Newmont Mining Corp

Latest Newmont Mining Corp News and Updates

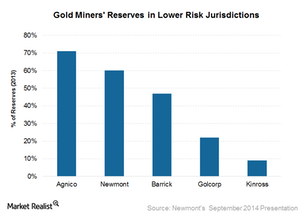

Gold Miners Are Cutting Down on Risky Geographical Exposure

While gold miners (GDX) are trying hard to limit their exposure to safe jurisdictions, it’s important to look at their geographic exposure and the implications it could have on their future prospects.

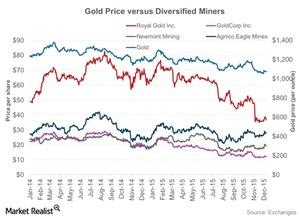

How Gold Prices Impact Diversified Miners

The term “diversified miners” refers to mining companies that are not into streamlined gold or silver mining, but also mine base metals.

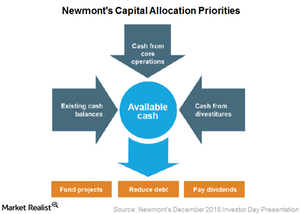

How Will Newmont’s Capital Allocation Priorities Look Like?

Newmont Mining outlined its capital allocation priorities. Management mentioned that they aim to fund their projects through cash generated from core operations.

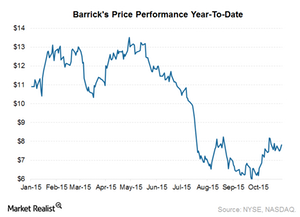

Must-Read Notes on Barrick Gold’s 3Q15 Earnings and Conference

Barrick Gold (ABX) reported its 3Q15 results on October 28 after market hours and held its conference call the next day. Its results beat market expectations.

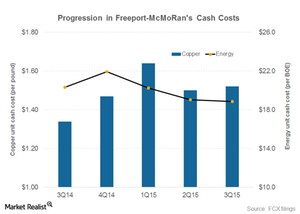

Is Freeport-McMoRan Doing Enough to Contain Its Costs?

In this part of ours series, we’ll explore the trend in Freeport-McMoRan’s unit production costs.

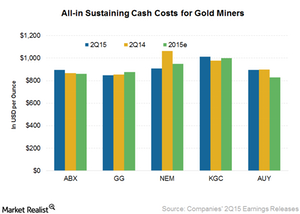

Comp: How Are Gold Miners Progressing on the Cost-Cutting Front?

For 2Q15, Newmont has been the most successful YoY in cost cutting. It had a reduction of 14.50%—mainly due to a rise in productivity and efficiency improvements.

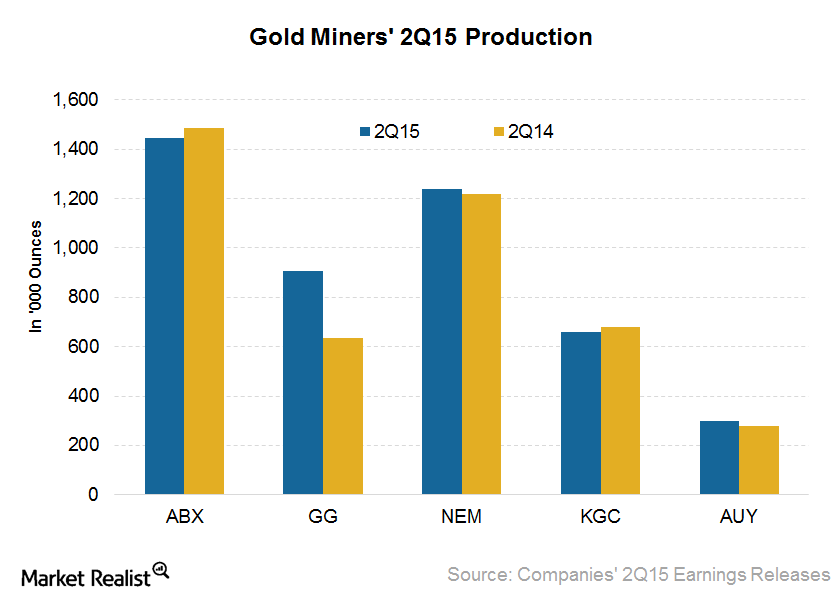

Comp: A Look at Gold Miners’ 2Q15 Production Profile

Gold miners’ (GDX) production profile is very important for investors. According to the WGC, gold mine production rose by 3% YoY to 786.6 tons in 2Q15.

