Vanguard Total Bond Market ETF

Latest Vanguard Total Bond Market ETF News and Updates

Why investors are preferring high-quality debt

High-quality bonds can be an investor refuge when there’s market volatility. These securities provide relatively stable cash flows. The default probability is low.

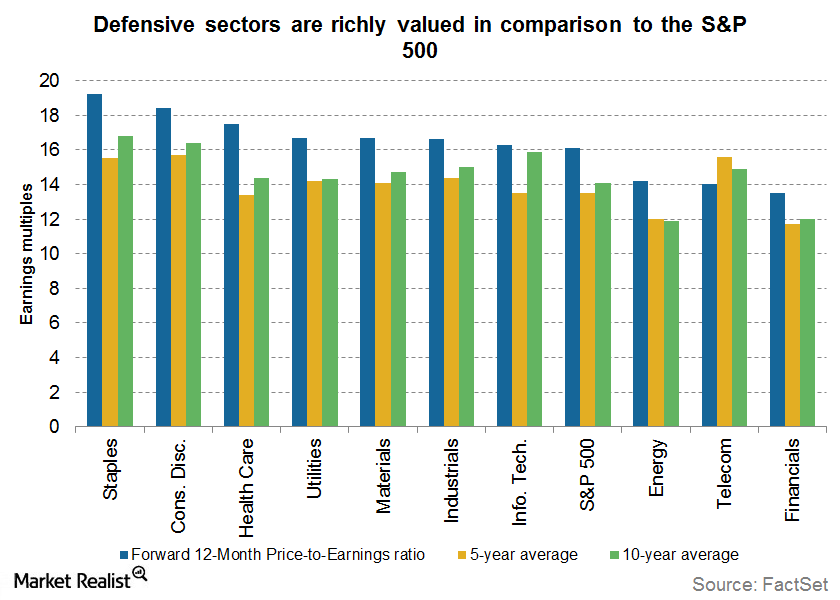

Investors Should Avoid Defensive Sectors If Rates Rise

Valuations are at the higher end of their historical range. Investors should avoid defensive sectors, which are highly sensitive to interest rate changes.

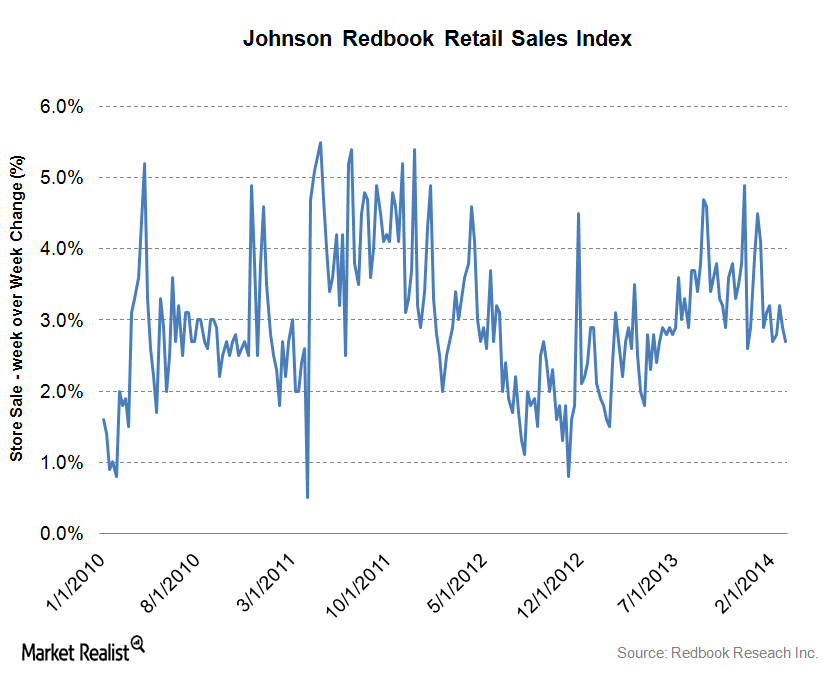

Must-know update: Redbook Index same-store sales data released

The Redbook Index released the same-store weekly data on Tuesday, March 11, 2014.

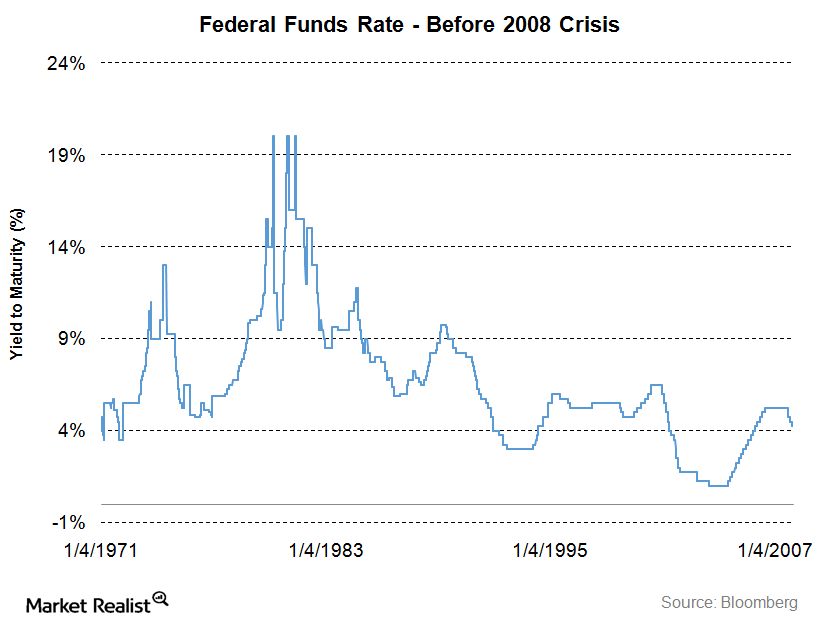

Pianalto’s take on the Fed funds rate before the financial crisis

When consumers can borrow at lower interest rates, they can afford to buy more goods and services, and the businesses that supply those goods and services can hire more people.

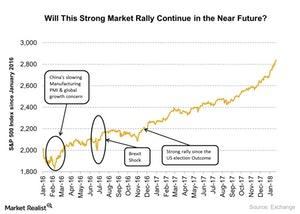

Miller: Bond Bear Market to ‘Propel Stocks Significantly Higher’

Legendary value investor Bill Miller has an optimistic view on the equity market.

Gundlach on Higher Yield: Watching the Copper-to-Gold Ratio

Billionaire investor and bond guru Jeffrey Gundlach also shared his view on bond yields in an interview with CNBC.

Is the Fed Sure What It’s Doing?

