Direxion Daily Gold Miners Bull 3X ETF

Latest Direxion Daily Gold Miners Bull 3X ETF News and Updates

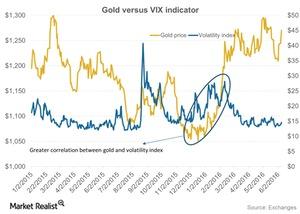

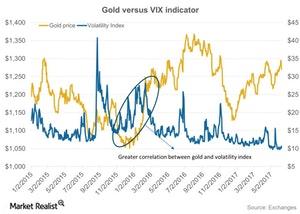

How Much Could Brexit and Volatility Control Gold?

Fears in the overall financial market about a Brexit, the possible exit of Britain from the European Union, have abated. This helped gold fall.

Which Gold Stocks Do Analysts Love and Hate?

Gold price’s reversal this year has created opportunities in gold stocks. The SPDR Gold Shares ETF (GLD) had gained 11% year-to-date as of Friday.

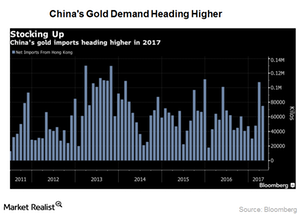

What Rising Physical Gold Demand Could Mean for Prices

After falling 18% in 1Q17, physical demand for gold seems to have picked up in 2Q17.

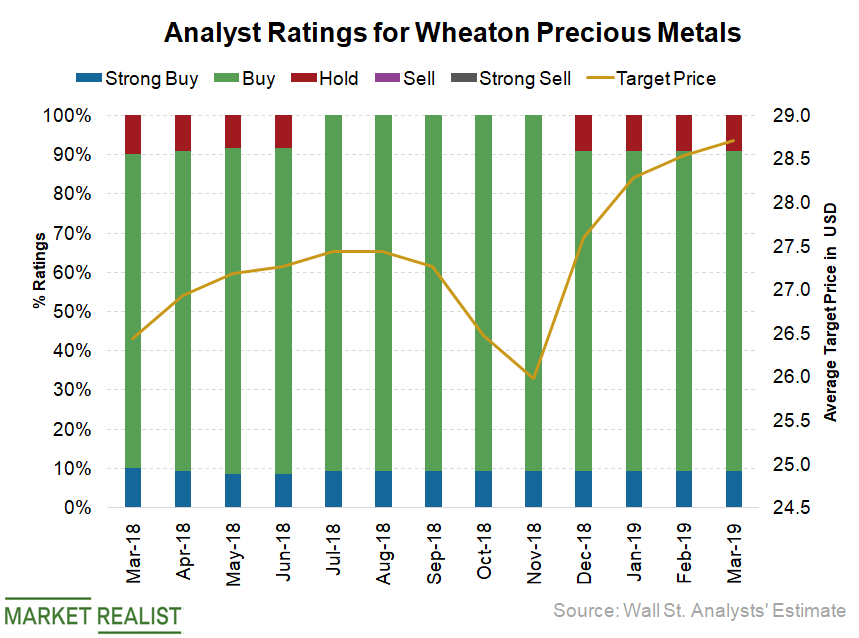

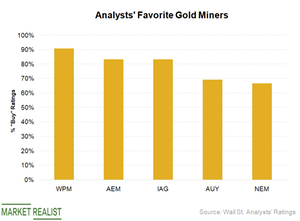

Why Wheaton Precious Metals Is Still Analysts’ Top Gold Bet

Among major gold (GLD)(IAU) mining and gold streaming companies (GOAU), Wheaton Precious Metals (WPM) is analysts’ favorite and has received the most “buy” recommendations at 91%.

Mining Stocks Are Recovering from Their Slump

The Direxion Daily Gold Miners (NUGT) and the ProShares Ultra Silver (AGQ), both leveraged mining funds, both have recovered and jumped 19.4% and 24.9%, respectively, on a five-day trailing basis.

