SPDR® S&P 500 ETF

Latest SPDR® S&P 500 ETF News and Updates

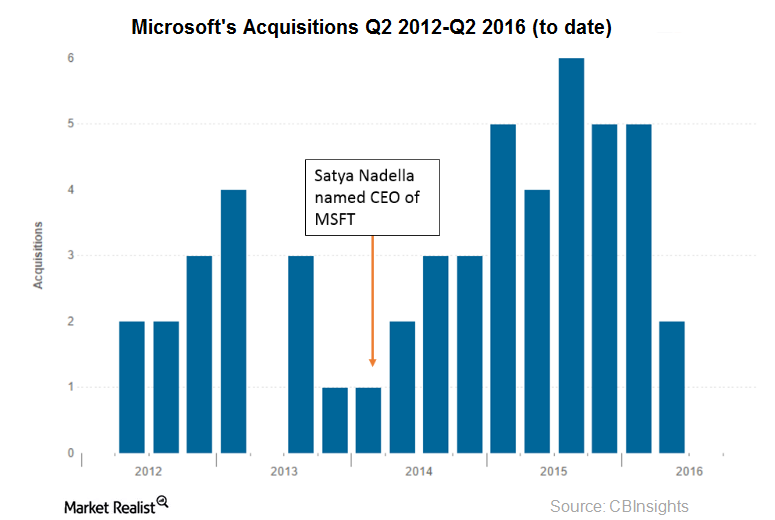

Why Decline in LinkedIn Stock Made It a Potential Target

LinkedIn’s stock, which traded at $269 in February 2015, fell to one of its lows of $101.11 in February 2016.

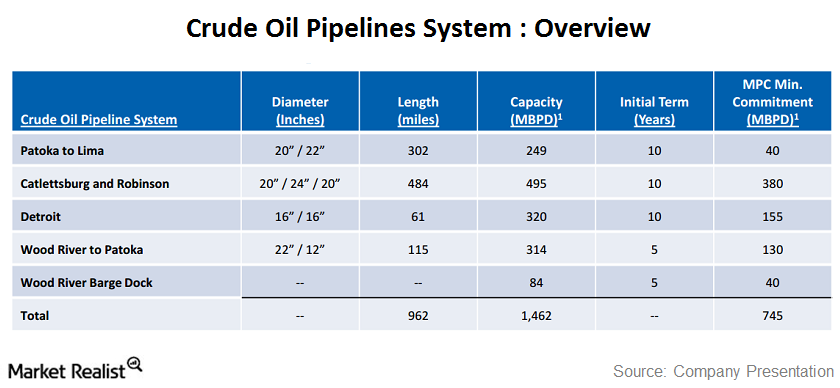

The MPLX crude oil pipeline system

MPLX crude pipelines are connected to supply hubs, and transport crude oil to Marathon Petroleum Corporation’s, or MPC’s, refineries and third parties.

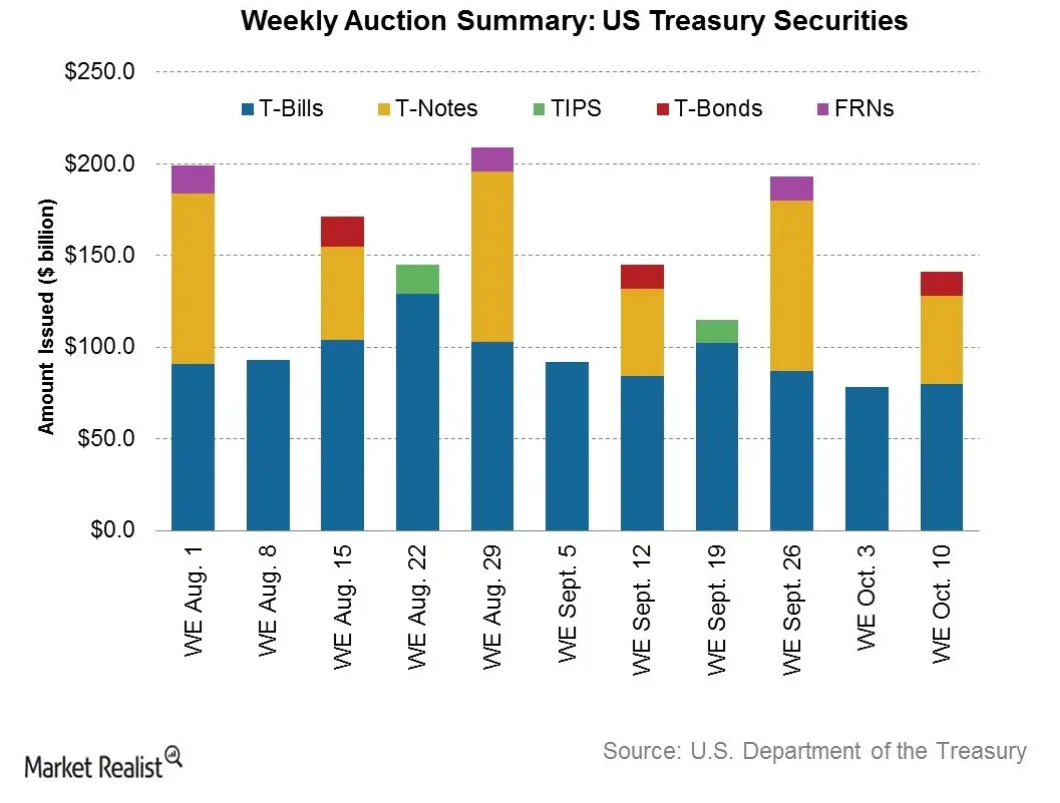

Why investors are preferring high-quality debt

High-quality bonds can be an investor refuge when there’s market volatility. These securities provide relatively stable cash flows. The default probability is low.