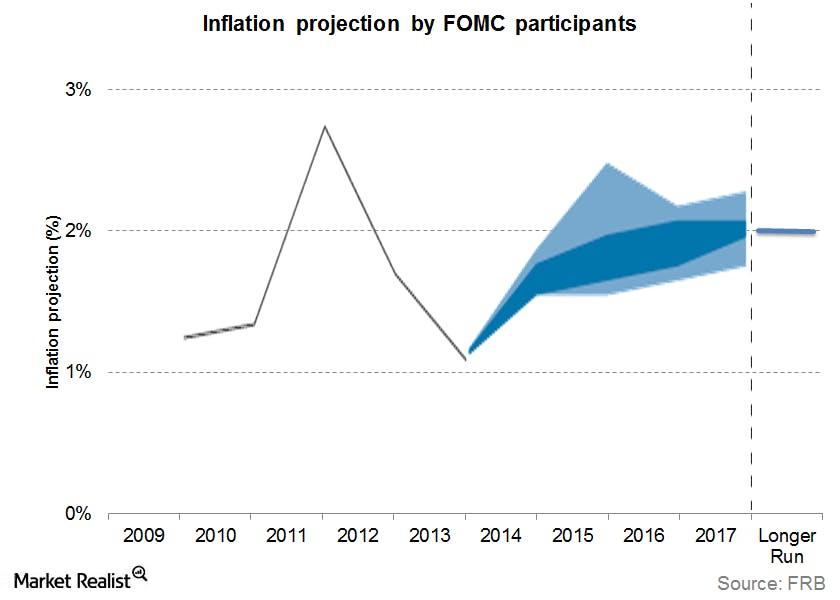

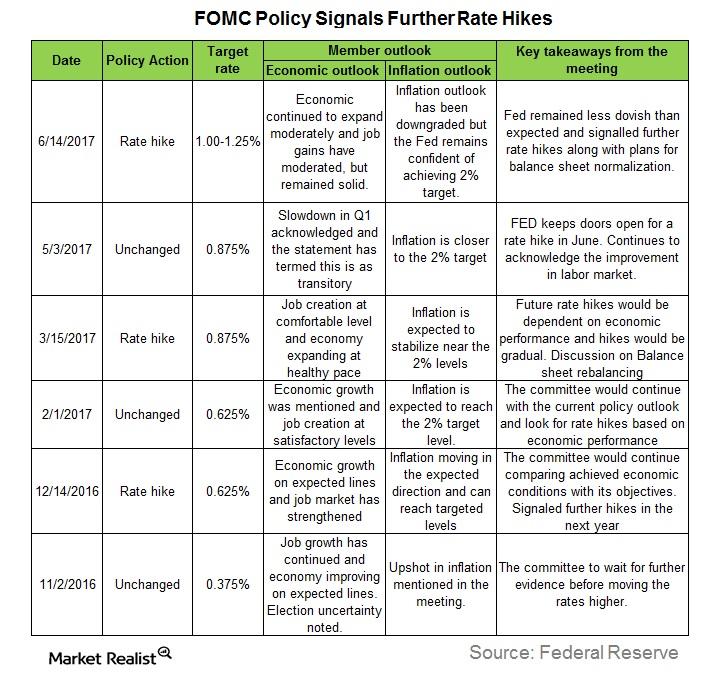

In this series, we’ll analyze Fed members’ comments in June 2017 to better understand their outlooks on the US economy and how they justify their hawkish or dovish stances.

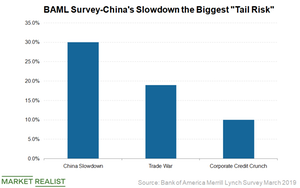

Markets Look at US-China Trade Talks as Slowdown Concerns Multiply

Today, another round of trade talks started in Beijing.

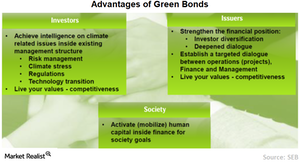

How Green Bonds Can Help Diversify Investor Base

Even if we assume that green bonds don’t offer any significant premium over conventional bonds, there are many who believe in other noteworthy advantages of green investing.Technology & Communications Why you should know the key differences between job reports

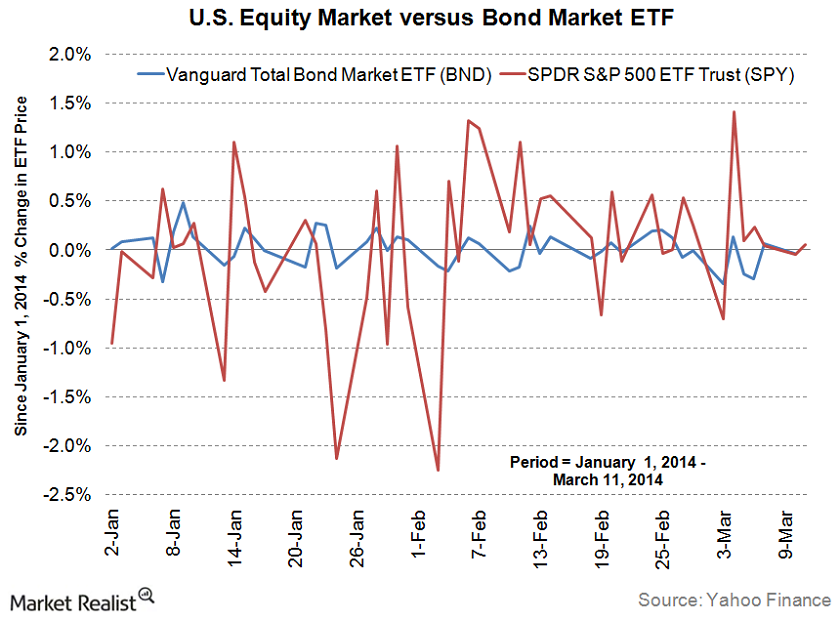

Few economic releases elicit as much reaction from both the stock (IVV) and bond (BND) markets as the employment reports issued by Automatic Data Processing (ADP) and the Bureau of Labor Statistics (the BLS).

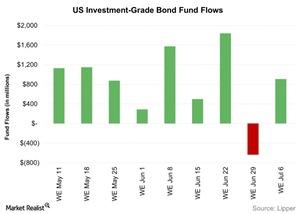

Investment-Grade Bond Funds Saw Inflows Last Week

Flows into investment-grade bond funds were positive last week. Investment-grade bond funds saw net inflows of $907.1 million during the week ending July 6.

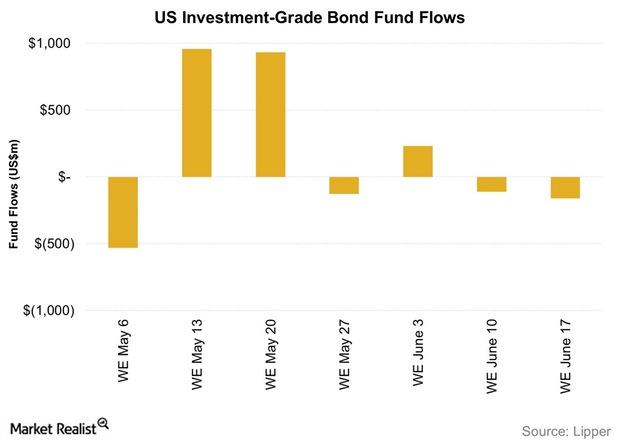

Investment-Grade Bond Funds Saw Outflows Last Week

Flows into investment-grade bond funds (LQD) were negative in the week ending June 17. This was the second consecutive week witnessing outflows.Financials Financial intermediation, systemic risks, and “too big to fail”

When financial intermediaries allocate funds, they assess the risks and returns that come from various risky claims. Intermediaries help allocate resources and risks throughout the economy. Financial intermediation can result in concentrated risks. The risks increase the financial system’s fragile state. These risks are called systemic risks.

