Newmont Mining Corp

Latest Newmont Mining Corp News and Updates

Yellen Wants to Keep Negative Rates on the Table, Helping Gold

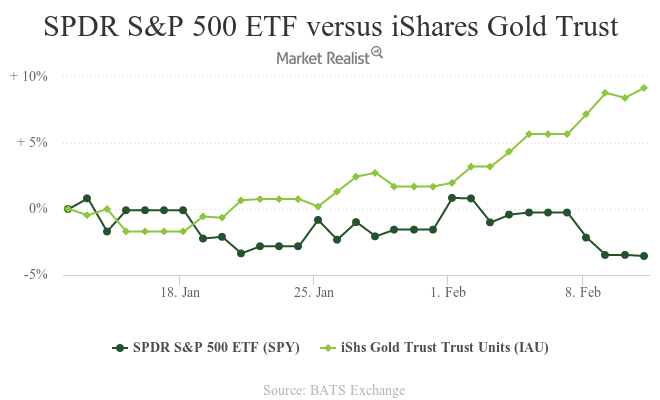

When the Federal Reserve chair, Janet Yellen, testified to Congress on February 11, she affirmed the Fed’s consideration of negative interest rates. Under a negative interest rate scenario, investors would pay interest to the bank for holding their money.

How Much Could Brexit and Volatility Control Gold?

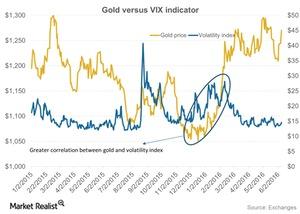

Fears in the overall financial market about a Brexit, the possible exit of Britain from the European Union, have abated. This helped gold fall.

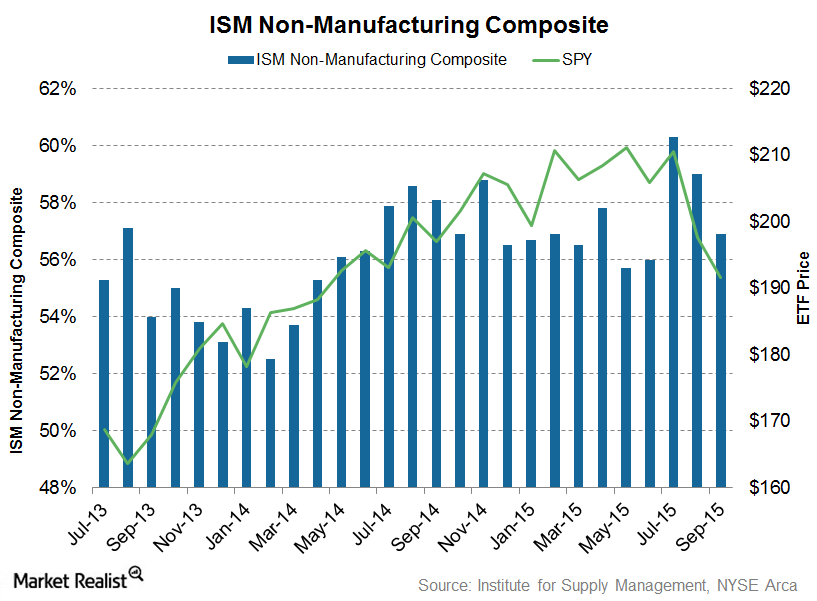

Expanding Service Sector Gives Relief to Economy in September

With manufacturing slowing, a reading of the Non-Manufacturing Index at an above-neutral level (56.9) may provide some relief to the US economy, which is highly dependent on the service sector for its economic growth.

