BTC iShares MSCI ACWI ETF

Latest BTC iShares MSCI ACWI ETF News and Updates

These Key Economic Indicators Were Released Last Week

In this series, we’ll take a look at the global final manufacturing PMIs and services PMIs for March 2017. These indicators help us understand the business condition of an economy.

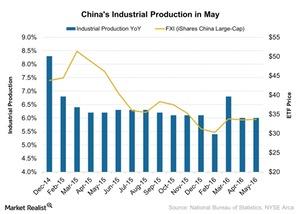

China’s Industrial Production Rises: Is Investor Confidence Back?

On a year-over-year basis, China’s industrial production increased to 6.0% in May 2016. That’s the same pace as April.

How Will the Fed Affect the Earnings Recovery Environment?

The dollar index (UUP) rallied about 22% between October 2014 to July 2016.

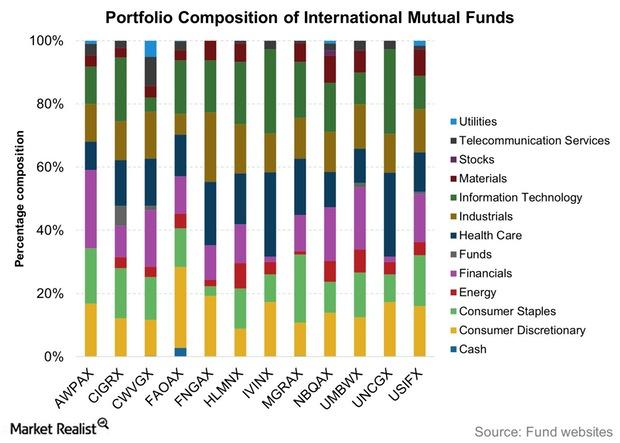

Is It Time to Invest in International Funds?

2016 has mostly been about macro trends, thus presenting a different set of challenges for active fund managers who mostly focus on companies rather than economic and sector trends.

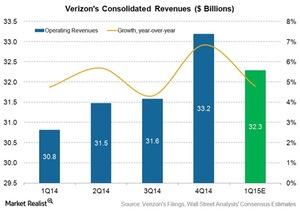

Verizon’s Revenue Growth Should Slow down in 1Q15

Verizon (VZ) will report its 1Q15 results on April 21, 2015. It’s the largest US telecom company. It had a market capitalization of $200.08 billion as of April 13, 2015.

Where Are Interest Rates Going? Ray Dalio Weighs In

Ray Dalio, and Marketplace Morning Report host David Brancaccio discussed the future of the economy and the next recession. Here’s what you need to know.

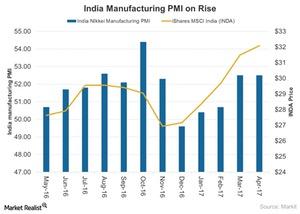

Improved Manufacturing in India, But Recovery?

The Nikkei India Manufacturing PMI for April 2017 matched its reading for the previous month.

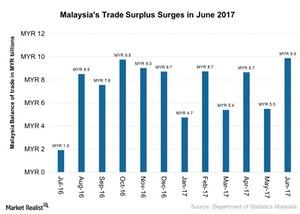

What’s behind Malaysia’s Large Trade Surplus in June 2017?

Malaysia’s trade surplus jumped to 9.9 billion Malaysian ringgit (MYR) (about $2.3 billion as of August 11, 2017) in June 2017—an 80% rise YoY.

New York Is Gearing Up for PepsiCo’s Kola House this Spring

PepsiCo is getting ready to launch Kola House, its first hospitality venture, at its flagship location in New York City’s Meatpacking District. The first Kola House, which will operate as a kola bar, restaurant, lounge, and event space, is expected to open this spring.

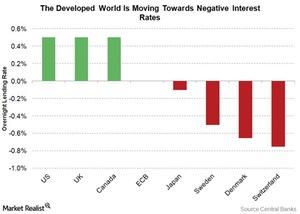

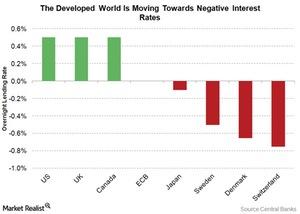

Will the Fed Have to Use More Unconventional Measures?

Global monetary policy is unconventional. From an era of lowering interest rates to boost economic growth, central bankers are taking rates into negative territory.

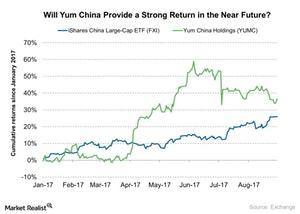

Why Druckenmiller Is Optimistic about Chinese Consumer Stocks

Druckenmiller’s firm bought 710,200 shares of Alibaba (BABA) in 2Q17. The holding accounted for nearly 5.4% of the firm’s portfolio in 2Q17.

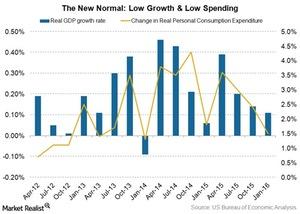

Bill Gross’s Views on Growth and Inflation

Gross believes that money has stopped generating growth and inflation. Equity prices are artificially elevated, and negative yields are guaranteeing capital losses.

