At What Cost Are Gold Miners Digging Out Gold This Year?

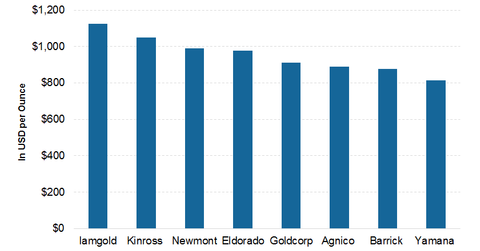

The average AISC for eight significant gold miners for 2015, as guided, is $950 per ounce compared to $900 per ounce for 1Q15.

Sept. 17 2015, Updated 1:53 a.m. ET

All-in sustaining costs

All-in sustaining costs (or AISC) include cash costs, sustaining capex (capital expenditures), exploration expenses, and general and administrative expenses. It’s quite an encompassing measure that can be compared across miners.

However, investors need to understand that even AISC doesn’t give a full picture of all the costs gold producers incur to produce an ounce of gold, since AISC excludes financing costs and taxes. To know more about AISC, you can read Market Realist’s Everything you need to know about gold and gold companies.

AISC for gold miners

AISC for various miners depends on the grades, efficiency, and geographical breakdown of assets. The average AISC for eight significant gold miners for 2015, as guided, is $950 per ounce compared to $900 per ounce for 1Q15. This cost excludes interest charges, impairment, and taxes. So including these charges, the margins for miners are very thin.

As the above graph shows, Iamgold Corporation’s (IAG) AISC guidance for 2015 is the highest at $1,125 per ounce. Next is Kinross Gold (KGC) at $1,050 per ounce. In comparison, Newmont Mining’s (NEM) AISC guidance is $990 per ounce, Barrick Gold’s (ABX) is $877, and Goldcorp’s (GG) is $912.

According to a 2015 survey by Gold Fields Mineral Services Ltd. (or GFMS), gold miners’ average all-in costs, including interest and extraordinary costs, were close to $1,208 per ounce in 2014. This excluded the impact of impairments. The average gold price was $1,260 per ounce.

Because of such narrow margins and debt issues, Allied Nevada had to file for Chapter 11 bankruptcy in March 2015.

Cost cutting

Gold miners have been consistently reducing their AISC since 2013 when gold prices came under increasing pressure from the sell-off led by gold ETFs. They’ve been doing this by cutting operating costs, overhead costs, exploration expenses, and capex.

Companies such as Barrick and Newmont are also engaging in non-core asset sales to lower production costs and capex requirements. Keeping with this, Barrick recently sold off stakes in the Cowal and Porgera mines.

If you don’t want to pick up individual miners, the VanEck Vectors Gold Miners ETF (GDX) provides an alternative. The fund invests in senior and intermediate miners. Iamgold and Kinross form 1.0% and 3.3% of GDX’s holdings, respectively. To get exposure to gold prices, investors can invest in gold-backed ETFs such as the SPDR Gold Trust (GLD) and the iShares Gold Trust (IAU).

In the next part of this series, we’ll look at the cost reductions gold miners have made in the face of weaker gold prices that may or may not be sustainable.