B2Gold Corp

Latest B2Gold Corp News and Updates

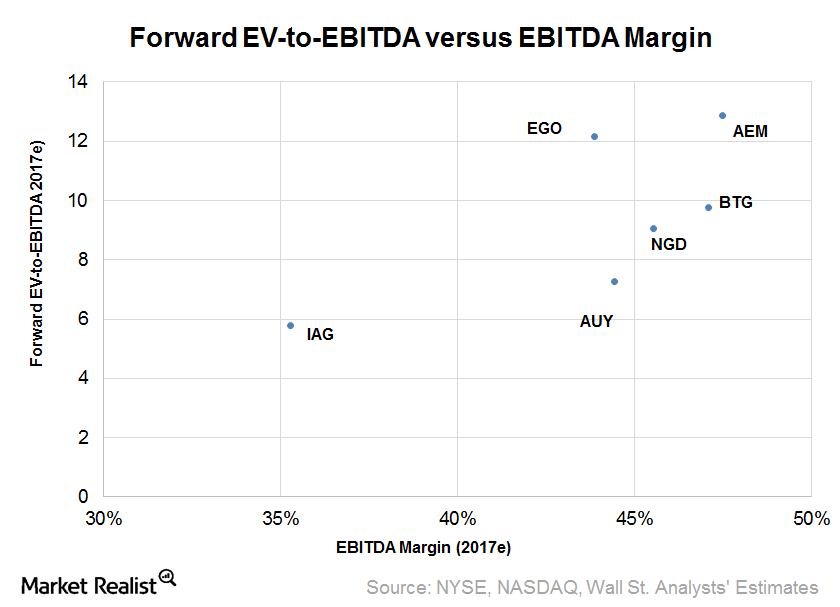

What Could Drive IAMGOLD Corp.’s Valuation Going Forward?

IAG stock could continue to gain traction due to its high operational leverage, at least as long as the upward trend in gold prices continues.

Which Gold Miners Are Ray Dalio and John Paulson Betting On?

Hedge funds increased their net positions in the SPDR Gold Shares ETF during the first quarter.

The Most Crucial Element in the Precious Metals Downtrend

Gold ended the day almost flat on Wednesday, May 2, and closed at $1,304.90 per ounce.

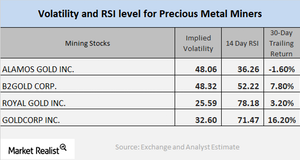

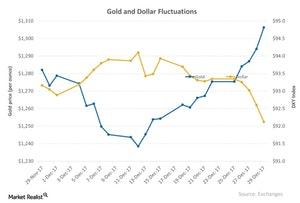

Analyzing the Technicals of Mining Stocks in January 2018

Most mining stocks have risen during the past month due to the revival in precious metals prices.

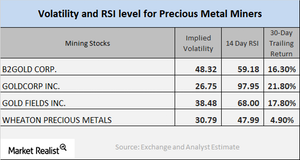

Reading the Performance of Mining Shares amid Surging Metals

On January 12, 2018, precious metals were once again on a rising streak, which also led to increasing prices for mining shares.

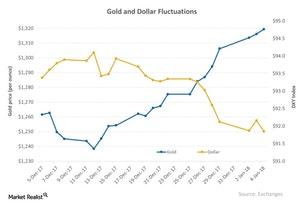

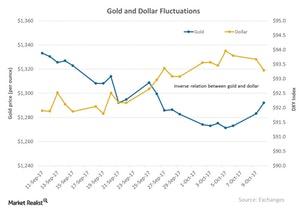

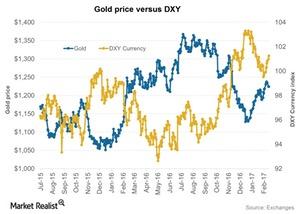

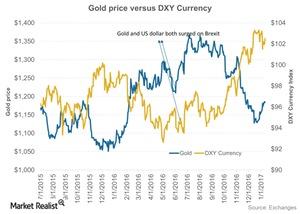

The Dollar and Its Relationship to Precious Metals

The US dollar rose 0.18% on Tuesday, January 9, 2018, which led to the lower price of spot gold (GLD) and silver.

