BTC iShares 7-10 Year Treasury Bond ETF

Latest BTC iShares 7-10 Year Treasury Bond ETF News and Updates

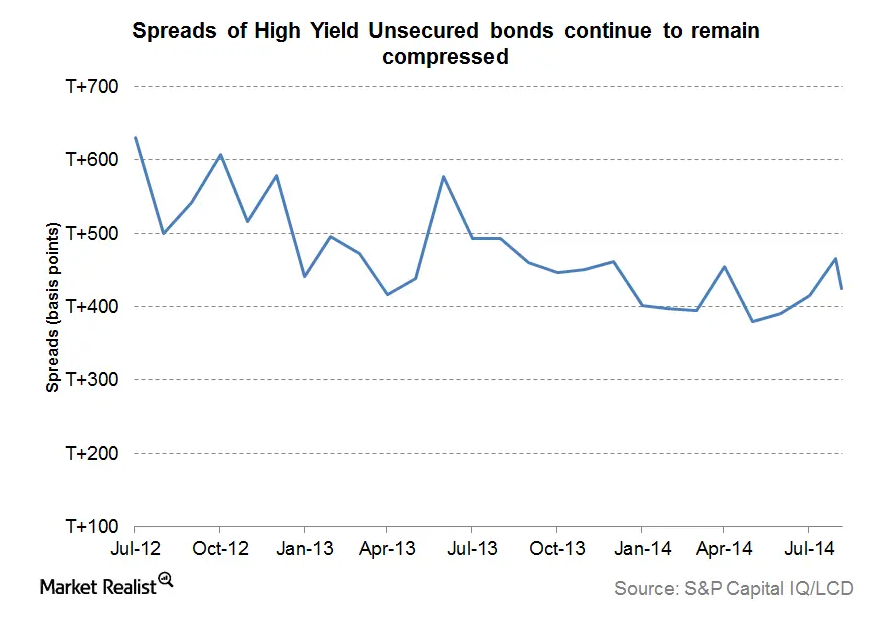

Why tight credit spreads usually mean a period of global expansion

Today, most measures of credit conditions are positive, with tight spreads across all of fixed income. Even high yield spreads have come in after a short scare last month.

Gold Prices Have Been Flat despite the Weak Dollar

Gold (IAU) (GLD) prices usually have a strong negative correlation with the US dollar (UUP). Gold, like other commodities, is denominated in the dollar.

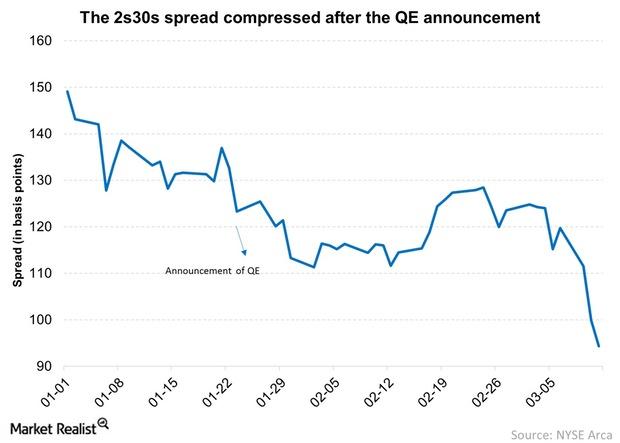

Why Did the German 2s30s Spread Dip on Quantitative Easing?

The 2s30s spread is the difference between the yield on the 30-year bond (TLT) and the yield on the two-year bond (SHY).

What Caused the Muni Defaults in 2016?

In 2016, Puerto Rico defaulted on constitutionally guaranteed GO (general obligation) bonds. On May 3, 2017, Puerto Rico filed for Title III bankruptcy.

Where Are Bond Markets Headed?

Rising US-China trade tensions have caused all assets, and especially bond markets, to move considerably over the last few sessions.

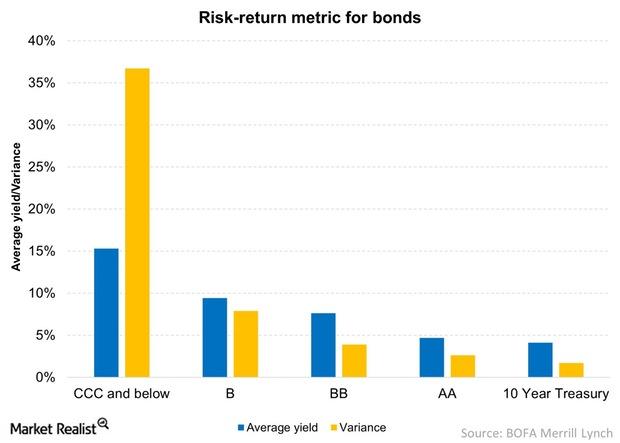

How Various Asset Classes Compare Using The Risk-Return Metric

The risk-return metric for ten-year Treasuries (IEF) are lowest, but also the safest, with a paltry 1.3% volatility and with an average yield of 4.1%.

How to Hedge Against the US-China Trade War

The US-China trade war escalated very quickly this month. This has caused global equities to plunge and safe havens like gold and treasuries to surge.

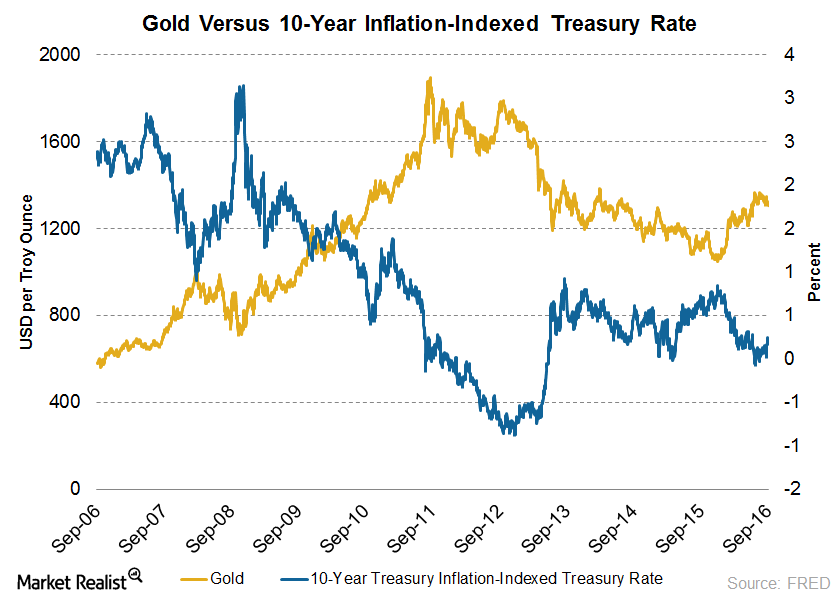

Gold versus 10-Year Treasury Bonds

The negative interest policy of the central banks is casting government bonds as a futile choice for investors compared to stocks and gold. As a result, bond prices dipped and yields started rising.Financials Overview: Investment-grade bond ETFs

U.S. investment-grade bonds can provide investors with a safe and steady income stream. They’re issued by the U.S. Department of the Treasury and corporates. The issuers have a very high ability to service the debt issued. There’s little risk of default.

