SSgA SPDR Gold Shares

Latest SSgA SPDR Gold Shares News and Updates

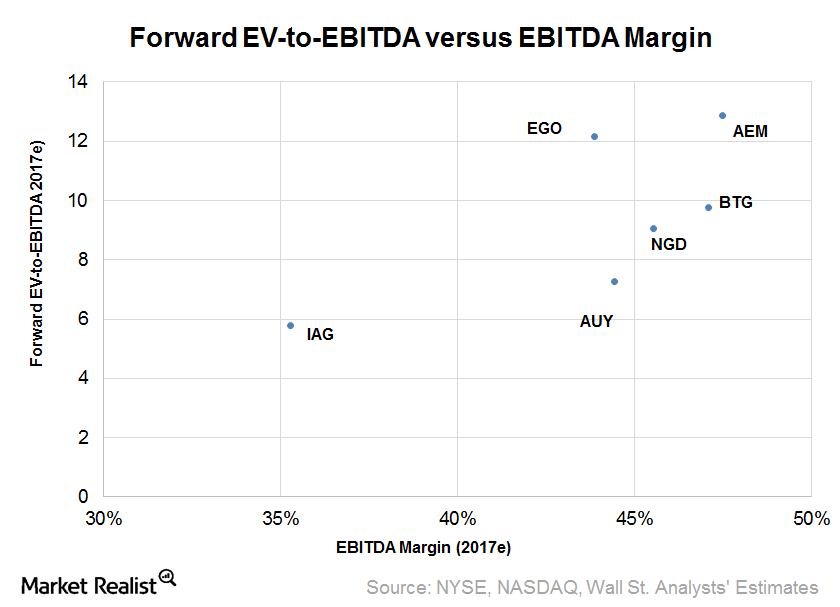

What Could Drive IAMGOLD Corp.’s Valuation Going Forward?

IAG stock could continue to gain traction due to its high operational leverage, at least as long as the upward trend in gold prices continues.

Gold Prices Have Been Flat despite the Weak Dollar

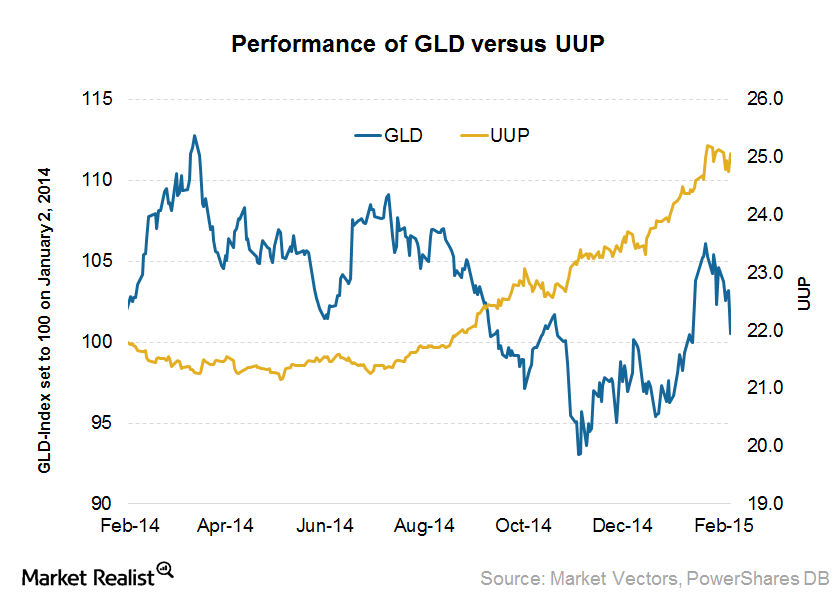

Gold (IAU) (GLD) prices usually have a strong negative correlation with the US dollar (UUP). Gold, like other commodities, is denominated in the dollar.

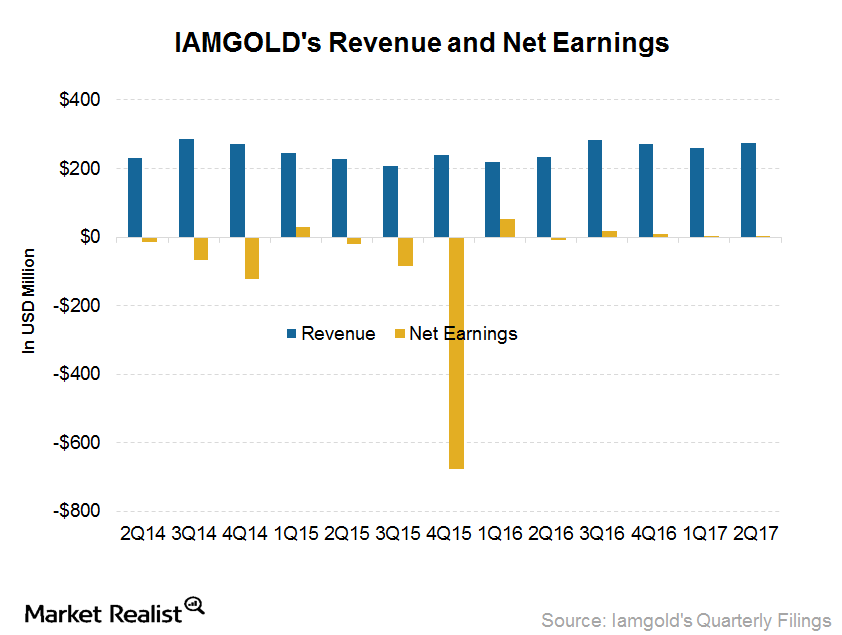

Understanding IAMGOLD’s 2Q17 Earnings Highlights

IAMGOLD’s (IAG) 2Q17 production was 223,000 ounces of gold—growth of 26,000 ounces or 13% year-over-year (or YoY).