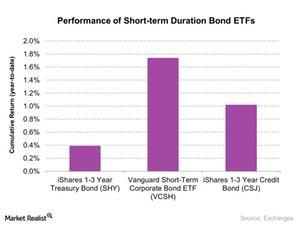

Investment Avenues during the Rise of Short-Term Interest Rates

Bill Gross thinks the central banks should implement their strategies very carefully and cautiously in this scenario.Financials Key differences between PCE and CPI as inflation measures

The CPI and PCE are both important indicators of U.S. inflation. CPI is more important from an individual perspective, while PCE is more important for monetary policy.Energy & Utilities Must-know: Is the utilities sector a bond market proxy?

It’s important to note that higher real yields, not rising inflation, are driving today’s higher nominal yields as investors are demanding more compensation for holding bondsFinancials Why unemployment data moves bond yields

Private and government construction both reported declines. The construction value chain has a multiplier effect on other sectors of the economy, and can significantly impact both stock and bond markets.

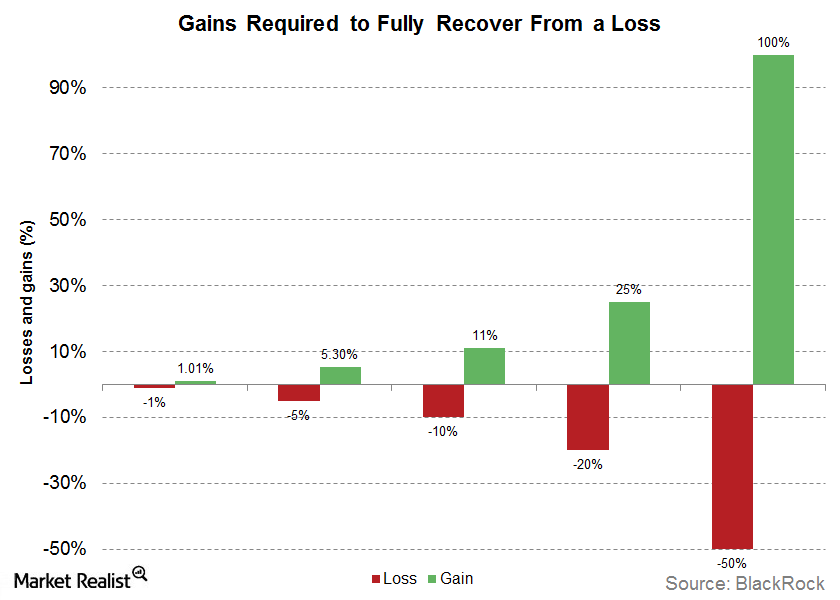

How You Can Win More By Losing Less

Most investors focus much of their time on picking assets that have the potential to win. However, limiting downside risk is just as important.

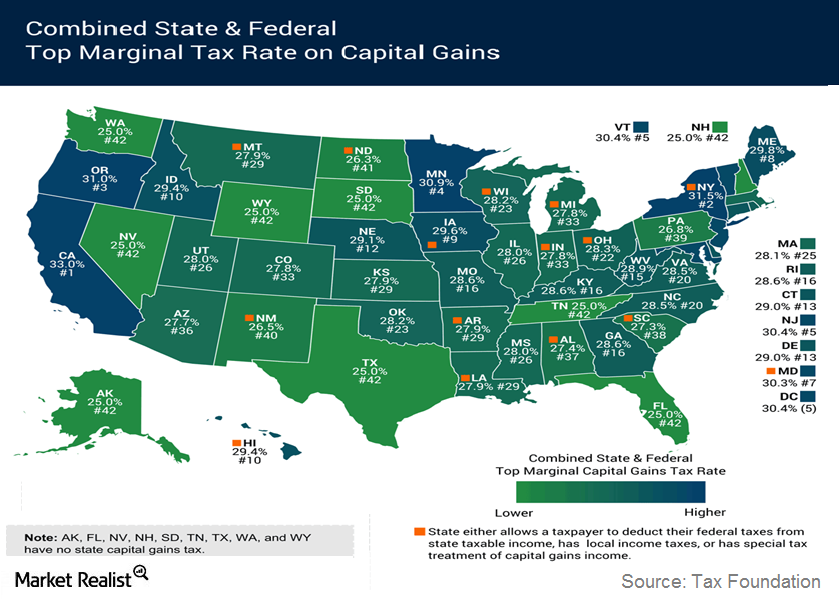

Basics About The Capital Gains Tax

The rates for capital gains tax depend on the asset’s holding period. If the holding period is less than one year, short-term capital gains tax is payable.

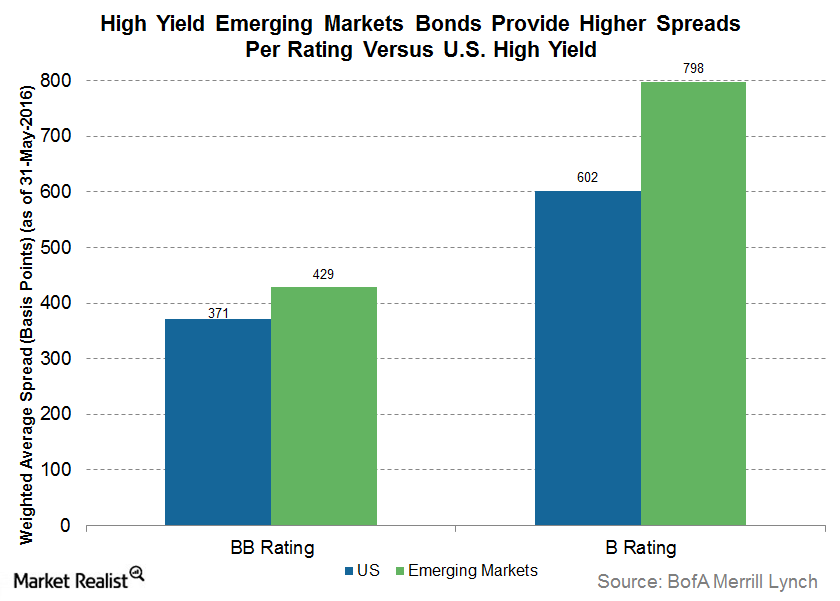

What Are the Attractive Characteristics of High Yield EM Bonds?