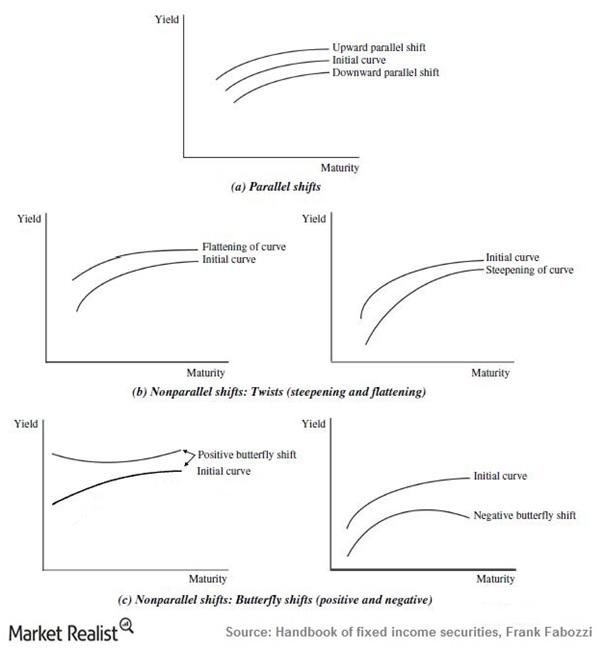

Why investors should follow shifts and twists in the yield curve

Yields on bonds don’t remain constant. When they change by the same magnitude across maturities, we call the change a “parallel shift.”Financials Key takeaways: Why is the yield curve normally upward-sloping?

In normal conditions, the yield curve is upward-sloping. As bonds pay only interest (the coupon) until maturity and pay face value at maturity, investors take longer to recover their principal.

Gundlach Discussed the Fed, Trade Deal, and Gold

Gundlach thinks that we’ve already seen a bottom in interest rates for 2019. US Treasury yields have been hitting lows in 2019.

Investors’ Obsession with Yield Curve Inversion

You’ve likely heard about it in the financial press recently: this ominous, notorious thing called the “yield curve inversion.”

Where the Stock Market Could Be Headed Soon

The stock market has seen big moves both ways this week. The S&P 500 (SPY) has surged 1.3% today as bond yields have risen.

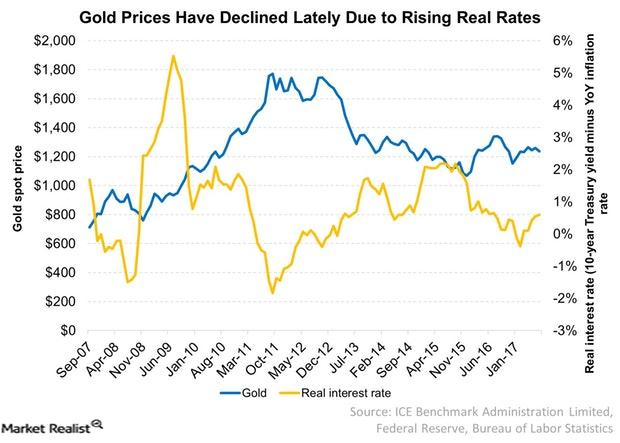

What’s the Impact of Interest Rates on Precious Metals?

Monetary policies have been crucial in determining the movement in precious metals.

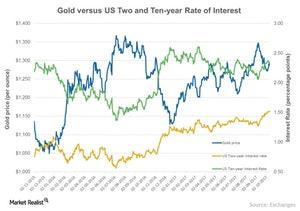

Is Gold Keeping Tabs on the US Interest Rate?

As we know, precious metals are closely tied to movements in US interest rates. Bonds and equities are both yield-bearing assets, so a rise in yields often causes a slump in demand for assets such as gold and silver.

Are Bond Yields Set to Move Higher this Week?

The US Treasury is not able to issue any more debt until the debt ceiling is raised, which could increase the volatility in the bond markets.

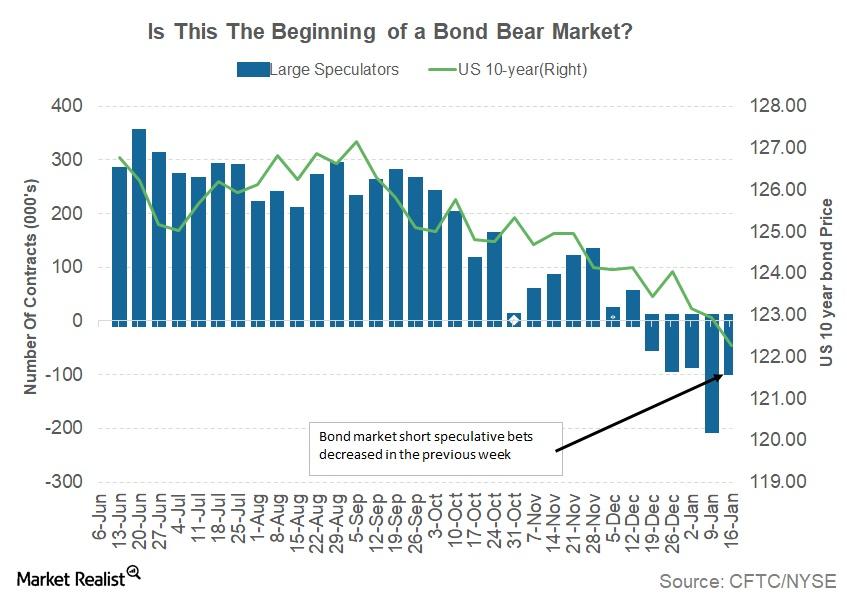

Why the US Bond Market Moved Lower Last Week

The core CPI of 0.3% pushed the annual number up by 0.1% to 1.8%.

