Will the Fed Have to Use More Unconventional Measures?

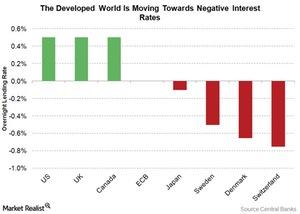

Global monetary policy is unconventional. From an era of lowering interest rates to boost economic growth, central bankers are taking rates into negative territory.

Nov. 20 2020, Updated 4:06 p.m. ET

Global monetary policy isn’t conventional

Global (ACWI) (VEU) (VTI) monetary policy has become very unconventional. From an era of lowering interest rates to boost economic growth, we entered an era where we’re seeing central bankers taking rates into negative territory.

Part of the reason for this change can be attributed to the loss in efficacy of traditional monetary policy tools in spurring growth and demand in the economy. Interest rates in the US (SPY) (IWM) (QQQ) have been zero bound for almost seven years. However, growth still seems hard to come by. Authorities in Europe (HEDJ) and Japan (EWJ) had to resort to negative interest rates. Low rates didn’t boost the demand conditions.

However, negative rates are causing more damage than repair in the economy. Bill Gross has been highly critical of negative rates on several occasions. According to Gross, investing in negative interest rates guarantees losses. They’re artificially inflating asset prices. This led to the creation of asset bubbles.

Central bankers have been criticized for introducing negative rates

Moreover, asset managers such as Ray Dalio, George Soros, Jeffrey Gundlach, Bill Gross, and Carl Icahn have been critical of the central bankers and their decisions on several occasions. Read, These Billionaires Think the Fed Made a Mistake for more insight into the topic. Gundlach thinks that with negative rates, central bankers are trying to fight deflation with deflation.