Barrick Gold Corporation

Latest Barrick Gold Corporation News and Updates

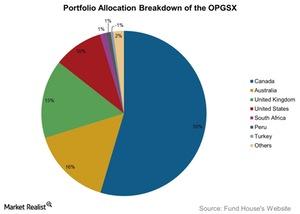

An Overview of OPGSX’s Precious Metal Holdings

OPGSX may also invest up to one-fifth of its portfolio directly into gold or silver bullion and other precious metals.

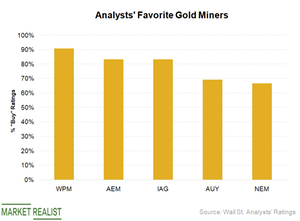

Which Gold Stocks Do Analysts Love and Hate?

Gold price’s reversal this year has created opportunities in gold stocks. The SPDR Gold Shares ETF (GLD) had gained 11% year-to-date as of Friday.

Gold Prices Soar: Which Stocks Do Analysts Favor?

Kirkland Lake is first among analysts’ favorite gold stocks with 91% “buy” and 9% “hold” ratings. The target price implies a potential upside of 16%.

Which Gold Miners Are Ray Dalio and John Paulson Betting On?

Hedge funds increased their net positions in the SPDR Gold Shares ETF during the first quarter.

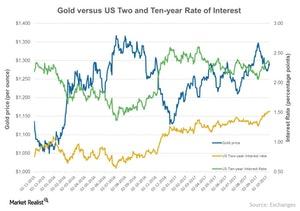

Why Jeffrey Gundlach Likes Gold

During DoubleLine’s investor webcast on June 13, Jeffrey Gundlach said, “I am certainly long gold.” His call on gold is based on his expectation that the US dollar (UUP) will finish lower this year.

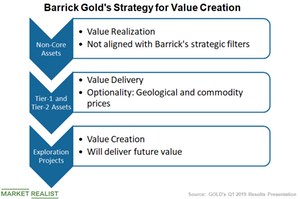

Barrick Gold’s Strategy for Creating Shareholder Value

The Barrick Gold (GOLD) and Randgold Resources combined company intends to achieve sector-leading (GDX) (JNUG) returns.

Which Gold Stocks Could Beat Analysts’ Earnings Expectations in Q1?

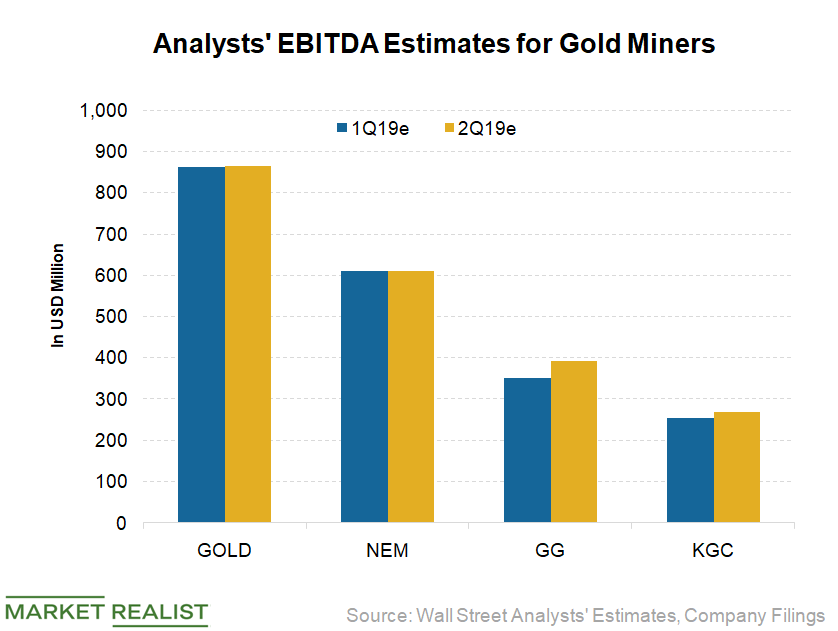

Many gold miners (RING) are set to release their first-quarter results shortly. Analysts expect Barrick Gold’s (GOLD) EBITDA to rise 6.2% YoY (year-over-year) in the first quarter.

