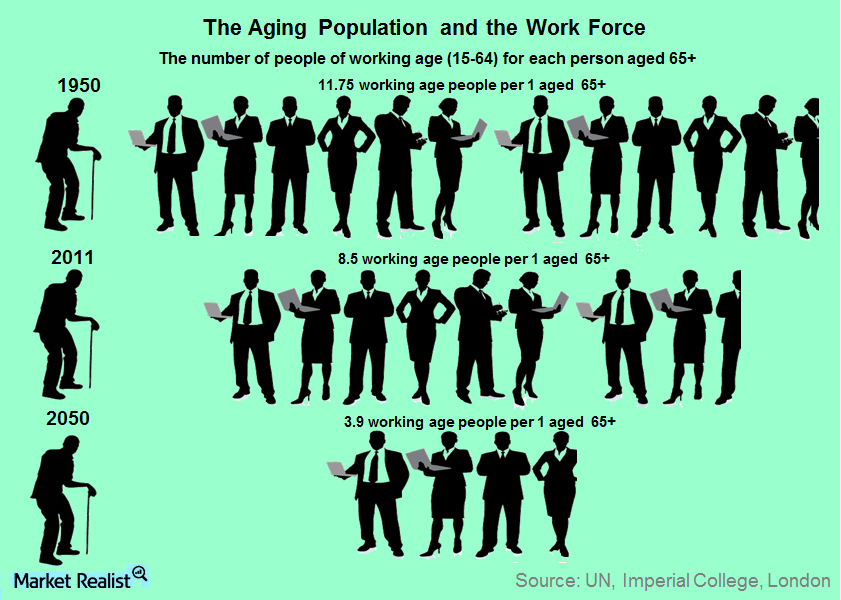

Aging Population May Keep Global Growth Muted

An aging population is likely to keep global economic growth muted in the years to come. This is primarily because the dynamics of the population are rapidly changing.

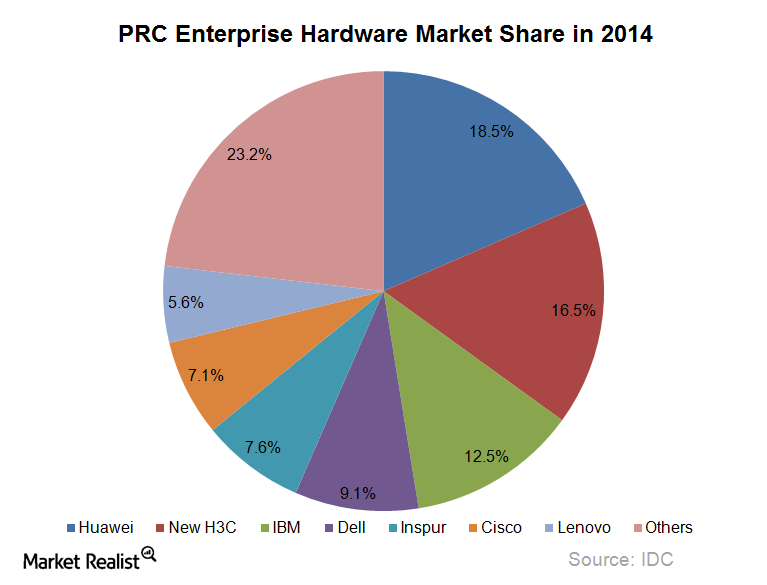

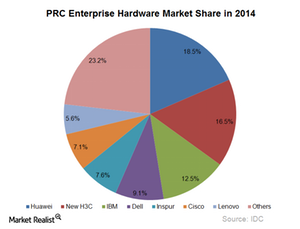

Why HP Sold Its 51% Stake in H3C Technologies This Month

On May 21, 2015, HP (HPQ) officially announced the sale of its 51% share in H3C Technologies to China-based Tsinghua Holdings subsidiary, Unisplendour.

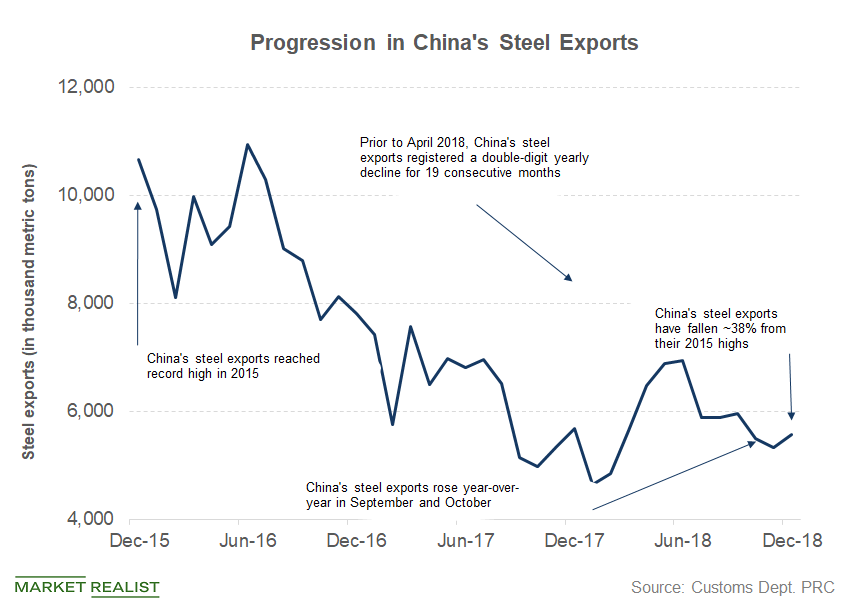

How to Counter China: Steel Could Show the Way

China (FXI) exported 5.56 million metric tons of steel in December, a yearly fall of 1.9%.

Why Competition Is Heating up for NVIDIA in the AI Space

Many companies are shifting their focus toward AI, which has been increasing the competition for NVIDIA (NVDA).

