Vanguard FTSE All-World ex-US ETF

Latest Vanguard FTSE All-World ex-US ETF News and Updates

Is It Time to Invest in International Funds?

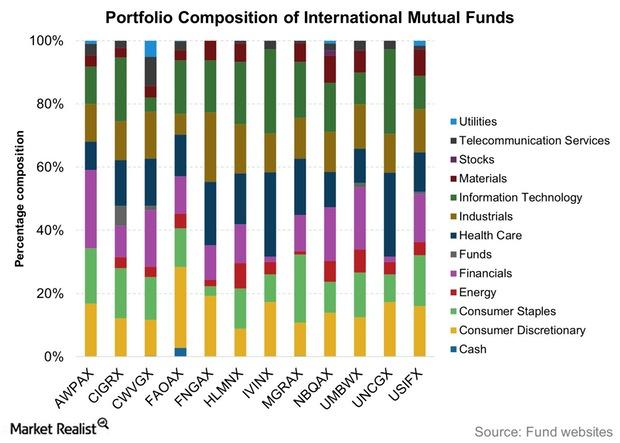

2016 has mostly been about macro trends, thus presenting a different set of challenges for active fund managers who mostly focus on companies rather than economic and sector trends.

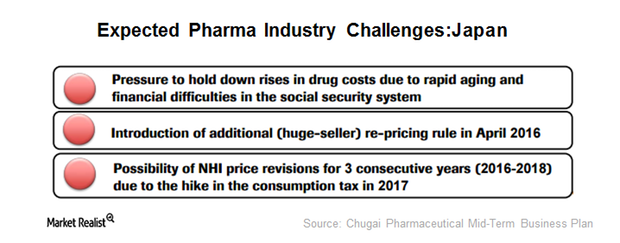

What Are the Challenges for the Pharmaceutical Industry in Japan?

Japan is the second-largest individual pharmaceutical market in the world. It accounts for less than 10% of the total global pharma market.

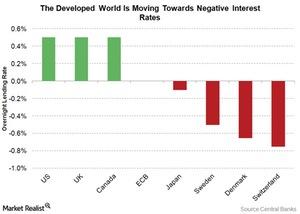

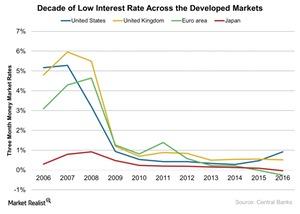

Will the Fed Have to Use More Unconventional Measures?

Global monetary policy is unconventional. From an era of lowering interest rates to boost economic growth, central bankers are taking rates into negative territory.

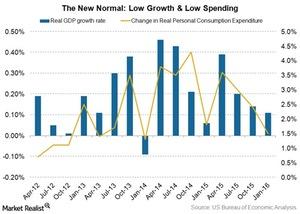

Bill Gross’s Views on Growth and Inflation

Gross believes that money has stopped generating growth and inflation. Equity prices are artificially elevated, and negative yields are guaranteeing capital losses.

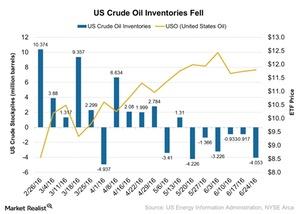

US Crude Oil Inventories Fall Again: How Is Crude Oil Reacting?

According to the U.S. Energy Information Administration’s report on June 29, 2016, US crude oil inventories fell by 4.1 MMbbls in the week ended June 24, 2016.

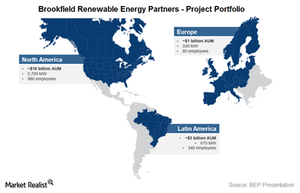

Brookfield Renewable Energy: Biggest Yieldco by Asset Base

With over 6,700 MW of hydro and wind capacity under operation, Brookfield Renewable Energy Partners (BEP) dwarfs all other yieldcos we’ve looked at.

