SPDR® S&P 500 ETF

Latest SPDR® S&P 500 ETF News and Updates

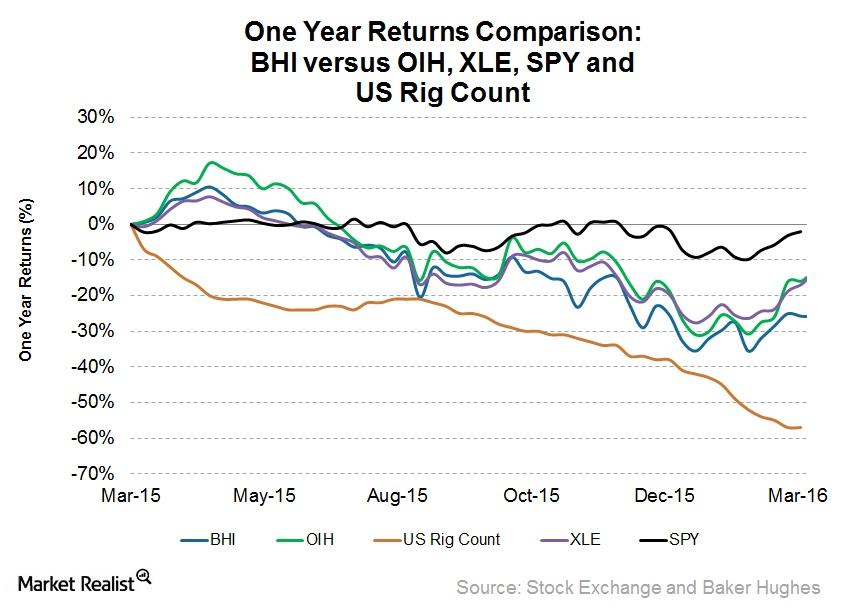

Why Did Baker Hughes Underperform the Industry ETFs?

Oilfield equipment and services companies like Baker Hughes (BHI) are affected by rig counts and energy prices. In the past year, West Texas Intermediate crude oil prices have dropped ~16%.

Why Facebook’s $1 Billion Video War Chest Isn’t Surprising

Paying $3 million per episode Facebook (FB) could spend as much as $1.0 billion on original content acquisition for its video business, according a Wall Street Journal report. While this is a huge content budget, for a company that has relied on free content generated by its users over the years, it isn’t surprising. First, ahead […]

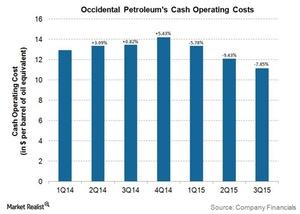

How Is Occidental Petroleum Managing the Falling Energy Prices?

According to Occidental Petroleum’s 3Q15 form 10Q filing, changes in energy prices affected its quarterly earnings by $30 million in crude oil.

How Tesla’s Q2 Earnings Could Impact NIO Stock

Tesla will likely release its second-quarter results today after the market close. The company’s results could offer insights into NIO’s outlook.

Tesla Delivers on Musk’s Vision in Q2, NIO Could Follow

Tesla and NIO stocks have risen sharply this year. Tesla reported a net profit in the second quarter, which makes it eligible for inclusion in the S&P 500.

Stanley Druckenmiller Is Bearish on Growth Stocks: What’s He Buying?

Amazon (NASDAQ:AMZN), Facebook (NASDAQ:FB), and Microsoft (NASDAQ:MSFT) remained in Stanley Druckenmiller’s top five holdings in the first quarter.

Will US Stock Markets Crash? IMF and Rogers Weigh In

Several analysts have said that US stock markets are ripe for a crash. They called out the disconnect between financial markets and the economy.

Bill Ackman Rolled the Dice, Profited from US Stock Market Crash

Bill Ackman made the correct bets when US stock markets crashed in the first quarter. He has been outperforming SPY by a wide margin this year.

Musk Might Consider Another Stock Offering for Tesla

Tesla raised over $2 billion through equity issuance in February. On February 13, Tesla stock closed with gains after it announced the capital raise.

Goldman Sachs Warns about a US Stock Market Crash

Goldman Sachs expects the S&P 500 to crash to 2,400. However, the firm expects the S&P 500 to end the year at 3,000 level.

Gold Prices: Undervaluation, Smart Money Piles Up

Since March, gold prices are on a tear due to uncertainty surrounding COVID-19. The SPDR Gold Shares has seen gains of 16.2% since March 18.

How Does the Oil Price Crash Impact Warren Buffett?

For the first time, WTI crude prices fell into the negative zone during trade on Monday. Warren Buffett invested in Occidental Petroleum last year.

TSLA Stock Spikes: Is It Fundamentals or Speculation?

While TSLA stock bulls see the rise as fundamental, bears and many observers are calling it a “speculative bubble.” So, where do we draw the line?

