iShares Russell 1000 Growth

Latest iShares Russell 1000 Growth News and Updates

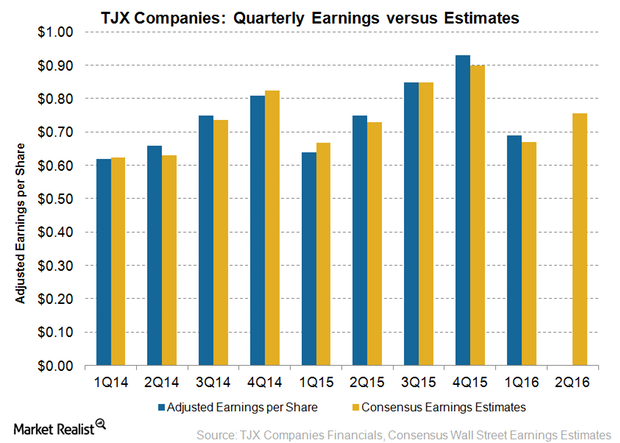

Why TJX Companies Might Post Tepid Earnings Growth in 2Q16

TJX Companies (TJX) will announce its results for the second quarter of fiscal 2016 on August 18. The second quarter ended on August 1, 2015.Real Estate Why the housing market impacts consumption and equity investors

This article considers the importance of investment, including residential investment, in the support of U.S. consumption data and the implications for investors.

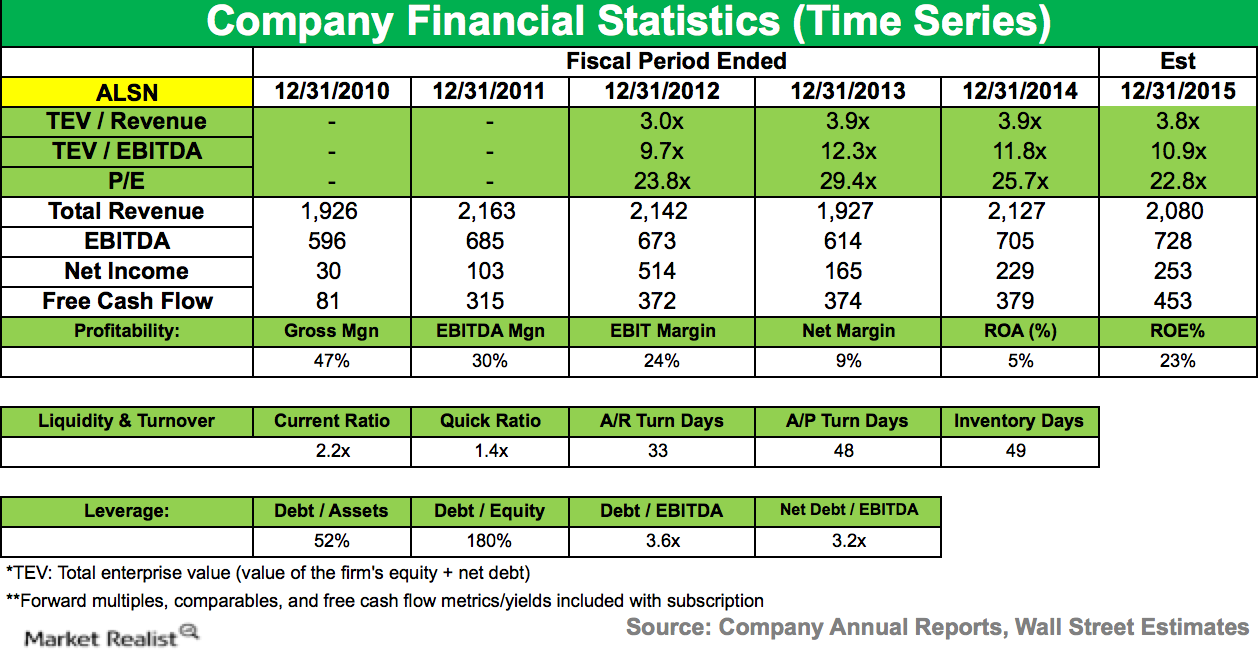

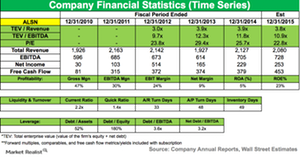

ValueAct Capital Ups Its Stake in Allison Transmission Holding

Allison Transmission Holding and its subsidiaries design and manufacture commercial and defense fully automatic transmissions.

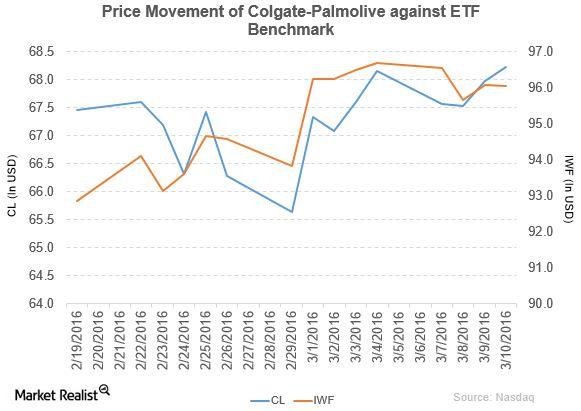

How Much Has Colgate-Palmolive Increased Its Dividend?

Colgate-Palmolive (CL) has a market capitalization of $60.9 billion. CL rose by 0.37% to close at $68.23 per share as of March 10, 2016.

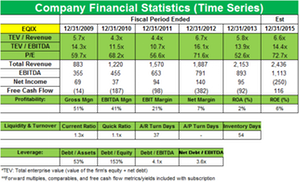

JANA sells stake in Equinix

JANA Partners sold a significant stake in Equinix (EQIX) during the fourth quarter. The position accounted for 3.38% of the fund’s third-quarter portfolio.

