Royal Gold Inc

Latest Royal Gold Inc News and Updates

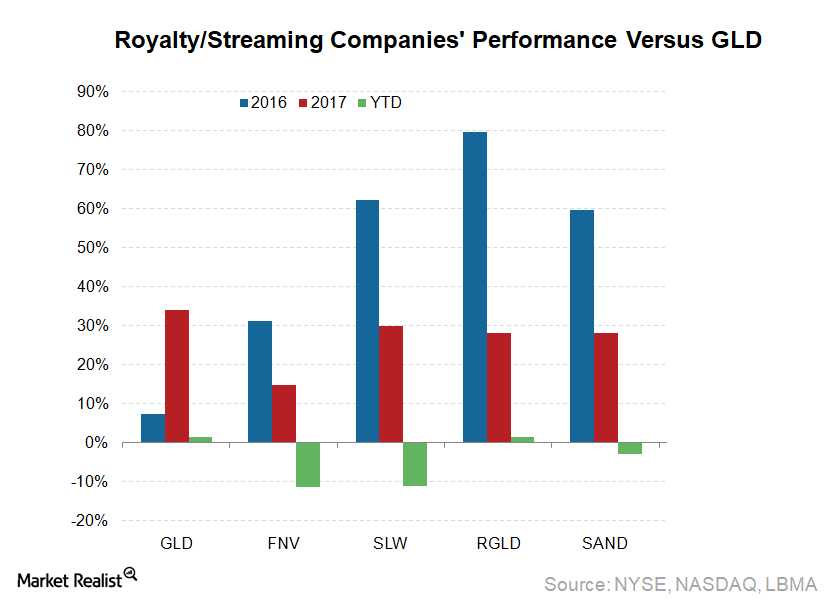

Could Royalty and Streaming Companies Stay Strong in 2018?

Royalty and streaming companies Royalty and streaming companies’ business model differs greatly from that of other precious metal miners (RING), mainly because royalty and streaming companies do not own mines. These companies make upfront payments to gain a right to a fixed percentage of future silver or gold mine production. Additional payments are then made […]

Gold Rose amid Increased Demand for Safe-Haven Assets

These economic concerns and monetary stimulus expectations have decreased the probability of an interest rate hike by the US Federal Reserve, and the chances of an interest rate hike in July dropped to zero.

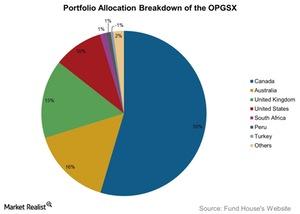

An Overview of OPGSX’s Precious Metal Holdings

OPGSX may also invest up to one-fifth of its portfolio directly into gold or silver bullion and other precious metals.

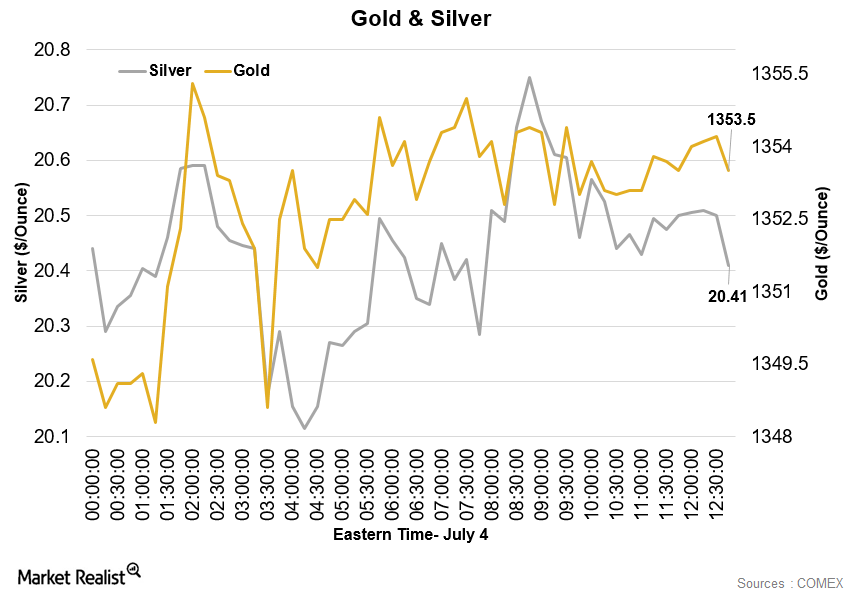

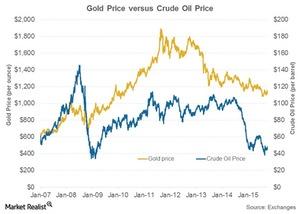

Copper Stabilizes While Gold Trades near Two-Year High

Copper prices stabilized on Monday, July 4, amid expectations of stimulus from central banks.