Cisco Systems’ Resurgence May Just Be Getting Started

Cisco (CSCO) stock was under pressure in 2019 due to the US-China trade war. Options traders are betting on CSCO’s rise by the middle of March.

Was 2019 a “Nightmare” for Warren Buffett and Berkshire?

Warren Buffett underperformed the stock markets last year. Berkshire Hathaway’s returns versus the S&P 500 were the worst since 2009.

China’s PMI: More Signs Emerge of Bottoming Out

Today, China released its official December manufacturing PMI. The PMI was 50.2 for December. The analysts polled by Reuters expected the PMI to be 50.1.

The 2019 US Stock Market Crash that Never Came!

Global stock markets added $17 trillion in value this year. A year back, most economists saw dismal stock market returns in 2019.

Goldman Sachs’ Best Stock Picks for 2020

Strategists at Goldman Sachs (GS) project Netflix (NFLX), T-Mobile (TMUS), and Coca-Cola (KO) to be among the best stock picks for 2020.

Why China Trade Deal Won’t End the Trade War

Although phase one of the China trade deal won’t end the US-China trade war, it will help restore market sentiments. The trade war is almost two years old.

Understanding PepsiCo’s Business Segments and More

PepsiCo (PEP) is one of two beverage-industry behemoths. We break down everything investors should know about the stock and the business.

What the Hewlett Packard Split Means for Shareholders

Hewlett Packard split into two $50 billion entities in order to provide value to shareholders, better manage the business, and drive growth.

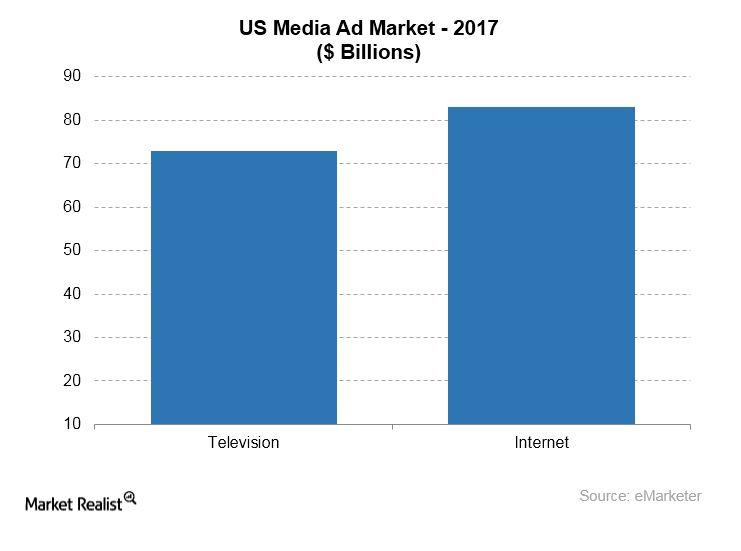

How Do Media Networks Make Money?

Media networks face stiff competition for acquisition and distribution of content. Quality and exclusivity add to competition across the media value chain.

Ray Dalio, the Role of Credit, and the Economic Machine

Credit is the most important part of the economy, leading to increased spending, increased income levels, higher GDP, and faster productivity growth.

Warren Buffett Has Loads of Cash and No Takers

Berkshire Hathaway’s huge cash pile might stay in place for a while. Warren Buffett was outbid by Apollo Global Management in his efforts to buy Tech Data.

Can Tesla Create a New Market with the Cybertruck?

Tesla’s (TSLA) electric pickup truck, also known as the Cybertruck, has been one of the most polarizing vehicles recently unveiled.

Will Tesla Solar’s Israel Expansion Bring Success?

Tesla registered a wholly-owned subsidiary in Israel last month. Along with expanding its EV business, its foray will be important for its Solar segment.

Will Consumer Confidence Data Hurt Chances of Rate Cut?

After declining in June, consumer confidence rebounded in July to its highest level yet in 2019.

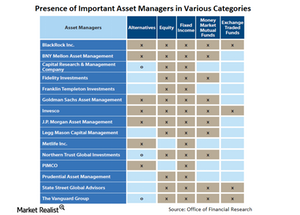

The main players in asset management

The efficient market hypothesis maintains that the market prices everything correctly and so it isn’t possible to outperform the market in the long run.

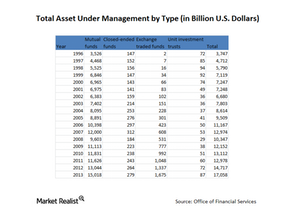

How big is the asset management industry?

Audited and verified annual figures at the end of 2013 indicate that total assets under management of US registered investment companies equalled nearly $17.1 trillion.