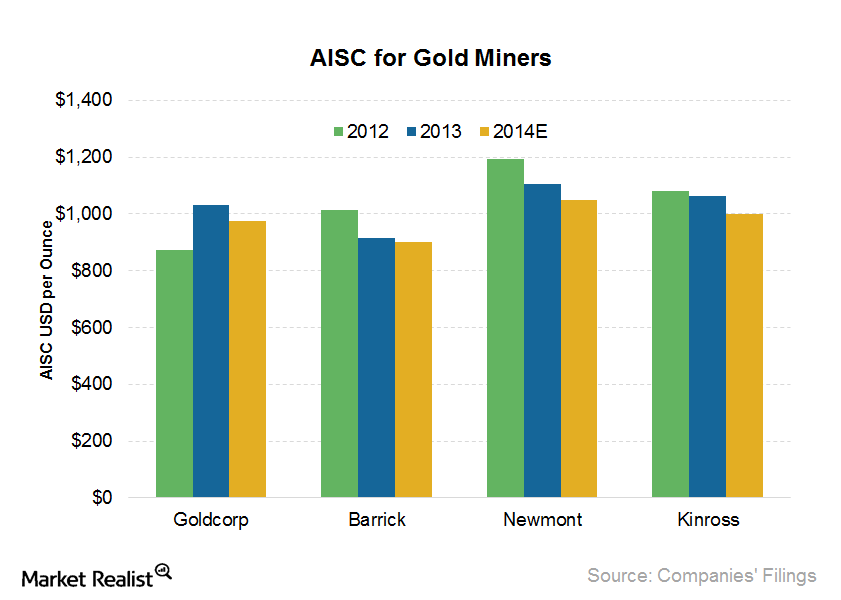

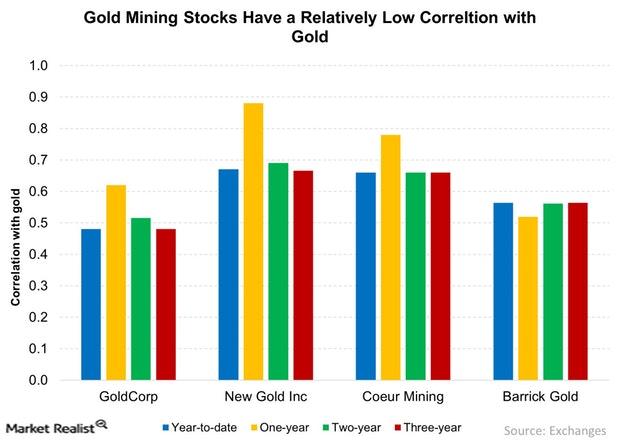

Goldcorp’s cost reduction compared to its peers

Goldcorp’s (GG) all-in sustaining costs (or AISC) are falling. In 2013, its AISC was $1,031 per ounce. It expects the AISC to be in the range of $950–$1,000 for 2014.

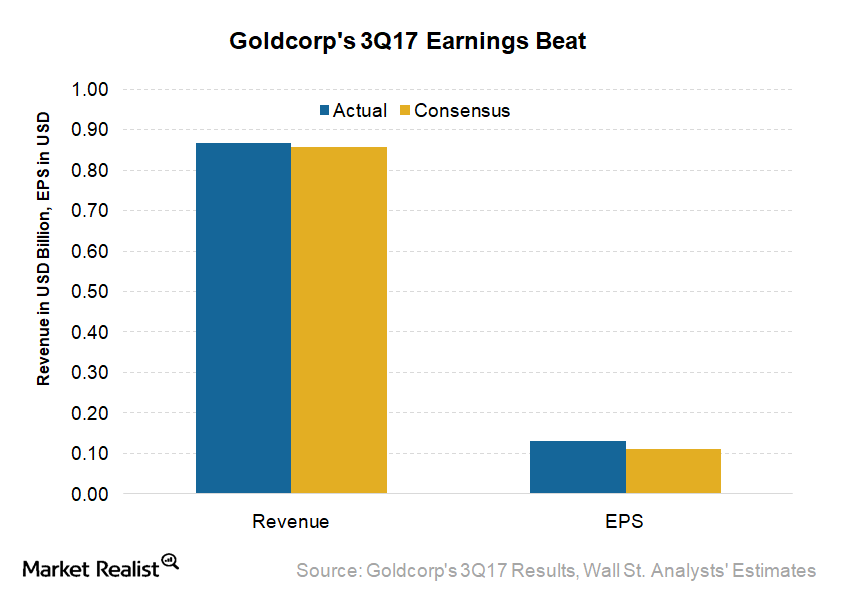

Key Insights from Goldcorp’s 3Q17 Earnings

Goldcorp (GG) reported its 3Q17 results after the market closed on October 25, 2017. It reported EPS (earnings per share) of $0.13, which beat analysts’ expectations by $0.02.

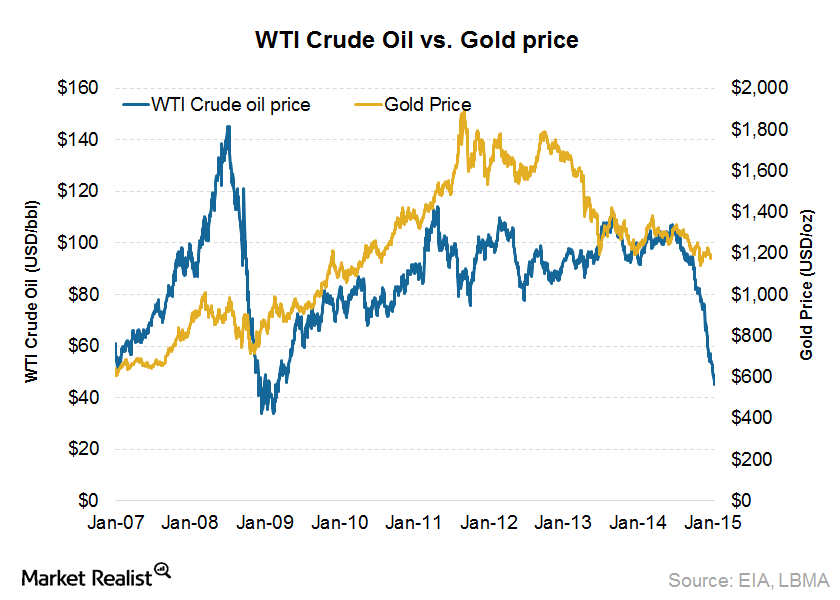

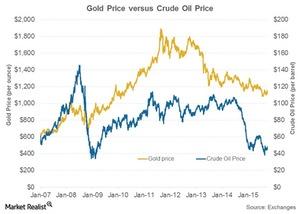

Low crude oil prices impact gold

Cheaper oil means lower inflation. This means gold should be affected negatively since it’s usually considered a hedge against inflation.