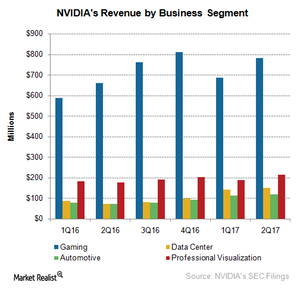

Fiscal 3Q17: An Activity-Filled Quarter for Nvidia

Nvidia (NVDA) took the stage in the past three months by launching a series of Pascal GPUs aimed at high-end and mainstream customers. Nvidia’s fiscal 3Q17 earnings are expected to be released in the first week of November.

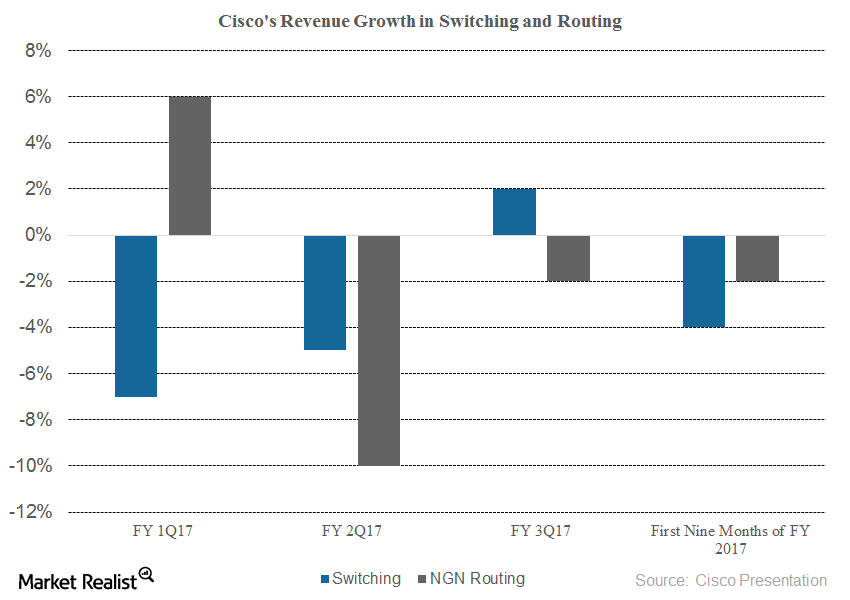

Can Cisco’s Switching and Routing Revenue Continue to Fall?

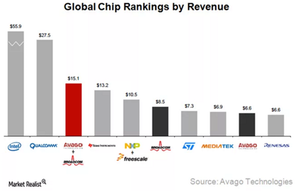

Cisco Systems’ (CSCO) Switching business revenue has fallen 4.0% YoY (year-over-year) to $10.5 billion in the first nine months of fiscal 2017.

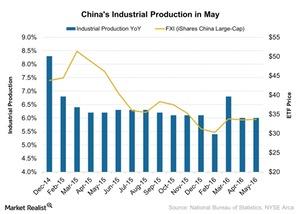

China’s Industrial Production Rises: Is Investor Confidence Back?

On a year-over-year basis, China’s industrial production increased to 6.0% in May 2016. That’s the same pace as April.

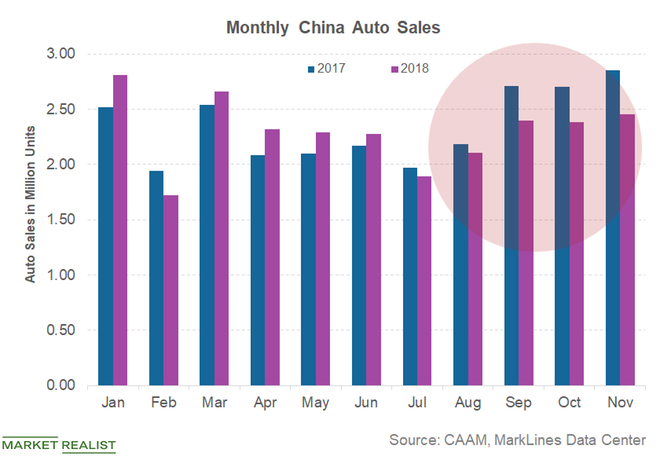

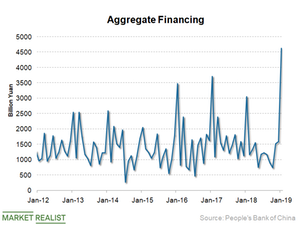

Can China Recover Like It Did in 2016?

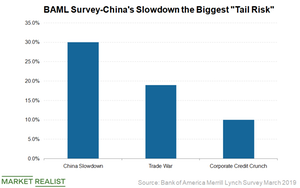

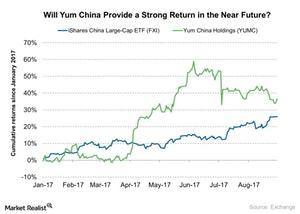

In some aspects, 2018 looked like 2015 for investors. Like in 2015, China’s (BABA) slowdown spooked investors in 2018.

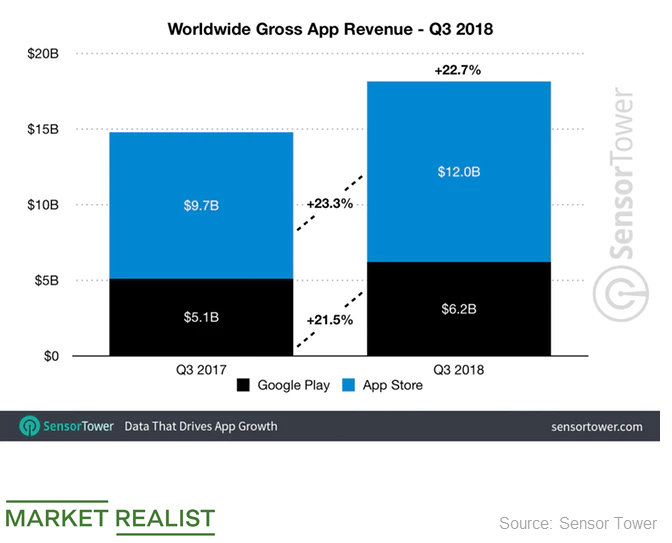

What Will Drive Services Revenue for Apple?