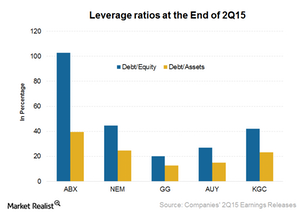

Comp: Analyzing the Financial Leverage for Gold Miners

Barrick Gold’s (ABX) financial leverage is among the highest in the industry. Barrick has a high debt-to-assets ratio of 40%.

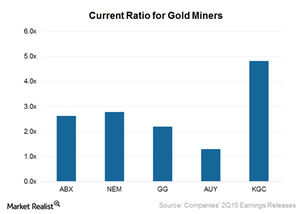

Comp: Importance of Looking at Gold Miners’ Liquidity Profile

In a weaker commodity price environment, a company’s short-term liquidity might come under more pressure. It could be forced to take drastic measures.

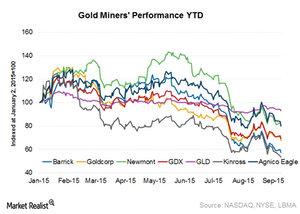

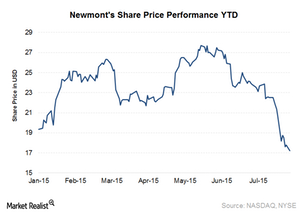

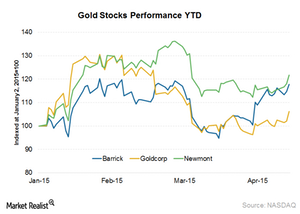

Comparative Analysis: How Have Gold Miners Performed This Year?

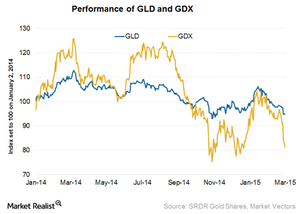

Gold prices, as tracked by the SPDR Gold Trust (GLD), have significantly outperformed the VanEck Vectors Gold Miners Index (GDX) since 2008.

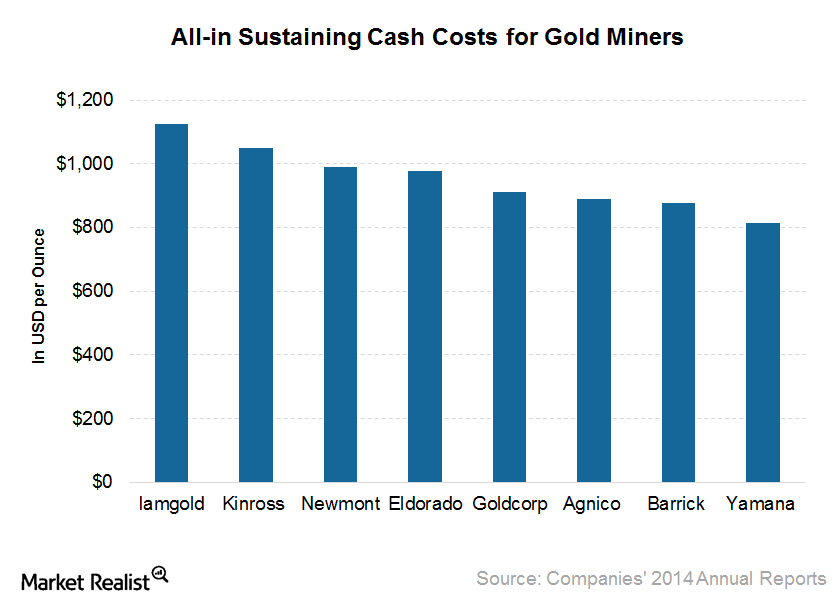

At What Cost Are Gold Miners Digging Out Gold This Year?

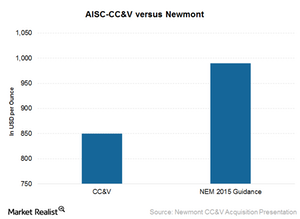

The average AISC for eight significant gold miners for 2015, as guided, is $950 per ounce compared to $900 per ounce for 1Q15.