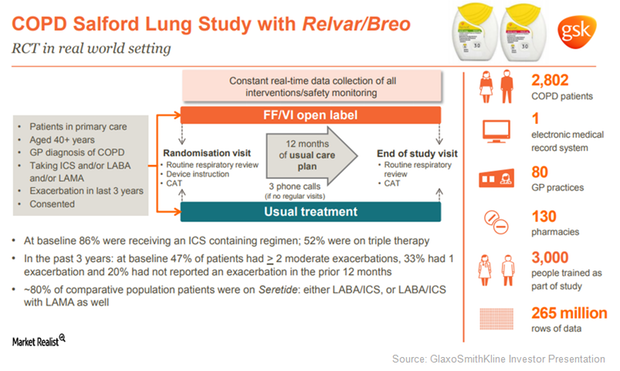

GlaxoSmithKline Is Focused on Maintaining Leadership in This Segment

To maintain its leadership in the chronic obstructive pulmonary disease (or COPD) segment, GlaxoSmithKline (GSK) has focused on shifting patients away from LAMA monotherapy to its LAMA/LABA bronchodilators.

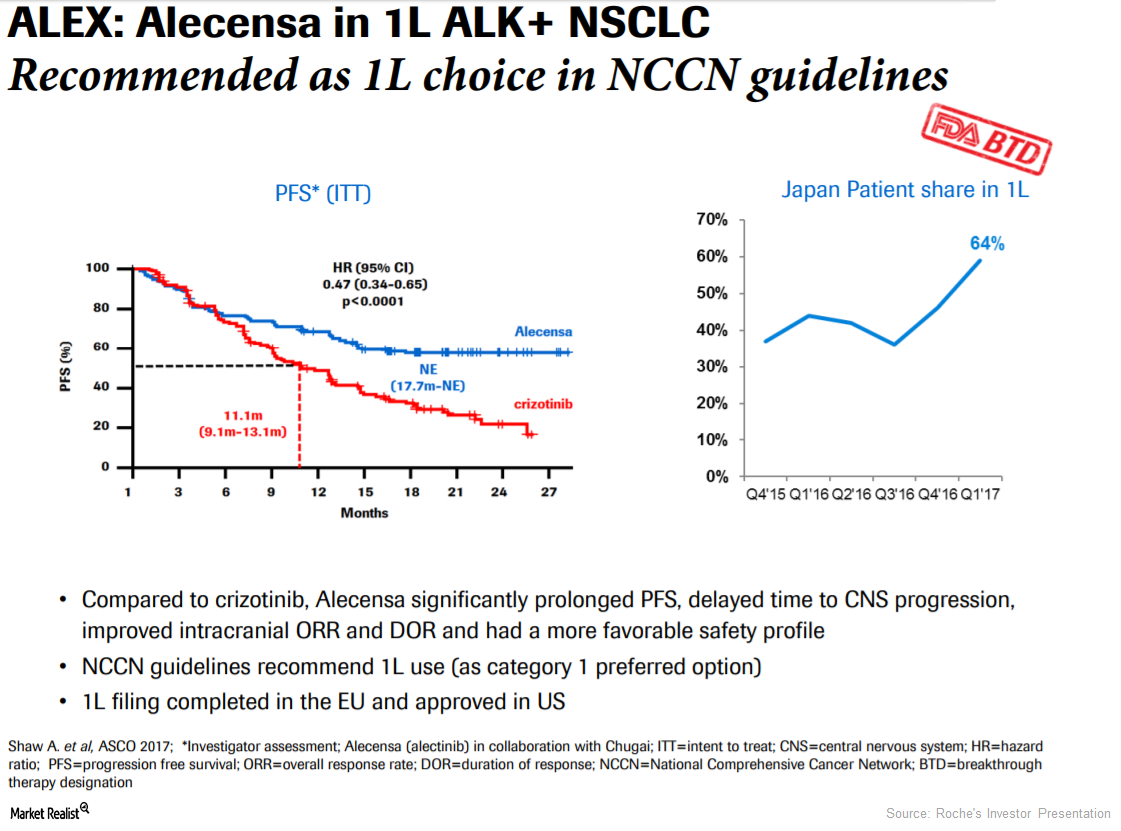

Approval of Alecensa in Europe Could Boost Roche’s Revenue Growth

In 1Q17, 2Q17, and 3Q17, Roche’s Alecensa reported revenues of 68 million Swiss francs, 80 million Swiss francs, and 96 million Swiss francs, respectively.

