BTC iShares U.S. Treasury Bond ETF

Latest BTC iShares U.S. Treasury Bond ETF News and Updates

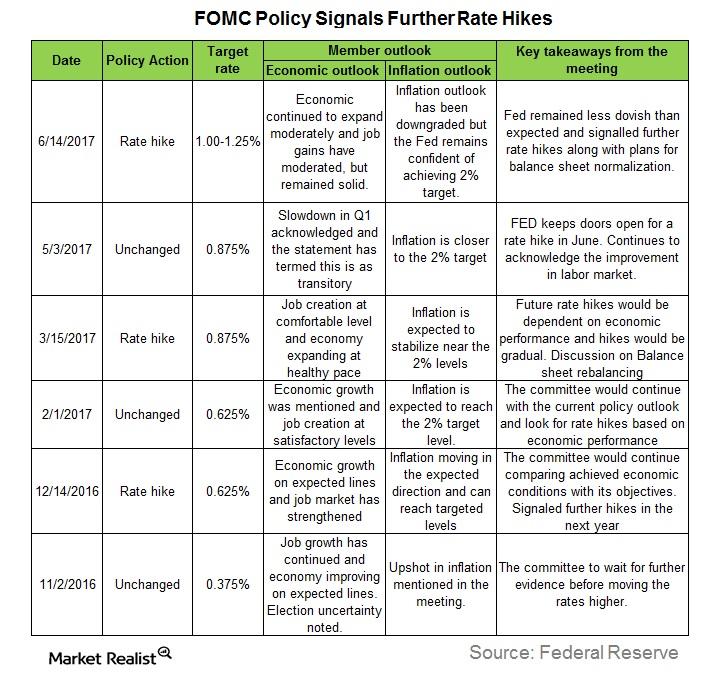

Is the Fed Sure What It’s Doing?

In this series, we’ll analyze Fed members’ comments in June 2017 to better understand their outlooks on the US economy and how they justify their hawkish or dovish stances.

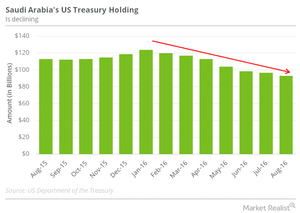

How Saudi Arabia’s Bond Sale Affects US Treasury Bonds

Saudi Arabia has also been involved in the sale of US Treasuries. The country is the 15th-largest holder of US Treasury bonds in the world.

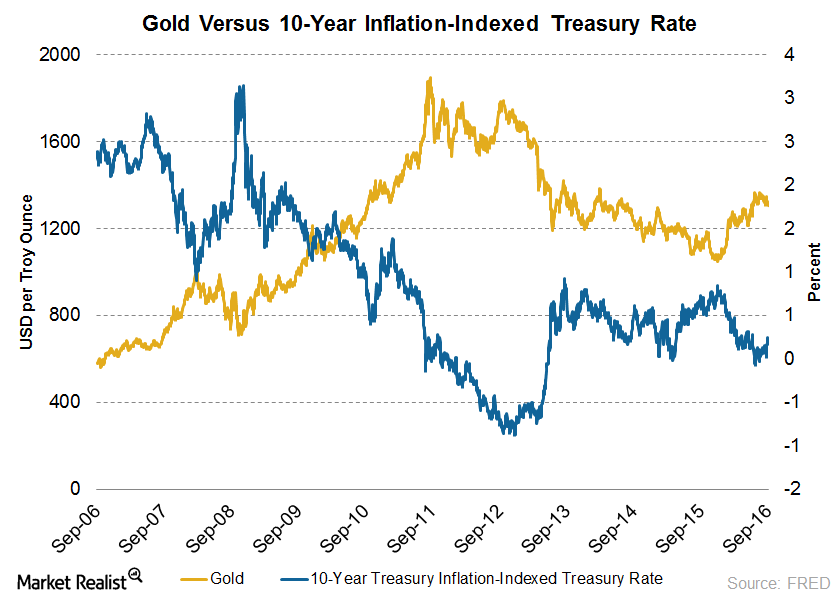

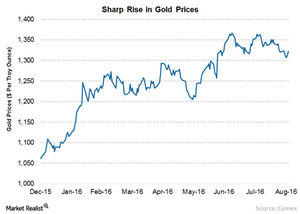

Gold versus 10-Year Treasury Bonds

The negative interest policy of the central banks is casting government bonds as a futile choice for investors compared to stocks and gold. As a result, bond prices dipped and yields started rising.

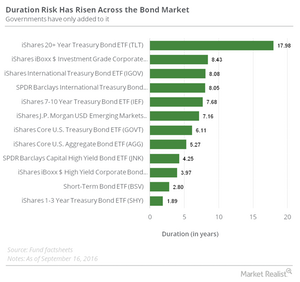

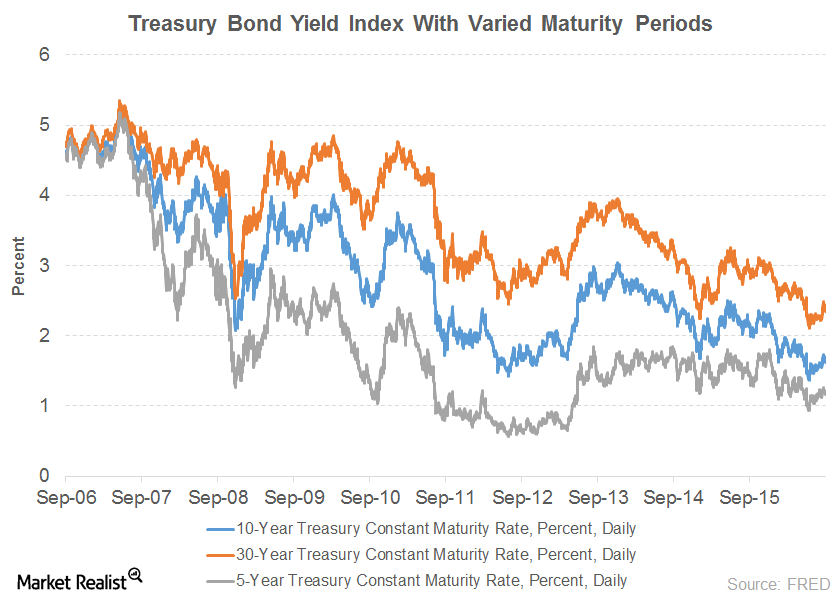

Investors Beware: Duration Risk Has Risen across the Bond Market

If you’re a bond (BSV) (AGG) investor or fund manager, fluctuation in interest rates is one of the key risk drivers for the returns you get from your portfolio.

