How Will the Fed Affect the Earnings Recovery Environment?

The dollar index (UUP) rallied about 22% between October 2014 to July 2016.

Dec. 4 2020, Updated 10:53 a.m. ET

The Fed’s role in the earnings recovery environment

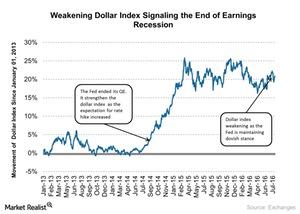

In the previous parts of this series, we discussed that the dollar index is one of the important factors that led to a decline in corporate earnings in the last two years. The dollar index (UUP) rallied about 22% between October 2014 to July 2016. During this period, the S&P 500 index’s (SPY) trailing-12-month earnings per share (or EPS) fell by nearly 50%.

Should the Fed go for a rate hike?

The Fed is cautious about the downside risk to the economy that could result from the Brexit vote and the deflationary situation across developed economies (EFA). The US (QQQ) (IWM) is the only economy that is moving to raise its interest rate among all the developed nations. Solid economic data is improving the chances that we could see a rate hike sooner rather than later. However, in her June statement, Janet Yellen said that although the jobs number has improved, inflation is still below the expectation. Crude oil is one of the important components of consumer spending that is still struggling just above $40 per barrel. This could delay the Fed’s next rate hike.

The Fed will consider a rate hike when the economy shows more strength. Global markets (ACWI) (VT) are jittery due to events such as Brexit. The Fed’s dovish stance will keep the dollar weaker, which will be helpful in the earnings recovery situation.

In the next part of this series, we will discuss where investors should look in the slower growth environment.