Vanguard 500 Index Inv

Latest Vanguard 500 Index Inv News and Updates

US Stock Indices Plunge after Oil Prices Rebound

The three US equity indices that we review in this weekly series fell from December 8 to December 15, 2015, after a rebound in oil prices.

Will We See a Recession within the Next 2 Years?

In a recent interview, Jim Rogers said, “I’m on record as saying that we’re going to have a recession certainly within a year or two.”

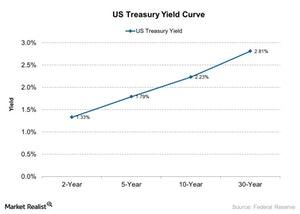

Gundlach on Higher Yield: Watching the Copper-to-Gold Ratio

Billionaire investor and bond guru Jeffrey Gundlach also shared his view on bond yields in an interview with CNBC.

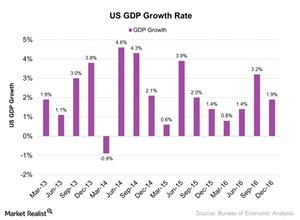

What Does Jack Bogle Predict for US Real GDP?

In 4Q16, US (SPY) (QQQ) (IVV) (VFINX) real GDP grew at an annual rate of 1.9% compared to a 3.5% rise in 3Q16.

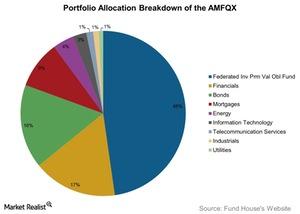

AMFQX: More Than 60% Exposure to Derivative Securities

AMFQX is an alternative mutual fund that seeks to generate positive absolute returns with a low correlation to the returns of broad stock and bond markets.

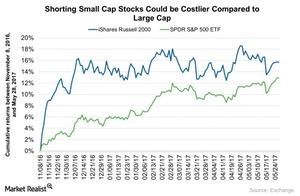

Will George Soros’s Position in IWM Provide a Strong Return?

According to the recent 13F filings, Soros Fund Management has increased its position in the iShares Russell 2000 ETF (IWM) by 36% in 1Q17 compared to the previous quarter.

How Could Investing in EBSAX Affect Your Portfolio’s Performance?

EBSAX seeks to generate attractive risk-adjusted returns across a broad range of market conditions.

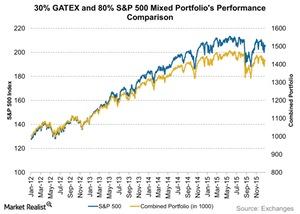

How Investing in GATEX Could Impact Your Portfolio

GATEX could increase the exposure of an investor’s portfolio in the equity market. It has less volatility risk than the equity markets.

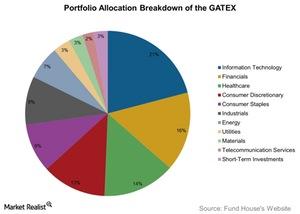

GATEX: A Sectorial Portfolio Breakdown

The Gateway Fund – Class A (GATEX) seeks to attain capital appreciation through its equity market investments. It has less risk compared to equity markets.

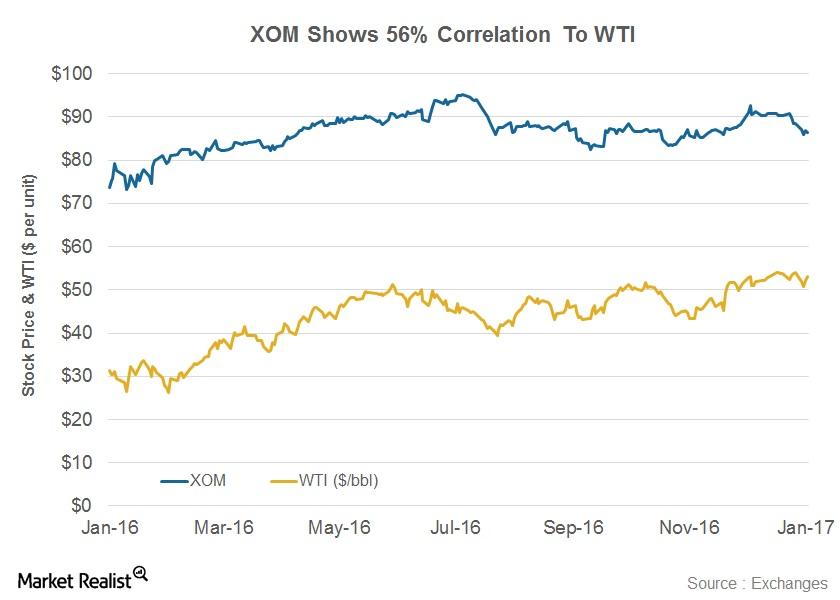

What’s the Correlation Between XOM and WTI?

Integrated energy companies such as ExxonMobil are affected to varying degrees by volatility in crude oil prices. XOM’s correlation coefficient with WTI stands at 0.56.

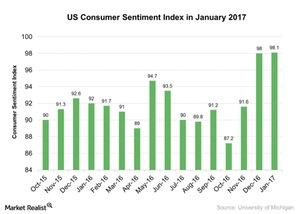

What Does the Rising US Consumer Sentiment Index Mean for the Economy?

The US Consumer Sentiment Index improved in January 2017. It stood at 98.1 in January 2017 compared to 98.2 in December 2016.

