Newmont Mining Corp

Latest Newmont Mining Corp News and Updates

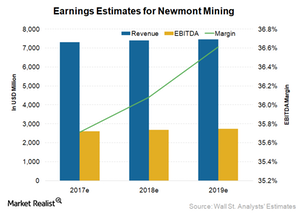

These Factors Are Driving Analysts’ Estimates for Newmont Mining

Newmont Mining’s mean consensus revenue for 2017 is $7.3 billion. This implies year-over-year (or YoY) growth of 8.1%.

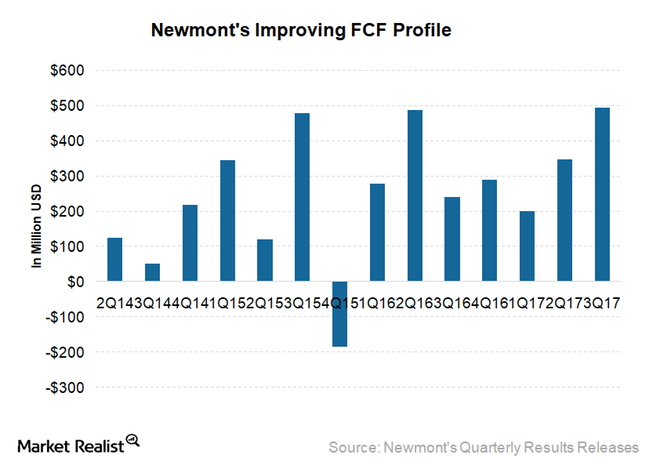

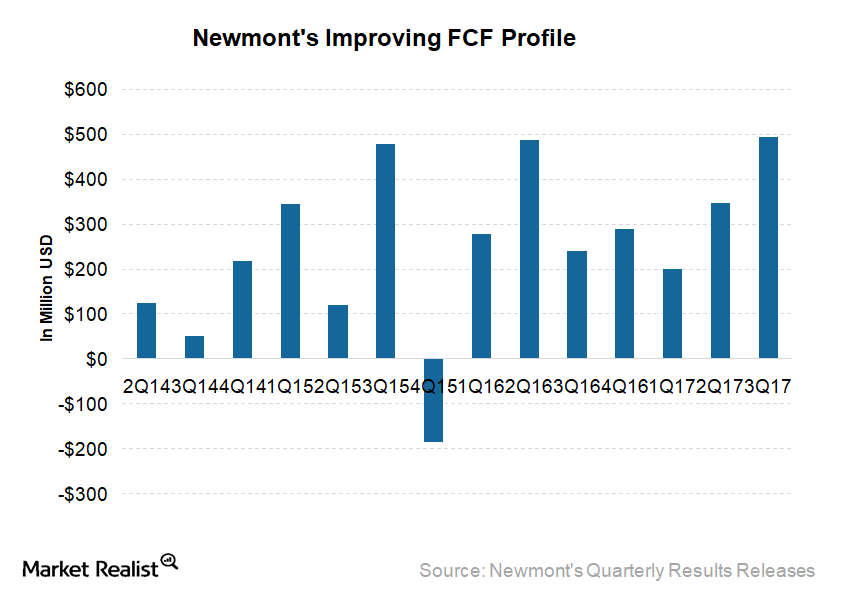

How Newmont Mining Plans to Generate Free Cash Flow in 2018

As NEM’s all-in sustaining costs (or AISC) have fallen 22.0% since 2012, its FCF has improved by $3.60 per share.

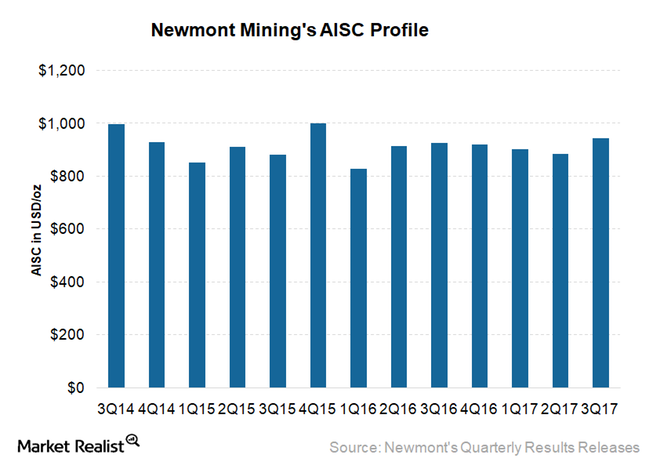

Investors Might See a Bump in Newmont’s Costs in 2018 before Improving

Newmont Mining (NEM) is expecting its newest mines to add production at just $750 per ounce.