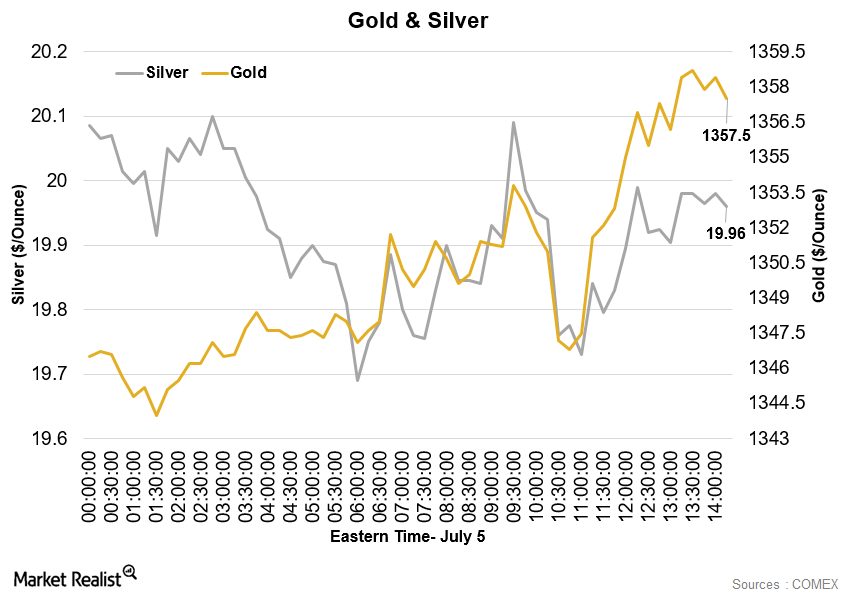

Gold Rose amid Increased Demand for Safe-Haven Assets

These economic concerns and monetary stimulus expectations have decreased the probability of an interest rate hike by the US Federal Reserve, and the chances of an interest rate hike in July dropped to zero.

Assessing variables that drive the outlook for gold prices

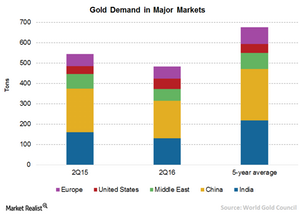

Physical buying from China and India should support the demand for gold. But a rate hike by the Fed could be the catalyst that could take gold down.

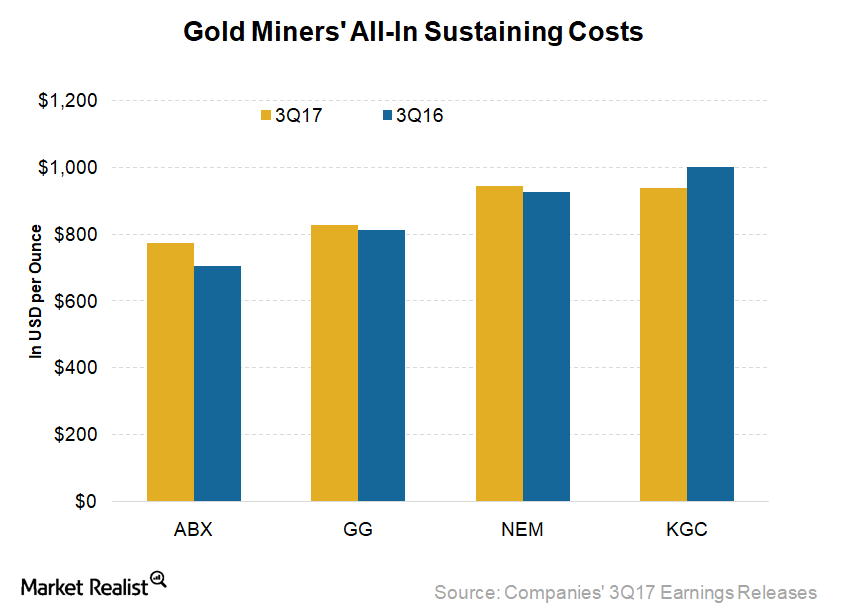

These Gold Miners Surprised Us with Unit Costs in 3Q17

AISC (all-in sustaining costs) are an encompassing measure that helps compare miners’ performance—a vital metric for investors. They show the company’s margin cushion at prevailing gold prices (GLD)(IAU).

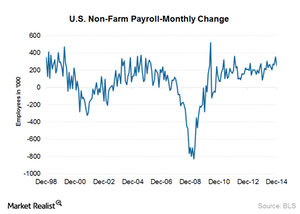

How US labor conditions impact gold investors

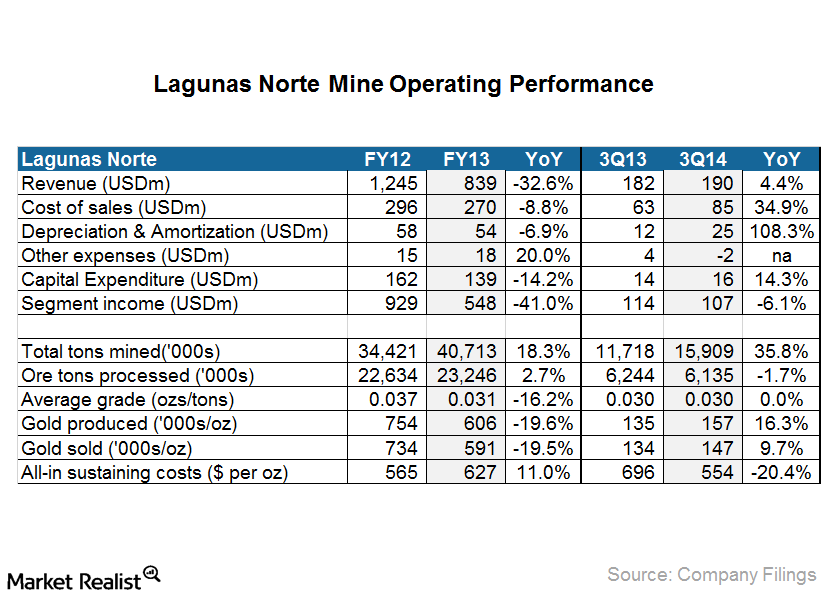

It’s important to keep an eye on labor conditions since they offer a look at the future direction of gold prices and ultimately gold-backed ETFs.Materials Lagunas Norte: Increasing Barrick’s cost per unit

Lower ore grade increases the amount of waste stripping required—in order to extract some volume of ore—as a result of mining more tons of waste.

Once Again, Soros Makes Money off the UK’s Woes

Four days before the UK (EWU) decided to leave the European Union (VGK), Soros warned the markets of a “Black Friday” and a crash in the pound.

What Are Leon Cooperman’s Top Holdings?

In Q3 2020, billionaire investor Leon Cooperman’s top five holdings were Fiserv, Mr. Cooper Group, Alphabet, Cigna, and Trinity Industries.

