Could Rising Government Debt Mean Long-Term Upside for Gold?

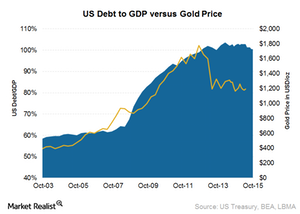

If you expect this positive correlation to resume, then gold would seem very cheap at its current levels, suggesting an upside in gold prices in the long term.

Dec. 4 2015, Updated 12:06 p.m. ET

The relationship between debt and gold prices

The more debt is created, the lower currencies’ value. Also, as debt rises beyond a certain point, the country would have to increase taxes and cut spending in productive areas. This would allow the country to service interest costs. This has a negative impact on economic growth. This leads to higher value for gold.

US debt and gold prices

As you can see in the graph above, until 2012, US debt to GDP (gross domestic product) growth and US dollar gold price growth had a positive and strong correlation. After that, the correlation has broken down. While US debt rose from $16.5 trillion to $18 trillion, with the debt to GDP ratio also rising, gold prices fell. Gold’s rally ended in 2013 as the Fed planned to decrease its monthly asset purchases.

Some market participants have attributed the break in correlation to manipulation by central banks to suppress their inflationary policies.

Debt outlook

The Congressional Budget Office (or CBO) has claimed for some time that the federal government’s debt is unsustainable. It forecasts that public debt will grow to 77% of gross domestic product (or GDP) by 2025 from the current 74%. According to the CBO, “The long-term outlook for the federal budget has worsened dramatically over the past several years.”

This is just the current debt—there are unfunded liabilities in the form of social security and Medicare. Estimates vary regarding the present value of these unfunded liabilities. But they’re huge. They’re two to 2.5 times the current US total debt. This could be catastrophic for future taxpayers.

If you expect this positive correlation to resume, then gold would seem very cheap at its current levels, suggesting an upside in gold prices in the long term as the government’s debt balloons further. This, in turn, would favorably affect mining equities such as B2Gold (BTG), Royal Gold (RGLD), and Sibanye Gold (SBGL) as well as gold ETFs such as the Direxion Daily Gold Miners ETF (NUGT) and the VanEck Vectors Gold Miners ETF (GDX). These three stocks make up 8.4% of the VanEck Vectors Gold Miners ETF (GDX).

Yet there have been periods when this relationship between gold and US debt hasn’t been very clear, so investors can’t rely on this indicator precisely at all times. It, however, does offer a directional clue.