Maverick Capital Decreases Position in Allison Transmission

Allison Transmission and its subsidiaries design and manufacture commercial and defense fully automatic transmissions. In 4Q14, net sales grew 11% to $544 million.

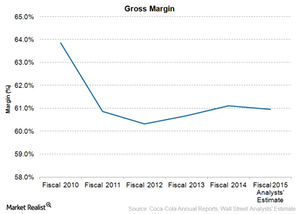

Coca-Cola’s Productivity Program to Improve 2015 Margins

Coca-Cola’s productivity program aims for annualized savings of $3 billion by 2019. The company will reinvest these savings in incremental media spending.

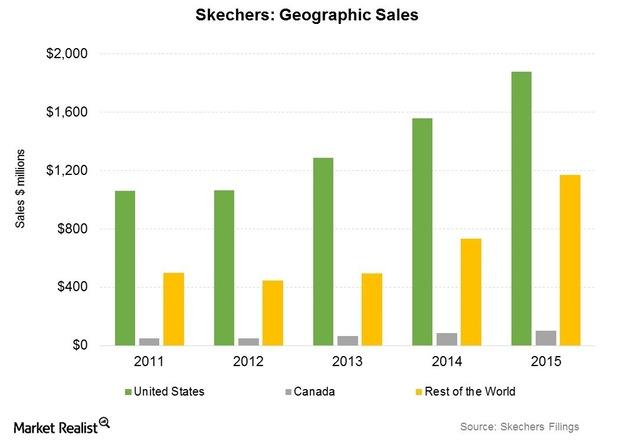

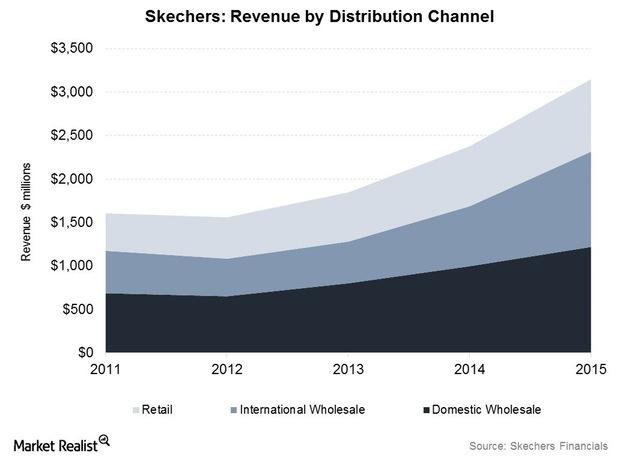

Skechers’ China Sales Rise: What’s the Growth Outlook?

China has been an important element in Skechers’ success in international markets. Sales from China rose to $220 million in 2015 from $86 million in 2014.

Mead Johnson Plans to Focus on R&D to Support Innovations

Mead Johnson follows a strategy of investments in innovation, having expanded its liquids portfolio and rolled out its key specialty formulas across Asia.

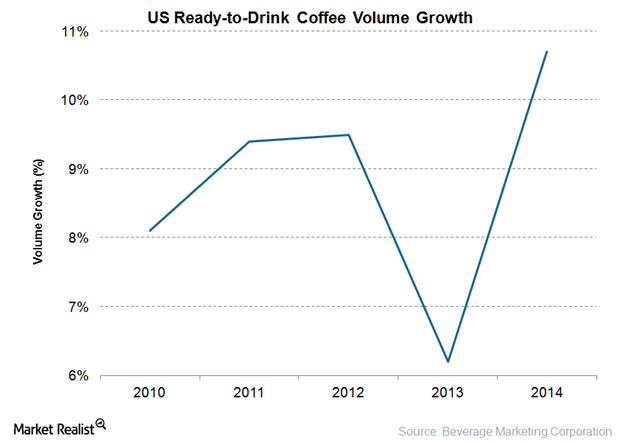

Why Ready-to-Drink Coffee Is Gaining Popularity with US Consumers

Coffee lovers in the United States are boosting ready-to-drink coffee volumes.

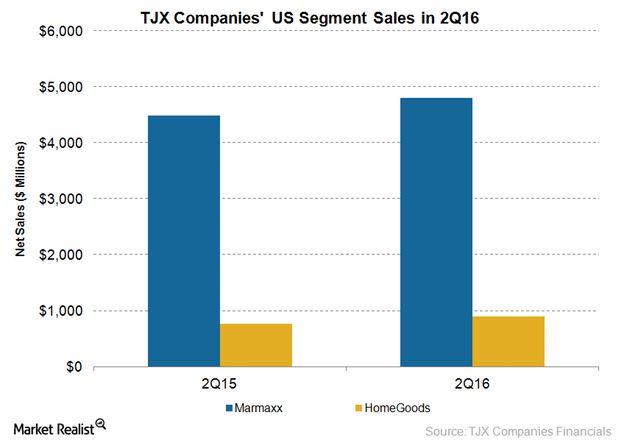

TJX Companies: Pricing Strategy Benefits US Sales in 2Q16

In the first six months of fiscal 2016, HomeGoods accounted for 12.2% of the consolidated net sales of TJX Companies. That’s up from 11.2% in the comparable period of the previous year.

