Fiscal 3Q17: An Activity-Filled Quarter for Nvidia

Nvidia (NVDA) took the stage in the past three months by launching a series of Pascal GPUs aimed at high-end and mainstream customers. Nvidia’s fiscal 3Q17 earnings are expected to be released in the first week of November.

Dec. 4 2020, Updated 10:53 a.m. ET

A lot of good things happening at Nvidia

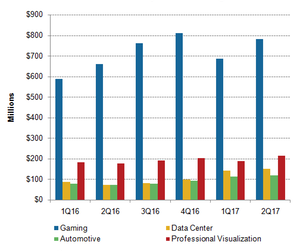

Nvidia (NVDA) took the stage in the last three months by launching a series of Pascal GPUs (graphics processing units) aimed at high-end and mainstream customers. While Gaming is the company’s core segment, things have started to pick up in the Automotive and Data Center segments as well.

Apart from launching new GPUs, the company has been in the news for all the right reasons, indicating strong opportunities for the fast-growing company in the fields of gaming, deep learning, automotive, and virtual reality.

Automotive

Over the past few months, Nvidia announced its partnership with China’s (FXI) Baidu (BIDU) to develop an autonomous car platform. An even bigger announcement in the automotive space came recently by Tesla Motors (TSLA). The carmaker announced that its Model S, Model X, and the upcoming Model 3 would feature one of the most expensive GPUs, Nvidia’s Titan, which can support computational tasks related to self-driving.

Gaming

In the gaming space, rival Advanced Micro Devices (AMD) managed to get a stake in the discrete GPU market through its lower-priced GPUs. However, AMD held this advantage for a brief period, as Nvidia launched high-performance GPUs at a competing price.

A new development came in the gaming space when Nvidia confirmed the news that it had secured an order from Japan’s game console-maker Nintendo for its upcoming console, Switch. This was a significant development because the game console market is dominated by AMD, which also supplies GPUs for Nintendo’s current console, Wii U.

Deep learning

Nvidia is leading the deep learning market with its Tesla GPUs. Server chip leader Intel (INTC) is looking to catch up with Nvidia in this space and has also acquired deep learning startup Nervana for more than $350 million.

However, Nvidia does not see Intel as a threat. Nvidia has been developing deep learning technology for five years and is well ahead of Intel, which has only recently started focusing on deep learning.

All these developments could be reflected in Nvidia’s fiscal 3Q17 earnings, which are expected to be released in the first week of November 2016. These product developments are just the beginning, and more next-generation products are lined up for the next few quarters.

In this series, we’ll see how these factors could affect Nvidia’s upcoming earnings.