Newmont Mining’s Project Pipeline Is as Strong as It Gets

Newmont Mining’s (NEM) has one of the best project pipelines in the sector (GDX)(GDXJ)—stronger than Kinross Gold (KGC), Barrick Gold (ABX), and AngloGold Ashanti (AU).

Feb. 27 2018, Updated 7:33 a.m. ET

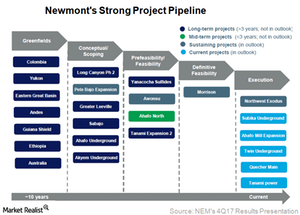

Project pipeline

Newmont Mining’s (NEM) has one of the best project pipelines in the sector (GDX)(GDXJ)—stronger than Kinross Gold (KGC), Barrick Gold (ABX), and AngloGold Ashanti (AU). It has approved eight projects since mid-2014, which are expected to add annual gold production of up to 1.2 million ounces at all-in sustaining costs (or AISC) of $750 per ounce. Another important thing about its project pipeline is that it remains scattered, with projects expected to come online in the near term, medium term, and long term, keeping growth ongoing.

Projects providing upside

In the last three years, it has built Merian and Long Canyon on time and 20% below budget. The company also sounded confident about finishing its next project, Northwest Exodus, in 2018.

Most recently, the company approved the Tanami Power project. This project is expected to lower power costs at Tanami, Australia, by ~20%, beginning in 2019. The company anticipates savings of ~$34 per ounce from this project, starting in 2019.

Other projects included in the outlook

Previously in 2017, the company announced it would fund four expansion projects, which are expected to improve profitability and extend mine life at Ahafo, Twin Creeks, and Yanacocha.

As you can see in the above graph, all the sustaining and current projects are included in Newmont’s outlook. Mid-term projects and long-term projects are currently excluded from the outlook.

Now let’s discuss Newmont’s cost improvement strategy in the next part of this series.