Vanguard Total World Stock ETF

Latest Vanguard Total World Stock ETF News and Updates

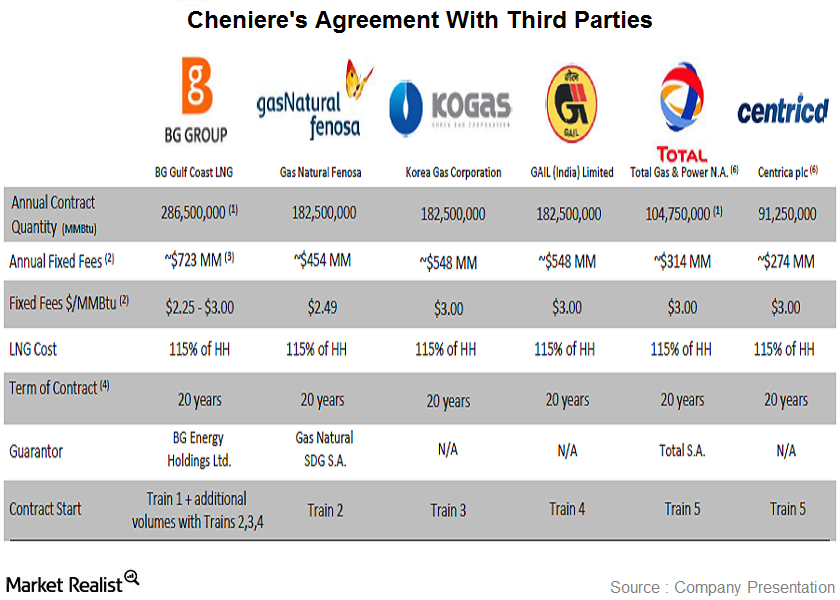

Overview of Cheniere’s sale and purchase contracts

Cheniere Energy, Inc.’s MLP company’s Sabine Pass liquefaction project has already secured four fixed-price, 20-year sales and purchase agreements with third parties.

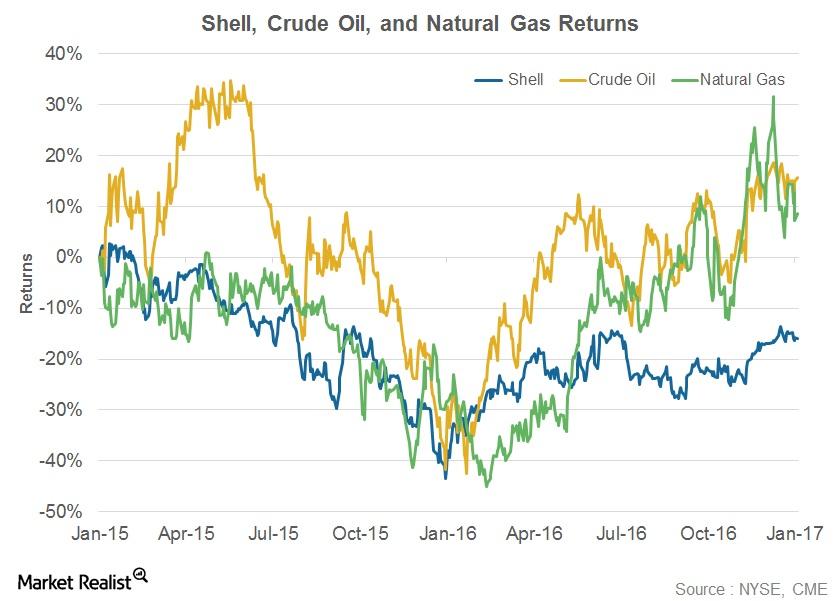

How Has Shell’s Stock Performed ahead of Its 4Q16 Earnings?

On January 20, 2016, Shell began recuperating from the falls it had experienced in the previous year. Shell has risen 49% since January 20, 2016.

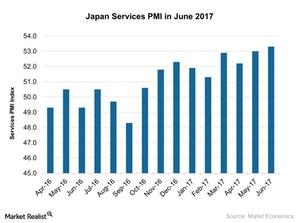

Why the Japan Services PMI Improved in June 2017

The Japan Services PMI (EWJ) (DXJ) stood at 53.3 in June 2017 compared to 53.0 in May 2017. It met the market expectation of 53.2.