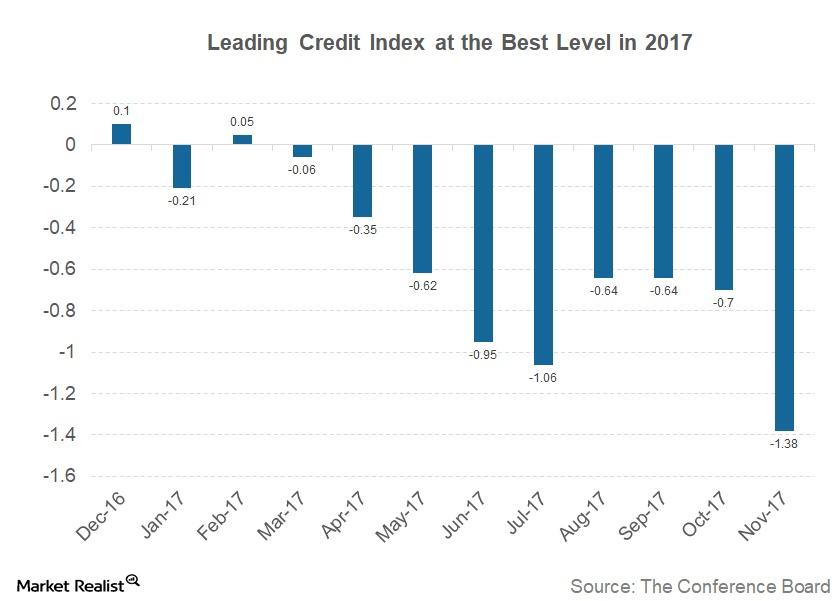

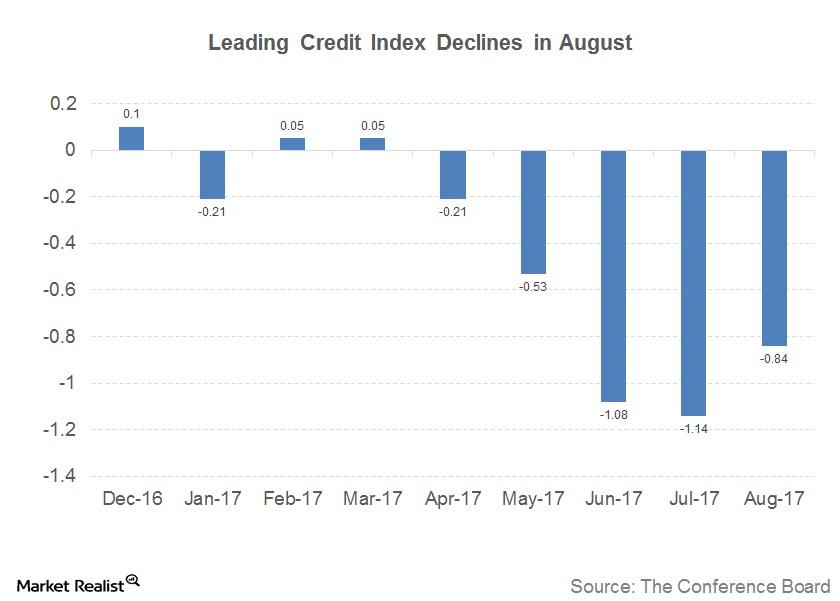

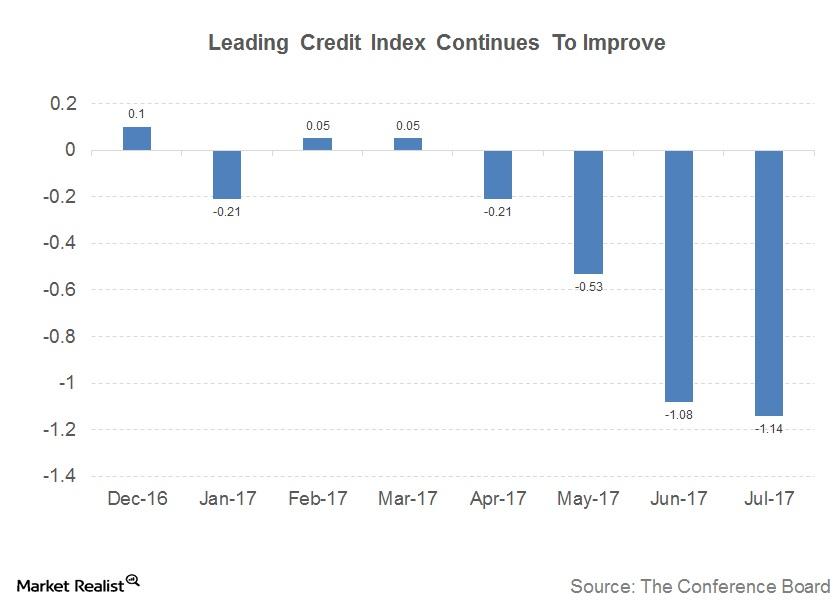

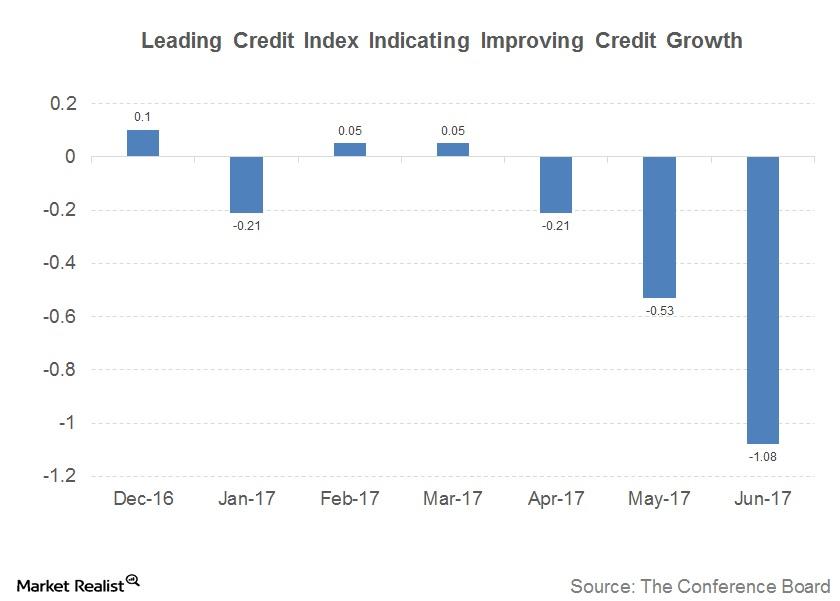

Is the Leading Credit Index Signaling Any Business Cycle Changes?

This constituent of the LEI is an economic model, constructed by modeling changes in six financial market instruments.

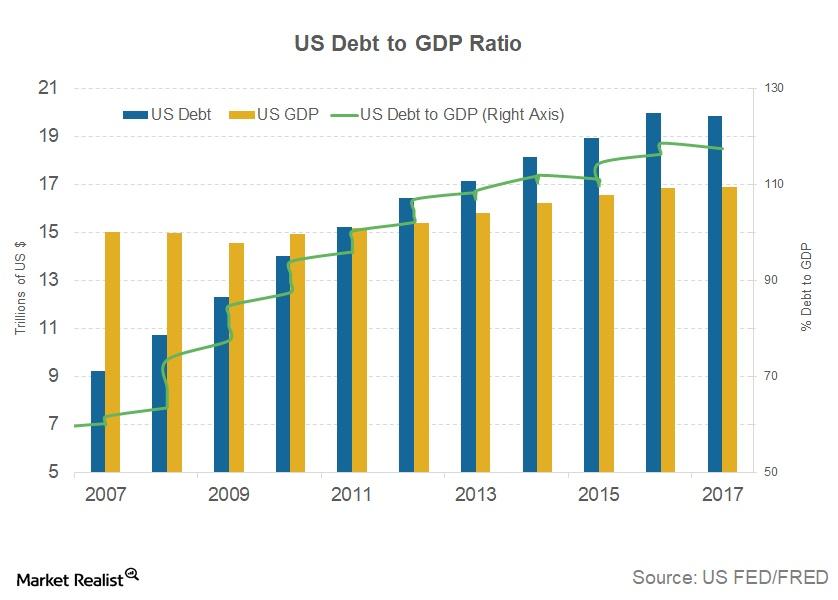

What Could Happen if the US Debt Ceiling Isn’t Raised

The failure of US Congress to raise the debt ceiling would result in a partial government shutdown. The US Treasury wouldn’t be able to issue any government debt, and it could end up borrowing from its retirement savings fund.

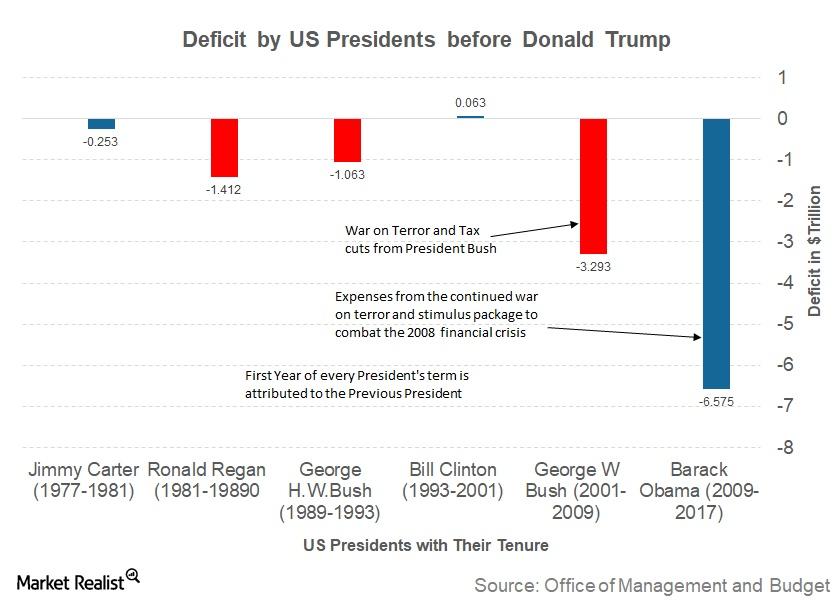

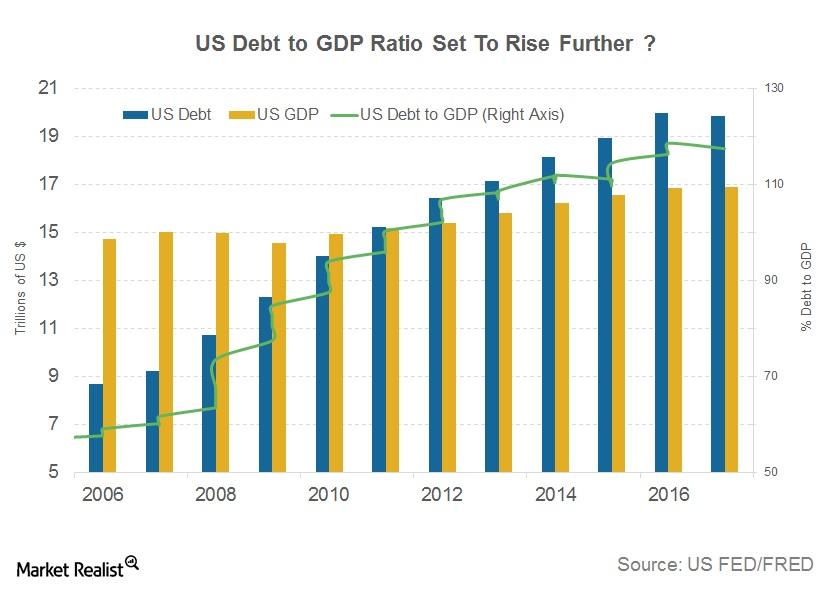

Why Is US Debt So High?

Most countries tend to issue debt to fund their deficits and keep paying interest on these borrowings. These revenues are generated through taxes from companies and individuals.

Your Guide to the US Debt Ceiling

The current debt ceiling is likely to be breached on January 19, and once that happens, the US Treasury must stop issuing any new debt (SHY).