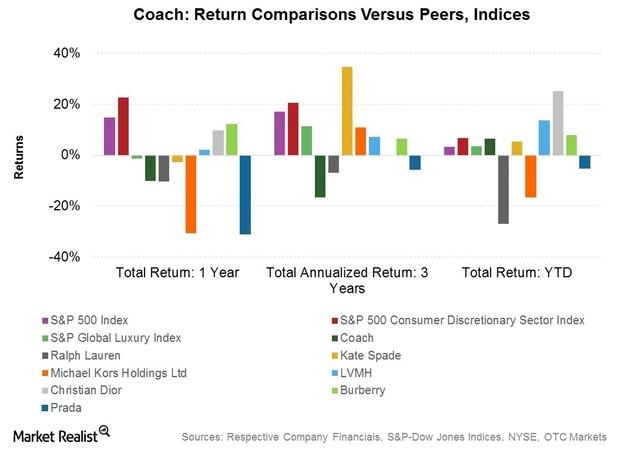

Opportunities and Challenges for Coach

Coach expects to realize $160 million in annual savings due to its restructuring initiatives from fiscal 2016 onward. It also expects to maintain its annual dividend of $1.35 per share.

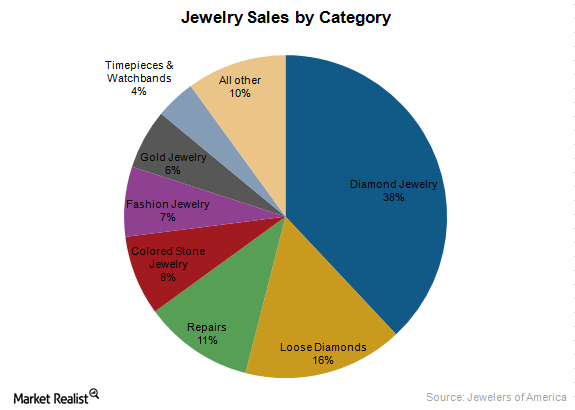

State of the Jewelry Industry in 2015: Growth and Challenges

Trends shaping the jewelry industry include Increasing demand for branded jewelry and an increased focus on e-commerce sales.

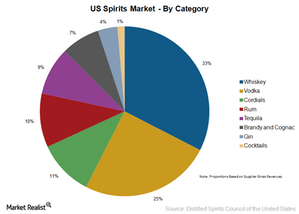

Key Categories of the Spirits Market

Whiskey is the largest category of the US spirits market with a 33% share of gross revenues. Vodka, cordials, and rum hold 25%, 11%, and 10%, respectively.

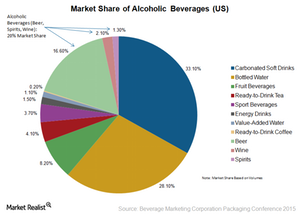

Alcoholic Beverages: A Key Category of the Beverage Industry

According to the Beverage Marketing Corporation, alcoholic beverages such as beer, wine, and distilled spirits, account for 20% of the US beverage market.

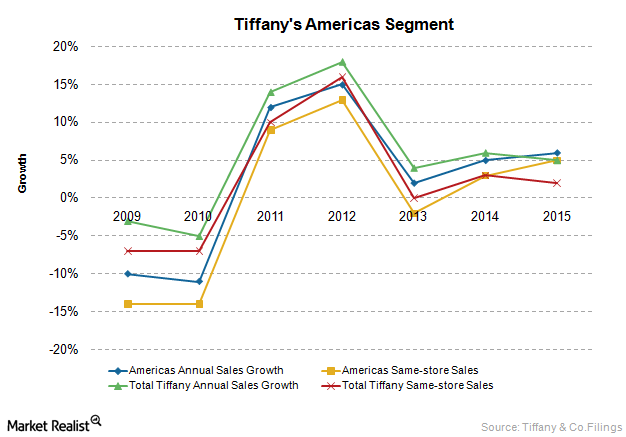

Analyzing Tiffany’s Largest Segment: The Americas

Tiffany & Co.’s Americas segment includes sales from company-operated retail stores in the United States, Canada, Mexico, and Brazil.

Signet Jeweler’s Market Positioning in the Retail Jewelry Industry

Total retail jewelry sales in the US grew at a CAGR of 4.4%, reaching $74.7 billion in 2014. Fine jewelry sales grew at a CAGR of 5%, reaching ~$69 billion.

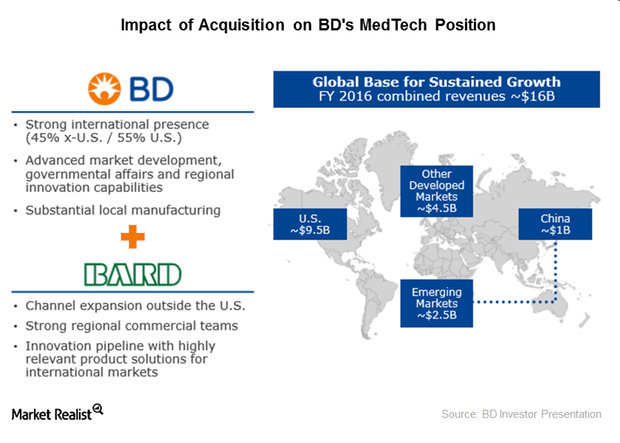

How BD-Bard Acquisition Will Strengthen International Presence

C.R. Bard (BCR) has grown significantly outside the United States in recent years, driven by its international channel expansion strategy.

