Kinross Gold Corp

Latest Kinross Gold Corp News and Updates

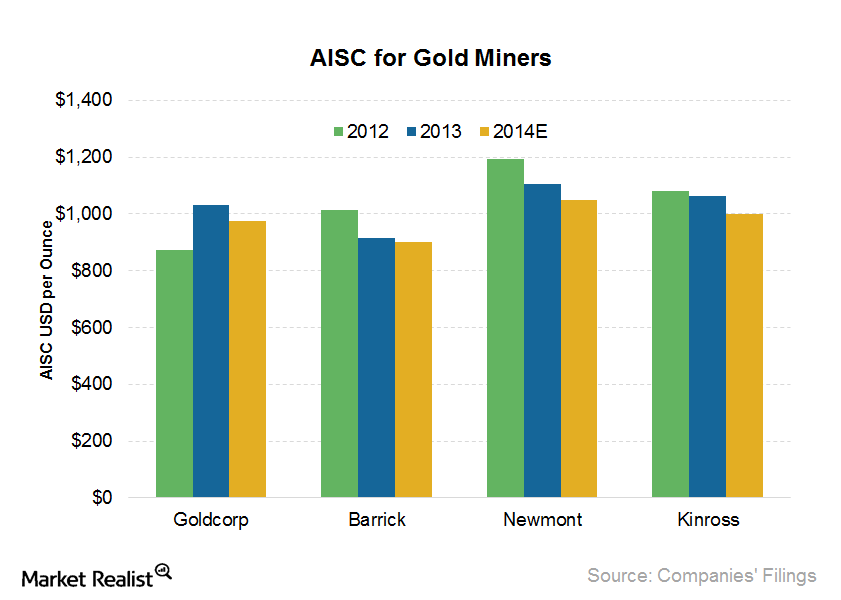

Goldcorp’s cost reduction compared to its peers

Goldcorp’s (GG) all-in sustaining costs (or AISC) are falling. In 2013, its AISC was $1,031 per ounce. It expects the AISC to be in the range of $950–$1,000 for 2014.

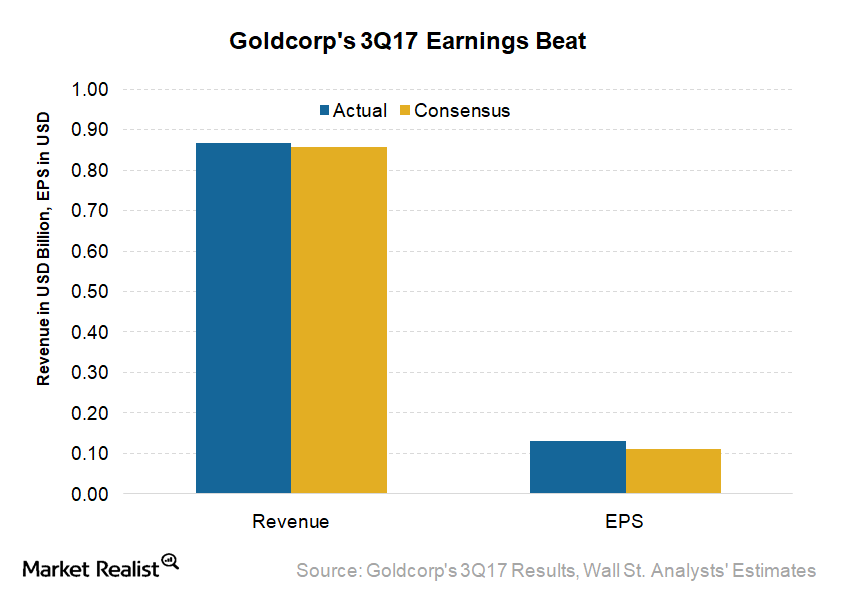

Key Insights from Goldcorp’s 3Q17 Earnings

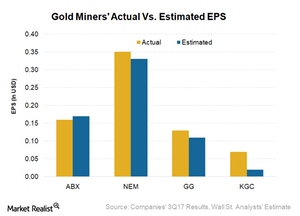

Goldcorp (GG) reported its 3Q17 results after the market closed on October 25, 2017. It reported EPS (earnings per share) of $0.13, which beat analysts’ expectations by $0.02.

