iShares Russell 2000

Latest iShares Russell 2000 News and Updates

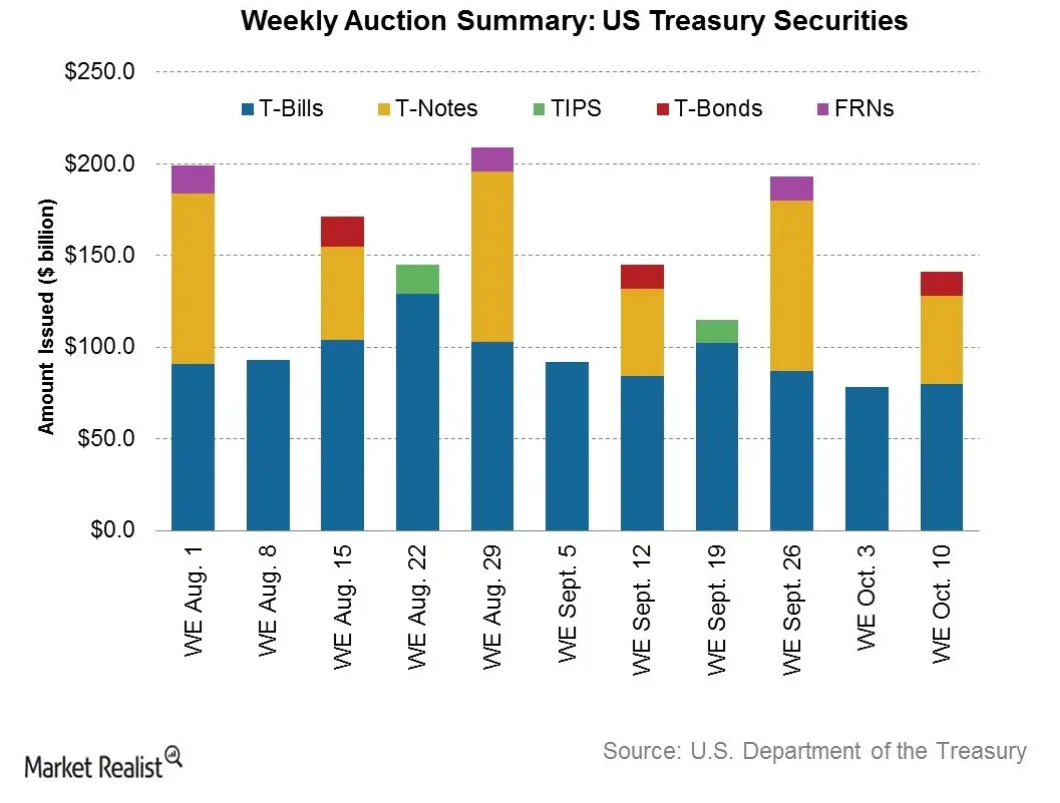

Why investors are preferring high-quality debt

High-quality bonds can be an investor refuge when there’s market volatility. These securities provide relatively stable cash flows. The default probability is low.

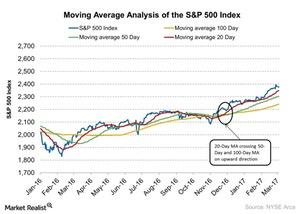

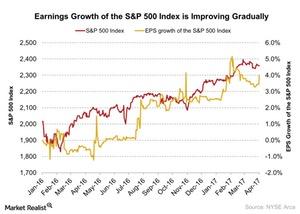

What S&P 500 Index Moving Averages Could Indicate

The S&P 500 Index is trading 1.2% above its 20-day moving average and 6% above its 100-day moving average.

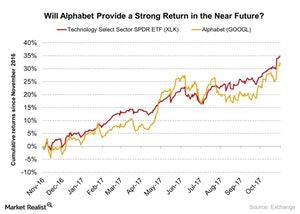

What’s Leon Cooperman’s Largest Position?

Alphabet reported its 3Q17 earnings on October 26, 2017. The company posted EPS (earnings per share) of $9.57, which beat analysts’ estimates of $8.33.

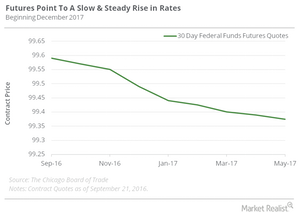

How Will the Fed Affect the Earnings Recovery Environment?

The dollar index (UUP) rallied about 22% between October 2014 to July 2016.

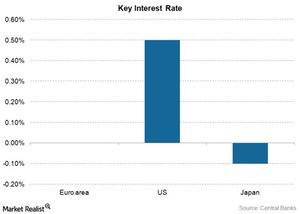

Why Do Central Bankers Continue to Surprise Bill Gross?

In his recent webcast by Janus Capital, Bill Gross expressed his surprise at the extent to which central bankers of the developed world (EFA) (VEA) have distorted the financial system.

Will We See a Recession within the Next 2 Years?

In a recent interview, Jim Rogers said, “I’m on record as saying that we’re going to have a recession certainly within a year or two.”