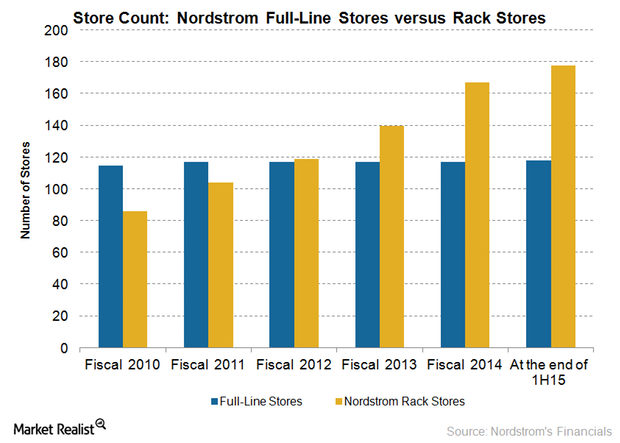

Will Nordstrom’s Rack Stores Continue to Be a Key Growth Driver?

In 2Q15, Nordstrom Rack store sales increased by 12.9% to $857 million from the comparable quarter of the previous year.

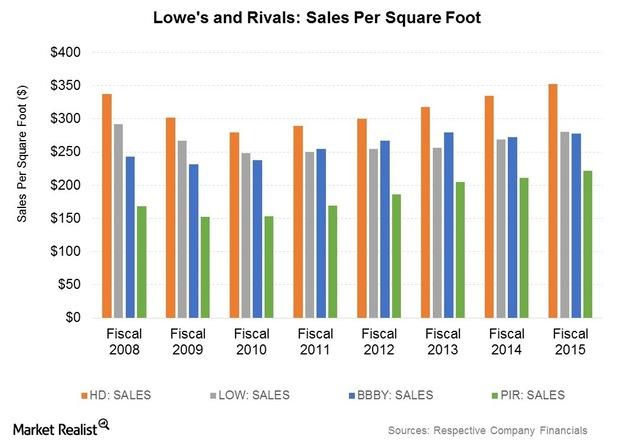

Why Lowe’s Store Productivity Is Growing Faster than Home Depot’s

One of the ways retailers can track their store performance is via productivity measures like sales and profitability per retail square foot.

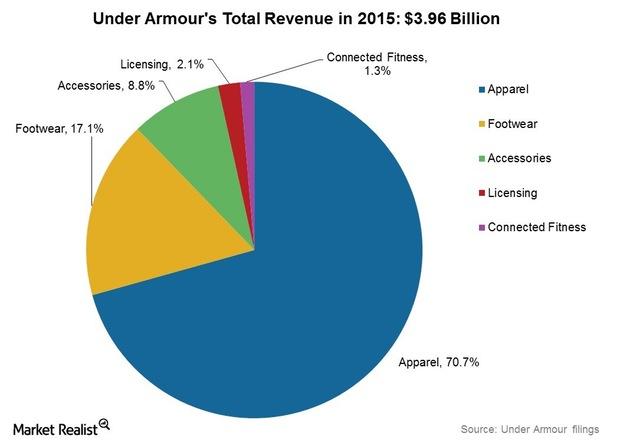

Under Armour Partners with IBM and SAP to Widen Connected Fitness Potential

Under Armour’s revenues from its Connected Fitness initiative came in at $53 million in 2015, which was up from $19 million in 2014.

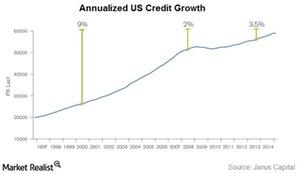

Bill Gross: Credit Is the Oil That Lubes the System

Currently, we’re in a highly levered system, especially the developed world. A levered economy depends on continued credit creation for stability and growth.

Why Student Debt May Not Affect the US Economy Like Sub-Prime

According to the White House Council of Economic Advisers, “Student debt is less likely to make a recession more severe or slow an expansion in the way that mortgage debt may have.”

Can Target Make the Most of Its Opportunities?

Target’s flexible and smaller format stores could prove a cost-effective and capital-efficient way for it to reach customers in new markets.

How Skechers Sells Its Products to Its Customers

In 2015, Skechers became the second-largest footwear company in the United States, trailing global market leader Nike (NKE).

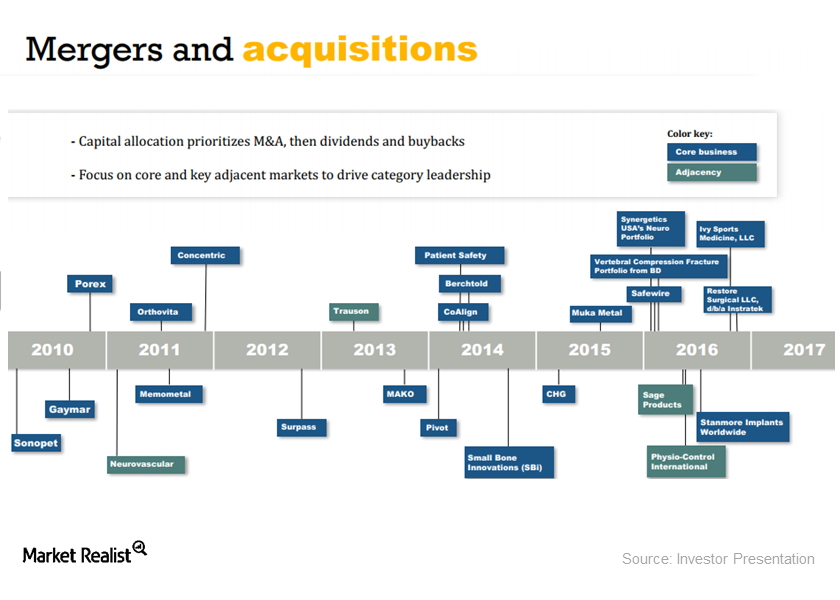

Stryker’s Inorganic Growth Strategy Continues to Boost Growth

Stryker’s acquisition-driven growth strategy Stryker (SYK) has been growing at a fast pace through inorganic growth. It has undertaken a number of strategic acquisitions recently. In 3Q17, acquisitions contributed approximately 0.6% of the company’s YoY (year-over-year) sales growth, and in the first three quarters of 2017, Stryker acquisitions contributed ~3.2% of the company’s sales growth […]

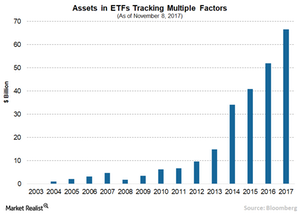

Can Smart Beta Go Wrong?