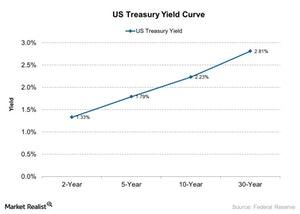

Gundlach on Higher Yield: Watching the Copper-to-Gold Ratio

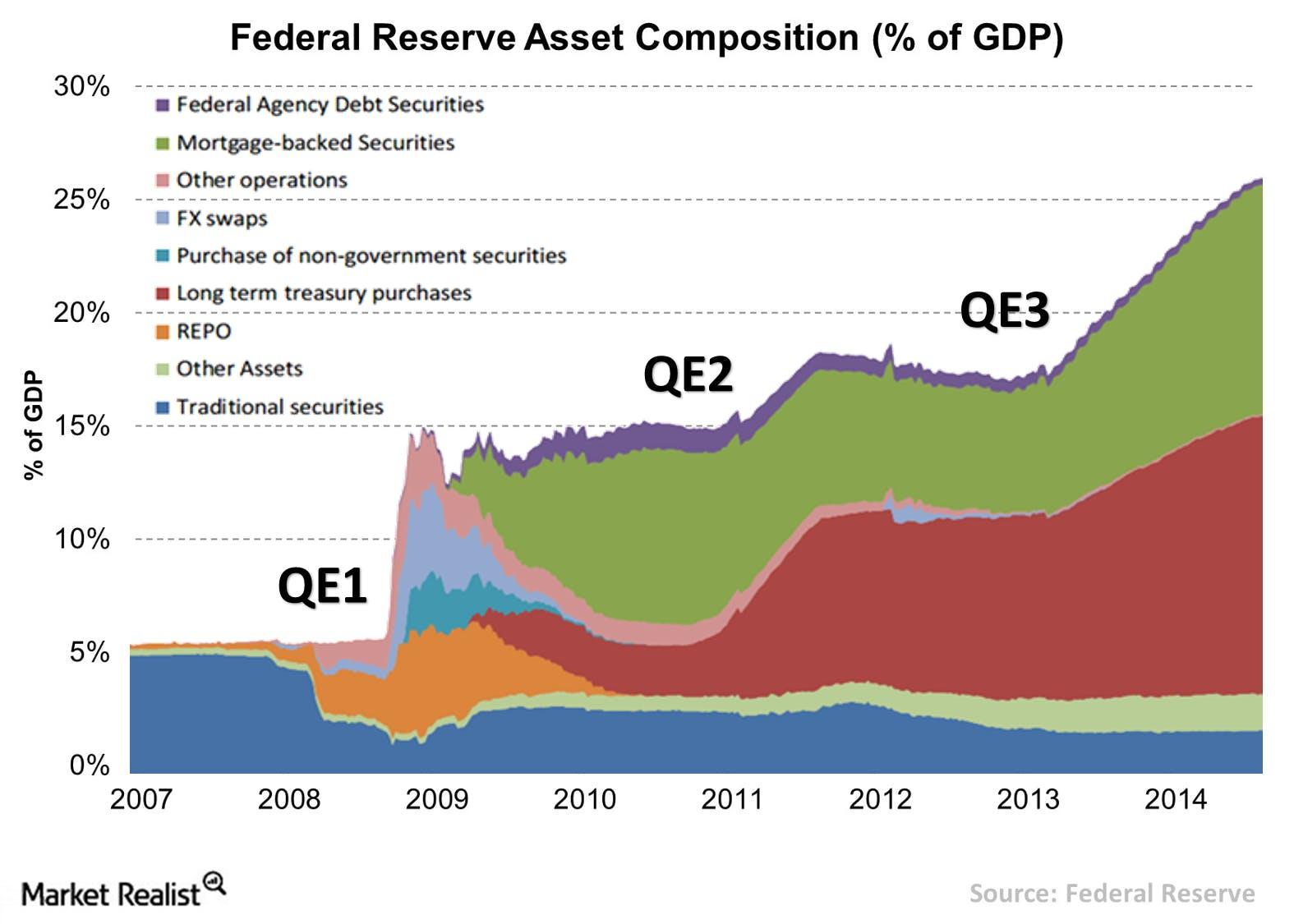

Billionaire investor and bond guru Jeffrey Gundlach also shared his view on bond yields in an interview with CNBC.Must-know: Why the Fed drove up emerging market asset prices

Many economists, like the Nobel Prize–winning Paul Krugman, believe that the Fed acted as a “white knight” in 2008, saving the global economy in the dire aftermath of the financial crisis.

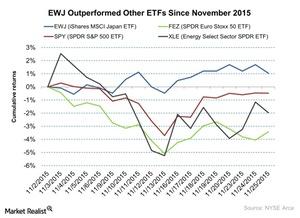

Overall Snapshot of the Market on November 25

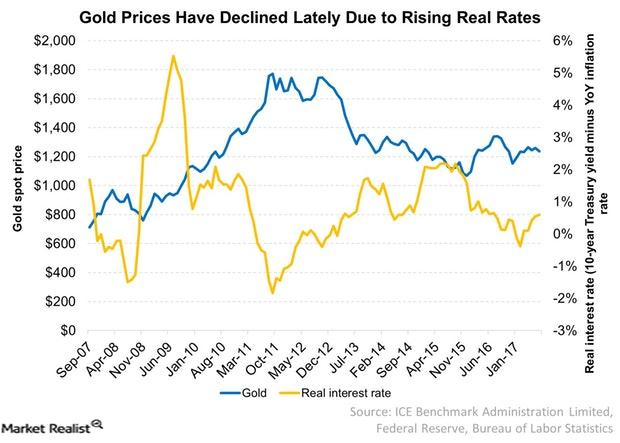

On November 25, the SPDR S&P 500 ETF closed on a flat note ahead of the holiday. It closed at $209.3. The Energy Select Sector SPDR ETF fell by 0.81% on the day.Materials Why an increase in real interest rates makes gold lose its sheen

Gold doesn’t give any returns besides appreciation. Appreciation doesn’t always happen. As a result, gold has to compete against assets that yield something. When the return on the alternate assets begins to rise, the demand for gold falls. In a scenario where the real interest rates are rising continuously, the demand for gold—as an investment—will start falling.

Which Gold Stocks Do Analysts Love and Hate?

Gold price’s reversal this year has created opportunities in gold stocks. The SPDR Gold Shares ETF (GLD) had gained 11% year-to-date as of Friday.