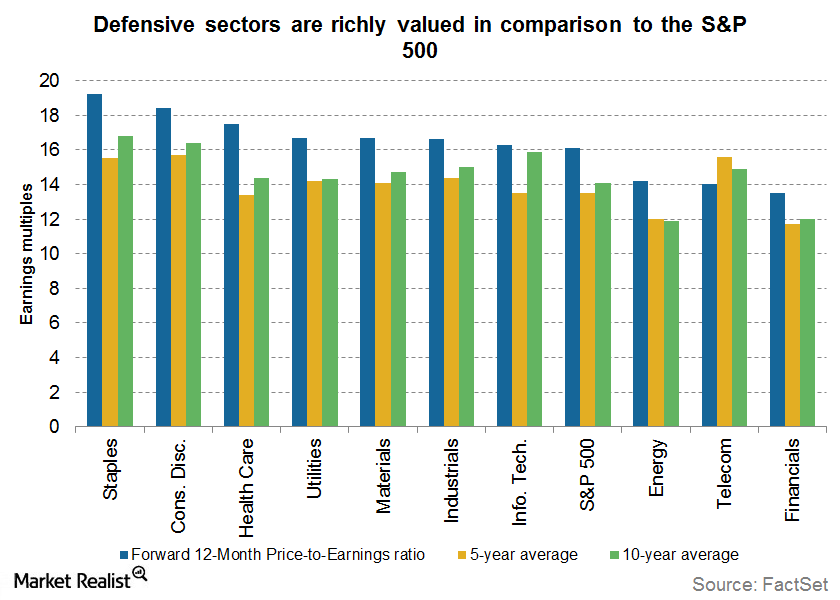

Investors Should Avoid Defensive Sectors If Rates Rise

Valuations are at the higher end of their historical range. Investors should avoid defensive sectors, which are highly sensitive to interest rate changes.

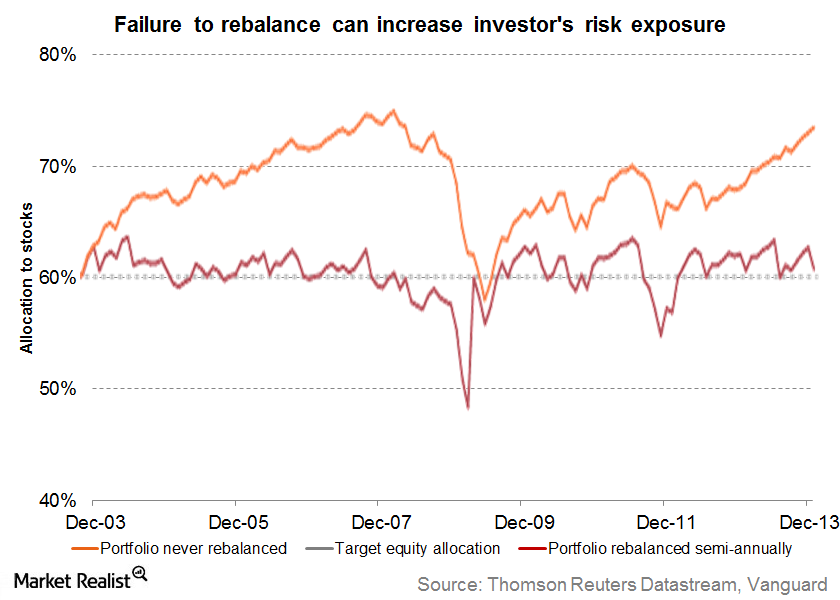

The Importance of Rebalancing Your Portfolio

Rebalancing your portfolio means bringing the portfolio back to the asset allocation levels specified in the financial plan. Not rebalancing can expose you to higher risk.

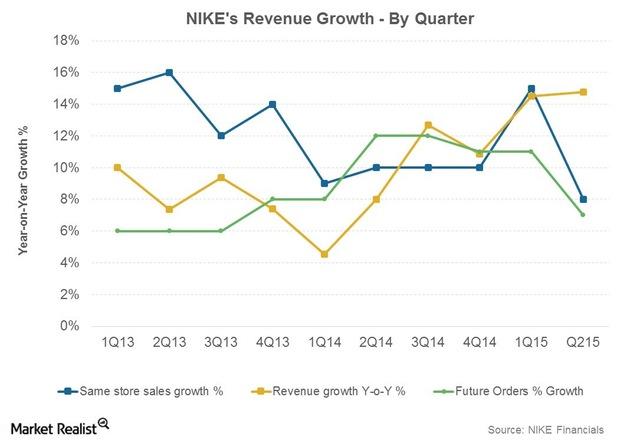

Analyzing the Prospects of Nike’s Geographic Segments

Most of Nike’s (NKE) incremental revenue was recorded in its North America market, Nike’s largest geographical segment.

Could the Model Y Change Tesla’s Profit Game?

This year, Tesla (TSLA) stock has fallen 21.3%, underperforming broader markets. Let’s look at how Tesla’s Model Y could turn things around.

Analysts Still Hate Steel Stocks despite Bumper Earnings

Overall, it has been a mixed earnings season for steel companies.

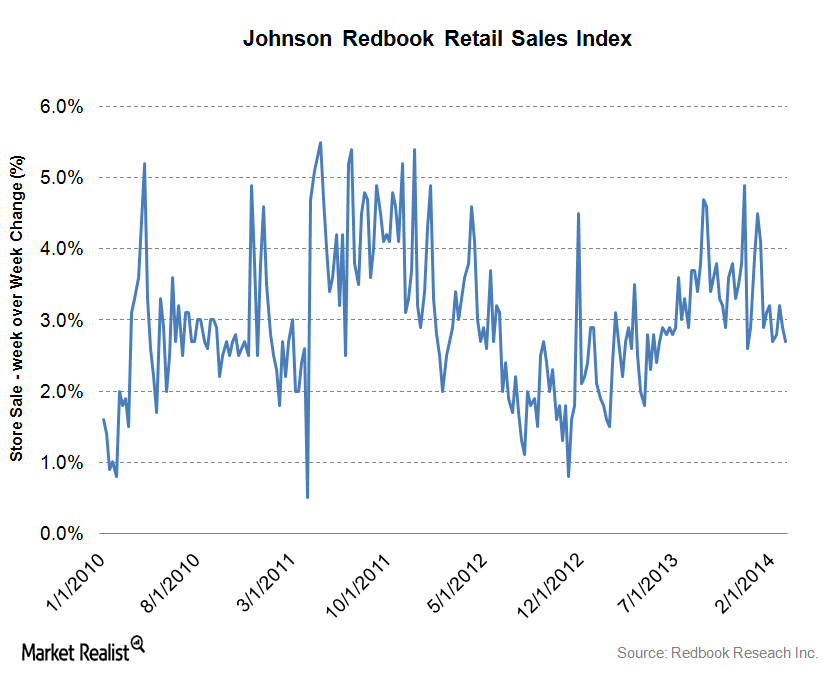

Must-know update: Redbook Index same-store sales data released

The Redbook Index released the same-store weekly data on Tuesday, March 11, 2014.