Assessing variables that drive the outlook for gold prices

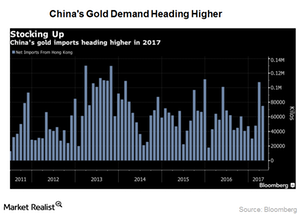

Physical buying from China and India should support the demand for gold. But a rate hike by the Fed could be the catalyst that could take gold down.

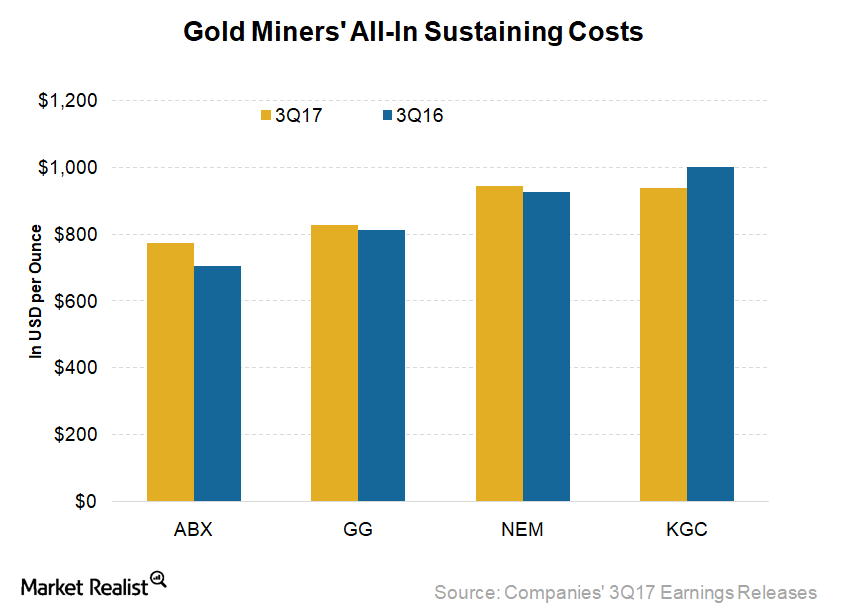

These Gold Miners Surprised Us with Unit Costs in 3Q17

AISC (all-in sustaining costs) are an encompassing measure that helps compare miners’ performance—a vital metric for investors. They show the company’s margin cushion at prevailing gold prices (GLD)(IAU).

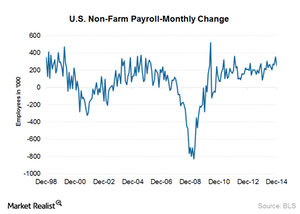

How US labor conditions impact gold investors

It’s important to keep an eye on labor conditions since they offer a look at the future direction of gold prices and ultimately gold-backed ETFs.

How Do US Economic Numbers Play on Gold?

Economic data from the United States on Tuesday, July 21, 2016, on home starts and building permits affected gold and other precious metals to a certain extent.

Which Gold Miners Could Offer Valuation Upsides after Q2 2018?

The average ratio of the NYSE Arca Gold Miners Index and the S&P 500 Index (SPY) is 0.18 compared to the ten-year average of 0.68.

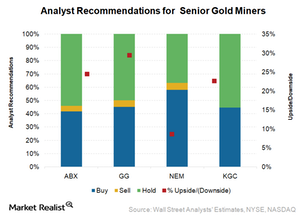

Which Senior Gold Miners Are Analysts Betting On?

As a group, the average gains of North American senior gold miners (GDX) (RING) have been muted.

Which Gold Stocks Do Analysts Love and Hate?

Gold price’s reversal this year has created opportunities in gold stocks. The SPDR Gold Shares ETF (GLD) had gained 11% year-to-date as of Friday.

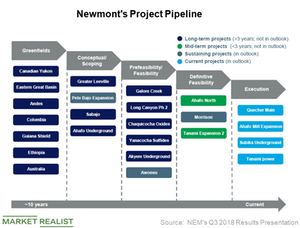

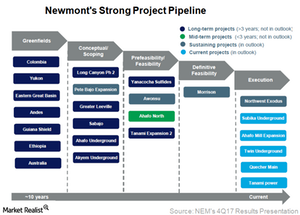

Newmont’s Project Pipeline Remains Strong: What’s the Upside?

Newmont Mining is poised to overtake Barrick Gold as the world’s largest gold producer in 2018.

Senior Gold Miners’ Earnings Beats and Misses in 3Q17

All the gold miners (RING)(GDX) we’re covering in this series except for Barrick Gold (ABX) reported earnings beats in 3Q17.