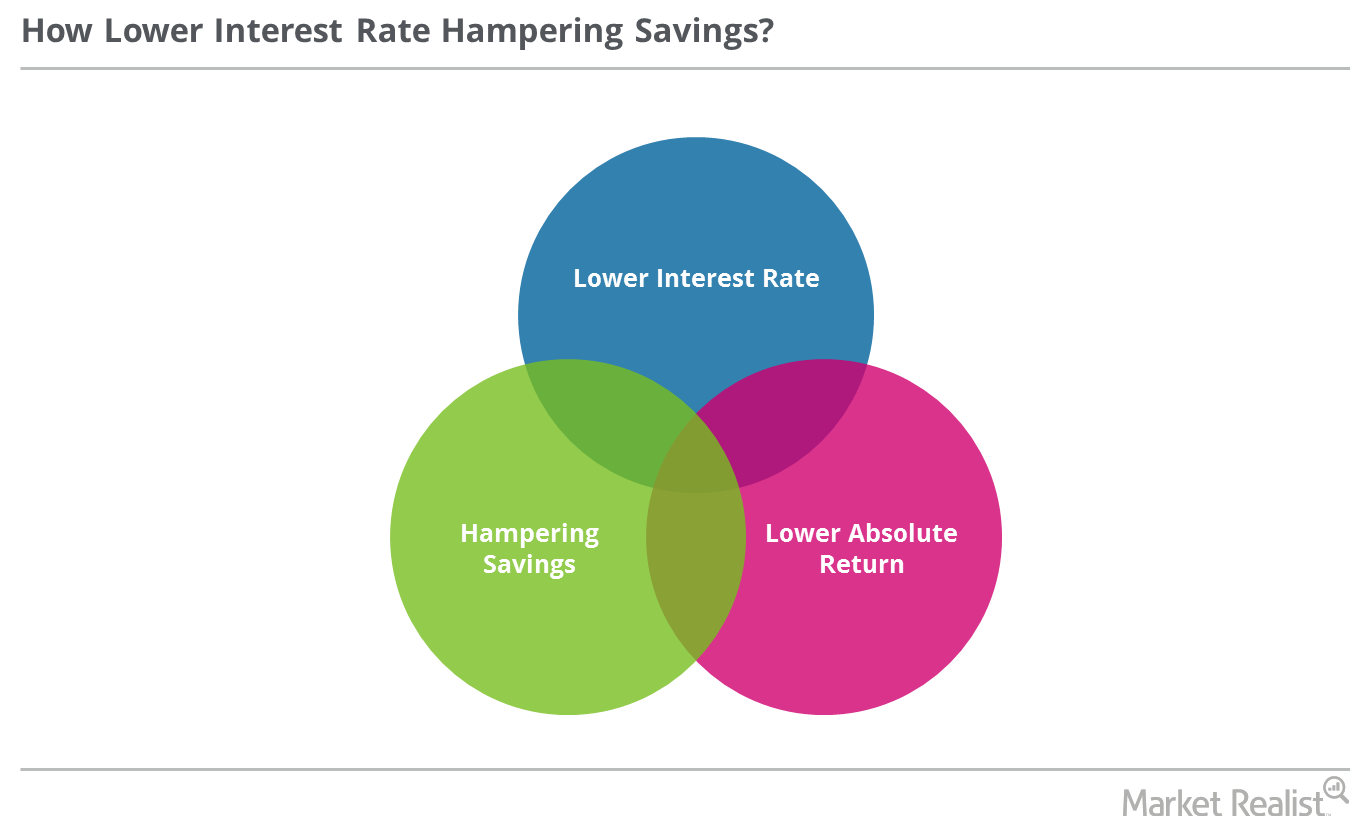

Larry Fink Says Lower Rates Hampered Savings around the World

Various central banks in developed nations (EFA) have lowered their key interest rates close to the zero level to revive their economies.

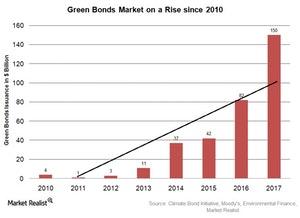

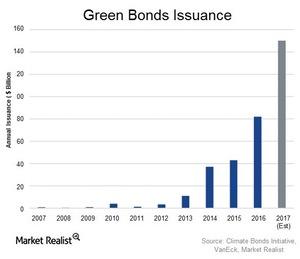

Green Bonds Issuance Show Signs of Growth in 2017

Green bonds carry the same risk-return profile as conventional bonds. However, these bonds fund projects focused on energy efficiency, clean water, transportation, biodiversity, and sustainable waste management.Financials Bank of Japan announces QQE2, expanded monetary stimulus

At its monetary policy meeting held on October 31, the Bank of Japan (or BOJ) announced new stimulus measures. The measures come in addition to those it announced earlier.