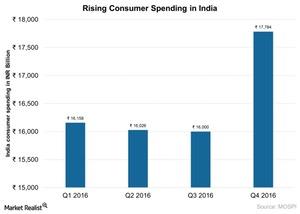

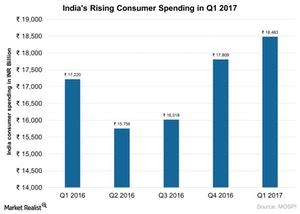

Consumer Activity Is on the Rise in India

Consumer spending in India (INDL) stood at ~17.8 trillion rupees in 4Q16, an 11% increase compared to 16.0 trillion rupees in 3Q16.

Bill Gross: Possibility of Deglobalization in the Economy

Gross warned about deglobalization in the global economy. Trade between nations, exacerbating immigration issues, and stagnant economic growth formed his belief.

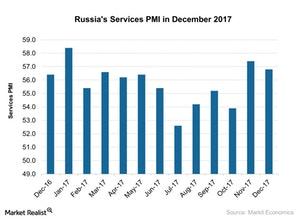

How Russia’s Service Activity Looked in December 2017

According to a report by Markit Economics, Russia’s service PMI (purchasing managers’ index) showed a weaker improvement in December as compared to November 2017.

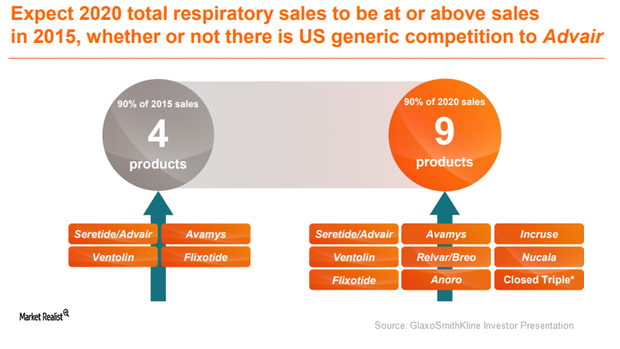

Anoro Ellipta May Boost GlaxoSmithKline’s Respiratory Franchise Revenues

Anoro Elipta earned revenues of close to 233 million pounds in the first nine months of 2017, which is 77% year-over-year (or YoY) growth on a reported basis and 63% YoY growth on a constant exchange rate (or CER) basis.

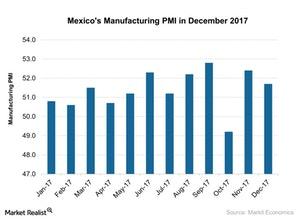

What Does Mexico’s Manufacturing PMI Indicate?

According to a report by Markit Economics, Mexico’s (EWW) manufacturing activity showed a slightly weaker improvement in December as compared to November 2017.