The smart beta approach aims to benefit from market inefficiencies to deliver higher risk-adjusted returns and improve diversification.

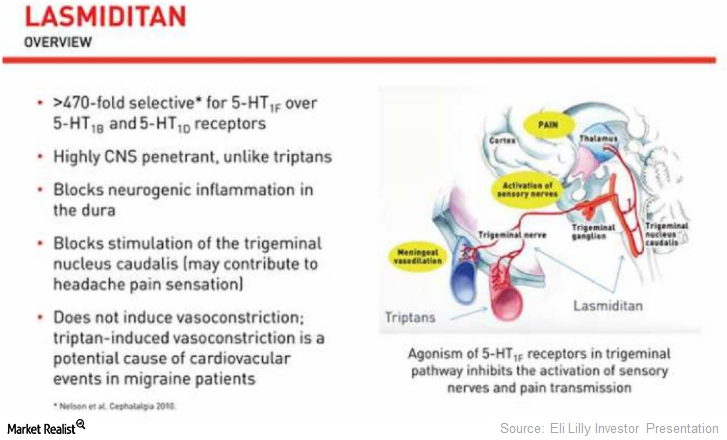

What Will Help Eli Lilly Build a Stronger Migraine Portfolio?

In September, Eli Lilly presented the results of its phase-3 Spartan trial, in which Lasmiditan demonstrated significant progress in the treatment of migraines.

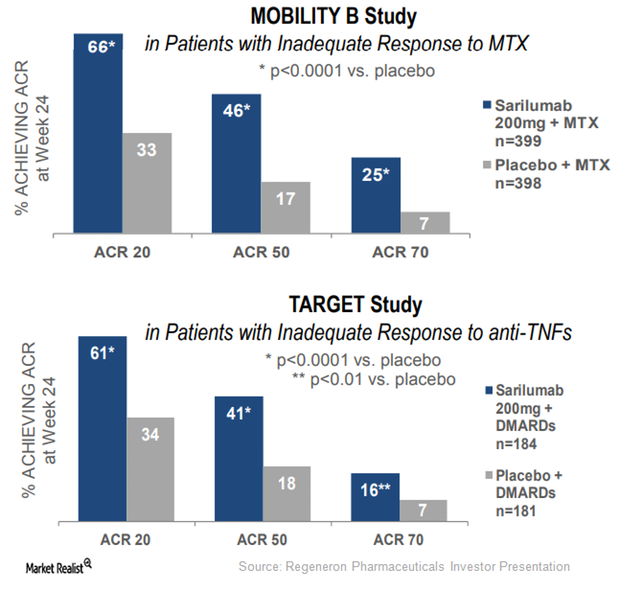

Kevzara May Emerge as a Prominent Rheumatoid Arthritis Drug in 2017

Regeneron and Sanofi have submitted an application seeking regulatory approval for Kevzara in Japan.

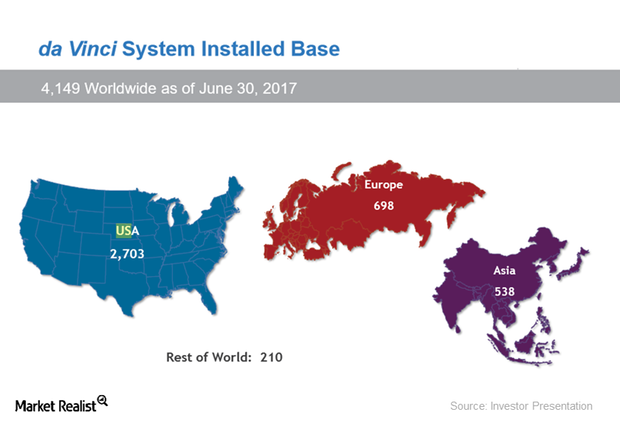

Intuitive Surgical Plans to Expand in Europe and Asia

Although Intuitive Surgical leads the surgical robotics market, there are competitive threats from other major players in the market.

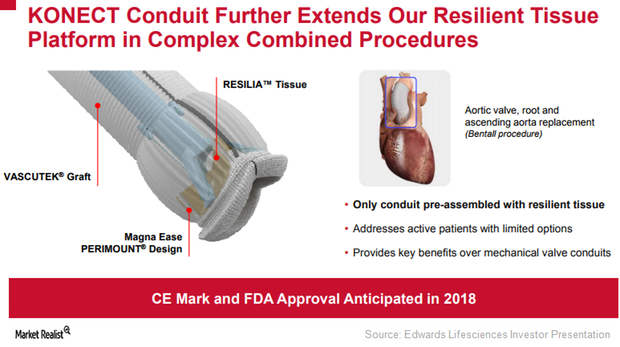

Edwards Lifesciences: Focused on Inspiris Resilia and Konect

To extend the durability of the Inspiris Resilia surgical aortic valve, Edwards Lifesciences (EW) has incorporated a new tissue platform, Resilia tissue.