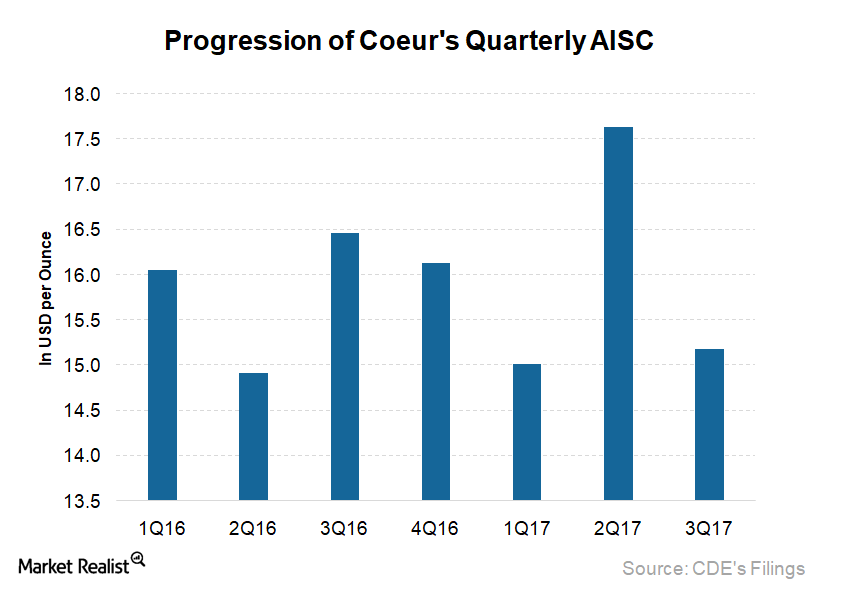

Coeur Mining: What Could Lead to Cost Improvement in 2018

Coeur Mining (CDE) reported AISC (all-in sustaining costs) of $15.18 per ounce for 3Q17.

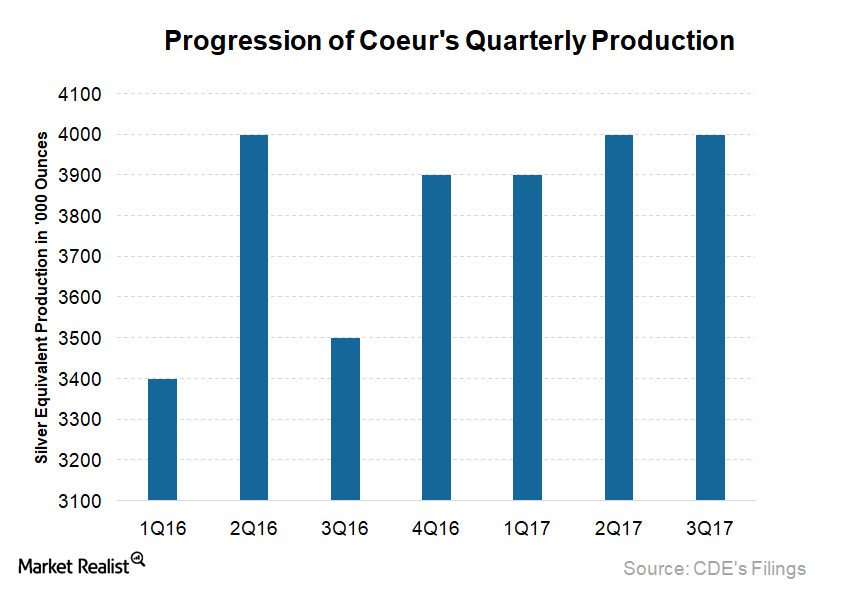

Why Coeur Mining Lowered Its Production Guidance

Coeur Mining (CDE) achieved silver equivalent ounces of 9.5 million for 3Q17. That is comprised of silver production of 4 million ounces and 93,293 ounces of gold.

