SPDR® S&P 500 ETF

Latest SPDR® S&P 500 ETF News and Updates

Is President Trump Robbing Peter to Pay Paul?

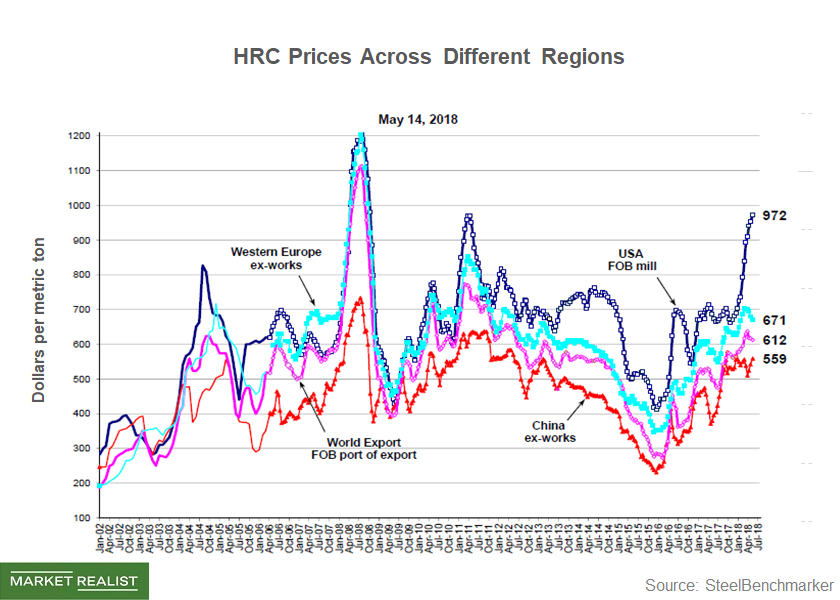

While higher steel prices benefit US steel producers, they raise input costs for downstream manufacturers.

How Moat Indexes Performed in September

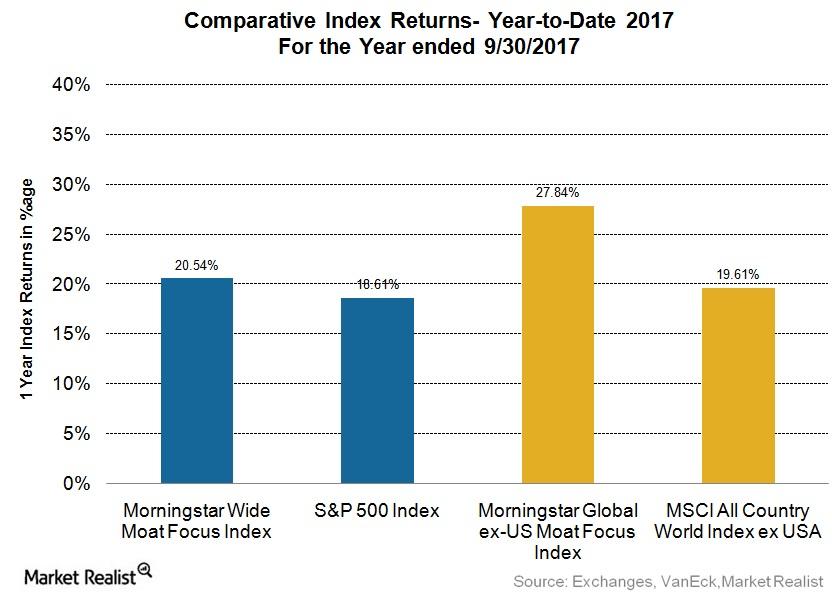

The US Moat Index has been performing fairly well this year. As of September 30, 2017, it has outperformed, rising 20.5% over the S&P 500 Index’s (SPY) (SPX-INDEX) rise of 18.6% YTD.

Why JCPenney Considers Its Private Brands to Be Vital

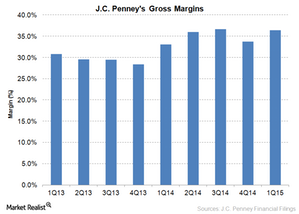

JCPenney (JCP) considers its private brands as key sales drivers. Some of the company’s popular private brands are St. John’s Bay, Arizona, Okie Dokie, Total Girl, and Xersion.

Downward trend: McDonald’s November Same-Store Sales

McDonald’s November same-store sales indicate a continued slide in all segments. Tensions between Russia and Ukraine are partially to blame.

Worried about a US Stock Market Crash? So Is Everyone!

Investors are concerned that US stock markets might crash. Notably, markets have staged a remarkable comeback from their March lows.

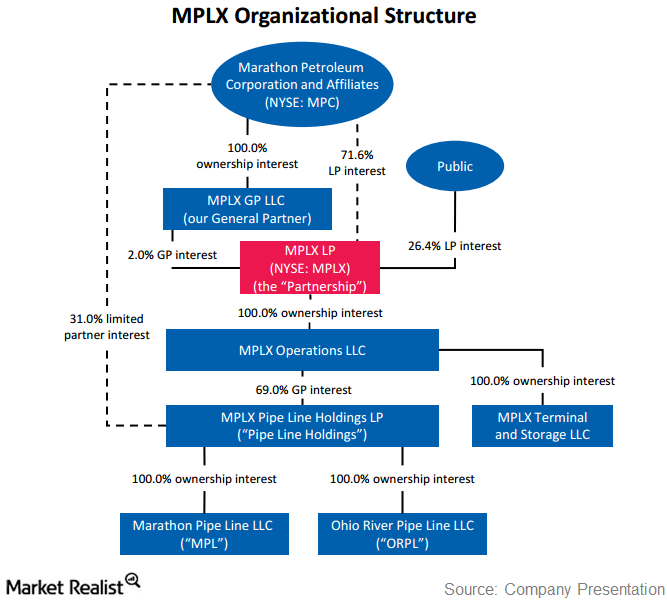

MPLX LP: The infrastructure link in Marathon Petroleum’s chain

Marathon Petroleum Corporation, or MPC, owns 100% of the MPLX general partnership, or GP, interests, as well as the incentive distribution rights.

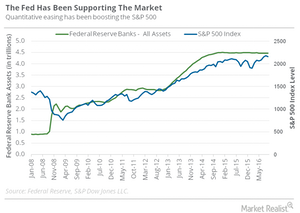

Jeffrey Gundlach: The Fed Has Been Supporting the S&P 500

Gundlach also believes it’s interesting to look at the correlation between the size of the Fed’s balance sheet and the S&P 500 (SPY) (SPXS) (SPXL) level.