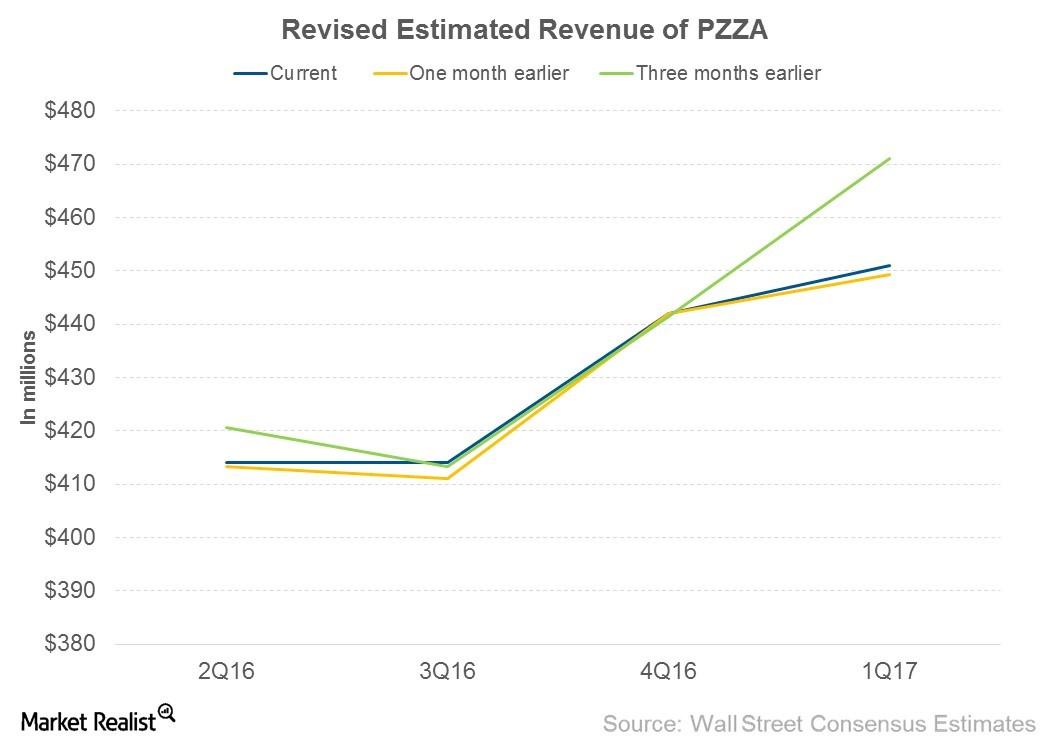

Why Have Analysts Raised their Revenue Estimates for Papa John’s?

In 1Q16, PZZA’s domestic company-owned restaurants generated nearly 48% of Papa John’s revenue, while domestic commissaries and others generated 39.4%.Real Estate Why the housing market impacts consumption and equity investors

This article considers the importance of investment, including residential investment, in the support of U.S. consumption data and the implications for investors.

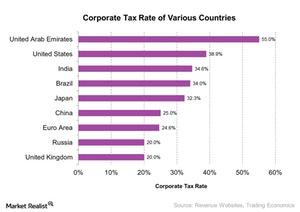

Why Buffett Believes US Businesses Aren’t Really Hurting from the US Corporate Tax

The US economy has been improving gradually, but some businesses in the US have suffered a lot over the years.

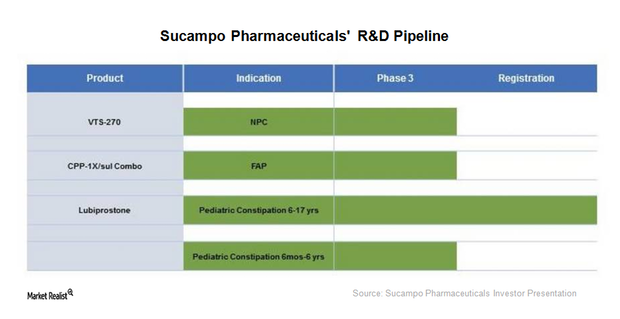

Sucampo Pharmaceuticals’ Research Pipeline in December 2017

Sucampo Pharmaceuticals (SCMP) recently completed a Phase 3 study for the alternate sprinkle formulation of Amitiza (lubiprostone) in adults with CIC (chronic idiopathic constipation).

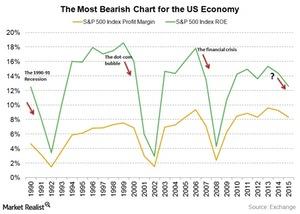

Why the S&P 500 Net Profit Margin May Predict a US Recession

Over a good four decades, the S&P 500’s net profit margin has fallen notably when the economy was on the verge of, or already into, a recession.

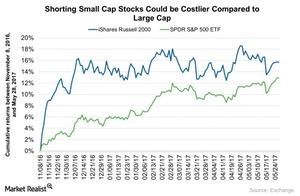

Will George Soros’s Position in IWM Provide a Strong Return?

According to the recent 13F filings, Soros Fund Management has increased its position in the iShares Russell 2000 ETF (IWM) by 36% in 1Q17 compared to the previous quarter.

Ray Dalio: The Next Downturn May Be a Difficult One to Reverse

“The next downturn may be a difficult one for central banks to reverse,” warned Ray Dalio, CEO of the world’s largest hedge fund.

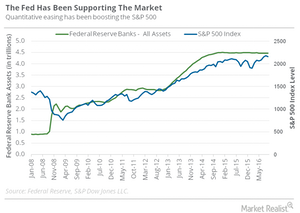

Jeffrey Gundlach: The Fed Has Been Supporting the S&P 500

Gundlach also believes it’s interesting to look at the correlation between the size of the Fed’s balance sheet and the S&P 500 (SPY) (SPXS) (SPXL) level.