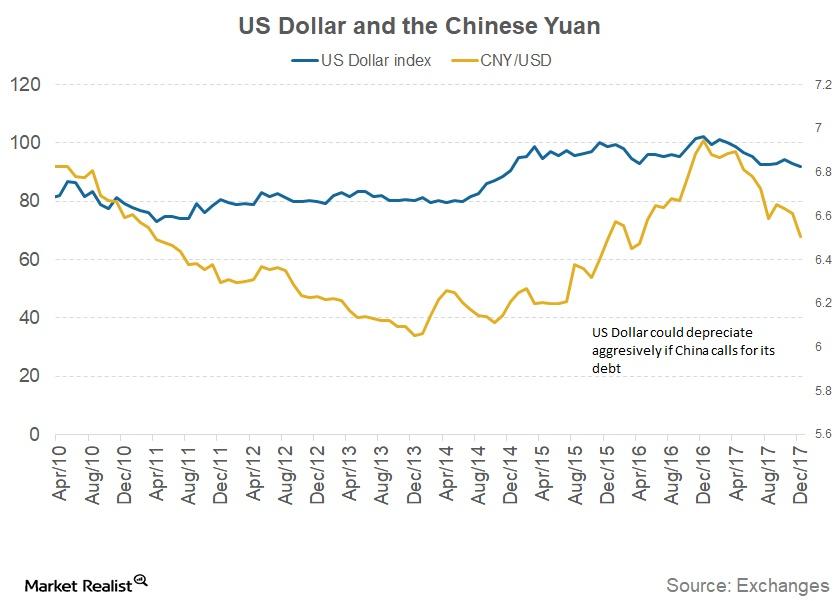

What Could Happen If China Wants Its Money Back?

If the Chinese government decides to sell its US debt (GOVT) holdings, it could lead to another possible global financial crisis.

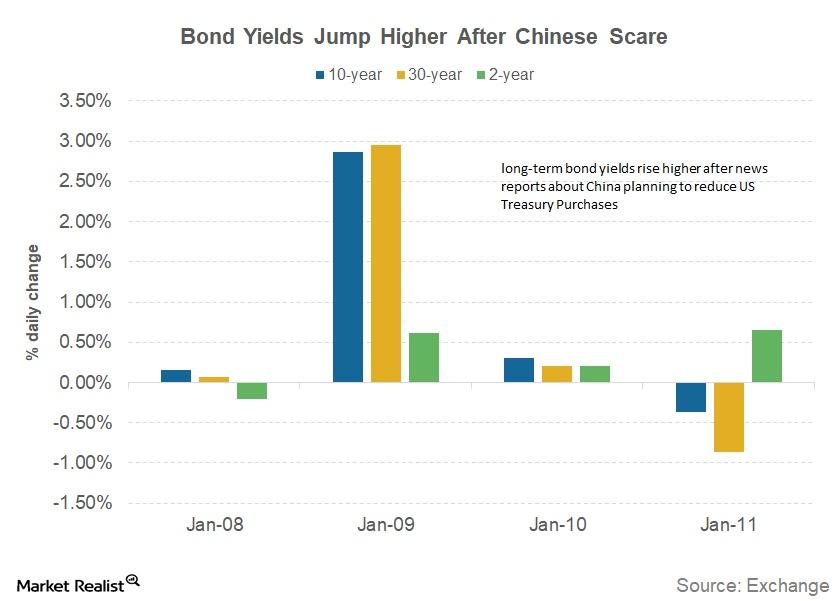

The US Bond Market and the Big Scare from China

On January 10, 2018, Bloomberg News broke a story that the Chinese government could be planning to slow down its purchases of US government debt (GOVT).

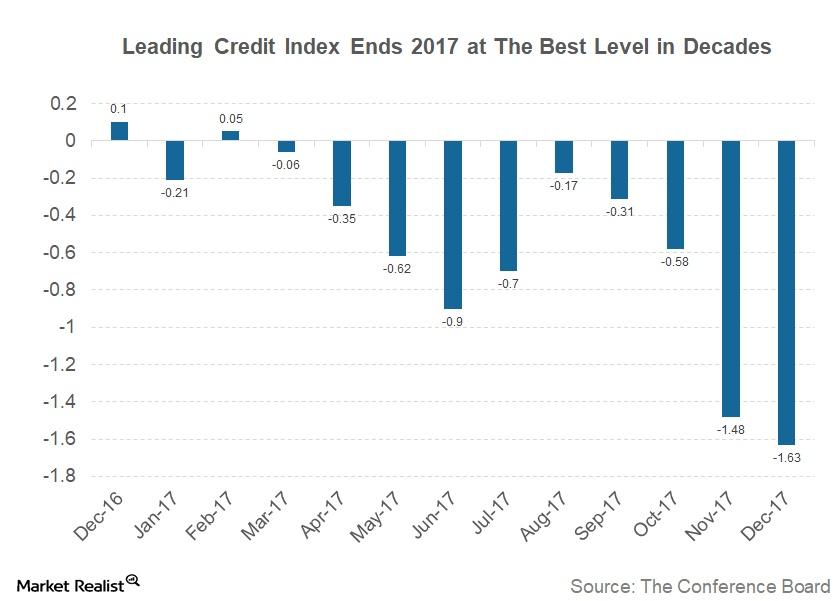

How the Leading Credit Index Tracks US Credit Conditions

Understanding the Leading Credit Index The Conference Board LCI (Leading Credit Index), a constituent in the LEI (Leading Economic Index), is published every month and tracks credit conditions in the US economy by following changes in six financial market instruments: the two-year swap (SHY) spread (real time) the three-month LIBOR[1.Intercontinental Exchange London Interbank Offered Rate] (SCHO) […]

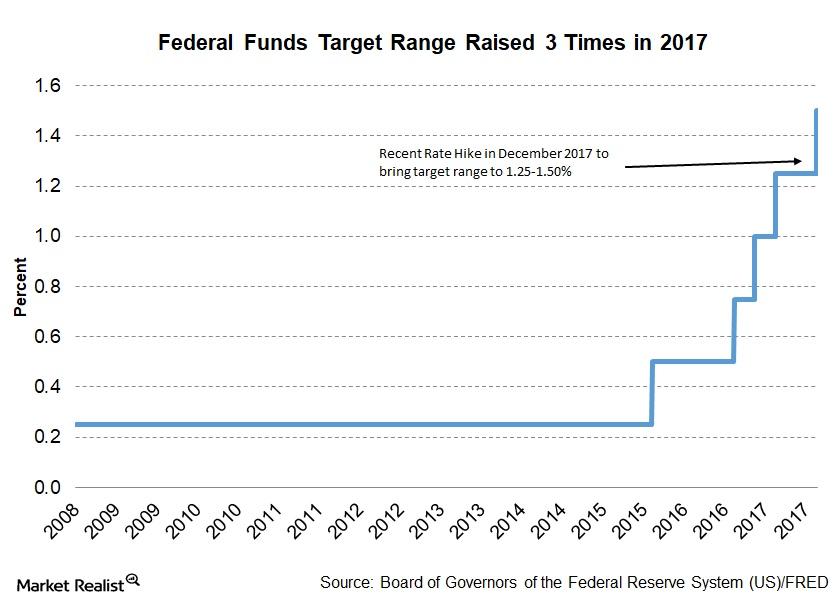

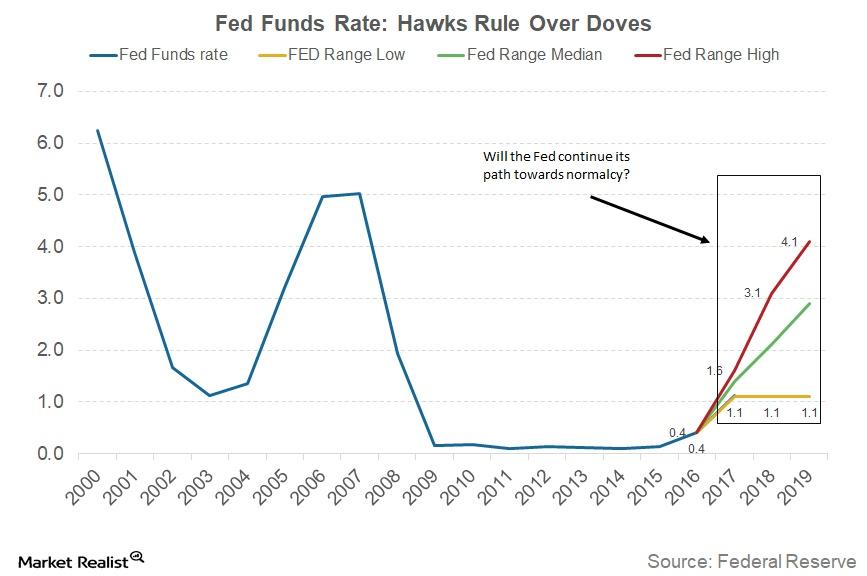

A Double Dose of Tightening from the Fed in 2017

In its December monetary policy statement, the Fed projected three interest rate hikes in 2018 and three in 2019, depending on the incoming economic data.

