Will We See a Recession within the Next 2 Years?

In a recent interview, Jim Rogers said, “I’m on record as saying that we’re going to have a recession certainly within a year or two.”

Dec. 4 2020, Updated 10:53 a.m. ET

Jim Rogers sees a recession in a year or two

In a recent interview with James West of Midas Letter, Jim Rogers, legendary investor and co-founder of Quantum Fund, shared his opinion about the US economy (QQQ) (VFINX) (IWM). “I’m on record as saying that we’re going to have a recession certainly within a year or two, no question about that.”

In March 2016, in an interview with Bloomberg TV’s Guy Johnson, Rogers said, “It’s been seven years, eight years since we had the last recession in the U.S. (IVV) (VOO), and normally, historically we have them every four to seven years for whatever reason—at least we always have.” The reason here that Rogers doesn’t specify is the business cycle.

Investors should pay attention to the real numbers

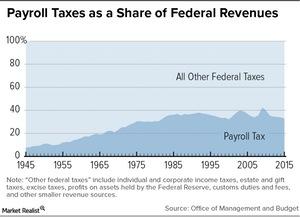

Rogers’ advice to investors is not to pay attention to the published numbers but the real numbers that state the health of the economy. He draws investor interest to debt and payroll tax figures. As he points out, “It doesn’t have to happen in four to seven years, but look at the debt, the debt is staggering.”

While commenting on the nature of the recession he sees coming up, Rogers said, “It will be worse than any we’ve had in a long time, perhaps in our lifetime, because the debt is so, so much higher now.” As for the payroll taxes figures in the United States, they’re “already flat,” says Rogers.

While unemployment figures may suggest a tightening labor market, payroll taxes haven’t risen for awhile now, putting a rise in total payroll revenue in doubt.

What is Jim Rogers invested in?

Rogers also shed light on the contagion effect that the economic slowdown in China (FXI), Japan (EWJ), and the Eurozone could have on the United States. In light of heightening economic uncertainty, Rogers is shorting the Japanese yen and buying the US dollar (UUP).

Rogers is also critical of central bankers and the effects of their policy decisions on the Market. We’ll discuss this in the next article.