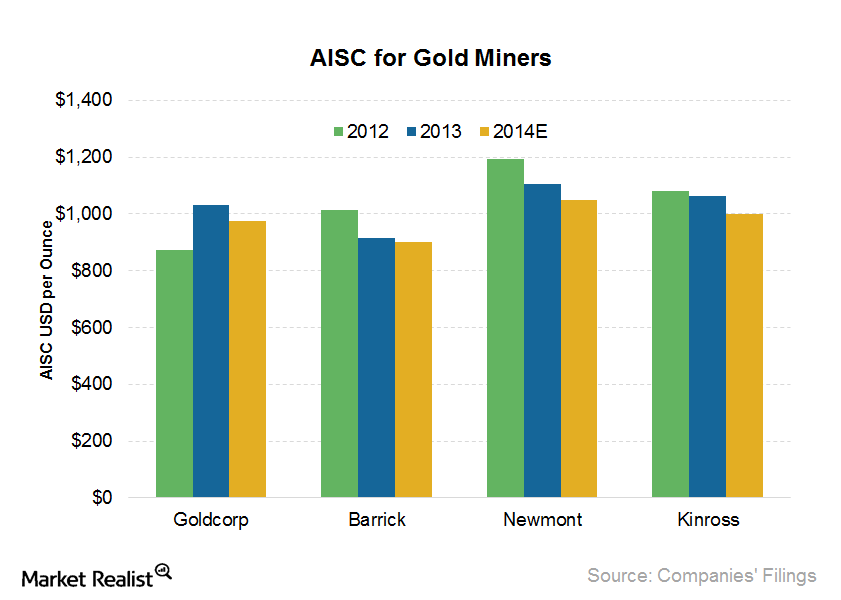

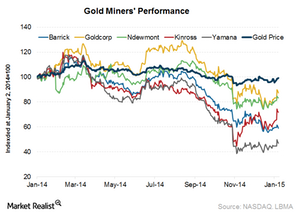

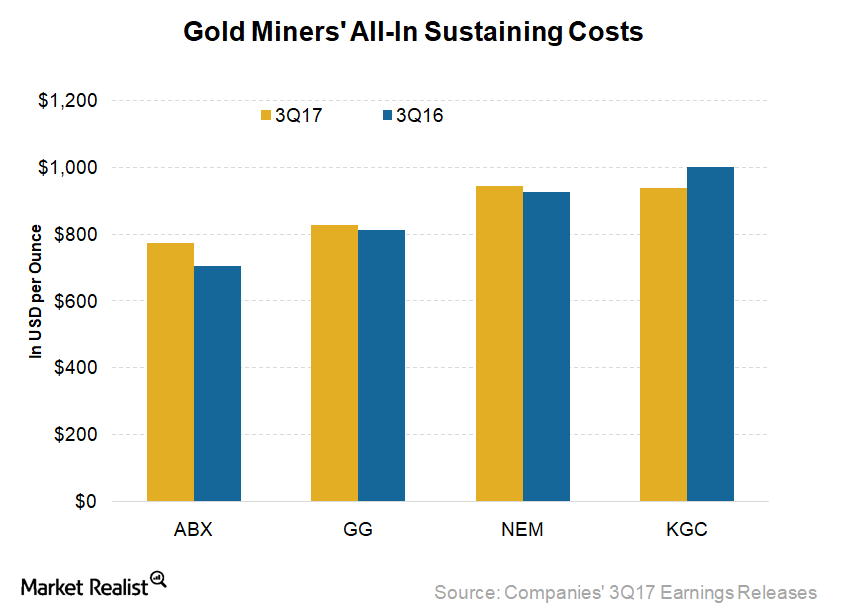

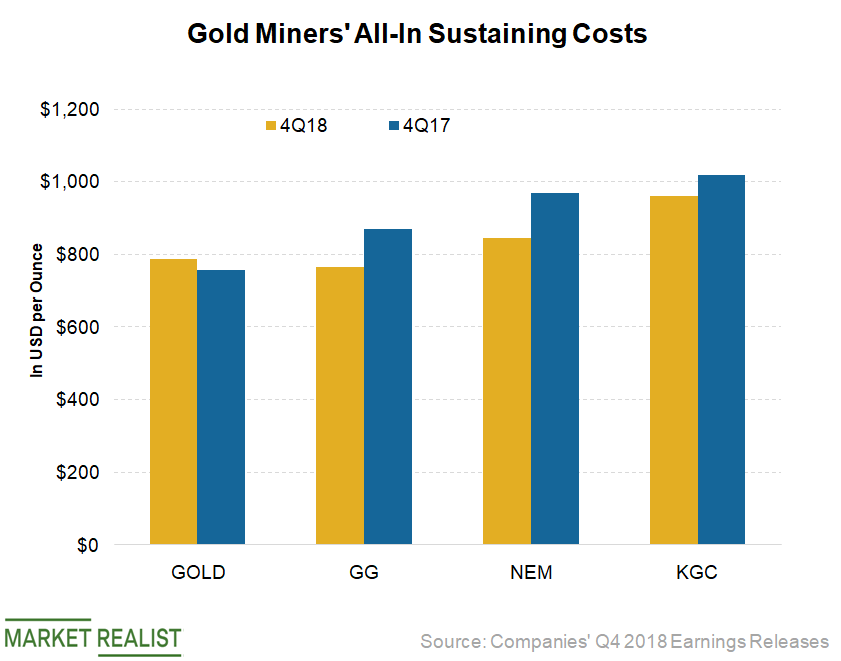

Goldcorp’s cost reduction compared to its peers

Goldcorp’s (GG) all-in sustaining costs (or AISC) are falling. In 2013, its AISC was $1,031 per ounce. It expects the AISC to be in the range of $950–$1,000 for 2014.

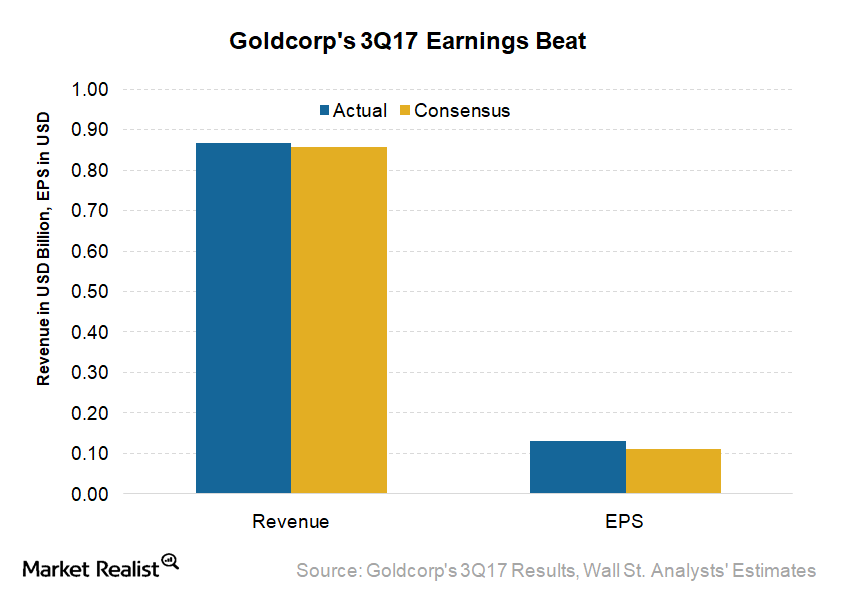

Key Insights from Goldcorp’s 3Q17 Earnings

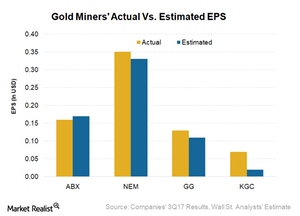

Goldcorp (GG) reported its 3Q17 results after the market closed on October 25, 2017. It reported EPS (earnings per share) of $0.13, which beat analysts’ expectations by $0.02.