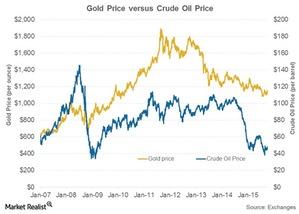

The Correlation between Gold and Oil

Oil is widely used in mining exploration, and a surge in oil prices may squeeze miners’ margins, leading to a fall in their share prices.

Trump, Trade War, Powell: More Upside for Gold Prices?

Gold hit a fresh six-year high on Friday as trade tensions between the US and China escalated. The SPDR Gold Shares ETF (GLD) closed up 2%.

Why Jeffrey Gundlach Likes Gold

During DoubleLine’s investor webcast on June 13, Jeffrey Gundlach said, “I am certainly long gold.” His call on gold is based on his expectation that the US dollar (UUP) will finish lower this year.

The Five Gold Stocks Wall Street Is Loving Lately

Gold miners usually act as a leveraged play on gold prices. In 2018, the VanEck Vectors Gold Miners ETF (GDX) fell 9.3%, amplifying the 1.9% fall in gold prices (GLD).

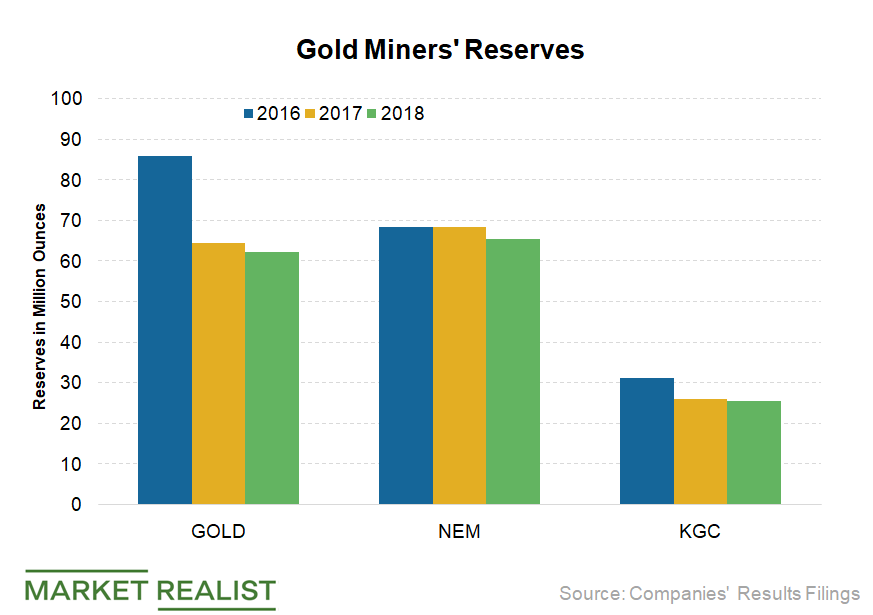

Why Did Barrick Gold’s Reserves Fall in 2018?

At the end of 2018, Barrick Gold (GOLD) reported mineral reserves of 64.5 million ounces—a decline of 3.4% YoY.

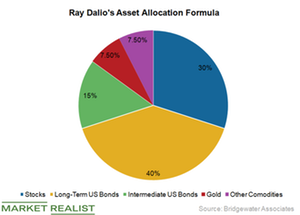

Buffett versus Dalio on Gold: Whose Advice Should You Take?

When it comes to investing in stocks, Berkshire Hathway’s (BRK.A) chair, Warren Buffett, and Bridgewater’s founder, Ray Dalio, have similar advice.

