What Narrowing Yield Spreads of US Treasuries Could Indicate

The US ten-year yield fell to 2.1% after the weak US data report, US inflation showed a decline of 0.1%, and retail sales fell by 0.3% for May 2017.

June 16 2017, Updated 9:08 a.m. ET

Bond market reaction before the Fed statement

The US Treasury bond market’s reaction to the FOMC statement was mixed. Opposite signals from weak US inflation and retail sales data and a hawkish tone from the Fed left bond markets (BND) unsettled. The US ten-year yield fell to 2.1% after the weak US data report, US inflation showed a decline of 0.1%, and retail sales fell by 0.3% for May 2017.

Reaction to the negative news was more prominent in the longer end of the curve. This trend was in contrast to Treasury notes and two-year US Treasuries as investors priced in a rate hike from the FOMC later in the day.

Yields remained negative despite a hawkish Fed

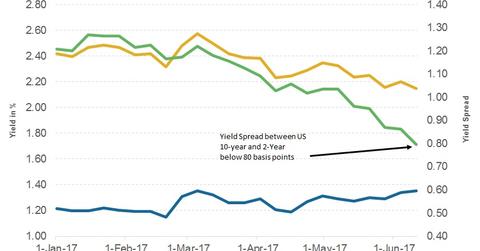

US Treasuries (GOVT) failed to reflect the hawkish tone of the US Fed. The ten-year yield, which fell 10 basis points to 2.10% after the US data release, managed to reclaim 2.12% after the statement. What needs to be observed is the narrowing yield spread between the short-term and long-term yields for US Treasuries.

The spread between the two-year (SHY) and ten-year (IEF) yields dropped from 105 basis points to 80 basis points in the last six months, resulting in a flatter yield curve. These narrowing yields indicate that investors are doubtful whether the Fed would continue with its tightening in the future and on the Fed’s outlook for the US economy.

Impact of balance sheet trimming on US Treasuries

The Fed’s normalization plans failed to revive US bond (SCHO) yields as demand for relatively higher-yielding US Treasuries remained high amid abundant liquidity in other developed economies.

Once the Fed starts to normalize its balance sheet, the impact could remain minimal as the Fed plans to offload $6 billion in US Treasuries each month. The Fed would increase this amount by $6 billion every quarter to a maximum level of $30 billion per month.

On June 15, 2017, US bond futures indicated a 50% chance of a rate hike in the September meeting after weak CPI and retail sales data. In our view, markets could revisit bond yields at the end of this quarter, depending on the incoming data.