What Rising Physical Gold Demand Could Mean for Prices

After falling 18% in 1Q17, physical demand for gold seems to have picked up in 2Q17.

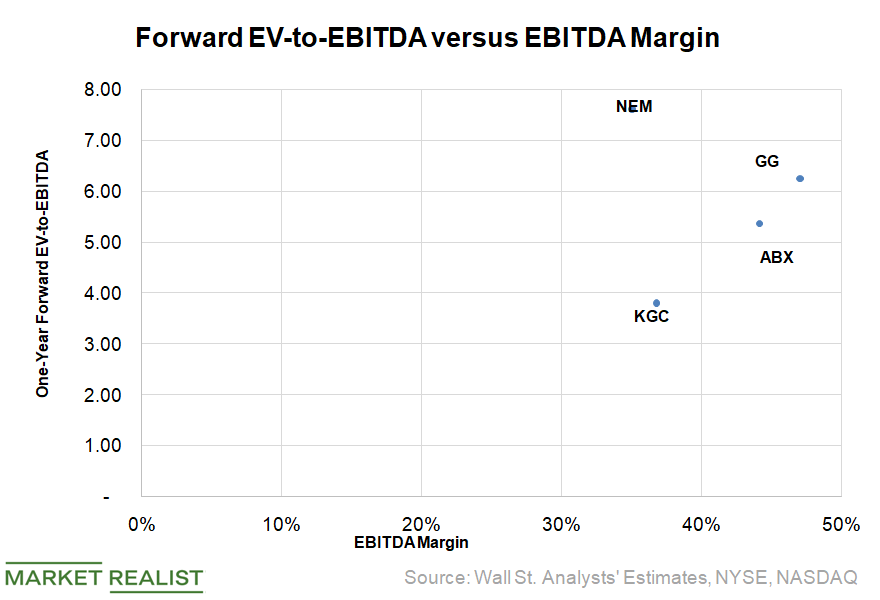

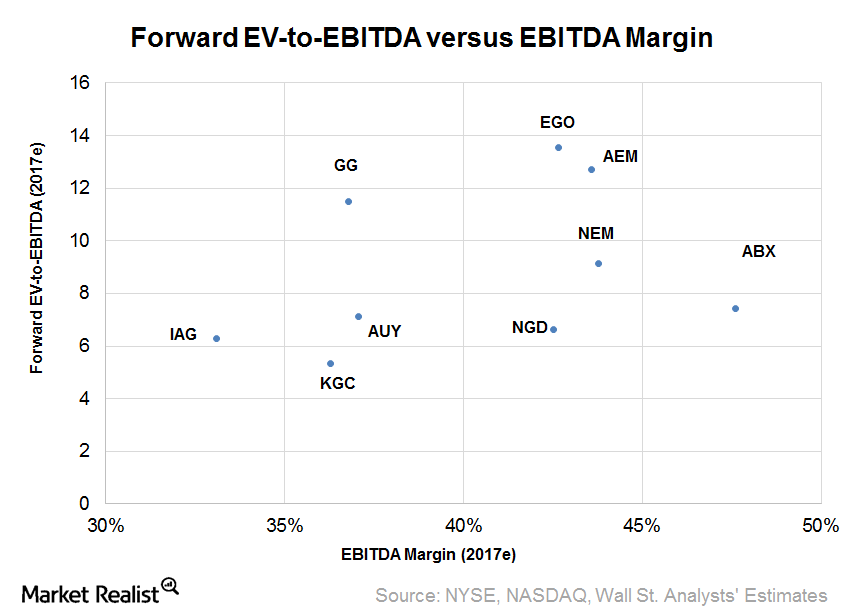

Valuations in Gold: Where’s the Upside among Miners Today?

Among senior gold miners, Goldcorp is trading at the highest multiple of 10.3x—a premium of 31% compared to the peer average.