Jurrien Timmer’s Take on What Will Drive Markets the Most in 2017

When asked in a recent interview his thoughts about the short-term and medium-term investment story, Jurrien Timmer said that the main issue for the market other than geopolitical risks is its valuation.

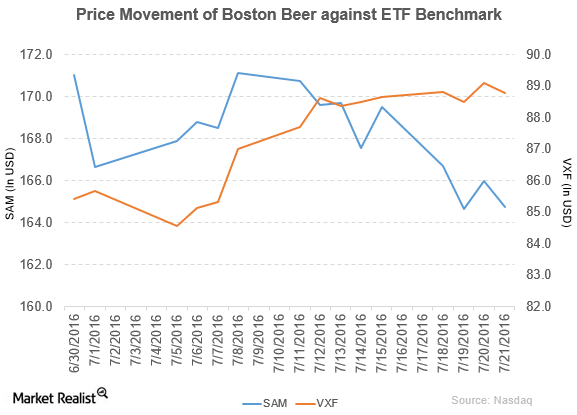

How Did Boston Beer Perform in 2Q16?

Boston Beer reported fiscal 2Q16 net revenue of $244.8 million, a fall of 2.9% compared to net revenue of $252.2 million in fiscal 2Q15.

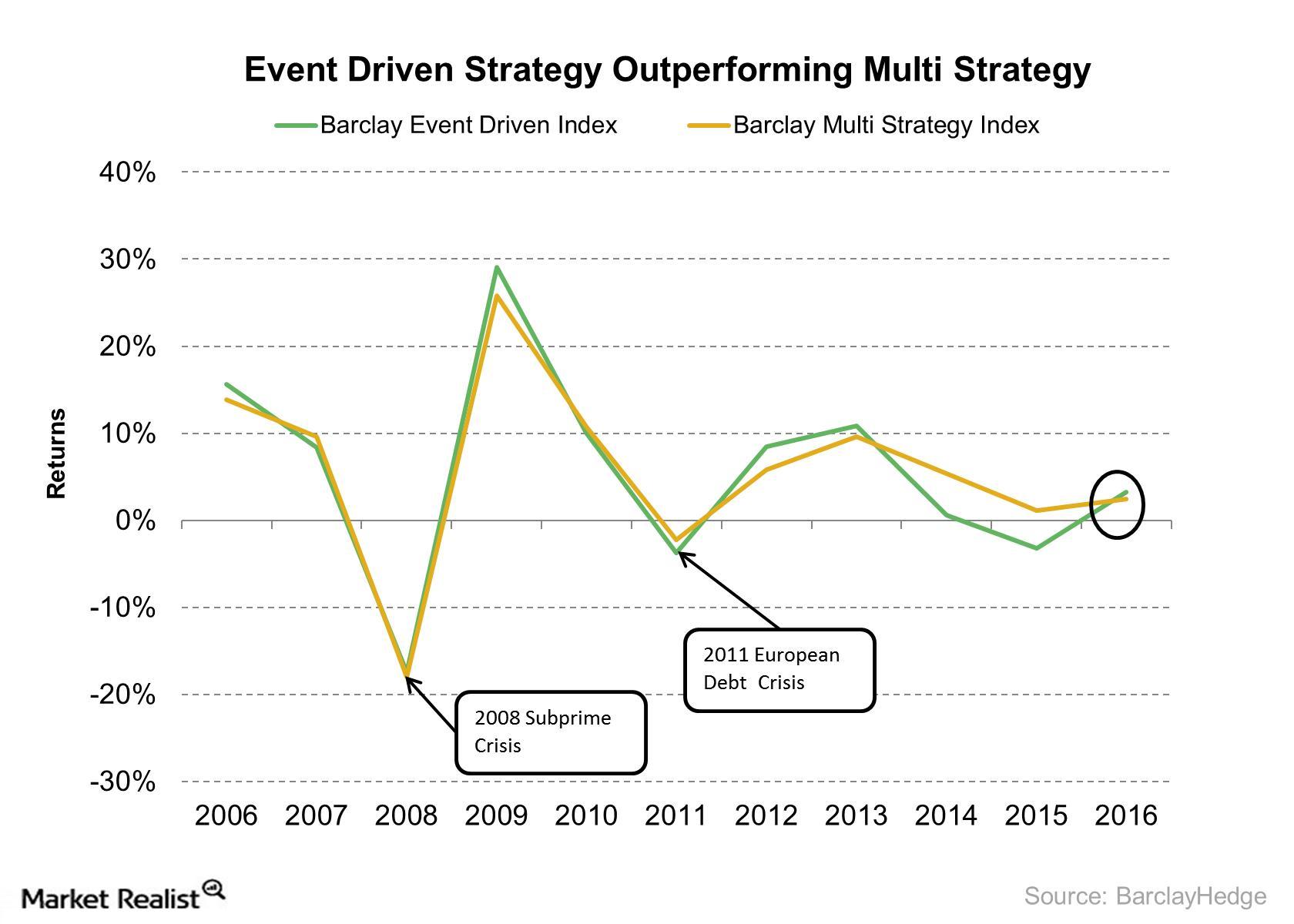

Event-Driven Strategy in a Volatile Market

Event-driven strategy is designed to make an investment in special situations, including mergers and acquisitions, restructuring, split-offs, bankruptcy, and other major events.