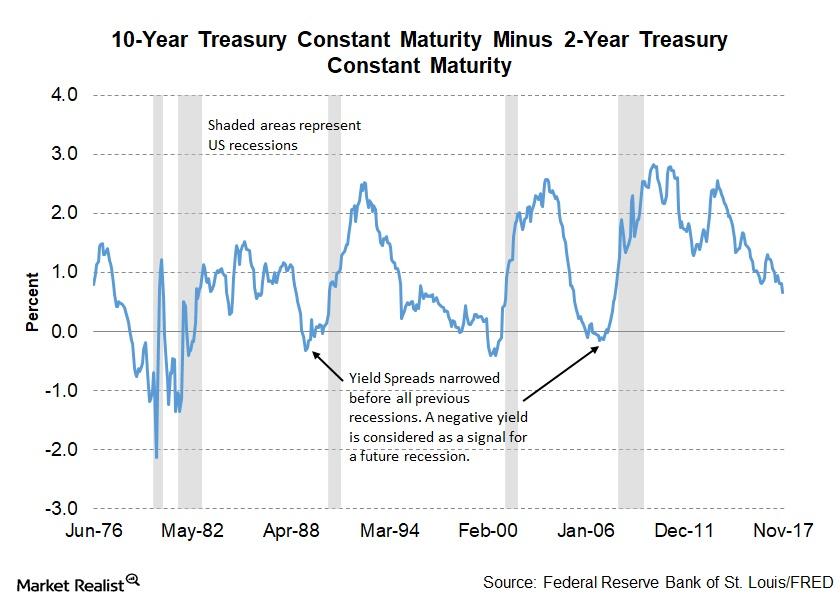

Assessing the Risk of a Flattening Yield Curve

St. Louis Fed president and CEO James Bullard gave a presentation at a regional economic briefing on December 1. Throughout this series, we’ll analyze Bullard’s take on the risks of an inverted yield curve.

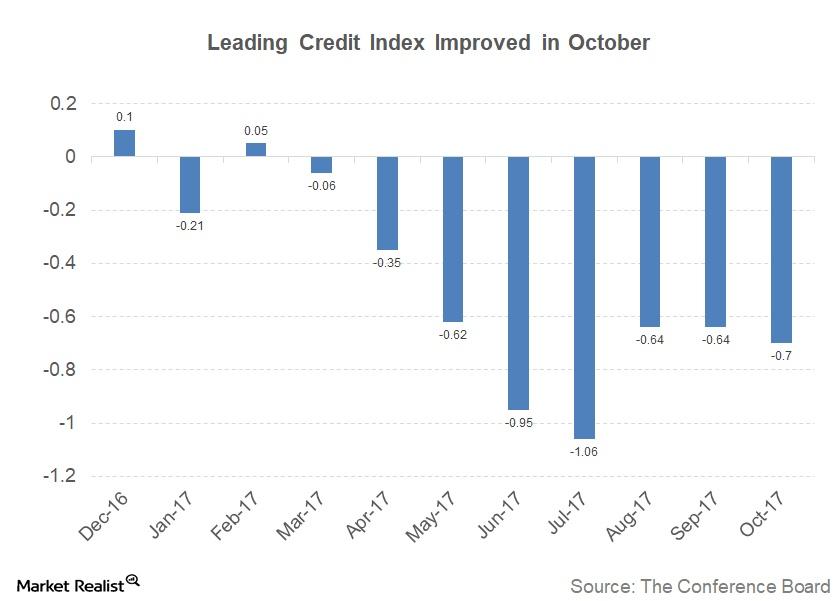

The Leading Credit Index: October Update

The Leading Credit Index for October was reported to be -0.70, improving from the revised September reading of -0.64.

Key FOMC Insights and the New Fed Chair

The US FOMC left rates unchanged after the November 2017 meeting, as expected, setting the stage for a potential rate hike in December.

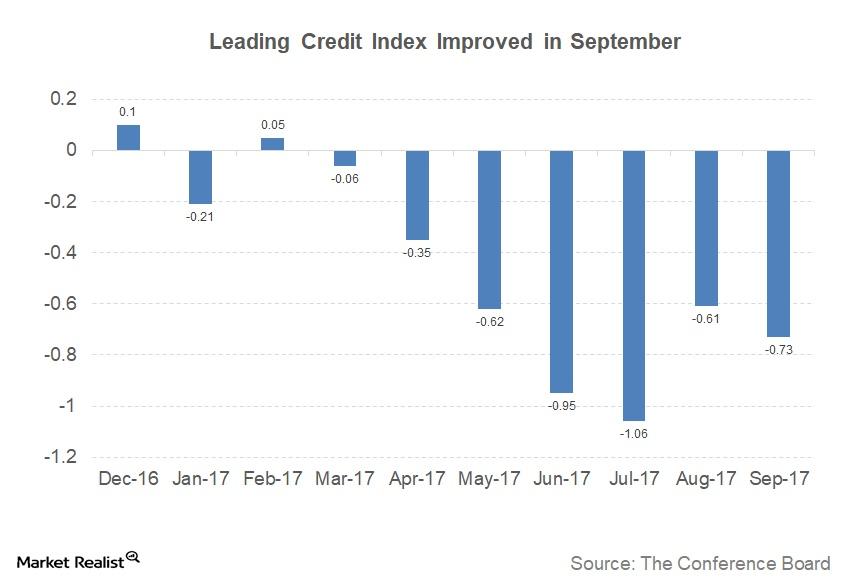

Understanding the Leading Credit Index for September 2017

The Leading Credit Index is an economic model that’s modeled on the performance of six major financial market instruments.

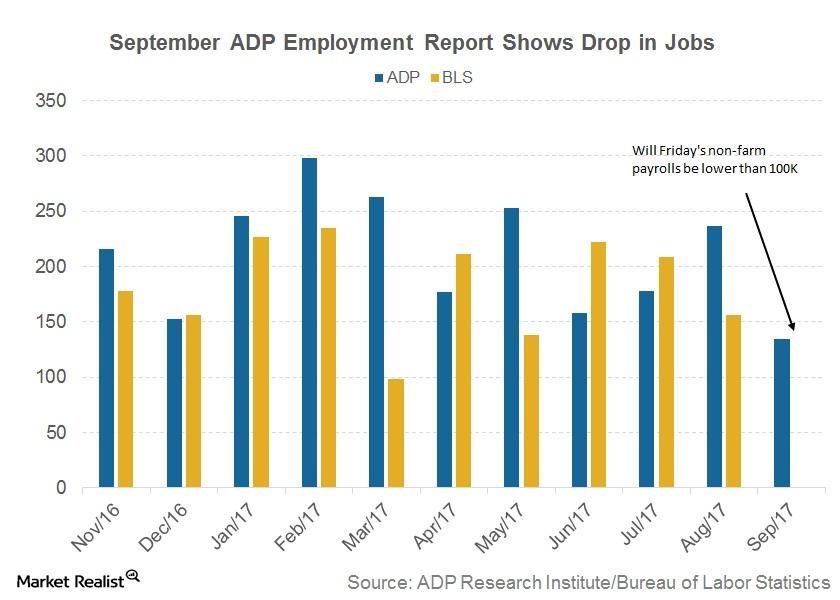

ADP Jobs Data Dragged Lower by Hurricanes in September

As per the September ADP National Employment Report, the US private sector added 135,000 jobs during the month. The figure is a sharp decrease from 228,000 in August.

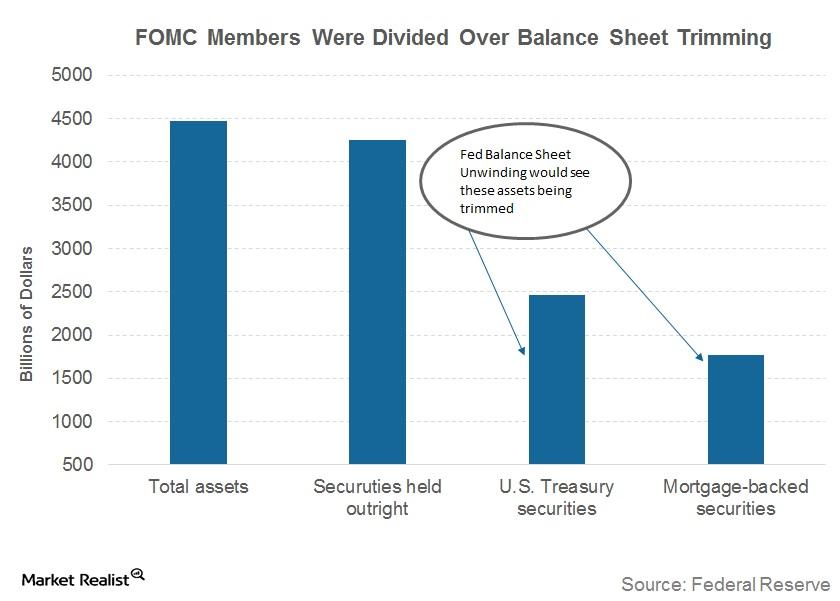

Why FOMC’s John Williams Sees No Impact of Balance Sheet Unwinding on Markets

In the long run, Williams said it would be difficult to predict how markets would react to the Fed’s balance sheet unwinding program.