Analyzing Precious Metals: Dollar Had Its Worst Year since 2003

Although most of the upswing in precious metals has been due to the rise in geopolitical risks in 2017, the dollar has been the most crucial factor.

Will Gold Maintain Its Close Correlation to Inflation?

The rise in inflation could be a positive sign for the current scenario.

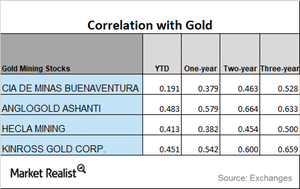

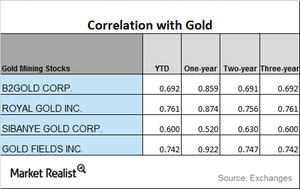

Today’s Correlation Study of Key Mining Stocks with Gold

The Global X Silver Miners ETF (SIL) and the Sprott Gold Miners (SGDM) have fallen 3.5% and 4.4%, respectively, on a 30-day trailing basis.

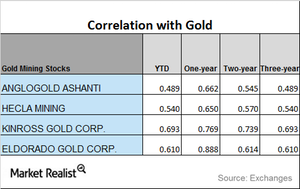

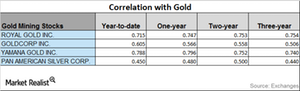

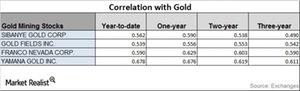

The Correlation Trends of Miners in 2017

If we look at the YTD correlations of the select mining shares to gold, there has been a reasonable fall. On a YTD basis, Sibanye Gold has the least correlation to gold.

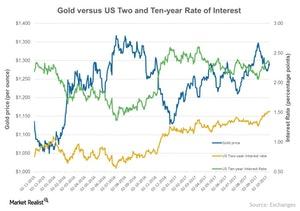

Rate Hike Could Move Precious Metals and Miners

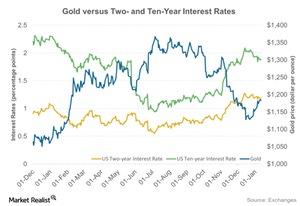

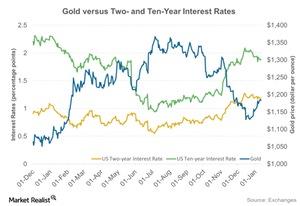

Investors have their eyes set on the interest rates. A rise in the interest rates causes the demand for precious metals to fall.

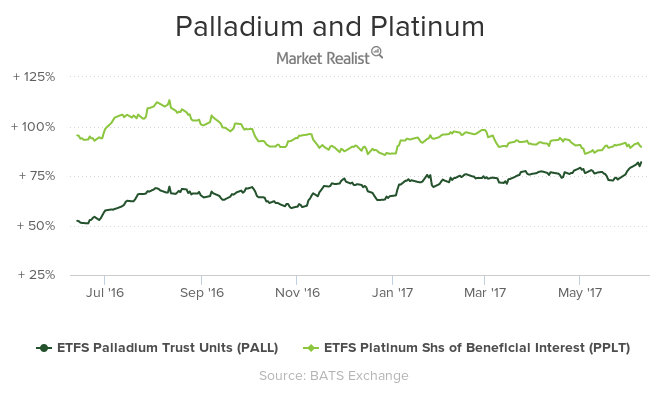

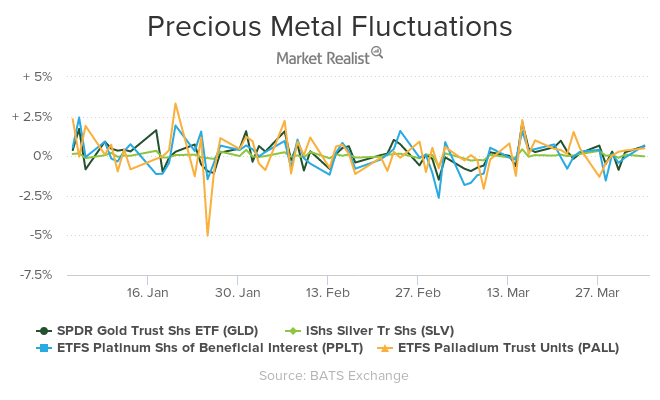

Where Are Precious Metal Spreads Moving?