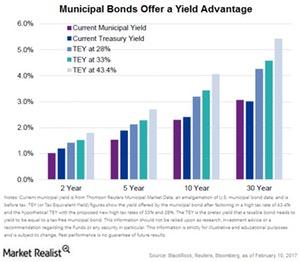

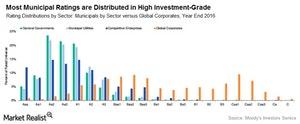

What Caused the Muni Defaults in 2016?

In 2016, Puerto Rico defaulted on constitutionally guaranteed GO (general obligation) bonds. On May 3, 2017, Puerto Rico filed for Title III bankruptcy.

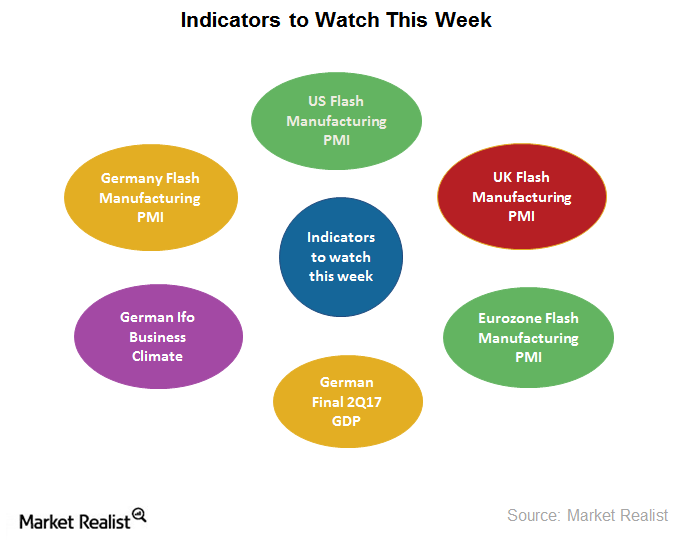

Important Economic Indicators to Watch Next Week

The most important indicators next week are the global flash manufacturing PMIs. Manufacturing PMIs are important indicators for the economy.Financials Hawks and doves: Why Fed-watching isn’t for the birds

The FOMC is made up of hawks and doves, and their balance could affect future policy. Investors who follow the Fed need be able to tell the differences.Financials Why you should pay attention to Scottish referendum opinion polls

As I write in my new weekly commentary, over the past two weeks, several polls have suggested a realistic chance that the people of Scotland will vote for independence in this week’s referendum.Financials Overview: What stretched valuations mean for investors

As I’ve been noting for some time, emerging markets (EEM) can offer compelling long-term value.

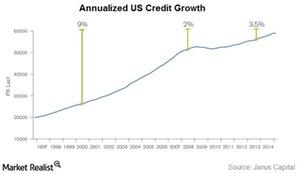

Bill Gross: Credit Is the Oil That Lubes the System

Currently, we’re in a highly levered system, especially the developed world. A levered economy depends on continued credit creation for stability and growth.

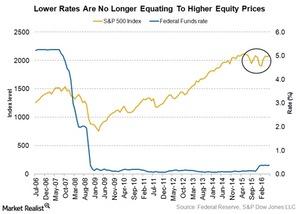

Lower Rates Aren’t Equating to Higher Equity Prices

Bill Gross provided his view on lower rates no longer resulting in credit creation in the economy. They have also lost their efficacy in raising equity prices.

Bill Gross: Possibility of Deglobalization in the Economy

Gross warned about deglobalization in the global economy. Trade between nations, exacerbating immigration issues, and stagnant economic growth formed his belief.

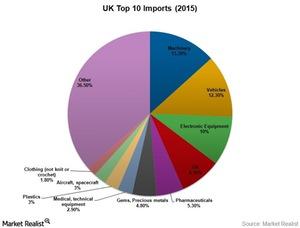

Will Brexit Weaken the UK’s Competitive Advantage over the US?

On Brexit, import restrictions and tariff quotas currently applicable to importers in the UK and foreign businesses that export to the UK are set to change.

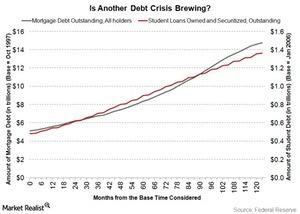

Is Student Debt the Next Bubble to Hit the US Economy?

Many are likening the current student debt situation in the United States to the mortgage debt situation that led to the 2009 financial meltdown in the US economy.

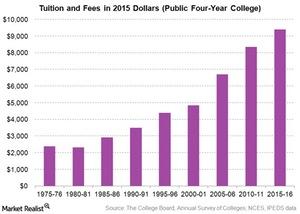

Why Is College Education So Expensive in the United States?

The rise in delinquencies on student loans in the United States (SPY) (IWM) (QQQ) can be partially attributed to the accelerated rise in college tuition and fees.

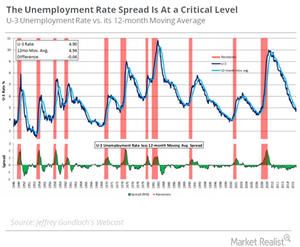

Gundlach Says This Chart Is ‘Early Warning Indicator’ of Recession

Jeffrey Gundlach seems quite bearish in his views about the US economy (IWM) (QQQ).