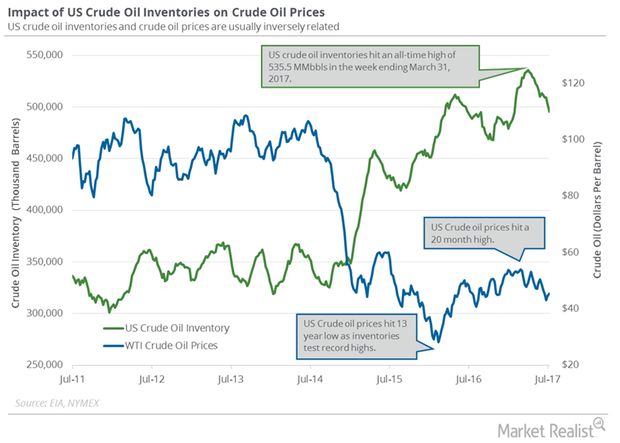

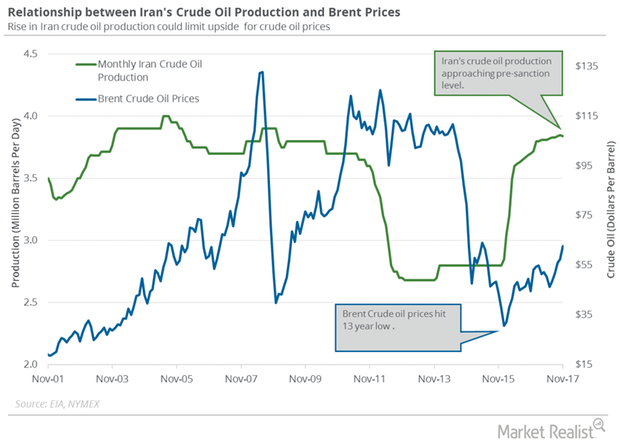

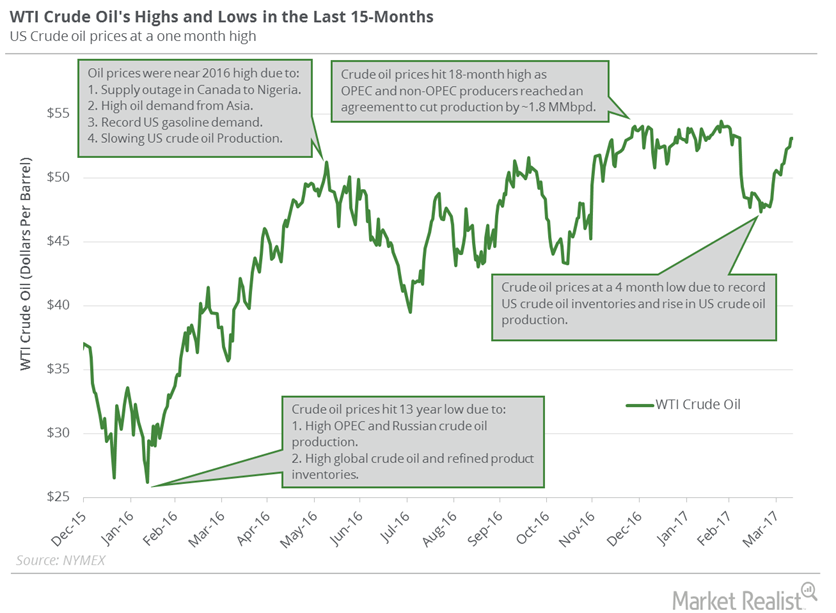

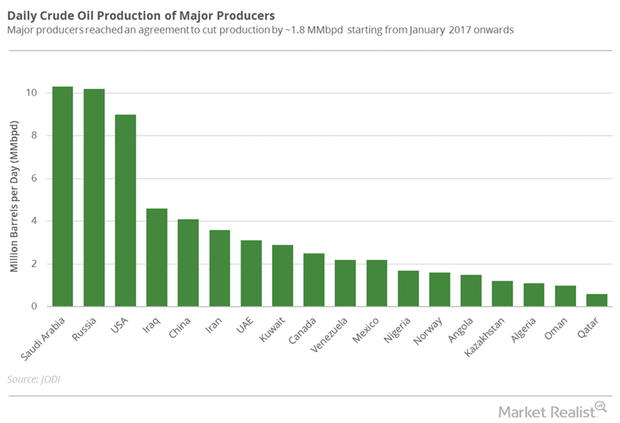

Supply, Demand: Will Crude Oil Futures Rally Be Short-Lived?

August WTI (West Texas Intermediate) crude oil futures contracts rose 1.0% and closed at $45.49 per barrel on Wednesday, July 12, 2017.

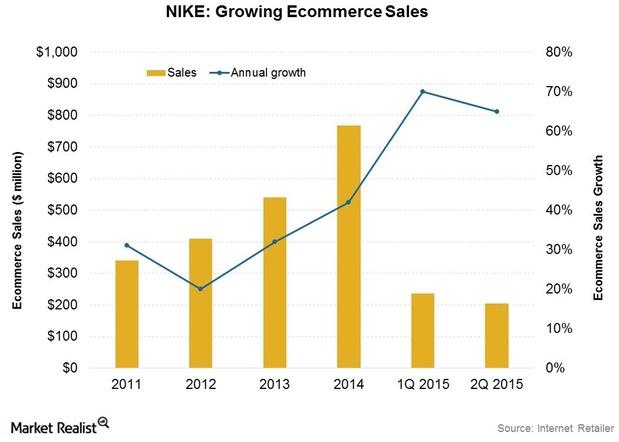

Why Nike Is Able to Turn a Profit in E-Commerce

The Nike+ Training Club clocked ~17 million downloads by 1Q15. The app is now available in 18 languages, creating the framework for a global community.

Ross Stores or Burlington Stores: Which Looks Better in 2019?

Ross Stores and Burlington Stores stocks have risen 8.9% and 1.2%, respectively, on a year-to-date basis as of January 14.