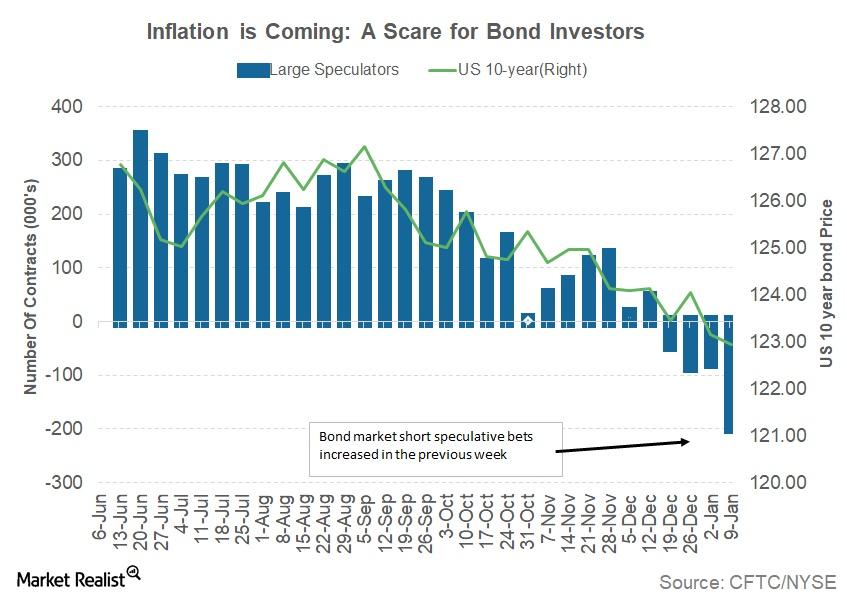

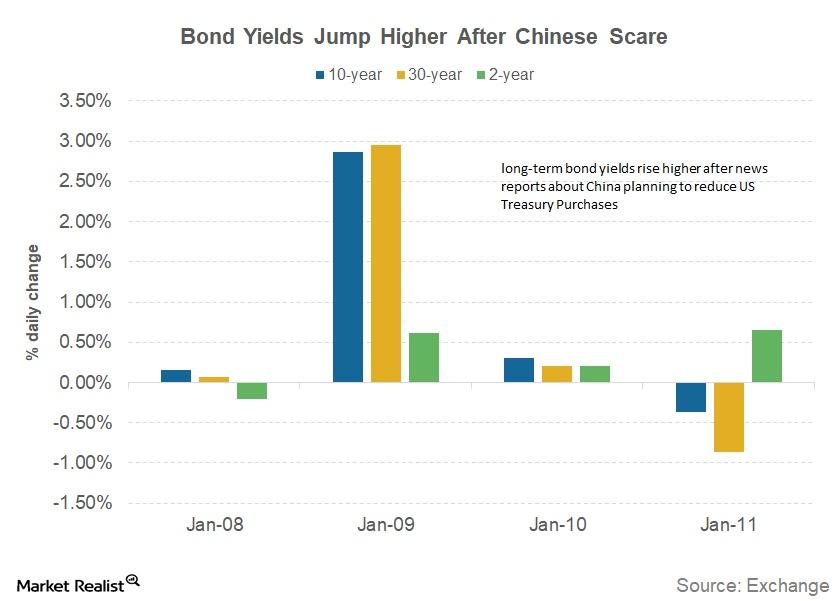

The US Bond Market and the Big Scare from China

On January 10, 2018, Bloomberg News broke a story that the Chinese government could be planning to slow down its purchases of US government debt (GOVT).

Interest Rate versus Gold: Interest Rate Wins Again

Gold is a non-yield bearing asset that reacts negatively to rises in the interest rate.

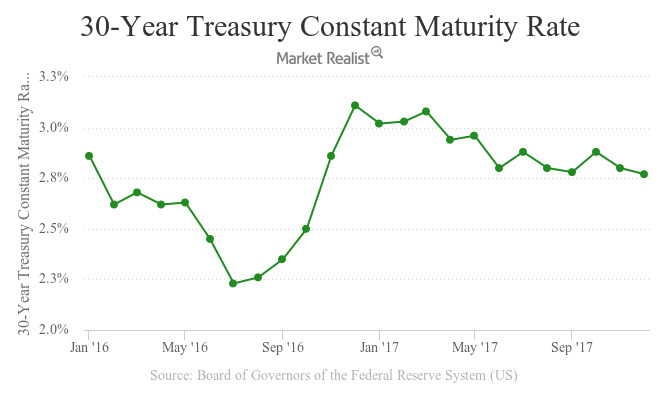

Analyzing the Yield Curve’s Ongoing Flatness

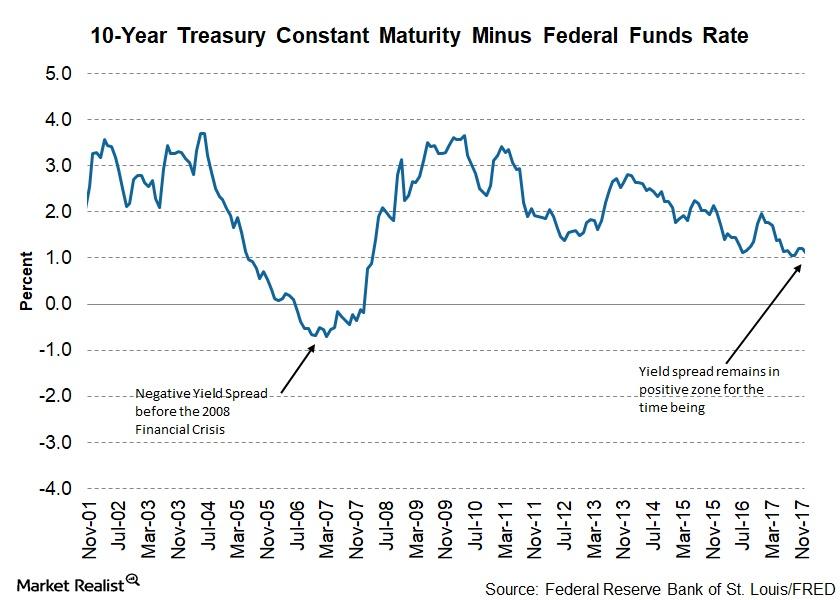

A December rate hike and a flattening yield curve The Fed rolled out another rate hike at its final meeting of 2017. The target range for the federal funds rate was increased by 0.25% to 1.25%–1.50%, and the Fed has signaled three more rate hikes in 2018. Two members dissented to the rate hike due to lower […]

All 4 Precious Metals Rose on December 20, 2017

All four precious metals had an up day on December 20, 2017. Gold increased 0.43% on the day and closed at $1,267.80 per ounce.

How the Federal Reserve’s Rate Hike Affected Precious Metals

Precious metals and miners saw some relief on December 13 after the Fed raised rates as expected. Sibanye Gold (SBGL), Aurico Gold (AUQ), and Goldcorp (GG) rose 3.5%, 3.6%, and 5.8%, respectively.