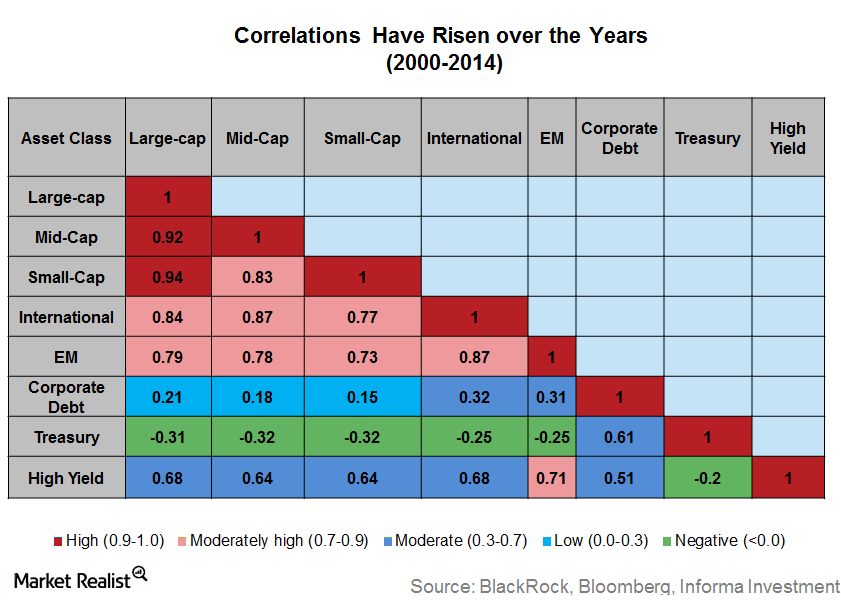

Diversify Broadly and Consider Alternative Investments

Rising correlation across asset classes is a sticky problem that investors face while investing in today’s markets.

Can Management Changes Break Gold’s Price Ceiling?

The gold mining industry is on a track to reverse its traditional method of mining to generate better shareholder returns.Materials Must-know: Why US debt to GDP and gold price move together

Debt to gross domestic product (or GDP) is the ratio that shows how much a country owes versus how much it earns. Investors use this ratio to measure a country’s ability to make future payments on its debt. This impacts the country’s borrowing costs and government bond yields.

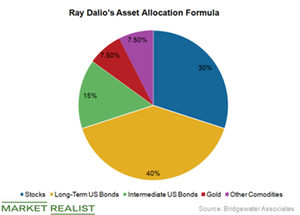

Ray Dalio Increased His Bets on Gold during Q1

Ray Dalio increased Bridgewater Associates’ stake in the SPDR Gold Shares (GLD) and the iShares Gold Trust ETF (IAU).

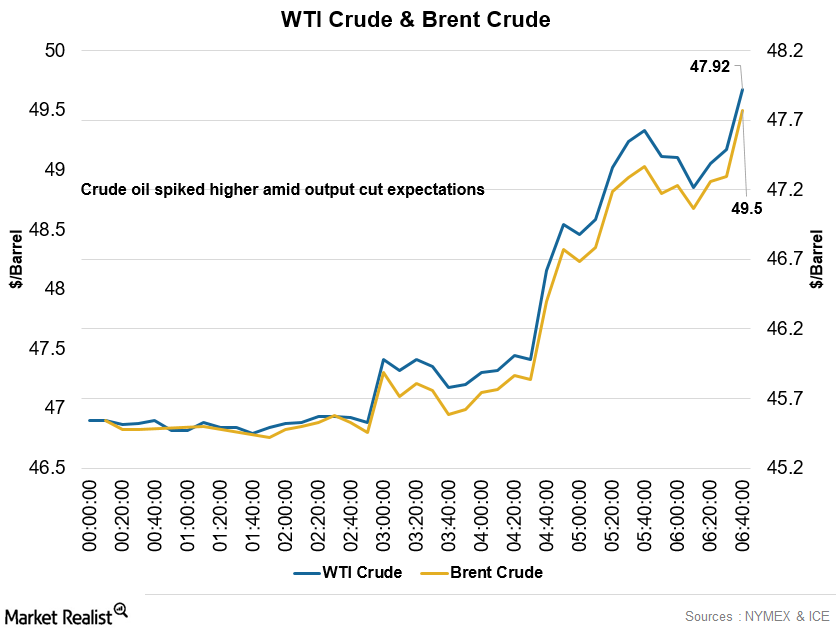

Crude Oil Rose, Copper and Gold Were Weaker in the Early Hours

At 5:35 AM EST, the West Texas Intermediate crude oil futures contract for January 2017 delivery was trading at $47.91 per barrel—a rise of ~5.9%.

How Gold Miners Could Benefit from Deregulation

A record number of junior companies attended the Precious Metals Summit. We are finding companies with attractive development projects in North America and West Africa as well as some exciting discoveries that merit watching.

Gold Prices Soar: Which Stocks Do Analysts Favor?

Kirkland Lake is first among analysts’ favorite gold stocks with 91% “buy” and 9% “hold” ratings. The target price implies a potential upside of 16%.

Why Are Gold ETFs Losing Their Allure?

With declining gold prices, the most famous gold ETF, the SPDR Gold Shares ETF (GLD), has also lost its allure. It’s trading at lower volume.

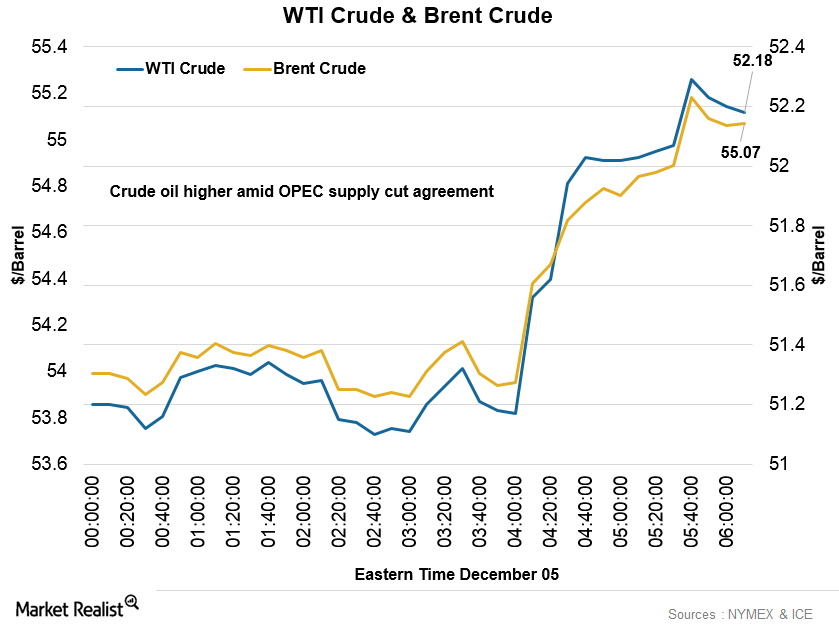

Why Did Crude Oil Prices Hit a 16-Month High?