Investors are flocking to government bonds (BND) of developed markets, which is causing downward pressure on interest rates.Why US inflation data is important and how we measure it

U.S. inflation is not just a measure of growth and price pressure in the U.S. economy. It has more far-reaching consequences.Financials How bond prices, interest rates, and credit spreads correlate

Bond prices and interest rates have an inverse relationship. If an interest rate increases, the price on a bond declines, and vice versa.Financials Why do floating rate notes, or FRNs, differ from regular bonds?

The U.S. Treasury Department’s latest issue on January 29, the floating rate note (or FRN) will fulfill two investor needs: participating in anticipated future interest rates increases and protecting principal against default.Financials Why investors should look at floating rate notes as an option

On January 29, 2014, the U.S. Treasury Department issued a new class of security: the floating rate note (or FRN). This is the first new security introduced by the Treasury since 1997.Financials An investor’s guide to the US leveraged financial market

According to the Securities Industry and Financial Market Association, SIFMA, the total U.S. fixed income market size is about $38.6 trillion.

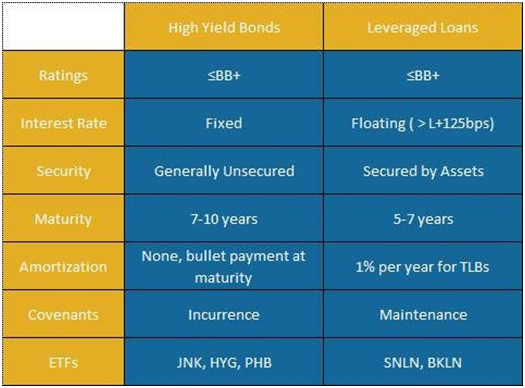

Comparing leveraged loans and high yield bonds: Credit rating

Credit rating measures the credit-worthiness of a debtor with respect to its financial and operational stability. Rating agencies such as Moody’s and Standard & Poor’s specialize in rating credit to government agencies and corporates.Financials Comparing leveraged loans and high yield bonds: Key distinctions

Leveraged loans (BKLN) are almost always secured or backed by a specific pledged asset or some form collateral. On the other hand, high yield bonds (JNK) may be secured or unsecured.Financials Comparing leveraged loans and high yield bonds: Debt terms

Another item that differentiates leveraged loans from high yield bonds is “covenants,” or the financial health metrics that issuers must adhere to.Financials Key drivers affecting investment-grade bond funds flows

Bond yields and prices move in opposite directions. As a result, returns on high-quality corporate bonds were positive. This year, demand for U.S. investment-grade debt benefited from geopolitical tensions overseas and economic growth fears in the first quarter. This raised prices and lowered yields on high-quality corporate bonds.Financials Overview: Investment-grade bond ETFs

U.S. investment-grade bonds can provide investors with a safe and steady income stream. They’re issued by the U.S. Department of the Treasury and corporates. The issuers have a very high ability to service the debt issued. There’s little risk of default.Financials Why Treasury auctions impact investors and financial markets

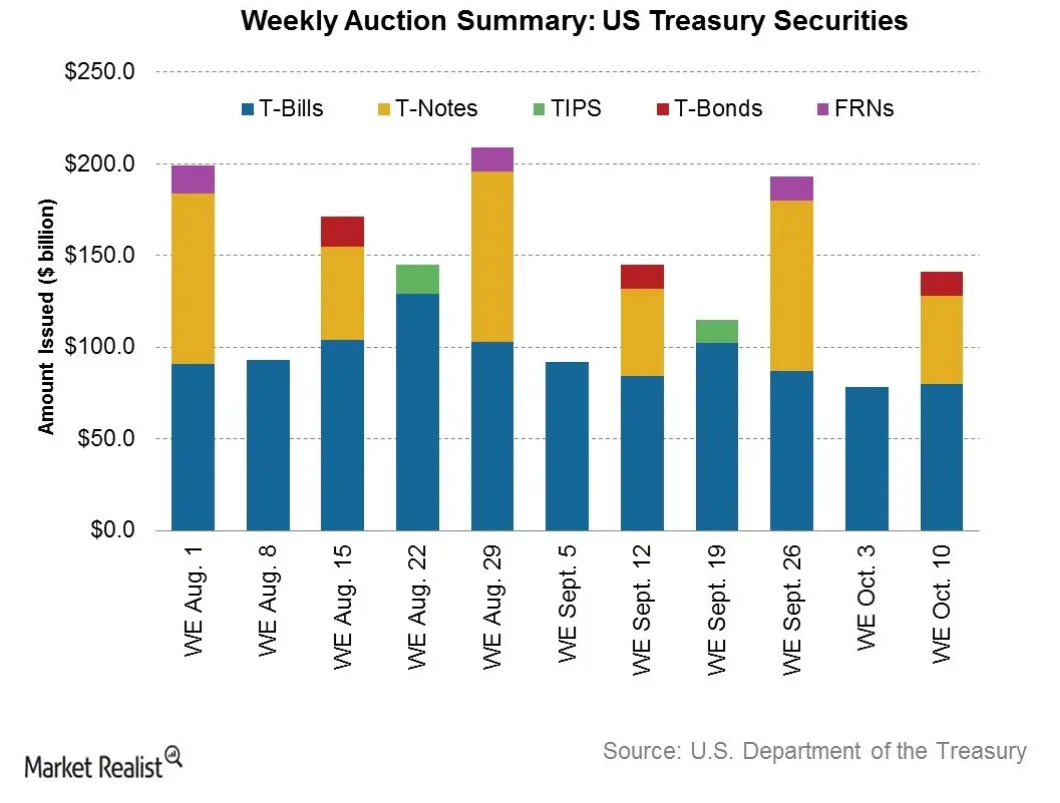

The purpose of Treasury auctions is to obtain financing from markets at the most competitive cost. The yield on these securities is determined through a public auction process. These yields affect the secondary market for U.S. Treasuries. Yields and bond prices move in opposite directions.Financials Why do floating rate notes, or FRNs, differ from leveraged loans?

FRNs are usually issued in capital markets, whereas leveraged loans are arranged by commercial and investment banks. While FRNs are typically unsecured and investment-grade, leveraged loans are secured.

How does the Redbook Index help fixed-income and equity investors?

The Redbook Sales Index compiles and analyzes comparable store sales at more than 9,000 stores.