How Eager Are Precious Metals to Hear the Fed’s Decision?

Gold, silver, and platinum all had a down day on Tuesday, December 13, mainly due to speculations over the Federal Reserve’s pending interest rate decision.

Why Decreasing Credit Spreads Are a Cause for Concern

The November Conference Board report, which takes October data into account, reported the credit spread at ~1.2—an improvement from the September reading of ~1.1.

Will Tax Cuts Bump Up Treasury Yields?

Since early September, US ten-year and longer-dated paper has been falling. Rates for the US government ten-year bond jumped from 2.04% on September 7 all the way to 2.36% on October 10.

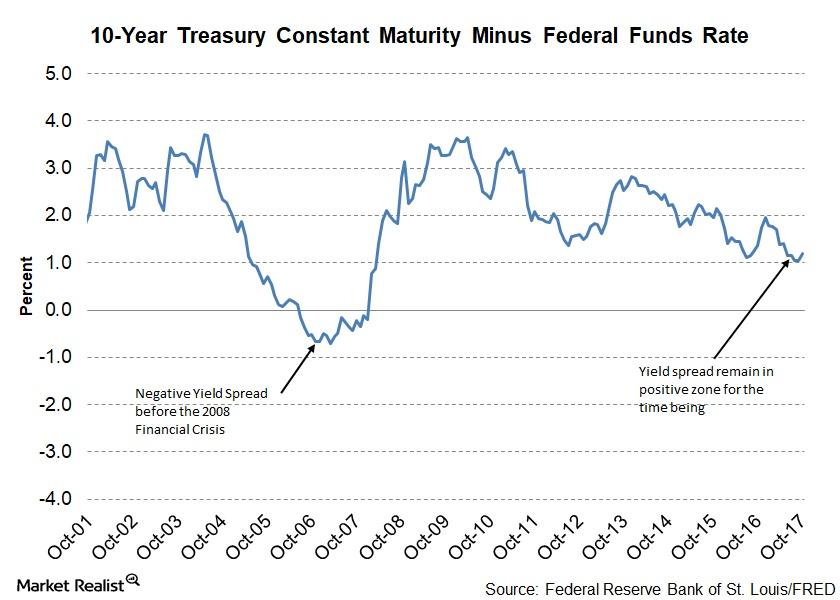

Are Declining Yield Spread Worries Done for Now?

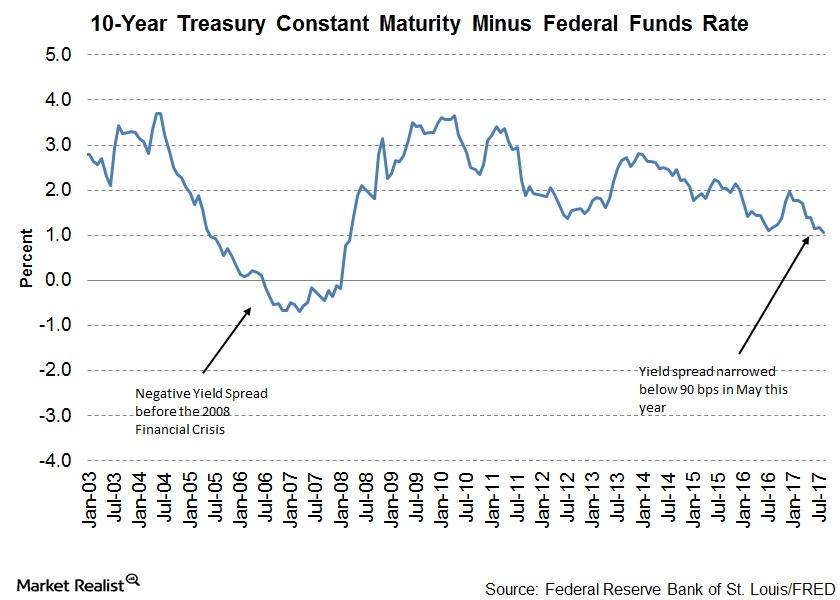

At the last FOMC (Federal Open Market Committee) meeting on September 20, 2017, Fed members decided to initiate a balance sheet normalization process starting in October.

How Credit Spreads May React to the Fed’s September Statement

Another rate hike in 2017 The FOMC’s (Federal Open Market Committee) meeting on September 20 changed the outlook for bond markets (BND). It suggested that the Fed could be looking at another rate hike by the end of this year, along with a balance sheet unwinding program. Gains in August inflation (TIP) boosted Fed members’ […]

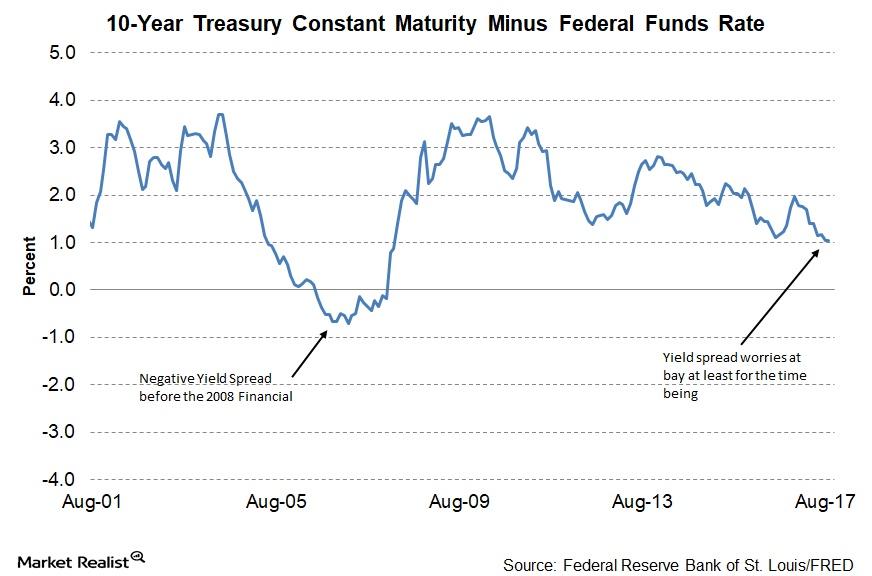

Why Interest Rate Spreads Are Growing

Reduced odds for another rate hike in 2017 Fears of flattening yield curves and rising interest rates have completely vanished in recent weeks. The FOMC’s (Federal Open Market Committee) July meeting statement confirmed the concerns about lagging inflation (TIP), making another rate hike in 2017 less likely. Focus has turned to the Fed’s balance sheet reduction […]