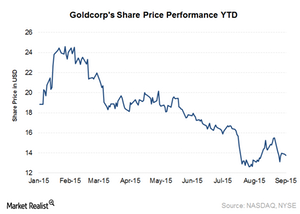

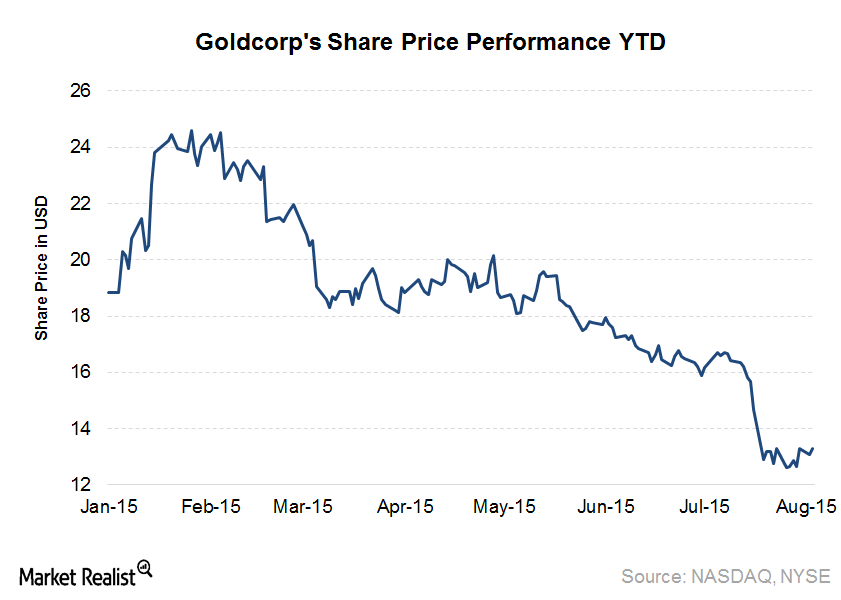

Is the Market Excited about Goldcorp’s Recent Moves?

Goldcorp (GG) announced on August 27 that it has bought the remaining 30% stake of El Morro from New Gold (NGD).

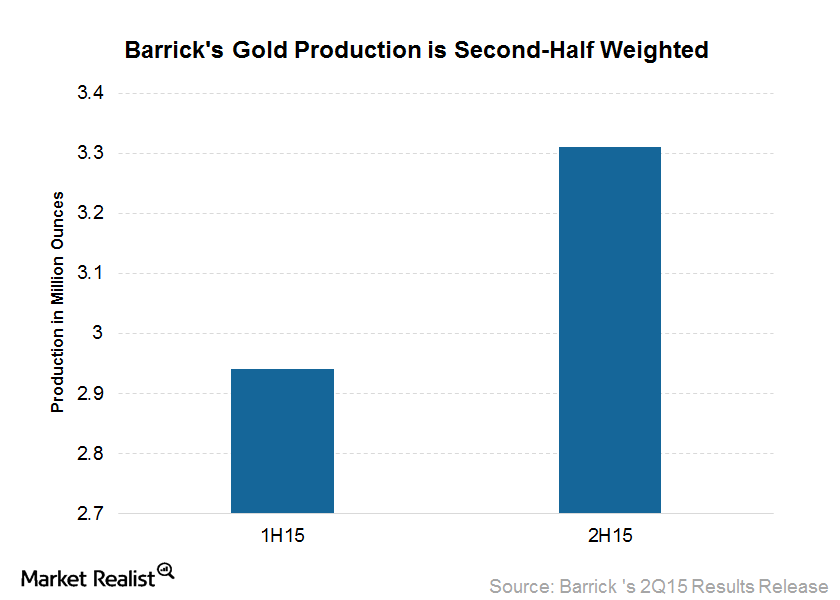

Barrick Gold Weights 2015 Production toward the 2nd Half

Barrick has reduced its 2015 gold production guidance to 6.1 million to 6.4 million ounces from 6.2 million to 6.6 million ounces.

