What Does the Rising US Consumer Sentiment Index Mean for the Economy?

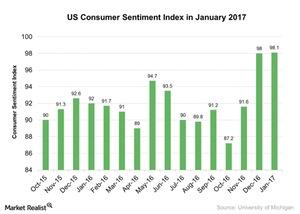

The US Consumer Sentiment Index improved in January 2017. It stood at 98.1 in January 2017 compared to 98.2 in December 2016.

Jan. 17 2017, Updated 2:36 p.m. ET

US Consumer Sentiment Index

According to a report from the University of Michigan, the US Consumer Sentiment Index improved in January 2017. It stood at 98.1 in January 2017 compared to 98.2 in December 2016. The January reading is below market expectations of 98.5.

The Consumer Sentiment Index focuses on three areas:

- What are consumers’ views of their own financial situation?

- How do consumers view the general economy over the short term?

- How do consumers view prospects for the economy over the long term?

Impact on the economy

The improvement in the US Consumer Sentiment Index is a positive sign for the economy. The US Consumer Sentiment Index improved in January 2017, which indicates that the overall situation for consumers seems to be improving.

The increase in per capita income is a welcome sign for the economy (SPXL) (IWM). The labor market also showed improved figures in the past few months. An improvement in labor market conditions could speed up consumer spending in the economy (VFINX) (VOO) (SPY) in the near future.

The improvement in this index also indicates that consumers’ long-term view of the economy (IWF) (QQQ) is improving. The Fed is also hinting at a gradual rate hike process in the next few years. It also announced that there could be at least three rate hikes in 2017.

Interest rate hikes are appropriate when the economy is on a stronger path. According to the Consumer Sentiment Index, the long-term path for the economy is improving, so it’s more likely the Fed could tighten interest rates.

In the final part of this series, we’ll see what indicators investors should look for this week.