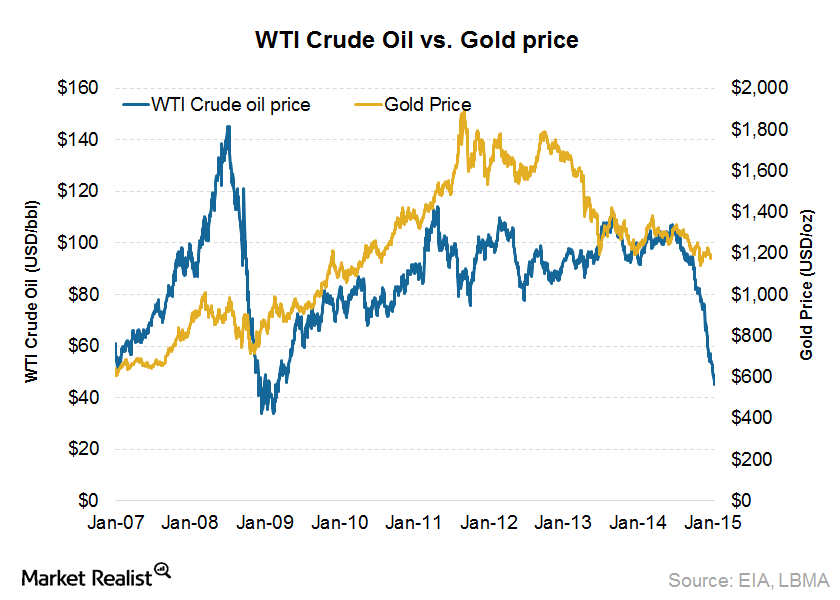

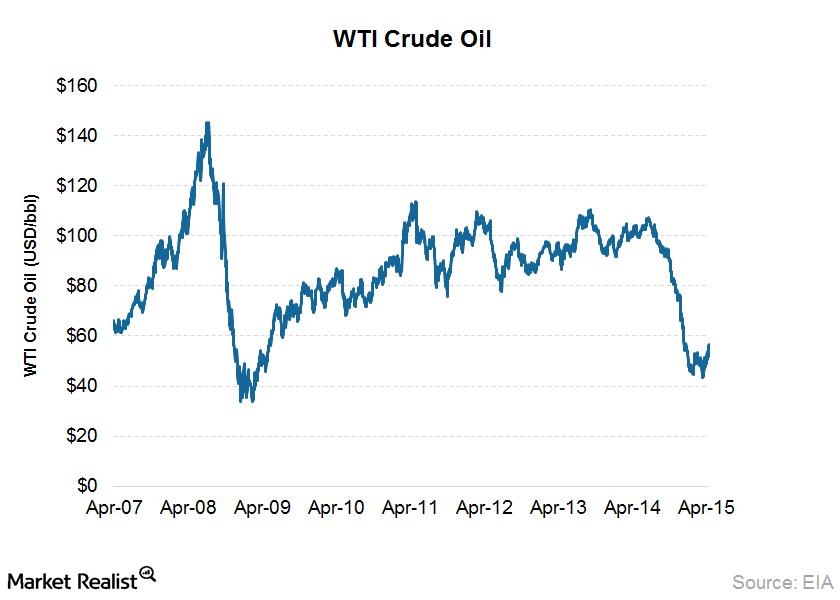

Low crude oil prices impact gold

Cheaper oil means lower inflation. This means gold should be affected negatively since it’s usually considered a hedge against inflation.

Gold Rose amid Increased Demand for Safe-Haven Assets

These economic concerns and monetary stimulus expectations have decreased the probability of an interest rate hike by the US Federal Reserve, and the chances of an interest rate hike in July dropped to zero.

Assessing variables that drive the outlook for gold prices

Physical buying from China and India should support the demand for gold. But a rate hike by the Fed could be the catalyst that could take gold down.

These Gold Miners Surprised Us with Unit Costs in 3Q17

AISC (all-in sustaining costs) are an encompassing measure that helps compare miners’ performance—a vital metric for investors. They show the company’s margin cushion at prevailing gold prices (GLD)(IAU).

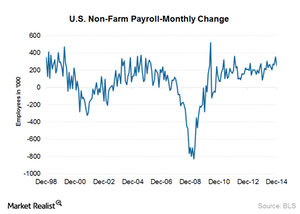

How US labor conditions impact gold investors

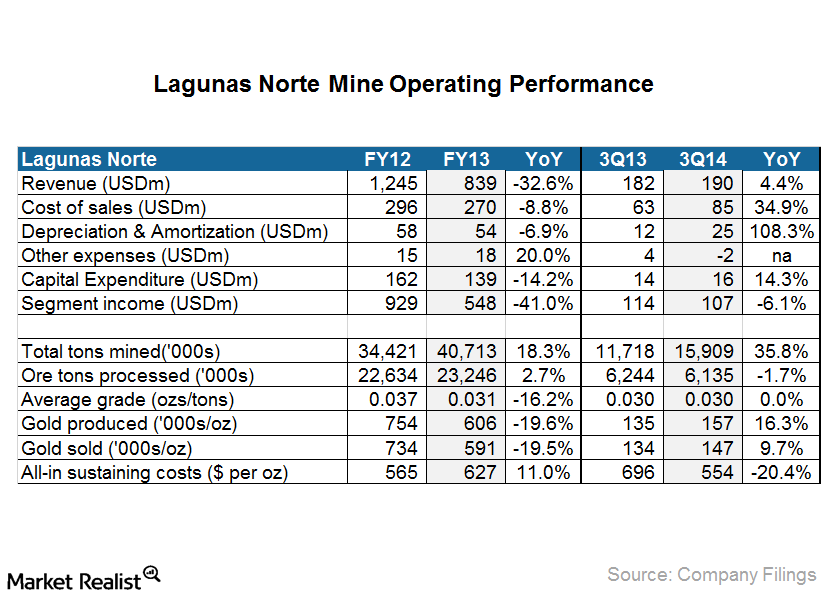

It’s important to keep an eye on labor conditions since they offer a look at the future direction of gold prices and ultimately gold-backed ETFs.Materials Lagunas Norte: Increasing Barrick’s cost per unit

Lower ore grade increases the amount of waste stripping required—in order to extract some volume of ore—as a result of mining more tons of waste.