The Five Gold Stocks Wall Street Is Loving Lately

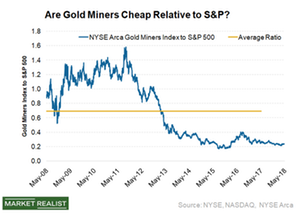

Gold miners usually act as a leveraged play on gold prices. In 2018, the VanEck Vectors Gold Miners ETF (GDX) fell 9.3%, amplifying the 1.9% fall in gold prices (GLD).

Which Senior Gold Miners Are Analysts Loving Lately and Why?

In this series, we’ll consider recommendations, target prices, estimates, and potential upsides and downsides for senior gold miners.

How Do Gold Miners’ Leverage Ratios Look?

Barrick has reduced its debt more than 57% in the last four years from $13.4 billion at the end of 2014 to $5.7 billion at the end of 2018.

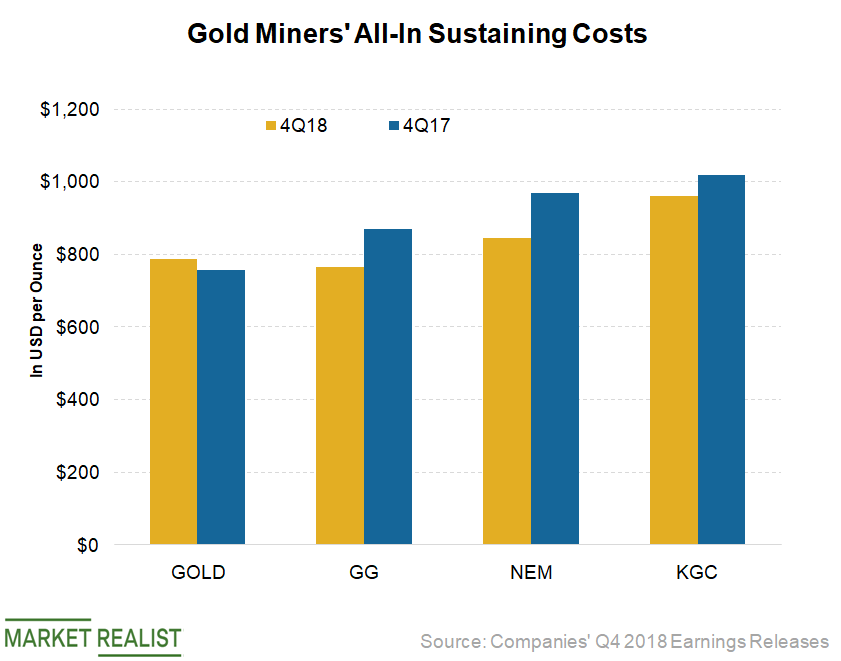

How Gold Miners’ Costs Stack Up

Barrick Gold (GOLD) reported AISC of $788 per ounce and a cost of sales of $980 per ounce in the fourth quarter.

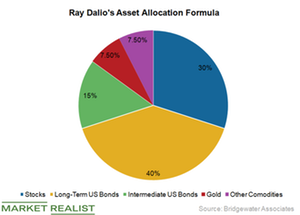

Buffett versus Dalio on Gold: Whose Advice Should You Take?

When it comes to investing in stocks, Berkshire Hathway’s (BRK.A) chair, Warren Buffett, and Bridgewater’s founder, Ray Dalio, have similar advice.

Can Newmont Mining Outperform Its Peers in 2019?

Newmont Mining (NEM) reported its fourth-quarter earnings results before the market opened on February 21.

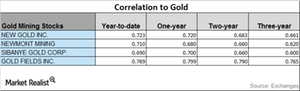

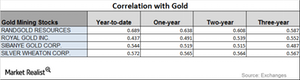

How Are Miners’ Correlations to Gold Trending?

Mining stocks tend to take their cues from gold.