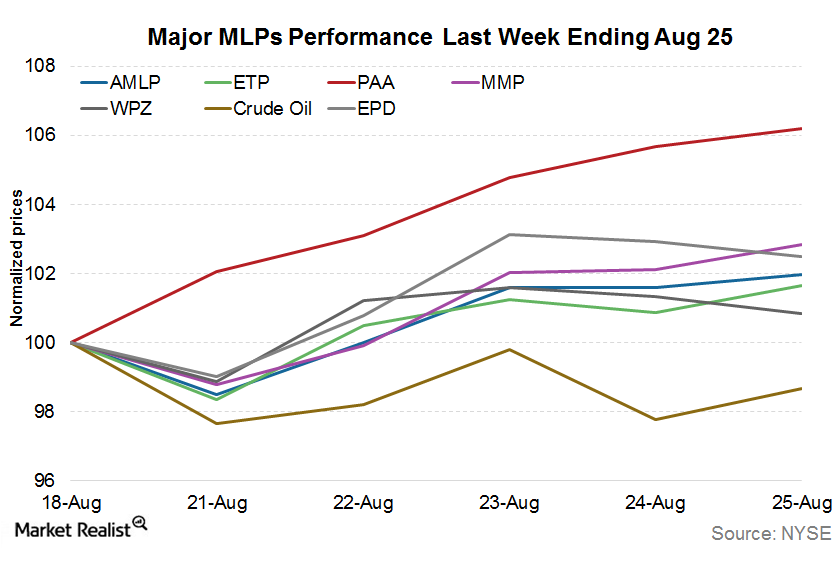

MLPs Recovered Slightly in the Week Ending August 25

MLPs recovered slightly in the week ending August 25—possibly due to an overcorrection in the first three weeks of the month.

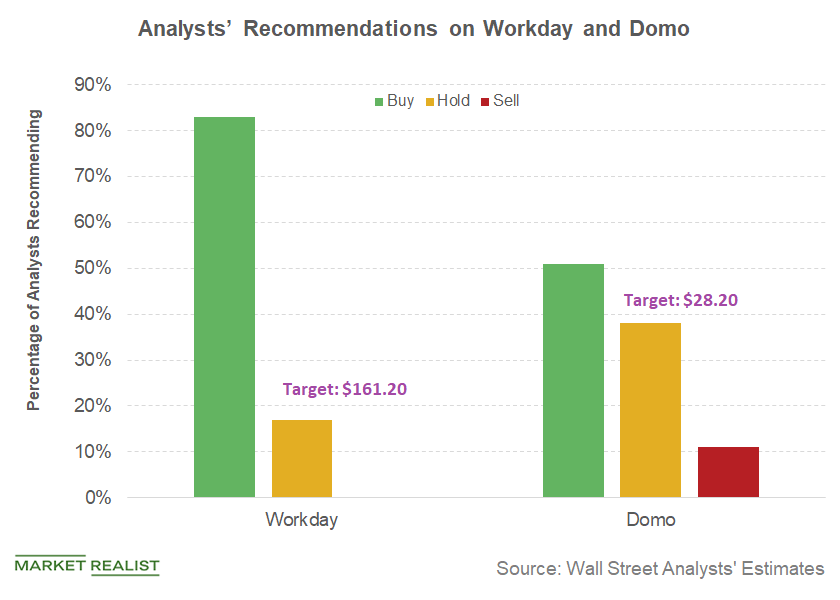

How Jeff Bezos’s Workday and Domo Investments Fared in 2018

Twitter stock surged by about 73% in the first trading day after its IPO to $44.90.

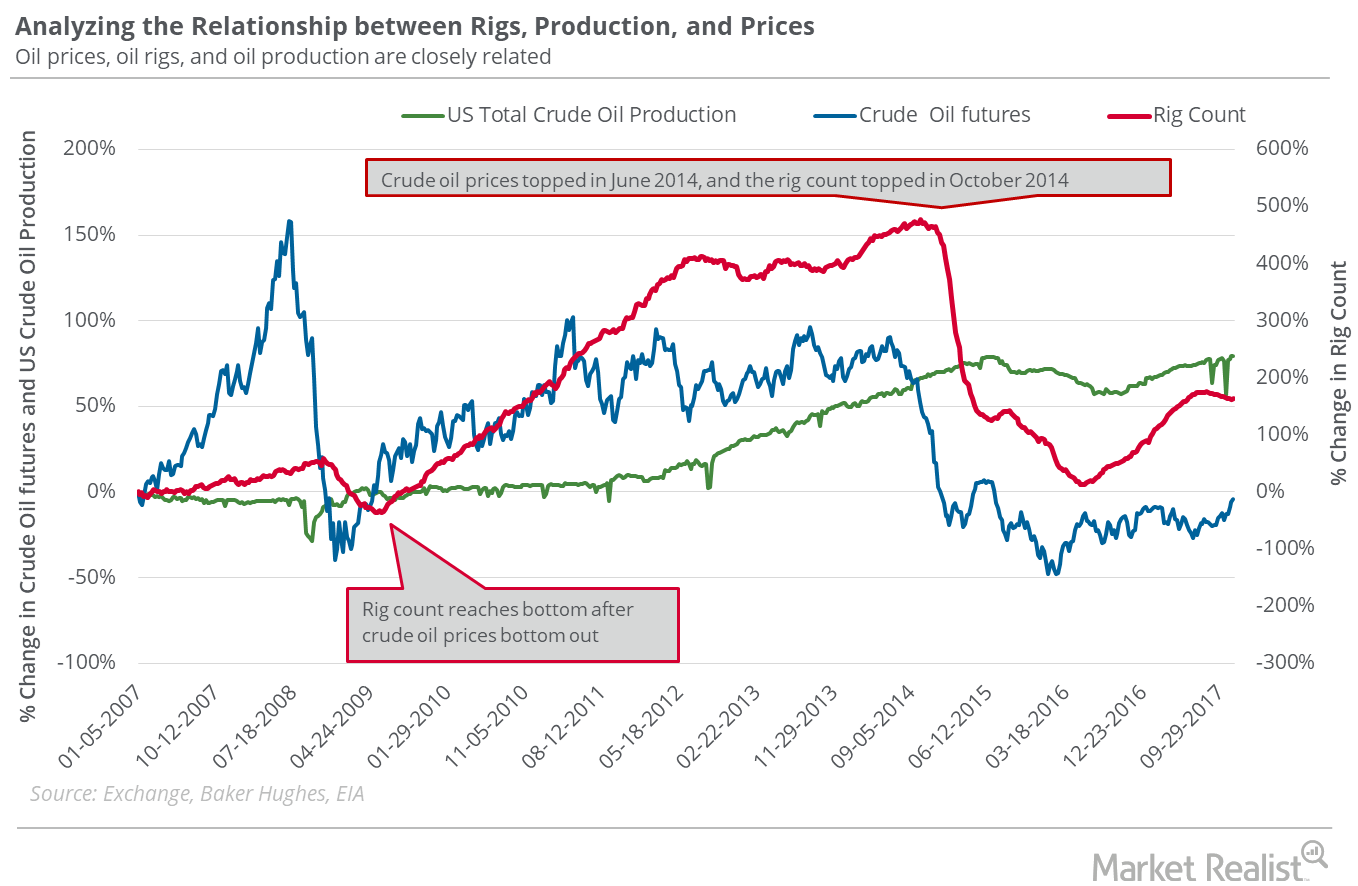

Bullish Oil Traders Must Count the Oil Rigs

On November 24, 2017, US crude oil settled at the highest closing price in 2017. The oil rig count could be at a three-year high by May 2018.