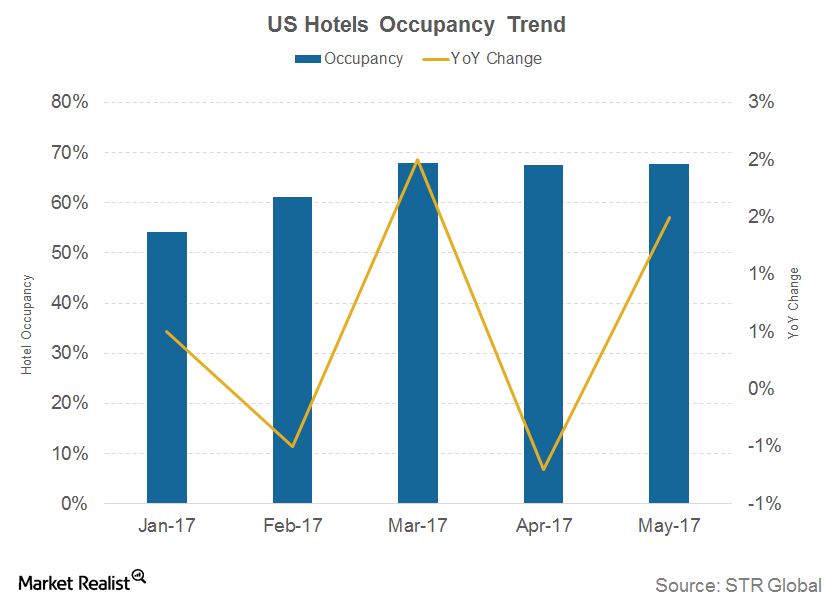

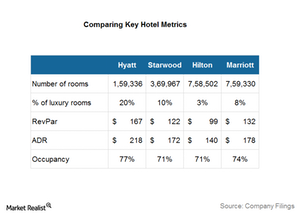

Average Daily Rate Will Drive US Hotel Industry Growth

The average daily rate (or ADR) measures the average room price paid in the market. In 1Q17, the ADR rose 2.5% year-over-year (or YoY) to $124.27.

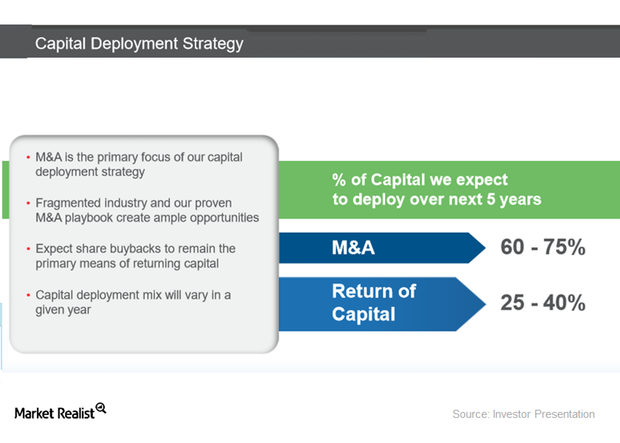

Understanding Thermo Fisher’s Capital Deployment Strategy

Thermo Fisher Scientific expects to deploy 60%–75% of its capital toward M&As (mergers and acquisitions).

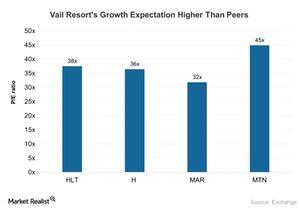

Vail Resorts: Exceptional Takes Time, According to Baron

Baron Capital began investing in Vail Resorts in 1997, and it owns a ~15%–20% stake in the company. According to Ron Baron, this investment has returned ~50%–75%.

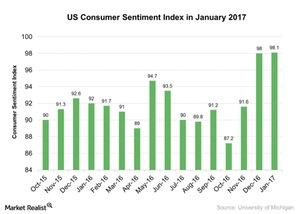

What Does the Rising US Consumer Sentiment Index Mean for the Economy?

The US Consumer Sentiment Index improved in January 2017. It stood at 98.1 in January 2017 compared to 98.2 in December 2016.

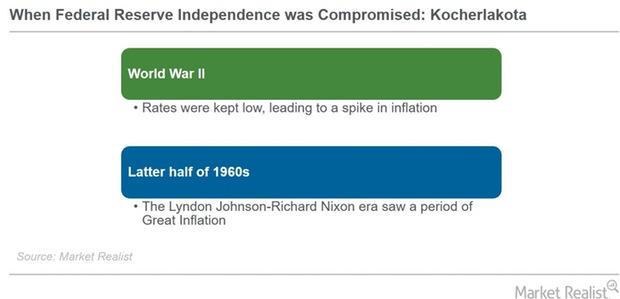

Narayana Kocherlakota on Trump and the Federal Reserve

Narayana Kocherlakota, 12th president of the Federal Reserve Bank of Minneapolis, said central banks have been able to control inflation better when left alone by the government.

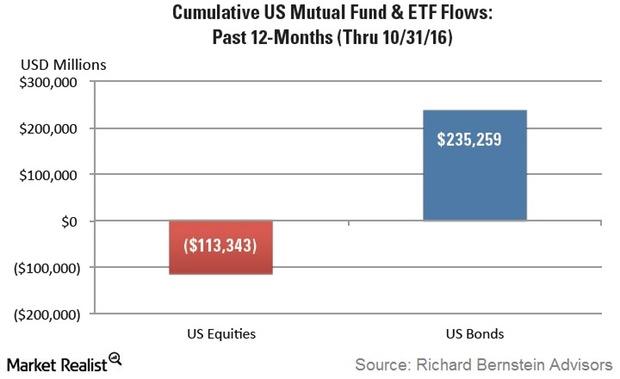

Bernstein: Excess Risk Aversion Has Made Investors ‘Wallflowers’

In his November Insights newsletter, Richard Bernstein stated, “It is incredible that investors have basically been wallflowers during the second longest bull market of the post-war period.”