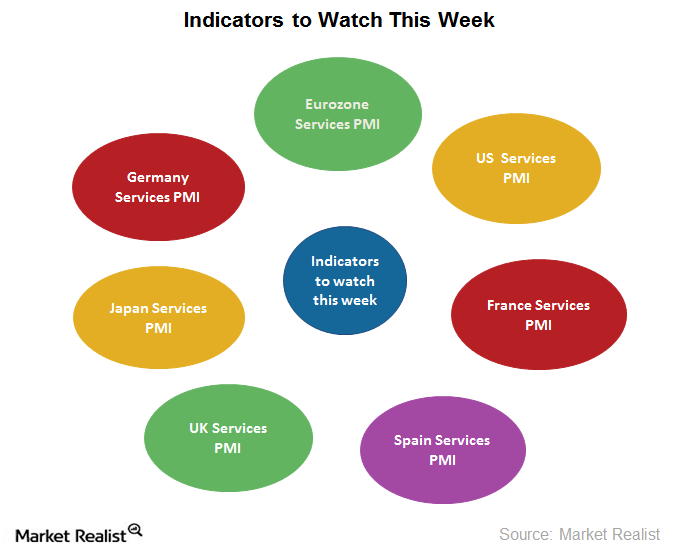

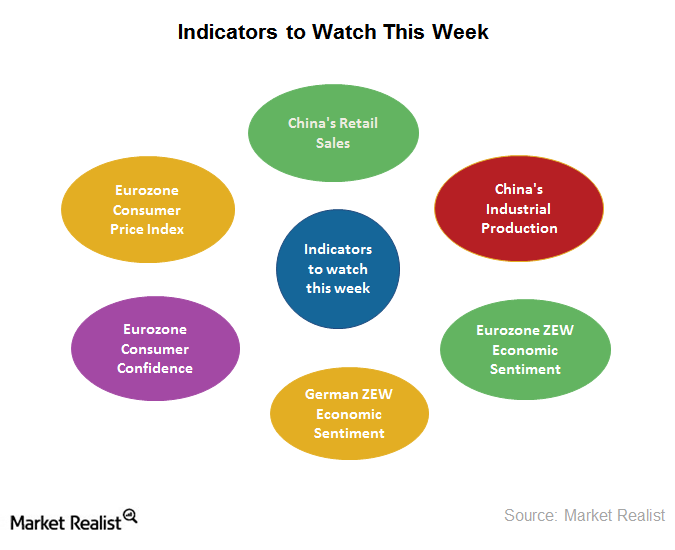

Economic Indicators Investors Should Watch This Week

If major Eurozone economic indicators improve in the coming months, we could expect those economies to regain some strength.

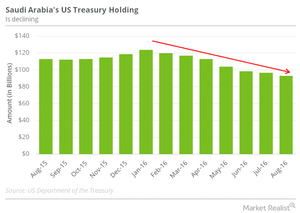

How Saudi Arabia’s Bond Sale Affects US Treasury Bonds

Saudi Arabia has also been involved in the sale of US Treasuries. The country is the 15th-largest holder of US Treasury bonds in the world.

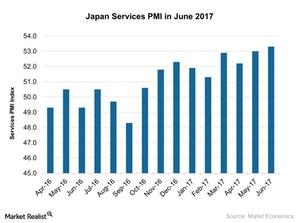

Why the Japan Services PMI Improved in June 2017

The Japan Services PMI (EWJ) (DXJ) stood at 53.3 in June 2017 compared to 53.0 in May 2017. It met the market expectation of 53.2.

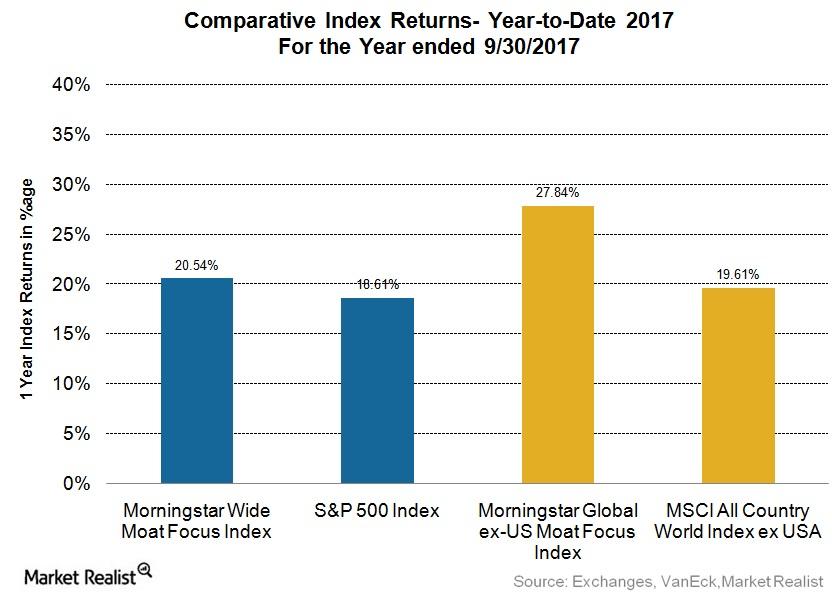

How Moat Indexes Performed in September

The US Moat Index has been performing fairly well this year. As of September 30, 2017, it has outperformed, rising 20.5% over the S&P 500 Index’s (SPY) (SPX-INDEX) rise of 18.6% YTD.

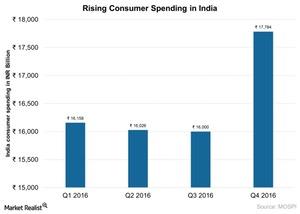

Consumer Activity Is on the Rise in India

Consumer spending in India (INDL) stood at ~17.8 trillion rupees in 4Q16, an 11% increase compared to 16.0 trillion rupees in 3Q16.

