Buffett versus Dalio on Gold: Whose Advice Should You Take?

When it comes to investing in stocks, Berkshire Hathway’s (BRK.A) chair, Warren Buffett, and Bridgewater’s founder, Ray Dalio, have similar advice.

Feb. 26 2019, Updated 4:50 p.m. ET

Buffett and Dalio on stock advice

When it comes to investing in stocks, Berkshire Hathway’s (BRK.A) chair, Warren Buffett, and Bridgewater’s founder, Ray Dalio, have similar advice. We said in Dalio and Buffett: What to Do When Stocks get Battered, that according to CNBC, Dalio and Buffett advise investors to keep calm and take a long-term view. Dalio believes that while it is tempting to sell when markets are falling, it may be better not to give into fear. Buffett has similar advice for investors in market meltdowns. He states that it is crucial for investors to not to look at markets and short-term fluctuations too closely, and instead hold investments for the long term for them to pay off.

Warren Buffett’s disdain for gold

While Buffett and Dalio share similar views as far as long-term stock investing is concerned, their opinions vary widely when it comes to gold. As we discussed in the previous part of this series, Buffett isn’t very fond of gold and has bashed the precious metal again and again. He thinks that the metal cannot return more than what stocks (SPY) return in the long run.

Ray Dalio’s love for gold

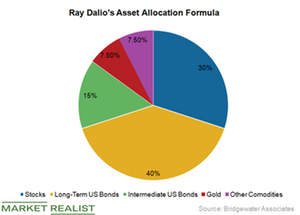

In contrast, Ray Dalio’s love for gold is well known. His hedge fund, Bridgewater Associates, maintained its stake in the SPDR Gold Shares ETF (GLD) and the iShares Gold Trust ETF (IAU) during the fourth quarter of 2018 at 3.91 million and 11.31 million shares, respectively. He also has exposure to gold players (GDX) such as Barrick Gold (GOLD), Goldcorp (GG), Kinross Gold (KGC), Franco-Nevada (FNV), and Newmont Mining (NEM).

Dalio also suggests buying gold for diversification and as an inflation hedge. He believes that because gold (NUGT) performs well when inflation (TIP) is high or growth is declining, it tends to diversify overall risk in your portfolio. He recommends that investors’ portfolios have a 5%–10% gold allocation. In a LinkedIn post last August, he wrote, “If you don’t have 5–10% of your assets in gold as a hedge, we’d suggest that you relook at this. Don’t let traditional biases, rather than an excellent analysis, stand in the way of you doing this.”

In the end, holding or not holding gold depends on investors’ risk appetite and the purpose of investment. Highly risk-tolerant investors might bypass gold and bear the uncertainties in hope of higher returns from stocks. If, however, investors would like to hedge their risks, gold could be an answer.

In the next part, we’ll see why central banks have been buying more gold than they have in the last 50 years.