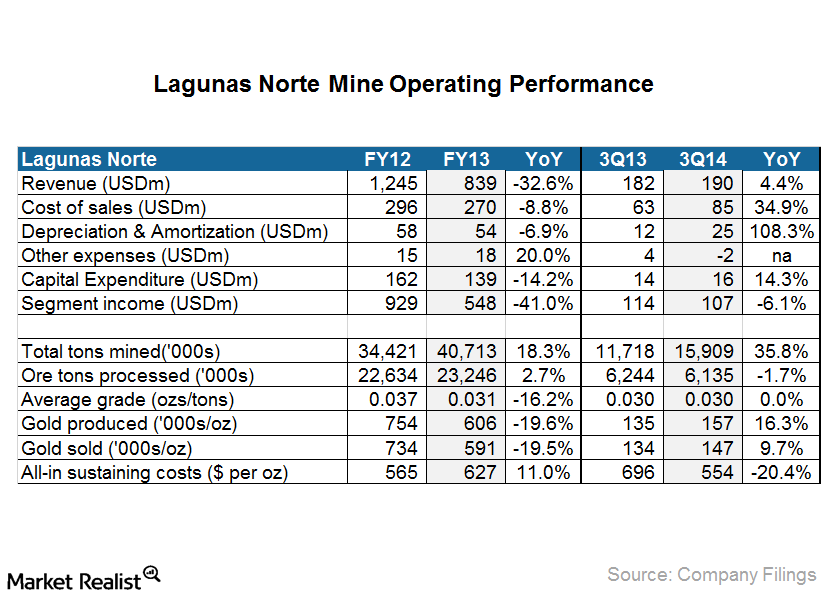

Lagunas Norte: AISC down due to lower sustaining capex

All-in sustaining costs (or AISC) came in at $554 per ounce, a reduction of $142 per ounce from the same period last year. The reduction was mainly due to lower sustaining capital expenditure (or capex).

Must Know: An Overview of Kinross Gold Corp.

In this series, we’ll analyze the various business aspects of Kinross Gold. We’ll also look at various key drivers that impact Kinross’s investors.

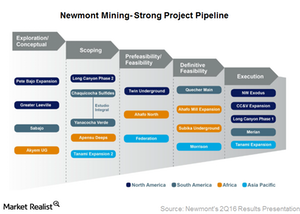

Newmont’s Project Pipeline: On Track and On Budget

Newmont Mining (NEM) has five projects in final stages, all of which will start production either this year or next.

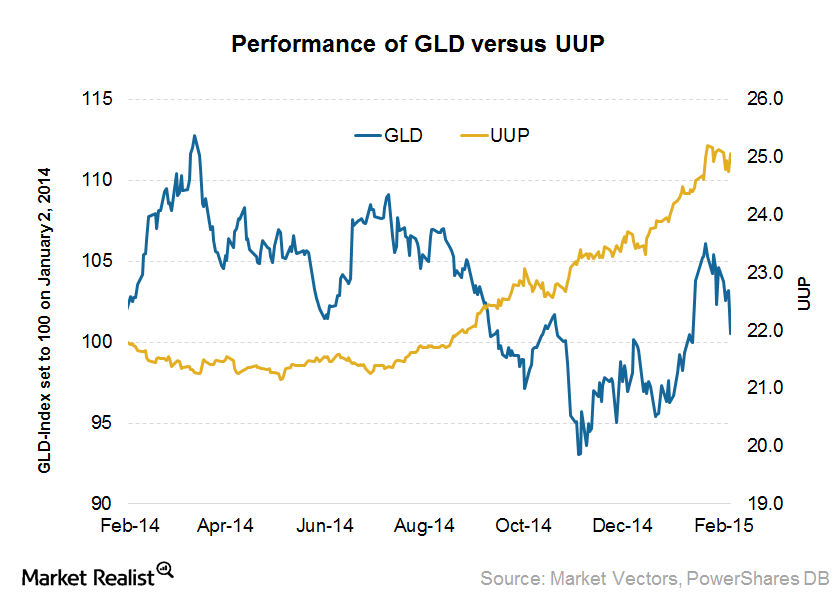

Investing in gold? Watch the US Dollar Index

Tracked by the Federal Reserve, the weekly US Dollar Index measures the value of the dollar compared to the currencies of its significant trading partners.

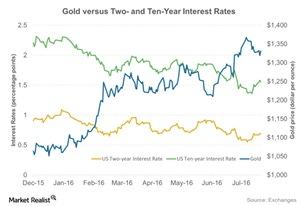

Will a Rate Hike Pull the Lid off Gold?

Though an increase in rates may initially dim the luster of the metal, after the hike, gold may soar, uninterrupted by looming fears.