Can We Build a More Environmentally Aware Portfolio?

In this highly uncertain global market, the climate change factor has taken a back seat. But we can’t ignore its effect on the economy and its financial impact.

Economic Indicators Investors Should Watch for This Week

Economic indicators Key economic indicators investors should watch for this week are: US (SPY) services PMI data UK (EWU) services PMI data Eurozone (IEV) (VGK) services PMI data German (EWG) services PMI data Spanish services PMI data French (EWQ) services PMI data Japanese services PMI data US ADP employment data US non-farm payroll data Wrapping up […]

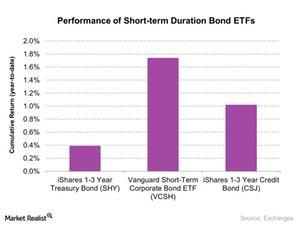

Investment Avenues during the Rise of Short-Term Interest Rates

Bill Gross thinks the central banks should implement their strategies very carefully and cautiously in this scenario.

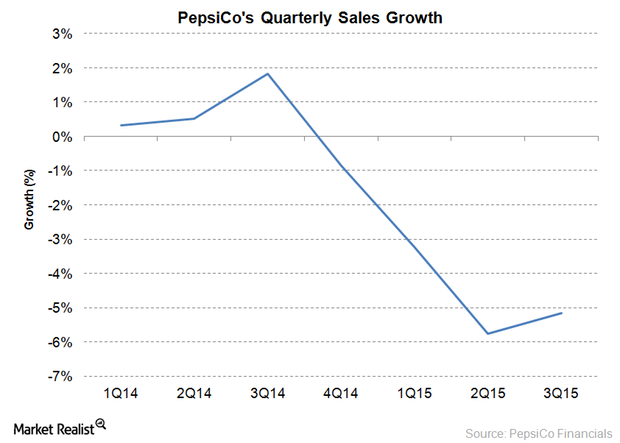

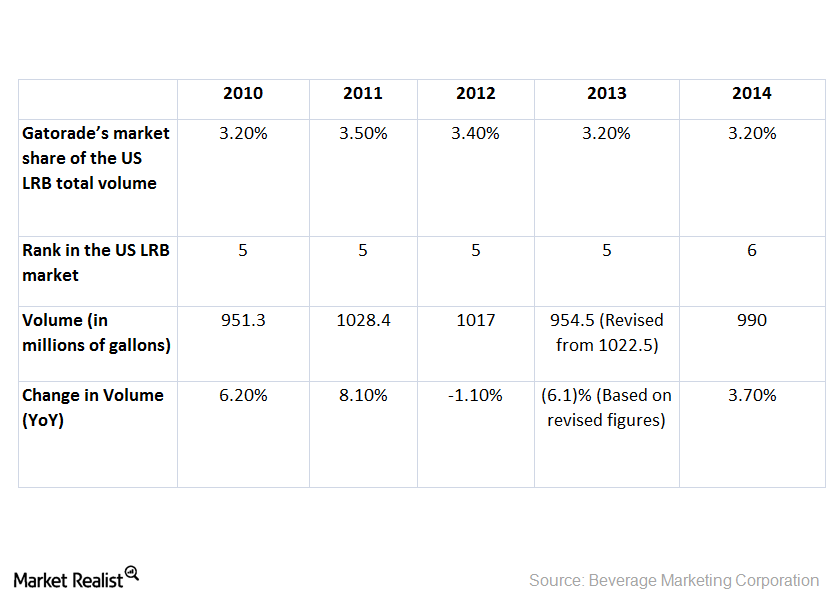

Gatorade’s Position in the Sports Beverage Market

Gatorade’s position and volumes have been impacted by rising competition. It has also felt the effect of the popularity of bottled water, ready-to-drink tea, coffee, and energy drinks.

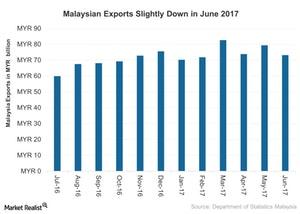

Understanding the Marginal Decline in Malaysian Exports in June

Exports from Malaysia in June 2017 stood at 73.1 billion Malaysian ringgit (MYR) (about $17 billion as of August 11, 2017), or 10% higher YoY.

What Indicators Should Investors Watch This Week?

As China is one of the important emerging economies, investors should keep an eye on its important indicators.

