Vanguard Total Stock Market ETF

Latest Vanguard Total Stock Market ETF News and Updates

VTI Versus VOO ETF: Tax Efficiency, Explained

What's the difference between VTI and VOO ETFs, and which one is more tax efficient? Keep reading for everything that investors need to know.

Does Vanguard Have Any Cryptocurrency ETFs?

Vanguard has a plethora of ETFs, but are any of them geared toward crypto? Here's everything investors need to know.

Where Are Interest Rates Going? Ray Dalio Weighs In

Ray Dalio, and Marketplace Morning Report host David Brancaccio discussed the future of the economy and the next recession. Here’s what you need to know.

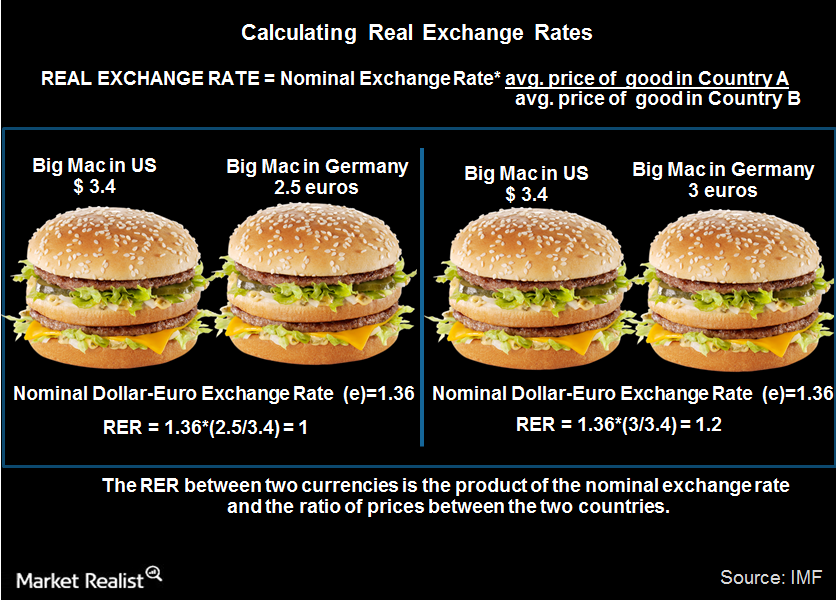

REER 101: An Introduction to Real Effective Exchange Rates

The International Monetary Fund defines REER as an average of the bilateral real exchange rates between a country and its trading partners, weighted by their respective trade shares.

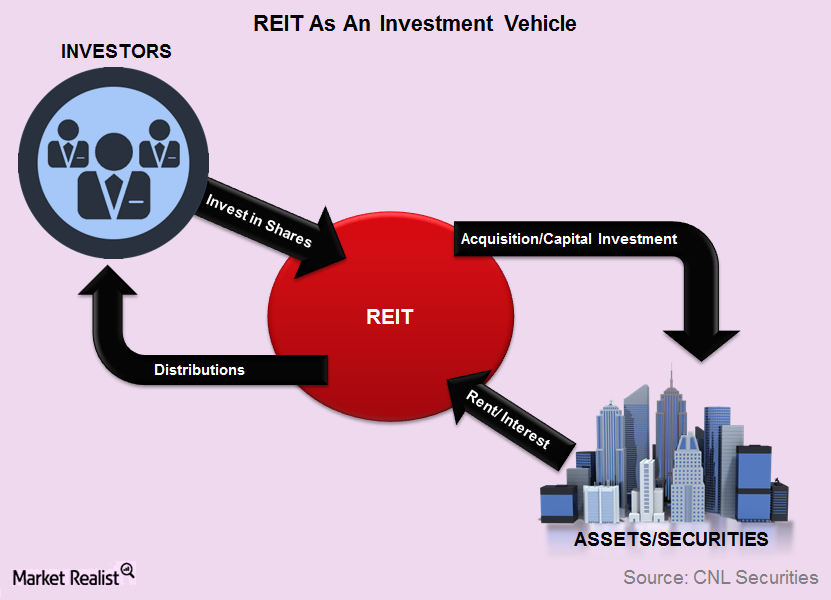

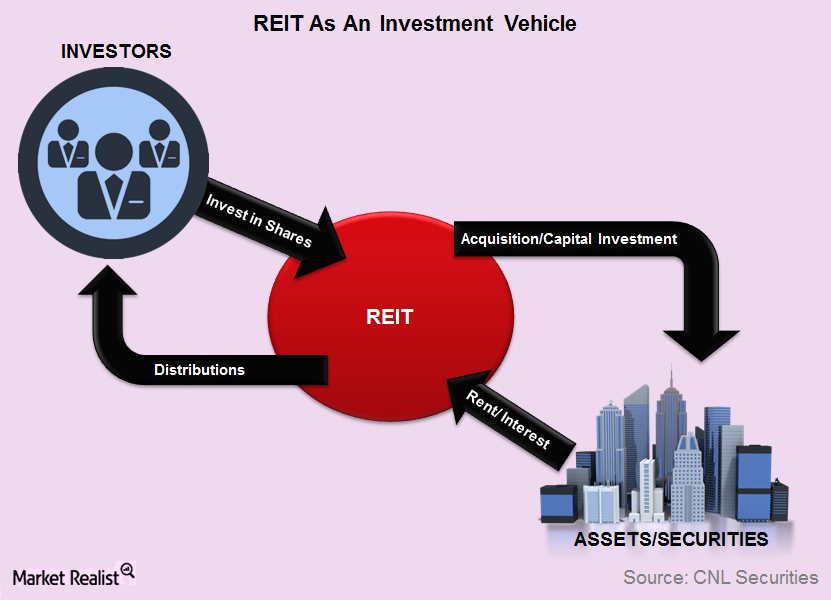

REITs 101: Understanding this Investment Vehicle

In this series, we’ll get down to the brass tacks of investing in the REIT sector, the market’s current landscape, and the benefits you can expect from this type of investment.

Will the Fed Have to Use More Unconventional Measures?

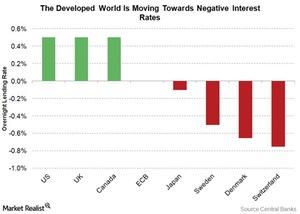

Global monetary policy is unconventional. From an era of lowering interest rates to boost economic growth, central bankers are taking rates into negative territory.