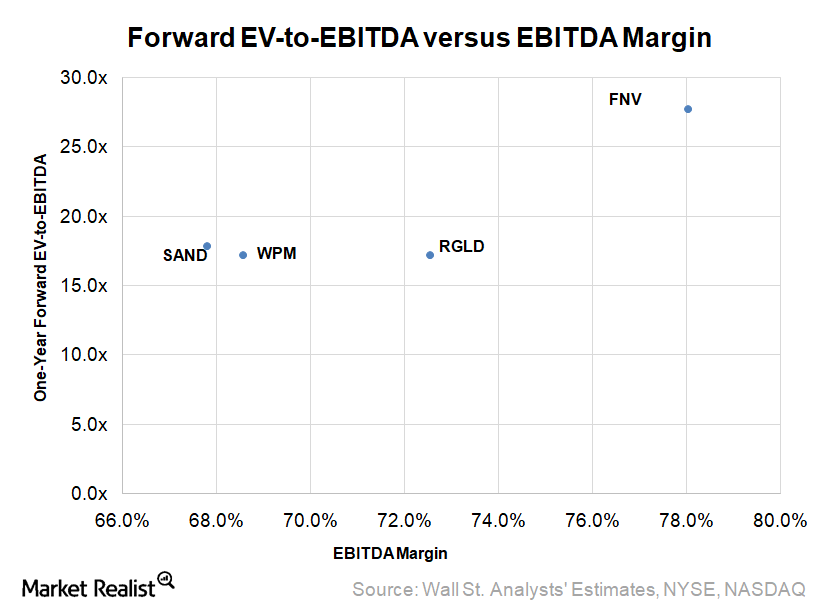

Why Valuation Multiples for Royalty and Streaming Companies Have Risen in 2017

Royalty and streaming mining companies (RING) (SIL) have business models that are considered quite conservative because they don’t own mines.