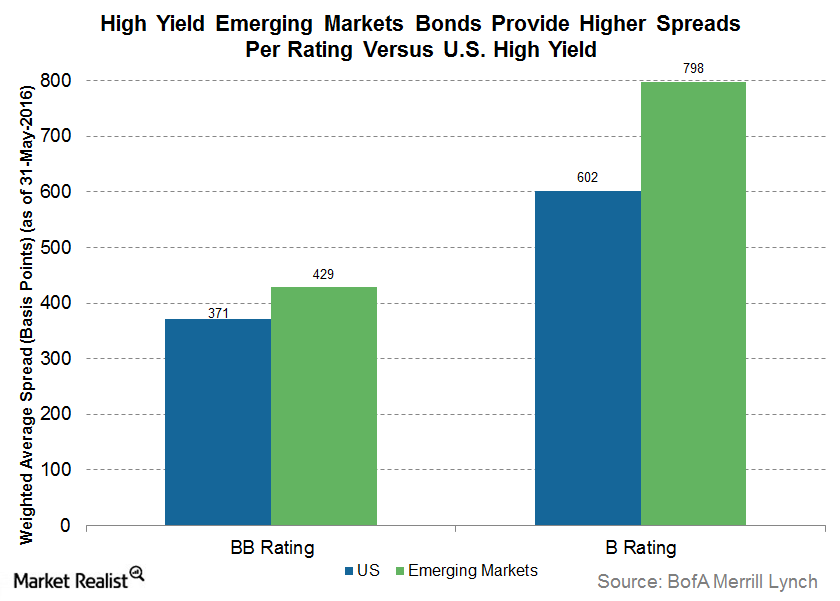

What Are the Attractive Characteristics of High Yield EM Bonds?

Investors are flocking to government bonds (BND) of developed markets, which is causing downward pressure on interest rates.

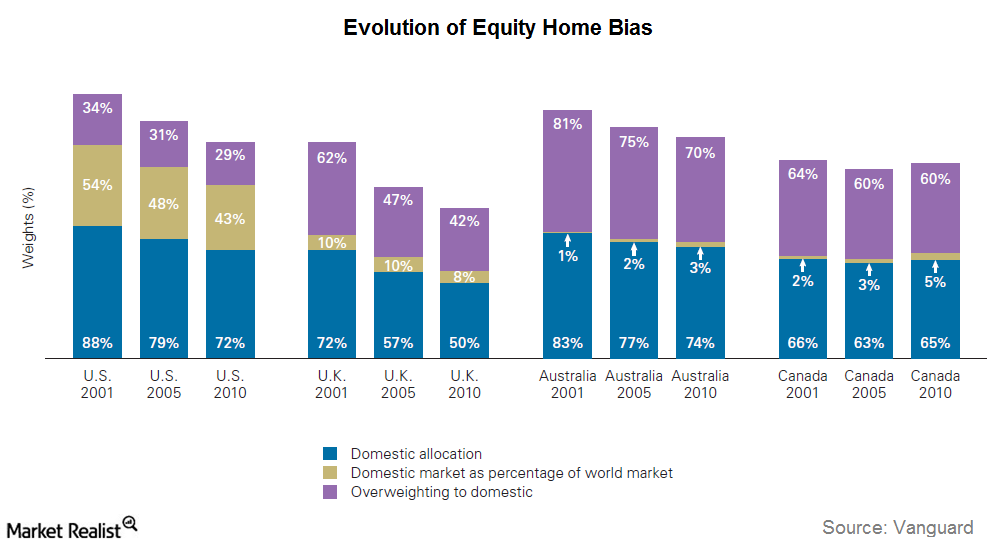

The Equity Home Bias Puzzle

In this series, we’ll look at the prevalence of home bias, the disadvantages of favoring home bias, and the benefits of international diversification.

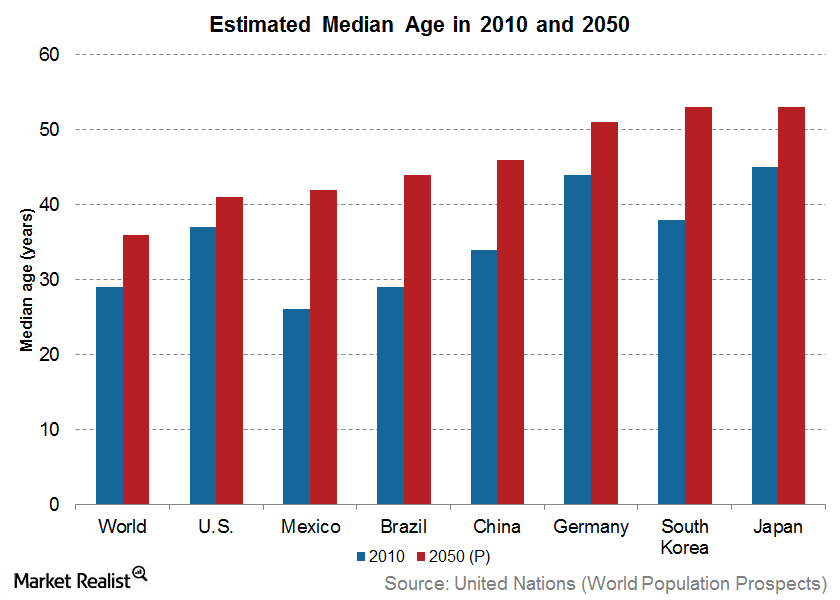

The Aging World Means a Graying Workforce

We’re in a rapidly aging world. According to the United Nations World Population Prospects report, the median age of the world is estimated to grow from 29 years in 2010 to 36 years by 2050.