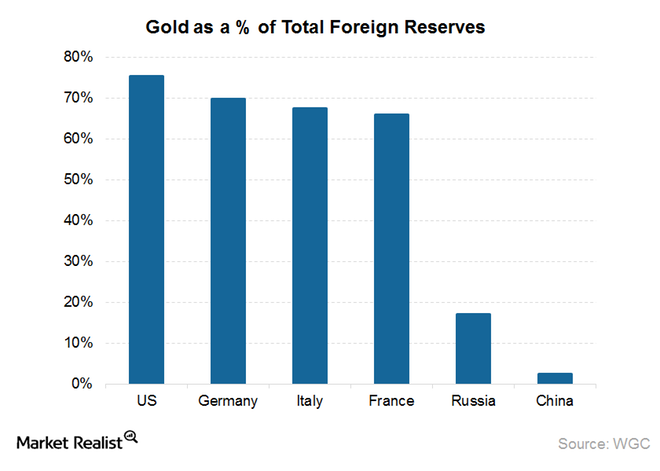

How Central Banks’ Gold Buying Spree Coud Benefit Prices

While China and Russia have the fifth and sixth largest gold reserves globally, the movements in them are the most watched by gold investors the world over mainly because these economies have been quite vocal about adding gold reserves.

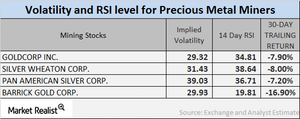

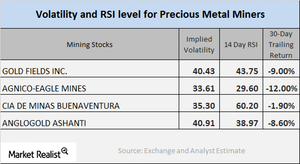

Mining Stocks Today: Your Technical Updates

On October 5, Gold Fields, Agnico-Eagle, Cia De Minas Buenaventura, and AngloGold had implied volatility readings of 40.4%, 33.6%, 35.3%, and 40.9%, respectively.

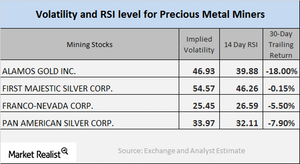

What Are Mining Stock Technical Indicators Telling Us?

On September 29, Alamos, First Majestic Silver, Franco-Nevada, and Pan American had call implied volatilities of 46.9%, 54.6%, 25.5%, and 34%, respectively.

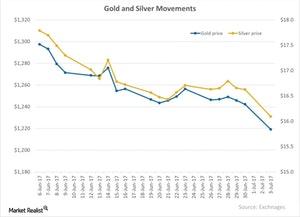

How Gold, Silver, and Mining Companies Performed on September 18

On September 18, gold fell 1.1% and closed at $1,306.90 per ounce. Of the precious metals, silver fell 3.1% and closed at $17.10 per ounce.

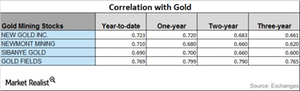

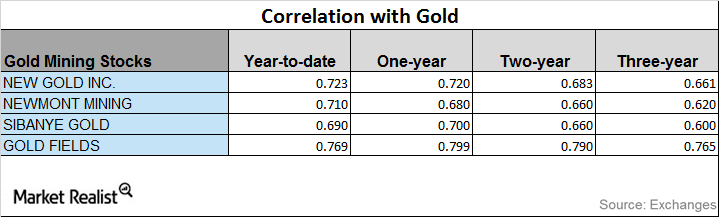

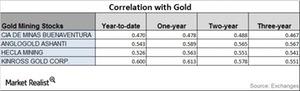

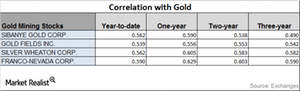

A Correlation Study of Mining Stocks in September 2017

Among the four miners we’re looking at, Gold Fields has the highest correlation to gold on a YTD basis, while Sibanye Gold has the lowest correlation to gold.