Is It Worth Risking Long Trades in Oil?

On November 24–December 1, 2017, US crude oil (USO) (USL) January futures fell 1%. On December 1, US crude oil January futures closed at $58.36 per barrel.

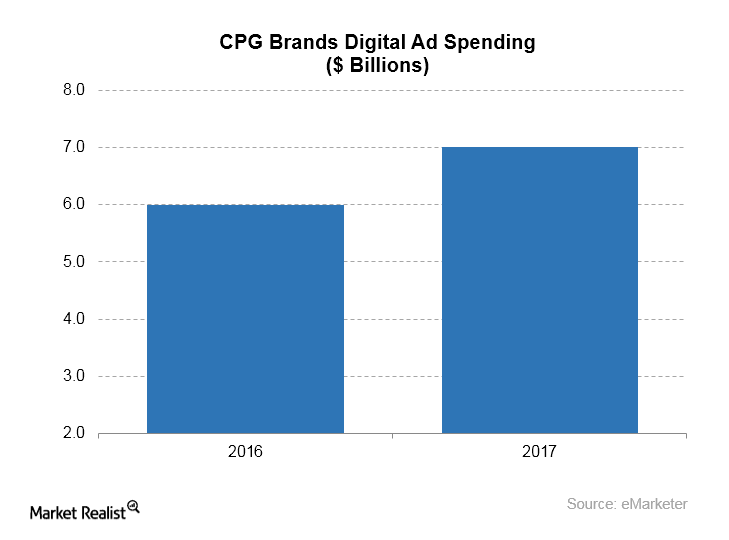

What Are the Trends in Facebook’s Largest Advertising Category?

Business intelligence firm eMarketer estimates that CPG brands spent more than $7.0 billion on digital advertising in 2017, compared with $6.0 billion in 2016.

What’s Holding US Crude Oil below $60?

On December 11, US crude oil January 2018 futures rose 1.1%. The 2% rise in Brent crude oil prices could have supported the gain in US crude oil prices.

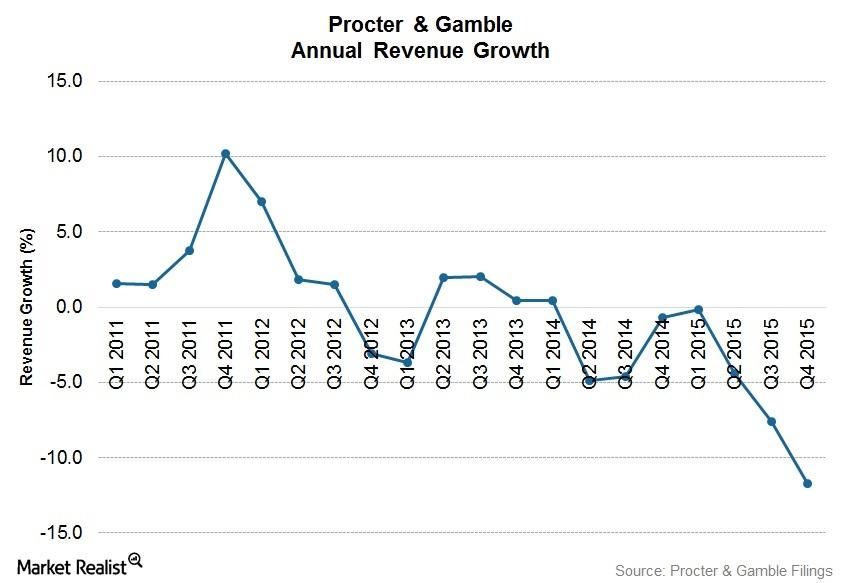

Mega Brands Set to Dominate in P&G’s New Product Portfolio

P&G plans to focus on superior brands in the 10 product categories in its portfolio. It expects one-third of them to surpass $1 billion in annual sales.

What to Watch when Oil’s at a 3-Year High

From January 5 to January 12, 2018, US crude oil February futures rose 4.7%. On January 12, US crude oil futures closed at $64.3 per barrel, their highest closing price since December 8, 2014.

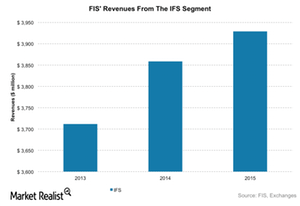

Inside FIS’s Integrated Financial Solutions Segment

FIS’s Integrated Financial Solutions segment caters to North American banks and is the largest contributor to the company’s total revenues (~60%).

Nike’s Target Markets: Everything You Need to Know

Nike (NKE) faces some challenges in its target markets. In the US, economic growth rates have tapered down, and the trade war could affect its China market.