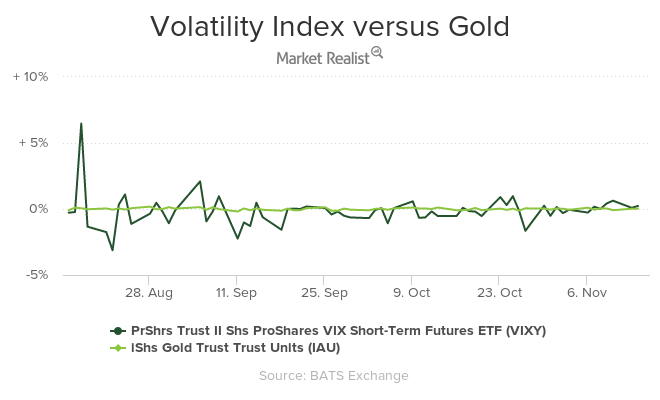

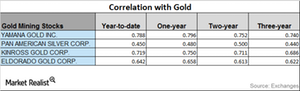

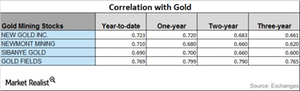

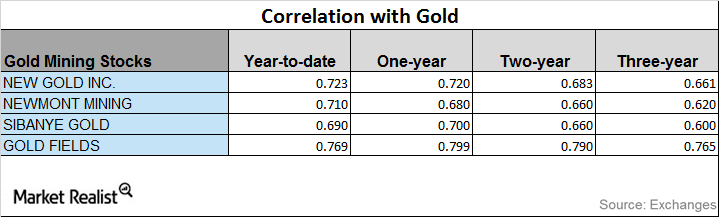

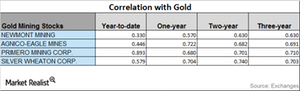

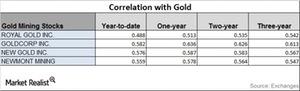

Directional Changes in the Correlation of Miners to Gold

New Gold and Goldcorp have seen upward trends in their correlations with gold, while Newmont Mining has seen its correlation decline.

Analyzing Gold’s Market Performance

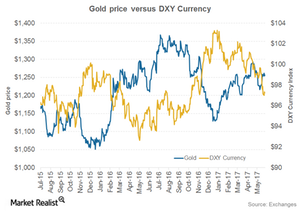

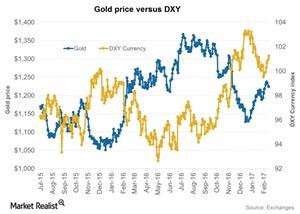

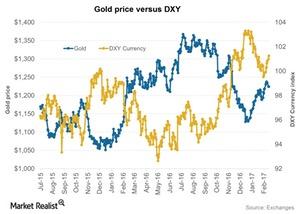

Besides the impact of interest rates, there are also other global indicators that could play on precious metals—the most important being the US dollar.

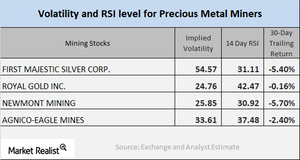

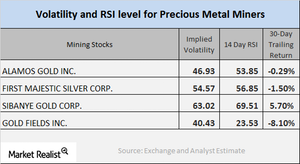

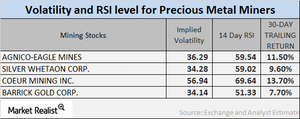

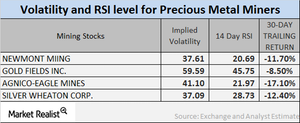

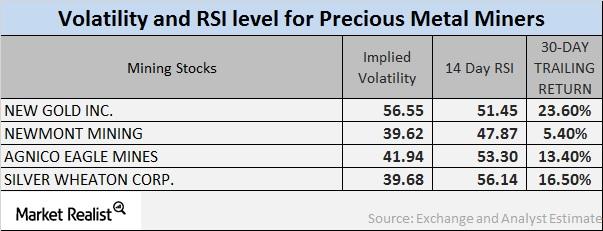

Behind the Technical Details of Key Mining Stocks Today

The Sprott Gold Miners (SGDM) and Global X Silver Miners (SIL) have fallen 0.21% and 1.9%, respectively, on a 30-day-trailing basis.

Analyzing Miners’ Trends in October

Mining stocks’ correlation with precious metals Most of the time, mining stocks’ performance follows that of precious metals. However, they can deviate. Correlational analysis can give investors some insight into how mining stocks relate to gold and silver. In this part of our series, we’ll compare Royal Gold (RGLD), Goldcorp (GG), New Gold (NGD), and Newmont Mining (NEM). Mining […]

These Factors Could Drive Newmont’s Free Cash Flow

Generating FCF (free cash flow) is very important for miners (GDX)(RING) as it helps them optimize their financial leverages, invest in projects supporting long-term value, and provide shareholder returns.