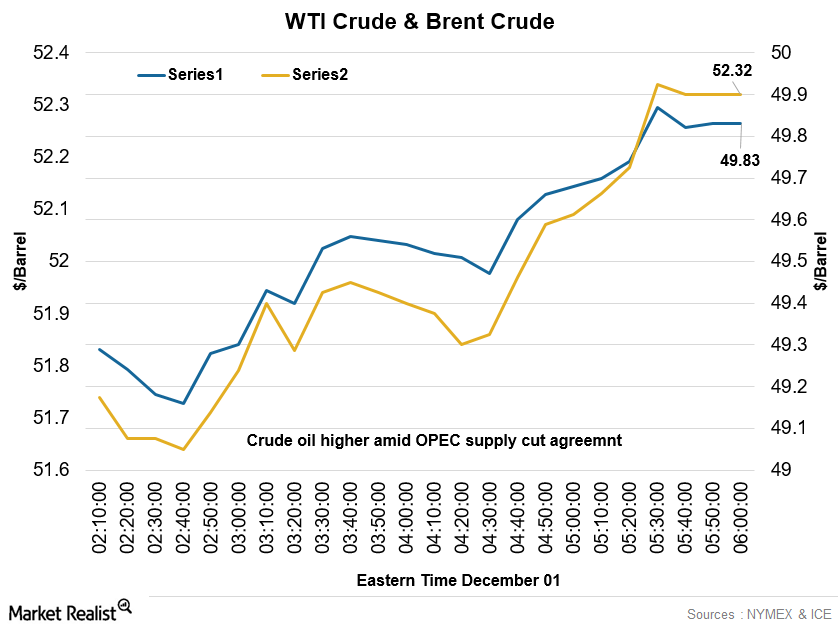

At 5:45 AM EST on December 5, the WTI crude oil futures contract for January 2017 delivery was trading at $52.18 per barrel—a rise of ~0.97%.

Foreign Exchange and Fuel Tailwinds Could Help Newmont in 1Q15

Investors should watch out for any tailwinds or headwinds that could impact Newmont’s costs in 1Q15.

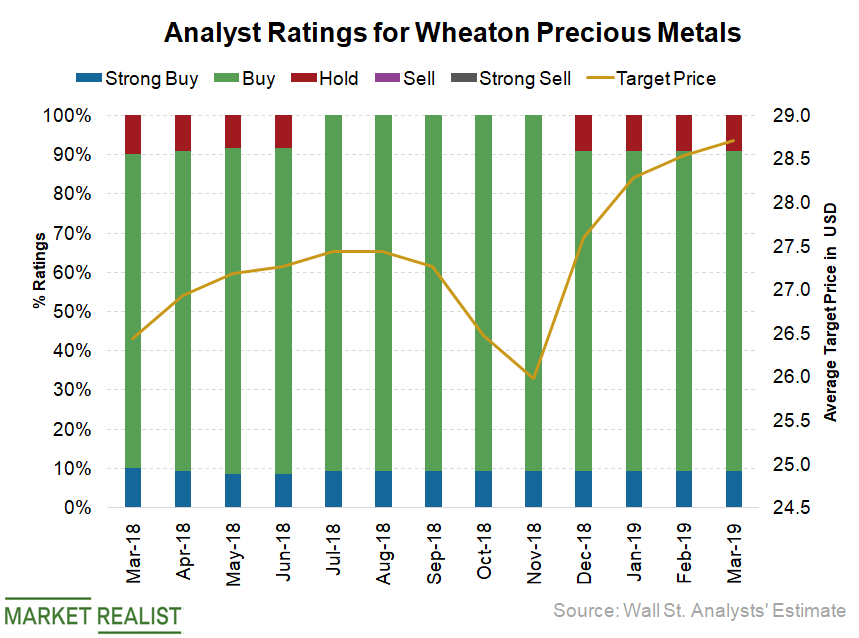

Why Wheaton Precious Metals Is Still Analysts’ Top Gold Bet

Among major gold (GLD)(IAU) mining and gold streaming companies (GOAU), Wheaton Precious Metals (WPM) is analysts’ favorite and has received the most “buy” recommendations at 91%.

Lagunas Norte: AISC down due to lower sustaining capex

All-in sustaining costs (or AISC) came in at $554 per ounce, a reduction of $142 per ounce from the same period last year. The reduction was mainly due to lower sustaining capital expenditure (or capex).

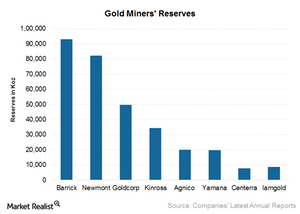

Must Know: An Overview of Kinross Gold Corp.

In this series, we’ll analyze the various business aspects of Kinross Gold. We’ll also look at various key drivers that impact Kinross’s investors.

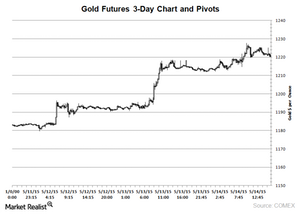

Gold Prices Extend Rally on Depreciating Dollar

This is the fifth up day for gold prices in the last ten days. Prices increased by 0.72% more on the average up days than on the average down days over the last ten trading sessions.Materials Why gold and the US dollar have an inverse relationship

Gold and the U.S. dollar were associated when the gold standard was being used. During this time, the value of a unit of currency was tied to the specific amount of gold. The gold standard was used from 1900 to 1971. The separation was made in 1971. The U.S. dollar and gold were freed. They could be valued based on supply and demand.

Crude Oil Continued to Rise, OPEC Agreed to the Supply Cut

At 5:45 AM EST, the WTI crude oil futures contract for January 2017 delivery was trading at $49.88 per barrel—a rise of ~0.89%.

How Strict Is the Gold-Regulated Market?

Bitcoin (ARKW) has seen its price plunge since the start of 2018 due to news that world leaders are planning to implement regulations on digital currencies.