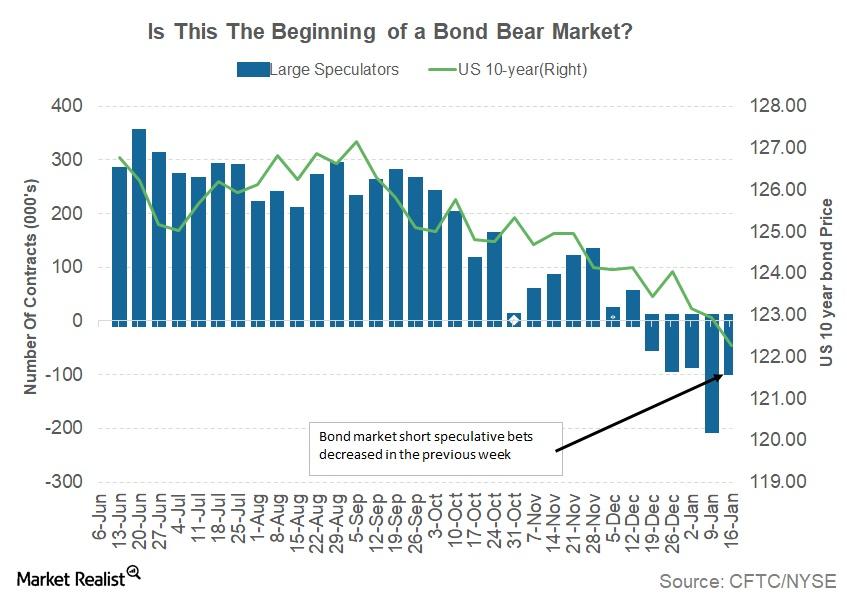

Why Bill Miller Thinks Bond Bull Market May Be Coming to an End

Bill Miller said, “Bonds, in my opinion, have entered a bear market, but one that is likely to be benign for the next year or so.”

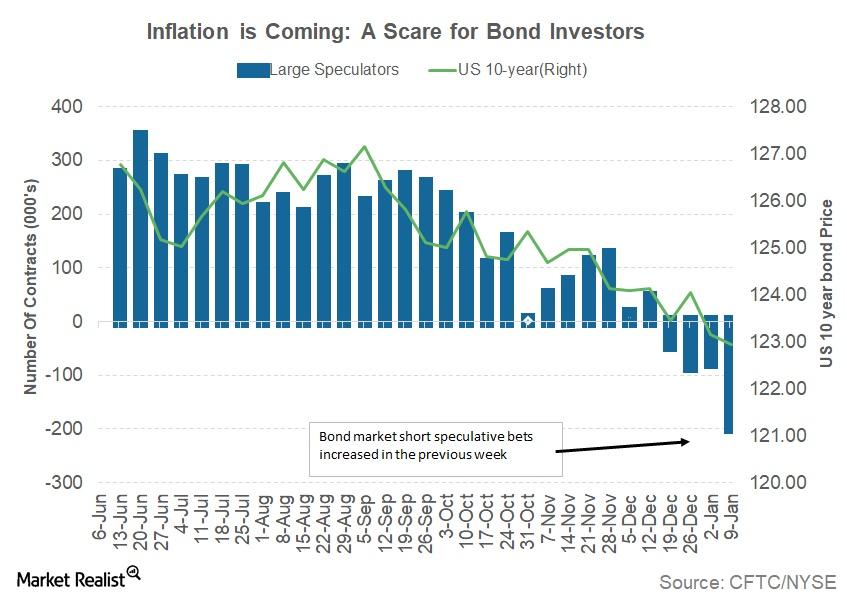

Are Bond Yields Set to Move Higher this Week?

The US Treasury is not able to issue any more debt until the debt ceiling is raised, which could increase the volatility in the bond markets.

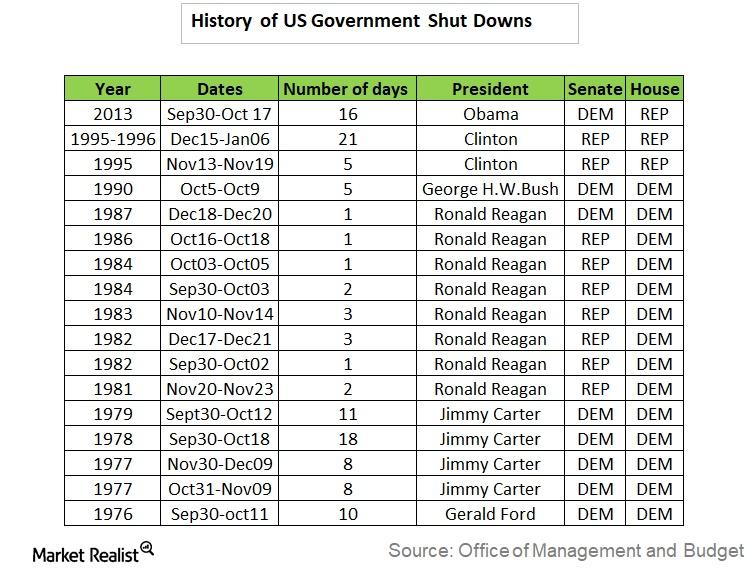

What Could Happen if the US Debt Ceiling Isn’t Raised

The failure of US Congress to raise the debt ceiling would result in a partial government shutdown. The US Treasury wouldn’t be able to issue any government debt, and it could end up borrowing from its retirement savings fund.

Your Guide to the US Debt Ceiling

The current debt ceiling is likely to be breached on January 19, and once that happens, the US Treasury must stop issuing any new debt (SHY).

Why the US Bond Market Moved Lower Last Week

The core CPI of 0.3% pushed the annual number up by 0.1% to 1.8%.