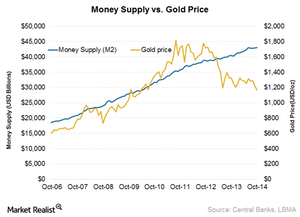

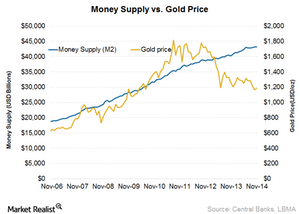

Price of gold relates to growth of global money supply

When money supply growth is used to prop up the financial and economic system instead of fuel strong economic growth, the price of gold relates to growth of the money supply.

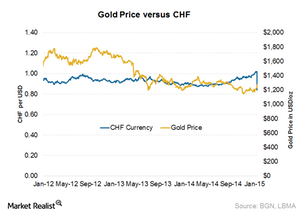

Why the Swiss National Bank removed the cap against the euro

A cap was put in place to stop the currency’s appreciation. An appreciating local currency is detrimental to exporters.

Global money supply and its link to gold

The gold price increase kept pace with the global money supply until recently. The relationship between the two appears to have broken.

Trump, Trade War, Powell: More Upside for Gold Prices?

Gold hit a fresh six-year high on Friday as trade tensions between the US and China escalated. The SPDR Gold Shares ETF (GLD) closed up 2%.

Which Gold Stocks Could Beat Analysts’ Earnings Expectations in Q1?

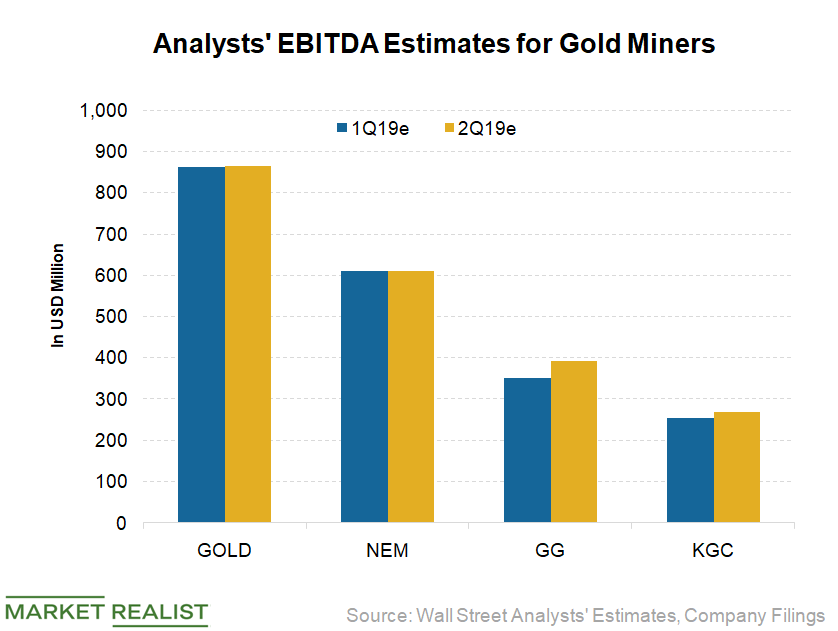

Many gold miners (RING) are set to release their first-quarter results shortly. Analysts expect Barrick Gold’s (GOLD) EBITDA to rise 6.2% YoY (year-over-year) in the first quarter.

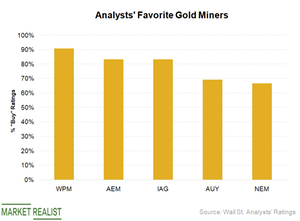

The Five Gold Stocks Wall Street Is Loving Lately

Gold miners usually act as a leveraged play on gold prices. In 2018, the VanEck Vectors Gold Miners ETF (GDX) fell 9.3%, amplifying the 1.9% fall in gold prices (GLD).

Which Senior Gold Miners Are Analysts Loving Lately and Why?

In this series, we’ll consider recommendations, target prices, estimates, and potential upsides and downsides for senior gold miners.

How Do Gold Miners’ Leverage Ratios Look?

Barrick has reduced its debt more than 57% in the last four years from $13.4 billion at the end of 2014 to $5.7 billion at the end of 2018.