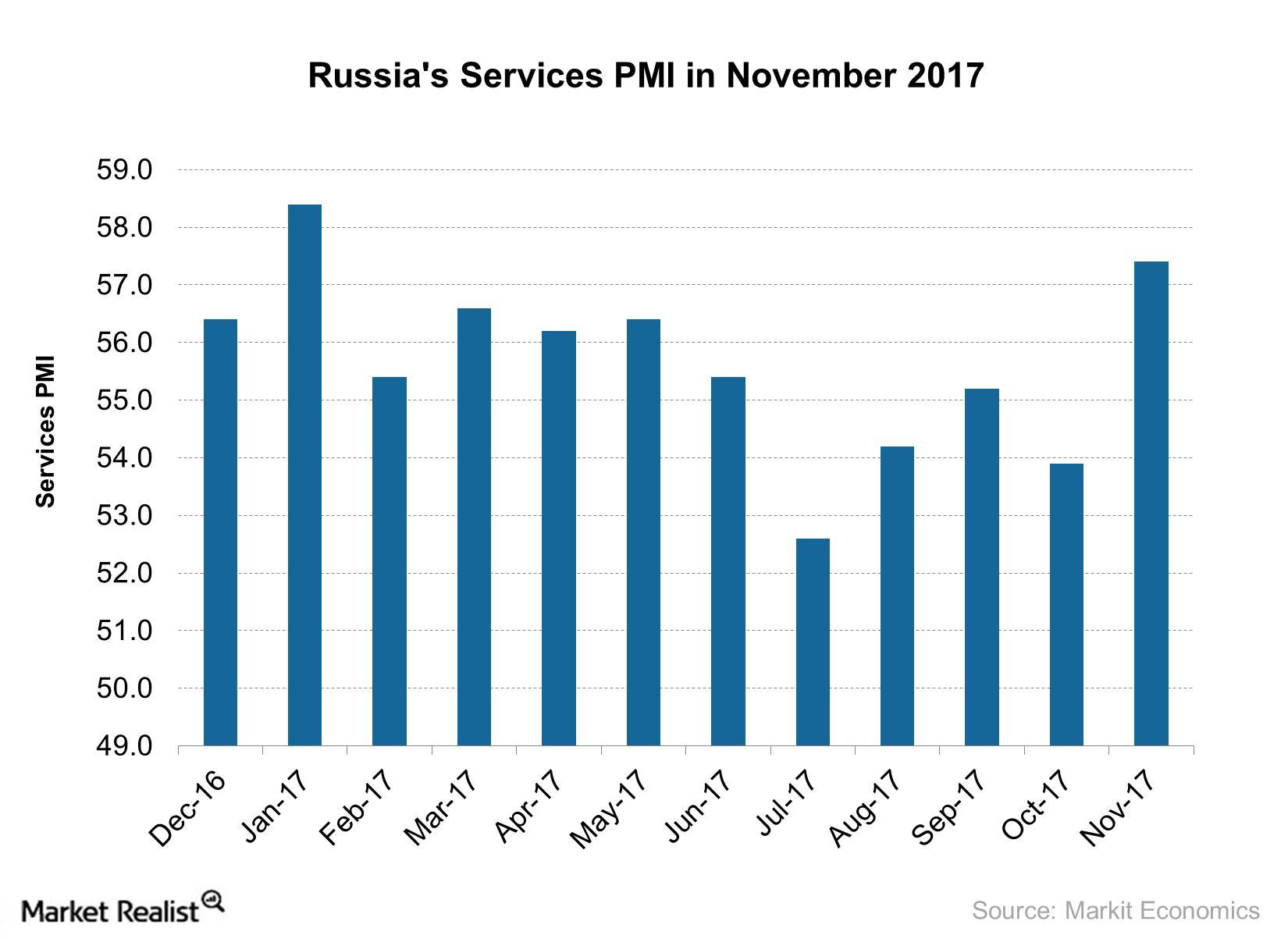

Why Russia’s Service Sector Strengthened in November 2017

Russia’s service sector in November According to a report by Markit Economics, Russia’s service PMI (purchasing managers’ index) showed a solid improvement in November 2017, rising to 57.4 from 53.9 in October. The figure beat the market expectation of 55.0 and marked the highest rise since January 2017. The strong improvement in Russia’s service PMI […]

Why Japan Services PMI Didn’t Meet Expectations in November

The Japan Services PMI fell in November 2017. It came in at 51.2 compared to 53.4 in October. It didn’t meet the market expectation of 52.0.

Why Japan’s Services PMI Improved Solidly in October 2017

Japan’s services PMI (EWJ) (DXJ) rose solidly in October 2017. It stood at 53.4 in October 2017 compared to 51.0 in September 2017.

Why Japan’s Services PMI Has Been Falling Gradually

According to the report provided by Markit Economics, Japan’s services PMI (EWJ) (DXJ) stood at 51.0 in September 2017 compared to 51.6 in August 2017.

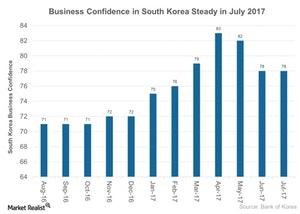

South Korea’s Business Confidence Remains Steady in July 2017

Business confidence in the manufacturing sector in South Korea (EWY) has remained stable at 78 in July 2017.

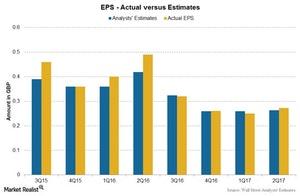

GlaxoSmithKline’s Valuations after Its 2Q17 Earnings

On July 28, 2017, GlaxoSmithKline (GSK) traded at a forward PE multiple of 13.4x, which is slightly lower than the industry average of 15.2x.

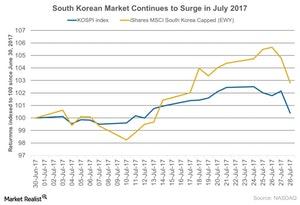

Equities in South Korea Rise with Tech Rally in July 2017

South Korean equities are soaring in 2017, with the Korea Composite Stock Price Index (or KOSPI), its benchmark index, reaching an all-time high of 2,451.5 in July 2017.

Is Consumer Spending Rising in India amid Reforms in 2017?

Consumer spending in India (INDA) is expected to grow via remonetization and other reforms undertaken by its government in 2017.

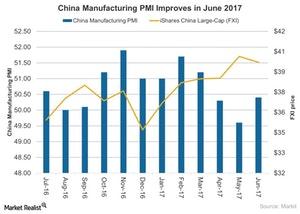

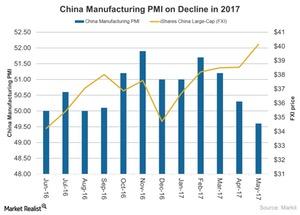

Will China’s Rebound in Manufacturing Activity Continue in 2017?