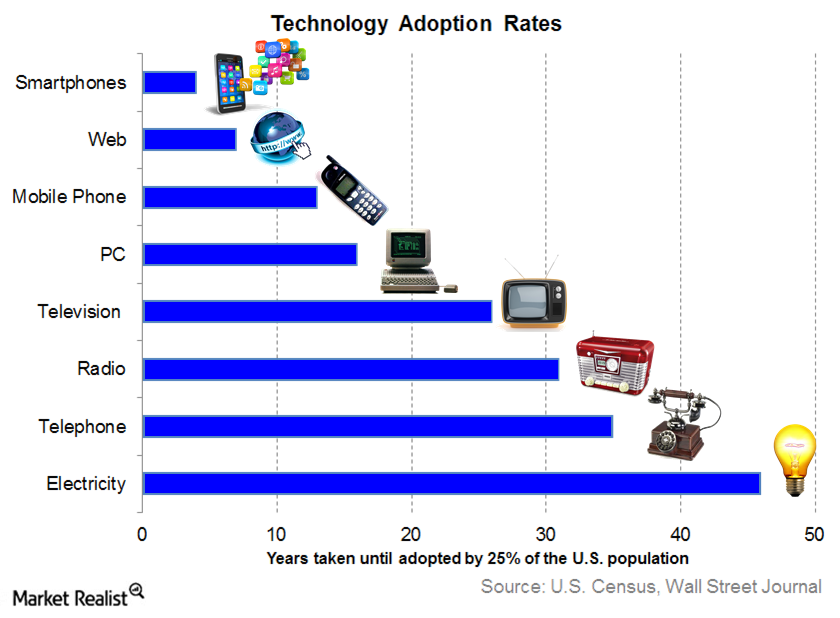

Tech Adoption Rates Have Reached Dizzying Heights

Technology (XLK) is advancing by leaps and bounds. The diffusion and adoption rates for new technologies have risen over the years as the population has become more tech-savvy.

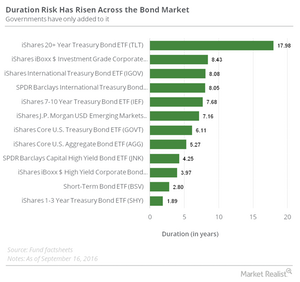

Investors Beware: Duration Risk Has Risen across the Bond Market

If you’re a bond (BSV) (AGG) investor or fund manager, fluctuation in interest rates is one of the key risk drivers for the returns you get from your portfolio.

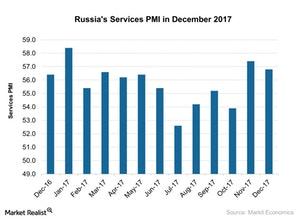

How Russia’s Service Activity Looked in December 2017

According to a report by Markit Economics, Russia’s service PMI (purchasing managers’ index) showed a weaker improvement in December as compared to November 2017.

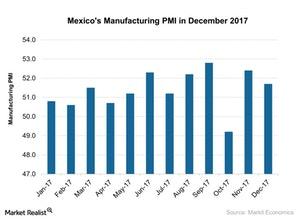

What Does Mexico’s Manufacturing PMI Indicate?

According to a report by Markit Economics, Mexico’s (EWW) manufacturing activity showed a slightly weaker improvement in December as compared to November 2017.

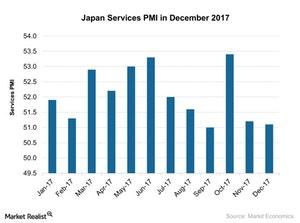

How Japan’s Services PMI Trended in December 2017

According to a report provided by Markit Economics, Japan’s services PMI (EWJ) (DXJ) remained weaker in December 2017.