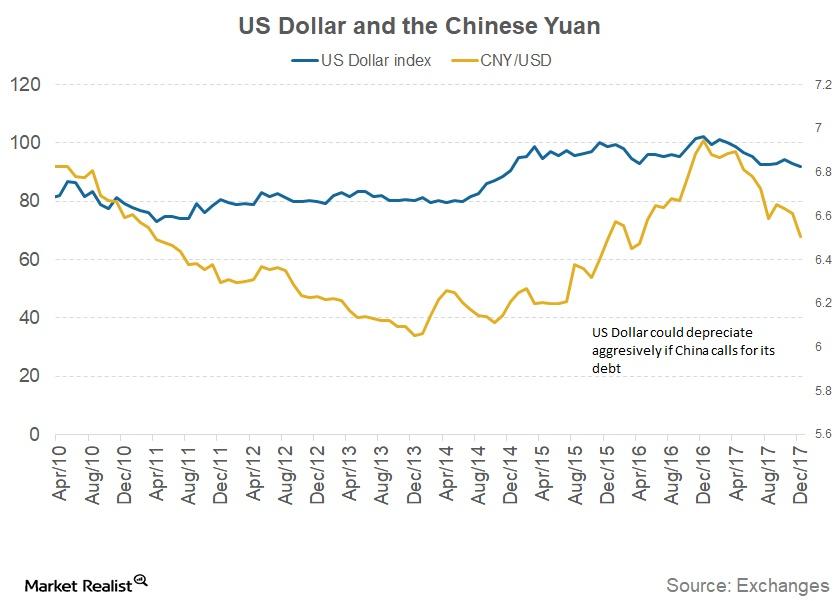

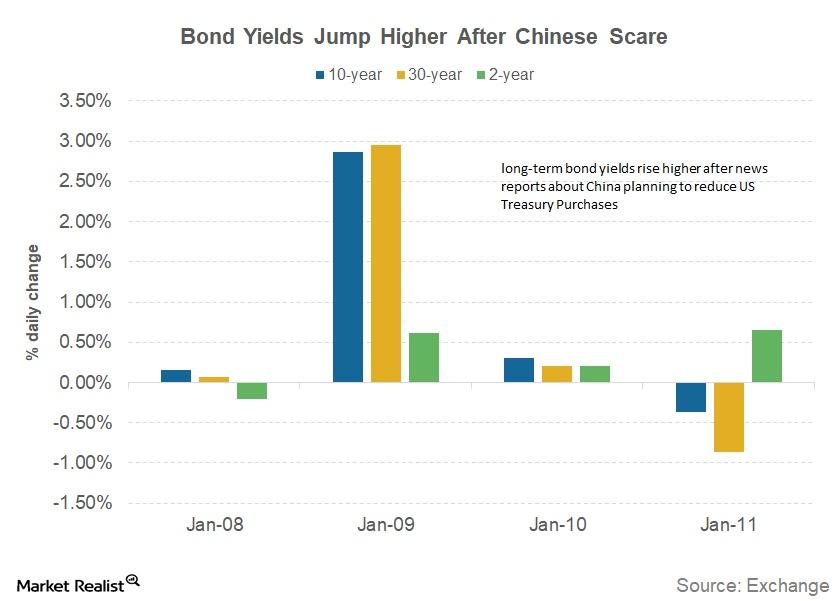

What Could Happen If China Wants Its Money Back?

If the Chinese government decides to sell its US debt (GOVT) holdings, it could lead to another possible global financial crisis.

The US Bond Market and the Big Scare from China

On January 10, 2018, Bloomberg News broke a story that the Chinese government could be planning to slow down its purchases of US government debt (GOVT).

What November Job Openings Say about US Economy

As per the January JOLTS report, there were 5.9 million job openings at the end of November.

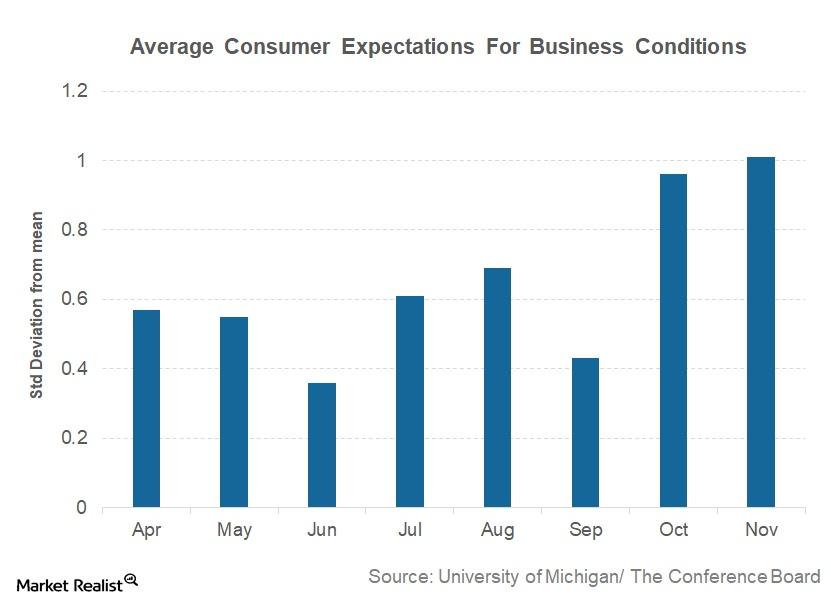

Why Consumer Expectations Continued to Increase in November

Consumer expectations for business conditions Average consumer expectations for business conditions form the only component of the Conference Board LEI (Leading Economic Index) that is not a leading indicator. Consumer expectations are based on two separate surveys. One survey is conducted by the University of Michigan and Reuters, while the second survey is conducted by […]

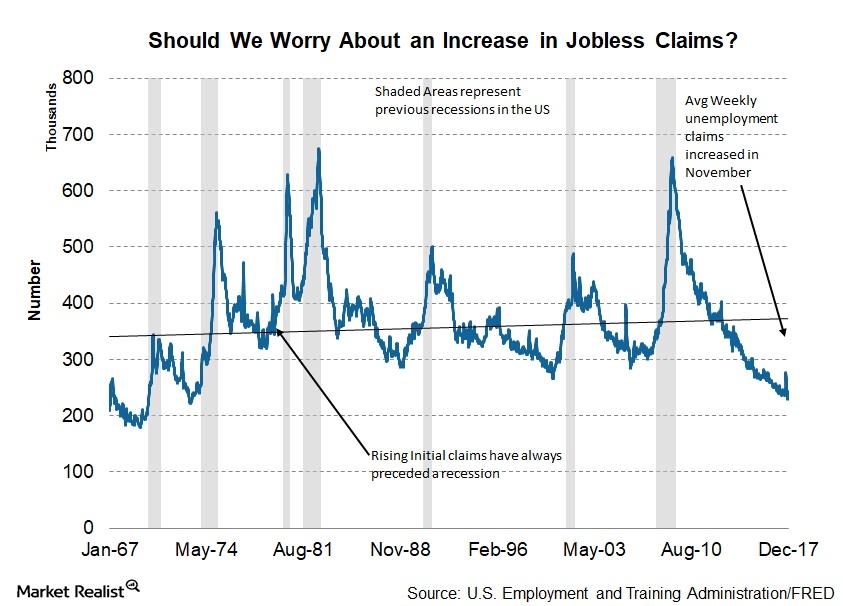

Should We Worry about Rising Unemployment Claims?

Average weekly claims and the economy Average weekly unemployment claims are a constituent of the Conference Board LEI (Leading Economic Index). Claims have a 3% weight in the LEI. Weekly unemployment claims, if adjusted for seasonality, give investors a clear understanding of changes in the employment market. Though the Bureau of Labor Statistics releases a monthly […]