Emerging markets such as China and international markets such as Japan have contributed significantly to Apple’s Services segment over the years.

Can China Manage Growth without Fueling a Debt Crisis?

While there is no denying that China (FXI) needs stimulus measures to kickstart its slowing economy, any propping up needs to be done in a way to avoid another debt-fueled crisis.

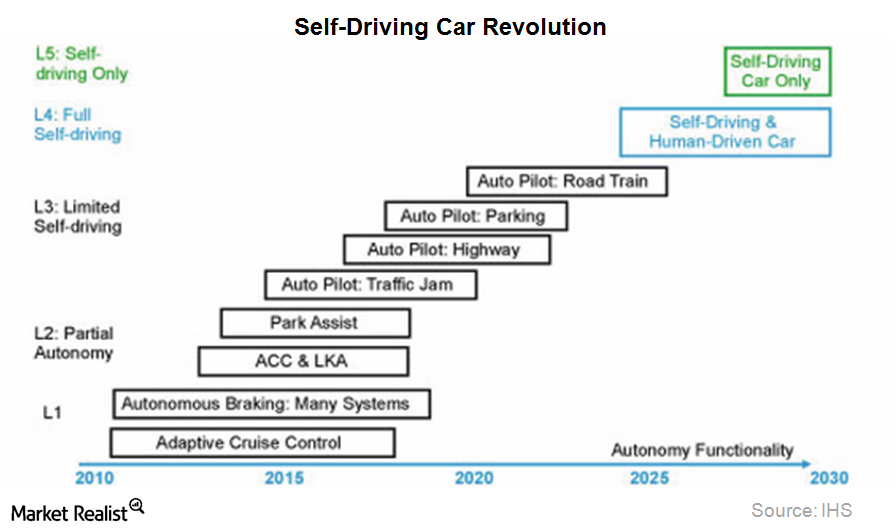

Google Could Put Self-Driving Cars on the Roads by Summer 2015

With a fleet of almost 20 self-driving cars, Google now averages ~10,000 self-driving miles per week. Google claims that its cars have 75 years of US adult driving experience.

IMF Provides a Positive Assessment of China’s Economy

In a press conference on June 14 on its annual Article Four Staff Report, the IMF provided a positive assessment of China’s economy.

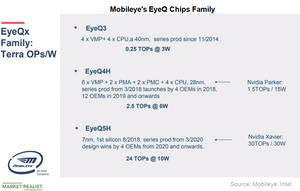

Progress Report: Intel’s Mobileye Business

Mobileye reported 37% year-over-year growth in the company’s second-quarter revenues as the adoption of its ADAS solutions increased.

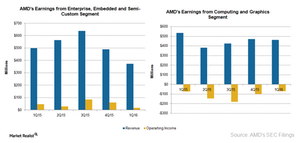

How Will AMD’s Price Strategy Impact its Earnings?

In fiscal 1Q16, Advanced Micro Devices reported strong guidance for fiscal 2Q16, whereas behemoths Intel and Qualcomm reported weak guidance.

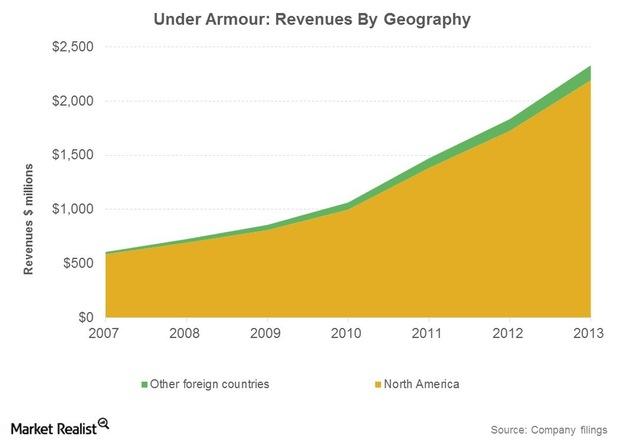

Can Under Armour’s Growth Model Cope With These Threats?

Key threats to the company include higher labor costs and greater regulation. After the Bangladesh factory tragedy, stricter regulations can be expected.

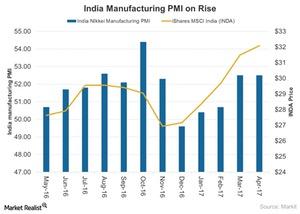

Improved Manufacturing in India, But Recovery?

The Nikkei India Manufacturing PMI for April 2017 matched its reading for the previous month.

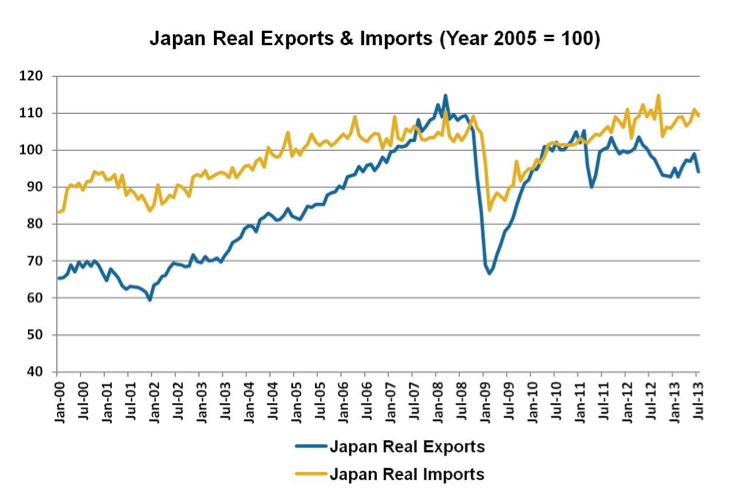

Why we could see a new trend in Japan’s exports and imports

Japan’s import and export dynamics The below graph provides a clearer picture of the import and export dynamics of the Japanese economy. By using 2005 as a base year and adjusting for inflation or deflation, the graph shows how exports and imports have changed on a “real” basis, as opposed to a “nominal” basis. Viewing […]Industrials Why China’s slowing consumption demand is an important threat

Real estate and construction are the two important drivers of China’s economic growth. They account for more than 20% of China’s gross domestic product (or GDP) when you also factor in cement, steel, chemicals, furniture and other related industries.