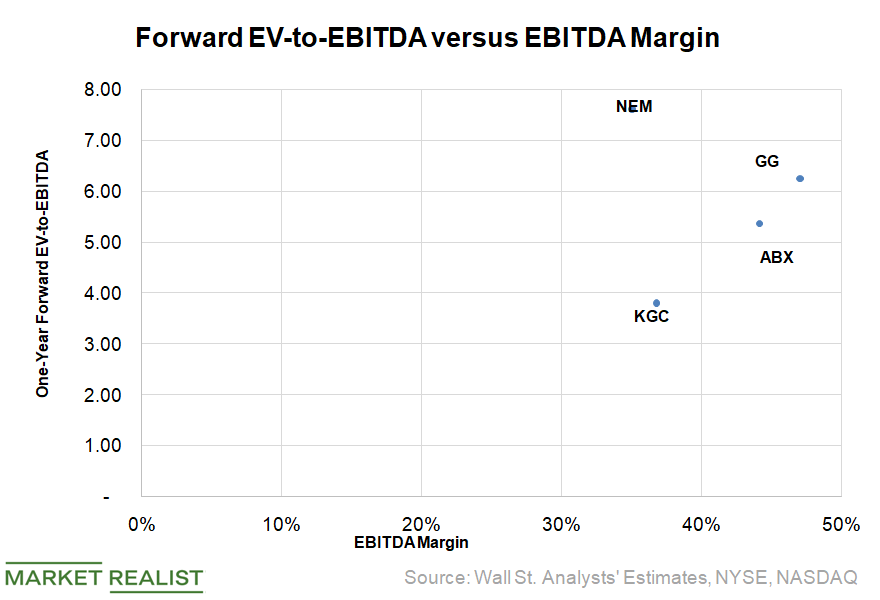

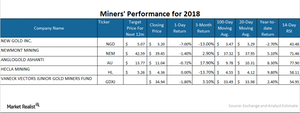

Which Gold Miners Could Offer Valuation Upsides after Q2 2018?

The average ratio of the NYSE Arca Gold Miners Index and the S&P 500 Index (SPY) is 0.18 compared to the ten-year average of 0.68.

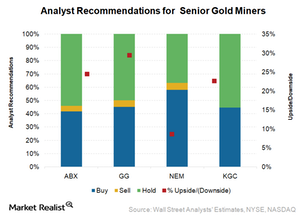

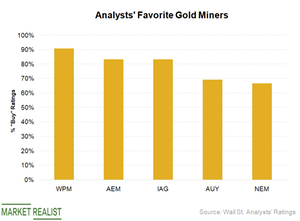

Which Senior Gold Miners Are Analysts Betting On?

As a group, the average gains of North American senior gold miners (GDX) (RING) have been muted.

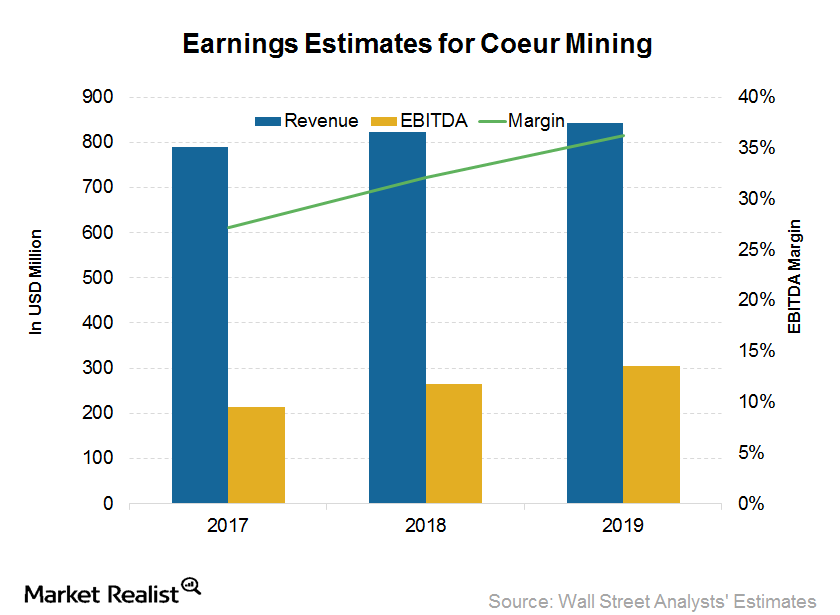

Analysts Are Optimistic about Coeur Mining

Market sentiment for Coeur Mining Coeur Mining (CDE) is a high-cost producer compared with peers (RING) (SIL). While it has initiated several measures to bring down its costs in the last few years, they remain high. Higher costs make CDE more leveraged to gold and silver prices than other low-cost producers such as Barrick Gold (ABX) […]Materials Why an increase in real interest rates makes gold lose its sheen

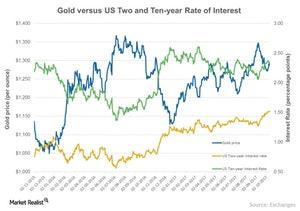

Gold doesn’t give any returns besides appreciation. Appreciation doesn’t always happen. As a result, gold has to compete against assets that yield something. When the return on the alternate assets begins to rise, the demand for gold falls. In a scenario where the real interest rates are rising continuously, the demand for gold—as an investment—will start falling.