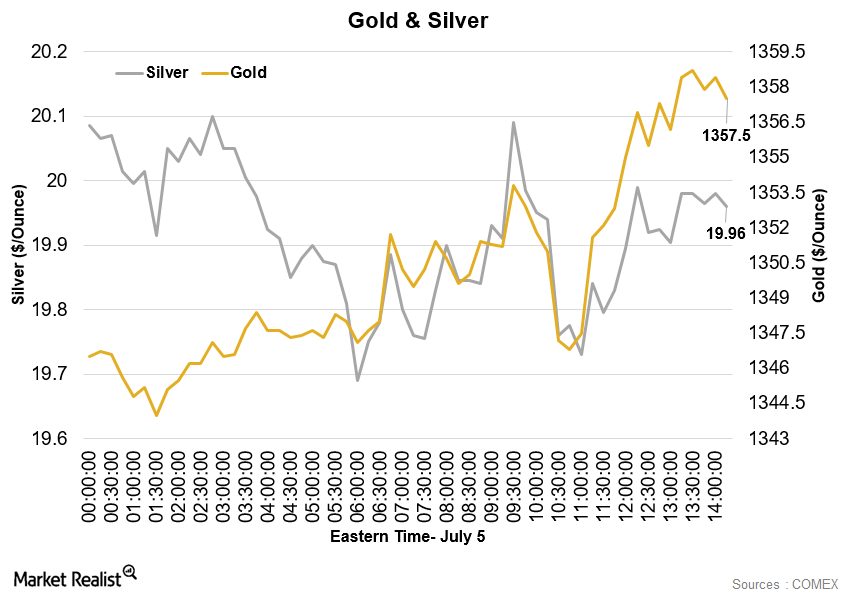

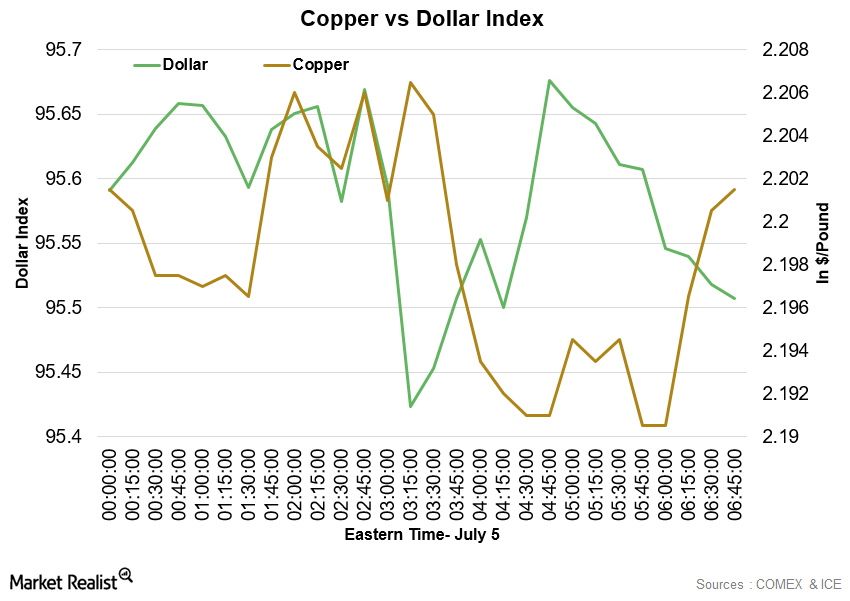

Copper Fell and Gold Stabilized on July 5

At 6:40 AM EST on July 5, the COMEX Copper futures contract for September delivery was trading at $2.2 per pound—a drop of 0.81%.

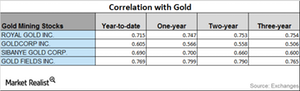

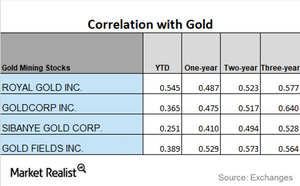

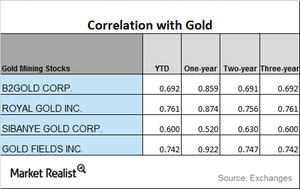

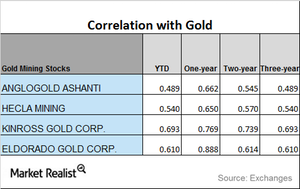

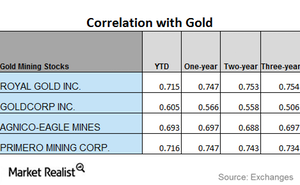

Which Stocks Are Uptrending in Their Correlations to Gold?

It’s expected that precious metal mining stocks will follow precious metals. So it’s crucial to know which stocks are closely associated with precious metals.

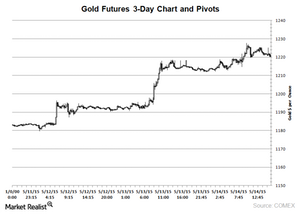

Gold Prices Extend Rally on Depreciating Dollar

This is the fifth up day for gold prices in the last ten days. Prices increased by 0.72% more on the average up days than on the average down days over the last ten trading sessions.

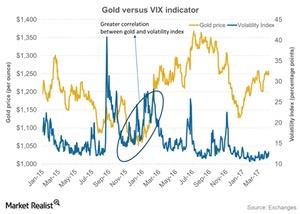

How the Economic Sentiment Is Playing on Gold

During the past week, average hourly earnings, excluding the farming industry, were below analysts’ expectation of 0.10%.

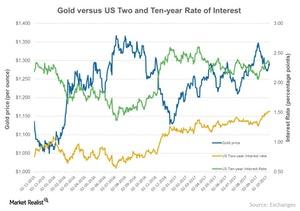

Will a Rate Hike Pull the Lid off Gold?

Though an increase in rates may initially dim the luster of the metal, after the hike, gold may soar, uninterrupted by looming fears.

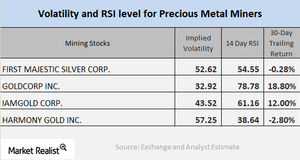

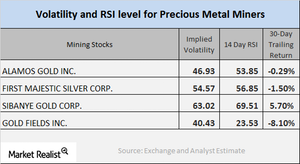

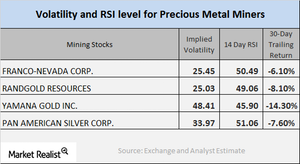

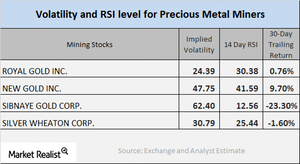

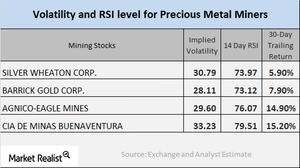

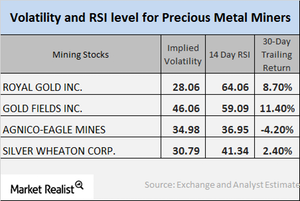

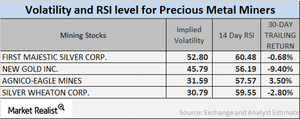

Reading the Technicals and Price Movements of Mining Stocks

In this article, we’ll do a technical analysis of a few select mining stocks. When investing in mining stocks, it’s crucial to read their indicators.