Larry Fink Says Lower Rates Hampered Savings around the World

Various central banks in developed nations (EFA) have lowered their key interest rates close to the zero level to revive their economies.

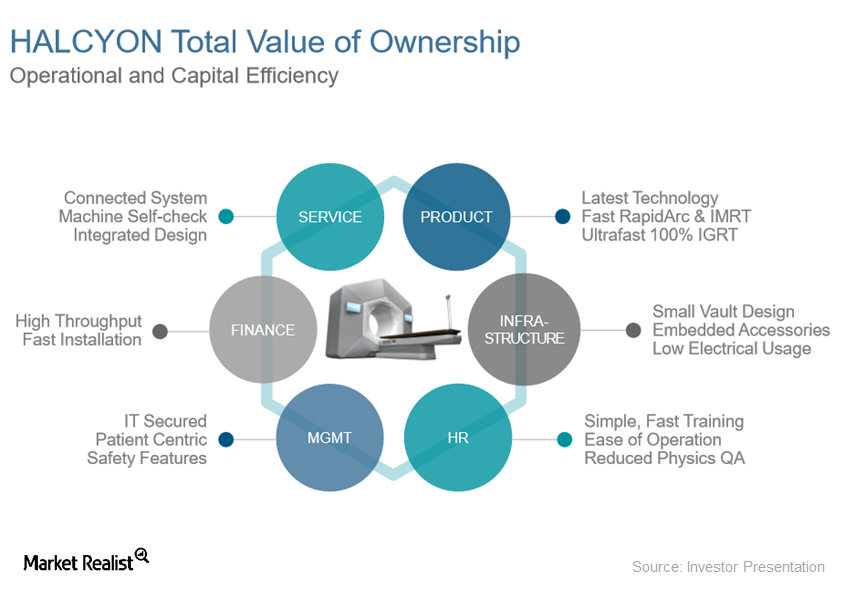

Varian’s Halcyon Treatment System Sees Emerging Market Demand

Halcyon The Halcyon system, Varian Medical Systems’ (VAR) recently launched cancer treatment device, aims to simplify and enhance IMRT (image-guided volumetric intensity modulated radiotherapy). The device has received clearance by the FDA (US Food and Drug Administration). By next year, Varian expects to receive regulatory approvals for the device in China and Japan. For more information […]

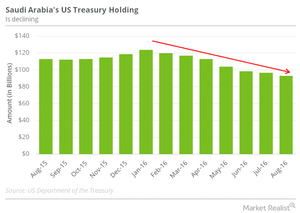

How Saudi Arabia’s Bond Sale Affects US Treasury Bonds

Saudi Arabia has also been involved in the sale of US Treasuries. The country is the 15th-largest holder of US Treasury bonds in the world.

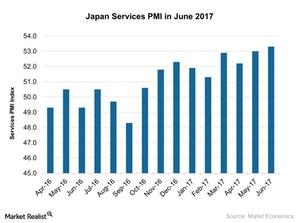

Why the Japan Services PMI Improved in June 2017

The Japan Services PMI (EWJ) (DXJ) stood at 53.3 in June 2017 compared to 53.0 in May 2017. It met the market expectation of 53.2.

Nike’s Target Markets: Everything You Need to Know

Nike (NKE) faces some challenges in its target markets. In the US, economic growth rates have tapered down, and the trade war could affect its China market.

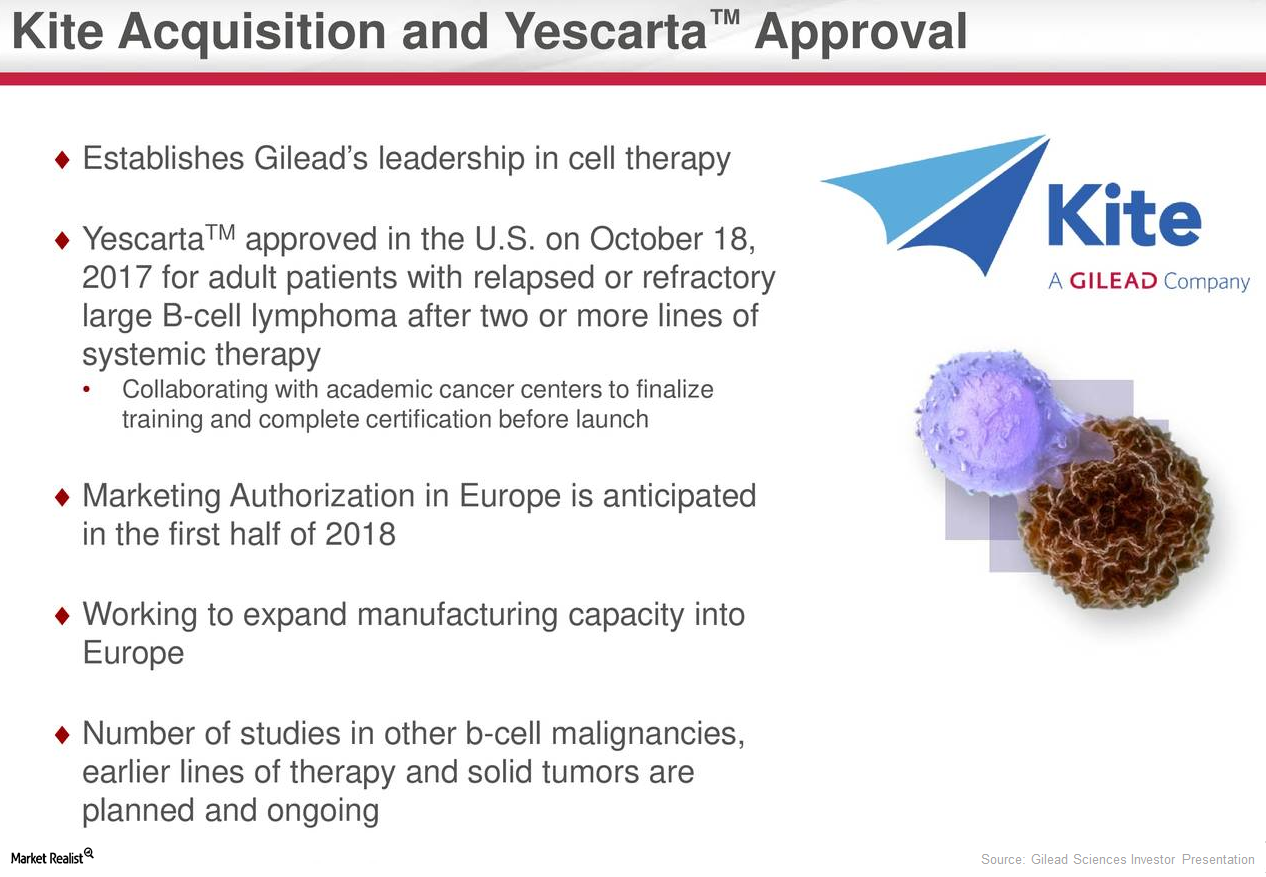

What Else Could Drive Gilead’s Long-Term Growth?