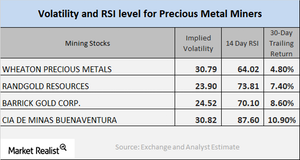

How Mining Stocks Have Performed in January So Far

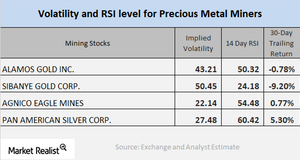

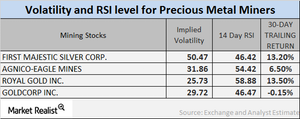

SLW, GOLD, ABX, and BVN have call implied volatilities of 30.8%, 23.9%, 24.5%, and 30.8%, respectively.

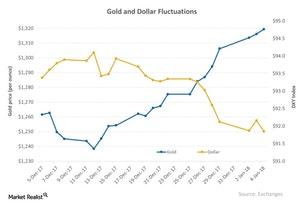

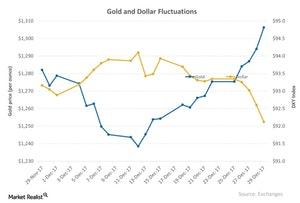

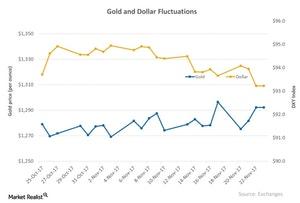

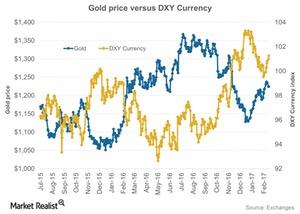

The Dollar and Its Relationship to Precious Metals

The US dollar rose 0.18% on Tuesday, January 9, 2018, which led to the lower price of spot gold (GLD) and silver.

Analyzing the Correlation between Miners and Gold in January

Most mining stocks have risen over the past one month due to the revival in gold prices.

Analyzing Precious Metals: Dollar Had Its Worst Year since 2003

Although most of the upswing in precious metals has been due to the rise in geopolitical risks in 2017, the dollar has been the most crucial factor.

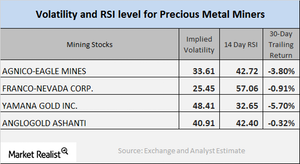

What Mining Stocks’ Indicators at the End of December Tell Us

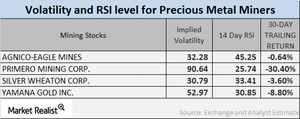

Agnico, Randgold, Yamana, and Barrick have call implied volatilities of 24.3%, 21.1%, 38.8%, and 22.8%, respectively.

All 4 Precious Metals Rose on December 20, 2017

All four precious metals had an up day on December 20, 2017. Gold increased 0.43% on the day and closed at $1,267.80 per ounce.

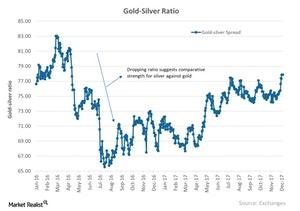

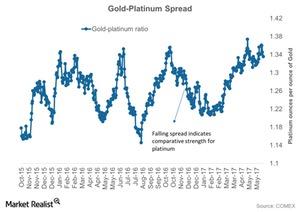

Where Are Precious Metal Spreads Moving?

In this part of the series, we’ll look at the gold-silver spread, the gold-platinum spread, and the gold-palladium spread.

A Brief Analysis of the Miners in November 2017

RGLD, GG, SBGL, and GOLD reported RSI levels of 52.5, 62.7, 49.2, and 81.4, respectively.

Is the Dollar-Gold Relationship Getting Stronger?

Precious metals have been closely associated with the movement of the US dollar over the last few months.