The ‘Three Big Forces’ That Drive All Economies

The “three big forces” Ray Dalio believes that “three big forces” drive all economies. These are: productivity growth the short-term debt cycle the long-term debt cycle An economy has to go through upturns and downturns Central bankers need to study the determinants of productivity for their economy. The determinants could include the costs of education, […]

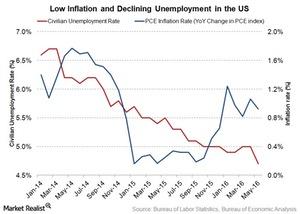

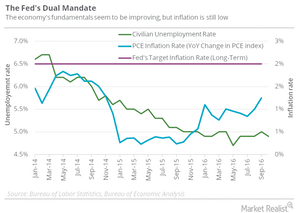

Paul Krugman to the Fed: Don’t Raise Rates

Inflation is moving up towards its target, but it still has a ways to go before it gets there. Paul Krugman believes raising rates could keep inflation from reaching that target.

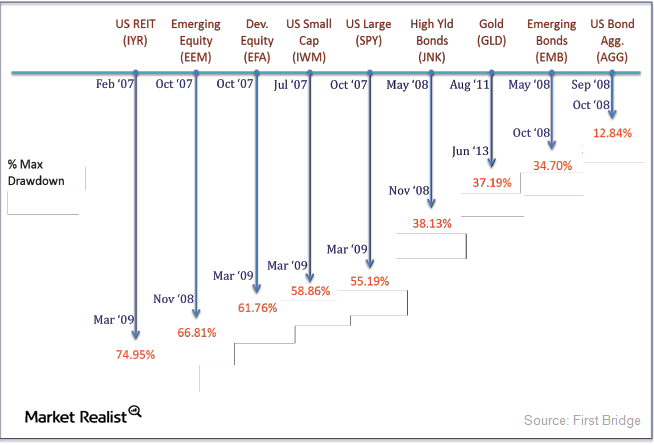

Must-know: Minimizing ETF losses by observing max drawdowns

In practice, asset owners (both retail and institutional) want to avoid significant portfolio drawdowns even if the benchmark index declines.

How Are Citadel Advisors Hedging their Portfolio?

Kenneth Cordele Griffin is the CEO of investment management firm Citadel Advisors LLC. He is the hedge fund manager and he founded Citadel in 1990.

Analyzing 22nd Century Group’s Year-to-Date Performance

Analysts expect 22nd Century Group to report revenue of $23.3 million in 2018, a 40.3% rise compared to $16.6 million in 2017.