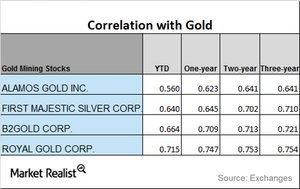

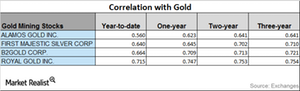

A Look at Mining Stocks’ Correlation with Gold

Miners’ correlation with gold In this part, we’ll look at mining stocks’ correlation with precious metals by comparing their price movement. Specifically, we’ll analyze Alamos Gold (AGI), First Majestic Silver (AG), B2Gold (BTG), and Royal Gold (RGLD). The mining stocks have recovered in the past few weeks. The Direxion Daily Gold Miners Bull 3x Shares […]

The Correlation Analysis of Miners through August 2017

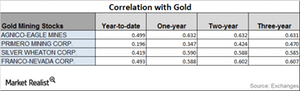

Silver Wheaton has a three-year correlation of ~0.70 with gold and a year-to-date correlation of ~0.80.

How Has Miners’ Volatility Trended in July?

Mining stocks have bounced back from the choppy markets seen over the past week.

How Precious Metals’ Slump Dragged Mining Shares and Funds Lower

Gold tumbled to an eight-week low on July 3, 2017. Gold futures for August delivery fell almost 1.9% to settle at $1,219.2 per ounce.

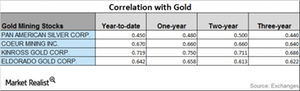

These Mining Companies Are Showing an Uptrend Correlation with Gold

When we try to interpret the performance of precious metals, it’s crucial to study the impact of metal price variations on mining shares.

Mining Stocks’ Relative Strength Index Hits Rock Bottom

The rise and fall of precious metals also significantly impact mining-based leveraged funds like the Direxion Daily Gold Miners (NUGT) and Proshares Ultra Silver (AGQ).

Why RSI levels of Mining Shares Are Rising

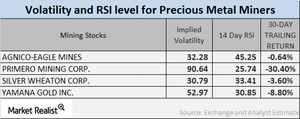

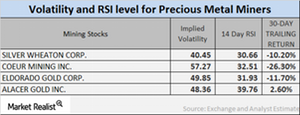

On June 6, the implied volatilities of Alamos Gold, Primero Mining, Silver Wheaton, and Franco-Nevada were 51.1%, 90.6%, 30.8%, and 24.5%, respectively.

How Are the Correlations of Mining Stocks Moving?

Fears surrounding a potential upcoming interest rate hike took over precious metals recently, and they fell at the beginning of May 2017.

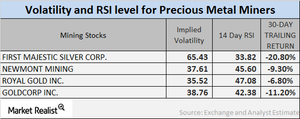

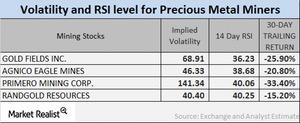

Reading the Mining Stocks’ Falling RSI Numbers

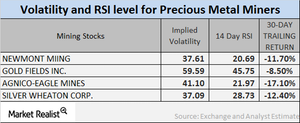

Newmont Mining, Silver Wheaton, Randgold, and Yamana have RSI levels of 45.5, 37.1, 41.2, and 43.0, respectively.

Correlation Trends of Miners to Gold

Among the leveraged mining funds, the Direxion Daily Gold Miners ETF (NUGT) and the Proshares Ultra Silver ETF (AGQ) have seen considerable losses over the past month.

A Look at Mining Stocks’ Correlation with Gold in 2017

Mining stocks and precious metals As global tumult grips markets and investors are turning to mining stocks as safe havens, it’s crucial to understand which stocks are closely tied to precious metals. Stocks with a higher correlation with precious metals will likely be impacted more by global indicators that influence precious metals. The Direxion Daily […]

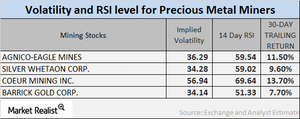

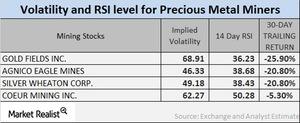

Behind Mining RSI Levels and Volatility Now

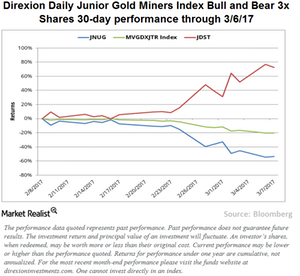

Leveraged mining funds including the Direxion Daily Gold Miners (NUGT) and the Proshares Ultra Silver (AGQ) saw big jumps in early 2017 due to the revival in precious metals.