In December 2017, Kite, a Gilead Sciences (GILD) company, presented long-term follow-up data from its pivotal ZUMA-1 trial of Yescarta.Financials The big 3 ETF providers in the US—iShares, SPDR, and Vanguard

In the U.S., Blackrock (BLK), State Street GA (STT), and Vanguard are the top three ETF providers. They have a 40.1%, 22.3%, and 20.7% market share, respectively.

REITs 101: Understanding this Vehicle

By Michael Orzano, Director, Global Equity Indices Publicly traded property stocks, including real estate investment trusts (or REITs) and real estate operating companies (or REOCs), allow investors to gain exposure to real estate, which is generally an illiquid asset class, without sacrificing the liquidity benefits of listed equities. They also typically offer higher yields than […]

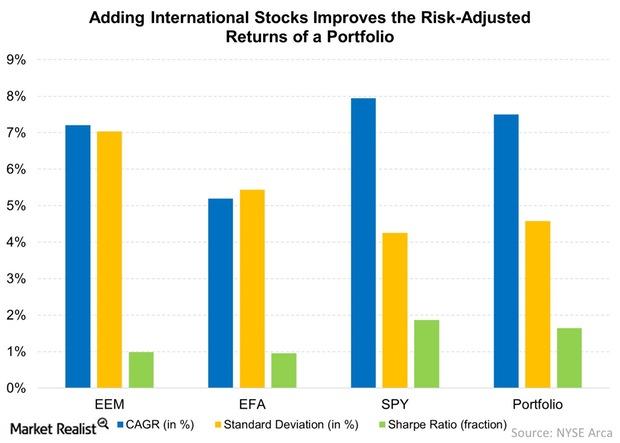

Why Diversification Is More than Just a Buzzword

Diversification is important because a diversified portfolio has higher risk-adjusted returns than a portfolio exposed to only one security.

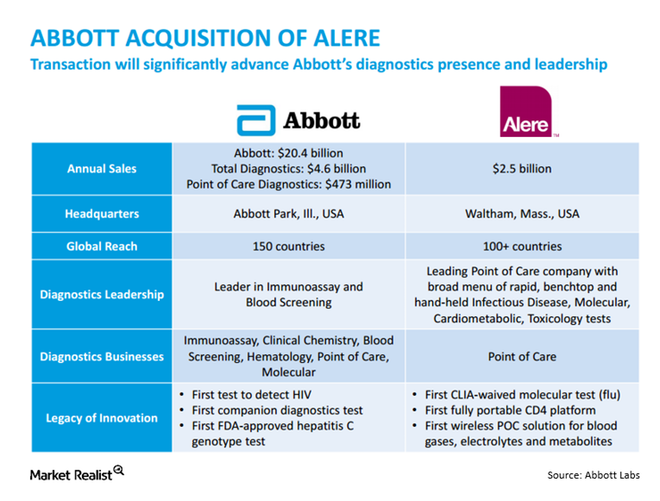

A Brief Recap of the Abbott–Alere Deal Developments

Three months after announcing a $5.8 billion deal in which Abbott Laboratories (ABT) would buy Alere (ALR), Alere rejected Abbott’s $50 million offer to end the deal. On December 7, Abbott sued Alere to terminate the deal.

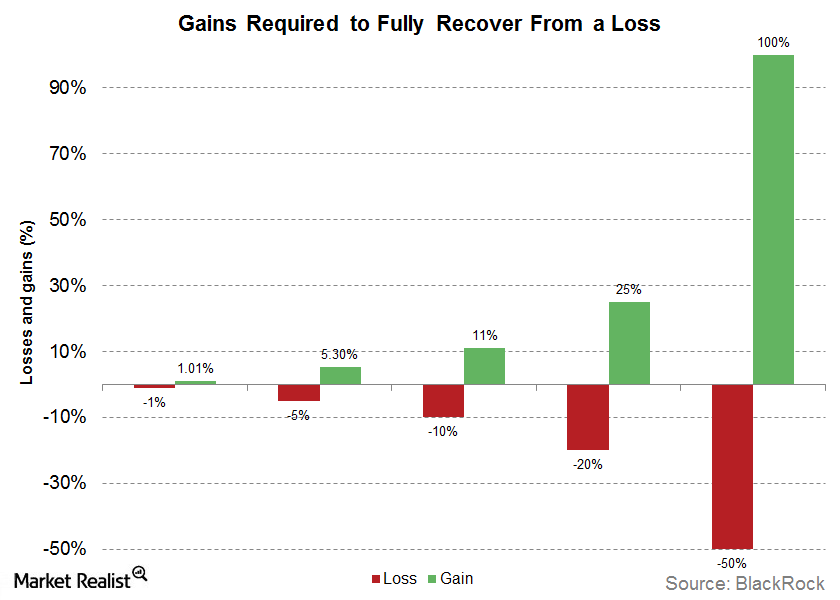

How You Can Win More By Losing Less

Most investors focus much of their time on picking assets that have the potential to win. However, limiting downside risk is just as important.