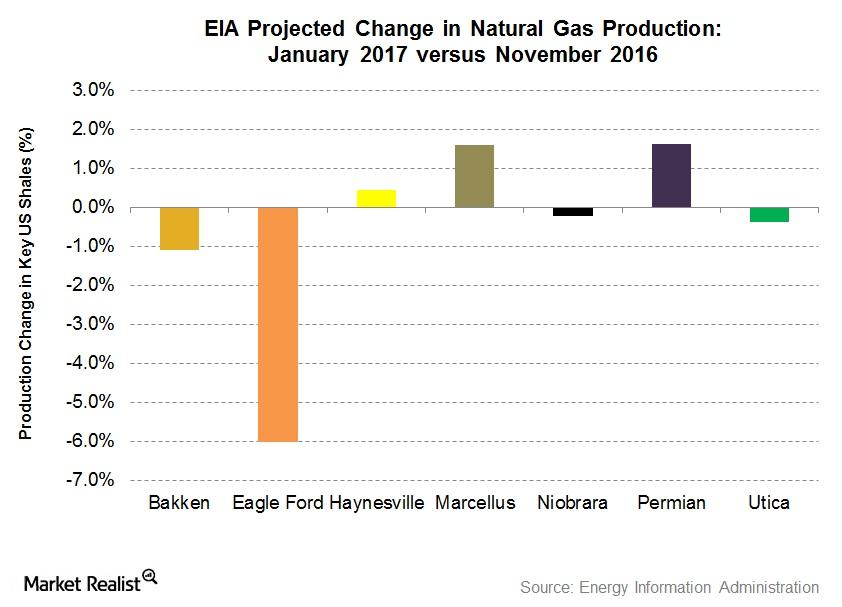

January 2017 EIA Estimates: US Shale Gas Production Could Fall

The EIA expects less natural gas production at four key US shales by January 2017 compared to November 2016. It expects production to rise at three key US shales.

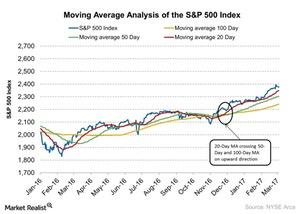

What S&P 500 Index Moving Averages Could Indicate

The S&P 500 Index is trading 1.2% above its 20-day moving average and 6% above its 100-day moving average.

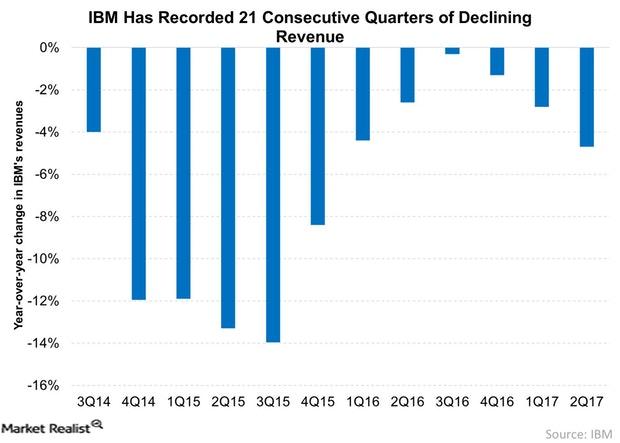

Why IBM’s Earnings Could Fall Going Forward

International Business Machines (IBM) reported its 2Q17 results on Tuesday, July 18. The company reported falling quarterly profits and sales yet again.Consumer Must-know: Why Peabody Energy fell 1.9% on July 22

Wall Street analysts’ consensus estimate for loss per share was $0.289.

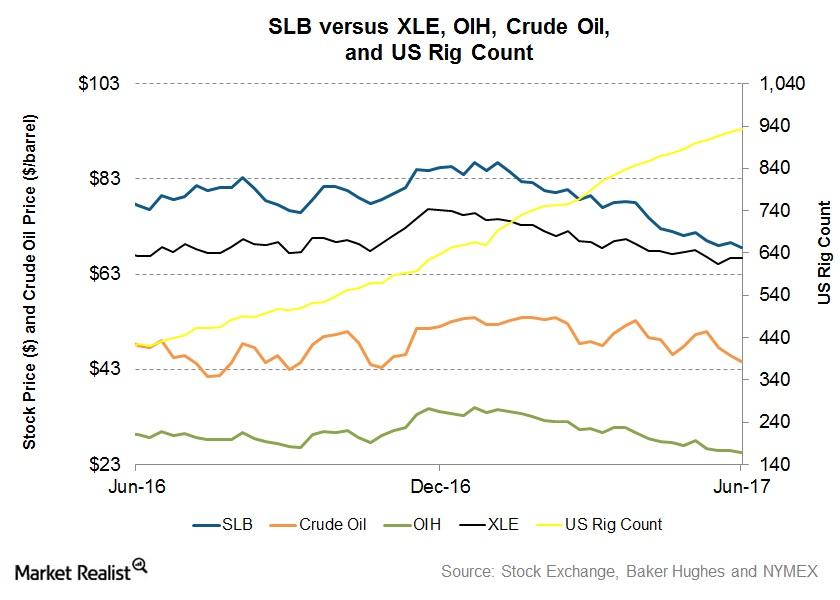

Inside Schlumberger’s 1-Year Returns as of June 16

Schlumberger’s trailing-one-year stock price has fallen 12% as of June 16, 2017, while XLE, the broader energy industry ETF, has fallen 3%.

Trump Thinks Fed’s ‘Ridiculously Timed’ Rate Hikes Hurt GDP

Last Friday, President Donald Trump in a tweet called the Federal Reserve’s interest rate hikes a mistake.

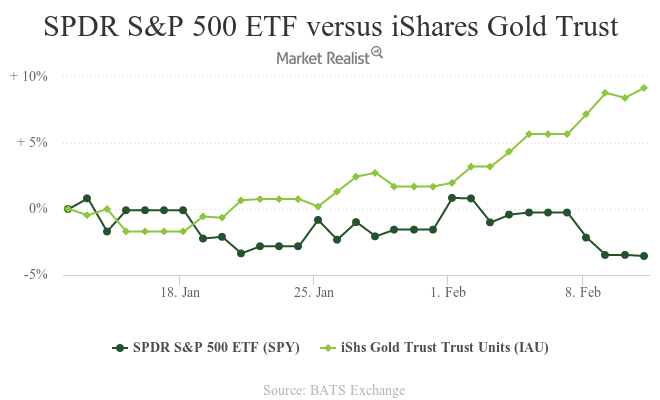

Yellen Wants to Keep Negative Rates on the Table, Helping Gold

When the Federal Reserve chair, Janet Yellen, testified to Congress on February 11, she affirmed the Fed’s consideration of negative interest rates. Under a negative interest rate scenario, investors would pay interest to the bank for holding their money.

ConocoPhillips: Investors’ Confidence Is Rising

Since ConocoPhillips (COP) reported its fourth-quarter earnings results on January 31, the stock has fallen 1.7%.