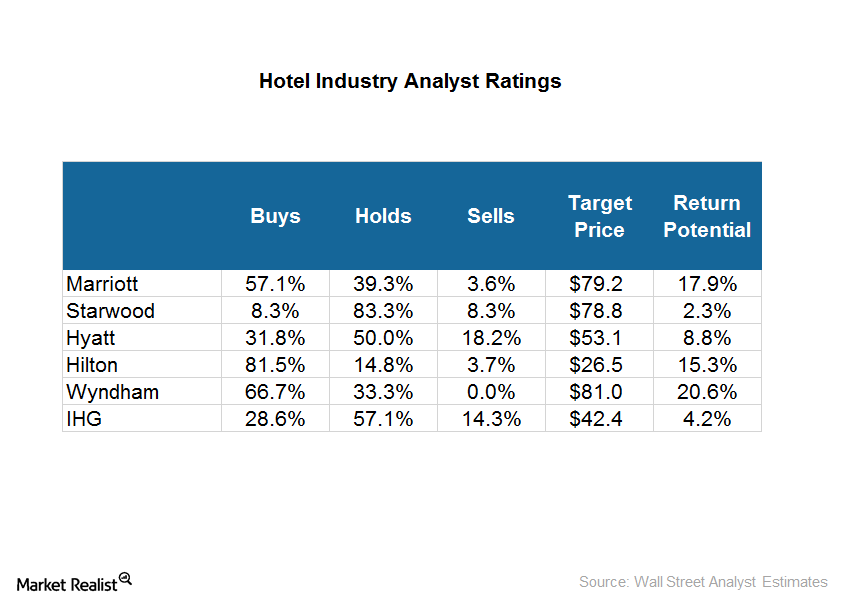

What Are Analysts’ Recommendations for Hotel Stocks?

Wyndham has the highest return potential of 21% with a target price of $81. Marriott is next with a return potential of 18% and a target price of $79.15.

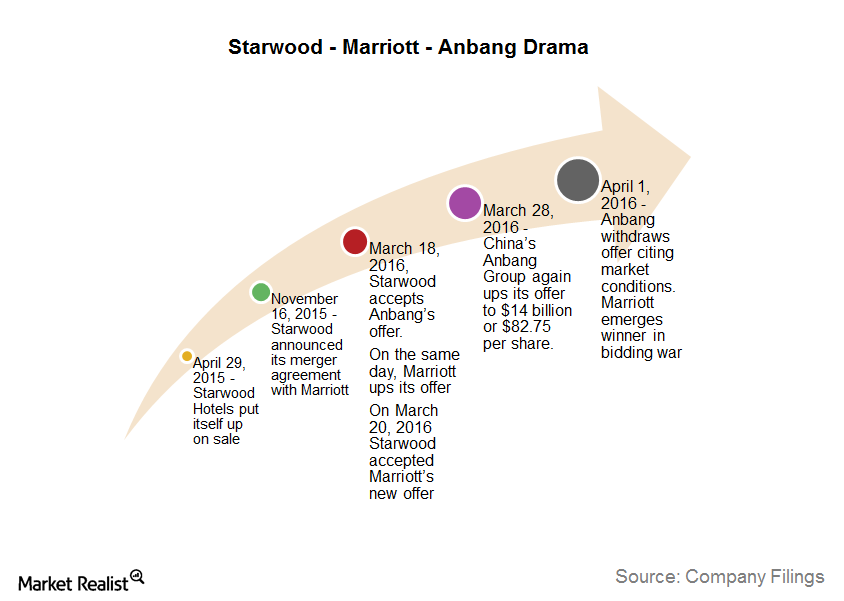

Analyzing the Key Events before the Marriott-Starwood Merger

On April 29, 2015, Starwood put itself up for sale. On August 29, 2015, Anbang offered to buy it at a 20% all-cash premium deal on its last closing price.

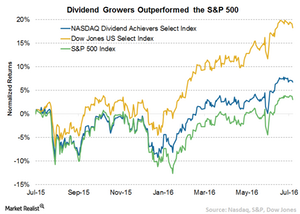

Do Dividend Growers Look Appealing?

Historically, dividend growers have often performed better than the S&P 500 (IVV) and provided higher income during Market volatility.

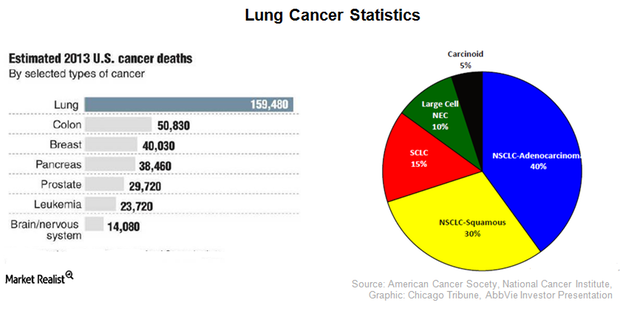

Why AbbVie Expects Rova-T to See Big Peak Sales

AbbVie project that Rova-T, a DLL3-targeted antibody conjugate acquired through the acquisition of Stemcentrx, will earn $5 billion in peak sales.