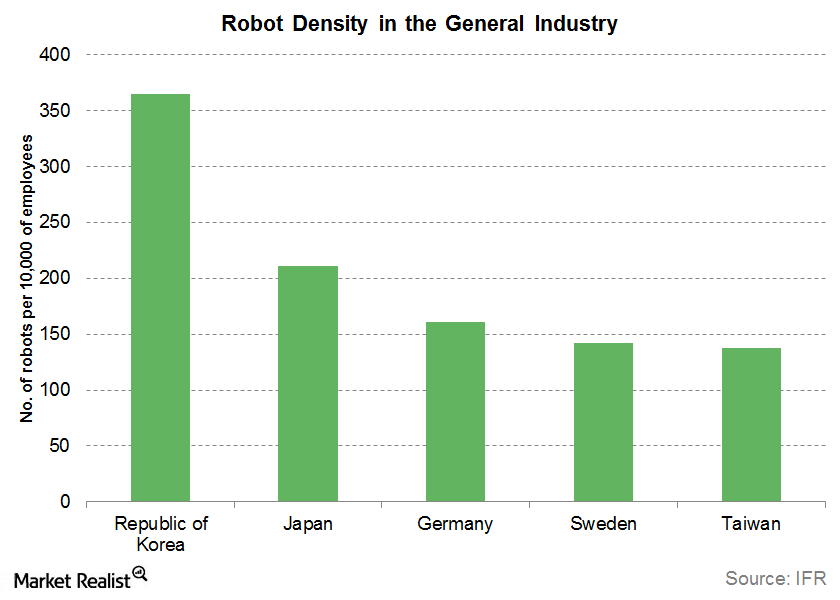

The Rise of Factory Automation in China

The rise of factory automation in China (GCH) has been rapid and unprecedented. China is the largest market for robots and automated parts.

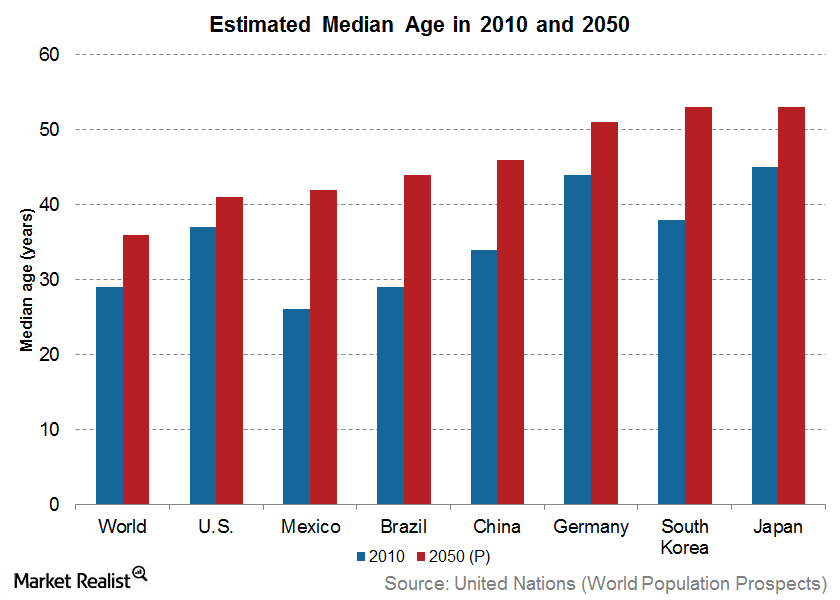

The Aging World Means a Graying Workforce

We’re in a rapidly aging world. According to the United Nations World Population Prospects report, the median age of the world is estimated to grow from 29 years in 2010 to 36 years by 2050.

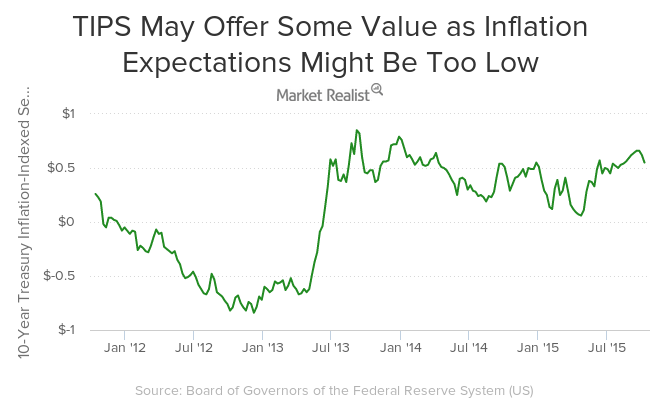

Why Treasury Inflation-Protected Securities May Offer Some Value

TIPS may offer some value as inflation breakeven seems modest. TIPS provide investors a hedge against inflation just like gold (GLD) and other commodities (DBC).

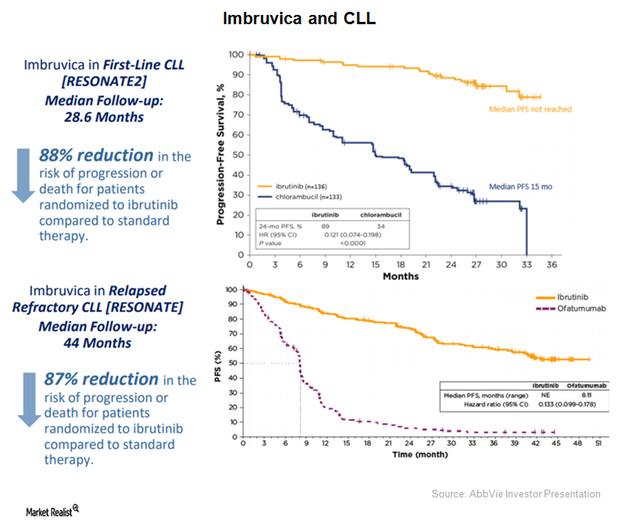

AbbVie Expects Peak Sales of $7 Billion for Imbruvica

AbbVie (ABBV) has projected Imbruvica’s annual revenues to be $5 billion by 2020. That would be driven by a rapid uptake in the first line chronic lymphocytic leukemia (or CLL) segment.

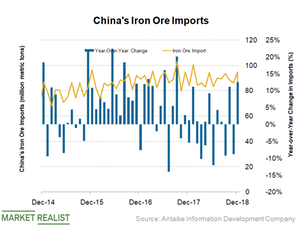

Why China’s Iron Ore Demand Could Soon Weaken

As China consumes more than 70% of seaborne-traded iron ore, it’s imperative for iron ore investors to track the country’s demand and outlook.

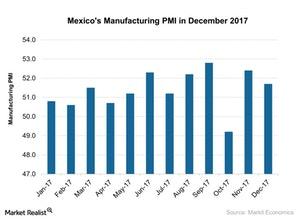

What Does Mexico’s Manufacturing PMI Indicate?

According to a report by Markit Economics, Mexico’s (EWW) manufacturing activity showed a slightly weaker improvement in December as compared to November 2017.

The Marijuana Ecosystem’s Potential Business Opportunities

Given that legislative approval is the strongest driving factor behind the boost in the marijuana industry, companies have rushed to capitalize on the wave.