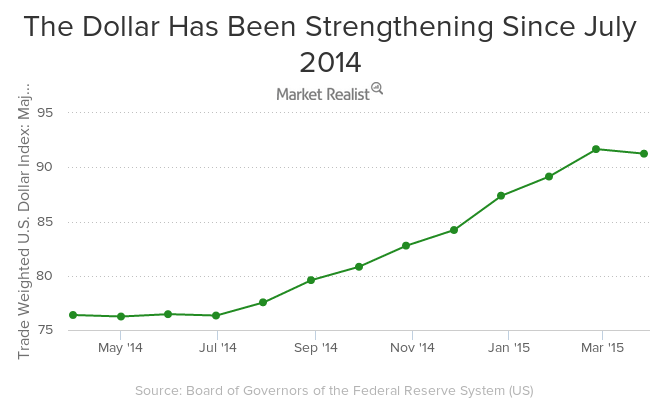

Why the US Economy Stalled in 1Q15

The US economy stalled in 2014 for several reasons, including seasonality, weather, strength of the dollar, the West Coast port strike, and the oil price slump.

These Key Economic Indicators Were Released Last Week

In this series, we’ll take a look at the global final manufacturing PMIs and services PMIs for March 2017. These indicators help us understand the business condition of an economy.

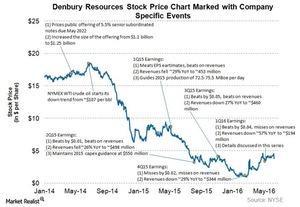

Analyzing Denbury Resources’ 1Q16 Earnings Call

For 1Q16, Denbury Resources (DNR) reported an adjusted EBITDA of ~$105 million with an EBITDA margin of ~40%. Its EBITDA margin is only ~20% lower.

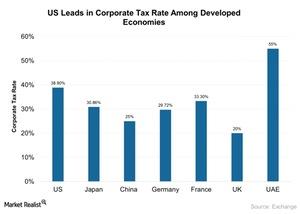

Inside the Market’s View of Corporate Tax Cuts

Are markets upbeat on potential tax reforms? The markets (SPY) (IVV) surged last week with the announcement of a phenomenal update on the corporate tax cut. The S&P and Nasdaq Comp gained ~2% in the week ended February 10, 2017. The Trump administration’s proposed tax cut is likely to boost the economy, though analysts have […]

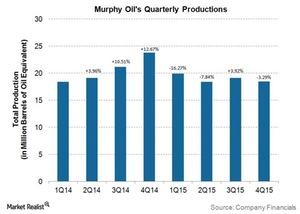

Murphy Oil’s 4Q15 Operational Performance, Management Strategies

Along with its 4Q15 earnings, Murphy Oil announced the divestiture of its Montney midstream assets located in Canada. The transaction includes the sale of existing infrastructure capable of processing up to 320 million cubic feet per day.

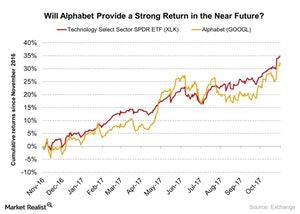

What’s Leon Cooperman’s Largest Position?

Alphabet reported its 3Q17 earnings on October 26, 2017. The company posted EPS (earnings per share) of $9.57, which beat analysts’ estimates of $8.33.

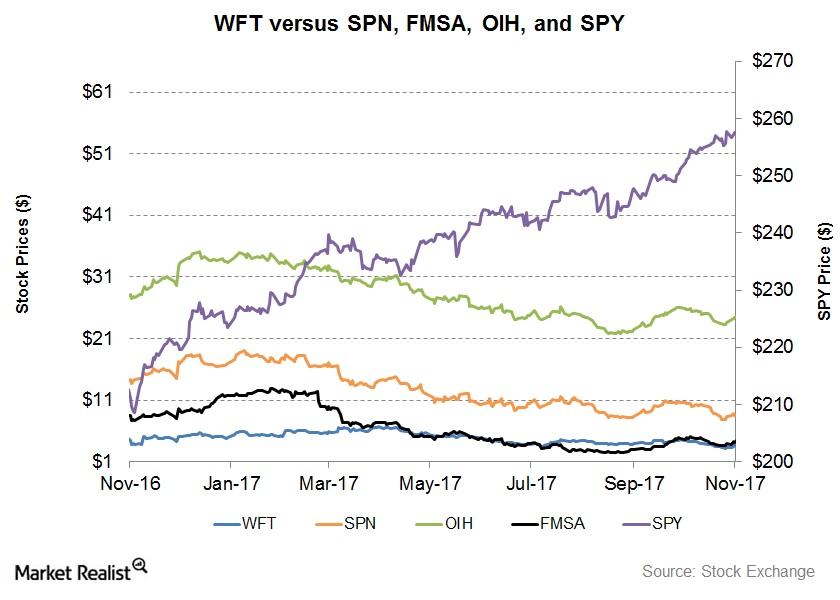

WFT, FMSA, and SPN: Returns and Outlook after 3Q17

WFT, SPN, and FMSA have significantly underperformed the SPDR S&P 500 ETF (SPY), which has produced 23.0% returns since November 3, 2016.

FOXA’s Views on Streaming Platforms: Advertising Opportunity?

Due to the coverage of the US presidential elections this year, 21st Century Fox (FOXA) expects substantial advertising revenue from Fox News.

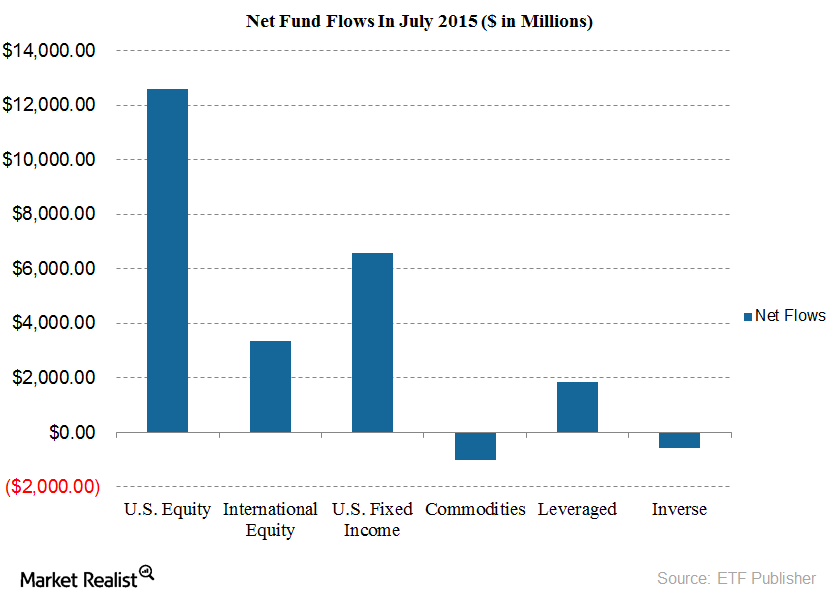

Investors Park Funds in Large-Cap ETFs in July

In July 2015, investors poured approximately $23 billion in US ETFs with 50% of total investments in equity funds.