Understanding the Leading Credit Index

Understanding the Leading Credit Index The Conference Board LCI (Leading Credit Index), a constituent of the LEI (Leading Economic Index), is constructed based on the performance of six financial market instruments. These components track lending conditions in the US economy. Performance of the LCI Improving credit conditions are considered positive for the economy. When the LCI […]

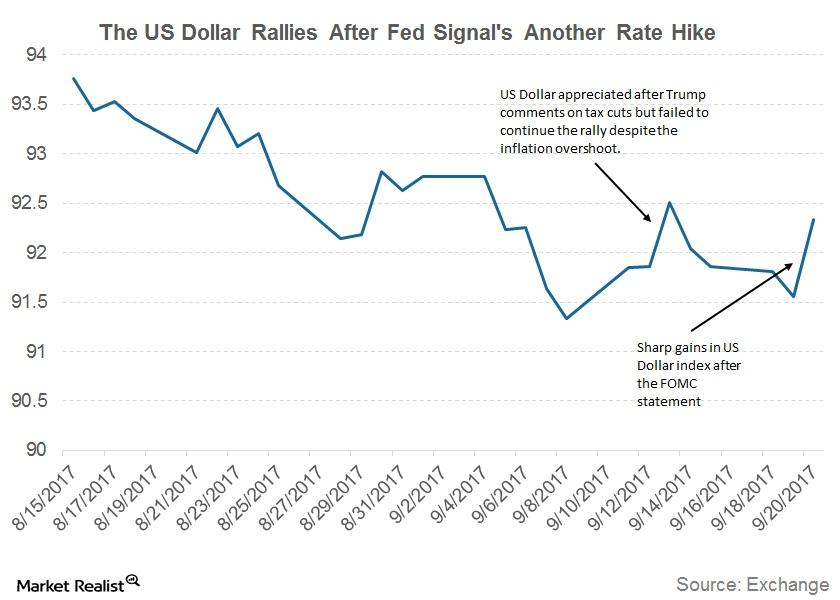

Assessing the US Dollar’s Rally after the Latest Hawkish Fed Statement

The US dollar rallied after the latest FOMC (Federal Open Market Committee) meeting statement was released on September 20.

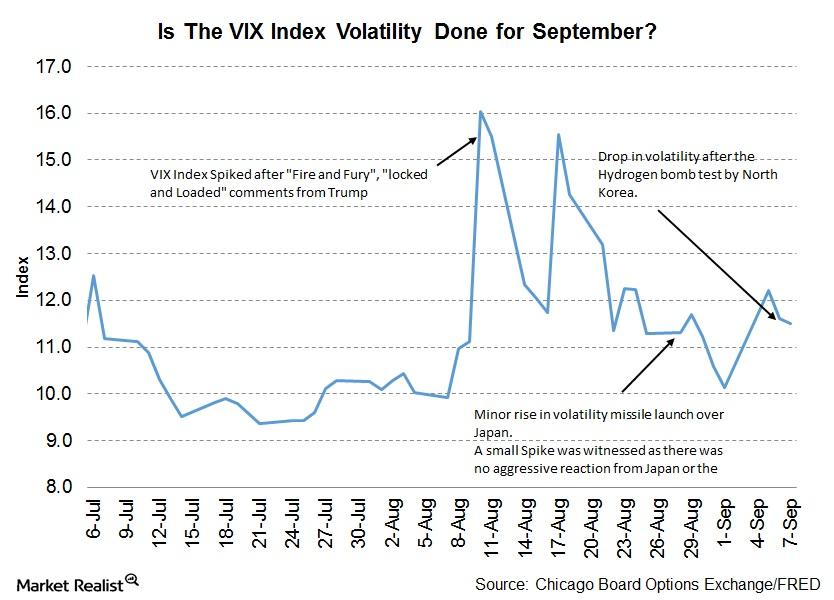

More Temporary Relief from North Korea Tensions?

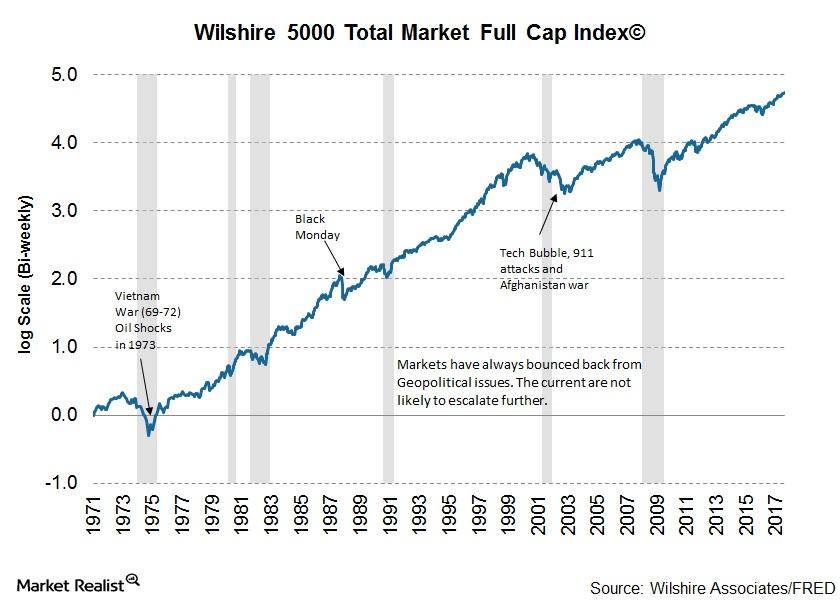

This week volatility (VXX) has continued to stick to its trend of sudden spikes and then dropping immediately.

Why the US Debt Ceiling Fight Has Been Postponed

The key reason for the debt ceiling deal was to approve aid to Hurricane Harvey victims. A US government shutdown could have adversely impacted relief operations.

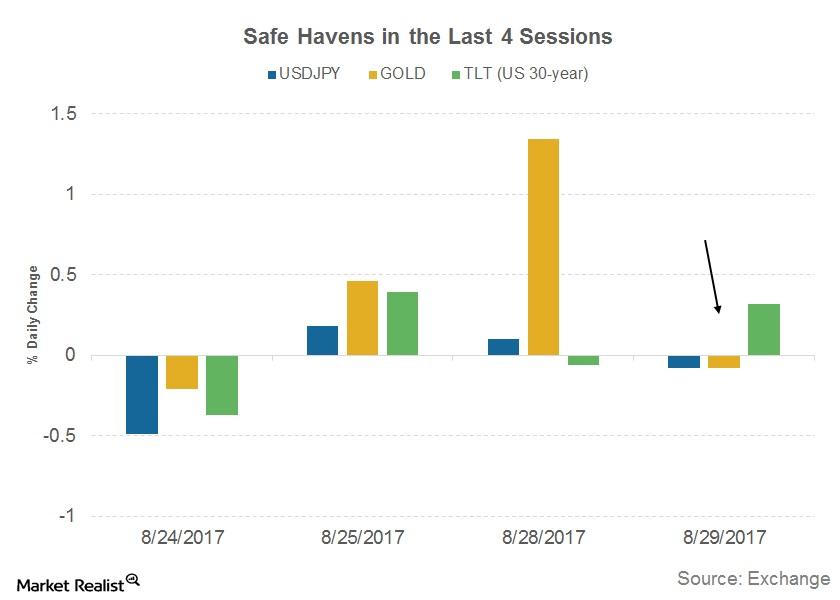

North Korea Tensions: Will Demand for Safe Havens Rise?

In the financial markets, there are a few financial assets whose demand increases dramatically in times of uncertainty.

What Financial Markets Predict for the US Economy

Understanding the Leading Credit Index The Conference Board Leading Credit Index (or LCI), which tracks lending conditions in the economy, is reported monthly. The index has six constituents: 2-Year Swap Spread (SHY) (real time) LIBOR[1.London Interbank Offered Rate] 3-month (SCHO) less 3-month Treasury-bill (VGSH) yield spread (real time) debit balances in margin accounts at broker dealers […]

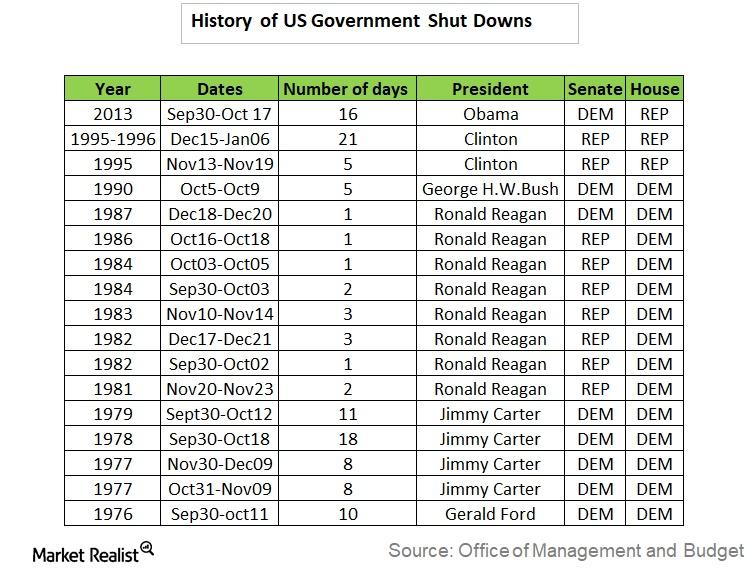

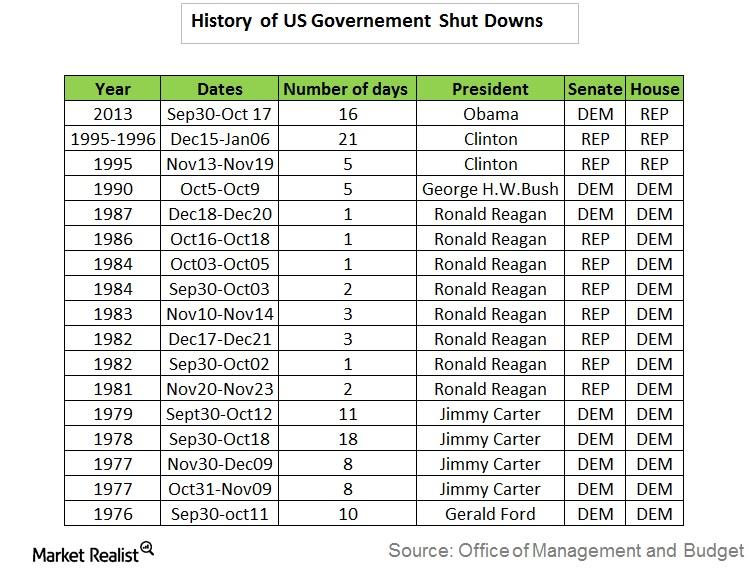

Why the US Government Has Been Shut Down Before

A failure to raise the debt ceiling will likely result in a US government shutdown and a default by the US, which would be catastrophic for the global economy and financial markets (VTI) (USMV).