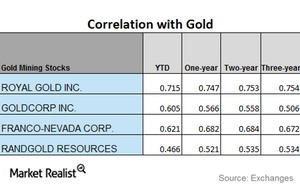

Comparing Miners’ Correlation with Gold

Correlation analysis Mining stocks’ performance usually depends on precious metal prices. Correlation analysis can give investors some perspective on how mining stocks relate to precious metals, especially gold. In this part of our series, we’ll look at four miners—Royal Gold (RGLD), Goldcorp (GG), Franco-Nevada (FNV), and Randgold Resources (GOLD)—and their correlation with gold. On Monday, the ETFS Physical […]

Who’s Pro Gold and Who’s Not?

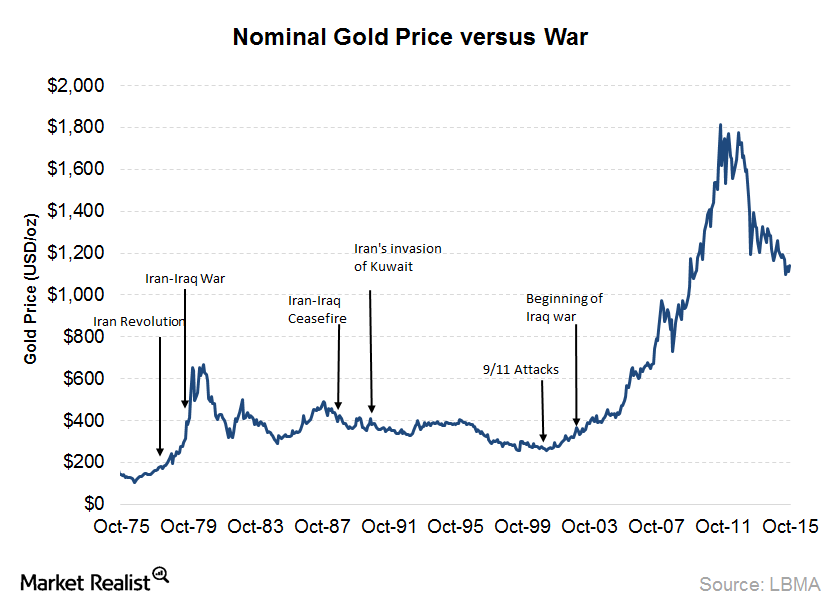

Geopolitical events like the tensions with North Korea helped drive the price of gold higher in September 2017.

Analyzing Gold’s Market Performance

Besides the impact of interest rates, there are also other global indicators that could play on precious metals—the most important being the US dollar.

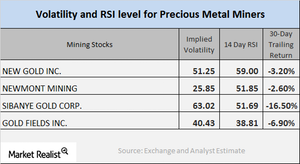

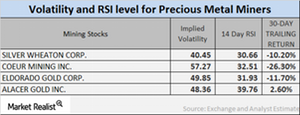

Mining Shares: RSI Numbers and Implied Volatility

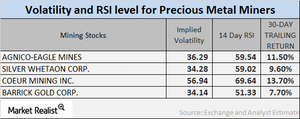

As of October 19, Sibanye Gold, Agnico Eagle Mines, Silver Wheaton, and Randgold Resources had implied volatility readings of 63%, 33.6%, 30.8%, and 25%.

Relative Strength Index Indicators of Mining Shares in October

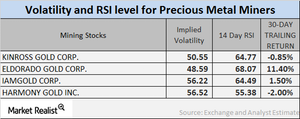

On October 11, 2017, Randgold Resources, Pan American Silver, Barrick Gold, and Kinross Gold had implied volatility readings of 25.0%, 34.0%, 29.1%, and 41.6%, respectively.

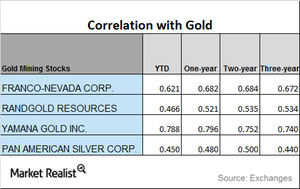

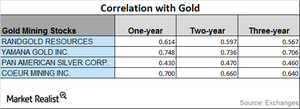

Reading the Correlation Analysis of Mining Shares in August 2017

Yamana Gold has the highest correlation with gold, while Pan American Silver has the lowest correlation.

Analyzing Miners’ Correlation in July 2017

Royal Gold’s correlation fell from a three-year correlation of ~0.75 and a year-to-date correlation of ~0.72 with gold.