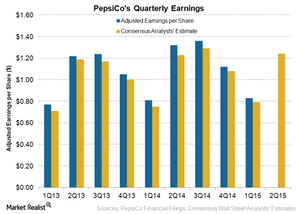

Will PepsiCo’s Earnings Stay Ahead of Wall Street in 2Q15?

PepsiCo expects currency headwinds to impact its fiscal 2015 core EPS by 11% compared to its previous estimate of 7%. It expects currency headwinds to drag down EPS in 2Q15 by 12%.

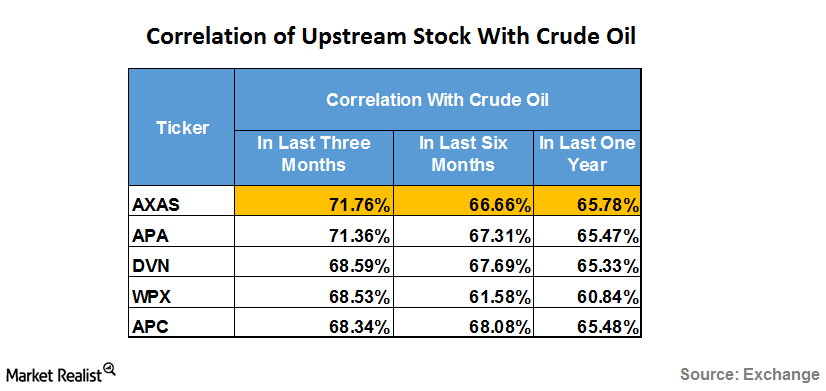

Which Upstream Stocks Are More Sensitive to Crude Oil?

In the last three months, Abraxas Petroleum (AXAS) has had the highest positive correlation with WTI crude oil among upstream companies that are part of XOP.

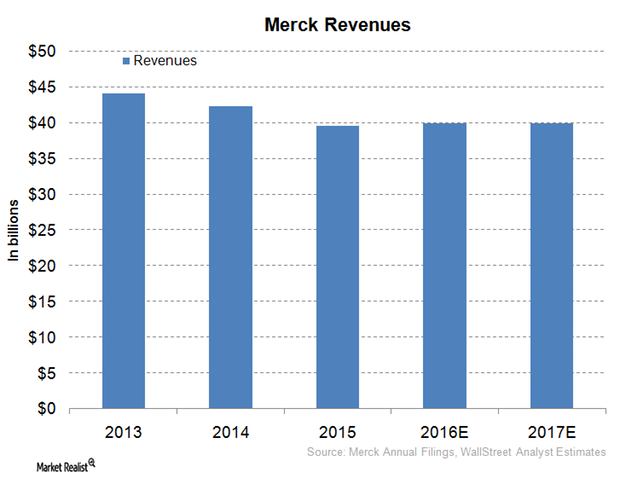

Merck Expects Modest Revenue Growth in Fiscal 2016

Merck provided revenue guidance of $39.7 billion–$40.2 billion in 2016. It expects negative foreign exchange fluctuations to reduce its fiscal 2016 revenue.

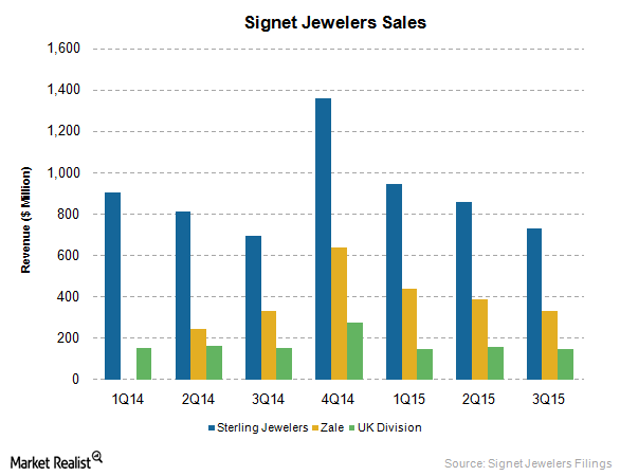

It Was a Festive Holiday Season for Signet Jewelers

On January 7, 2016, Signet Jewelers (SIG), the world’s largest retailer of diamond jewelry, announced its broad-based success in the holiday season with revenue of $1.9 billion.

US Retail Sales Flat in April on Rising Oil Prices, Yet XRT Up 1%

Retail sales in the United States in April didn’t see any growth over March’s sales figures. But the jobless claims reading brought some positive news for the consumer sector.

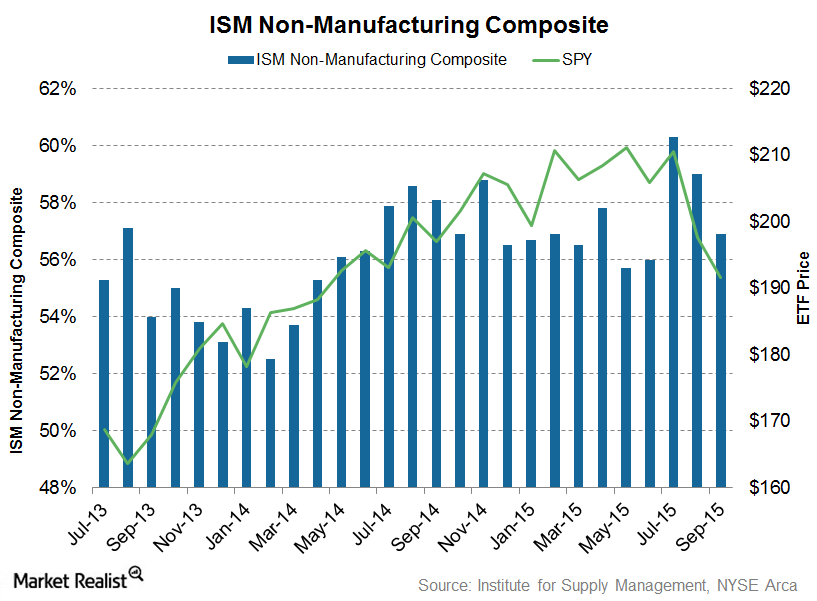

Expanding Service Sector Gives Relief to Economy in September

With manufacturing slowing, a reading of the Non-Manufacturing Index at an above-neutral level (56.9) may provide some relief to the US economy, which is highly dependent on the service sector for its economic growth.

