Royal Gold Inc

Latest Royal Gold Inc News and Updates

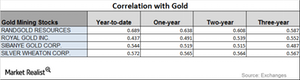

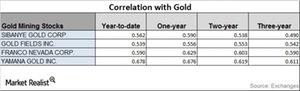

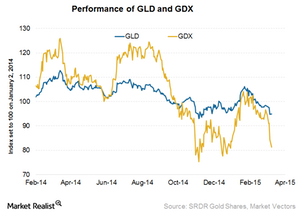

These Mining Stocks Have Downward Trending Correlations with Gold

Uncertainty in the market significantly affects the performances of precious metals. It also affects precious metals mining stocks, which are known to closely track precious metals.

What Scenarios Decide How Precious Metals Move?

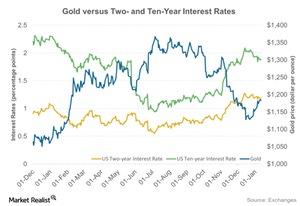

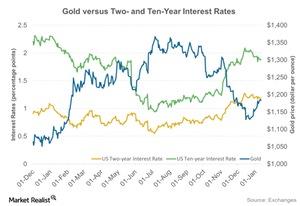

The directional move of the interest rate is a crucial determinant of the direction precious metals will take.

Analyzing the Correlations of Precious Metals Mining Stocks

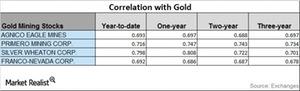

Mining companies that have high correlations with gold include B2Gold (BTG), Royal Gold (RGLD), Agnico Eagle Mines (AEM), and Primero Mining (PPP).

How Interest Rates Are Impacting Precious Metals

Many of the recent changes in precious metals have been determined by changes in the interest rates offered on US Treasuries.

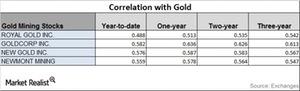

Understanding the Correlation of Mining Stocks in 2017

Precious metal prices have been falling since Trump won the US Presidential election on November 8, 2016. Mining stocks quickly followed suit.

How Mining Stocks Reacted to Plummeting Metals

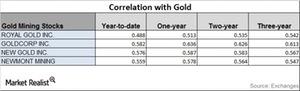

Mining companies that have high correlations to gold include Royal Gold (RGLD), Goldcorp (GG), New Gold (NGD), and Newmont Mining (NEM).

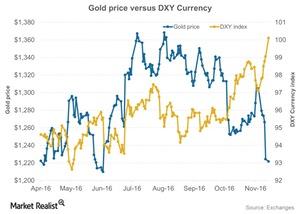

US Dollar Played on Gold in 2016

The correlation between gold and the US Dollar Index is -0.36. It means that about 36.0% of the time, gold and the dollar move in opposite directions.

How Are Miners and Gold Correlated?

The substantial returns of most mining companies have been due to safe-haven bids that boosted gold and other precious metals.

Analyzing the Correlation of Mining Stocks

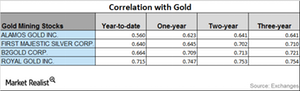

Mining companies that have high correlations with gold include Alamos Gold (AGI), First Majestic Silver (AG), B2Gold (BTG), and Royal Gold (RGLD).

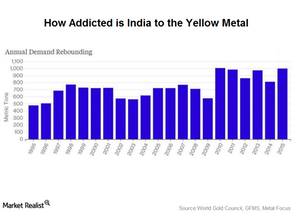

India’s Gold Demand May Touch 1000 Tonnes in 2015

The World Gold Council predicted that India’s gold demand in the October–December quarter would be muted. Gold imports shrank 36.5% to $3.53 billion in November.

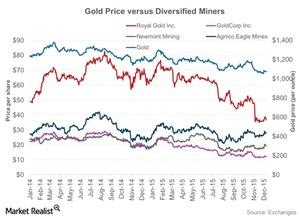

How Gold Prices Impact Diversified Miners

The term “diversified miners” refers to mining companies that are not into streamlined gold or silver mining, but also mine base metals.

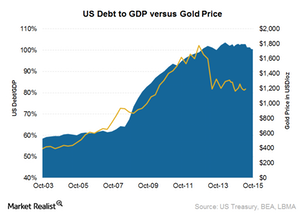

Could Rising Government Debt Mean Long-Term Upside for Gold?

If you expect this positive correlation to resume, then gold would seem very cheap at its current levels, suggesting an upside in gold prices in the long term.

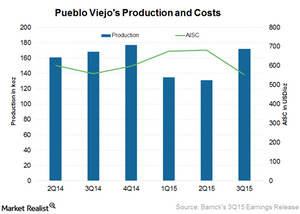

Barrick: What Will Drive Increased Recoveries for Pueblo Viejo?

The Pueblo Viejo mine is a joint venture between Barrick Gold Corporation (ABX) at 60% and Goldcorp (GG) at 40%.

Did Strong Data Push Gold Prices South?

Gold prices don’t seem to have caught up with interest rate expectations, which have gone from 1.5% at the start of the year to about 0.5% today. The loosening monetary policy has probably worked in favor of gold.

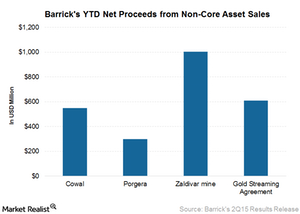

Barrick Gold in 2Q15: The Benefits of Asset Monetization

So far, Barrick has achieved 90% of its 2015 debt reduction target of $3 billion, mainly thanks to asset monetization.

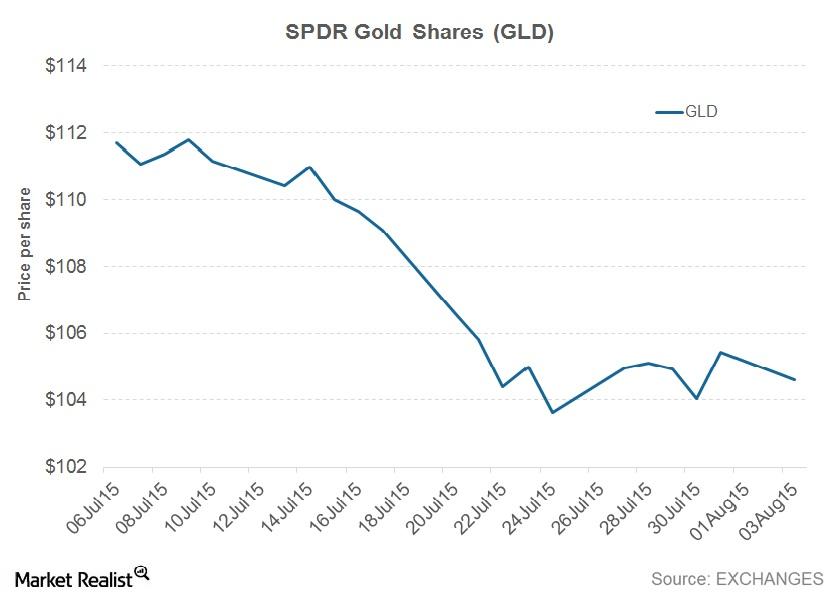

Why Is the SPDR Gold Shares ETF (GLD) Losing Its Sheen?

The SPDR Gold Shares ETF (GLD) is the world’s largest ETF. It’s also the highest-traded. Friday’s price for GLD was $104.39.

Key Indicators Impacting Gold Price Performance

Gold prices are holding steady in April. The SPDR Gold Trust ETF traded at $115.43 on April 15, almost flat when compared with April 1’s value of $115.60.