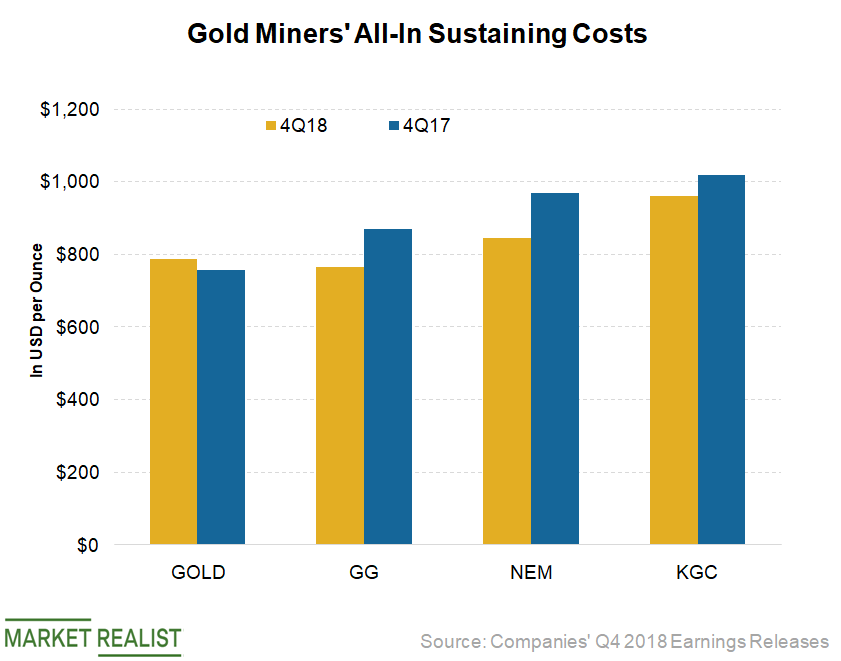

How Gold Miners’ Costs Stack Up

Barrick Gold (GOLD) reported AISC of $788 per ounce and a cost of sales of $980 per ounce in the fourth quarter.

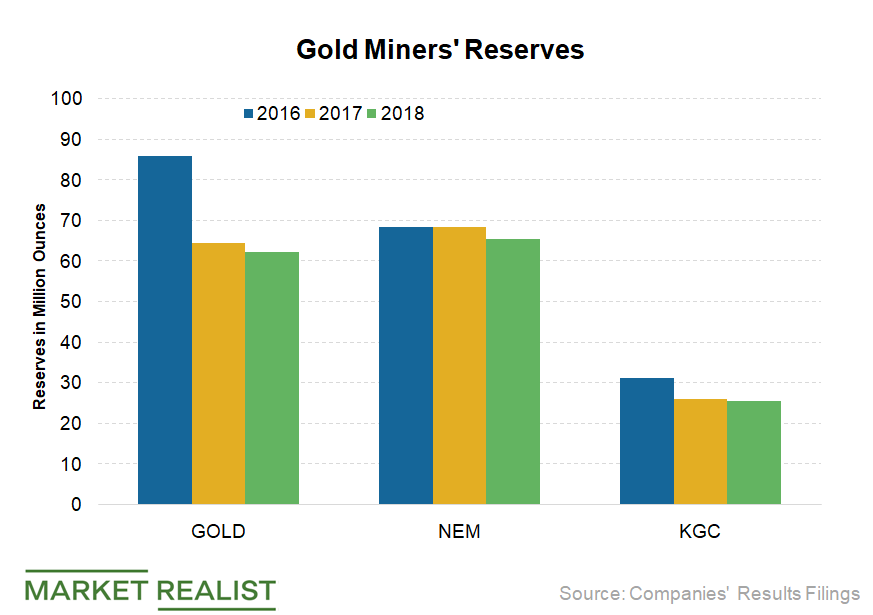

Why Did Barrick Gold’s Reserves Fall in 2018?

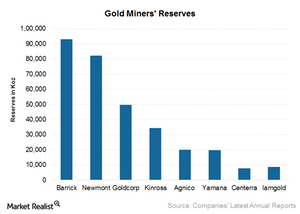

At the end of 2018, Barrick Gold (GOLD) reported mineral reserves of 64.5 million ounces—a decline of 3.4% YoY.

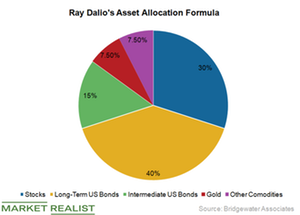

Buffett versus Dalio on Gold: Whose Advice Should You Take?

When it comes to investing in stocks, Berkshire Hathway’s (BRK.A) chair, Warren Buffett, and Bridgewater’s founder, Ray Dalio, have similar advice.

Can Newmont Mining Outperform Its Peers in 2019?

