How Gold Miners’ Costs Stack Up

Barrick Gold (GOLD) reported AISC of $788 per ounce and a cost of sales of $980 per ounce in the fourth quarter.

March 14 2019, Published 1:59 p.m. ET

All-in sustaining costs and gold miners

AISC (all-in sustaining costs) is an encompassing measure that helps investors compare performances of gold miners. It also helps gauge a company’s margin cushion at prevailing gold prices (GLD) (IAU).

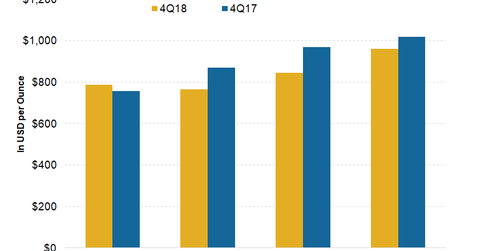

Barrick Gold (GOLD) reported AISC of $788 per ounce and a cost of sales of $980 per ounce in the fourth quarter. The company’s AISC was 4.2% higher YoY due to lower ounces sold. The company is still the lowest-cost senior gold producer. GOLD has guided for an AISC of $870–$920 per ounce for 2019. At the midpoint, the guidance implies a rise of 11% for 2019. In the long term, due to its merger with Randgold Resources, GOLD’s costs per unit are expected to fall.

GG and NEM

Goldcorp’s (GG) AISC for the fourth quarter came in at $765 per ounce, a decline of 12% as compared to costs in Q4 2017. The company is guiding for AISC of between $750 and $850 per ounce in 2019. After its merger completion with Newmont Mining (NEM), the combined company is expected to give updated guidance.

Newmont Mining’s (NEM) AISC for the fourth quarter was $845 per ounce, which implies a fall of 9% compared to the same quarter last year. The lower costs were due to higher ounces sold and lower sustaining capital. It expects its 2019 AISC to be $935 per ounce, higher than the $909 per ounce achieved in 2018.

Kinross Gold’s costs to worsen

Kinross Gold (KGC) reported AISC of $961 per ounce in the fourth quarter, reflecting a decline of 5.7% YoY. Its AISC for 2018 was $965 per ounce, which reflects an increase of 1.1%. The company has guided for AISC of $995 per ounce with a variance of 5% to either side for 2019. This is higher than Kinross’s actual AISC of $965 for 2018.

As we’ve seen, Barrick Gold’s unit costs have risen. However, it’s still among the lowest cost producers of precious metals. Its unit costs are in the first quarter of the industry’s cost curve. For any given gold price, it could make the most money if other factors remain constant.