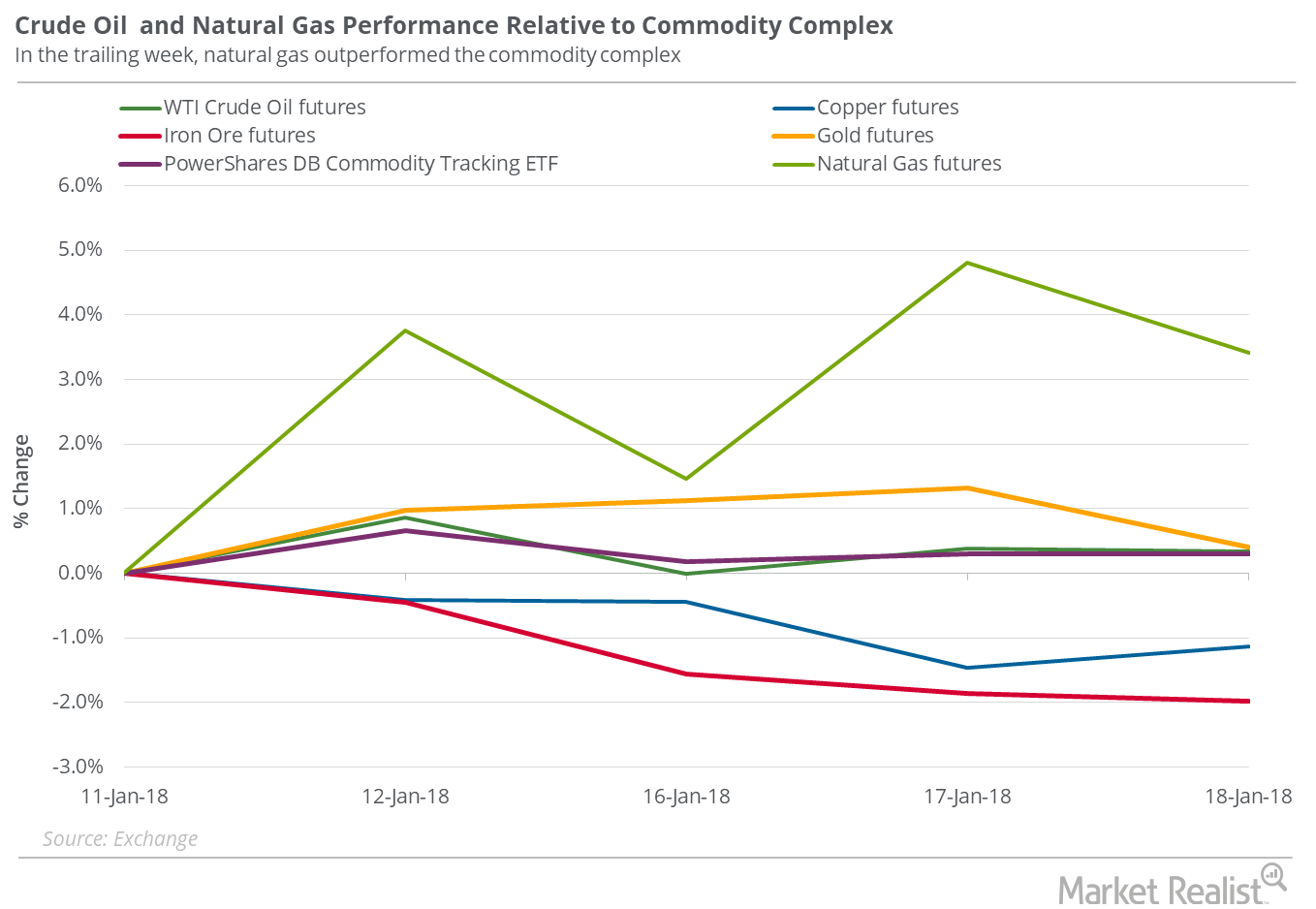

Why Oil Prices Have Been Relatively Flat

On January 18, 2018, US crude oil (USO) (USL) March 2018 futures were almost unchanged at $63.89 per barrel.

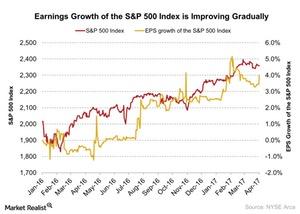

Jurrien Timmer’s Take on What Will Drive Markets the Most in 2017

When asked in a recent interview his thoughts about the short-term and medium-term investment story, Jurrien Timmer said that the main issue for the market other than geopolitical risks is its valuation.

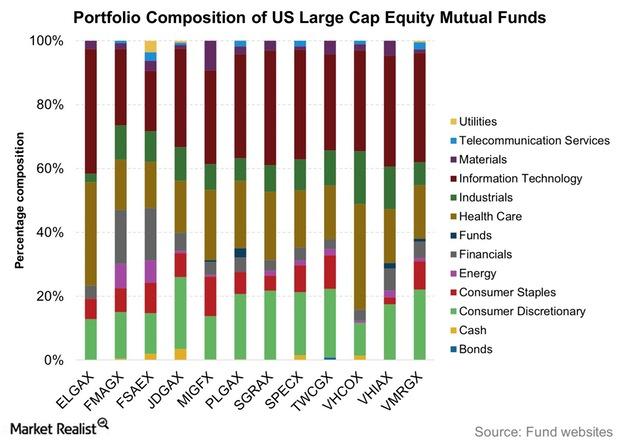

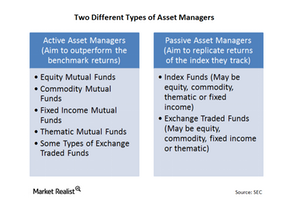

US Large-Cap Equity Funds: Is Active or Passive Investment Best?

Except for one fund (MIGFX), no other actively managed fund that we have reviewed in this series has been able to outperform the passively managed SPY.

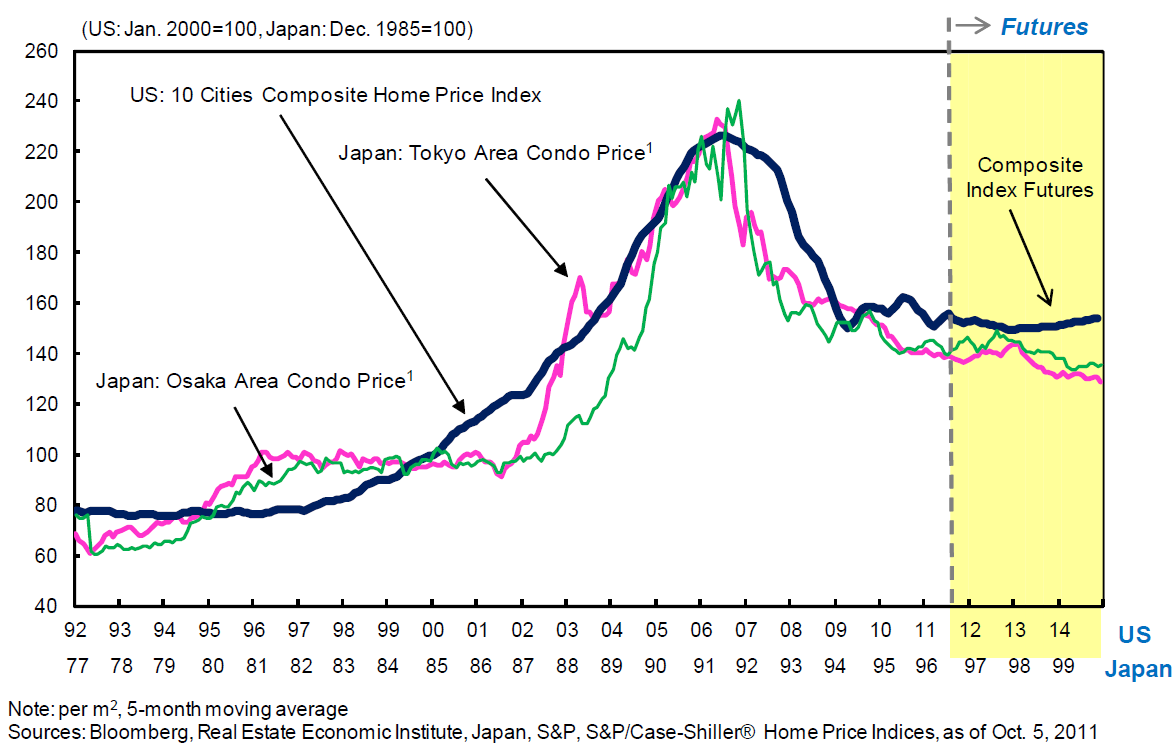

Why we’re seeing a brand new housing bubble—Japan style

Residential investments in Japan The below graph reflects the ongoing decline in the rate at which residential investments are being made in Japan. As with other forms of fixed investment noted earlier in this series, Japan has seen a long-term decline in the housing market since the peak of the economic bubble, which was accompanied […]

Will Crude Oil Futures and S&P 500 Move in the Same Direction?