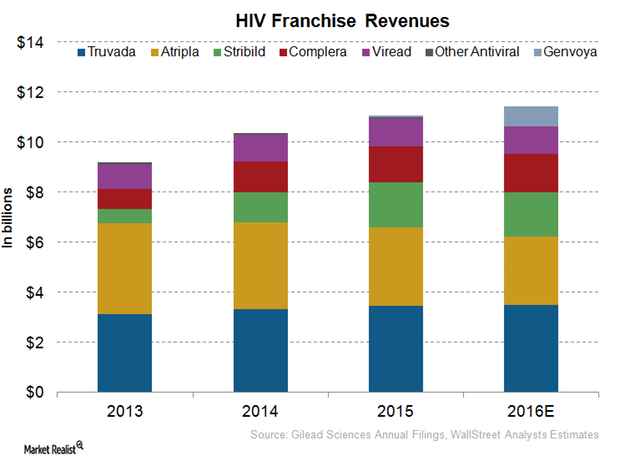

Inside Gilead Sciences’ Involvement in TAF Therapies

On March 01, 2016, the FDA approved Gilead Sciences’ TAF-based HIV drug, Odefsey, for the treatment of certain HIV-1 afflicted patients.

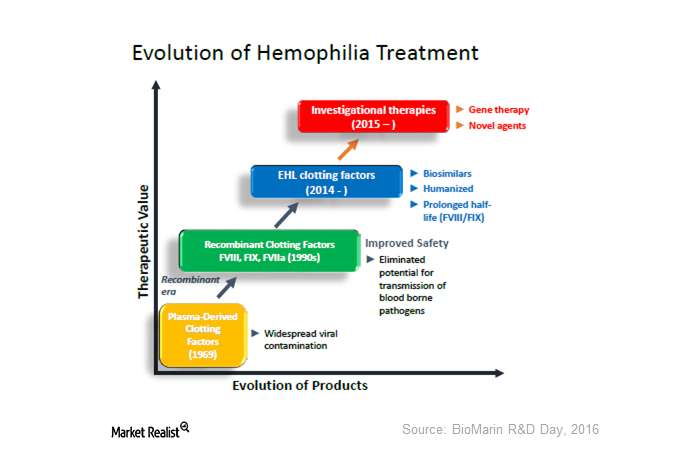

Could Gene Therapy Be a Next-Generation Treatment for Hemophilia?

Gene therapy is the emerging platform for hemophilia care. If approved, it would be a paradigm.

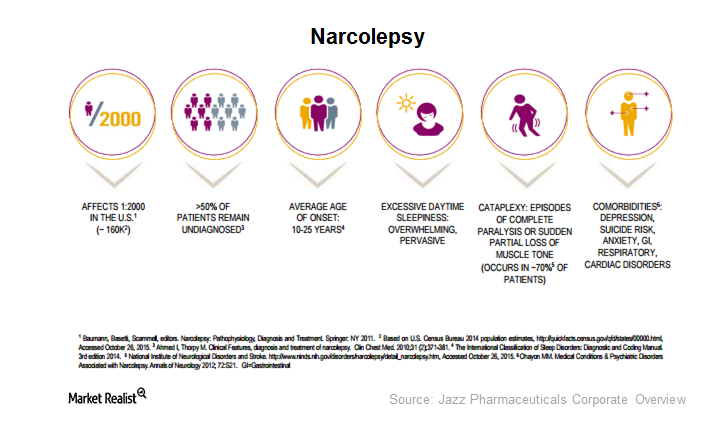

Can Xyrem Maintain Leadership in the Narcolepsy Space?

Jazz Pharmaceuticals’ (JAZZ) Xyrem is a drug for cataplexy and excessive daytime sleepiness occurring in patients with narcolepsy, a serious orphan disease.

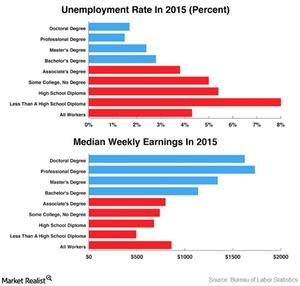

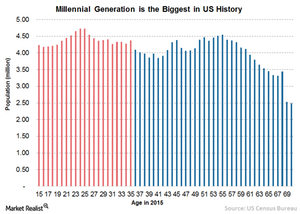

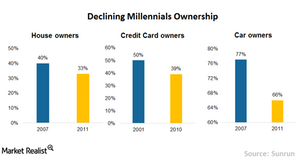

Why Millennials Are Often Called ‘the Unluckiest Generation’

A population of 80 million strong in the U.S., millennials – those born between 1980 and 1999 – are breaking with tradition.

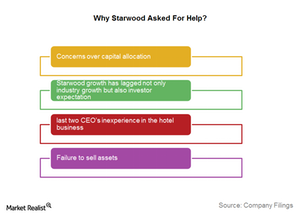

Why Did Starwood Sell Itself?

The last two years have been marked by turmoil for Starwood Hotels (HOT). Starwood’s properties include brands like the Sheraton, Westin, St. Regis, and W hotels.

Marriott–Starwood Merger Synergies: The World’s Largest Hotel Chain

The Marriott–Starwood deal holds immense significance for Marriott International because the combined entity of Marriott International and Starwood Hotels and Resorts Worldwide would create the world’s largest lodging company.

How Millennials Are Driving the Sharing Economy

Millennials resonate with the idea of the sharing economy since it perfectly fits their budgets. Millennials took longer than expected to enter the job market—and at lower wages.

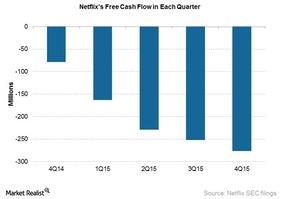

A Look at Netflix’s Capital Structure

At -$276 million, Netflix had negative free cash flow for the fourth straight quarter in 2015 as the company continued investing in original programming.

Signet Jewelers’ Ever Us Is Setting Trend for Jewelry Industry

Signet launched a new collection called Ever Us in October 2015. It’s meant to meet the need for jewelry that represents the bond between two people.