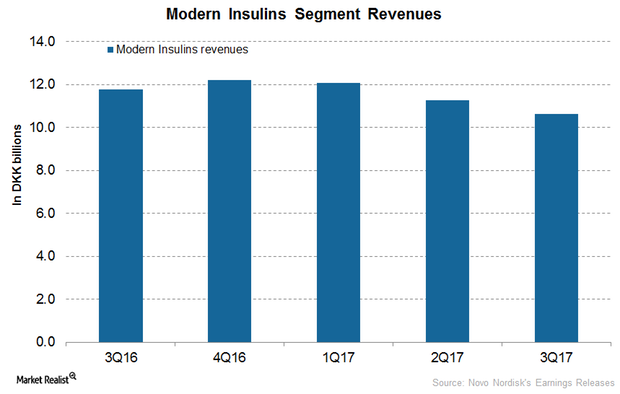

How Did Novo Nordisk’s Modern Insulin Segment Perform in 3Q17?

In 3Q17, Novo Nordisk’s (NVO) NovoRapid reported revenues of 5.0 billion Danish krone (or DKK), which reflected ~9% growth on year-over-year (or YoY) basis.

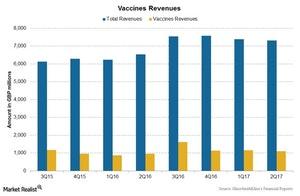

GlaxoSmithKline’s 2Q17 Earnings: Vaccines Business

GSK’s Vaccines business reported 16.0% growth to ~1.1 billion pounds in 2Q17, including 5.0% growth at constant exchange rates and 11.0% positive impact of foreign exchange.

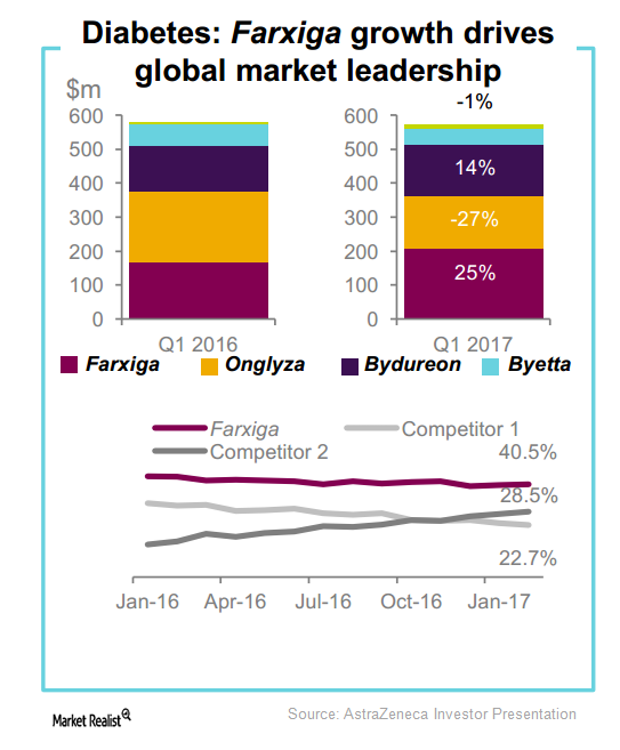

Farxiga Expected to Drive AstraZeneca’s Performance in Diabetes Segment

In 1Q17, AstraZeneca’s leading sodium-glucose co-transporter 2 (or SGLT2) therapy for type-2 diabetes, Farxiga, reported revenues close to $270 million. This represents YoY growth of ~25% on a constant currency basis.Macroeconomic Analysis What Japan’s Manufacturing Suggests for Its Economy

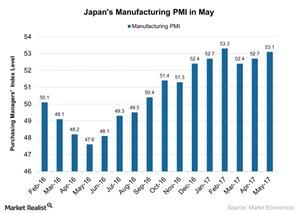

Japan’s manufacturing PMI (purchasing managers’ index) stood at 52.4 in June 2017 compared to 53.1 in May.

Japan’s Manufacturing PMI in May, and What to Make of It

The Japan Manufacturing PMI stood at 53.1 in May 2017, as compared to 52.7 in April, outperforming the preliminary market estimation of 52.0.

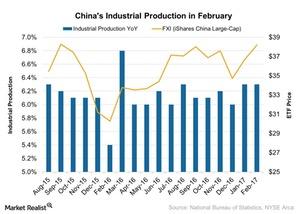

Will China’s Improved Industrial Production Impact Manufacturing?

According to the National Bureau of Statistics of China, on a year-over-year (or YoY) basis, the country’s industrial production rose 6.3% in February 2017.