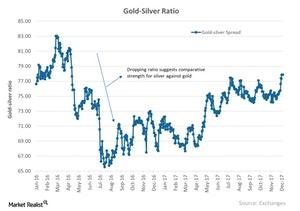

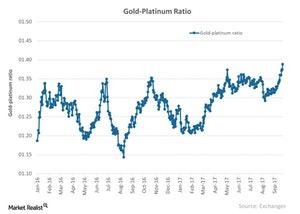

In this part of the series, we’ll look at the gold-silver spread, the gold-platinum spread, and the gold-palladium spread.

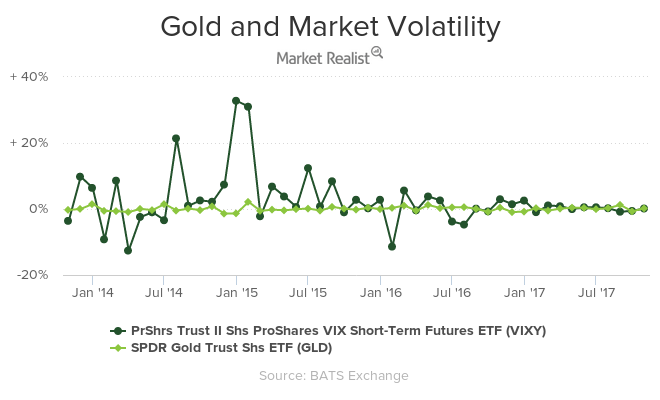

Gauging Global Risk against Gold

All four precious metals rose on Monday, October 30, as multiple speculations in the market gripped investors’ attention.

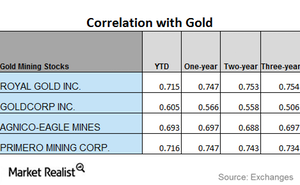

A Look at the Correlation Trends for Miners

Franco-Nevada and Silver Wheaton have seen an upward trend in their correlations with gold.

Platinum Ratio Analysis: Which Way Is Platinum Moving?

The gold-platinum spread was ~1.38 on October 23. The RSI (relative strength index) level for the gold-platinum spread is now at 93.9.

A Brief Correlation Study of Mining Stocks as of October 23

The iShares MSCI Global Gold Min (RING) and the VanEck Vectors Gold Miners (GDX) have fallen 1.3% and 1.4%, respectively, on a five-day-trailing basis.

Analyzing Mining Shares’ Correlation in October

Understanding mining stocks’ correlation with gold is crucial for investors in precious metal mining stocks.

Reading the Drop in Precious Metals on Monday, October 16

After the rise we saw on Friday, October 13, precious metals had a down day on Monday, October 16.

How Mining Stocks Are Performing

The precious metals continued rising on Wednesday, and gold also witnessed a rebound.

Why Most Mining Stocks Fell on Friday

Precious metal mining stocks follow trends in precious metals, and they’re a very volatile segment of the equity markets.

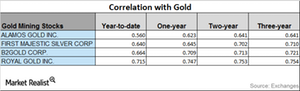

A Look at Mining Stocks’ Correlation with Gold

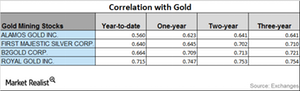

Miners’ correlation with gold In this part, we’ll look at mining stocks’ correlation with precious metals by comparing their price movement. Specifically, we’ll analyze Alamos Gold (AGI), First Majestic Silver (AG), B2Gold (BTG), and Royal Gold (RGLD). The mining stocks have recovered in the past few weeks. The Direxion Daily Gold Miners Bull 3x Shares […]

Palladium Skyrockets: A Look at What’s in Store Next

Although gold and silver had a down day on Friday, June 9, 2017, platinum and palladium rose about 0.23% and 1.2%, respectively.