Markets Look at US-China Trade Talks as Slowdown Concerns Multiply

Today, another round of trade talks started in Beijing.

What Revenue Synergies Would a Fairchild-ON Merger Bring?

Looking at revenue synergies, we see that Fairchild’s strong portfolio in the high voltage and medium voltage power semiconductor market complements ON’s low voltage and small-signal market.

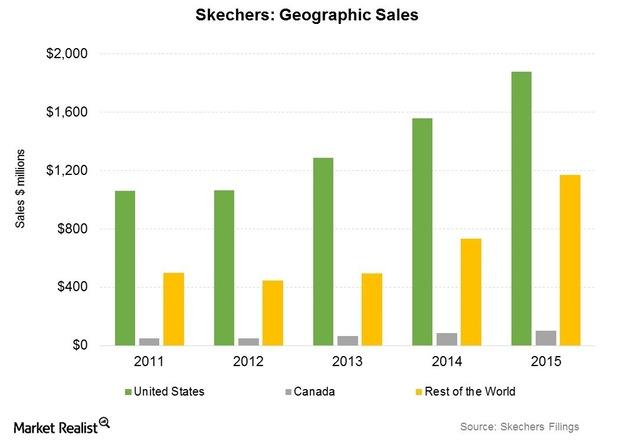

Skechers’ China Sales Rise: What’s the Growth Outlook?

China has been an important element in Skechers’ success in international markets. Sales from China rose to $220 million in 2015 from $86 million in 2014.

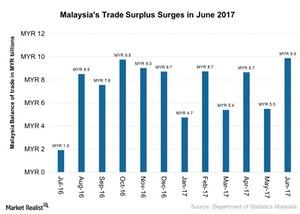

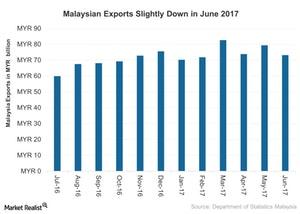

What’s behind Malaysia’s Large Trade Surplus in June 2017?

Malaysia’s trade surplus jumped to 9.9 billion Malaysian ringgit (MYR) (about $2.3 billion as of August 11, 2017) in June 2017—an 80% rise YoY.

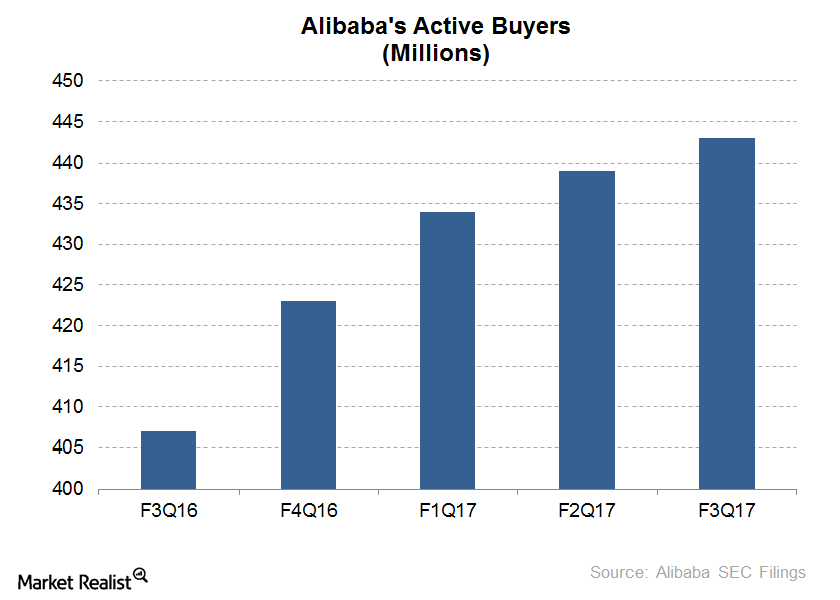

Why Druckenmiller Is Optimistic about Chinese Consumer Stocks

Druckenmiller’s firm bought 710,200 shares of Alibaba (BABA) in 2Q17. The holding accounted for nearly 5.4% of the firm’s portfolio in 2Q17.

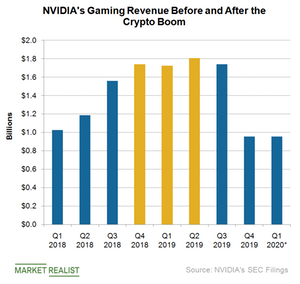

NVIDIA’s Gaming Revenue Declines May Be Temporary

NVIDIA’s (NVDA) revenue declined due to weakness in the Gaming and Data Center segments.

The US–China Trade War Impacts Apple

A study by Bank of America Merrill Lynch noted that US labor is 2.6 times more expensive than Chinese labor, which could increase Apple’s product prices by 20%.