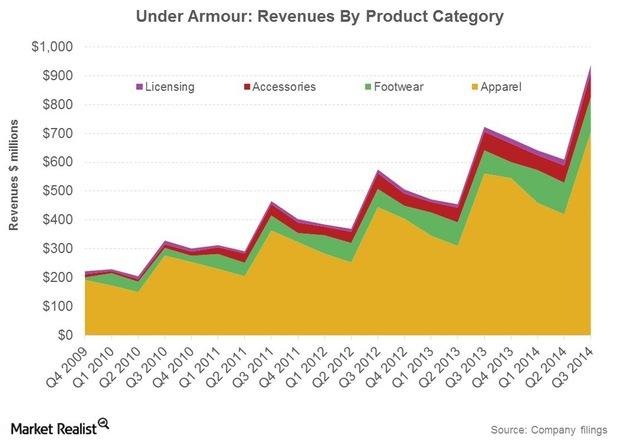

Under Armour: The Nature Of Its Business, Product Portfolio

UA’s product, marketing, and sales teams each play an active role in the design process. This collaboration helps control brand and product consistency.

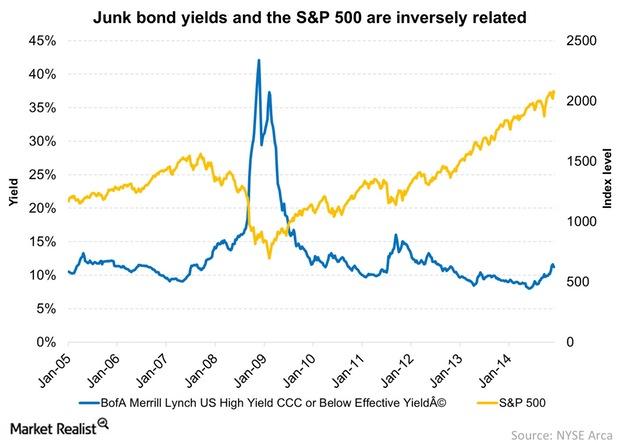

Connection Between Equities And High Yield Bonds

Equities and high yield bonds perform well when the economy is improving, and both underperform when the economy is slumping.Financials Hawks and doves: Why Fed-watching isn’t for the birds

The FOMC is made up of hawks and doves, and their balance could affect future policy. Investors who follow the Fed need be able to tell the differences.

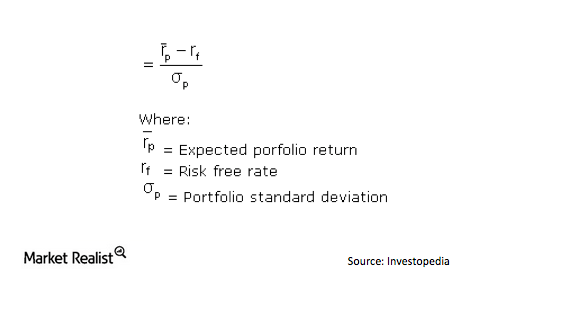

Why you should use the Sharpe ratio when investing in the medical device industry

What is a Sharpe ratio? A Sharpe ratio is a tool that measures the amount of returns for each unit of volatility that’s generated by a portfolio (higher returns and lower volatility equals more returns per unit of volatility). The measurement allows investors to analyze how much return they’re receiving from a portfolio in exchange for […]Financials How close is the FOMC to achieving its dual mandate?

We’ve talked about the dual mandate and factors constraining the Federal Reserve from achieving this mandate. Let’s now assess how close the Fed has come to achieving its macroeconomic objectives.Financials Why credit upgrades and downgrades affect bond returns

A ratings upgrade or downgrade has a direct impact on fixed income yields, and therefore directly affects bond prices.Materials Is gold no longer an inflation hedge?

Gold certainly can be an inflation hedge, and it has worked in the past. Obviously, one of the reasons gold has been weak of late is that people are becoming less concerned about inflation.Financials Why we need to relook at the consumer in this week’s releases

This week is full of indicators, with most of them being measures of national-level economic activity.Financials Overview: The must-know characteristics of frontier markets

Looking for the next frontier in emerging market investing? Del Stafford dives into these underdeveloped countries to assess the investment case.Financials Why you should pay attention to Scottish referendum opinion polls

As I write in my new weekly commentary, over the past two weeks, several polls have suggested a realistic chance that the people of Scotland will vote for independence in this week’s referendum.

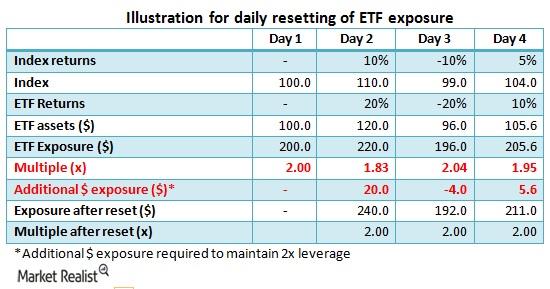

How daily re-balancing affects returns on leveraged ETFs

Leveraged ETFs seek to provide a certain multiple (generally 2x or 3x) of daily returns on the underlying index. The daily movements in the underlying index and subsequent changes in ETF exposure may mean the ETF manager needs to rebalance the portfolio daily.