Analyzing the Technicals of Mining Stocks in January 2018

Most mining stocks have risen during the past month due to the revival in precious metals prices.

What’s the 3-Year Correlation between Miners and Gold?

Gold is the most influential precious metal, and most miners follow its price trends.

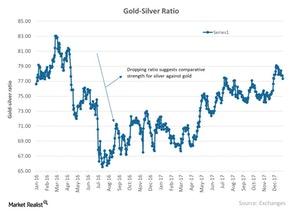

Reading the Recent Gold-Silver Spread

Among these spreads, the gold-silver spread is the most talked about because it measures the number of silver ounces it takes to buy a single ounce of gold.

How the Federal Reserve’s Rate Hike Affected Precious Metals

Precious metals and miners saw some relief on December 13 after the Fed raised rates as expected. Sibanye Gold (SBGL), Aurico Gold (AUQ), and Goldcorp (GG) rose 3.5%, 3.6%, and 5.8%, respectively.

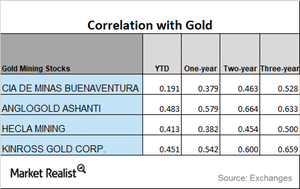

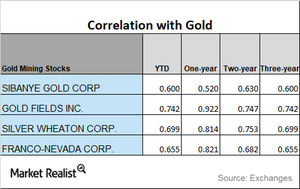

Today’s Correlation Study of Key Mining Stocks with Gold

The Global X Silver Miners ETF (SIL) and the Sprott Gold Miners (SGDM) have fallen 3.5% and 4.4%, respectively, on a 30-day trailing basis.

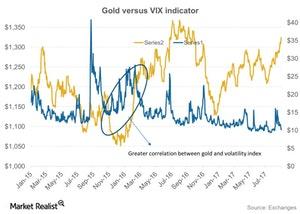

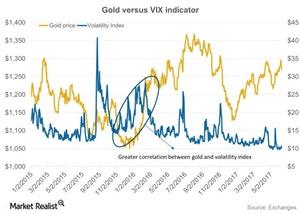

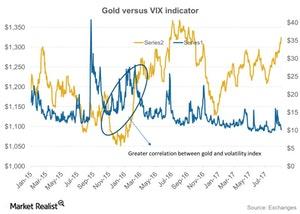

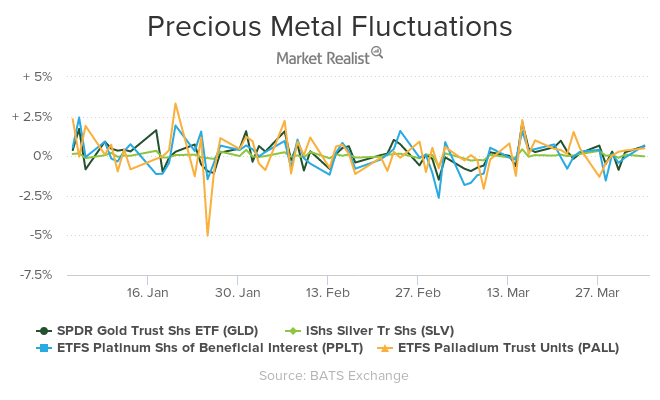

How Turbulence in the Market Has Moved Precious Metals

Often, gold, silver, platinum, and palladium react to the overall risk in the market.

A Brief Analysis of the Miners in November 2017

RGLD, GG, SBGL, and GOLD reported RSI levels of 52.5, 62.7, 49.2, and 81.4, respectively.

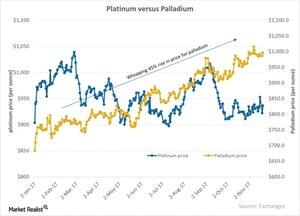

An Overview of the Platinum and Palladium Markets in 2017

In September 2017, palladium prices overtook the price of platinum.