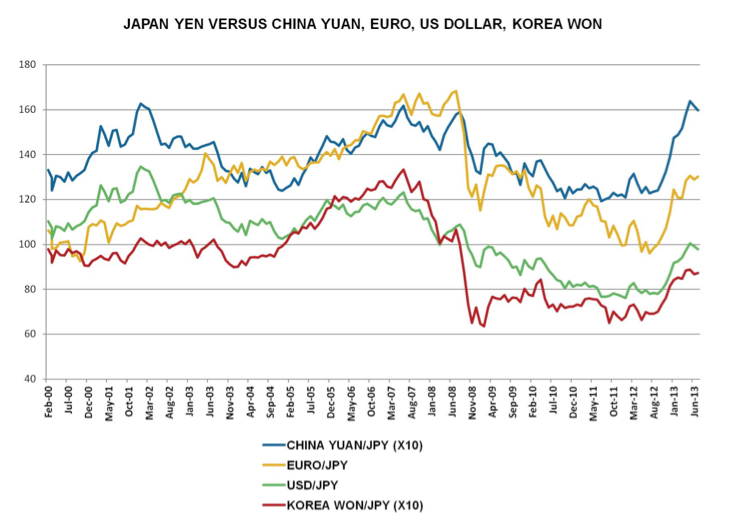

Does “Abenomics” mean a new era of yen depreciation?

A change in yen appreciation? The below graph reflects a potential big change in Japan post-2012—has yen appreciation turned the corner as a result of post-2012 “Abenomics“? In the mid 1970’s, the U.S. dollar bought 300 yen, and by the mid-1980’s, the U.S. dollar bought 250 yen. By the end of the 1980s, the dollar […]

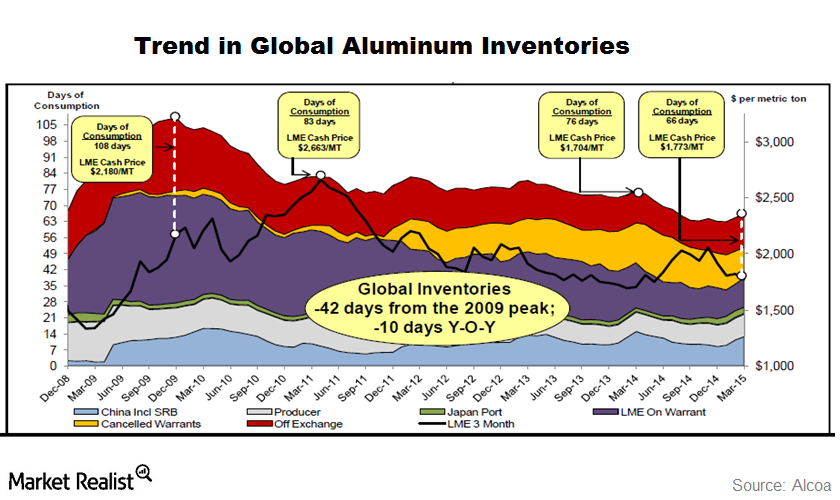

How Do Aluminum Inventories Work?

Aluminum inventories with London Metal Exchange (or LME) registered warehouses have declined this year. Aluminum inventories have been on a decline for almost two years.

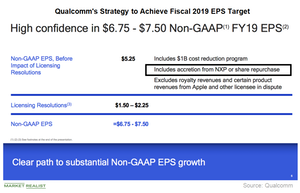

How Successful Has Qualcomm’s $30 Billion Buyback Been?

Qualcomm (QCOM) is a leader in the mobile market, with its chips powering 95% of the world’s smartphones.

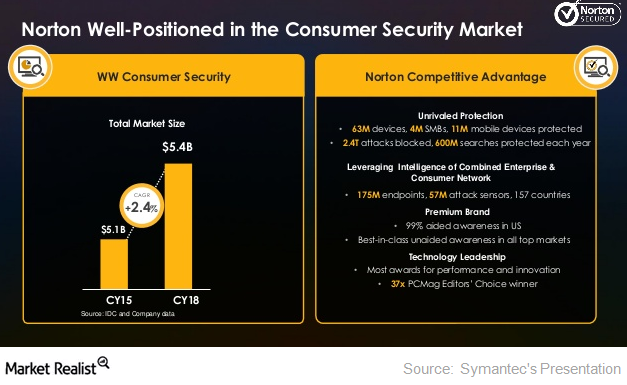

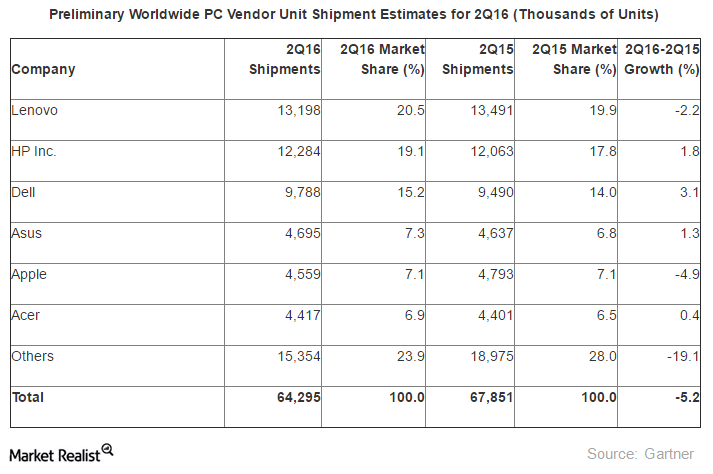

How Could Symantec’s Norton Benefit from LifeLock’s Buyout?

Continued sluggishness in computer market In the previous part, we discussed Symantec’s (SYMC) latest acquisition of LifeLock. PC (personal computer) shipments fell for the eighth consecutive quarter in 3Q16. Gartner said that this was “the longest duration of decline in the history of the PC industry.” Let’s discuss how this acquisition is going to enhance its […]

Is Alibaba Harming US Businesses?

Alibaba’s (BABA) war on fake goods on its marketplaces has been widely criticized as being weak or lacking direction.

Why Microsoft Has Sought Growth in China through Local Partnerships

According to a Wall Street Journal report, China’s cloud computing player 21Vianet Group, a Microsoft partner, will set up a joint venture with Tsinghua Unigroup.