Do Low Interest Rates Inflate Asset Prices?

On January 26, financial adviser Andy Chase told CNBC’s Mike Santoli that equity valuations are at an all-time low. Chase believes that stocks provide the strongest investment opportunity in 2017.

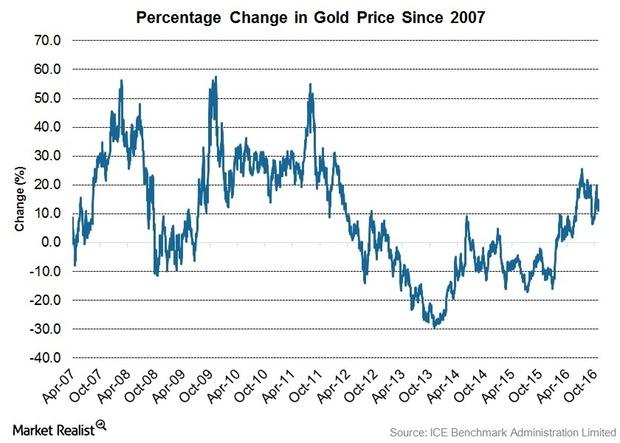

Bull Market: Expected for Gold, Not for Bonds

Long-Term Outlook Remains Positive for Gold Bull Market Our view on the long-term gold price is unchanged. We see the recent weakness as a consolidation phase within what we believe is the early stages of the next bull market for gold. We continue to believe dislocations created by the unconventional policies being implemented by central […]

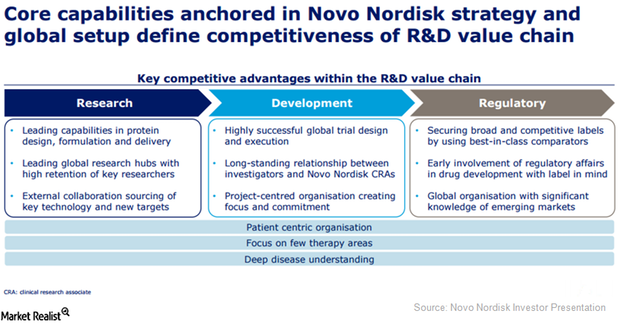

Will Novo Nordisk’s Core Capabilities Be Enough to Differentiate Its Research Pipeline?

Novo Nordisk’s search for new molecules through partnerships and other alliances has proven instrumental in strengthening its R&D pipeline.

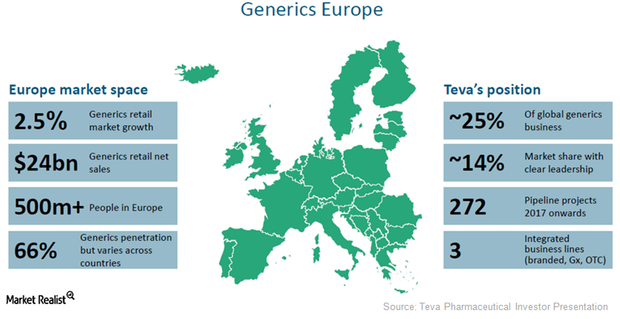

Teva Pharmaceutical Still Dominates the Generic Market in Europe

With a share of about 14%, Teva Pharmaceutical Industries (TEVA) is currently the top-ranking player in the European generic pharmaceutical market.

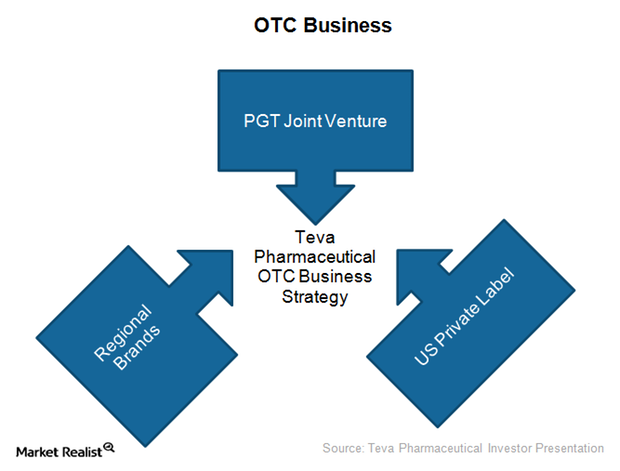

Teva’s OTC Business Is Playing out to Be a Key Growth Driver

In addition to its generic pharmaceutical business, Teva Pharmaceutical also has a significant presence in the major categories of the OTC drug business.