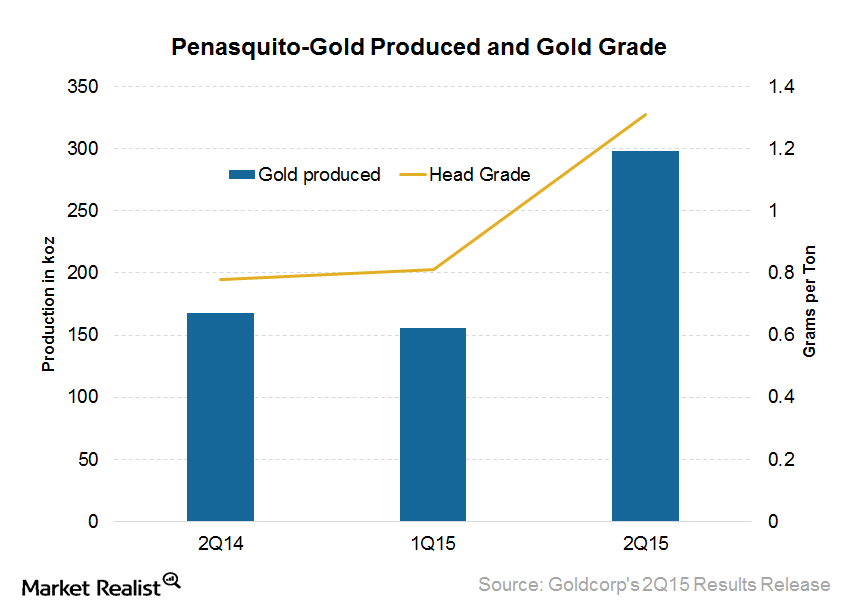

Peñasquito Helps Achieve Record Quarterly Production for Goldcorp

The Peñasquito mine contains gold, silver, lead, and zinc. It achieved its first commercial production in 2010, on schedule and on budget.

How Goldcorp Beat Estimates in Its 2Q15 Earnings

Goldcorp announced its 2Q15 results on July 30. The company’s gold production showed very strong growth at 25.3% quarter-over-quarter.

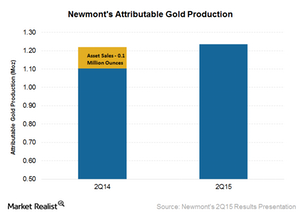

Newmont Reports Strong Gold Production in 2Q15

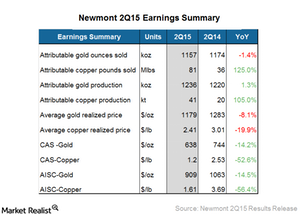

Newmont Mining’s (NEM) attributable gold production for 2Q15 was 1.24 million ounces. This is higher by 0.2 million ounces compared to the same quarter last year.

Newmont Mining Reports Solid 2Q15 Results

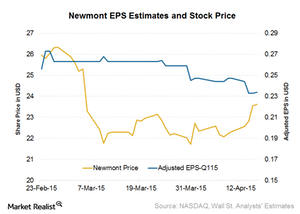

Newmont Mining (NEM) announced its 2Q15 results on July 22. It reported adjusted EPS of $0.26 and adjusted EBITDA of $692 million.

Key Highlights of Newmont’s 2Q15 Earnings

In its 2Q15 earnings release, Newmont Mining (NEM) reported net income attributable to shareholders of $131 million, or $0.26 per share. This compares to $101 million, or $0.20 per share, in 2Q14.

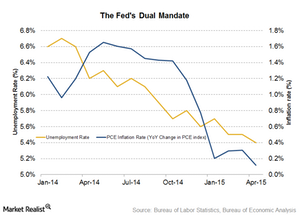

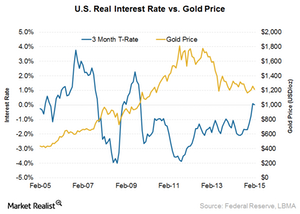

Rate Hike Expectations: How They Shape the Price of Gold

An interest rate hike by the Fed will lead to pressure on the price of gold. When alternative investments are attractive due to an increase in the interest rate, money flows from gold.

Newmont Mining’s Acquisition Makes Strategic Sense

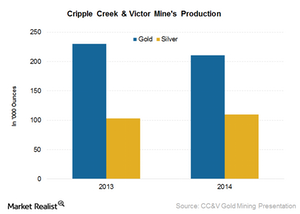

The CC&V mine acquisition will help Newmont achieve a lower-cost profile. The mine’s cost attributable to sales and all-in sustaining costs are lower than Newmont’s current averages.