Manufacturing activity in China expanded in June 2017 compared to its fall in May. Chinese manufacturing activity is showing a mixed outlook for economic growth in 2017.

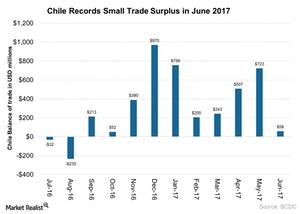

Sluggish Mining Sector and Chile’s Trade Surplus in June

Chile’s economy is highly dependent on copper mining activities. The recent long strike at BHP Billiton’s Escondida copper mine continues to impact Chile.

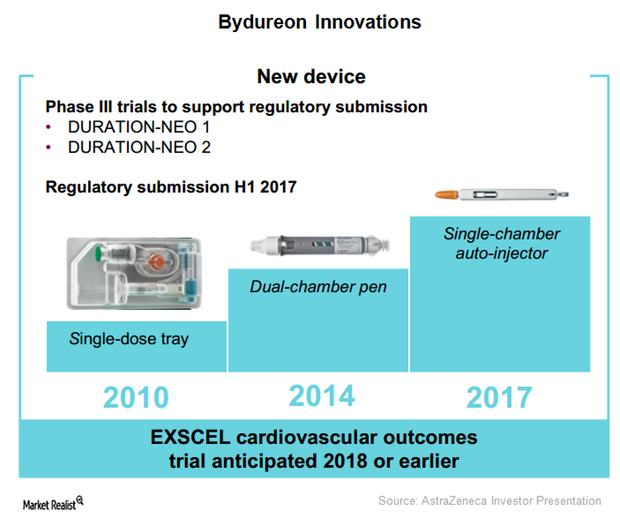

Bydureon Auto-Injector May Boost the Drug’s Sales in Future Years

The combined product sales of Bydureon and Byetta globally in 1Q17 was ~$199 million, which represents 1% YoY growth on a reported basis.Macroeconomic Analysis Did the UK Election Affect Manufacturing in June?

The UK’s manufacturing PMI recorded a weaker improvement in June 2017. It stood at 54.3 in June compared to 56.3 in May.

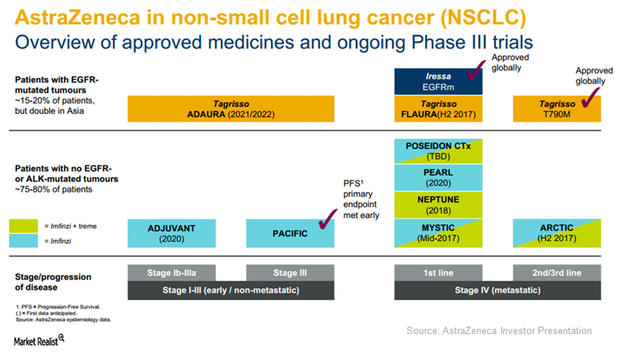

AstraZeneca Aims to Offer Multiple Therapies in NSCLC Segment

EGFR mutant NSCLC has become a major market opportunity for AstraZeneca’s drugs Tagrisso and Iressa.

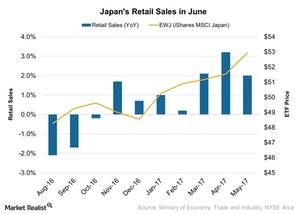

What Japan’s Falling Retail Sales Indicate for the Economy

According to the data provided by Japan’s Ministry of Economy, Trade and Industry, Japan’s retail sales rose to 2% in May 2017 on a yearly basis.

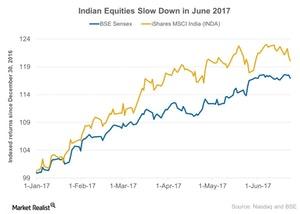

Indian Equity Markets: Waiting for the GST?

Indian equities have remained steady in June 2017, but markets remain cautious about the end of the quarter, given the impact of the GST (Goods and Services Tax).

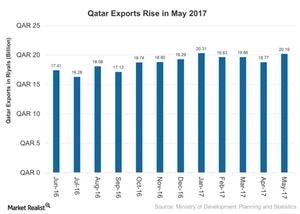

Qatar’s Exports Could Rise despite the Crisis in 2017

Qatar’s exports stood at 20.2 billion riyals in May 2017—an increase of 8% compared to a fall of 5% in the previous month.