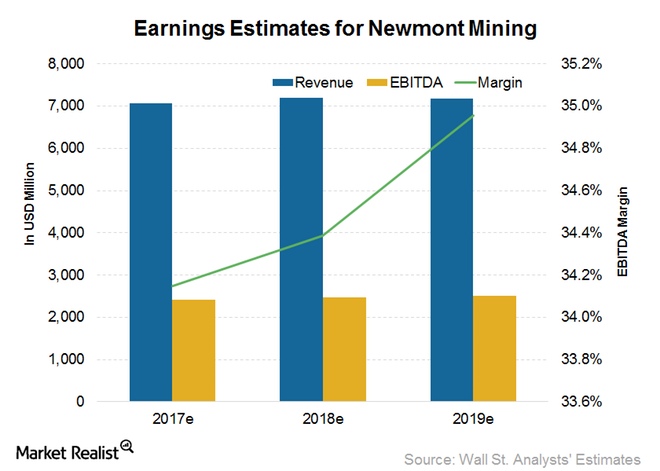

Analysts’ Estimates: Could NEM’s Near-Term Profitability Decline?

Although 2017 has not been very good for Newmont Mining stock due to short-term issues, its outlook remains strong.

Which Gold Stocks Do Analysts Love and Hate?

Gold price’s reversal this year has created opportunities in gold stocks. The SPDR Gold Shares ETF (GLD) had gained 11% year-to-date as of Friday.

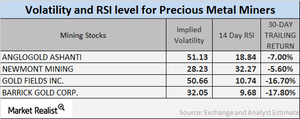

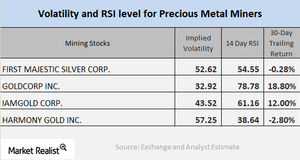

What Falling Miner RSI Levels Suggest

The RSI levels of our four select mining giants have all increased lately due to their higher stock prices.

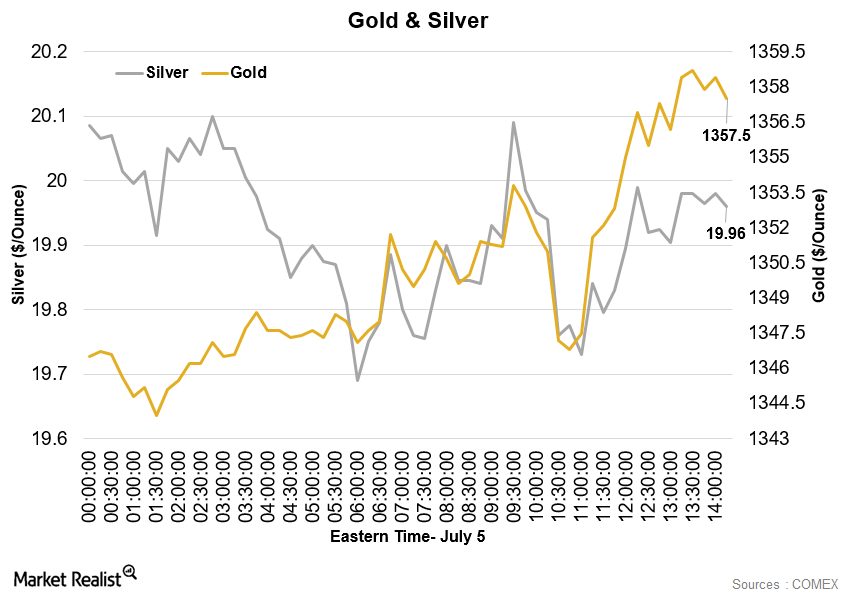

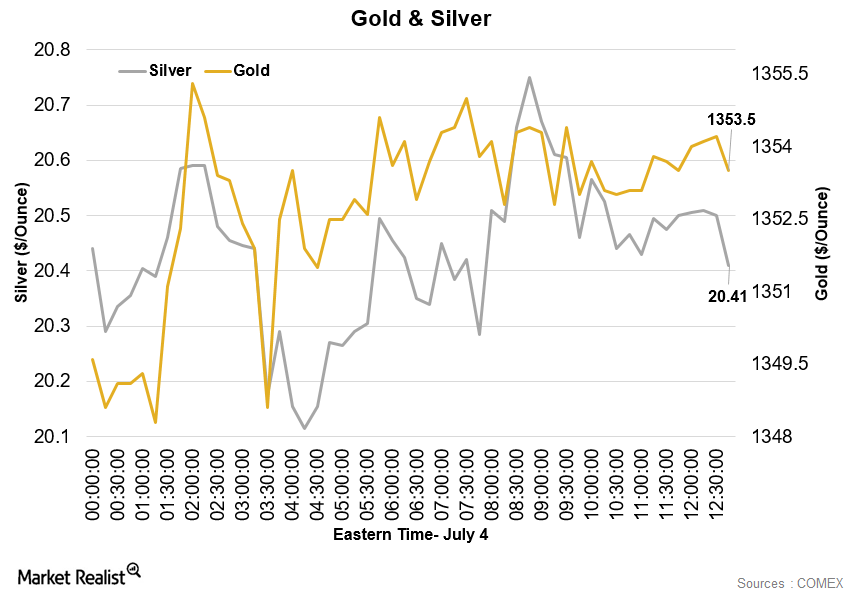

Copper Stabilizes While Gold Trades near Two-Year High

Copper prices stabilized on Monday, July 4, amid expectations of stimulus from central banks.

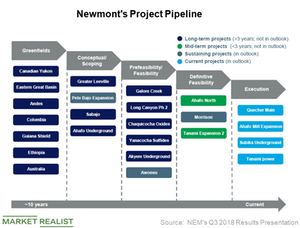

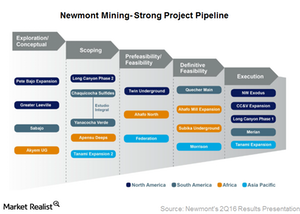

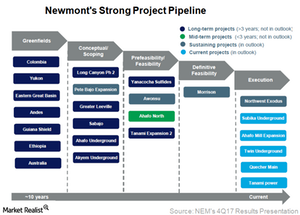

Newmont’s Project Pipeline Remains Strong: What’s the Upside?

Newmont Mining is poised to overtake Barrick Gold as the world’s largest gold producer in 2018.Materials Must-know: Why US debt to GDP and gold price move together

Debt to gross domestic product (or GDP) is the ratio that shows how much a country owes versus how much it earns. Investors use this ratio to measure a country’s ability to make future payments on its debt. This impacts the country’s borrowing costs and government bond yields.

