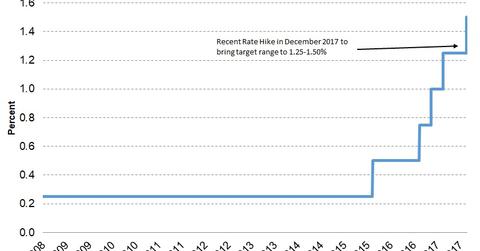

A Double Dose of Tightening from the Fed in 2017

In its December monetary policy statement, the Fed projected three interest rate hikes in 2018 and three in 2019, depending on the incoming economic data.

Dec. 22 2017, Published 1:40 p.m. ET

3 rate hikes this year

In 2017, the Fed continued its journey of monetary tightening. After a decade of low interest rates, it began the process of increasing interest rates in December 2015. There was only one rate hike in 2015 and one in 2016, but in 2017, there were three as well as the initiation of its balance sheet unwinding program. The Fed announced these changes in its forward guidance and member speeches. The financial markets (QQQ) seemed well-prepared for these announcements, thus limiting volatility when the rate hikes happened. In its policy statements, the Fed sounded confident about economic progress, with low inflation the only concern among FOMC (Federal Open Market Committee) members.

Unwinding of the balance sheet

The Federal Reserve’s balance sheet has ballooned to $4.5 trillion as the United States purchased huge quantities of fixed income securities (BND) in its bid to keep yields lower after it ran out of conventional monetary policy tools. In October 2017, the Fed initiated the process of slowly unwinding the balance sheet with predetermined caps on reinvestments.

For US Treasuries (GOVT), the cap will be $6 billion per month initially and will increase by $6 billion every three months until it reaches $30 billion per month. For agency debt (MBB), the corresponding figures will be $4 billion and a max cap of $20 billion per month. The size of these rollovers was so low that the unwinding process has had a limited impact on the bond markets (AGG) so far.

The Fed in 2018

In its December monetary policy statement, the Fed projected three interest rate hikes in 2018 and three in 2019, depending on the incoming economic data. But is the market agreeing with this forward guidance? Although the Fed’s plan includes rate hikes, low inflation (VTIP) expectations are keeping long-term yields suppressed. This variation in expectations is leading to a flattening yield curve, which is considered a signal for a future recession. Will the Fed continue with rate hikes if inflation remains low? That’s an interesting question, and we’ll have to wait for the answer.

In the next part of this series, we’ll see how the employment has improved in 2017.