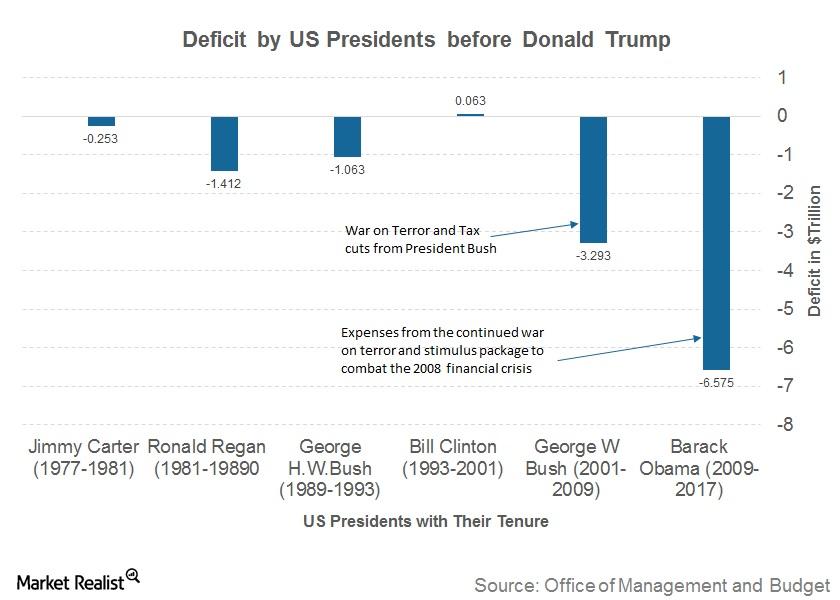

How the US’s Debt Has Become So Big

The US debt-to-GDP ratio now stands at 106.1%, which means that the total US debt is more than the annual US GDP.

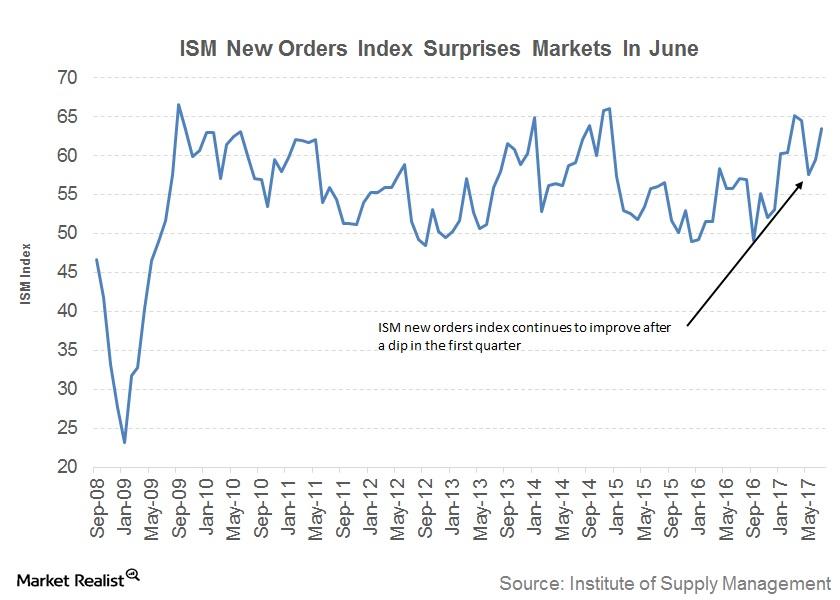

What the ISM New Orders Index Indicates for the US Economy

The Institute of Supply Management (or ISM) New Orders Index indicates the number of new orders from customers.

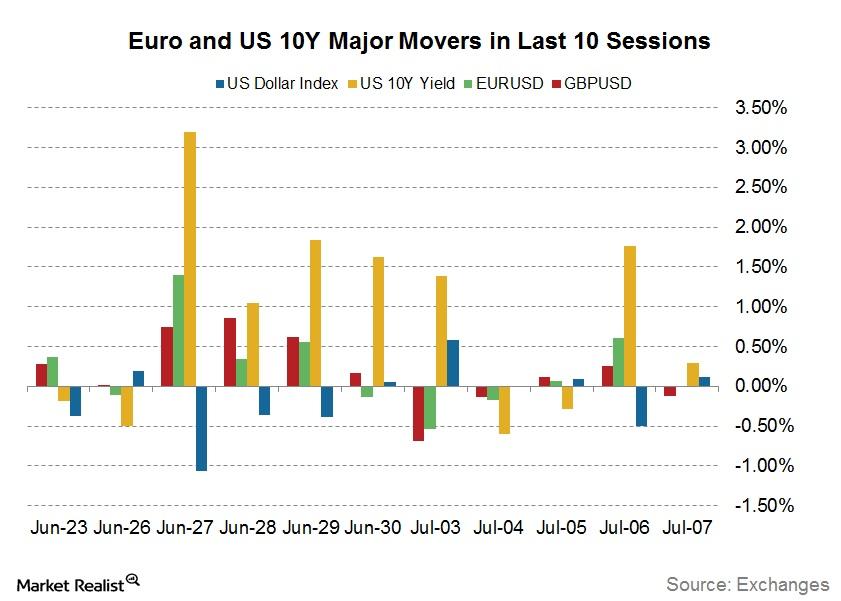

How Central Bankers Are Rattling Bonds and Currencies

Since the FOMC minutes and the hawkish turn of events at the European Central Bank and the Bank of England, bond yields across the board have been trending higher.

Why Bond Traders Continue to Be Confused

US Treasuries (GOVT) had another roller coaster ride this week due in part to the conflicting views from Fed members and weaker-than-expected economic data.

What Does Rise in US Interest Rates Mean for Bond Markets?

US Treasuries (GOVT) had a mixed response to the FOMC statement and the Fed’s interest rate hike.