Do Financial Markets Have Another Tense Week Ahead?

Equity markets in the US and across the globe reported heavy losses as risk aversion set in.

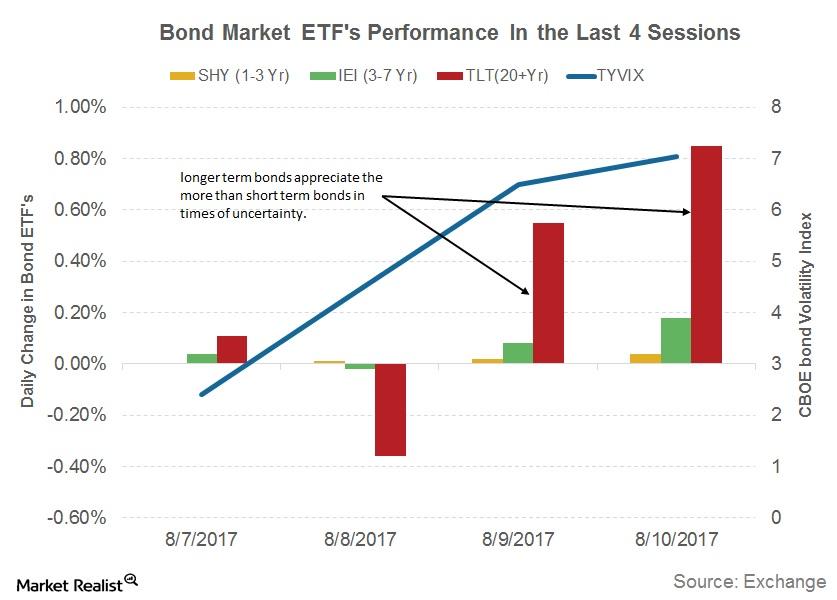

Will Bond Yields Continue to Fall amid Geopolitical Tensions?

Bonds, especially U.S. Treasuries (GOVT), are considered one of the safest assets in which to park your funds in times of uncertainty.

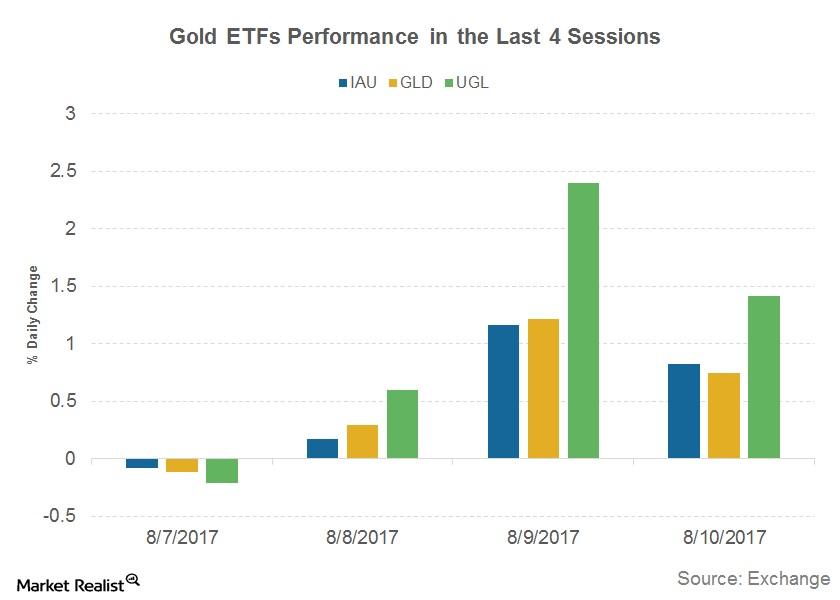

How Are Safe Havens Faring in This North Korea Fear?

The safe havens that benefit the most in times of uncertainty include gold (GLD) and U.S. Treasuries (GOVT).

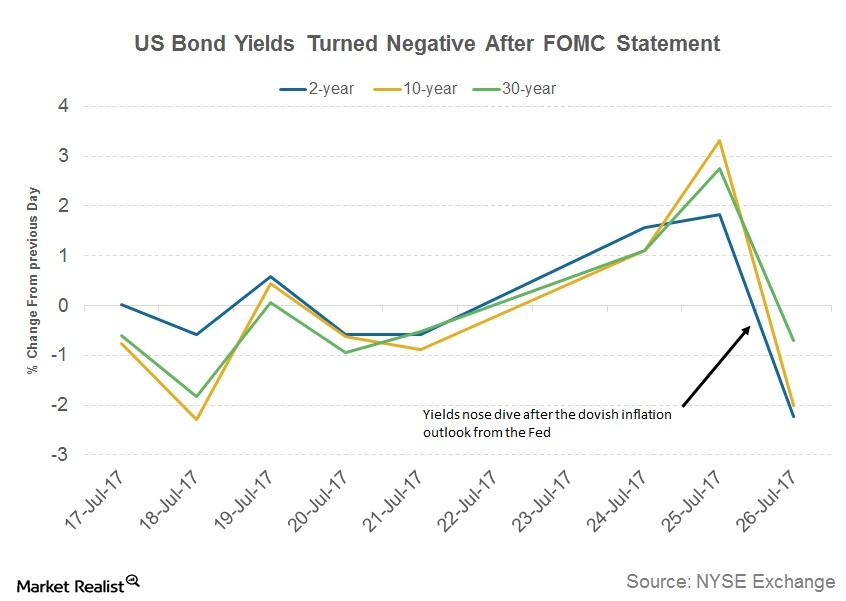

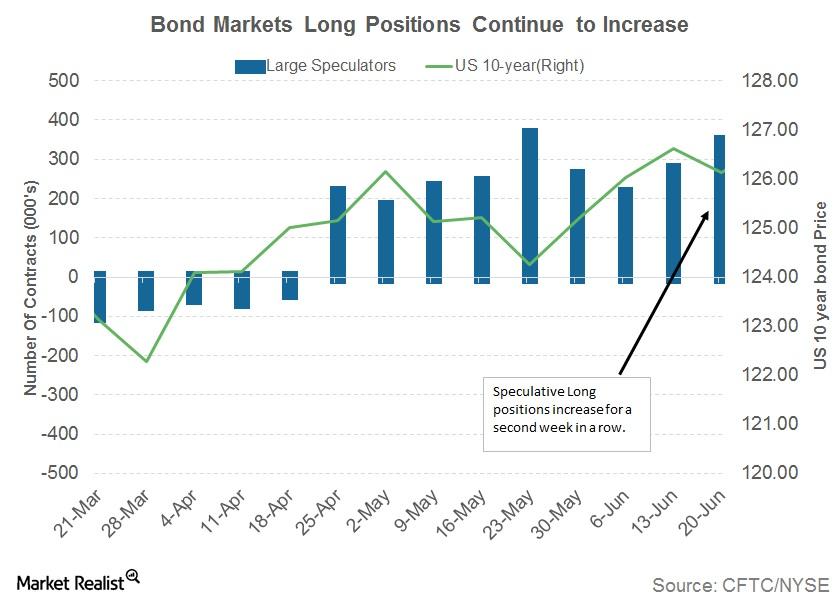

Why Bond Prices Rose after the FOMC’s Statement

US government bonds gained after the FOMC (Federal Open Market Committee) indicated in its July 2017 statement that near-term inflation could remain below its 2% target.

Will the US Balance Sheet Unwind Affect the Markets?