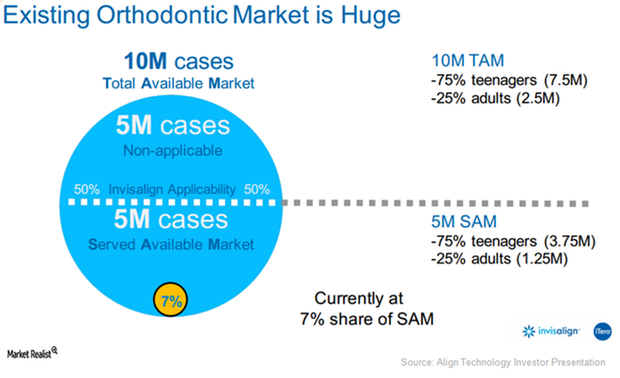

Align Technology’s Growth Prospects amid Increasing Competition

The Chinese market is Align Technology’s major growth driver. However, the company is starting to witness strong competition from startups focused on the clear aligners market.

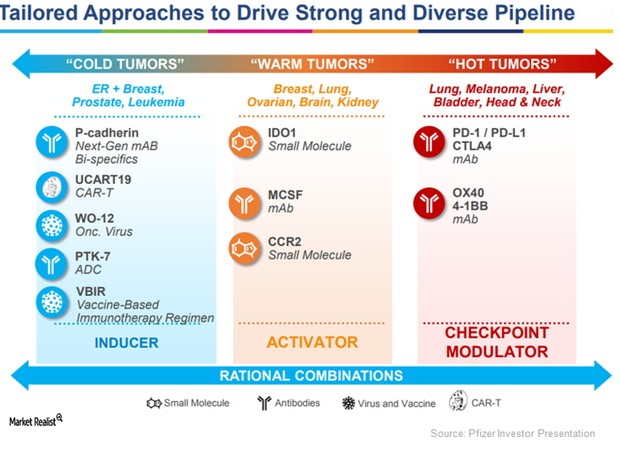

Pfizer Is Pursuing Oncology, Inflammation, and Immunology Research

On May 9, 2017, the US Food and Drug Administration (or FDA) approved Pfizer (PFE) and Merck’s Bavencio (avelumab) as a treatment option for patients suffering from locally advanced or metastatic urothelial carcinoma (or UC).

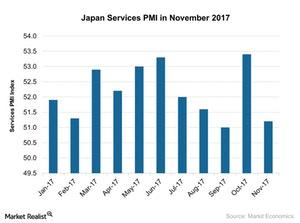

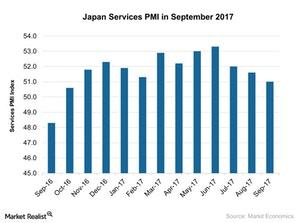

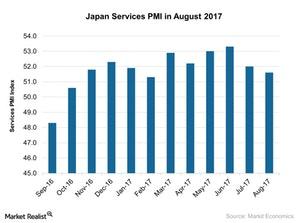

Why Japan Services PMI Didn’t Meet Expectations in November

The Japan Services PMI fell in November 2017. It came in at 51.2 compared to 53.4 in October. It didn’t meet the market expectation of 52.0.

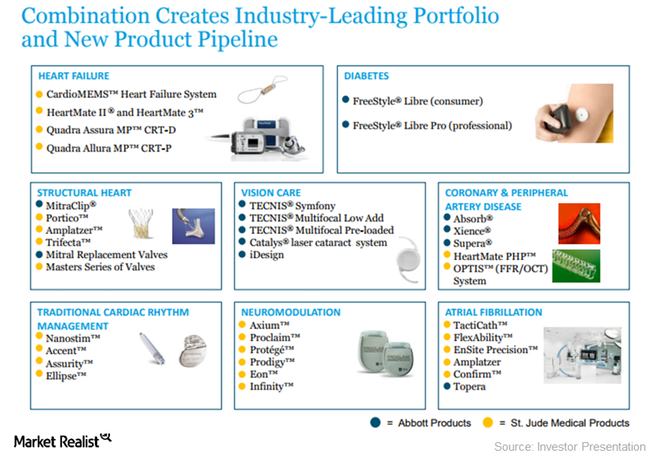

Inside Abbott’s Neuromodulation Business Growth

Abbott’s Medical Devices segment has products for rhythm management, heart failure, electrophysiology, structural heart diseases, neuromodulation, and more.

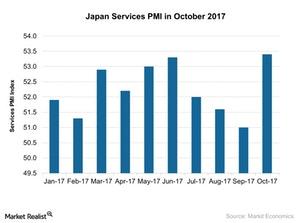

Why Japan’s Services PMI Improved Solidly in October 2017

Japan’s services PMI (EWJ) (DXJ) rose solidly in October 2017. It stood at 53.4 in October 2017 compared to 51.0 in September 2017.

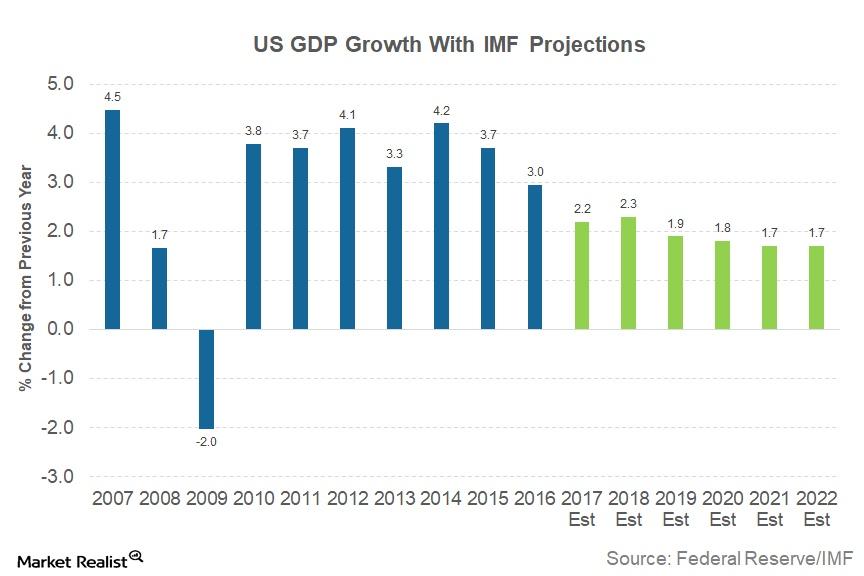

IMF: Why US Economic Growth Could Slow

The International Monetary Fund (or IMF), in its “World Economic Outlook” (or WEO) released in October, upgraded the economic forecast for the United Statess for 2017.