Gold Prices Soar: Which Stocks Do Analysts Favor?

Kirkland Lake is first among analysts’ favorite gold stocks with 91% “buy” and 9% “hold” ratings. The target price implies a potential upside of 16%.

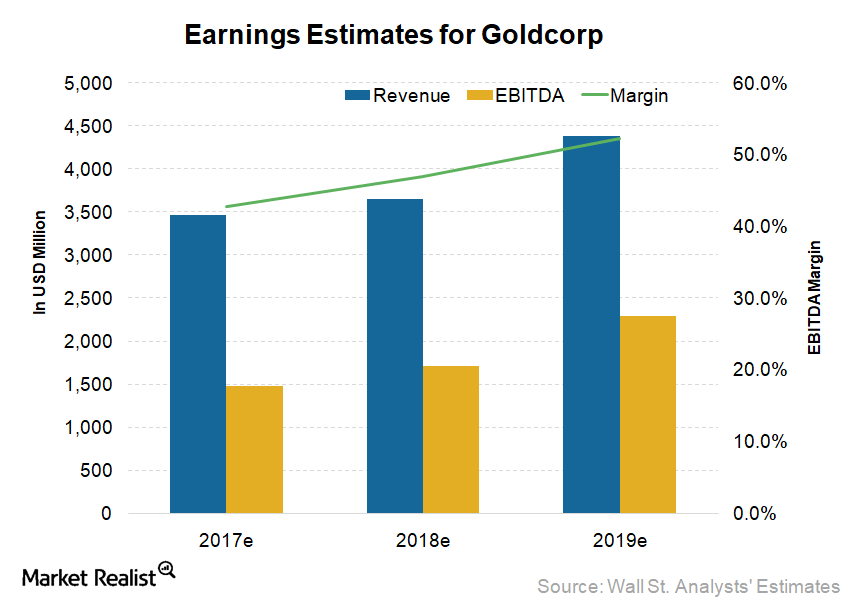

Do Goldcorp’s Earnings Estimates Reflect Analysts’ Increasing Optimism?

Goldcorp (GG) has given negative returns in 2017. Its stock has lost 6.1% of its value as compared to a gain of 12.8% in the iShares Gold Trust (GLD) and 11.1% in the VanEck Vectors Gold Miners ETF (GDX).

Senior Gold Miners’ Earnings Beats and Misses in 3Q17

All the gold miners (RING)(GDX) we’re covering in this series except for Barrick Gold (ABX) reported earnings beats in 3Q17.

Foreign Exchange and Fuel Tailwinds Could Help Newmont in 1Q15

Investors should watch out for any tailwinds or headwinds that could impact Newmont’s costs in 1Q15.

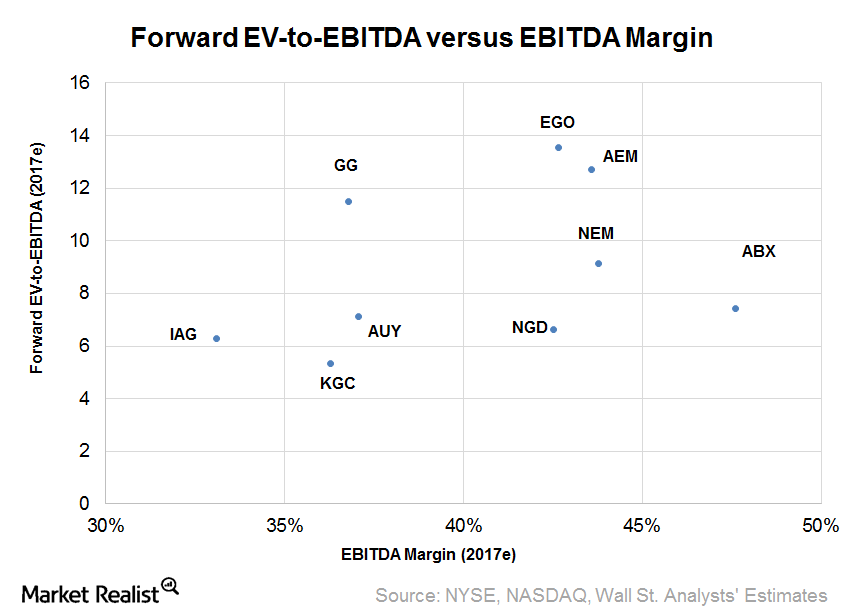

Valuations in Gold: Where’s the Upside among Miners Today?

Among senior gold miners, Goldcorp is trading at the highest multiple of 10.3x—a premium of 31% compared to the peer average.

Lagunas Norte: AISC down due to lower sustaining capex

All-in sustaining costs (or AISC) came in at $554 per ounce, a reduction of $142 per ounce from the same period last year. The reduction was mainly due to lower sustaining capital expenditure (or capex).Materials Why gold and the US dollar have an inverse relationship

Gold and the U.S. dollar were associated when the gold standard was being used. During this time, the value of a unit of currency was tied to the specific amount of gold. The gold standard was used from 1900 to 1971. The separation was made in 1971. The U.S. dollar and gold were freed. They could be valued based on supply and demand.

Newmont’s Project Pipeline: On Track and On Budget

Newmont Mining (NEM) has five projects in final stages, all of which will start production either this year or next.