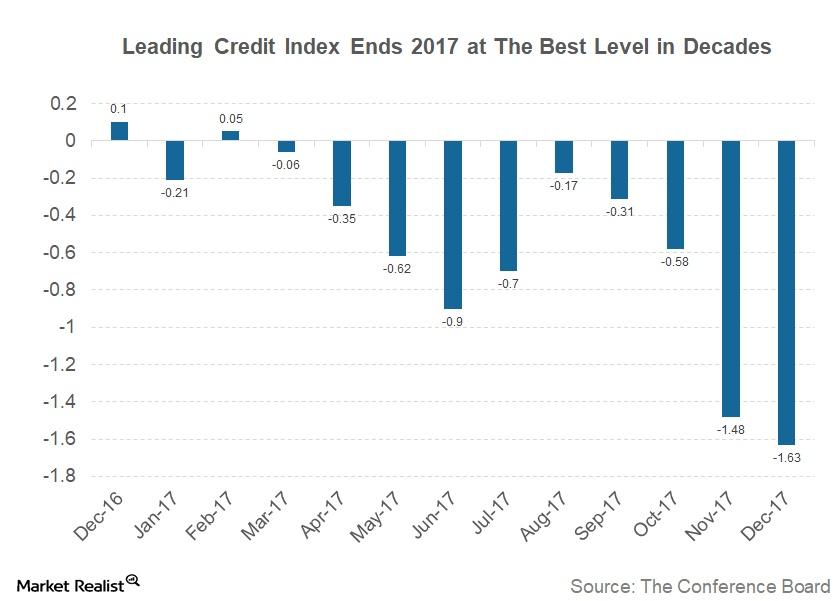

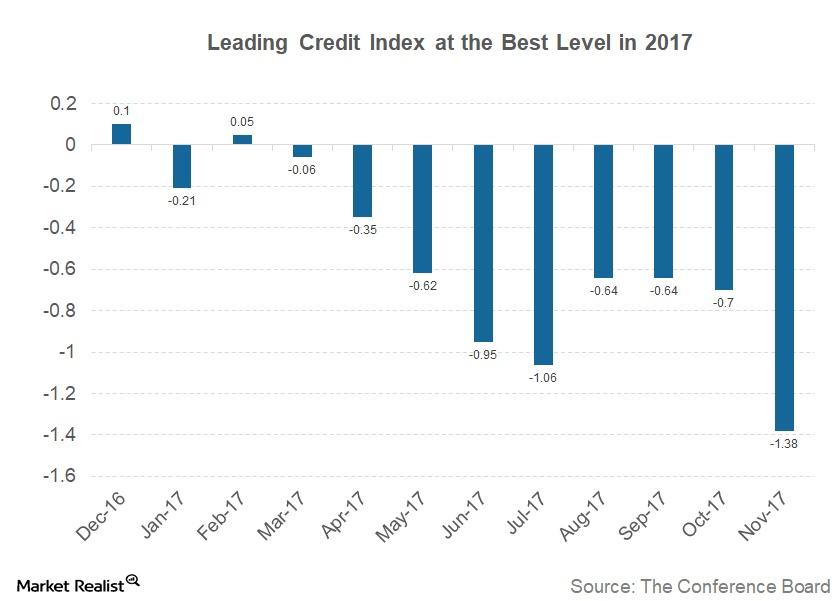

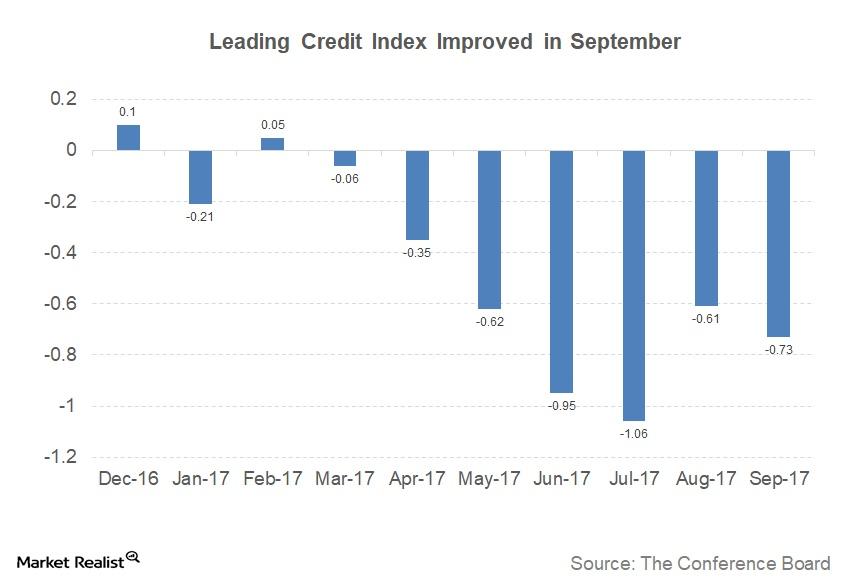

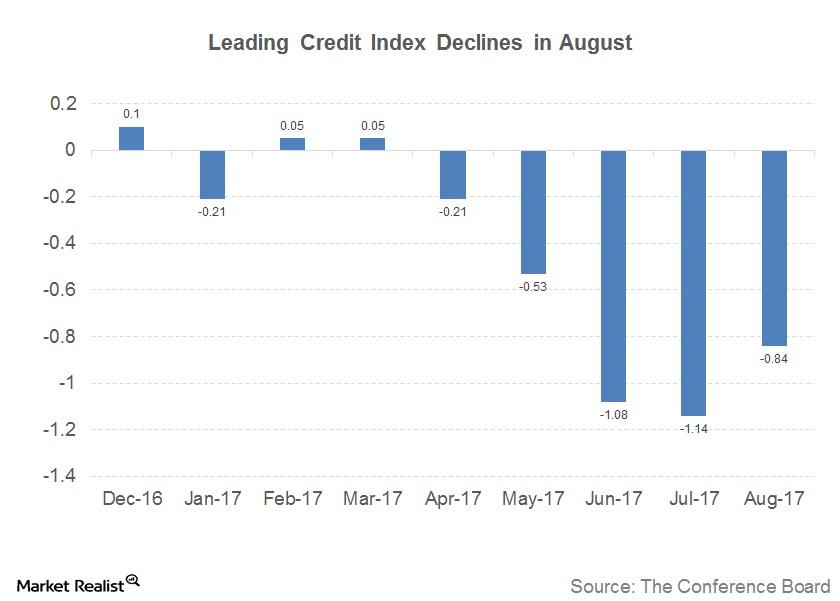

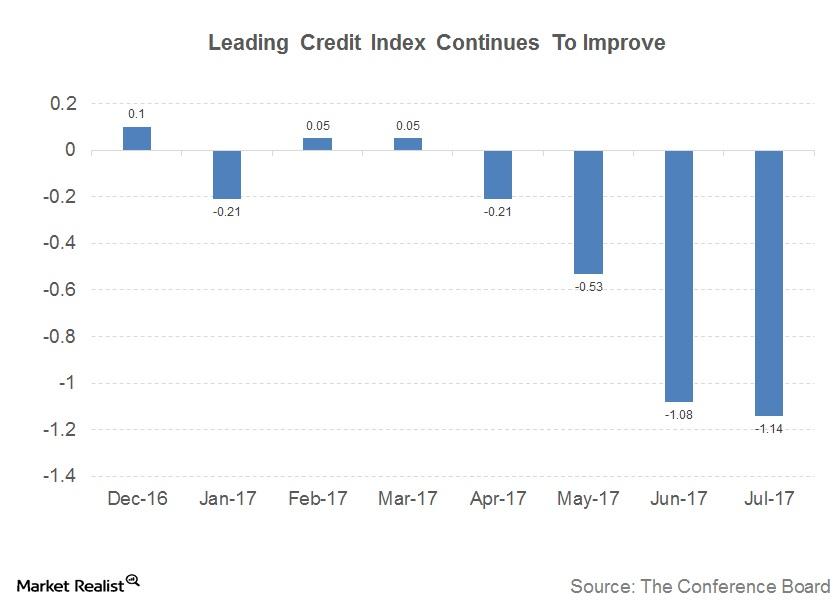

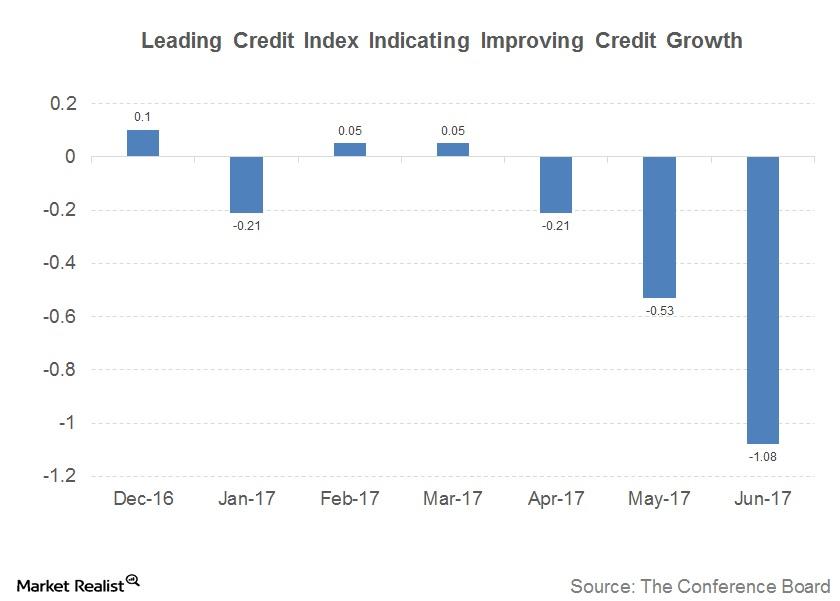

Is the Leading Credit Index Signaling Any Business Cycle Changes?

This constituent of the LEI is an economic model, constructed by modeling changes in six financial market instruments.

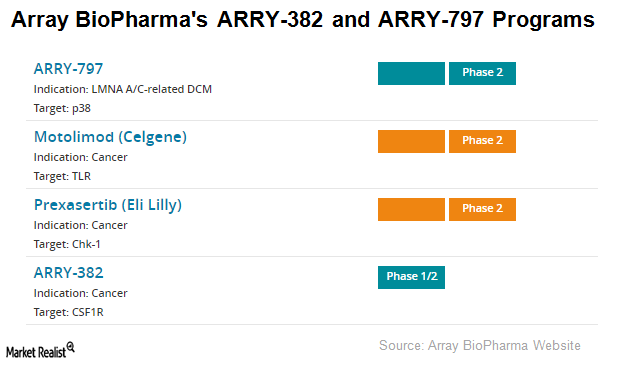

Array BioPharma’s ARRY-382 and ARRY-797

Array BioPharma (ARRY) completed its Phase 1b clinical trial of its investigational drug candidate ARRY-382 in combination with Merck’s (MRK) Keytruda for advanced tumor indications.

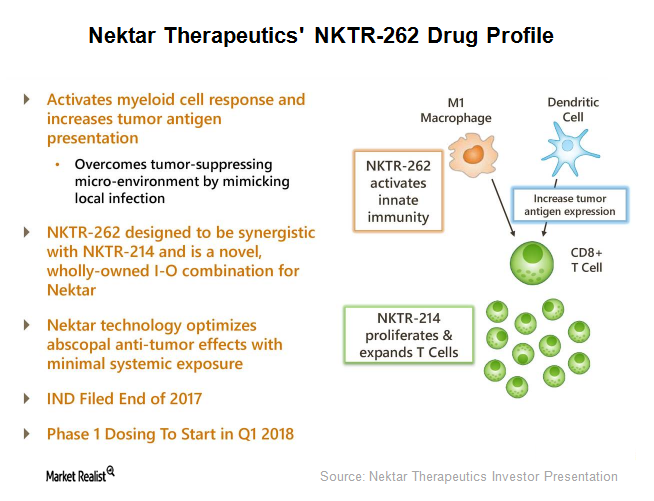

Nektar’s Deals: Daiichi Sankyo, Ophthotech, Bristol-Myers Squibb

Agreement with Daiichi Sankyo In May 2016, Nektar Therapeutics (NKTR) entered into a collaboration and licensing agreement with Daiichi Sankyo, under which Nektar granted exclusive commercialization rights for its product candidate, Onezeald, to Daiichi Sankyo in Europe. Onezeald is a long-acting topoisomerase-1 inhibitor in clinical development for treating adult patients with advanced breast cancer. Nektar […]

How the Leading Credit Index Tracks US Credit Conditions

Understanding the Leading Credit Index The Conference Board LCI (Leading Credit Index), a constituent in the LEI (Leading Economic Index), is published every month and tracks credit conditions in the US economy by following changes in six financial market instruments: the two-year swap (SHY) spread (real time) the three-month LIBOR[1.Intercontinental Exchange London Interbank Offered Rate] (SCHO) […]