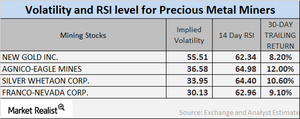

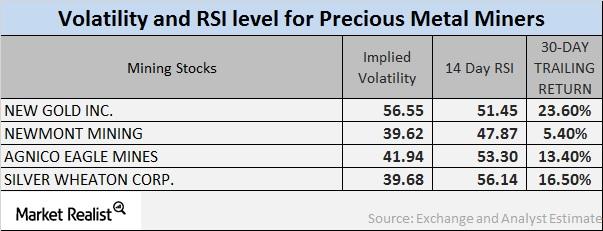

Analyzing the Volatility of Mining Stocks

As of April 6, 2017, the volatilities of New Gold (NGD), Agnico Eagle (AEM), Silver Wheaton (SLW), and Franco-Nevada (FNV) were 55.5%, 36.6%, 34%, and 30.1%, respectively.

How Are Mining Stocks Performing at the Start of April 2017?

As of April 4, 2017, the volatilities of New Gold (NGD), Agnico Eagle Mines (AEM), Silver Wheaton (SLW), and Randgold Resources (GOLD) were 51.5%, 35.4%, 61.7%, and 54.1%, respectively.

Why Gold Stocks Edged Higher after Rate Hike

After remaining subdued for the past few months, gold futures last week recorded their highest weekly gain of 2.4% since February 3.

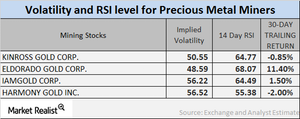

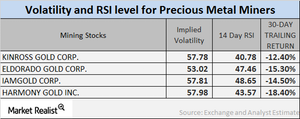

Understanding Mining Stock Volatility in March

Now that mining companies have begun witnessing revivals from their losses earlier this year, it becomes crucial to examine the volatility figures and RSI.

Mining Stock RSI levels: What the Indicators Suggest

NUGT and AGQ have seen YTD rises of 18.6% and 27.5%, respectively. But the volatility of such mining funds can be higher than that of precious metals.

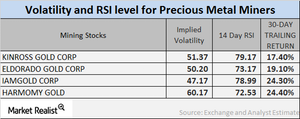

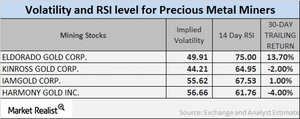

Reading Mining Companies’ Volatilities and RSI Levels

Mining companies’ volatilities are significant to the buying process. The mining shares we’ve selected in this article are Kinross Gold, Eldorado Gold, IAMGOLD, and Harmony Gold.

Analyzing Mining Stocks’ Volatility

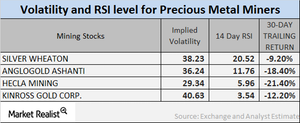

As of March 15, the volatilities of Silver Wheaton, AngloGold Ashanti, Hecla Mining, and Kinross Gold were 38.2%, 36.2%, 29.3%, and 40.6%, respectively.

Are Miners Rebounding from Last Week’s Slump?

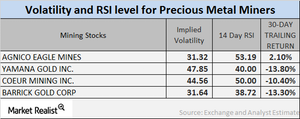

Monitoring the implied volatilities of large mining stocks is important. We should also watch their RSI (relative strength index) levels, particularly in the wake of changing precious metals prices.

How Precious Metals Have Performed amid Volatility

Precious metal mining stocks are known to closely track the performances of precious metals.