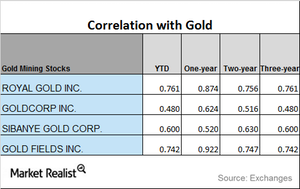

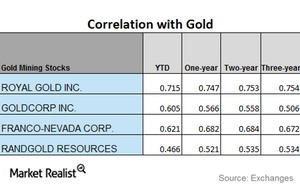

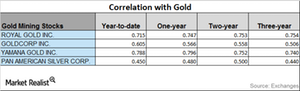

Comparing Miners’ Correlation with Gold

Correlation analysis Mining stocks’ performance usually depends on precious metal prices. Correlation analysis can give investors some perspective on how mining stocks relate to precious metals, especially gold. In this part of our series, we’ll look at four miners—Royal Gold (RGLD), Goldcorp (GG), Franco-Nevada (FNV), and Randgold Resources (GOLD)—and their correlation with gold. On Monday, the ETFS Physical […]

India’s Gold Imports Have Fallen: What’s Going On?

For India, gold imports have fallen 16% in value to ~$2.9 billion in October 2017 compared to $3.5 billion in the corresponding month last year.

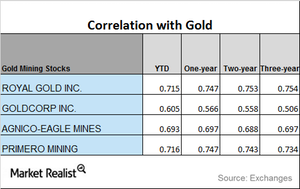

Directional Changes in the Correlation of Miners to Gold

New Gold and Goldcorp have seen upward trends in their correlations with gold, while Newmont Mining has seen its correlation decline.

Yield Changes for Precious Metals: What Could Be the Impact?

If we look beyond the dollar influence on precious metals, we can analyze how the probability of an interest rate hike could influence precious metals and their miners.

Your Brief Correlation Study of Major Mining Stocks Last Week

The iShares MSCI Global Gold Min (RING) and the VanEck Vectors Junior Gold Miners (GDXJ) have seen YTD (year-to-date) gains of 6.4% and 9%, respectively.

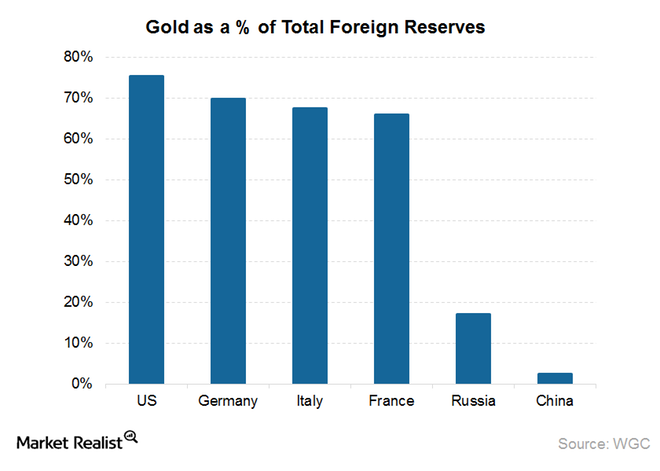

How Central Banks’ Gold Buying Spree Coud Benefit Prices

While China and Russia have the fifth and sixth largest gold reserves globally, the movements in them are the most watched by gold investors the world over mainly because these economies have been quite vocal about adding gold reserves.

Analyzing Miners’ Trends in October

Mining stocks’ correlation with precious metals Most of the time, mining stocks’ performance follows that of precious metals. However, they can deviate. Correlational analysis can give investors some insight into how mining stocks relate to gold and silver. In this part of our series, we’ll compare Royal Gold (RGLD), Goldcorp (GG), New Gold (NGD), and Newmont Mining (NEM). Mining […]

Reading the Correlation Movements of Precious Metal Miners with Gold

The iShares MSCI Global Gold Min (RING) and the VanEck Vectors Junior Gold Miners (GDXJ) fell 2.6% and 1.5%, respectively, on October 26.

A Technical Analysis of Mining Shares as of October 27

On October 26, 2017, Royal Gold, Newmont, Sibanye, and Yamana had call implied volatilities of 24.8%, 25.9%, 63%, and 48.4%, respectively.

A Brief Correlation Study of Mining Stocks as of October 23

The iShares MSCI Global Gold Min (RING) and the VanEck Vectors Gold Miners (GDX) have fallen 1.3% and 1.4%, respectively, on a five-day-trailing basis.

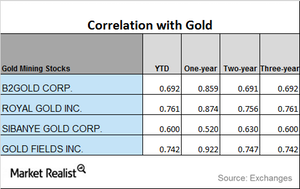

Analyzing Mining Shares’ Correlation in October

Understanding mining stocks’ correlation with gold is crucial for investors in precious metal mining stocks.