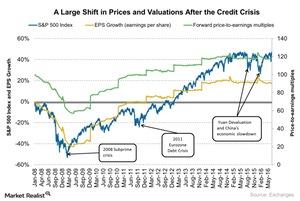

In Retrospect: How the 2008 Crisis Affected SPY’s Valuation

When the 2008 credit crisis affected the S&P 500 Index (SPY), we saw a large shift in valuations and the index level.

Active Fund Management: Will It Make Passive Attractive?

In recent years, the performance of various mutual funds and hedge funds followed by an active fund management strategy haven’t been so impressive.

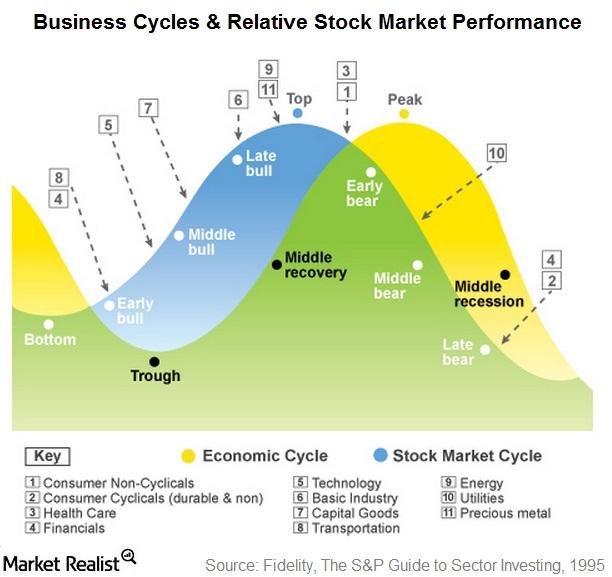

What Phase of the Business Cycle Are We In?

Studied in conjunction, stock market and economic conditions give clear indications of the business cycle phase we are in.

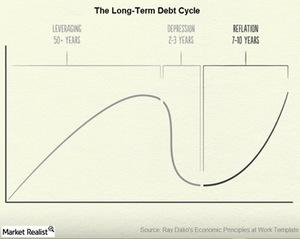

Where Are We in the Long-Term Debt Cycle? Ray Dalio Weighs In

According to Ray Dalio, the Fed needs to study the long-term debt cycle in order to understand the huge downside risks that currently face the US economy.

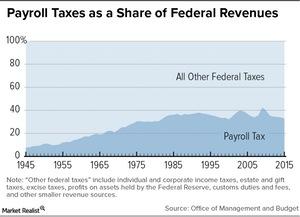

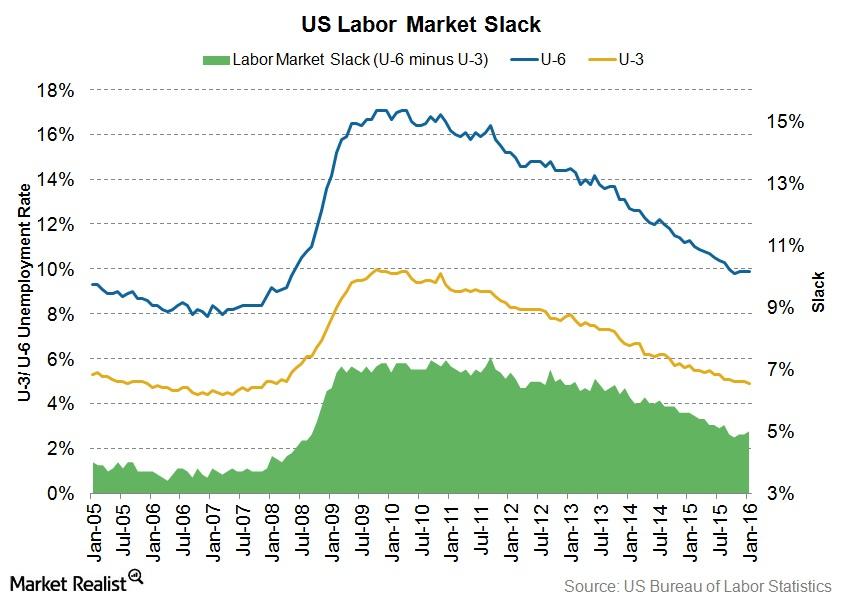

What Is Labor Market Slack?

The unemployment rate doesn’t help us gauge the extent of labor market slack. The actual employment gap that exists also consists of a slack component.

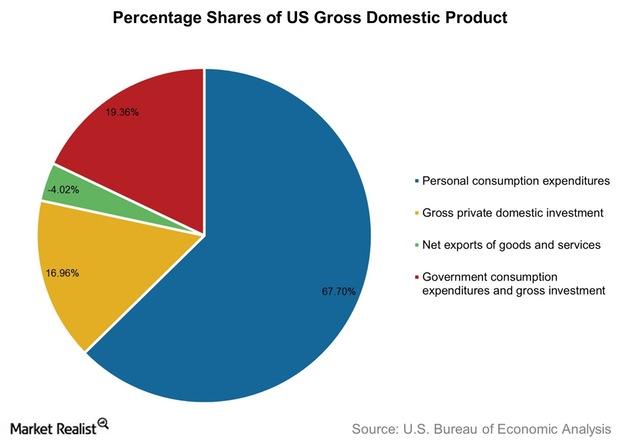

Importance of Spending on US GDP and Related Mutual Funds

Nearly 68% of the US GDP is composed of PCE or consumer spending. The negative value of net exports shows that the United States imports more than it exports, and this eats into the total economic output.