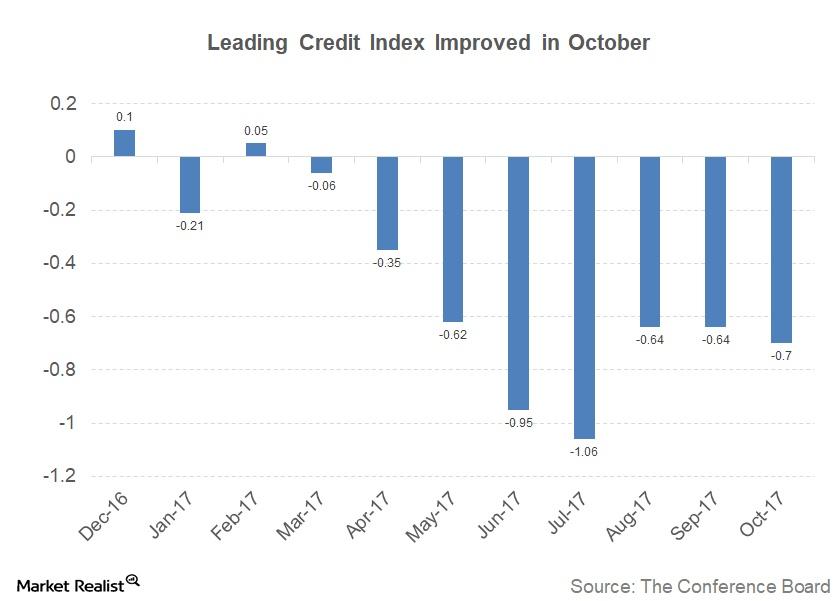

The Leading Credit Index: October Update

The Leading Credit Index for October was reported to be -0.70, improving from the revised September reading of -0.64.

These Major Economic Indicators Were Released Last Week

In this series, we’ll analyze the performance of the Eurozone Consumer Confidence Index and the ZEW Economic Sentiment Index in October 2017.

Understanding the Leading Credit Index for September 2017

The Leading Credit Index is an economic model that’s modeled on the performance of six major financial market instruments.

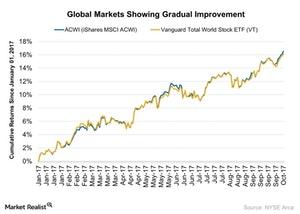

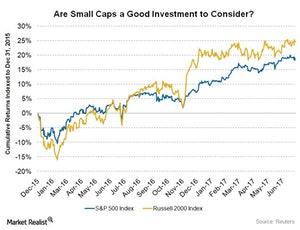

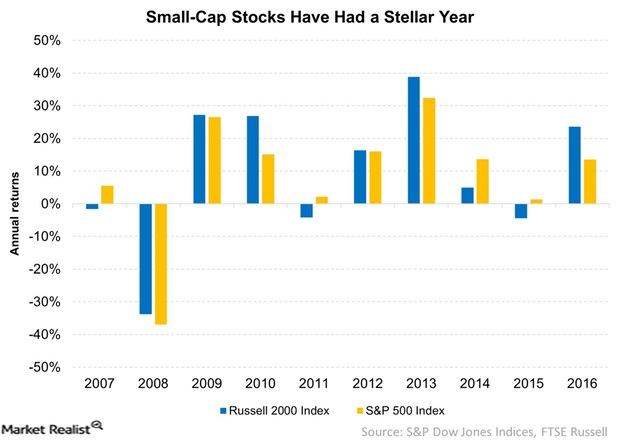

Are Small Caps Worth the Risk Right Now?

The small-cap stock universe started rallying after Trump’s victory in November.

A Glance at Muni Bonds’ Performance in 2016

The performance of municipal bonds has fallen since the 2016 election, as President Trump’s tax reform and infrastructure spending plans have caused some concern among investors.

Understanding the Leading Credit Index

Understanding the Leading Credit Index The Conference Board LCI (Leading Credit Index), a constituent of the LEI (Leading Economic Index), is constructed based on the performance of six financial market instruments. These components track lending conditions in the US economy. Performance of the LCI Improving credit conditions are considered positive for the economy. When the LCI […]

US Retail Sales Dropped: How Will It Affect the S&P 500 Index?

According to data provided by the U.S. Census Bureau, US retail sales fell 0.2% in August 2017.

What Financial Markets Predict for the US Economy

Understanding the Leading Credit Index The Conference Board Leading Credit Index (or LCI), which tracks lending conditions in the economy, is reported monthly. The index has six constituents: 2-Year Swap Spread (SHY) (real time) LIBOR[1.London Interbank Offered Rate] 3-month (SCHO) less 3-month Treasury-bill (VGSH) yield spread (real time) debit balances in margin accounts at broker dealers […]

What the Conference Board LEI Tells Us about the Market

The Leading Credit Index is one of the constituents of The Conference Board Leading Economic Index (or LEI), which is reported by The Conference Board on a monthly basis.

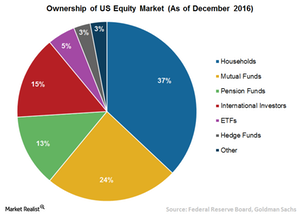

Jury Hasn’t Decided on ETFs’ Role in Stock Market Rise

Although ETF (VTV) ownership increased substantially during the last 20 years, it still isn’t high enough to meaningfully impact stock prices.

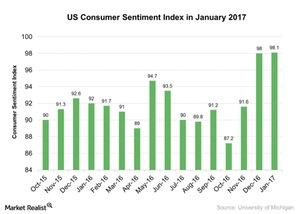

What Does the Rising US Consumer Sentiment Index Mean for the Economy?

The US Consumer Sentiment Index improved in January 2017. It stood at 98.1 in January 2017 compared to 98.2 in December 2016.

Why Did Small-Cap Stocks Have a Stellar Year in 2016?

Small-cap stocks have outperformed large caps on a regular basis since 1926. Small-cap stocks had a stellar year in 2016.