Inside Mining Stock Technicals on October 12

Most precious metals had a down day on Tuesday, October 10, despite the recent overall upward movement in precious metals.

Are North Korea Tensions Continuing to Affect Precious Metals?

All the four precious metals saw an up day on Monday, October 9, 2017.

Mining Stocks so Far in 2017: A Correlation Study

Among these four mining stocks, Goldcorp has the lowest correlation with gold on a YTD basis, while Royal Gold (RGLD) has the highest correlation.

How Mining Stocks Are Performing

The precious metals continued rising on Wednesday, and gold also witnessed a rebound.

Chart in Focus: Correlation of Mining Stocks with Gold

New Gold has a three-year correlation of 0.67 and a one-year correlation of 0.88 to gold.

Reading the Correlation of Mining Shares

Monday, September 25, 2017, was a day of revival for mining shares as tensions in North Korea resurfaced.

Reading the Technicals of Mining Shares in September 2017

Most mining shares witnessed an up day on Monday, September 25, 2017, as precious metals increased over the ongoing global tensions.

Why Most Mining Stocks Fell on Friday

Precious metal mining stocks follow trends in precious metals, and they’re a very volatile segment of the equity markets.

Analyzing the RSI Movements of Precious Metals

The price movement in precious metals is often closely traced by mining stocks. Before investors opt for mining stocks, they should analyze a few of the crucial technical details.

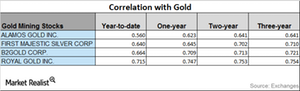

A Look at Mining Stocks’ Correlation with Gold

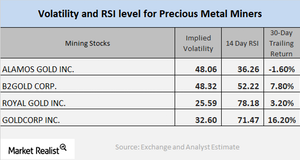

Miners’ correlation with gold In this part, we’ll look at mining stocks’ correlation with precious metals by comparing their price movement. Specifically, we’ll analyze Alamos Gold (AGI), First Majestic Silver (AG), B2Gold (BTG), and Royal Gold (RGLD). The mining stocks have recovered in the past few weeks. The Direxion Daily Gold Miners Bull 3x Shares […]

How Gold Is Coping amid Market Turmoil

Precious metals have maintained upward movement over the past month as geopolitical tensions hover.

Analyzing Miners’ Correlation in July 2017

Royal Gold’s correlation fell from a three-year correlation of ~0.75 and a year-to-date correlation of ~0.72 with gold.

How the Euro Pushed the Dollar Lower and What It Meant for Gold

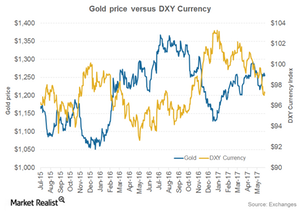

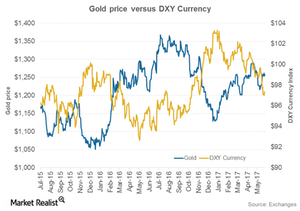

July 20, 2017, was an up day for the euro, which put downward pressure on the US dollar as represented by the U.S. Dollar Index (or DXY).

How Has Miners’ Volatility Trended in July?

Mining stocks have bounced back from the choppy markets seen over the past week.

What’s the Correlation between the Dollar and Gold?

The rise in gold on June 6 also boosted the other three precious metals. Silver futures for August delivery were 1.4% higher for the day and closed at $17.6 per ounce.

Are RSI Numbers Moving Away from or Close to Critical Levels?

Investors are constantly speculating about the impact on precious metals of a possible Fed rate hike in June. Let’s look at some 14-day RSI scores and implied volatility.

Inside the Monthly Mining Correlations as of May 3

Metal investors have to study upward and downward trends as price change predictability can be affected by rises and falls in precious metal prices.

A Look at Mining Stocks’ Correlation with Gold in 2017

Mining stocks and precious metals As global tumult grips markets and investors are turning to mining stocks as safe havens, it’s crucial to understand which stocks are closely tied to precious metals. Stocks with a higher correlation with precious metals will likely be impacted more by global indicators that influence precious metals. The Direxion Daily […]

Upcoming French Elections Could Impact Gold

Since the French elections are right around the corner, investors might start parking their money in safe-haven assets like gold.

Reading the Performances of Precious Metals in 1Q17

Precious metals had a bright first quarter, which ended March 31, 2017. Gold rose about 8.4%, marking its best quarter in almost a year.