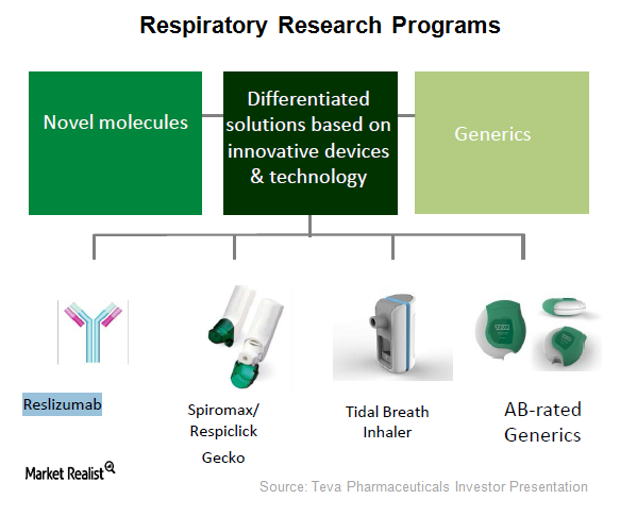

Teva’s Asthma Segment: What Could Boost Its Revenues in 2016?

On March 23, 2016, the FDA approved Cinqair (reslizumab) as a maintenance therapy for patients with severe asthma.

What Happened in the Valeant-Philidor Controversy?

Valeant’s (VRX) controversies started with Philidor, a specialty pharmacy company that was accused of altering doctor’s prescriptions so it could sell more of Valeant’s costly drugs.

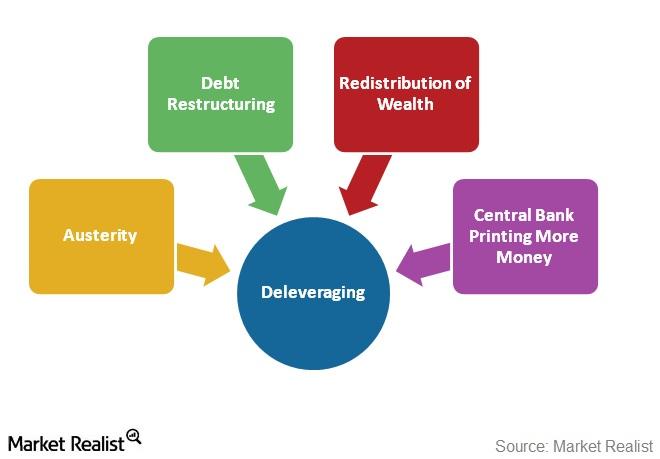

4 Ways an Economy Can Deleverage: Ray Dalio Explains

In his “Economic Principles at Work” template, Ray Dalio identifies four ways any world (ACWI)(VTI)(VEU) economy can deleverage. Find out why this matters.

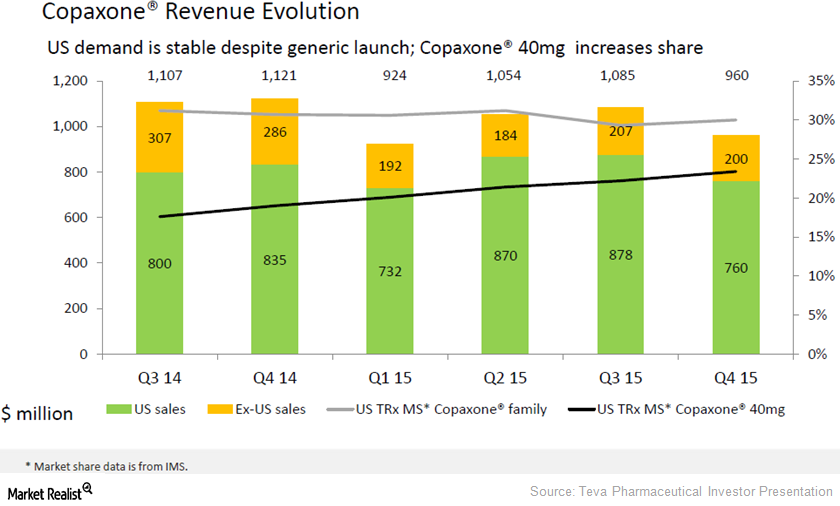

How Could Generic Competition Affect Copaxone’s Revenues in 2016?

