Do Low Interest Rates Inflate Asset Prices?

On January 26, financial adviser Andy Chase told CNBC’s Mike Santoli that equity valuations are at an all-time low. Chase believes that stocks provide the strongest investment opportunity in 2017.

Feb. 7 2017, Published 1:16 p.m. ET

Andy Chase takes on 2017

During a January 26, 2017, interview, Morgan Stanley Private Wealth Management’s Andy Chase discussed his investment picks for the year with CNBC’s Mike Santoli. Chase, who was named Barron’s top financial adviser in the US for 2016, noted that equity valuations are at an all-time low and believes that they provide the strongest investment opportunity in 2017.

In this series, we’ll look at Chase’s views on the current market situation and his allocation choices for 2017.

Inverse relation between interest rates and asset prices

The increase or decrease in interest rates can impact asset prices due to the interrelation between the two variables. Central banks control interest rates through their monetary policy decisions, as well as other factors such as inflation, the labor market, and national savings and investment rates.

There is an inverse relationship between interest rates and asset prices. Traditional asset valuation discounts future returns to present values. The discount rate is the risk-free rate, which is decided by the central bank, and the additional risk premium, according to the investor risk profile.

The lower risk-free rate should give a higher valuation to these assets. If the discount rate for the present value is low, the discounted value would be high, leading to inflated asset prices.

Could the global low interest rate environment impact the Fed’s policy decisions?

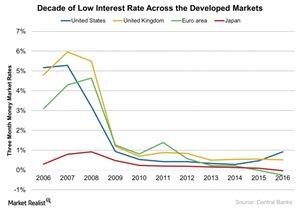

Global markets (ACWI) (VEU) are currently experiencing record-low interest rates, as shown in the above chart. The US and the UK had short-term interest rates of close to 1% during the last decade. Japan and the Eurozone have experienced near-0% rates in the last decade.

After the 2008 global financial crisis, most central banks kept their interest rates low to avoid a deep recession or worse. Low interest rates allow for easy availability of capital, which encourages spending and investment. Assets such as stocks, bonds, and real estate should trade at higher valuations with the low interest rate scenario due to asset inflation.

With the recent improvement in the macroeconomic indicators in the US, the Federal Reserve’s decision to revise interest rates has been accepted by the markets. However, central banks in other parts of the world seem to continuing their loose monetary policies.

According to Chase, it would be difficult to see a big increase in the Federal Reserve’s rate compared with low interest rates in other parts of the world. Some of the stocks that rallied in January 2017 include General Motors (GM), Ford (F), Fiat Chrysler (FCAU), International Business Machines (IBM), and Yahoo! (YHOO).

In our next article, we’ll look at the impact that increased interest rates have on assets such as stocks, bonds, and real estate.