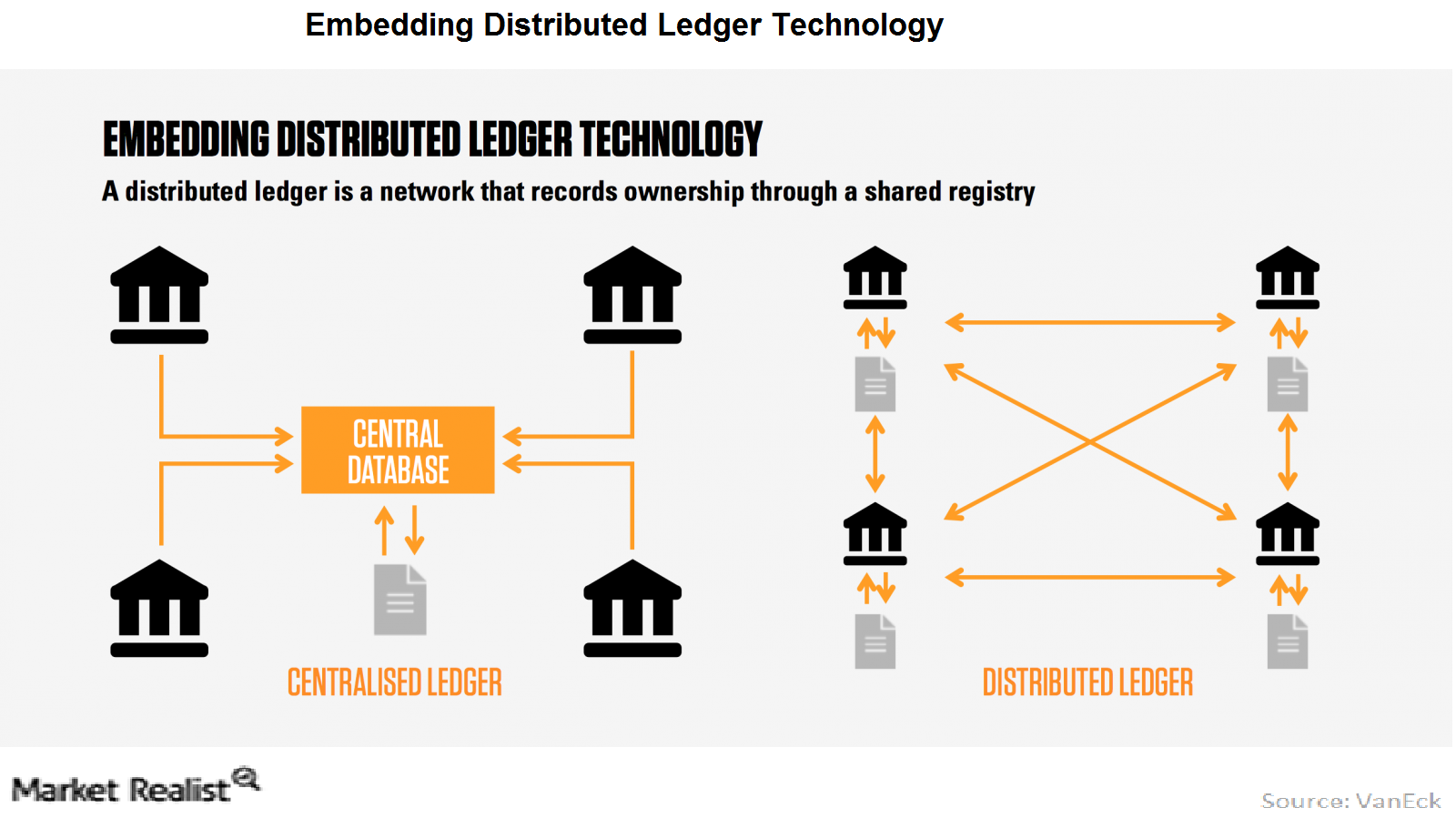

Why Distributed Ledger Technology Is Game Changing

A distributed ledger is a database of transactions held and updated in decentralized form across different locations.

The Re-Emergence of Seasonal Gold Demand Trends

With selling pressure removed, normal gold demand trends may re-emerge Historically, there is a seasonal pattern to gold prices dependent on physical demand trends. Often, there is weakness in the summer when jewelry demand, primarily from China and India, is low and trading volumes decline. Seasonal strength often occurs from August to January, beginning with […]

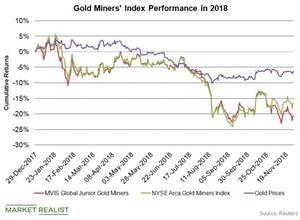

How Gold Stocks Have Performed This Year

Gold and gold miners didn’t start off the year on a good note.

Investing in gold? Watch the US Dollar Index

Tracked by the Federal Reserve, the weekly US Dollar Index measures the value of the dollar compared to the currencies of its significant trading partners.