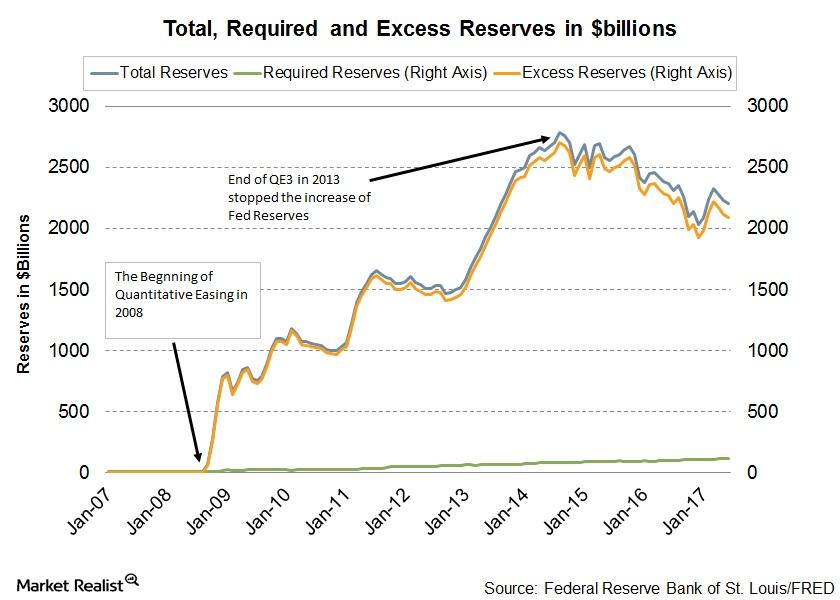

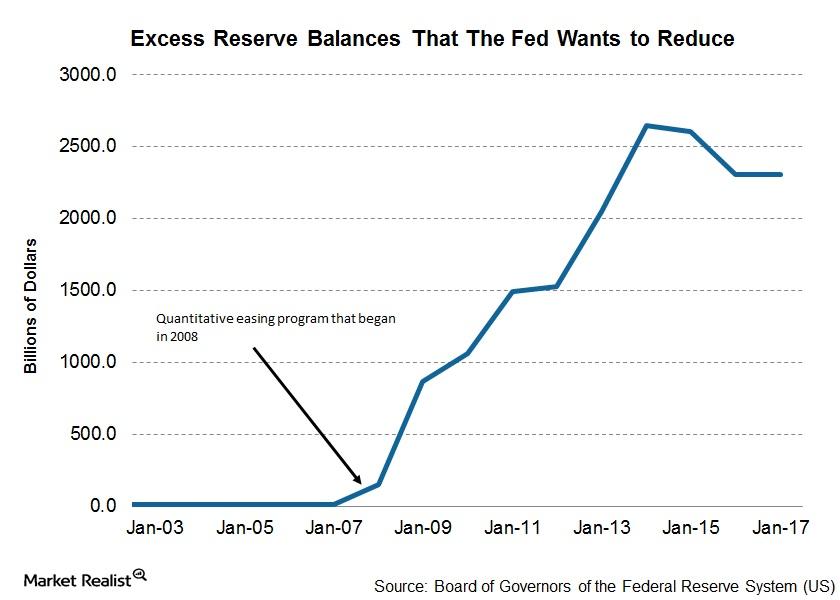

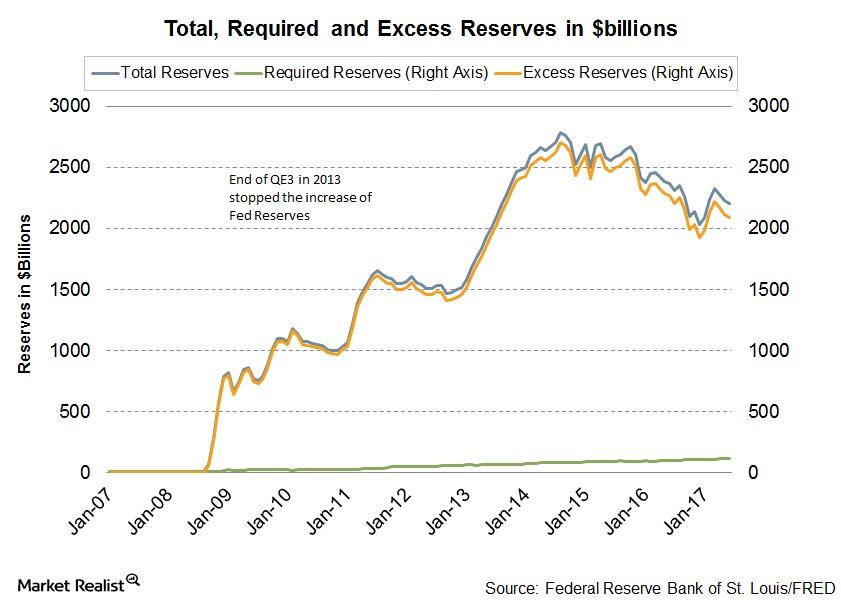

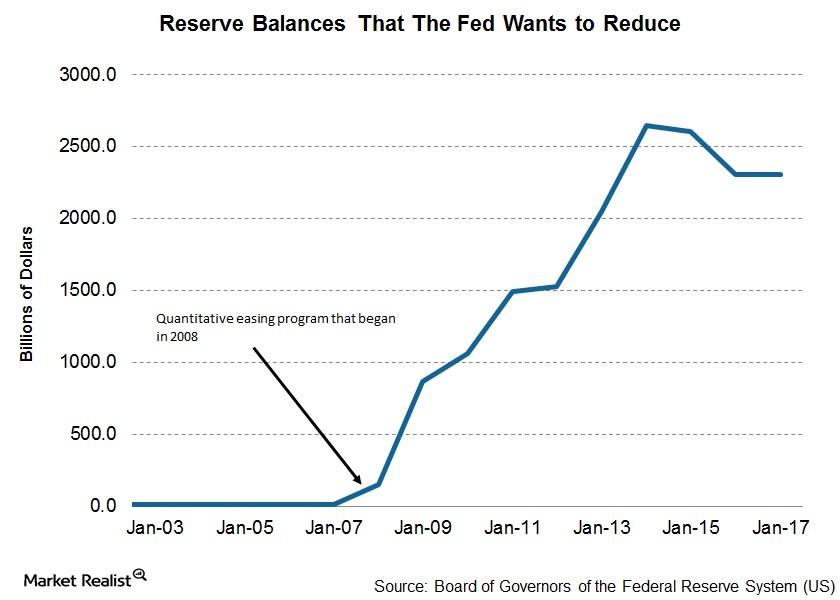

After the July FOMC meeting statement was released, market participants came to believe that the Fed would begin the process of balance sheet normalization soon.

What the Conference Board LEI Tells Us about the Market

The Leading Credit Index is one of the constituents of The Conference Board Leading Economic Index (or LEI), which is reported by The Conference Board on a monthly basis.

Will Market Shocks Really Be Minimal to Balance Sheet Unwinding?

In its June policy meeting, the Fed has signaled that it will stop replacing maturing securities and slowly reduce the size of its balance sheet.

Why FOMC Members Were Divided about Balance Sheet Shrinking

The FOMC June meeting minutes that were released on July 5, 2017, indicated that the FOMC members were divided over when to begin shrinking the Fed’s bloated balance sheet.

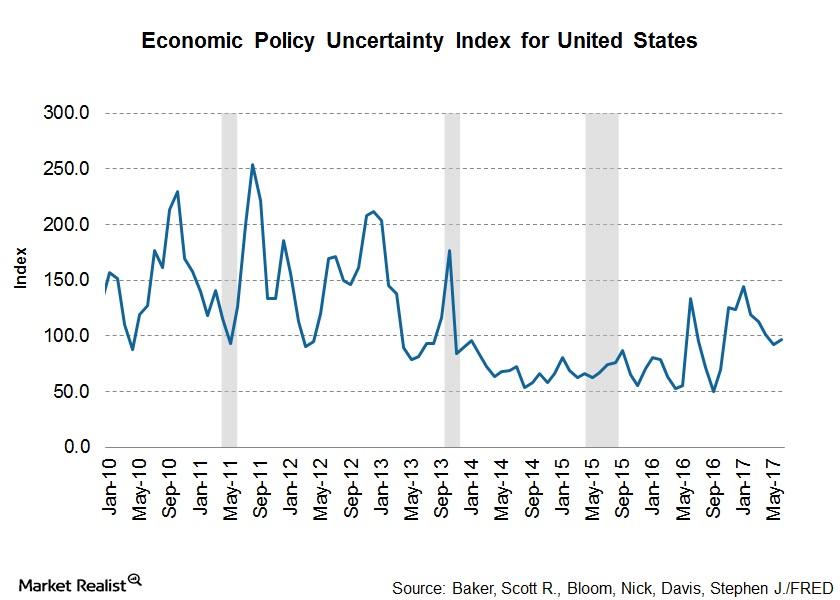

Dallas’s Kaplan Discusses the Biggest Headwind for the US Economy

Dallas’s Federal Reserve president, Robert S. Kaplan, said that the rebound in the US economy is likely to continue for the rest of 2017.

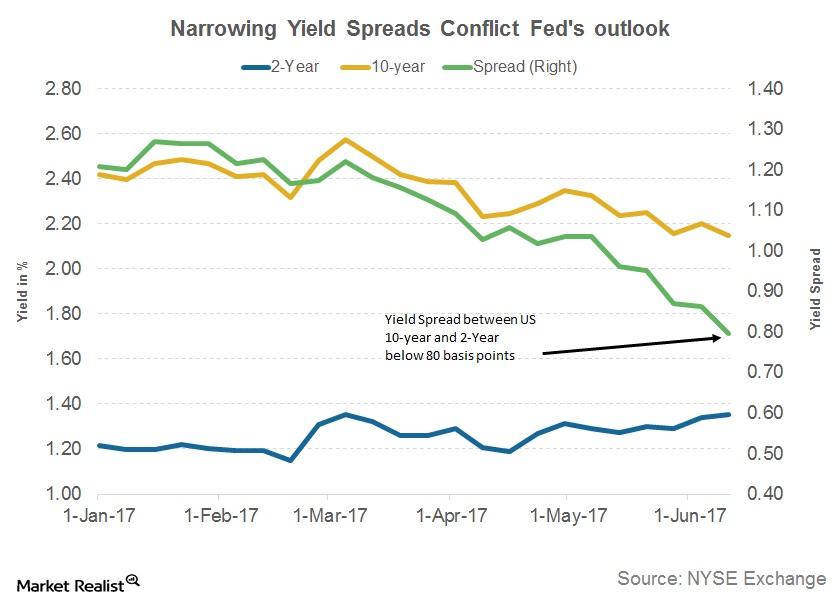

Why NY’s Fed President Doesn’t Feel a Flattening Yield Curve Is Negative

New York’s Federal Reserve president, William C. Dudley, recently spoke at a business forum in New York and said that he was pleased with the current state of the US economy.