Inside the Gold-Platinum Spread Now

The platinum industry is now headed for its third-straight year of surplus, likely due to the higher demand for petroleum-based cars.

Mining Stocks’ Relative Strength Index Hits Rock Bottom

The rise and fall of precious metals also significantly impact mining-based leveraged funds like the Direxion Daily Gold Miners (NUGT) and Proshares Ultra Silver (AGQ).

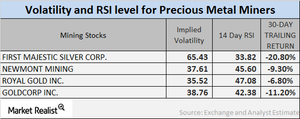

What’s the Volatility of Mining Stocks?

Though the precious metals survived the Fed’s interest rate hike, the miners took a hit. Most mining stocks saw a considerable down day on Wednesday.

Reading the Mining Stocks’ Falling RSI Numbers

Newmont Mining, Silver Wheaton, Randgold, and Yamana have RSI levels of 45.5, 37.1, 41.2, and 43.0, respectively.

How Are Mining Stocks Performing at the Start of April 2017?

As of April 4, 2017, the volatilities of New Gold (NGD), Agnico Eagle Mines (AEM), Silver Wheaton (SLW), and Randgold Resources (GOLD) were 51.5%, 35.4%, 61.7%, and 54.1%, respectively.

How Did Mining Stocks Correlate with Gold in March 2017?

Yamana’s correlation with gold has increased from a three-year correlation of ~0.74 to a one-year correlation of ~0.80.

Mining Stock RSI levels: What the Indicators Suggest

NUGT and AGQ have seen YTD rises of 18.6% and 27.5%, respectively. But the volatility of such mining funds can be higher than that of precious metals.

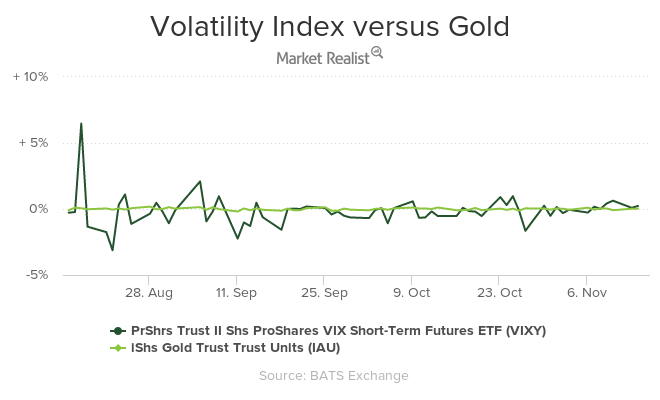

How Precious Metals Have Performed amid Volatility

Precious metal mining stocks are known to closely track the performances of precious metals.

Analyzing the Upward-Downward Correlation of Precious Metals

Mining companies with high correlations to gold include Randgold Resources (GOLD), Yamana Gold (AUY), Pan American Silver (PAAS), and Coeur Mining (CDE).

Why Gold and the US Dollar Are Moving in Opposite Directions

Gold prices tumbled on Tuesday, February 14, as the US dollar rose after the US Federal Reserve chair, Janet Yellen, seemed optimistic about raising interest rates.

Understanding the Correlation of Mining Stocks in 2017

Precious metal prices have been falling since Trump won the US Presidential election on November 8, 2016. Mining stocks quickly followed suit.

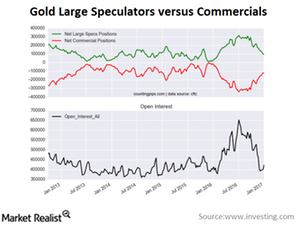

Reading Speculators’and Hedgers’ Positions in Gold

Large speculators and traders continued to reduce their bullish net positions in gold futures markets last week for the eighth consecutive week.

How the Threat of War Affects Gold Prices

Gold’s safe haven appeal might lead investors to gold and other precious metals in terms of heightened geopolitical tensions and war.

Do Falling Gold Prices Mean More Mergers Are in the Cards?

Gold touched its lowest level on July 24. Its price fell to $1,073.70. Miner ETFs have suffered more than gold prices themselves.