US Large-Cap Equity Funds: Is Active or Passive Investment Best?

Except for one fund (MIGFX), no other actively managed fund that we have reviewed in this series has been able to outperform the passively managed SPY.

Nov. 20 2020, Updated 1:34 p.m. ET

US large-cap equity funds

US equity markets have done well in YTD 2016 after seeing a trough on February 11, 2016. The purpose of evaluating the chosen 12 US large cap equity funds was to give you an idea about how these funds look in terms of performance and sectoral composition. We also illustrated how their fund managers have fared in the face of a challenging 2016.

We have also compared the performance of these funds with two ETFs: the iShares S&P 500 Growth ETF (IVW) and the iShares Russell 1000 Growth ETF (IWF). We benchmarked these funds to the SPDR S&P 500 ETF Trust (SPY) to give you an idea how the 12 actively managed funds fared in compared to these passively managed funds.

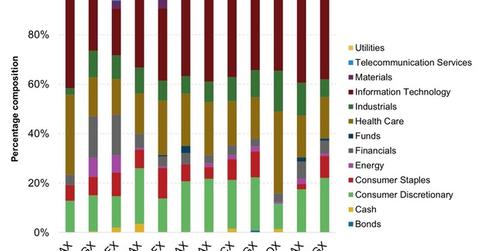

The graph above shows the latest available portfolio composition of each of the 12 US large-cap equity funds that we have individually reviewed in this series.

Bullish on US equities?

If you were to ask Richard Bernstein this question, he would respond with a resounding “yes.” Throughout the past four months or so, he has opined in his newsletters and his speaking engagements that his firm, which focuses on macro factors rather than company-specific research, believes that the corporate profit cycle in the US is turning for the better.

This means that the current bull run, which is already the second longest in the post-war period, may still have legs. He suggests looking at cyclical sectors and companies like automakers (GM) (FCAU), airline stocks (AAL) (LUV), and hotels (HLT) (MAR) to benefit from a possible rise in US equities.

Active or passive?

The next step to consider is whether to go the active or the passive way to invest in US large-cap equity funds.

If equities are actually in for another phase of the bull run, then good actively managed funds have a better chance of providing superior returns to you than passively managed funds. We should note, however, that except for one fund (MIGFX), no other actively managed fund that we have reviewed in this series has been able to outperform the passively managed SPY. This may change, though, if corporate profits in the US improve.

If you like risk, we suggest investing in either a broad-based actively managed fund or a passive fund, along with a much more concentrated actively managed fund that focuses on generating alpha.

This series should have helped you in short-listing those actively managed funds that have navigated 2016 better than others and are worth the fund manager’s fee. For more analysis on mutual funds, please visit our mutual funds page.