Newmont Mining Acquires Cripple Creek from AngloGold

The Cripple Creek & Victor mine is located near Colorado Springs, Colorado. It’s and open-pit mine that has been operational since 1995.

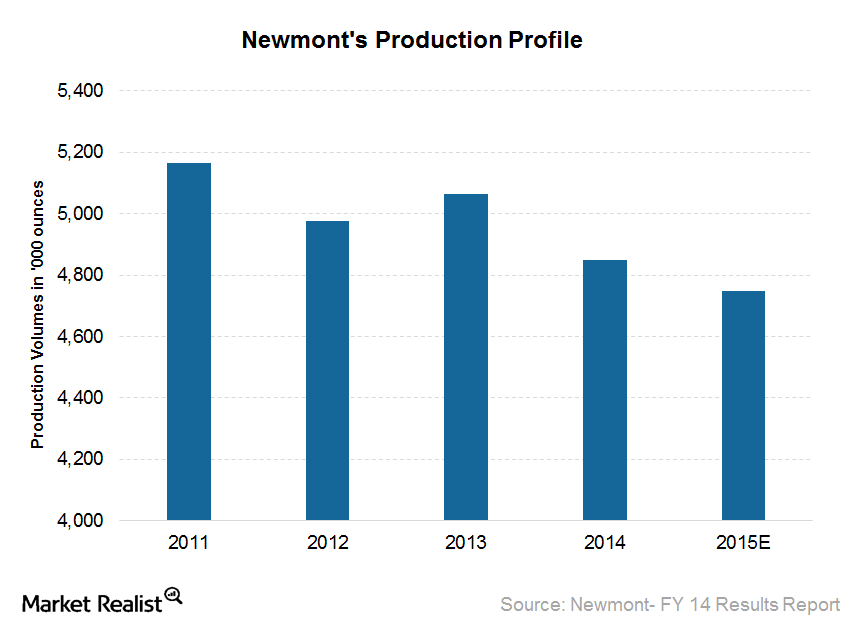

Newmont Mining Asset Optimization Efforts Encourage Analysts

Newmont Mining is the world’s second-largest gold producer. In this series, we’ll analyze various steps taken by Newmont toward asset optimization.

What Were Newmont’s Key Events Since Its Last Earnings Release?

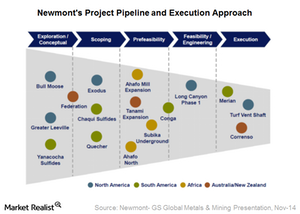

Investors should be aware of two key events for Newmont Mining (NEM): the go ahead for Long Canyon Phase 1 and the renewal of the contract at Batu Hijau.

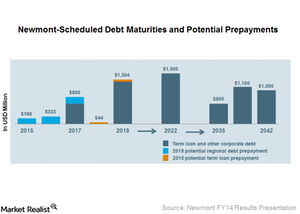

Key Updates Investors Should Look for in Newmont’s 1Q15 Results

Newmont stated during its 4Q14 earnings call that it is analyzing potential opportunities to pay its liabilities in advance.

What Are Market Expectations for Newmont in 1Q15?

Analysts’ sales estimate for Newmont is $1.93 billion for 1Q15 compared to $1.80 billion in 4Q14.

What Do Declining US Real Interest Rates Mean for Gold?

Gold is used as an investment alternative because investors perceive it as a way to protect money’s purchasing power.

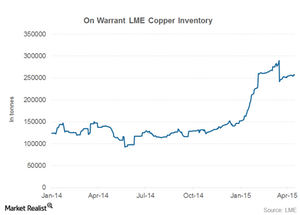

London Metal Exchange Copper Inventory Sees On-Warrant Stock Dip

A declining on-warrant copper inventory means that more metal is being booked for delivery. This is generally associated with stronger demand.

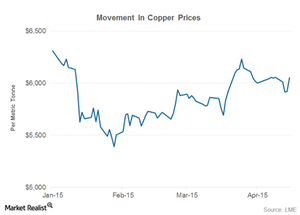

Supply Disruptions in 2015 Support Copper Prices

Copper prices have traded largely sideways in April. Copper prices fell sharply in January but have recovered smartly since then. Year-to-date, copper prices are down ~4%.