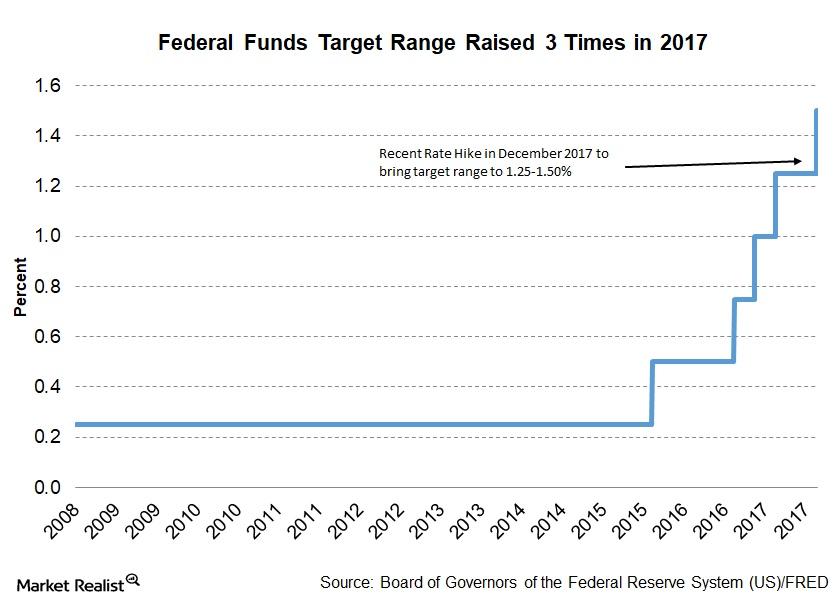

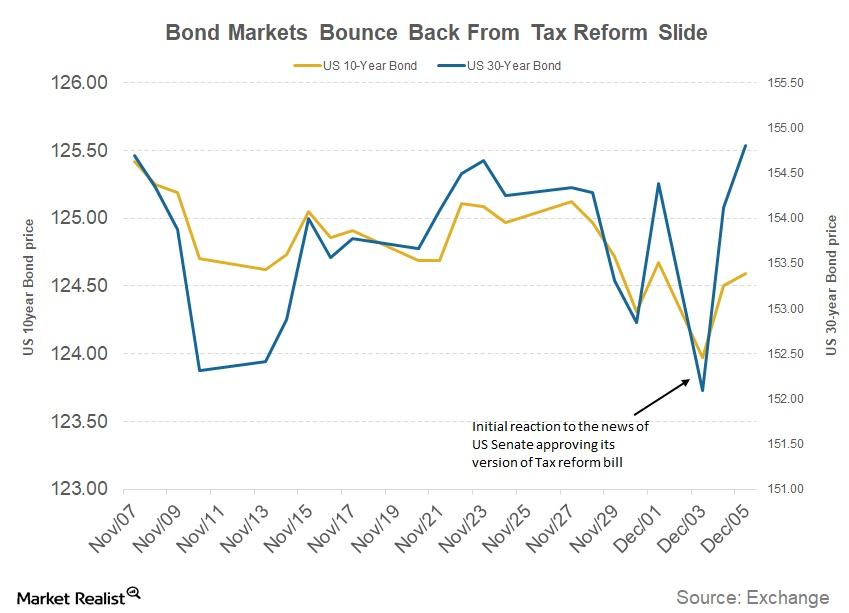

A Double Dose of Tightening from the Fed in 2017

In its December monetary policy statement, the Fed projected three interest rate hikes in 2018 and three in 2019, depending on the incoming economic data.

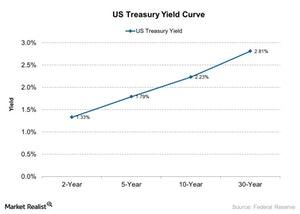

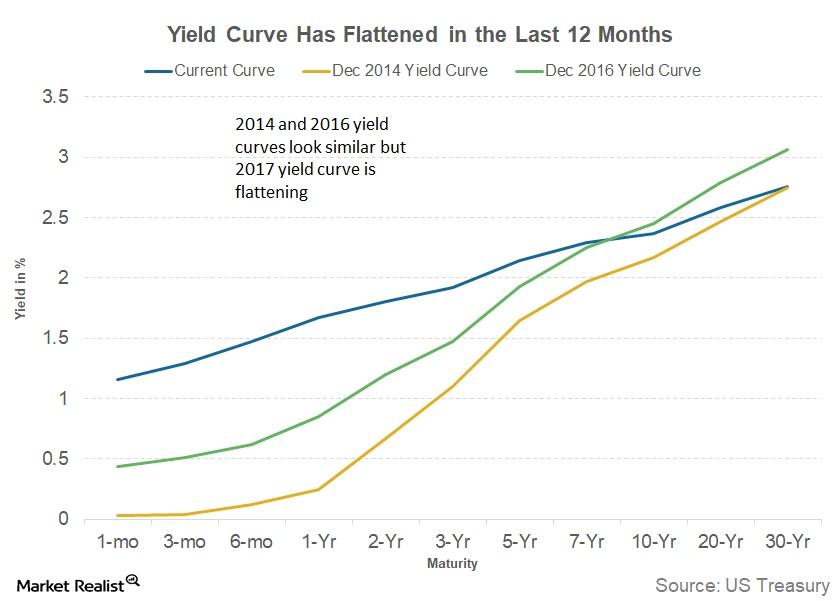

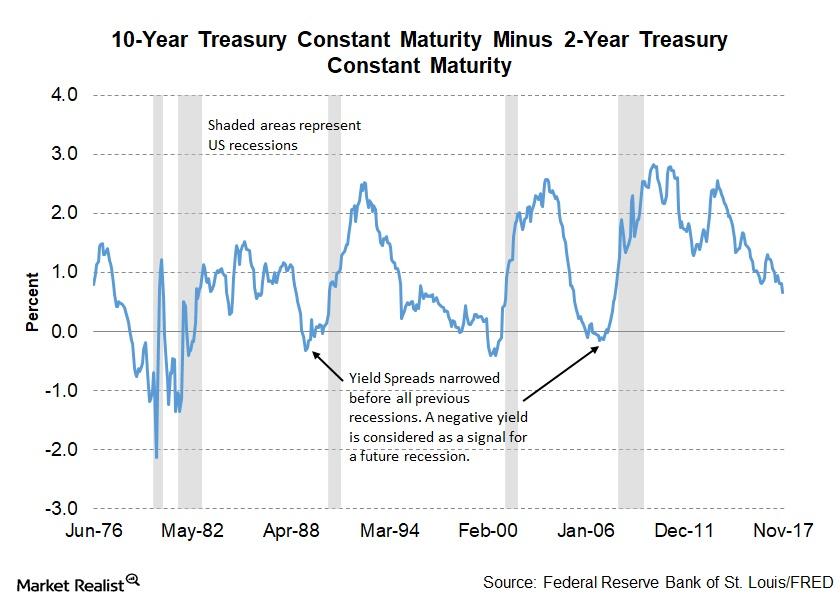

What Leads to Yield Curves Flattening

Factors leading to yield curves flattening There are multiple factors that can affect the shape of yield curves. Bonds (BND) with different maturities react differently to changes in economic conditions and expectations. For example, when the US Fed announces an interest rate hike, short-term bonds (SHY), which are to the left side of a yield curve, react […]

Assessing the Risk of a Flattening Yield Curve

St. Louis Fed president and CEO James Bullard gave a presentation at a regional economic briefing on December 1. Throughout this series, we’ll analyze Bullard’s take on the risks of an inverted yield curve.