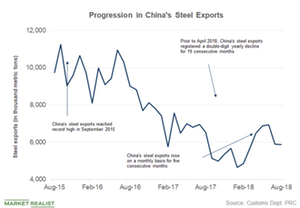

Will President Trump’s Pressure Tactics Work Out?

In March 2018, President Donald Trump imposed a tariff of 25% on steel imports. What’s happened since?

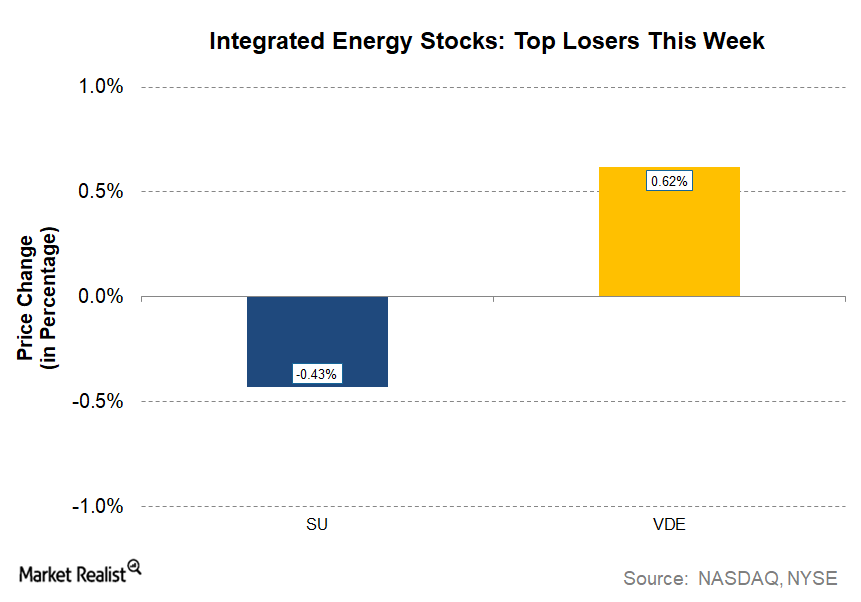

Suncor Energy: The Only Integrated Energy Loser This Week

Suncor Energy (SU) is the only losing stock in the current week from the integrated energy sector. It fell from last week’s close of $34.67 to $34.52 on October 11, 2017.

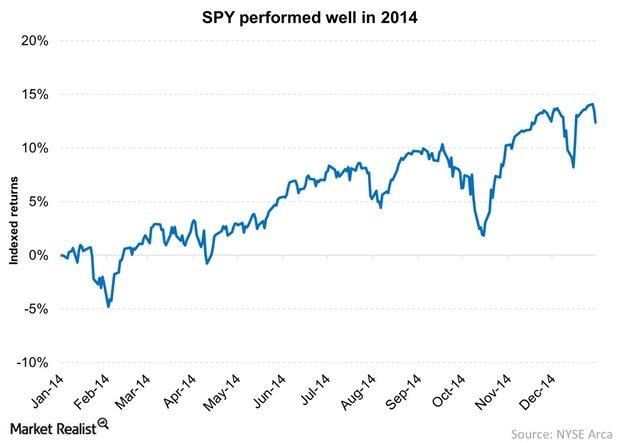

Why The US Saw Positive Fund Flows In 2014

The US saw positive fund flows in 2014 due to a relatively better economic position.

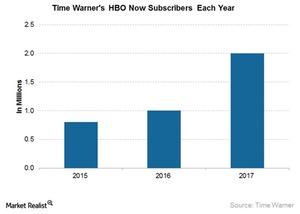

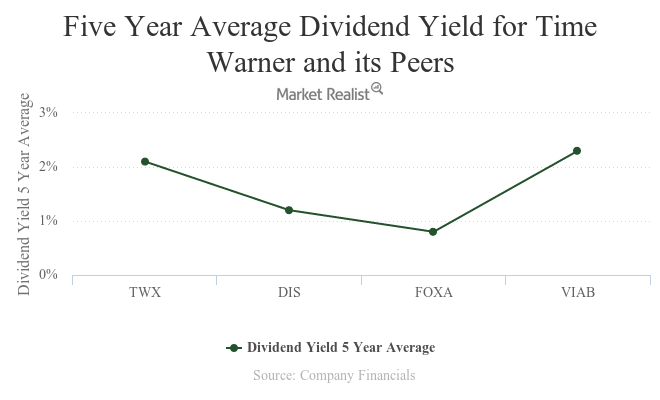

Why Time Warner Intends to Pull Its HBO Programming from Amazon

Time Warner announced at its fiscal 1Q17 earnings call that it most likely won’t extend its agreement with Amazon beyond 2018.

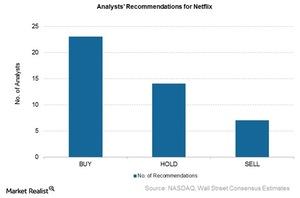

Trading at a Discount, Netflix Has Mixed Recommendations

Of the 44 analysts covering Netflix, 23 have given it a “buy” recommendation, seven have given it a “sell” recommendation, and 14 have given it a “hold” recommendation.

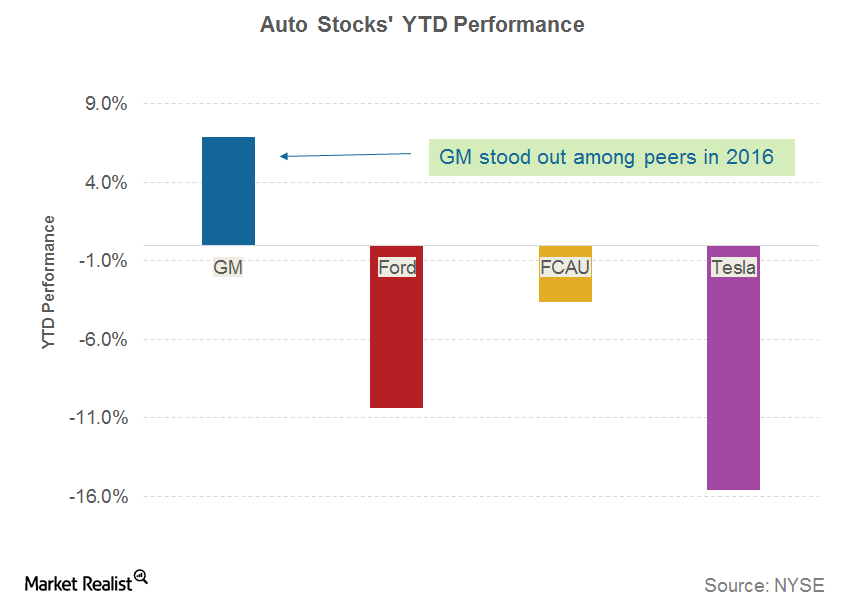

Can GM’s Stock Sustain Its Year-to-Date Rise in December?