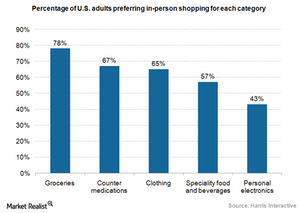

Blue Apron Could Raise New Funding at a Valuation of $2 Billion

The key to unlocking success is for Blue Apron to convince consumers that the food items the company delivers are just as fresh as items bought in person from a supermarket.

Why Microsoft Partnered with Lenovo

Microsoft has extended its partnership with Lenovo, a leading vendor in the PC space, because it generates the majority of its revenue from the PC market.

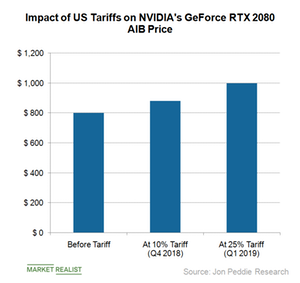

NVIDIA and AMD to See Higher GPU Prices Because of US Tariffs

According to Jon Peddie Research, NVIDIA’s new RTX 2080 AIB would cost gamers $800 in September, $880 in the fourth quarter, and $1,000 in the first quarter of 2019.

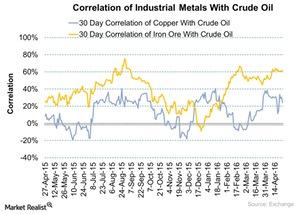

Analyzing the Correlation of Crude Oil and Industrial Metals

In the past year, US crude oil was more correlated with iron ore than copper. In August 2015, the correlation between crude oil and iron ore touched 75.5%.

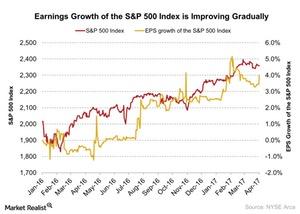

Jurrien Timmer’s Take on What Will Drive Markets the Most in 2017

When asked in a recent interview his thoughts about the short-term and medium-term investment story, Jurrien Timmer said that the main issue for the market other than geopolitical risks is its valuation.

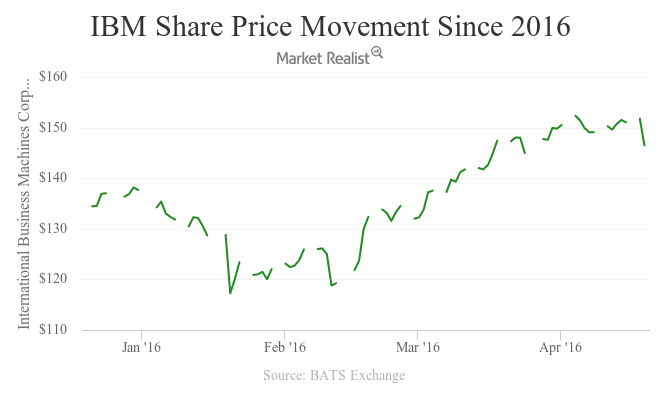

Why Did IBM Stock Fall after Its Fiscal 1Q16 Results?

Despite exceeding analysts’ estimates, IBM stock fell after the earnings announcement on April 18, 2016. It was IBM’s 16th consecutive quarter of revenue decline.

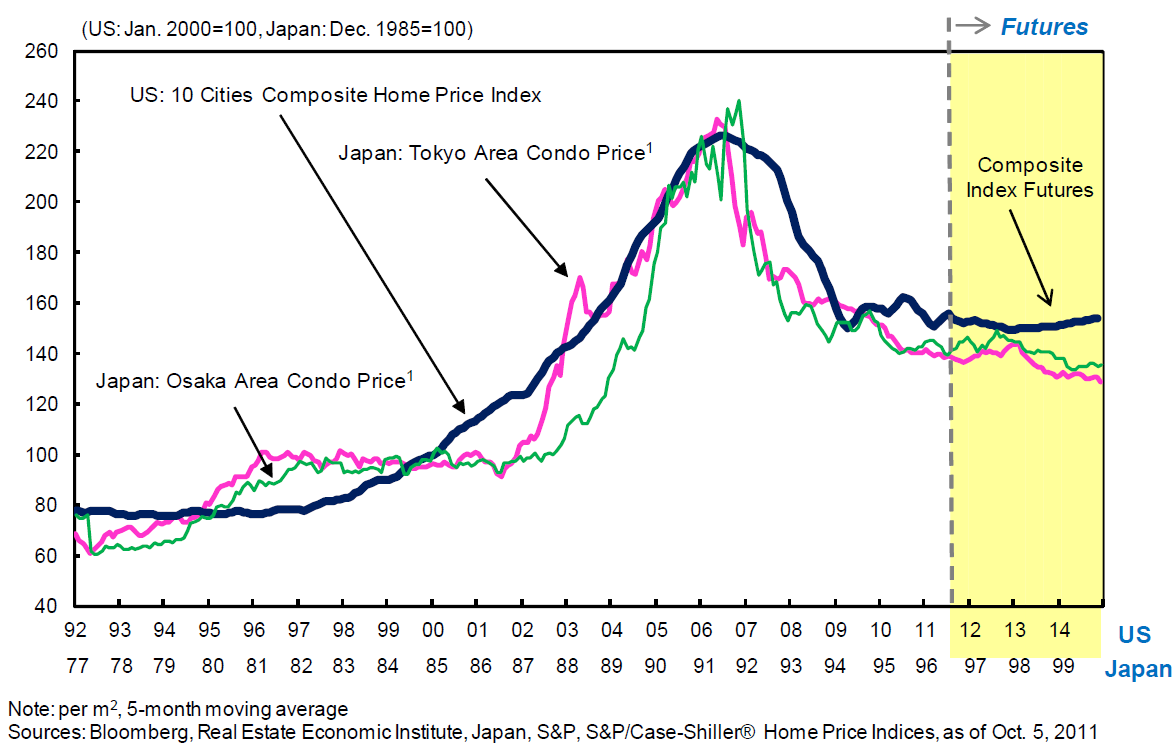

Why we’re seeing a brand new housing bubble—Japan style

Residential investments in Japan The below graph reflects the ongoing decline in the rate at which residential investments are being made in Japan. As with other forms of fixed investment noted earlier in this series, Japan has seen a long-term decline in the housing market since the peak of the economic bubble, which was accompanied […]

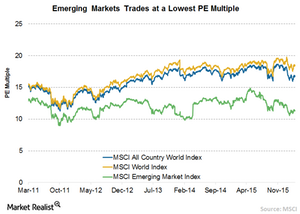

Why Emerging Markets Are Trading at a Discount to Developed Markets

With the recent fall, some of these emerging markets have certainly become very cheap compared to most of the developed markets.