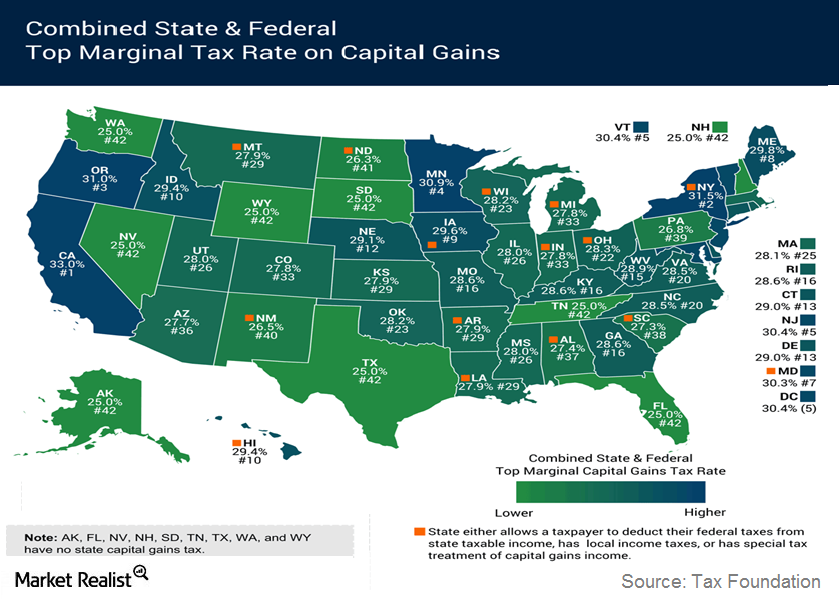

Basics About The Capital Gains Tax

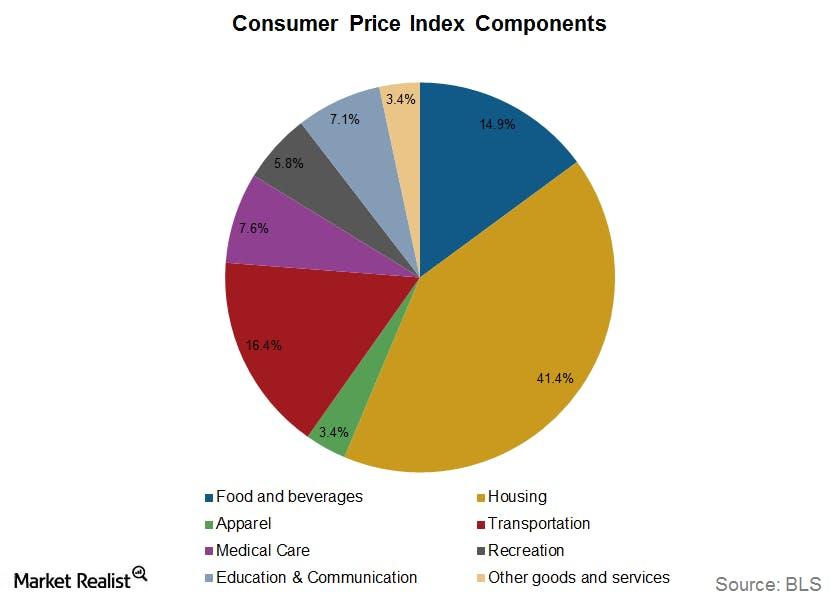

The rates for capital gains tax depend on the asset’s holding period. If the holding period is less than one year, short-term capital gains tax is payable.Must-know fundamentals about the US Consumer Price Index

The Bureau of Labor Statistics (or BLS) developed the U.S. CPI in 1913 to measure the change in prices.

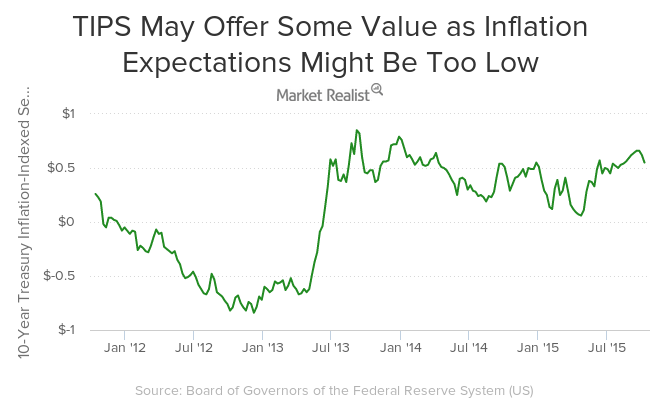

Why Treasury Inflation-Protected Securities May Offer Some Value

TIPS may offer some value as inflation breakeven seems modest. TIPS provide investors a hedge against inflation just like gold (GLD) and other commodities (DBC).

Will a Rate Hike Pull the Lid off Gold?

Though an increase in rates may initially dim the luster of the metal, after the hike, gold may soar, uninterrupted by looming fears.

Goldman Sachs and Gundlach See Upside in Gold Prices

Gundlach is bullish on gold. He expects the metal to reach new highs. His bullishness for gold also stems from his bearishness for the US dollar.

Gold Prices: Undervaluation, Smart Money Piles Up

Since March, gold prices are on a tear due to uncertainty surrounding COVID-19. The SPDR Gold Shares has seen gains of 16.2% since March 18.

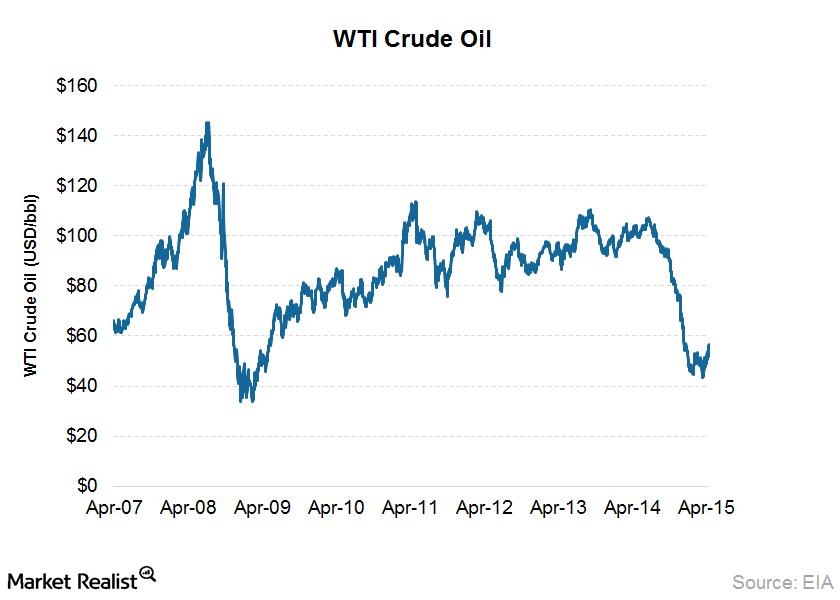

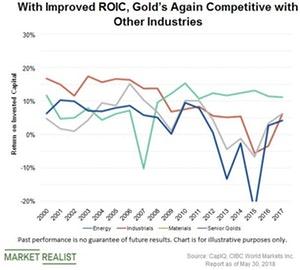

How Gold Mining Industry Has Revived Itself

The last ten years have been a roller coaster ride for the gold (GLD) (GDXJ) (GDX) mining industry.

How to Hedge Against the US-China Trade War

The US-China trade war escalated very quickly this month. This has caused global equities to plunge and safe havens like gold and treasuries to surge.

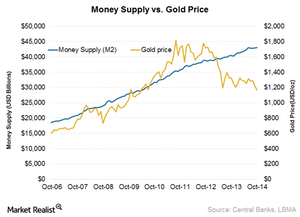

Price of gold relates to growth of global money supply

When money supply growth is used to prop up the financial and economic system instead of fuel strong economic growth, the price of gold relates to growth of the money supply.Financials GG’s merger and acquisition strategy is different than its peers

Although every gold miner talks about only doing merger and acquisition (or M&A) strategies that are in shareholders’ best interests, GG sticks to its strategy—unlike most of its peers.Financials Hawks and doves: Why Fed-watching isn’t for the birds

The FOMC is made up of hawks and doves, and their balance could affect future policy. Investors who follow the Fed need be able to tell the differences.