February US crude oil (UWT) (USL) futures contracts rose 0.5% to $61.73 per barrel on January 8. Prices are near the highest level since December 2014.

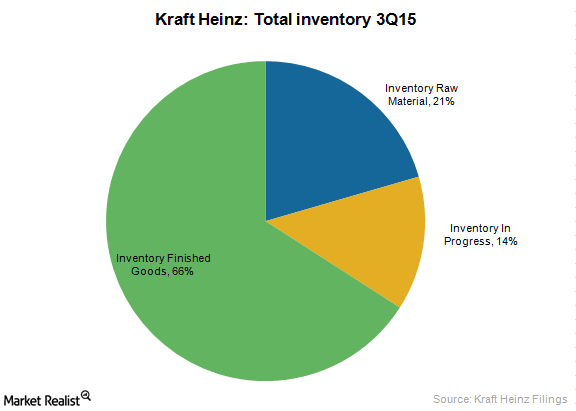

Sizing up Kraft Heinz’s SKU Rationalization Technique to Manage Inventory

Heinz has been using an inventory management technique, SKU rationalization to focus on profitable growth, which helps improve sales and profitability.

S&P 500 Index Nears Record High amid Earnings Season

The S&P 500 Index, represented by the SPDR S&P 500 ETF (SPY), rose 0.3% on October 23, nearing the all-time high it saw in July.

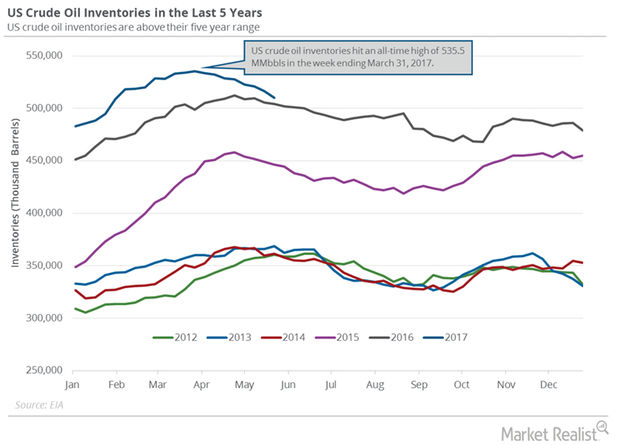

US Crude Oil Inventories: Lower than the Market’s Expectation

The EIA reported that US crude oil inventories fell by 6.4 MMbbls (million barrels) to 509.9 MMbbls on May 19–26, 2017.

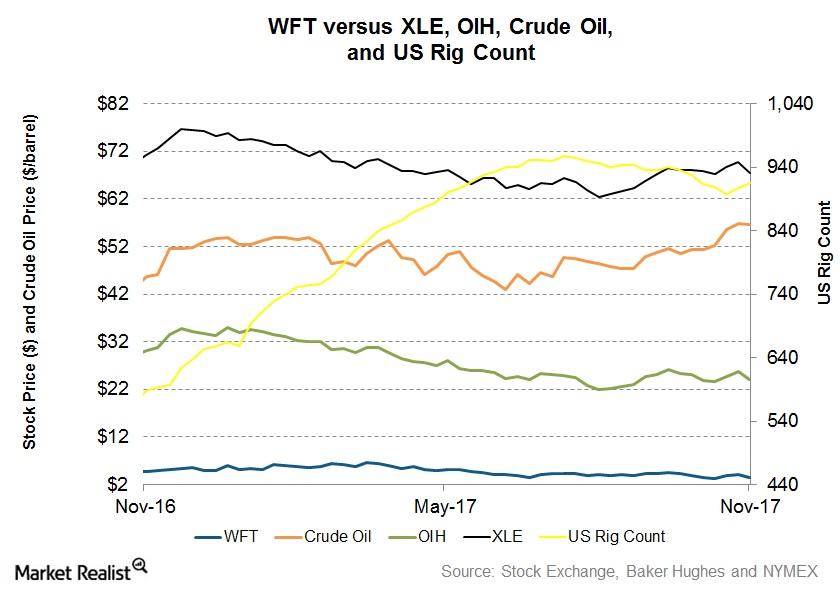

How Weatherford Stock Moved in the Week Ended November 17

Weatherford International (WFT) stock fell 16.0% in the week ended November 17, 2017. The VanEck Vectors Oil Services ETF (OIH) generated a return of -6.0% during this period.

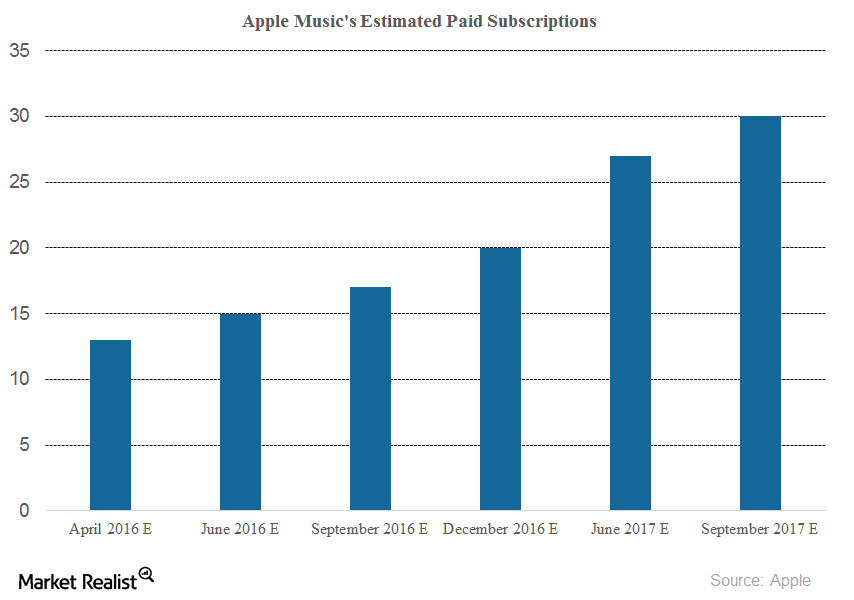

Understanding Apple Music’s Rising Subscriber Base

Last month, Apple (AAPL) announced that its music streaming service, Apple Music, now has over 30 million subscribers—up from 27 million in June 2017.