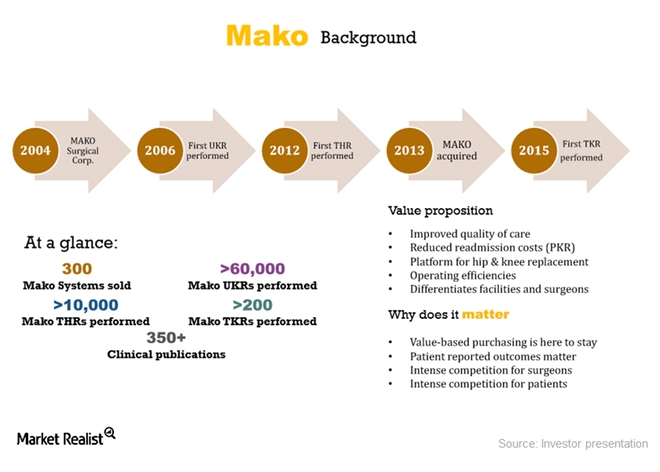

How Mako Robots Are Driving Stryker’s Sales in 2017

Mako sales in 3Q17 In 3Q17, Stryker sold 33 Mako robots, compared with 30 robots in 3Q16. In 2Q17, Stryker installed 26 Mako robots. Of these 33 robots, 23 were installed in the United States. Around 40% of US sales are expected to be in competitive accounts. Stryker is training surgeons on its total knee application […]

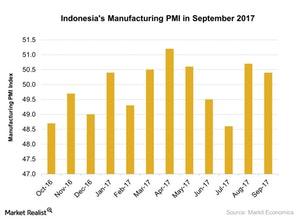

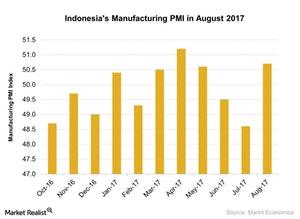

A Look at Indonesia’s Manufacturing PMI in September 2017

Indonesia’s (IDX) (ASEA) manufacturing activity stood at 50.4 in September 2017 compared to 50.7 in August 2017.

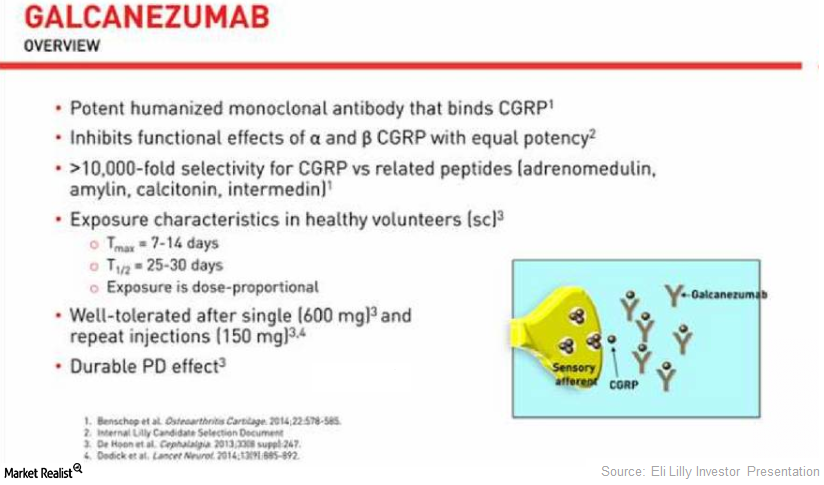

This Could Be Eli Lilly’s Long-Term Growth Driver

In September 2017, Eli Lilly announced that a 12-month open-label study showed a positive safety and tolerability profile of Galcanezumab for migraines.

Why Japan’s Services PMI Has Been Falling Gradually

According to the report provided by Markit Economics, Japan’s services PMI (EWJ) (DXJ) stood at 51.0 in September 2017 compared to 51.6 in August 2017.

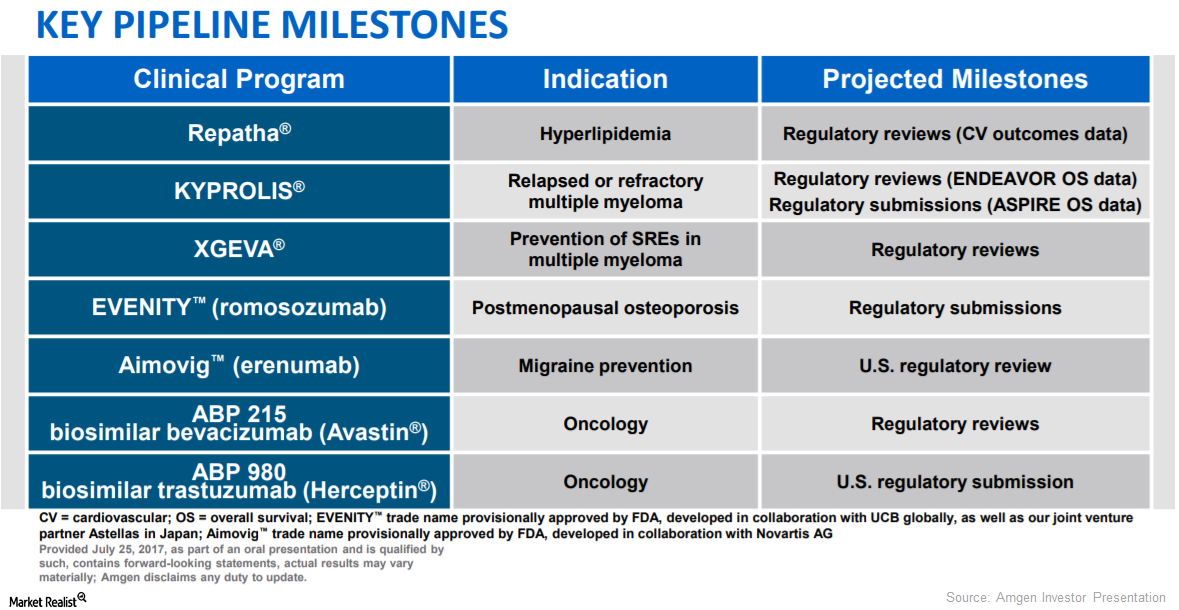

Amgen’s Pipeline Could Boost Its Long-Term Growth Opportunities

EVENITY (romosozumab) is a monoclonal antibody under investigation that acts by inhibiting the activity of sclerostin.