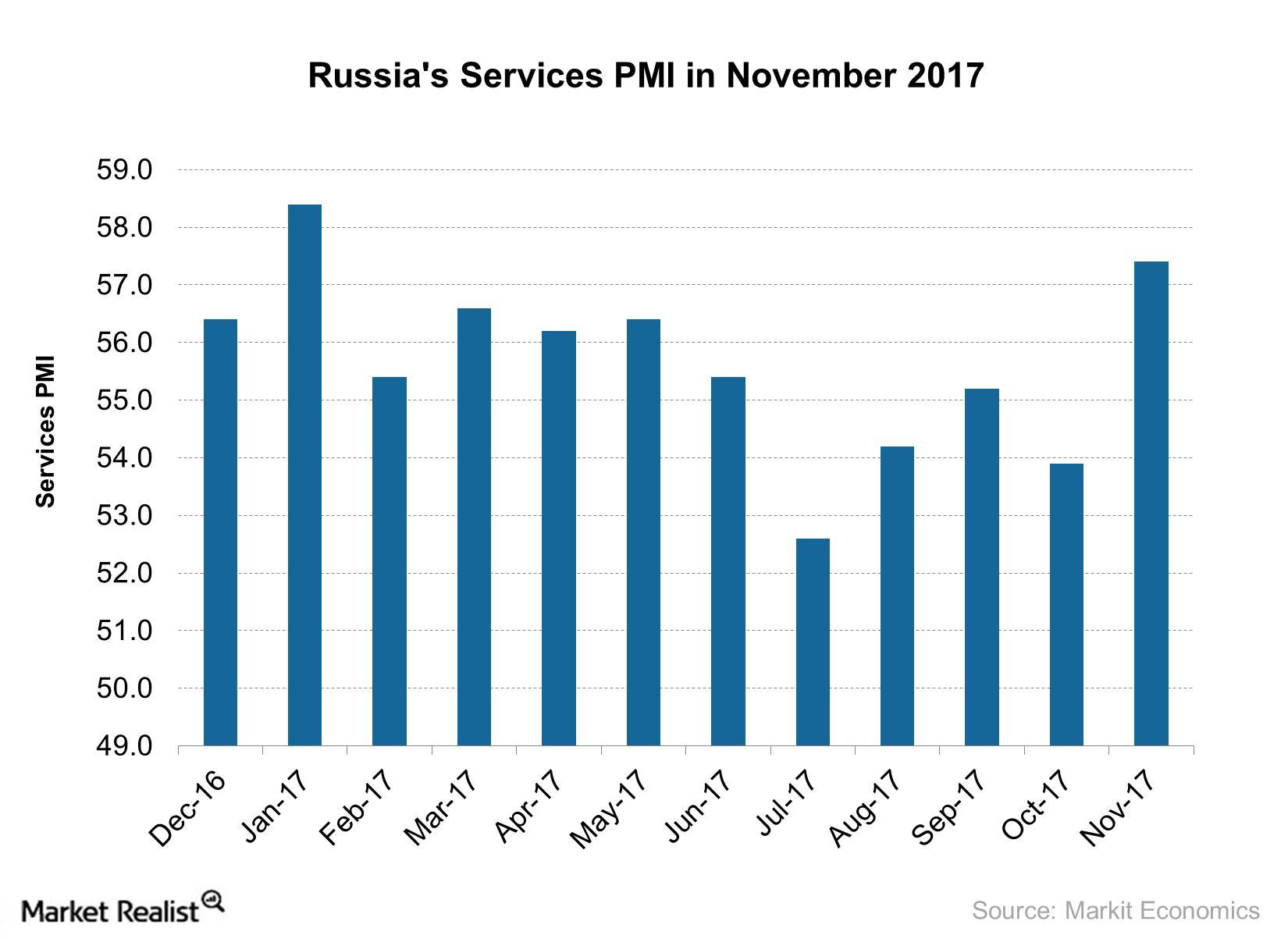

Why Russia’s Service Sector Strengthened in November 2017

Russia’s service sector in November According to a report by Markit Economics, Russia’s service PMI (purchasing managers’ index) showed a solid improvement in November 2017, rising to 57.4 from 53.9 in October. The figure beat the market expectation of 55.0 and marked the highest rise since January 2017. The strong improvement in Russia’s service PMI […]

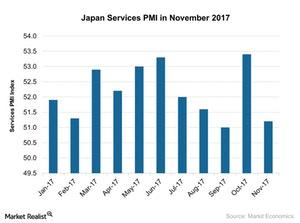

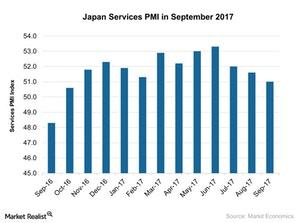

Why Japan Services PMI Didn’t Meet Expectations in November

The Japan Services PMI fell in November 2017. It came in at 51.2 compared to 53.4 in October. It didn’t meet the market expectation of 52.0.

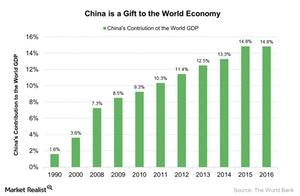

James Gorman Says China ‘Is a Gift to the World Economic Growth’

James Gorman, chair and CEO of Morgan Stanley (MS), shared his view on China (FXI) (YINN) in an interview with CNBC.

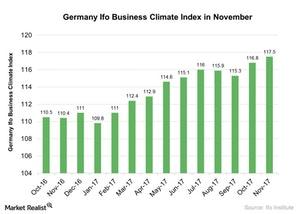

German Ifo Business Climate Rises: Are Investors Optimistic?

According to the report provided by the Ifo Institute for Economic Research, the German Ifo Business Climate Index is 117.5 so far in November 2017 compared to 116.8 in October 2017.

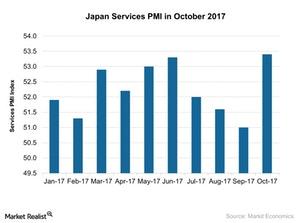

Why Japan’s Services PMI Improved Solidly in October 2017

Japan’s services PMI (EWJ) (DXJ) rose solidly in October 2017. It stood at 53.4 in October 2017 compared to 51.0 in September 2017.

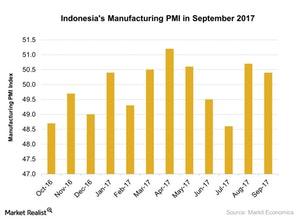

A Look at Indonesia’s Manufacturing PMI in September 2017

Indonesia’s (IDX) (ASEA) manufacturing activity stood at 50.4 in September 2017 compared to 50.7 in August 2017.

Why Japan’s Services PMI Has Been Falling Gradually

According to the report provided by Markit Economics, Japan’s services PMI (EWJ) (DXJ) stood at 51.0 in September 2017 compared to 51.6 in August 2017.

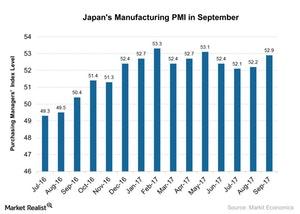

Insight into Japan’s Manufacturing in September 2017

Japan’s manufacturing PMI stood at 52.90 in September 2017, compared to 52.20 in August 2017. The PMI figure beat the preliminary market estimation of 52.5.