Newmont Mining (NEM) reported its fourth-quarter earnings results before the market opened on February 21.

A Quick Look at the Technicals of the 4 Precious Metals

Gold’s price dipped 0.13% to $1,312.8 per ounce on May 9. The fall in gold was extended for a number of reasons.

Newmont Mining’s Project Pipeline Is as Strong as It Gets

Newmont Mining’s (NEM) has one of the best project pipelines in the sector (GDX)(GDXJ)—stronger than Kinross Gold (KGC), Barrick Gold (ABX), and AngloGold Ashanti (AU).

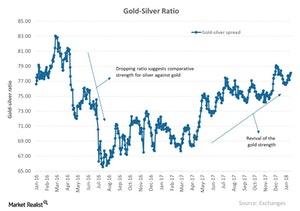

A Brief Analysis of the Gold-Silver Spread in January 2018

A quick look at the relationship between the two core precious metals, gold and silver, could also be helpful in the analysis of the overall precious metals market.

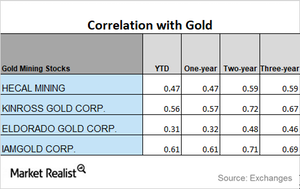

Analyzing the Correlation of Gold to Miners in January 2018

First Majestic Silver saw correlation drop during the past three years. On a three-year basis, its correlation with gold was 0.57.

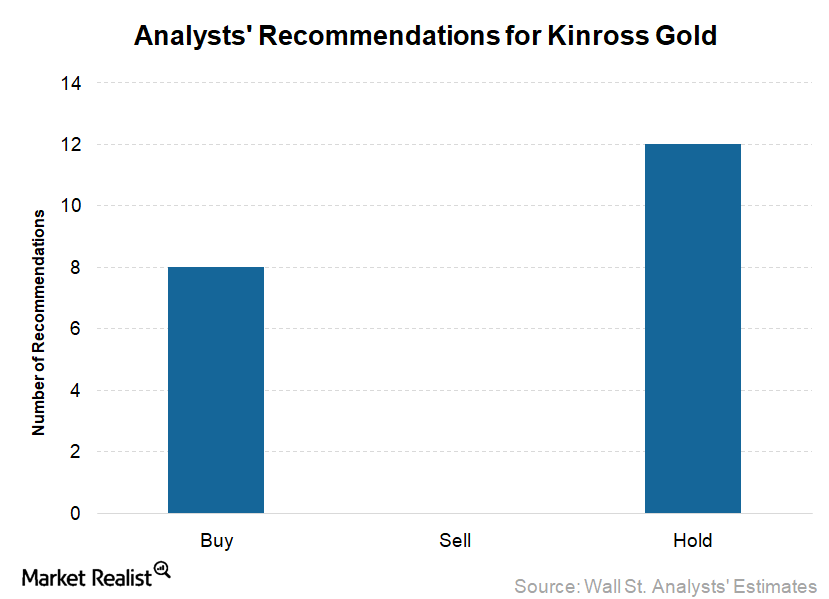

A Look at Recent Analyst Ratings for Kinross Gold

None of the analysts covering Kinross Gold (KGC) recommended a “sell” rating on the stock. 40% of them have “buy” ratings, while 60% suggest a “hold” for the stock.

A Look at Miners’ Correlation Trends

AngloGold Ashanti has seen the highest correlation to gold in the past year, while Eldorado Gold has seen the lowest correlation.

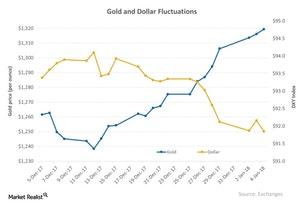

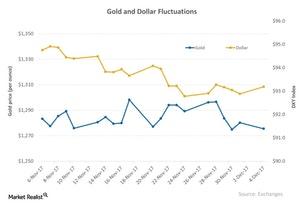

The Dollar and Its Relationship to Precious Metals

The US dollar rose 0.18% on Tuesday, January 9, 2018, which led to the lower price of spot gold (GLD) and silver.

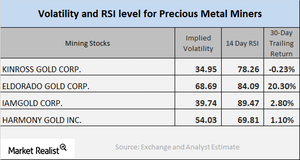

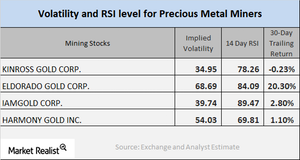

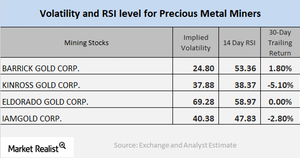

How Do Miners’ Technical Details Look?