Newmont Will Release 1Q15 Results on April 24

Newmont Mining is the world’s second largest gold producer. It’s the only gold company included in the S&P 500 Index and Fortune 500.

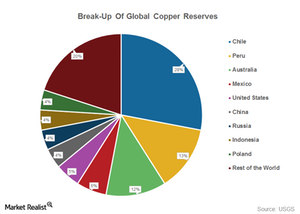

An Investor’s Guide to the Copper Supply Chain

Copper is also known as “Dr. Copper,” as analysts see the metal’s prices as a reflection of the global economy’s health.

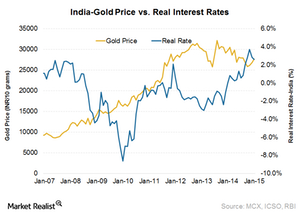

India’s rising real interest rate is negative for gold

India’s real interest rate has moved up rapidly in the last few months due to declining inflation.

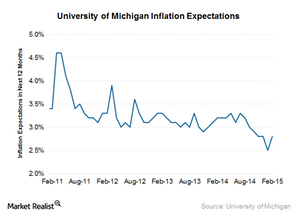

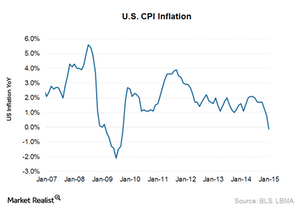

What do US inflation expectations mean?

In 2014, inflation expectations were 2.8% to 3.3%. In January 2015, expectations dropped to 2.5%, the lowest since September 2010.

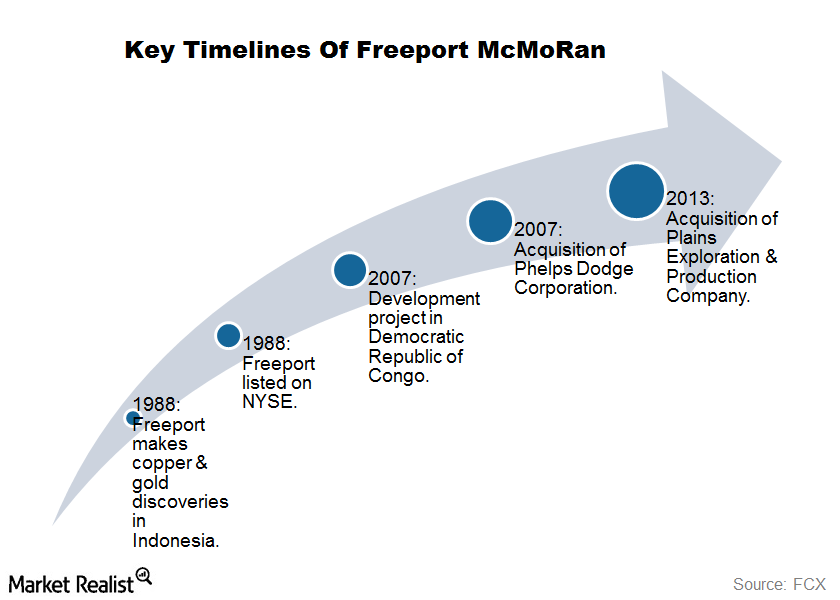

Why is Freeport’s key historical timeline important?

Freeport’s key historical timeline starts more than a century ago when Freeport Sulphur established the city of Freeport, Texas, near its sulphur mine.

US inflation rate hits negative for the first time since 2009

The US Consumer Price Index reading for the month of January was -0.1%. This is the first negative US inflation reading since October 2009.

Why tracking gold indicators is important for investors

In this series, we’ll look at some gold indicators investors can track to get a sense of what direction the price of gold will take.

How is Newmont’s project pipeline looking?

Newmont Mining has a strong project pipeline of 16 projects across different stages of development throughout the world.