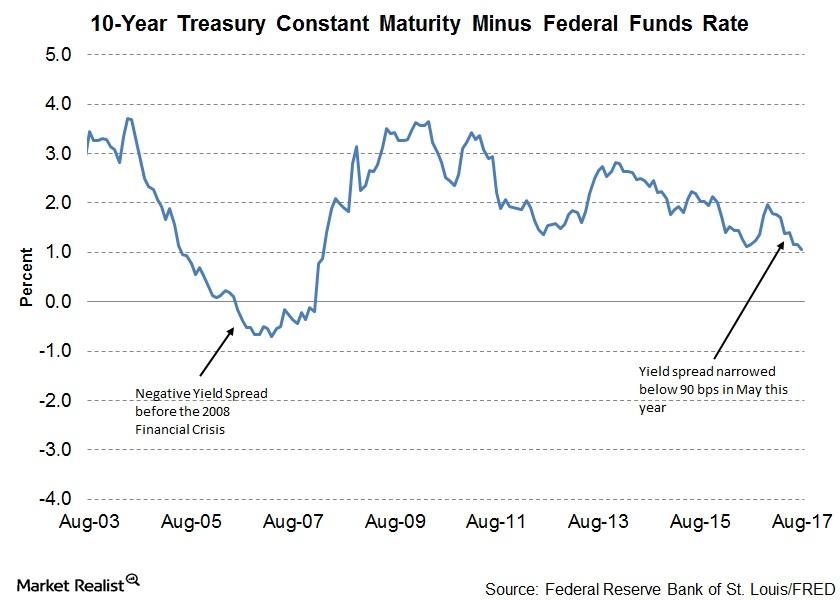

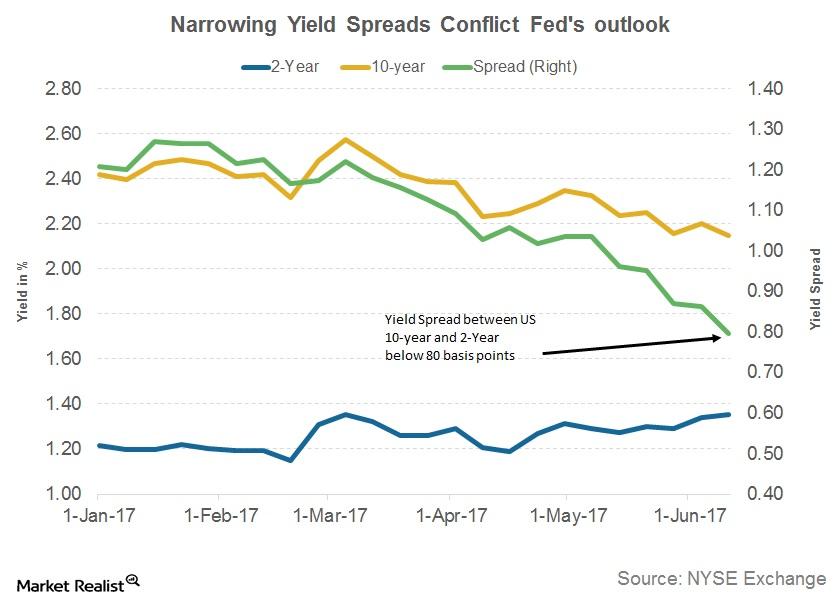

What Narrowing Yield Spreads of US Treasuries Could Indicate

The US ten-year yield fell to 2.1% after the weak US data report, US inflation showed a decline of 0.1%, and retail sales fell by 0.3% for May 2017.

Could an FOMC Rate Hike Drive Bond Yields Higher?

Bond yields of U.S. Treasuries managed to recover from the losses of the previous week. Demand for US bonds receded.

Why Bond Yields Were Unaffected by Trump News

US Treasuries (SCHO) rallied all through the previous week supported by heavy safe-haven inflows into US bonds.