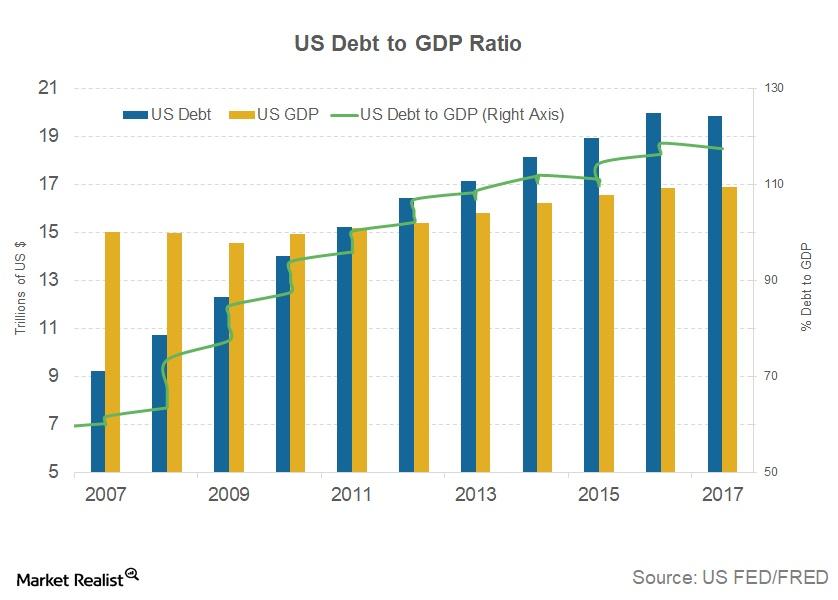

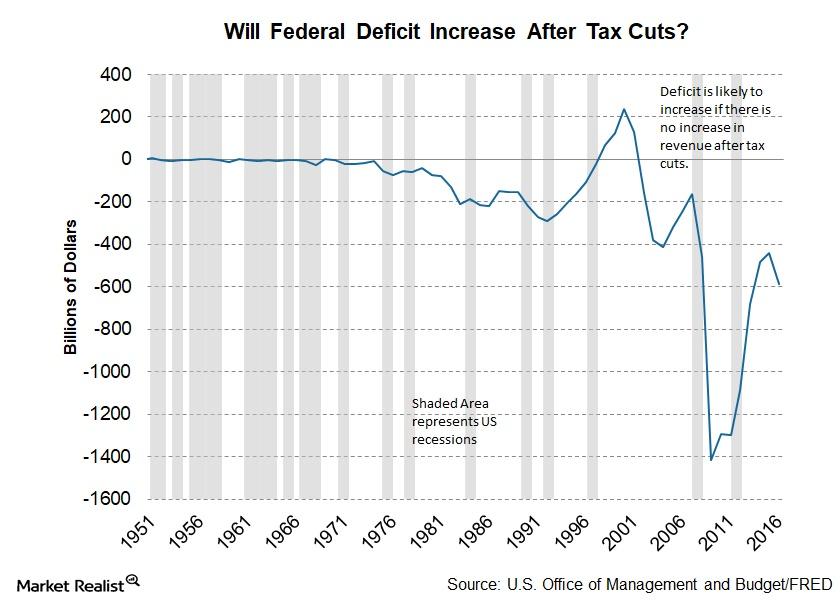

How Will Tax Cuts Impact the Federal Deficit?

The report from the Joint Committee on Taxation included an estimate of budgetary deficits for 2018–2027. Tax reforms could have a limited impact in 2018.

Tax Cuts and Rate Hikes Could Impact the Fed

The proposed tax cuts and the resulting increase in the federal deficit are expected to impact bond markets. It’s important to consider the Fed’s stance.

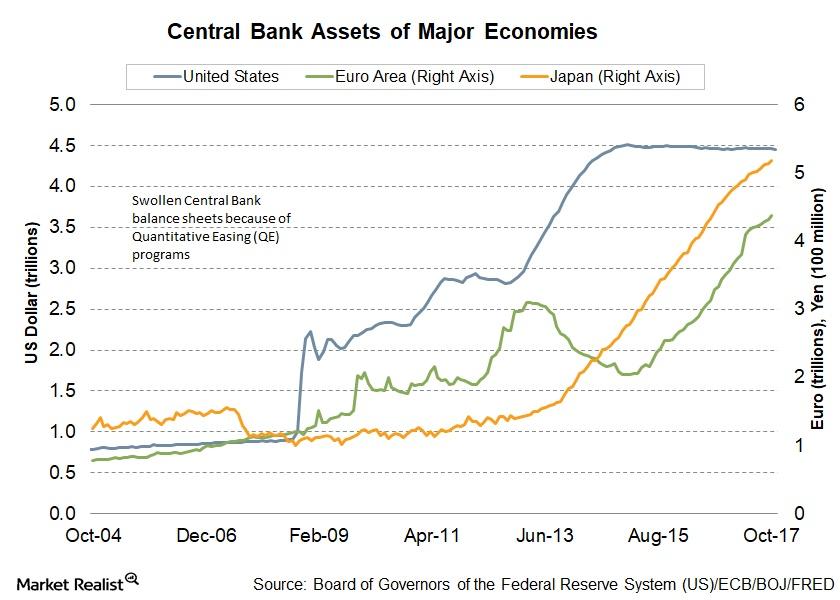

When the United States Sneezes, Will the World Catch a Cold?

Williams suggested that the monetary policy framework should be designed considering the global scenario rather than central banks looking at their economies in isolation.

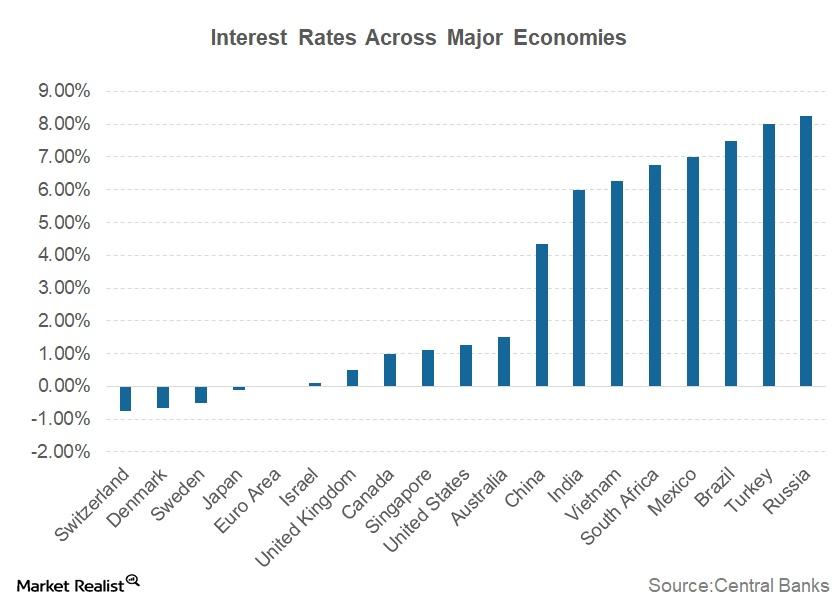

The Problem with the Current Interest Rates

With global economies progressing toward normalcy or the “new normal,” as Williams called it, central banks are moving toward normalizing policy by signaling interest rate hikes.