IMF: Why US Economic Growth Could Slow

The International Monetary Fund (or IMF), in its “World Economic Outlook” (or WEO) released in October, upgraded the economic forecast for the United Statess for 2017.

Nov. 9 2017, Updated 5:35 p.m. ET

IMF upgrades US economic forecast

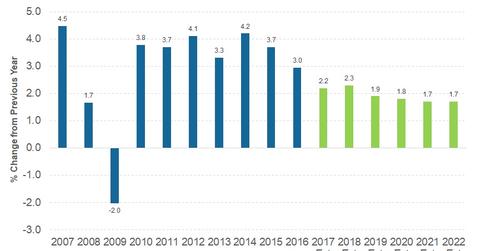

The International Monetary Fund (or IMF), in its “World Economic Outlook” (or WEO) released in October, upgraded the economic forecast for the United States for 2017. But at the same time, it warned about a slowdown if there are no growth-oriented policies from the US administration. The IMF said that improvements to market sentiment in the United States led to an upward revision of growth expectations. The US GDP is expected to rise 2.2% in 2017, an increase of 0.1% from the IMF’s July WEO update. For 2018, the growth rate is expected to accelerate at a rate of 2.3%, an upward revision of 0.2% from the July update.

Reasons for downgrade from April’s WEO report

The October WEO report from the IMF revised growth upward for the United States compared to the July update, but the projections remain lower than the April WEO report. The IMF said the downward revision reflects a correction in assumptions for US fiscal policy. The October report assumed that the policies wouldn’t change as the Trump administration failed to make any progress with reforms. Since the publication of this report, there have been positive developments concerning tax reforms, and the successful implementation of these reforms could push growth expectations higher than what the IMF outlined.

Long-term reasons for slower US growth

The US economy continues to grow at a moderate pace with the latest reading of 3% quarterly growth. The IMF, however, says that in the longer run, US economic growth could grow at a slower pace of 1.8% because of lower levels of productivity and slowing workforce growth. Inflation (VTIP) remains another pain area for the US economy, and the WEO report paints no rosy picture for prices.

US markets (VTI) don’t seem to be sharing the same view as the IMF, as investors remain invested. Stock prices have discounted expectations of future returns, but the current market (SPY) valuations don’t seem to take such a slowdown into account. The bond markets (BND) side with the long-term outlook of the IMF, with narrowing yield spreads between short-term (SHY) and long-term (TLT) bonds supporting this view.

In the next part of this series, we’ll analyze why the IMF has downgraded the growth forecast for the United Kingdom.