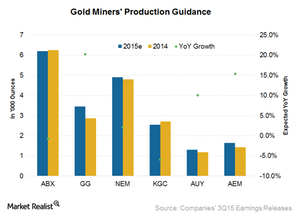

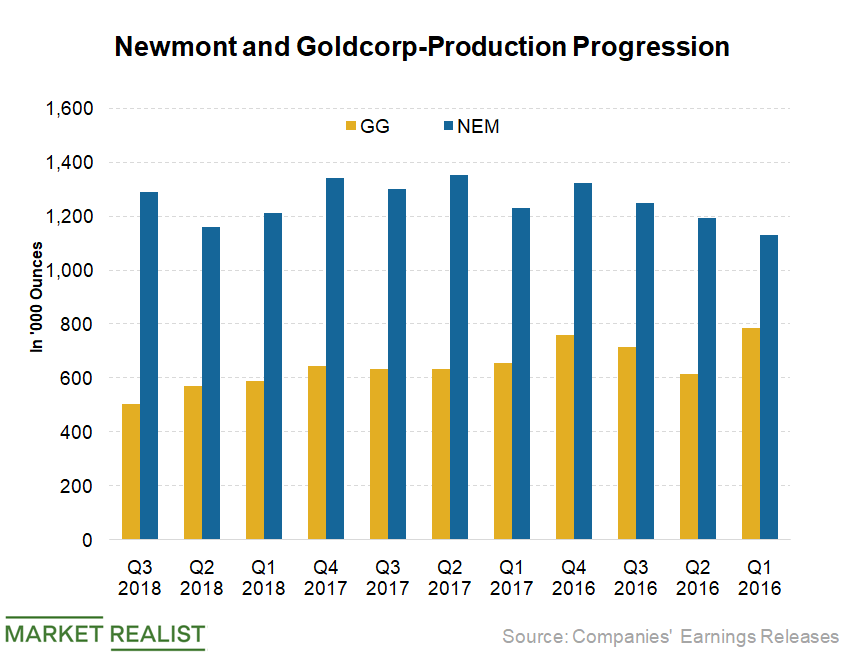

As Good as Gold: Analyzing Gold Miners’ Production Growth

In 3Q15, Goldcorp (GG) posted record gold production of 922,200 ounces—2% growth quarter-over-quarter and 42% growth year-over-year.

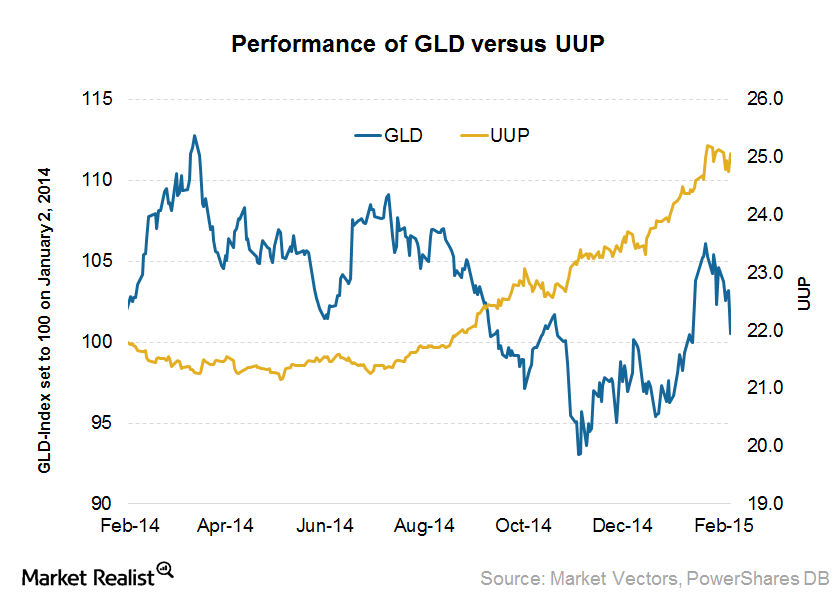

Investing in gold? Watch the US Dollar Index

Tracked by the Federal Reserve, the weekly US Dollar Index measures the value of the dollar compared to the currencies of its significant trading partners.

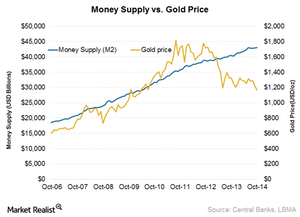

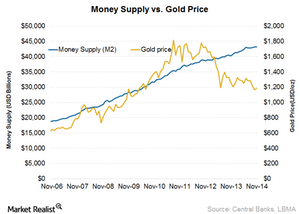

Price of gold relates to growth of global money supply

When money supply growth is used to prop up the financial and economic system instead of fuel strong economic growth, the price of gold relates to growth of the money supply.

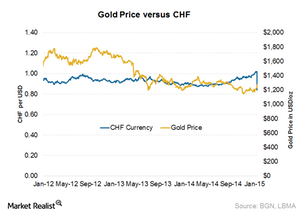

Why the Swiss National Bank removed the cap against the euro

A cap was put in place to stop the currency’s appreciation. An appreciating local currency is detrimental to exporters.

Global money supply and its link to gold

The gold price increase kept pace with the global money supply until recently. The relationship between the two appears to have broken.

What Synergies Does Newmont Expect from Merger with Goldcorp?

Increased shareholder returns were the main motivation behind the Newmont Mining and Goldcorp merger.

The Five Gold Stocks Wall Street Is Loving Lately

Gold miners usually act as a leveraged play on gold prices. In 2018, the VanEck Vectors Gold Miners ETF (GDX) fell 9.3%, amplifying the 1.9% fall in gold prices (GLD).

Which Senior Gold Miners Are Analysts Loving Lately and Why?

In this series, we’ll consider recommendations, target prices, estimates, and potential upsides and downsides for senior gold miners.

How Do Gold Miners’ Leverage Ratios Look?

Barrick has reduced its debt more than 57% in the last four years from $13.4 billion at the end of 2014 to $5.7 billion at the end of 2018.

How Gold Miners’ Costs Stack Up

Barrick Gold (GOLD) reported AISC of $788 per ounce and a cost of sales of $980 per ounce in the fourth quarter.