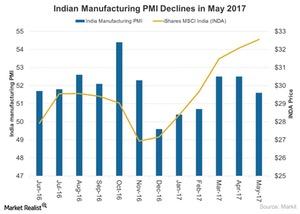

India’s Manufacturing Activity in May 2017

The Nikkei Manufacturing PMI in India dropped to 51.6 in May 2017 compared to 52.5 in April 2017.

A Look at China’s Manufacturing Activity in 2017

China’s (FXI) economic activity slowed down in May 2017 as the country’s manufacturing activity touched its 11-month low.

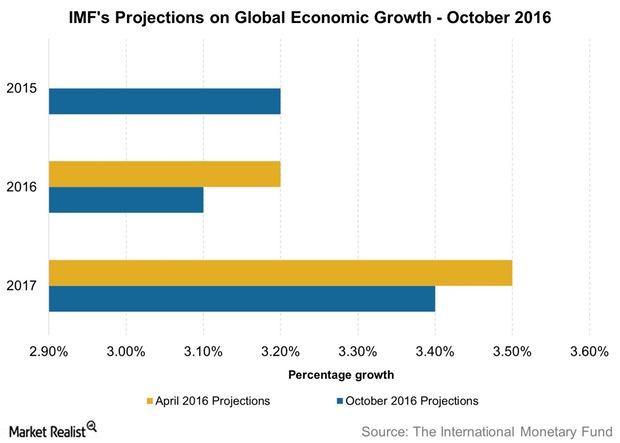

International Monetary Fund Weighs in on Slowing Global Economy

In its October World Economic Outlook report, the IMF estimated that the global economy will likely continue to slow down, reaching growth of 3.1% in 2016.

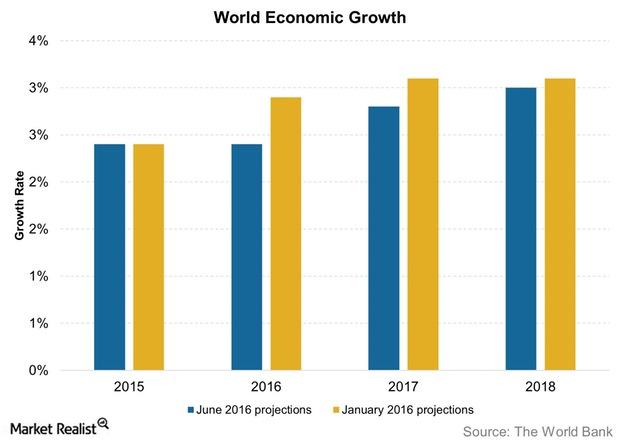

The World Bank Has News about the Global Economy, and It’s Not Good

In its 25th annual Global Economic Prospects report, the World Bank did not have many good things to say about the global economy in 2016.

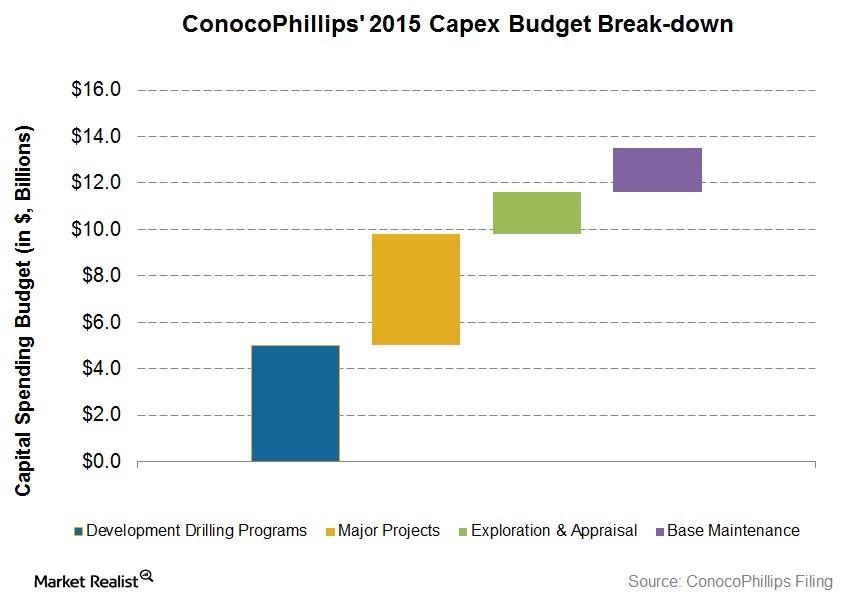

A key analysis of ConocoPhillips’ capex breakdown for 2015

ConocoPhillips’ capex breakdown for 2015 includes major projects, development drilling, exploration and appraisal, and base maintenance.