General Motors has delivered a return of 6.9% year-to-date as of December 16, 2016. This return was much lower than the 10.5% return of the S&P 500 Index.

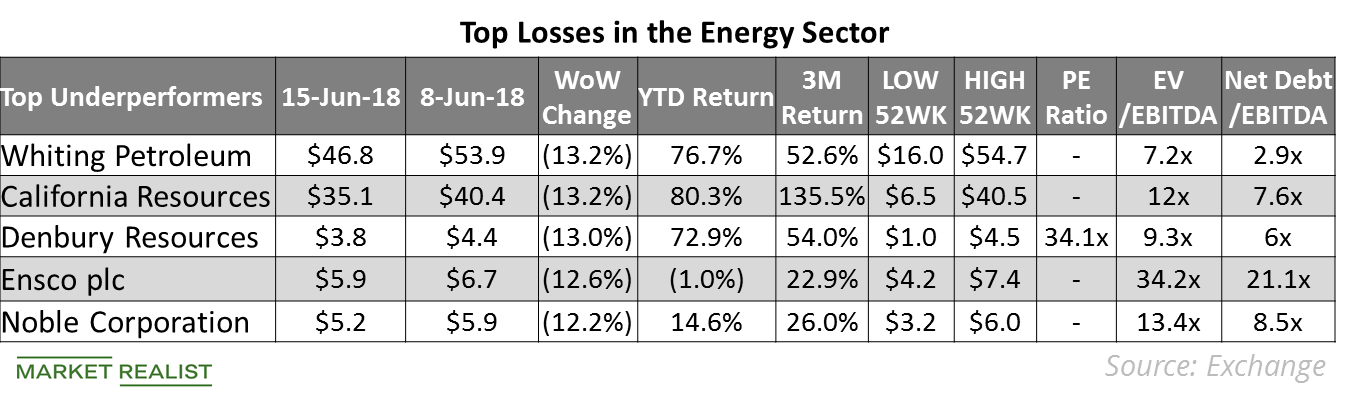

Top Energy Losses Last Week

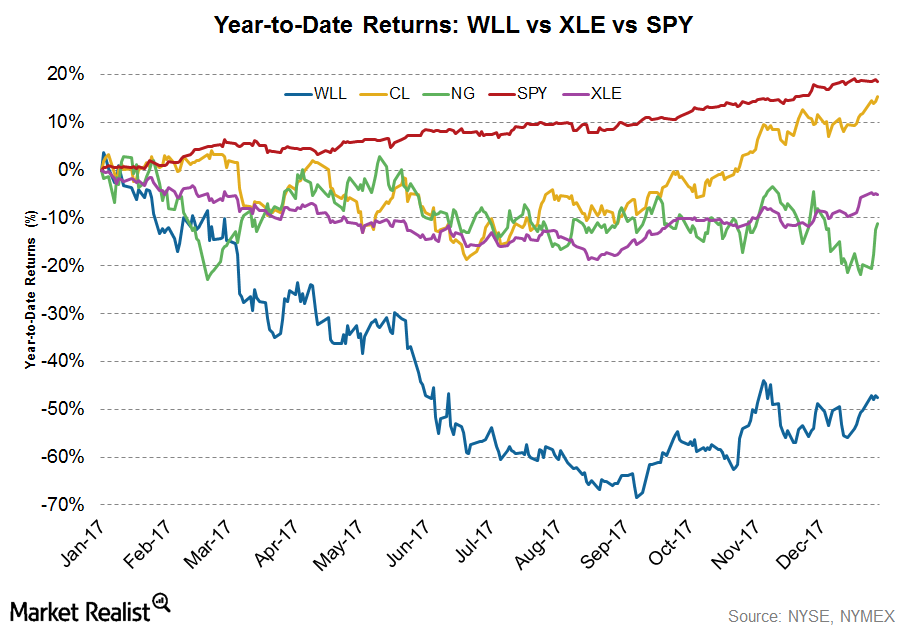

On June 8–15, Whiting Petroleum (WLL) and California Resources (CRC) fell the most on our list of energy stocks.

US Businesses Push Back against Trump’s Tariffs

Farmers for Free Trade’s campaign was rolled out on September 12 with the slogan “Tariffs Hurt the Heartland.”

A Look at Time Warner’s Key Metrics

In fiscal 1Q16, Time Warner bought back $700 million worth of shares. Including dividends, it has returned around $1.3 billion to its shareholders year-to-date.

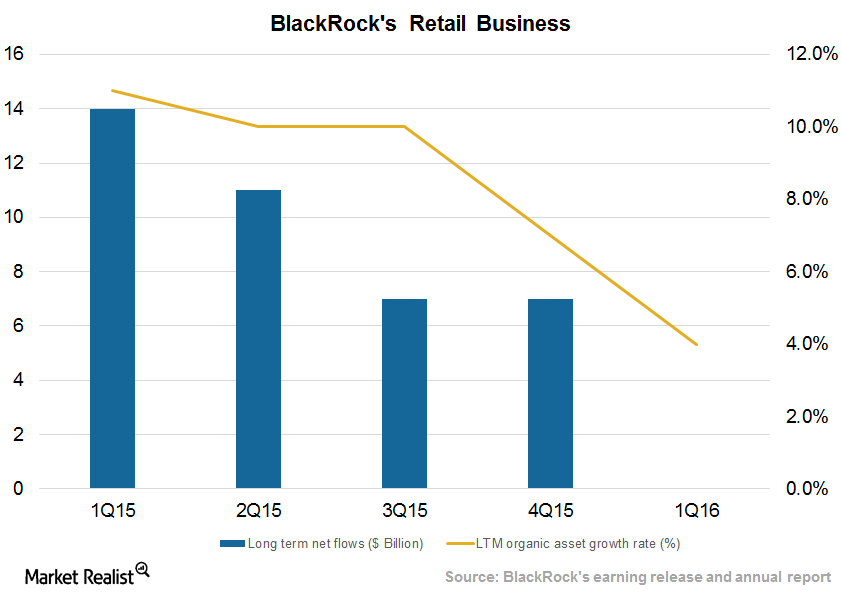

BlackRock’s Retail Continues to Attract New Clients across Classes

BlackRock’s (BLK) retail business had assets under management (or AUM) of $542 billion as of March 31, 2016.