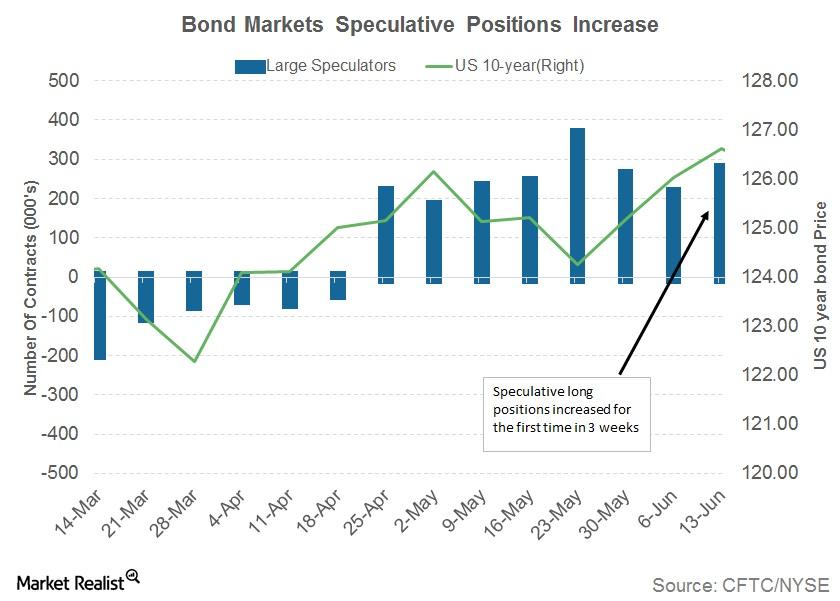

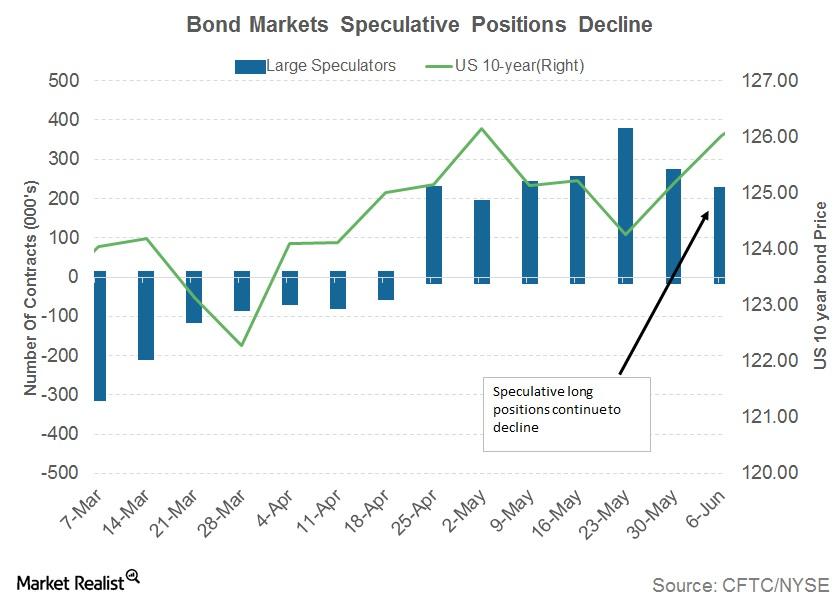

Why Bond Traders Continue to Be Confused

US Treasuries (GOVT) had another roller coaster ride this week due in part to the conflicting views from Fed members and weaker-than-expected economic data.

What Does Rise in US Interest Rates Mean for Bond Markets?

US Treasuries (GOVT) had a mixed response to the FOMC statement and the Fed’s interest rate hike.

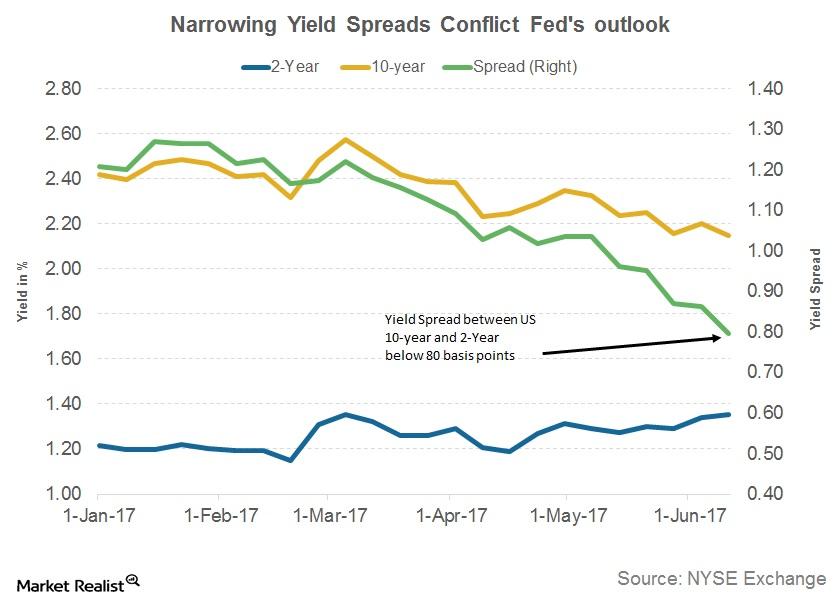

What Narrowing Yield Spreads of US Treasuries Could Indicate

The US ten-year yield fell to 2.1% after the weak US data report, US inflation showed a decline of 0.1%, and retail sales fell by 0.3% for May 2017.

Fed Chair Yellen Warns about Its $4.5 Trillion Balance Sheet Unwinding

In her post-meeting press conference, Janet Yellen warned that the Fed could implement its balance sheet unwinding process soon if the economy continues to perform as expected.

Could an FOMC Rate Hike Drive Bond Yields Higher?

Bond yields of U.S. Treasuries managed to recover from the losses of the previous week. Demand for US bonds receded.

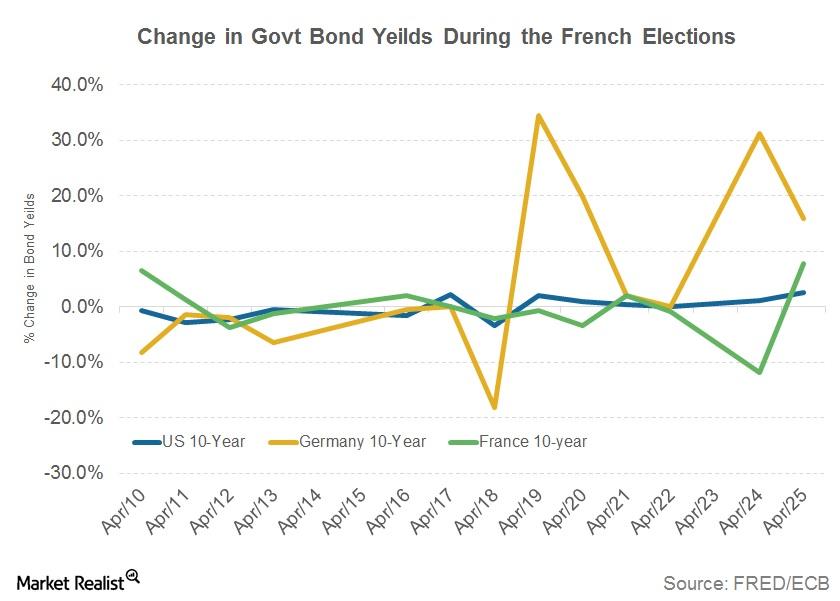

How Did Fixed Income Markets React to the First Round?

Demand for fixed income securities will likely be subdued because of excess supply this week, which would mean additional support for bond yields.

How the Next President Could Shape US Monetary Policy

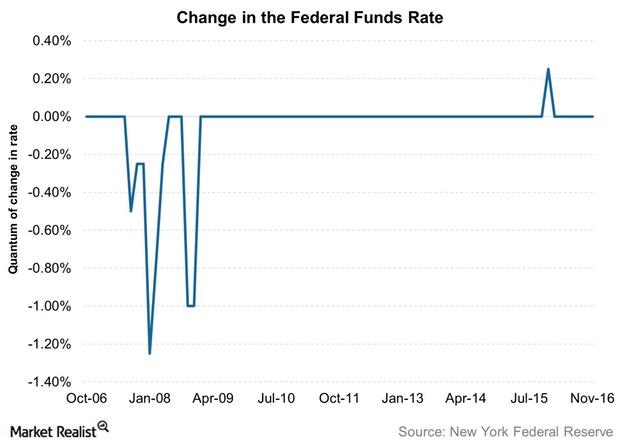

The Federal Reserve’s second last meeting of 2016 is now over, leaving only one meeting left in which the central bank can enact a rate hike.

Policymakers Are Getting Vocal about the Fed’s Credibility

The issue of the Fed’s credibility is not a new one. The effectiveness of the prolonged monetary accommodation has sparked a lot of debate in the past.

Why Did Treasury Bonds Record a Fall in Yield?

The yield on US ten-year Treasury securities fell below the 1.6% mark for the first time on September 26, 2016 due to a rise in demand.

Why Caution Holds the Key

The UK has taken over other countries as the most sought-after bond market destination, especially after the Brexit vote.

Why Does Janus Think Inflation Is on the Rise?

In the “Janus Market GPS,” the team had outlined its belief that a low unemployment rate signaled tighter labor market conditions.

The Relationship between TIPS and the Break-Even Rate

Between Jan 2014 and September 2015, the break-even rate was higher than the CPI inflation rate, as markets were surprised by the sudden dip in oil (USO) prices.Industrials Must-know: Do credit spreads only represent credit risk?

While credit spreads do give you a good picture of the credit risk of one bond compared to another, it’s not the only factor they represent.