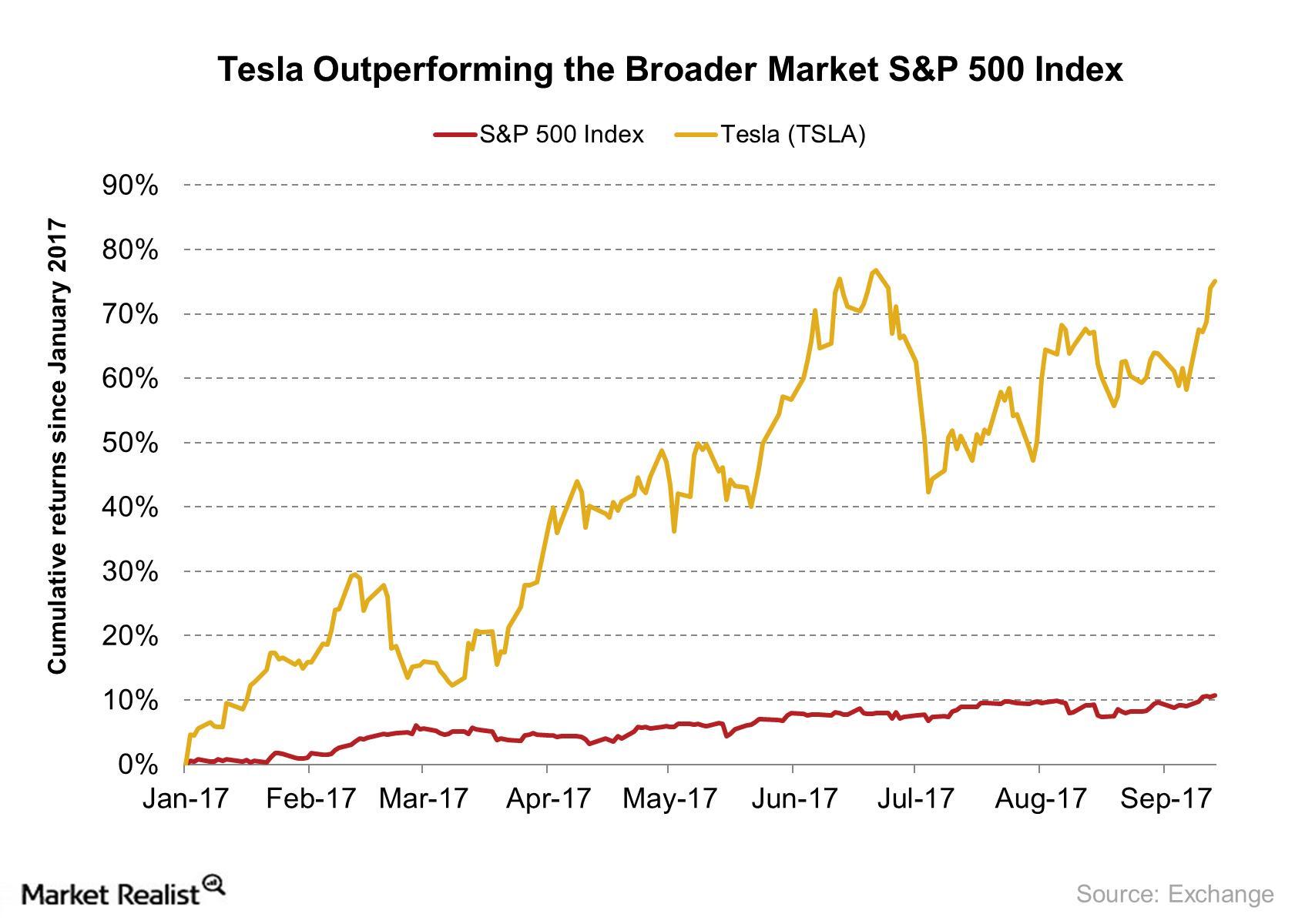

Why Jim Chanos Is Continuing His Short Position in Tesla

Jim Chanos, the billionaire investor and a well-known short seller in the hedge fund industry, said at the Delivering Alpha Conference on Tuesday, September 12, 2017, that he is continuing his short position in Tesla (TSLA).

Why NIO Stock Tanked after Its Q4 2018 Earnings Release

In this series, we’ll take a look at the key highlights of NIO’s fourth-quarter earnings release.

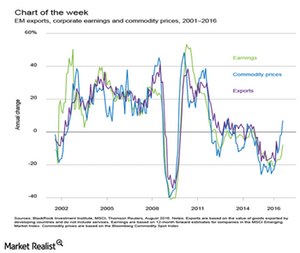

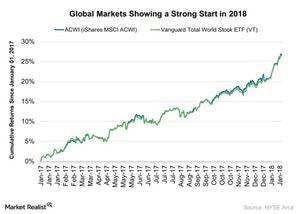

Why Emerging Markets Are Rebounding

Emerging markets (IEMG) (AAXJ) are expected to grow at a healthy pace of 4% in 2016 and see even higher growth in 2017.

Qualcomm’s Quarterly Licensing Revenue Stalled at $1 Billion

After enjoying strong cash flows from its Qualcomm Technology Licensing segment, Qualcomm’s licensing model came under the scrutiny of several regulators.