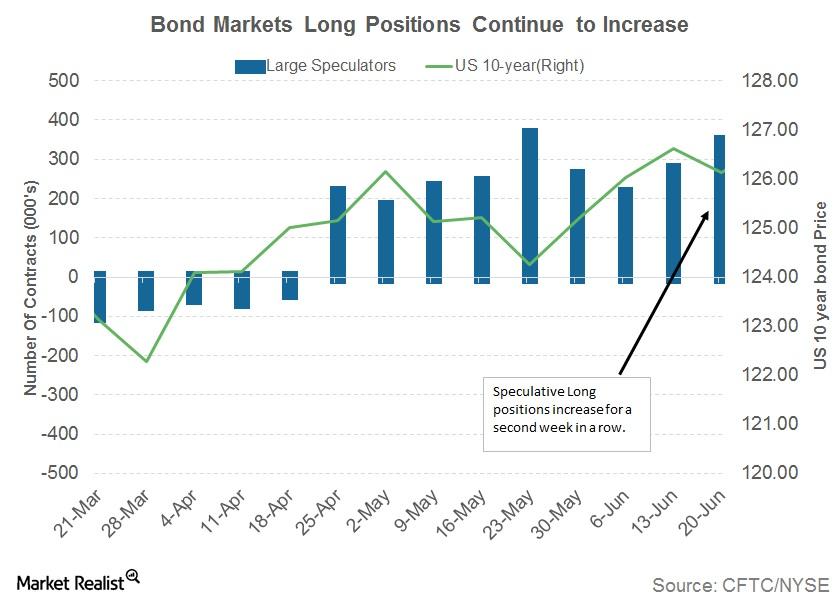

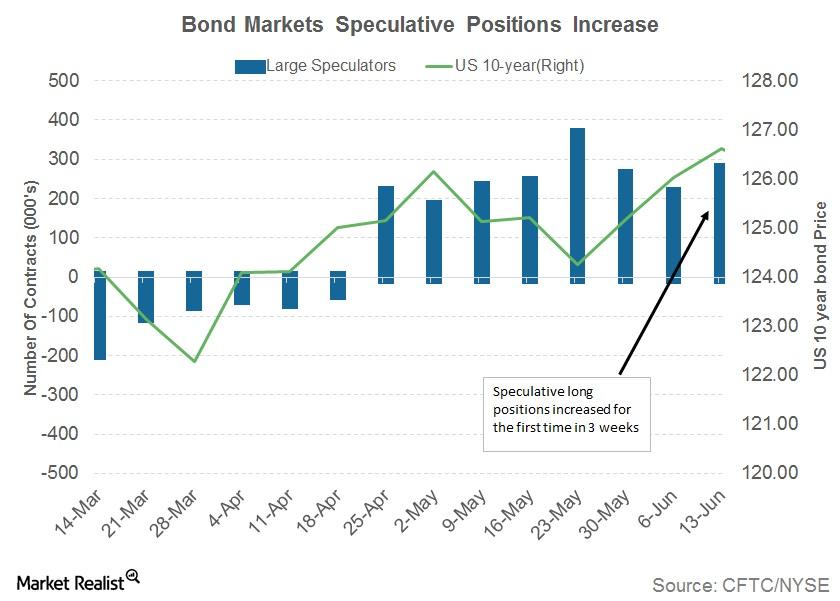

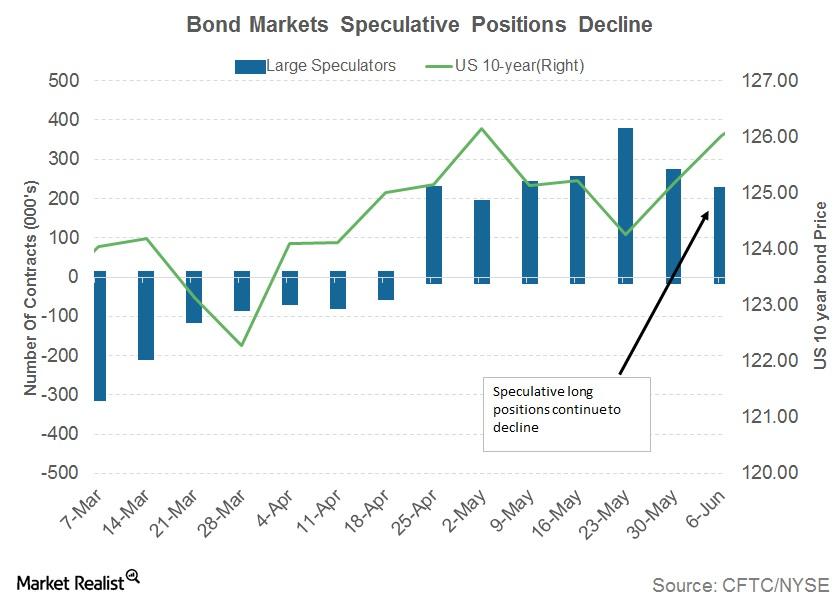

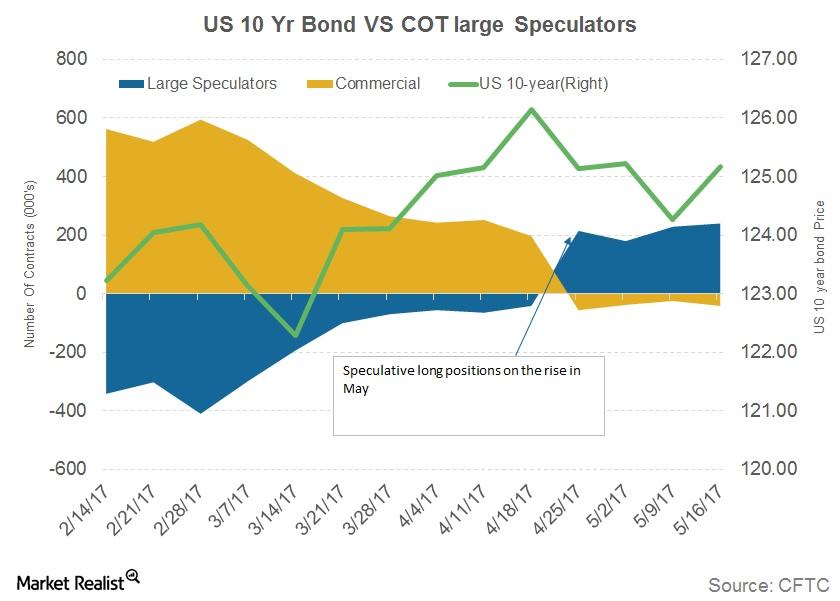

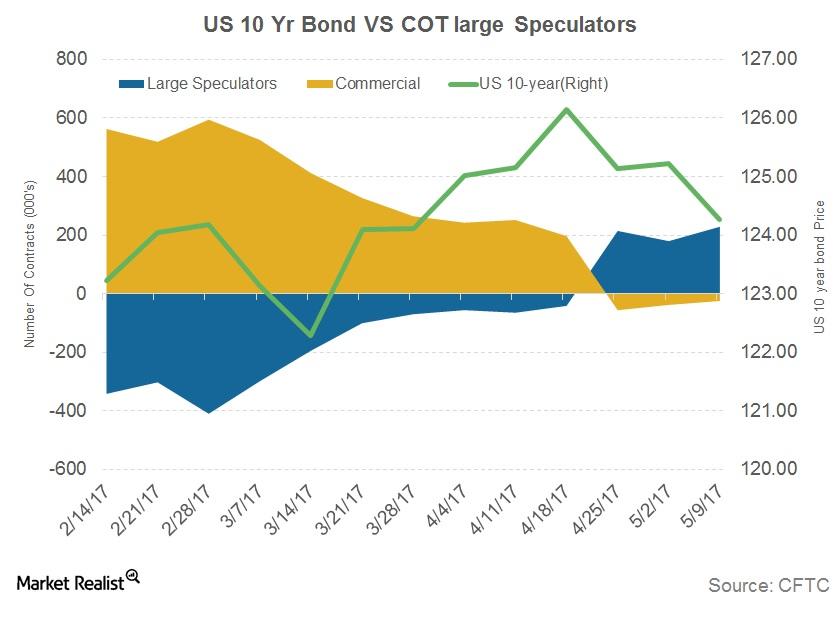

Why Are Bond Traders Increasing Their Net Positions?

US bond markets are trading on the expectation of an interest rate hike by the US Federal Reserve in June 2017. Last week, bond yields extended their slides.

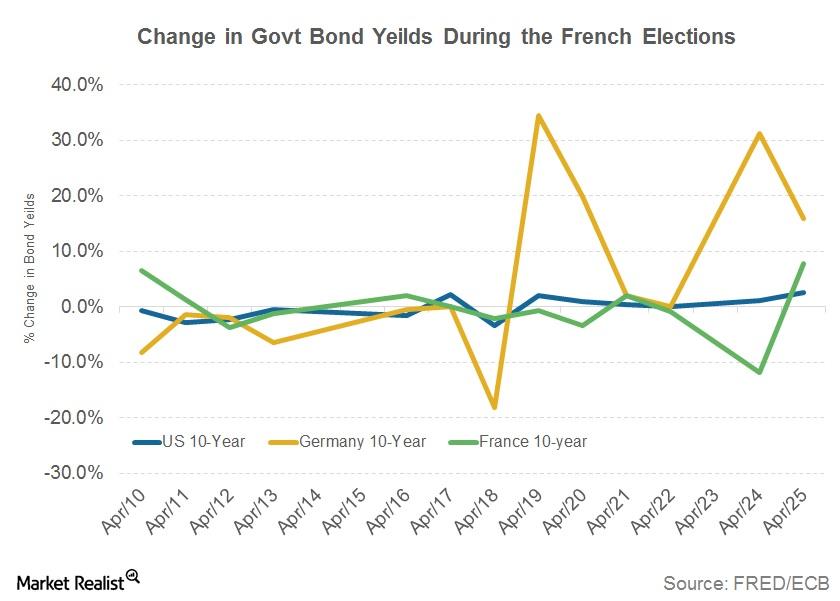

How Did Fixed Income Markets React to the First Round?

Demand for fixed income securities will likely be subdued because of excess supply this week, which would mean additional support for bond yields.