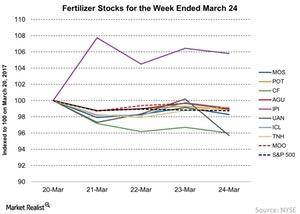

Fertilizer Stocks and Commodity Prices: Week Ending March 24

The week ending March 24, 2017, was broadly negative for agricultural fertilizer stocks. The VanEck Vectors Agribusiness ETF (MOO) fell 0.98%.

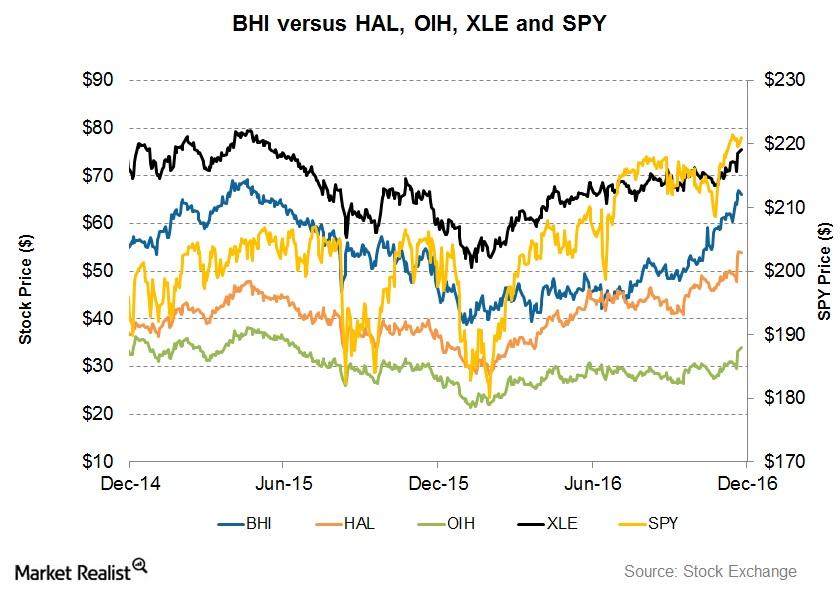

Will a Partnership with GE Improve BHI’s Returns?

Between December 2014 and December 2016, Baker Hughes (BHI) stock hit its peak in April 2015. It troughed at ~$39 in January 2016.

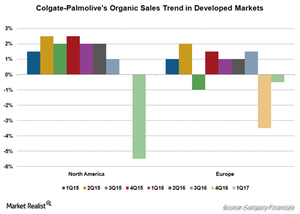

Colgate-Palmolive’s Developed Markets Remained a Drag in 1Q17

Net sales in North America fell 5.0% in 1Q17, reflecting a strong decline in volumes coupled with lower pricing.

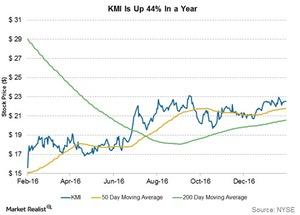

Will Kinder Morgan Stock Continue to Surge in 2017?

Kinder Morgan stock has risen 44% in the past year, as compared to Enterprise Products Partners’ 32% rise and ONEOK’s 162% rise.

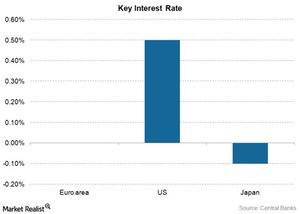

Why Do Central Bankers Continue to Surprise Bill Gross?

In his recent webcast by Janus Capital, Bill Gross expressed his surprise at the extent to which central bankers of the developed world (EFA) (VEA) have distorted the financial system.

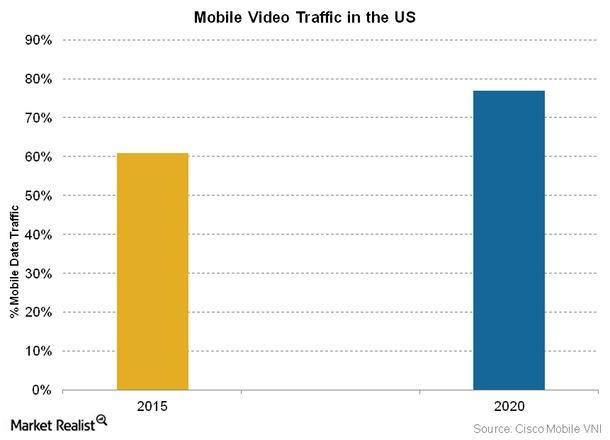

Why Netflix Is Streaming Low-Quality Video on AT&T and Verizon

Netflix has been streaming low-quality videos for subscribers on AT&T and Verizon Communications’ (VZ) wireless networks. Here’s why.

What Drove Whiting Petroleum Stock in 2017?

Whiting Petroleum (WLL) stock rose 5.3% in the week ending December 29 from the previous week. However, the stock fell ~47.6% by the end of 2017.

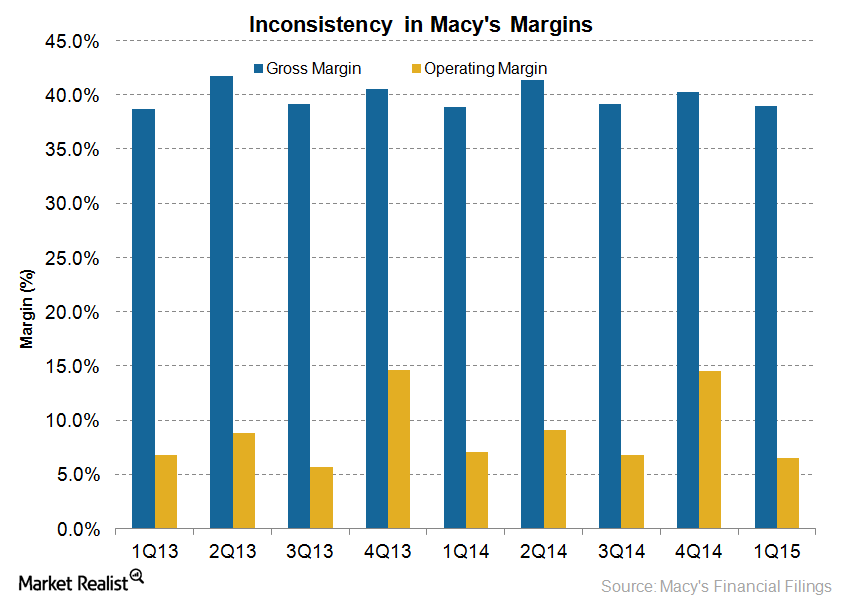

What Went Wrong with Macy’s 1Q15 Operating Margins?

Macy’s (M) operating margins declined to 6.6% in 1Q15—ending May 2, 2015—from 7.1% in the same quarter last year. The operating income declined by 7.7%.