NXP Stock Jumps 11% on Acquisition Rumors

NXP Semiconductors (NXPI) stock rose 11% after hours yesterday following rumors of South Korean tech giant Samsung’s (SSNLF) interest in NXP.

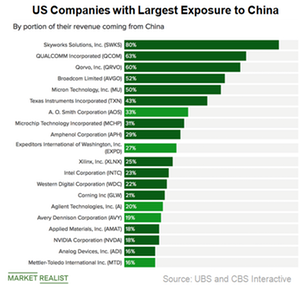

Micron Stock Is Vulnerable Due to Chinese Exposure

Micron Technology (MU) and stocks related to the memory market and China (FXI) fell due to a temporary injunction in China.

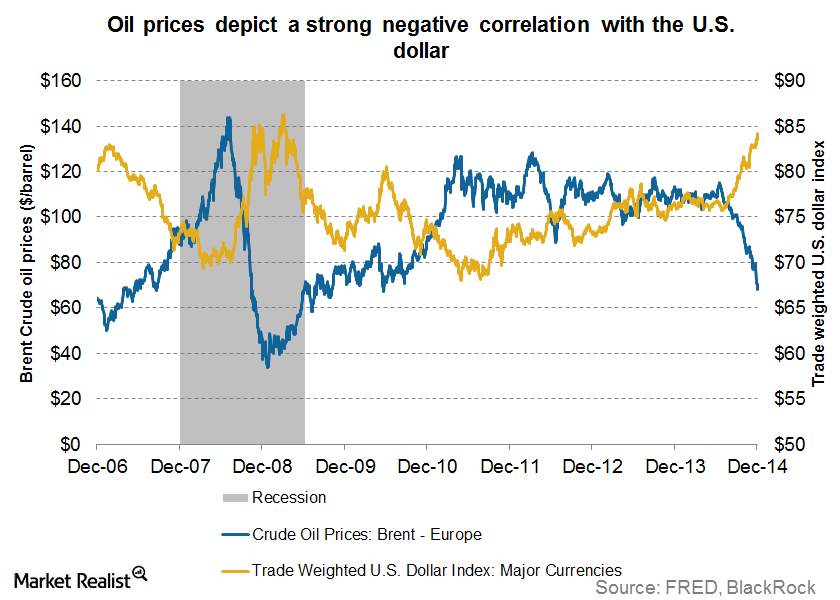

How The Rising Dollar Is Causing Oil Prices To Fall

A rising dollar has and will continue to put downward pressure on oil prices, causing trouble for the energy sector (XLE).

Understanding the Marginal Decline in Malaysian Exports in June

Exports from Malaysia in June 2017 stood at 73.1 billion Malaysian ringgit (MYR) (about $17 billion as of August 11, 2017), or 10% higher YoY.

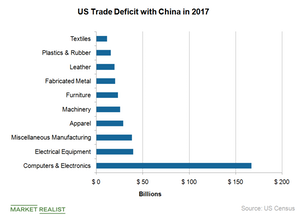

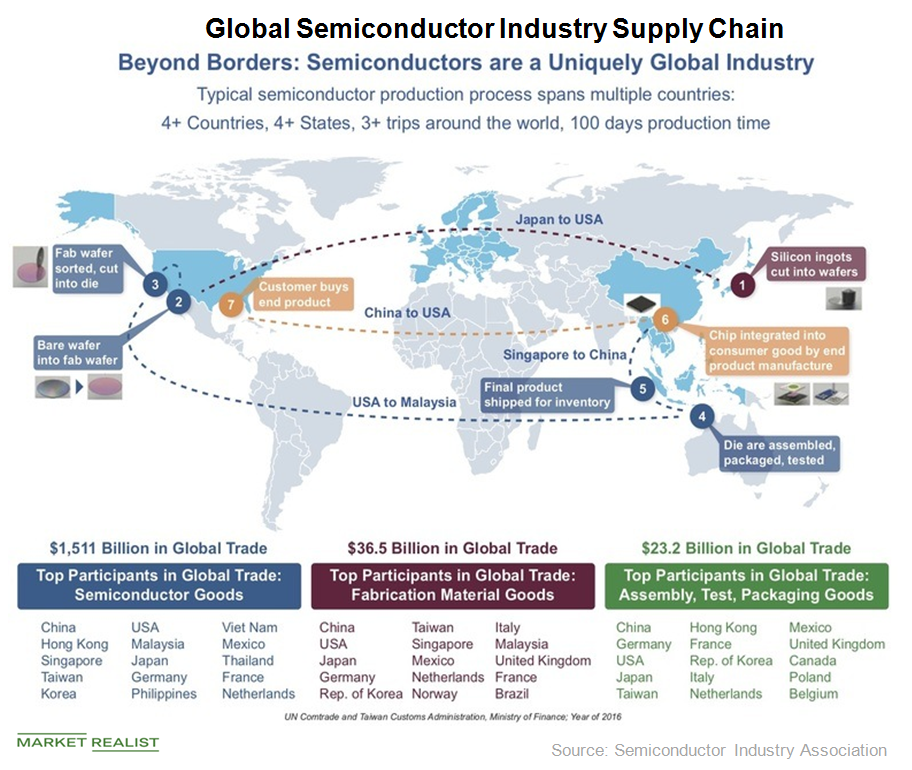

Semiconductor Industry Opposes Trump’s Tariffs on Chinese Imports

SIA and SEMI supported the administration’s objective but stated that tariffs would not end China’s unfair trade practices.

Immediate Impact of UK Election: Market Up, Volatility Down

After the announcement of the United Kingdom’s election outcome on June 9, 2017, global markets showed mixed responses.

A Look at Emerging Markets PMI Reports in December 2017

In this series, we’ll analyze the manufacturing and services activity of China, India, and Brazil (EEM) in December 2017.