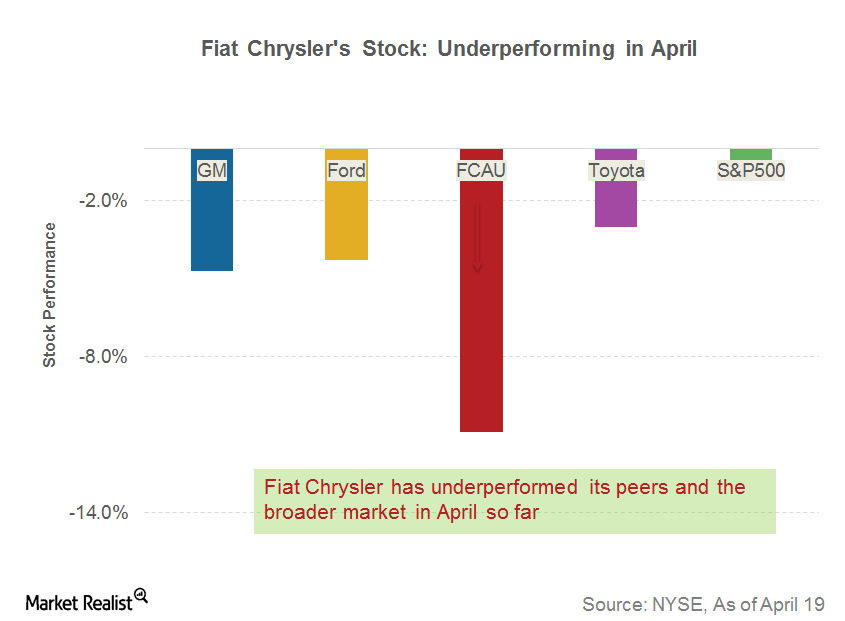

How Has Fiat Chrysler’s Stock Fared in April So Far?

Fiat Chrysler Automobiles (FCAU) is set to release its 1Q17 earnings report on April 26, 2017. By 2016 vehicle sales volume, FCAU was the fourth-largest automaker in the US.

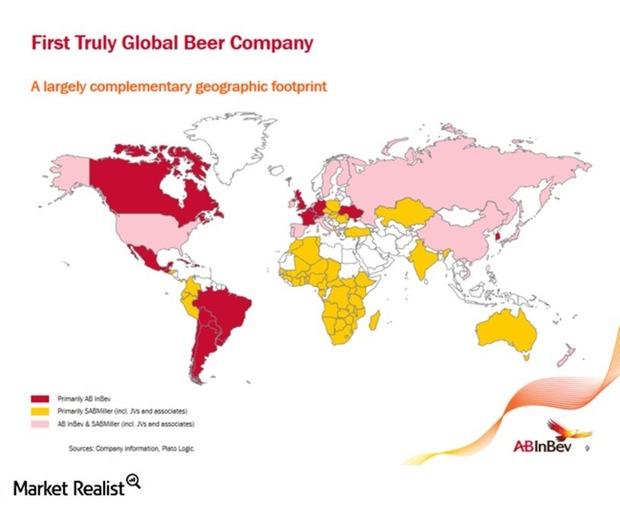

Anheuser-Busch InBev Bids for SABMiller: Analysis

On October 7, Anheuser-Busch InBev announced a formal cash bid of 42.2 pounds per share to SABMiller’s board. This was the third offer rejected by SABMiller.

Will Crude Oil Prices Hit a New High?

US WTI crude oil prices were at $54.45 per barrel on February 23—the highest level since June 2015. As of April 10, prices were 2.5% below their high.

Who Are the Biggest Players in the Fertilizer Industry?

There’s a handful of big players in the agricultural fertilizer industry. Setting up business requires huge capital, which makes for a high barrier to entry.

NIO, TSLA, and WKHS: Are EV Stocks the Pot Stocks of 2020?

Amid the global pandemic and somber mood elsewhere, 2020 has been incredible for EV stocks. Their gains have beat the benchmark indices.

Nike’s Outlook: Category Offense All the Way

Consensus Wall Street analyst estimates project Nike’s adjusted diluted EPS to be $3.58 in fiscal 2015, an increase of 19.7% over the previous year.

Traditional assets: Defining active and passive management

Active asset management refers to those asset managers that essentially try to outperform the average market return, a benchmark, or a hurdle rate that may have been set internally.

An Investor’s Guide to Chipotle and Its Customers

Chipotle Mexican Grill (CMG) operates more than 1,700 fast-casual restaurants. Here’s everything you need to know about the business.

Crude Oil and Product Inventories Impact Crude Oil Futures

US crude oil futures have risen 6% from the ten-month low on June 21, 2017. Futures have also risen 2% in the last month.

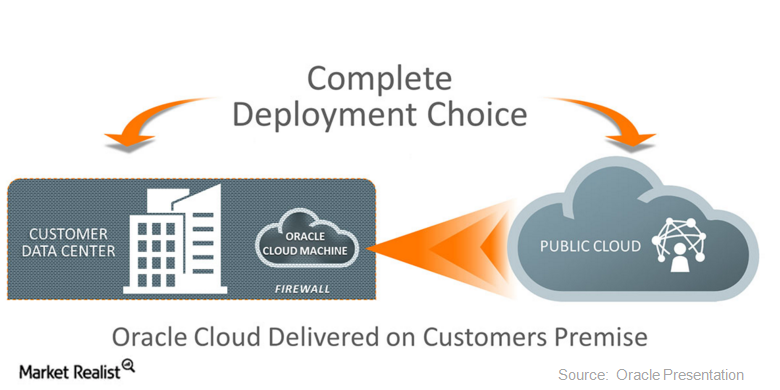

Oracle Cloud at Customer: Could It Boost Oracle’s Position?

On March 24, 2016, Oracle (ORCL) announced a new service in the cloud: Oracle Cloud at Customer. It’s a hybrid structure in which a client can run the workload on-premise or in Oracle cloud.

Should You Follow Jeff Bezos and Invest in Uber and Airbnb IPOs?

Bezos invested about $37 million in the American ride-hailing service provider Uber in 2011.