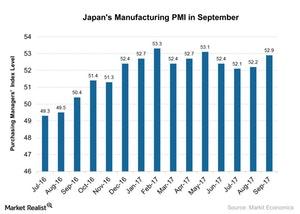

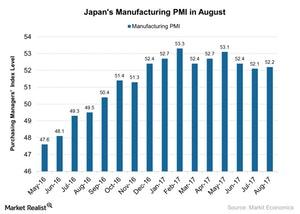

Insight into Japan’s Manufacturing in September 2017

Japan’s manufacturing PMI stood at 52.90 in September 2017, compared to 52.20 in August 2017. The PMI figure beat the preliminary market estimation of 52.5.

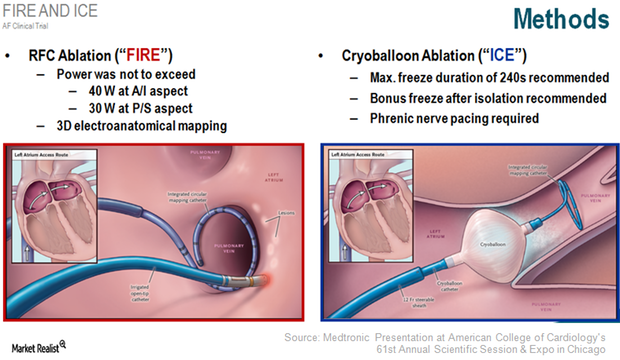

Atrial Fibrillation Ablation Could Be a Short-Term Growth Driver for MDT

More than 33 million patients suffer from AF, the most common form of heart arrhythmia. About 30% of these patients respond to antiarrhythmic drugs (or AAD).

How Japan’s Service Activity Trended in August 2017

According to the latest report by Markit Economics, the Japan Services PMI (EWJ) (DXJ) stood at 51.6 in August 2017, compared with 52 in July 2017.

Indonesia Manufacturing PMI Saw Sharp Rise in August 2017

In August 2017, Indonesia’s (IDX) (ASEA) manufacturing activity saw a sharp rise in the overall business conditions as compared to a contraction in the previous month.

How Japan’s Manufacturing Activity Trended in August 2017

Japan’s manufacturing PMI stood at 52.2 in August 2017 as compared to 52.1 in July 2017.

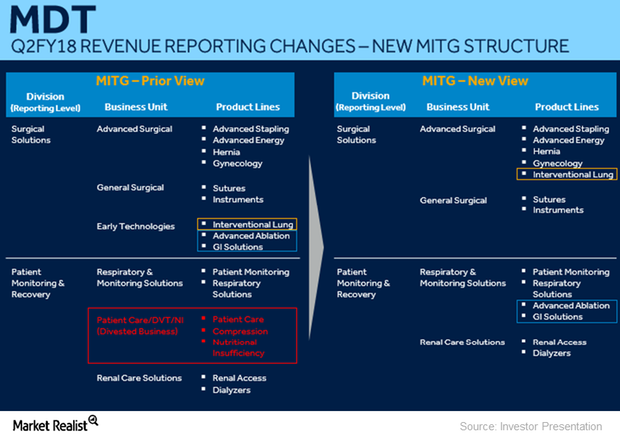

Divestiture of a Part of Medtronic’s PMR Business to Cardinal Health

Medtronics’ MITG (Minimally Invasive Therapies Group) business is expected to grow 3.5%–4.5%.

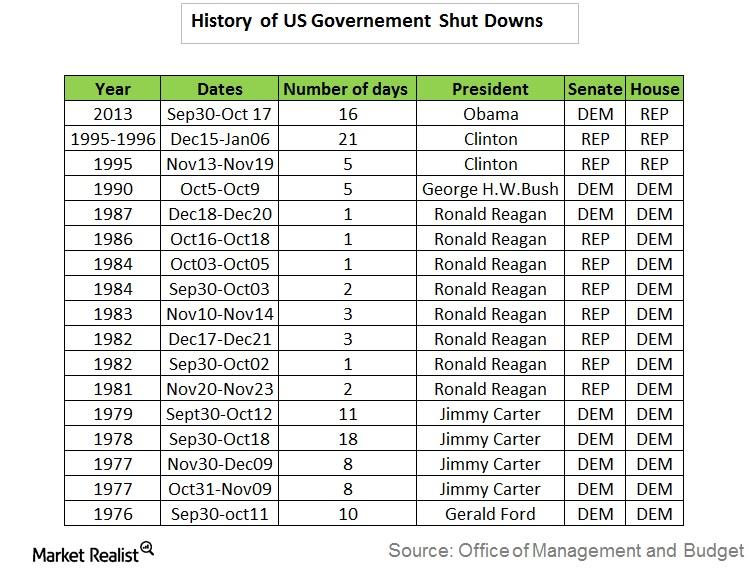

Why the US Government Has Been Shut Down Before

A failure to raise the debt ceiling will likely result in a US government shutdown and a default by the US, which would be catastrophic for the global economy and financial markets (VTI) (USMV).

Should We Be Worried about Greenspan’s Bond Market Warning?

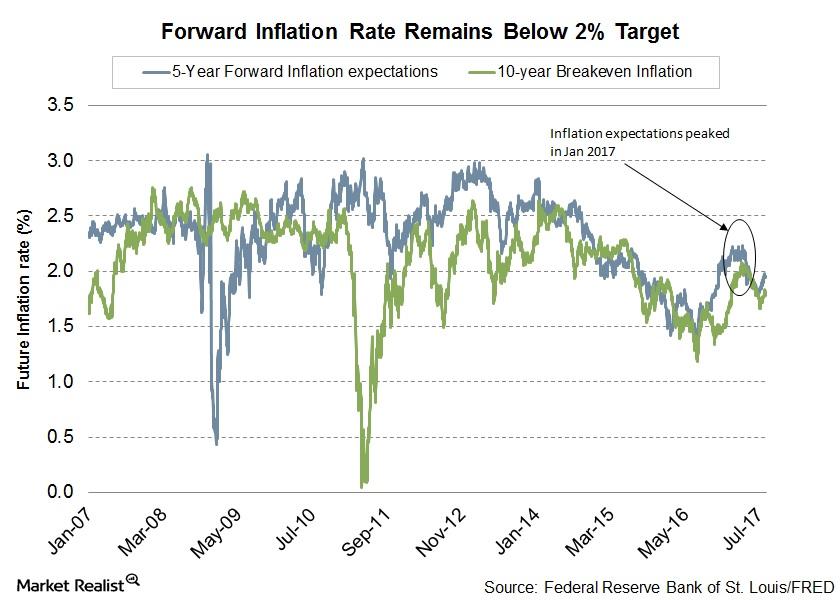

Greenspan cites rapid inflation growth as the reason for a bond market collapse. But the markets and Fed officials think otherwise.Macroeconomic Analysis What Japan’s Manufacturing Suggests for Its Economy