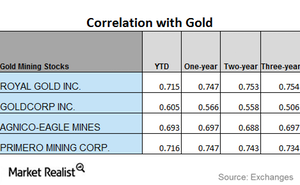

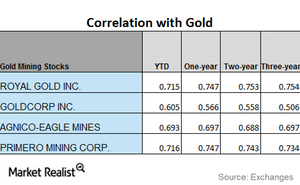

Mining Stocks: An Upward or Downward Correlation to Gold?

Agnico-Eagle Mines has the highest correlation to gold year-to-date. Primero Mining is the least correlated to gold.

Analyzing the Volatility of Miners in February 2017

Call implied volatility takes into account the changes in an asset’s price due to variations in the price of its call option.

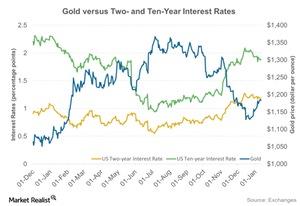

How Interest Rates Are Impacting Precious Metals

Many of the recent changes in precious metals have been determined by changes in the interest rates offered on US Treasuries.

Reading the Volatility Numbers for Mining Stocks

It’s important to monitor the implied volatilities and RSI levels of large mining stocks, particularly in the wake of the changes in precious metal prices.

Reading the Volatility and RSI Levels for Miners

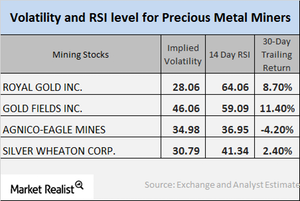

Precious metal mining stocks are known to closely track the performance of their respective precious metals. Mining stocks often show more volatility than metals.

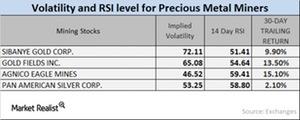

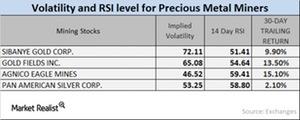

Volatility among the Miners in 2017

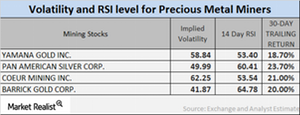

Sibanye Gold, Gold Fields, Agnico-Eagle Mines, and Pan American Silver had RSI levels of 51.4, 54.6, 59.4, and 58.8, respectively.

Why Mining Stocks Are Seeing Rising RSI Levels

In this part, we’ll look at the implied volatilities of large mining stocks and their RSI levels in the wake of precious metal prices.

What Are Miners’ Volatility and RSI Levels?

Precious-metal-based funds such as the ProShares Ultra Silver (AGQ) and the Direxion Daily Gold Miners (NUGT) have seen a revival in their price during the last month.

Analyzing Silver’s January Technicals

Among the other precious metals trading on the COMEX, silver shares for March expiration maintained an almost flat end to the day on January 11, 2017.

What Were Mining Stocks’ Correlations during December?

Precious metals had a great start to 2016. Franco-Nevada’s correlation rose from an ~0.59 three-year correlation to an ~0.63 one-year correlation.

Analyzing Mining Stocks’ Correlation in 2016

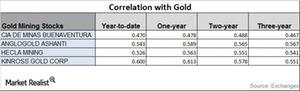

Mining companies that have high correlations with gold include Buenaventura (BVN), AngloGold Ashanti (AU), Hecla Mining (HL), and Kinross Gold (KGC).

Analyzing Upward and Downward Correlations among Miners

Precious metals had a great start to 2016, but they’ve been falling since Donald Trump won the US presidential election. As a result, mining stocks have also been falling.

Reading the Correlation of the Mining Stocks

Mining stocks and gold Although precious metals were doing well at the beginning of 2016, it’s important to know which mining stocks overperformed and underperformed precious metals. Precious metal prices have been falling since Donald Trump won the US presidential election on November 8, 2016. As a result, mining stocks have also been falling. Mining […]