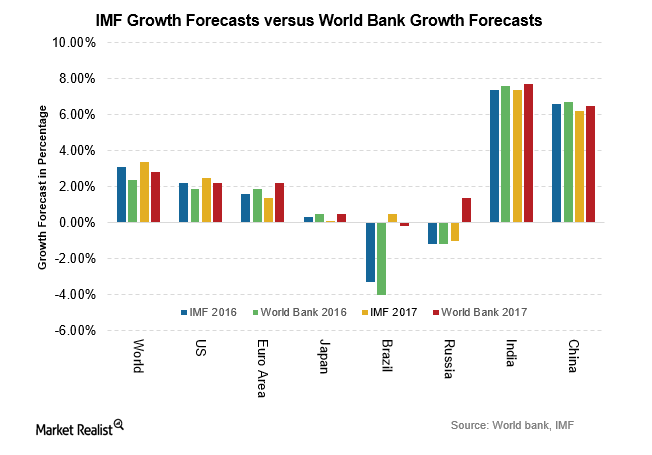

Outlook Projections: IMF Cuts Global Growth Forecasts

The IMF cut its global economic growth forecasts, according to the latest IMF World Economic Output Update dated July 19. The cut in forecasts was expected.

Oil: Famous Recession Indicator Might Be a Concern

On January 2, US crude oil active futures settled at $46.54 per barrel—2.5% higher than the last closing level due to short covering.

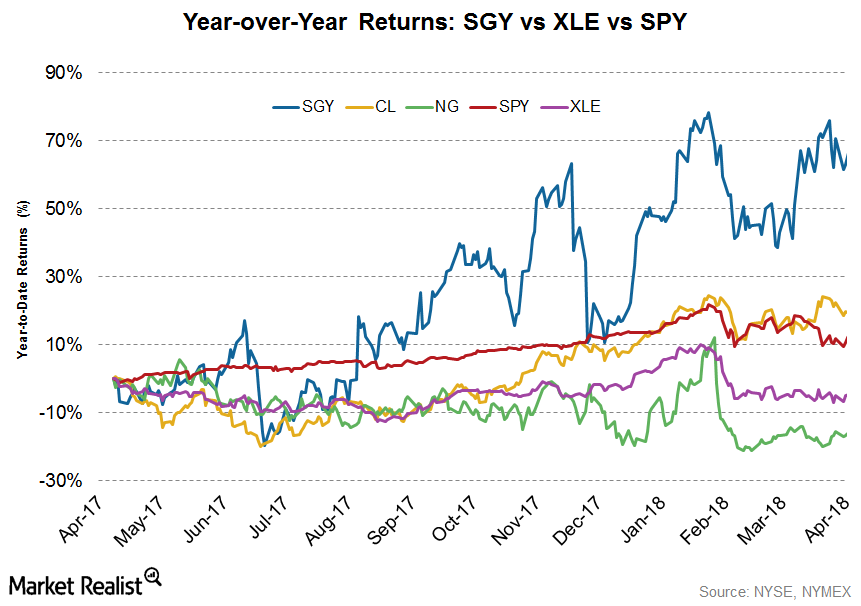

Stone Energy’s Stock Performance in 2018

Stone Energy stock has increased the most among our top five companies. Stone Energy stock has risen 60% YoY (year-over-year).

Verizon and Cablevision: Market Share after the Altice Transaction

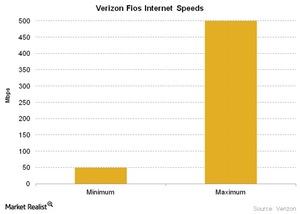

An improving broadband proposition with higher Internet speeds should positively affect Cablevision (CVC), considering the competitive dynamics in its industry.

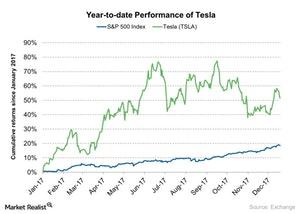

Jim Chanos on Tesla: ‘We Think the Equity Is Worthless’

Jim Chanos, a prominent short seller, discussed his view on Tesla in a recent interview with CNBC. He has a short bet on Tesla (TSLA) and said, “we think the equity is worthless.”

Why Oil Prices Could Move Higher

On January 12, 2018, US crude oil (USO) (USL) February 2018 futures gained 0.8% and settled at $64.3 per barrel—a three-year high.

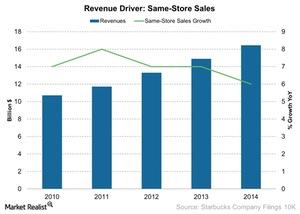

Starbucks’ Same-Store Sales Growth Is Declining

Same-store sales indicate the sales at the existing location over a period of time—usually one year. Same-store sales are driven by traffic and ticket.

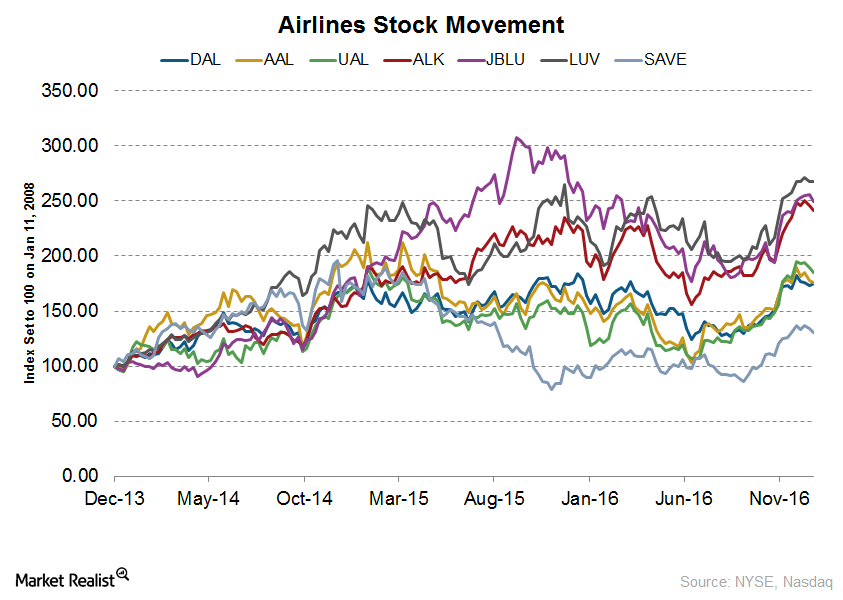

Why Delta Air Lines Stock Fell after Q4 Earnings

Delta Air Lines (DAL) reported its fourth quarter 2016 results on January 12, 2016. The airline’s revenue fell.

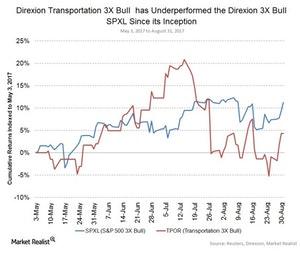

What to Expect from Transportation Stocks This Fall

The airline industry has maintained its stellar performance in the last five years.