Twitter Stock Is Poised for a Rebound

We take a close look at Twitter’s chart, options activity, and institutional transactions to see if the stock could rise in the coming weeks.Financials Why the banking sector is better, but with room for improvement

Russ explains the good news behind his upgrade of the global financial sector as well as the bad news keeping his sector outlook somewhat subdued.Financials Overview: What stretched valuations mean for investors

As I’ve been noting for some time, emerging markets (EEM) can offer compelling long-term value.

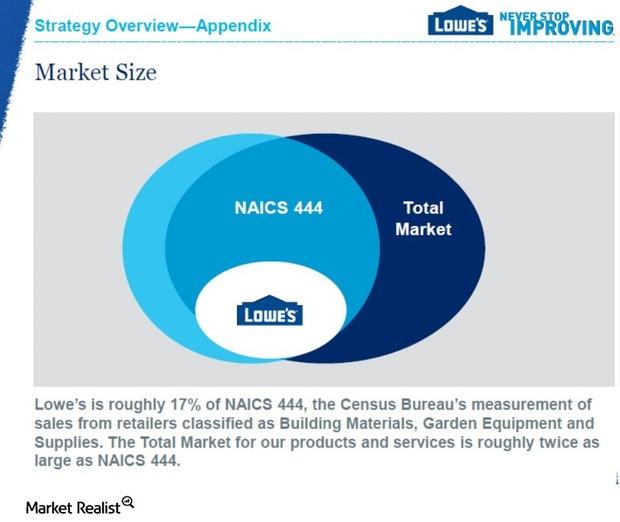

Porter’s 5 Forces: Lowe’s Position in a Competitive Industry

Lowe’s (LOW) operates in the home improvement industry where most products, especially building materials, are largely standardized and undifferentiated.

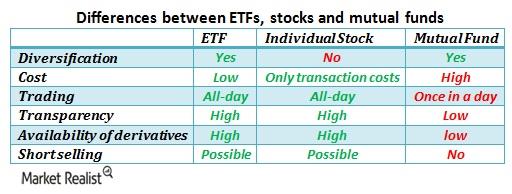

A closer look at the difference between ETFs and mutual funds

Before moving to inverse and leveraged ETFs in the next part of this series, we’d like to quickly discuss the differences between ETFs and mutual funds.

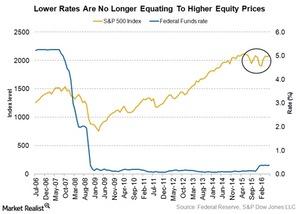

Lower Rates Aren’t Equating to Higher Equity Prices

Bill Gross provided his view on lower rates no longer resulting in credit creation in the economy. They have also lost their efficacy in raising equity prices.

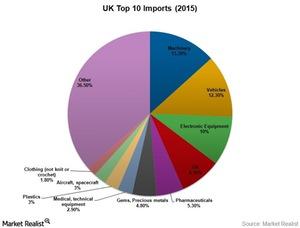

Will Brexit Weaken the UK’s Competitive Advantage over the US?

On Brexit, import restrictions and tariff quotas currently applicable to importers in the UK and foreign businesses that export to the UK are set to change.

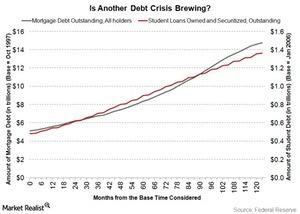

Is Student Debt the Next Bubble to Hit the US Economy?

Many are likening the current student debt situation in the United States to the mortgage debt situation that led to the 2009 financial meltdown in the US economy.

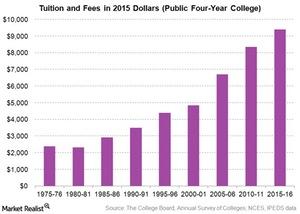

Why Is College Education So Expensive in the United States?

The rise in delinquencies on student loans in the United States (SPY) (IWM) (QQQ) can be partially attributed to the accelerated rise in college tuition and fees.

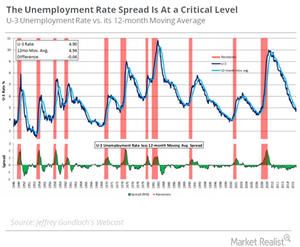

Gundlach Says This Chart Is ‘Early Warning Indicator’ of Recession

Jeffrey Gundlach seems quite bearish in his views about the US economy (IWM) (QQQ).