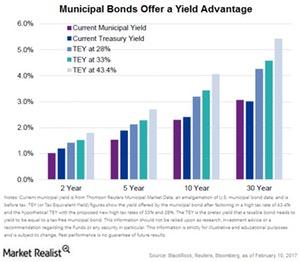

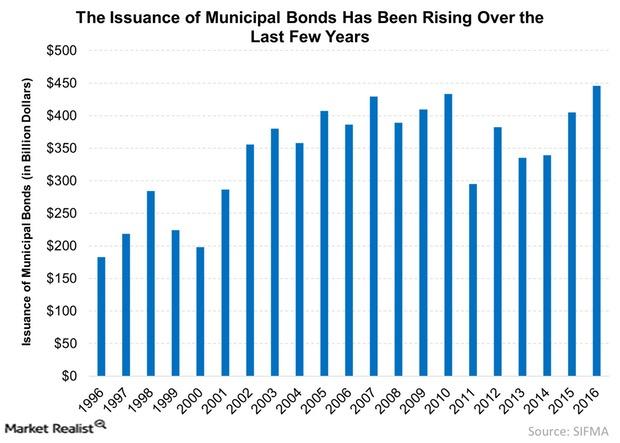

How Refundings Could Affect Municipal Bond Returns This Year

Municipal bond issuance has been rising over the last few years. More refundings would cause the supply to rise further.

Richard Bernstein: Be Safe on Your Quest for Safety

After expressing his thoughts on the Baby Boomer generation’s having become risk-averse, Richard Bernstein moved on to the topic of the safety of “safe” investments.

Why Did Treasury Bonds Record a Fall in Yield?

The yield on US ten-year Treasury securities fell below the 1.6% mark for the first time on September 26, 2016 due to a rise in demand.

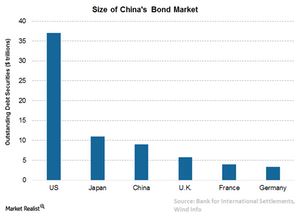

Regulatory Hurdles Affecting Chinese and Indian Bond Markets

As the intensifying search for yield goes international, Matt examines and shares his thoughts on the different Asian bond markets.

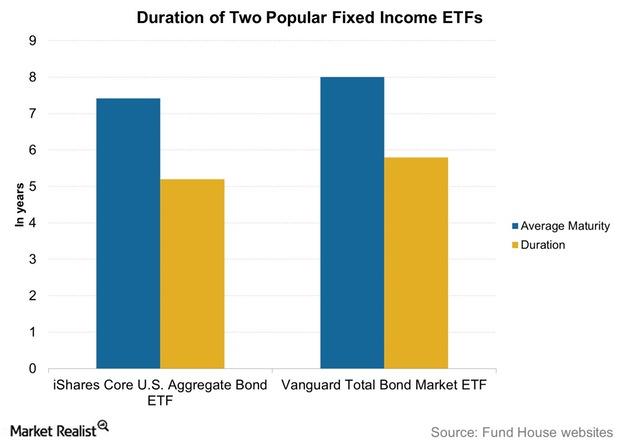

How Holding Duration Is Risky during Rising Inflation

Moving on to the fixed income space, the Janus team sees holding duration in portfolios as a risk.

What Does the Break-Even Rate Suggest?

The break-even rate is the difference between the yields of ten-year Treasuries (IEF) (TLH) and ten-year TIPS (VTIP).

Richard Bernstein Discusses the Risk of Seeking Safety

In his July 2016 Insights newsletter, Richard Bernstein stated, “Safe investments are safe until everyone wants them.”

Yield-O-Philes Face a Difficult Challenge

Yields remain at unattractive levels. This has caused yield-thirsty investors to flock to high-dividend-yielding stocks, driving their valuations higher.

Yield Is the Workhorse of Municipal Bond Returns

Over the years, average returns from municipal bonds (CMF) are in line with the broader index. They outperformed in some years and underperformed in others.

Are Municipal Bonds Really for Me?

Municipal bonds (MUB) have provided an excellent return in the past year. The returns are even better if we account for their tax benefits.

Treasury Yields Could Stay Low: Here’s Why

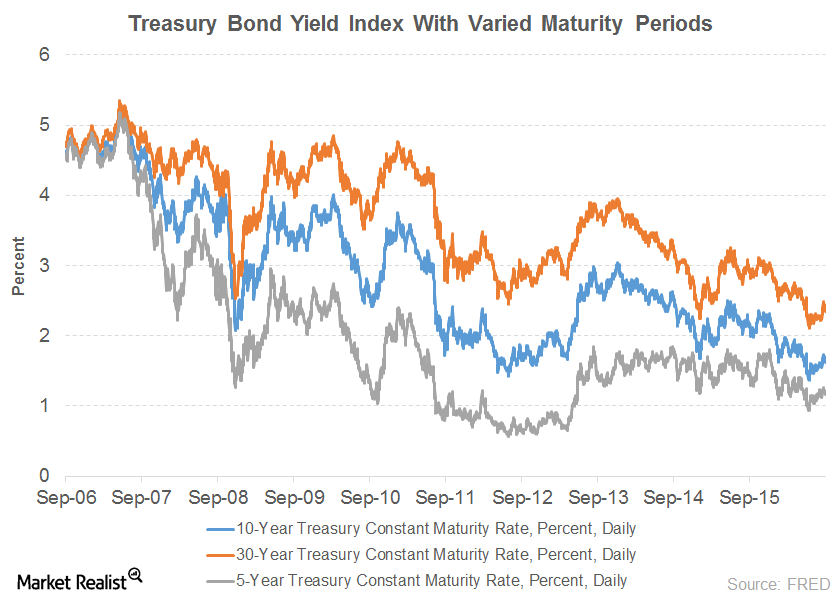

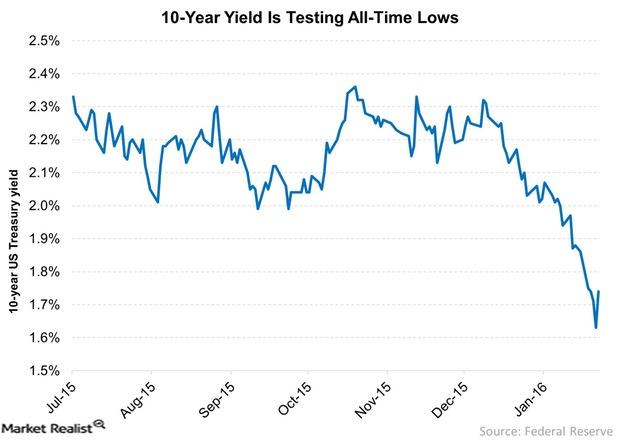

The ten-year Treasury (IEF) yield has plunged in recent weeks. It dipped from 2.3% at the start of this year to ~1.6% currently, in a risk-off trade.