Wall Street analysts have projected that Teva Pharmaceutical Industries (TEVA) will earn about $3.5 billion in revenues from Copaxone sales in 2016

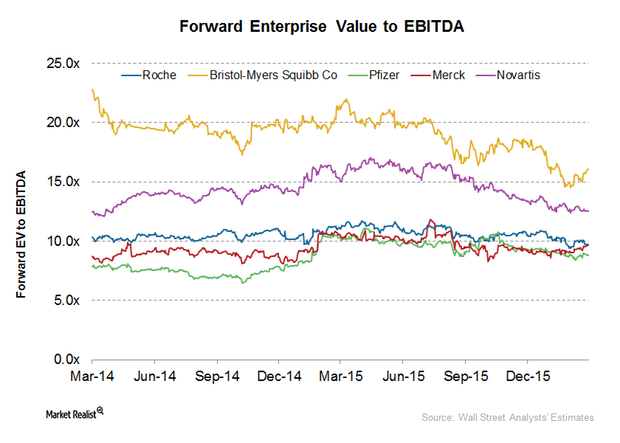

Decoding Roche’s Performance on EV-to-EBITDA Basis

As of March 8, Roche Holding was trading at a forward EV-to-EBITDA multiple of 9.73x—a discount compared to Bristol-Myers Squibb’s 16.09x.

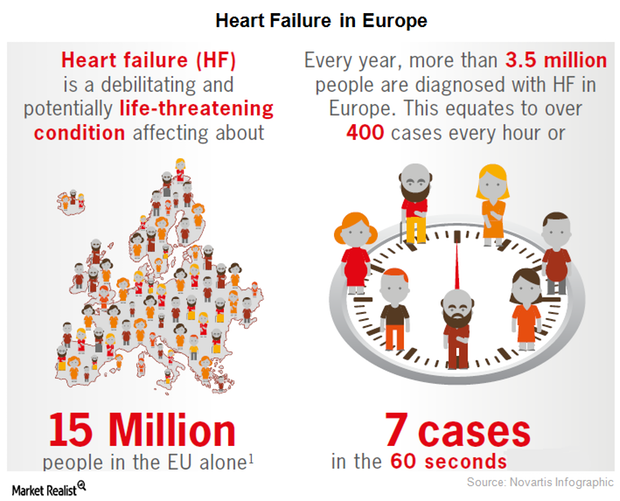

The European Commission Approved Novartis’s Entresto

On November 24, Novartis announced that the European Commission had approved Entresto as a therapy for adult patients suffering from symptomatic chronic heart failure with reduced ejection fraction.

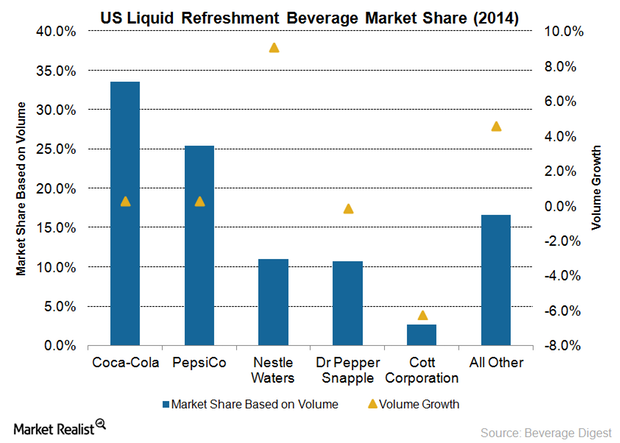

Nestle Continues to Dominate the US Bottled Water Industry

Nestle Waters North America is the market leader of the US bottled water industry.

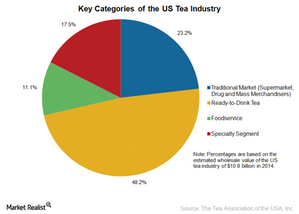

What Are the Key Categories in the US Tea Industry?

Data from the Tea Association of the USA estimates that the wholesale value of the US tea industry grew by 4.1% to reach $10.8 billion in 2014.