How the Federal Reserve’s Rate Hike Affected Precious Metals

Precious metals and miners saw some relief on December 13 after the Fed raised rates as expected. Sibanye Gold (SBGL), Aurico Gold (AUQ), and Goldcorp (GG) rose 3.5%, 3.6%, and 5.8%, respectively.

Dec. 14 2017, Published 2:22 p.m. ET

How gold reacted to the Fed’s latest rate hike

Precious metals tend to face losses while anticipating an interest rate hike. Among the four precious metals that we’re covering, gold, silver, and platinum posted 30-day trailing losses of 1.4%, 0.53%, and 3%, respectively. Although palladium saw some down days during the last month, it rose 1.6% in the previous one-month period.

Gold and silver have reported five-day trailing losses of 1.4% and 0.38%, respectively. This slide reversed on December 13, as the rate hike was already priced in by the market. The outgoing Federal Reserve chair, Janet Yellen, raised interest rates for the third time in 2017, ending her four-year term.

The incoming Federal Reserve chair, Jerome Powell, has hinted that he holds a somewhat cautious approach to rate increases. However, it seems that the market is expecting more interest rate hikes in 2018.

Precious metals and miners saw some relief on Wednesday, December 13, after the Fed raised rates as expected. Mining shares Sibanye Gold (SBGL), Aurico Gold (AUQ), Goldcorp (GG), and Royal Gold (RGLD) rose 3.5%, 3.6%, 5.8%, and 1.5%, respectively.

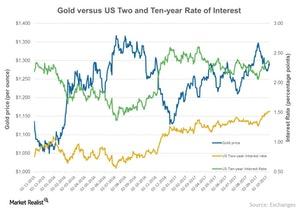

Gold versus Treasuries

As non-yield-paying assets, precious metals can fall when the interest rates offered on Treasuries rise. Notably, gold (GLD) is susceptible to rate increases as Treasuries and gold are both known as haven assets. During times of market unrest, investors often prefer either gold or Treasuries. The chart above compares gold to the US two-year and ten-year interest rates (SHY) (IEF).

The SPDR Gold Shares ETF (GLD) and the iShares Silver Trust ETF (SLV) rose 0.86% and 2.0%, respectively, on December 13, 2017.