Why Japan’s Services PMI Has Been Falling Gradually

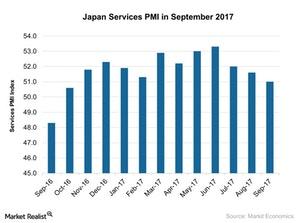

According to the report provided by Markit Economics, Japan’s services PMI (EWJ) (DXJ) stood at 51.0 in September 2017 compared to 51.6 in August 2017.

Oct. 11 2017, Updated 9:13 a.m. ET

Japan’s services PMI in September

According to the report provided by Markit Economics, Japan’s services PMI (EWJ) (DXJ) stood at 51.0 in September 2017 compared to 51.6 in August 2017. It didn’t meet the market expectations of 51.8.

This movement was the 12th consecutive month of expansion in service activity. A level above 50 indicates expansion in activity while a level below 50 indicates a contraction in activity. However, the September services PMI was the lowest reading since October 2016.

The services PMI has been showing a gradual decline since July 2017. The weaker improvement in the September services PMI was mostly due to the weaker improvement in export and new orders.

Production output fell in September as new orders didn’t show a significant rise. However, job growth remained strong in that month. The overall domestic demand and overseas (VT)(ACWI)(VTI) demand in the service sector slowed in the economy.

Performance of ETFs

The iShares MSCI Japan ETF (EWJ), which tracks Japan’s performance, rose nearly 1.8% in September 2017. The WisdomTree Japan Hedged Equity ETF (DXJ) rose nearly 5.1% during the month.

Japan’s economy has shown a strong recovery in the past few months. The improving consumer confidence in Japan is strengthening investors’ optimism in the economy.

The rising consumer demand is also expected to boost the earnings of various businesses. However, the rising geopolitical risk that arose from North Korea is affecting the movement of the yen and the country’s exports.

In the next part of this series, we’ll analyze the performance of the ADP employment report for September 2017.