Why we’re seeing a brand new housing bubble—Japan style

Residential investments in Japan The below graph reflects the ongoing decline in the rate at which residential investments are being made in Japan. As with other forms of fixed investment noted earlier in this series, Japan has seen a long-term decline in the housing market since the peak of the economic bubble, which was accompanied […]

Nov. 20 2020, Updated 1:34 p.m. ET

Residential investments in Japan

The below graph reflects the ongoing decline in the rate at which residential investments are being made in Japan. As with other forms of fixed investment noted earlier in this series, Japan has seen a long-term decline in the housing market since the peak of the economic bubble, which was accompanied by a real estate bubble much like the one the United States experienced until 2008.

The decline in residential investment in Japan has been driven by overbuilding during the housing bubble of the 1980s into the early 1990s. Plus, Japan’s population has also remained largely unchanged since 1995, while the US population has grown approximately 18% since 1995. Clearly, Japan’s aging society demographics and flat real GDP (gross domestic product) growth would suggest that Japan has little need for incremental growth in the number of housing structures outside of replacement-related building.

By why let that stop the building?

Bloomberg recently reported that there’s evidence of a Japan-style housing bubble developing once again. In an effort to spur the Japanese economy, Japan’s new Prime Minister, Shinzo Abe, has pushed for reforms to encourage the construction industry. As noted in the above graph, Japanese residential investment has been on a notable upswing—or at least a modest bounce—since 2011. With Abe in office, this trend could continue. Should Abe achieve his 2% inflation target and slay Japan’s deflationary demons, housing prices might even firm up and reinforce additional new construction.

The 1.8% mortgage and creative destruction

Many Japanese lament this development, as estimates suggest nearly 20% of Japan’s housing stock will be abandoned. This sounds like Japan is on its way to becoming the world’s biggest Detroit, though things are a little different in Japan. (Aren’t they always?) A large number of the abandoned housing units in Japan are very cheaply constructed units, whose reasonably utility is somewhat out of step with modern standards.

As a result, Japanese landlords (or slumlords) renting shabby 1980s construction–style units are understandably upset that the younger generation doesn’t wish to rent the old units, which may not even have central heating and air. The old-fashioned tatami flooring doesn’t age well, and the modern urban Japanese citizen tends to strongly prefer contemporary Western-style dwellings. This has been great news for Japan’s major homebuilders such as Daiwa House and Sekisui House.

Perhaps, in order to rectify the oversupply of abandoned houses, the Japanese government could take the advice former Federal Reserve Bank Chairman gave the US government: . The Japanese government would be unlikely to consider such advice, much as they didn’t take Larry Summers’ advice during the 1990s, when (representing the US Treasury) he suggested that the Japanese government should allow financial institutions to go bankrupt after the housing bubble had burst. Clearly, Summers didn’t prescribe the same policy solutions to the Obama Administration after the 2008 housing market collapse in the United States, reflecting a certain tendency toward Keynesianism at home and monetarism abroad. Summers’ financial deregulation advocacy during the Clinton Administration was also not a particularly celebrated example of his economic advisory work, which may have been duly noted in Washington, contributing to his recent withdrawal as a candidate for the Federal Reserve Chairmanship.

As the above graph suggests, these homebuilders were in terrible need of new orders, and the vested interests of slumlords was likely a significant hurdle in a much-desired urban renovation of housing stock. Perhaps “Abenomics” will accompany the boom of creative destruction, though changing the rules against Japan’s vested interest has remained a major challenge in achieving any real form of “structural reform” in Japan since 1990. Perhaps this is a step in the right direction. The current 35-year mortgage rate of 1.8% certainly seems to have attracted some new buyers.

It was such a great idea that the United States had to try it too

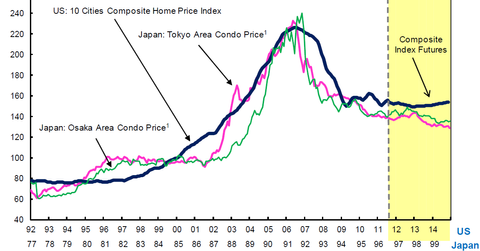

As the below graph reflects, the magnitude and duration of the Japanese housing bubble and the United States’ housing bubble bear a striking resemblance. Without banking deregulation post-1995, such an accomplishment may have been hard to achieve for the United States.

(Source: Richard Koo. Nomura Research Institute, Tokyo. “The World Balance Sheet Recession: Causes, Cure, and Politics.” Real World Economics Review, Issue #58.)

However, as the above graphs suggests, the US market is starting to improve. Japan’s 15-year bear market in housing ended in 2006, though the crisis of 2008 reignited downward pressure on the Japanese housing market. Condominium prices in Japan are once again back to their 2008 peak, though the residential market is nearly 15% lower than the 2008 levels. This suggests an ongoing increase in demand for newer construction condominiums versus the older housing stock, as we’ve seen.

What “Abenomics” means for Japan’s housing market

“Abenomics” means that the Japanese housing market could go through a significant phase of creative destruction. One of the “three pillars” of the Abe agenda is to engage in structural reform, which involves tax policy—including how land is used in Japan. This could be a positive change for Japan in the long run. As the first graph in this series indicates, the lack of creative destruction in the real estate sector in Japan has led to an aging stock of real estate, which has limited Japan’s economic activity since the mid-1990s. With some reform in this area of the economy, residential construction could continue to make a more significant contribution to Japan’s flat GDP numbers.

Outlook

As 2013 progresses, investors could see a continued outperformance of Wisdom Tree Japan Hedged (DXJ) and the iShares MSCI Japan ETF (EWJ) versus China’s iShares FTSE China 25 Index Fund (FXI) and Korea’s iShares MSCI South Korea Capped Index Fund (EWY). For further clarification as to why DXJ could outperform both EWJ and other Asian equity indices, please see Why Japanese ETFs outperform Chinese and Korean ETFs on “Abenomics.” Plus, as Japan pursues unprecedented monetary expansion, and the US Fed ponders monetary tightening, Japanese equities could also outperform broad US equity indices, as reflected in the State Street Global Advisors S&P 500 SPDR (SPY), State Street Global Advisors Dow Jones Index SPDR (DIA), and Blackrock iShares S&P 500 Index (IVV).

For related analysis, please see the following articles.

- China’s exports: Is the golden age of cheap labor coming to an end?

- U.S. consumer spending: Sustaining the unsustainable?

- Japanese exports: Are we seeing an “Abenomics”-led recovery in Japan?

- “Abenomics”: A bull market for Japan’s consumers?