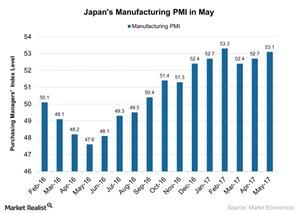

Japan’s manufacturing PMI (purchasing managers’ index) stood at 52.4 in June 2017 compared to 53.1 in May.

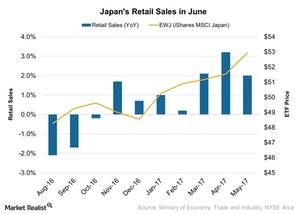

What Japan’s Falling Retail Sales Indicate for the Economy

According to the data provided by Japan’s Ministry of Economy, Trade and Industry, Japan’s retail sales rose to 2% in May 2017 on a yearly basis.

Japan’s Manufacturing PMI in May, and What to Make of It

The Japan Manufacturing PMI stood at 53.1 in May 2017, as compared to 52.7 in April, outperforming the preliminary market estimation of 52.0.

Why Zoetis’s Apoquel and Cytopoint Are Expected to Report Robust Revenues

In 1Q17, Zoetis’s (ZTS) dermatology portfolio reported revenues of ~$57 million, driven by the steady adoption of Cytopoint and Apoquel.

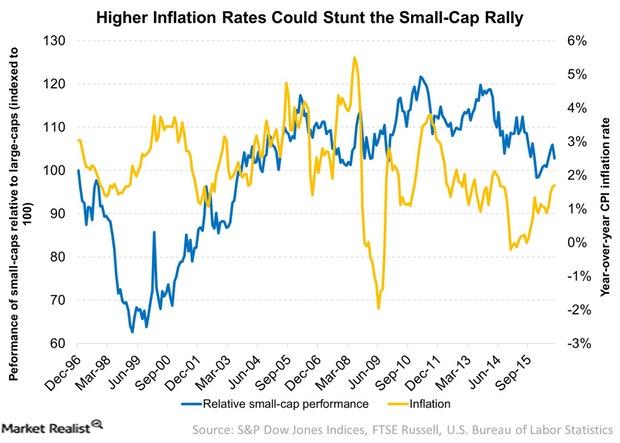

How Would Higher Inflation Impact Small Caps?

Higher inflation rates suggest that the economy might be improving. It’s good for small caps. They tend to outperform large caps during economic upturns.

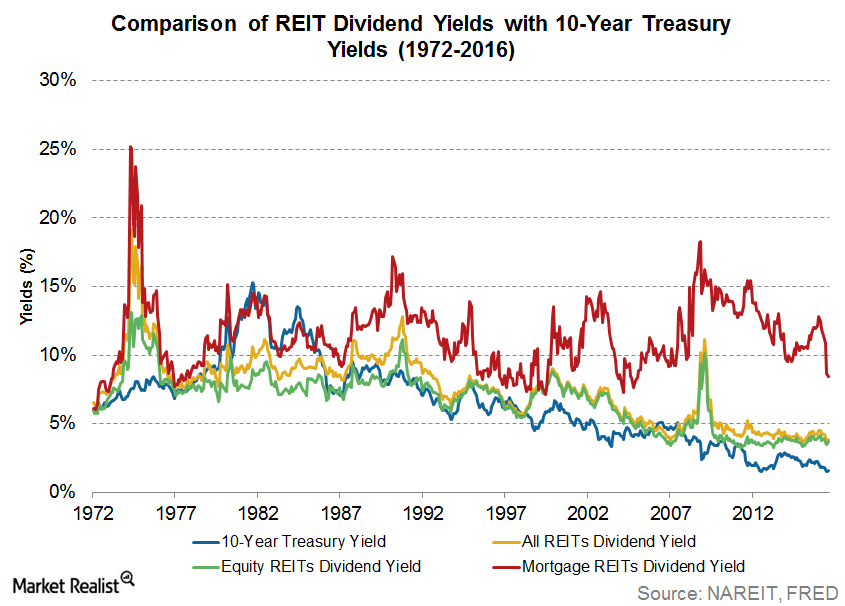

Why REITs Tend to Offer High Dividend Yield

COMPARING DIVIDEND YIELDS ACROSS ASSET CLASSES Since 1999, approximately half of the total return of the Dow Jones U.S. Select REIT Index has come from dividends. During periods of heightened volatility, this income could act as a buffer and may mitigate negative price movements. Historically, the Dow Jones U.S. Select REIT Index has produced higher […]

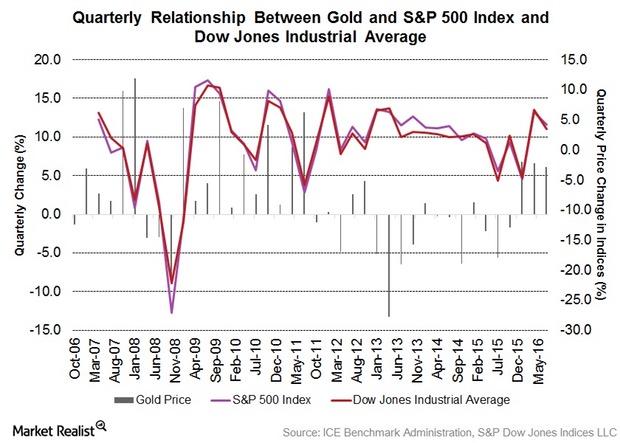

Gold Prices Recover amid Sell-Off

Demand for Gold Withstood Recent Selloff Despite the drop in the gold price in October, demand for gold bullion-backed exchange traded products (ETPs) held firm. Inflows have no doubt slowed down compared to earlier in the year (0.4% increase in holdings in October compared to 12% and 6% increases in February and June respectively), but […]