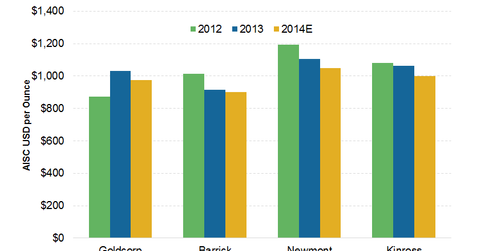

Goldcorp’s cost reduction compared to its peers

Goldcorp’s (GG) all-in sustaining costs (or AISC) are falling. In 2013, its AISC was $1,031 per ounce. It expects the AISC to be in the range of $950–$1,000 for 2014.

Dec. 4 2020, Updated 10:53 a.m. ET

Goldcorp compared to its peers

Goldcorp’s (GG) all-in sustaining costs (or AISC) are falling. In 2013, its AISC was $1,031 per ounce. It expects the AISC to be in the range of $950–$1,000 for 2014. There are many factors that help Goldcorp reduce its costs.

New low-cost mines

Goldcorp has three new mines. Their costs are lower compared to the company’s overall costs. This should lower Goldcorp’s costs per ton going forward.

High grading and divestiture

Goldcorp reduced its costs for last few quarters by high grading some of its mines. It changed the plan for the Peñasquito mine. Goldcorp reduced the life of the mine from 19 to 13 years. However, it increased the mine’s cash flow.

High grading also leads to less overburden and waste removal. This lessens stripping costs—costs associated with removing overburden and waste.

Barrick Gold (ABX) reduced its costs by mainly selling high-cost mines, deferring capex on Pascua-Lama, and reducing sustaining capex.

Goldcorp divested its interests in the Marigold mine and Primero Mining Corporation (PPP). This led to portfolio optimization. Marigold’s high-cost tons were dragging the whole cost structure down. This should normalize to some extent.

Cost guidance is lower

However, Goldcorp isn’t the only gold mining company that’s on a cost-cutting spree. Most senior gold miners guided for lower AISC for 2014—compared to 2013. Goldcorp guided for AISC of $950–$1,000 per ounce for 2014. This compares with Barrick’s guidance for $880–$920 per ounce, Newmont Mining’s (NEM) $1,075–$1,175 per ounce, and Kinross Gold’s (KGC) $950–$1,050 per ounce.

Miners are decreasing costs like sustaining capital and exploration budgets. Mines have been closed or idled. Mines also completed high grading.

Exchange-traded funds (or ETFs)—like the SPDR Gold Trust (GLD)—that track spot gold prices are also a good way to invest in gold. The VanEck Vectors Gold Miners Index (GDX) replicates the NYSE Gold Mining Index. It’s a good way to invest in major and intermediate gold stocks.