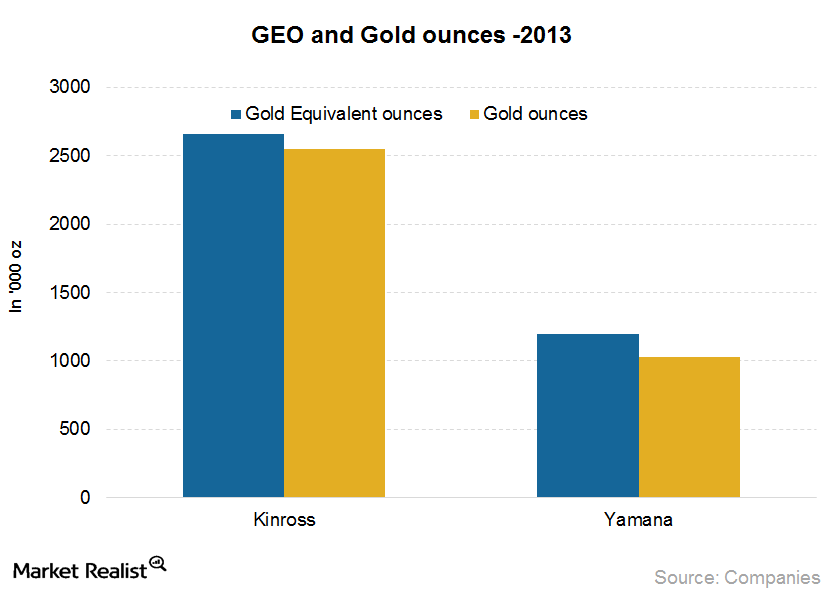

Must-read: Understanding gold companies’ gold equivalent ounces

It’s important to understand GEO or gold equivalent ounces because gold companies like Goldcorp (GG), Barrick Gold (ABX), Newmont Mining (NEM), and Kinross (KGC), measure their production and reserves in different ways. You need to make sure you’re comparing apples to apples.

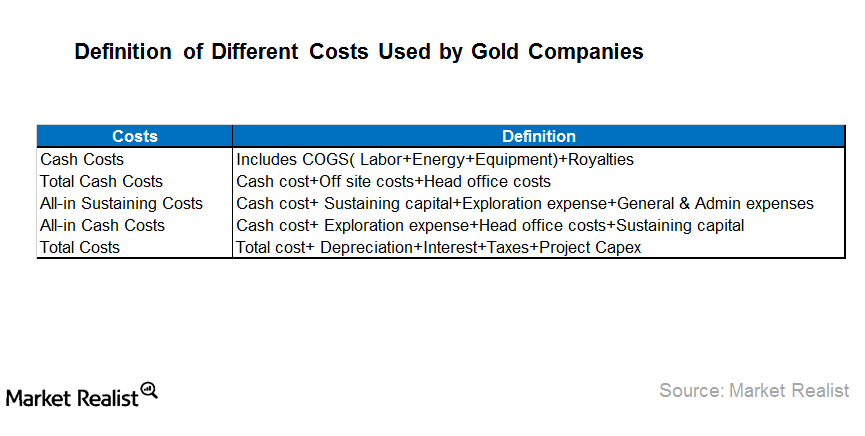

Must-know: Deciphering gold companies’ cost reporting

Gold mining companies like Goldcorp Inc. (GG), Barrick Gold Corp. (ABX), and Newmont Mining Inc. (NEM) report cash costs, total cash costs, total costs, and all-in cash costs. It can be very confusing for investors to understand exactly what’s what here.Materials Gold companies’ cash costs and all-in sustaining cash costs

In the gold industry, substantial discrepancies exist between the actual costs incurred and the costs reported by the companies. In this part, we’ll discuss different methodologies and how effective they are at representing a company’s true costs.Materials Must-know: Is gold an effective hedge against inflation?

An inflation hedge is basically an investment that’s expected to increase its value over a specific period of time. Gold might not have a linear relationship with inflation. However, it’s probably better than most of the investment alternatives available. It protects the portfolio against inflation.

Why is gold considered so special as an investment?

Gold is an unusual metal. It exists in the Earth’s crust as an element. It’s not chemically combined with other metals. Silver and copper are the only other metals naturally found in their elemental form.Materials Must-know: A guide to investing in gold

Investing in gold is complex. It’s challenging because it’s hard to predict gold prices in the future. However, there are many indicators that investors can track. The indicators help to determine the direction that gold prices will take.