Most of the mining companies have risen during the past few weeks. The miners tend to move according to precious metal prices rather than the equities market in general.

Correlation Reading of Miners and Funds in the Last 3 Years

During the past year, IamGold has seen the highest correlation to gold, while Eldorado Gold has the lowest correlation.

Reading Key Mining Stock Technicals as of December

Most of the mining companies have increased during the past two weeks due to the rise of gold and silver.

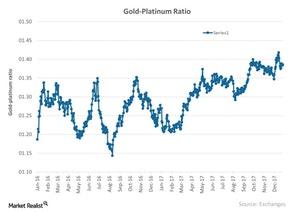

Understanding the Recent Gold-Platinum Cross Rate

When analyzing platinum markets, it’s important to compare the metal’s performance with that of gold, which is the most crucial of the precious metals.

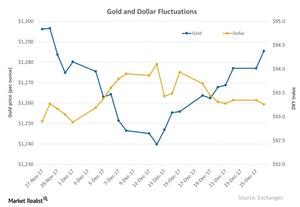

How the Dollar and Gold Moved in December

Gold and the US dollar are mostly inversely related to each other.

What Direction Is the Correlation of Miners Headed?

On a year-to-date basis, AngloGold has seen the highest correlation to gold, while Cia De Minas has the lowest year-to-date correlation.

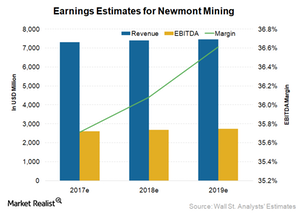

These Factors Are Driving Analysts’ Estimates for Newmont Mining

Newmont Mining’s mean consensus revenue for 2017 is $7.3 billion. This implies year-over-year (or YoY) growth of 8.1%.

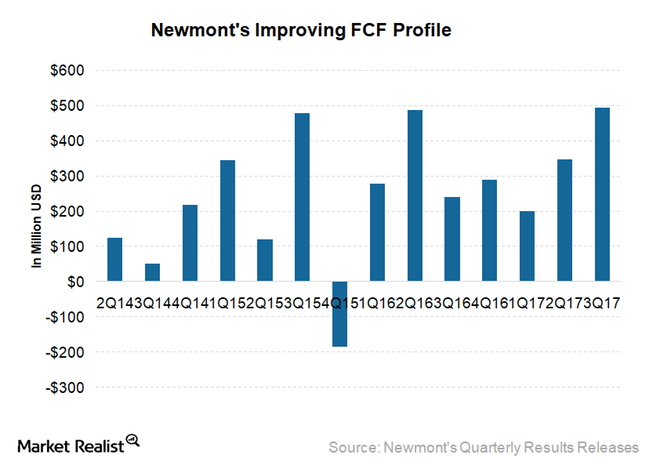

How Newmont Mining Plans to Generate Free Cash Flow in 2018

As NEM’s all-in sustaining costs (or AISC) have fallen 22.0% since 2012, its FCF has improved by $3.60 per share.

Reading Miner Volatility in December 2017

In this article, we’ll take a look at the call-implied volatilities and RSI scores of Barrick Gold, Kinross Gold, Eldorado Gold, and IAMGOLD.

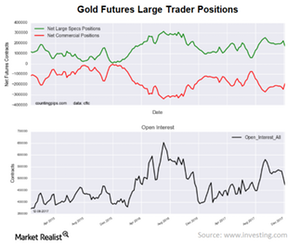

How Is Gold, Commercial and Non-Commercial, Moving?

Speculative positions fell sharply last week. It was the most significant one-week fall since May 2016.

Correlation and Mining Stocks this Month

We’ll briefly analyze mining stocks’ correlation with gold. Gold is the most crucial of the precious metals, and mining stocks tend to increasingly take their price changes from gold.

The Tax Reform Bill’s Impact on Precious Metals

All four precious metals saw a down day on Monday, December 4, 2017, after the US dollar, in which the four metals are priced, rose $0.39%, propelled by the Senate passing its tax reform bill.

How Inflation Becomes a Core Determinant of the Price of Gold

The possible interest rate hike is taking a lot of market participants’ attention. Many policymakers are also focusing on inflation numbers.