How Silver-Based Funds Plunged Their Way through April 2017

Precious metals were doing considerably well until the first half of April 2017. As investors’ risk appetites revived, haven assets slumped. Among these metals, silver has plummeted the most.

Inside the Monthly Mining Correlations as of May 3

Metal investors have to study upward and downward trends as price change predictability can be affected by rises and falls in precious metal prices.

Gauging the Role of the US Dollar in the April 19 Fall of Precious Metals

Another important phenomenon that played on the fall of precious metals on Wednesday, April 19, was the upswing of the US dollar.

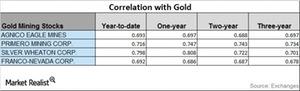

A Look at Mining Stocks’ Correlation with Gold in 2017

Mining stocks and precious metals As global tumult grips markets and investors are turning to mining stocks as safe havens, it’s crucial to understand which stocks are closely tied to precious metals. Stocks with a higher correlation with precious metals will likely be impacted more by global indicators that influence precious metals. The Direxion Daily […]

Reading the Performances of Precious Metals in 1Q17

Precious metals had a bright first quarter, which ended March 31, 2017. Gold rose about 8.4%, marking its best quarter in almost a year.

These Mining Stocks Have Downward Trending Correlations with Gold

Uncertainty in the market significantly affects the performances of precious metals. It also affects precious metals mining stocks, which are known to closely track precious metals.

What Scenarios Decide How Precious Metals Move?

The directional move of the interest rate is a crucial determinant of the direction precious metals will take.

Analyzing the Correlations of Precious Metals Mining Stocks

Mining companies that have high correlations with gold include B2Gold (BTG), Royal Gold (RGLD), Agnico Eagle Mines (AEM), and Primero Mining (PPP).

How Interest Rates Are Impacting Precious Metals

Many of the recent changes in precious metals have been determined by changes in the interest rates offered on US Treasuries.

How GDP Numbers Impacted Gold and the Dollar

The reason behind the fall of the dollar on Friday, January 27, 2017, was lower-than-expected GDP numbers. The DXY ended the day 0.10% higher.

Analyzing the Correlation of Mining Stocks

Mining companies that have high correlations with gold include Alamos Gold (AGI), First Majestic Silver (AG), B2Gold (BTG), and Royal Gold (RGLD).

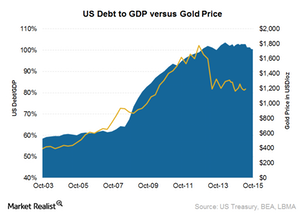

Could Rising Government Debt Mean Long-Term Upside for Gold?

If you expect this positive correlation to resume, then gold would seem very cheap at its current levels, suggesting an upside in gold prices in the long term.

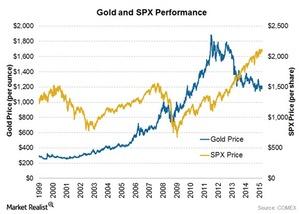

Gold’s Correlation to the Equity Markets

A look at gold and equity market performance demonstrates that a falling stock market isn’t necessarily a catalyst for a major rally in gold.

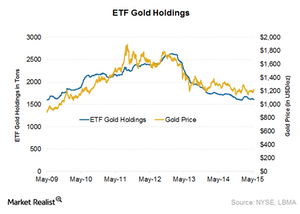

Gold ETF Holdings Fall to 4-Month Low Led by the SPDR Gold Trust

Gold ETF holdings reached a peak of 1,679.8 tons on February 24. In January and early February, gold holdings surged because of the Swiss National Bank’s decision to remove the euro cap.