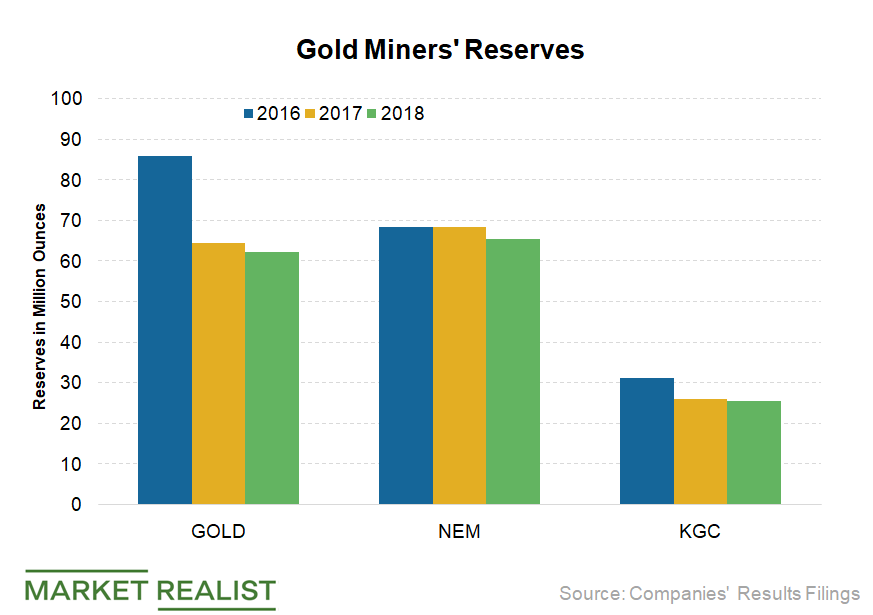

Why Did Barrick Gold’s Reserves Fall in 2018?

At the end of 2018, Barrick Gold (GOLD) reported mineral reserves of 64.5 million ounces—a decline of 3.4% YoY.

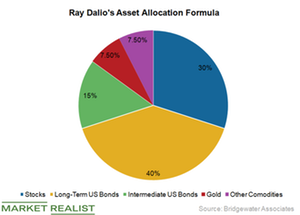

Buffett versus Dalio on Gold: Whose Advice Should You Take?

When it comes to investing in stocks, Berkshire Hathway’s (BRK.A) chair, Warren Buffett, and Bridgewater’s founder, Ray Dalio, have similar advice.

Can Newmont Mining Outperform Its Peers in 2019?

Newmont Mining (NEM) reported its fourth-quarter earnings results before the market opened on February 21.

Newmont Mining’s Project Pipeline Is as Strong as It Gets

Newmont Mining’s (NEM) has one of the best project pipelines in the sector (GDX)(GDXJ)—stronger than Kinross Gold (KGC), Barrick Gold (ABX), and AngloGold Ashanti (AU).

Reading the Technicals and Price Movements of Mining Stocks

In this article, we’ll do a technical analysis of a few select mining stocks. When investing in mining stocks, it’s crucial to read their indicators.

What Miners’ Moving Averages Indicate

NGD and HL are both trading below their longer-term 100-day moving averages.

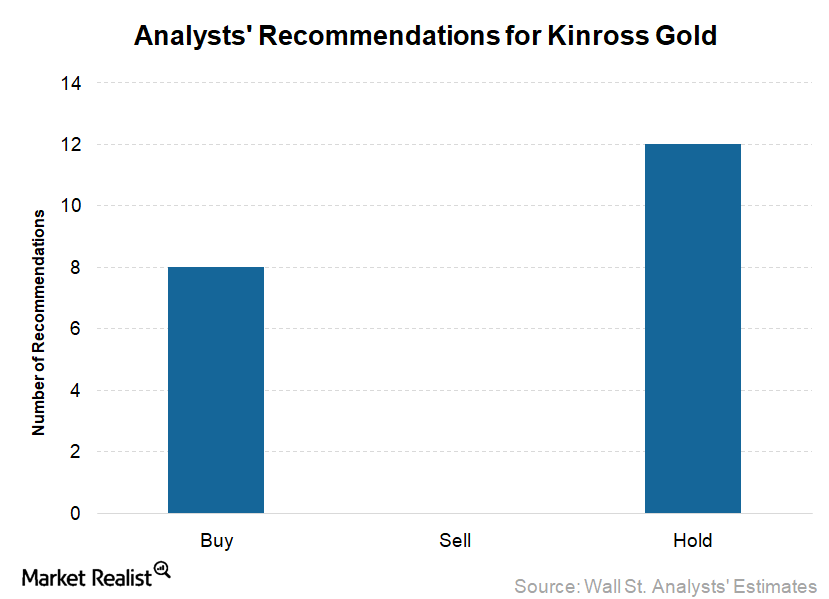

A Look at Recent Analyst Ratings for Kinross Gold

None of the analysts covering Kinross Gold (KGC) recommended a “sell” rating on the stock. 40% of them have “buy” ratings, while 60% suggest a “hold” for the stock.

Interest Rate versus Gold: Interest Rate Wins Again

Gold is a non-yield bearing asset that reacts negatively to rises in the interest rate.

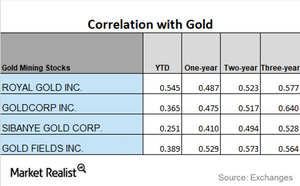

What’s the 3-Year Correlation between Miners and Gold?

Gold is the most influential precious metal, and most miners follow its price trends.

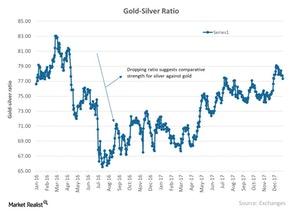

Reading the Recent Gold-Silver Spread

Among these spreads, the gold-silver spread is the most talked about because it measures the number of silver ounces it takes to buy a single ounce of gold.

Your End-of-2017 Correlation Study of the Major Miners

The PowerShares DB Gold Fund (DGL) and the VanEck Merk Gold Trust (OUNZ) rose 2.2% over the five trading days leading up to December 27, 2017.