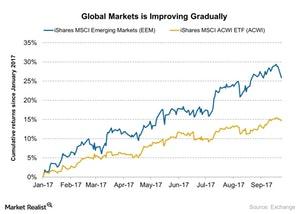

How Emerging Economies Are Supporting Global Growth

According to the report provided by the World Bank in June 2017, global (ACWI) growth is expected to strengthen to 2.7% in 2017.

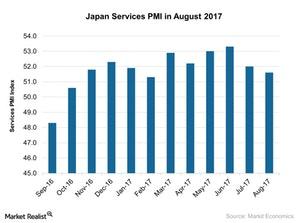

How Japan’s Service Activity Trended in August 2017

According to the latest report by Markit Economics, the Japan Services PMI (EWJ) (DXJ) stood at 51.6 in August 2017, compared with 52 in July 2017.

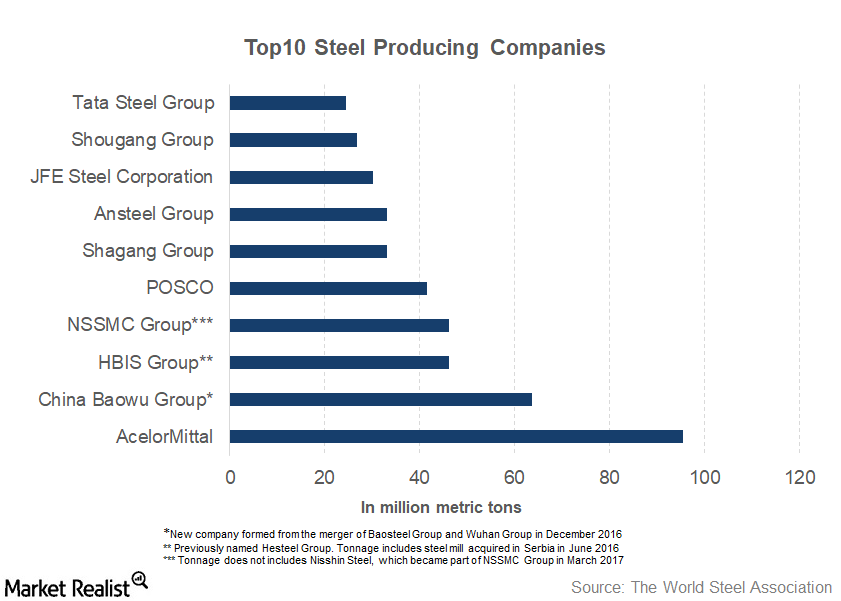

Size Matters: Which Are the Top 10 Steel-Producing Companies?

In this series, we’ll look at the top ten companies in the global steel industry based on steel production, steel consumption, and steel imports.

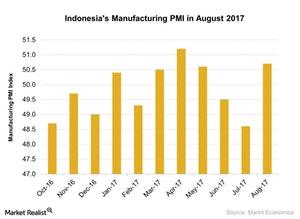

Indonesia Manufacturing PMI Saw Sharp Rise in August 2017

In August 2017, Indonesia’s (IDX) (ASEA) manufacturing activity saw a sharp rise in the overall business conditions as compared to a contraction in the previous month.

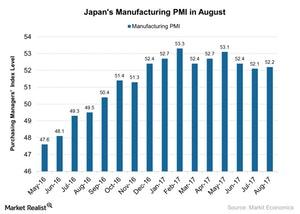

How Japan’s Manufacturing Activity Trended in August 2017

Japan’s manufacturing PMI stood at 52.2 in August 2017 as compared to 52.1 in July 2017.

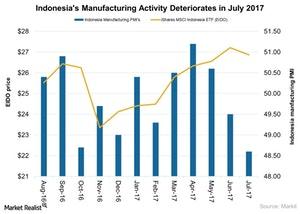

Why Indonesia’s Manufacturing Activity Fell

Manufacturing activity in Indonesia In July 2017, manufacturing activity in Indonesia (EIDO) fell at the fastest pace in 19 months, mainly due to sharp decline in its output. Indonesia’S (EEM) manufacturing PMI (purchasing managers’ index) fell to 48.6, compared with 49.5 in June 2017, according to an IHS Markit report. New orders also fell in July […]

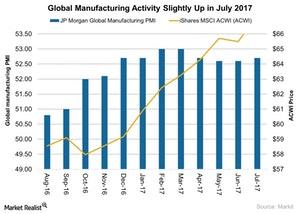

Global Manufacturing Activity Picks Up the Pace in July 2017

In this series, we’ll look at the performance of global (ACWI) manufacturing indexes and manufacturing activity in emerging markets.

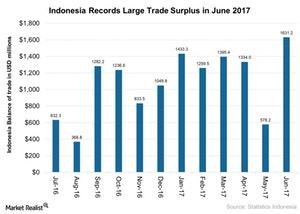

Here’s Why Indonesia’s Trade Surplus Rose in June 2017

Indonesia’s (EIDO) trade surplus in June 2017 stood at $1.6 billion as compared to $1.1 billion in the corresponding period last year and $0.57 billion in the previous month.