A Technical Analysis of Mining Shares as of October 27

On October 26, 2017, Royal Gold, Newmont, Sibanye, and Yamana had call implied volatilities of 24.8%, 25.9%, 63%, and 48.4%, respectively.

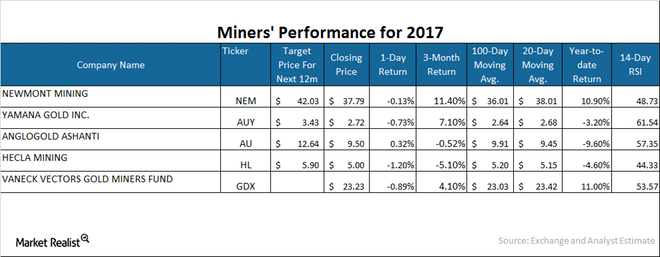

How Gold Companies Have Performed in 2017

Gold stock indices also traded near their highs for the year, but then followed the gold price lower. During September the NYSE Arca Gold Miners Index (GDMNTR) retreated 6.5%.

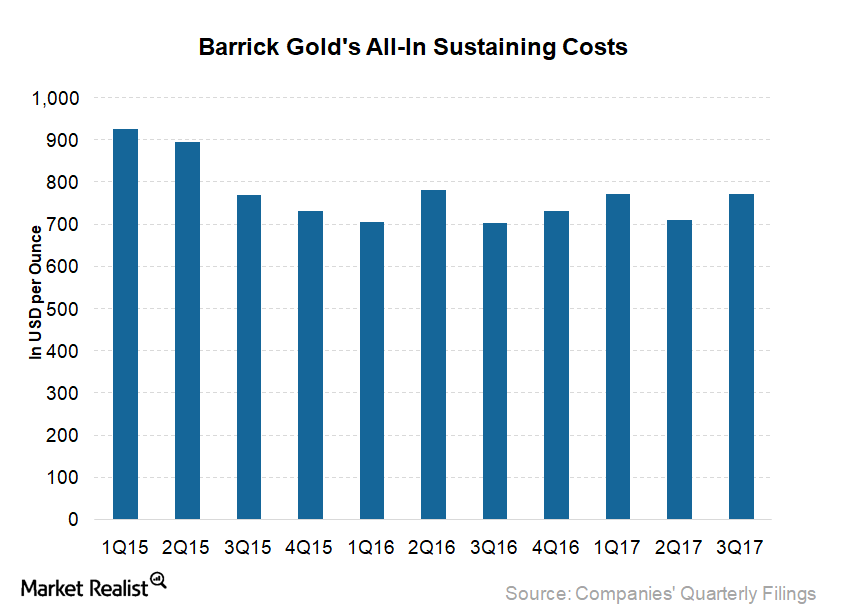

Is Barrick Gold behind in Achieving Its Unit Cost Target?

Barrick Gold (ABX) reported AISC (all-in sustaining costs) of $772 per ounce in 3Q17, which is 10% higher year-over-year and 9% higher sequentially.

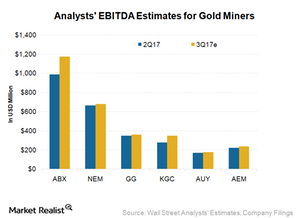

What Analysts Are Forecasting for Gold Miners’ 3Q17 Earnings

Analysts expect Barrick Gold’s (ABX) EBITDA to fall 17% YoY in 3Q17 to $988 million.

How Mining Stocks Are Reacting as of October 17

Despite the overall downturn among precious metals on Tuesday, October 17, precious metal mining stocks witnessed a mixed reaction that day.

Chart in Focus: Correlation of Mining Stocks with Gold

New Gold has a three-year correlation of 0.67 and a one-year correlation of 0.88 to gold.

Understanding Mining Company Technicals amid Today’s Turbulence

Many mining stocks saw a revival in prices on Monday, September 25, 2017, since precious metals saw an upswing.

Analyzing Miners’ Technicals in September 2017

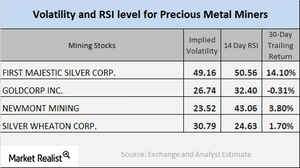

On September 22, 2017, First Majestic Silver, Goldcorp, Newmont Mining, and Silver Wheaton had volatilities of 49.1%, 26.7%, 23.5%, and 30.8%, respectively.

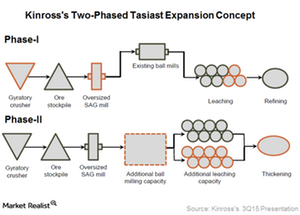

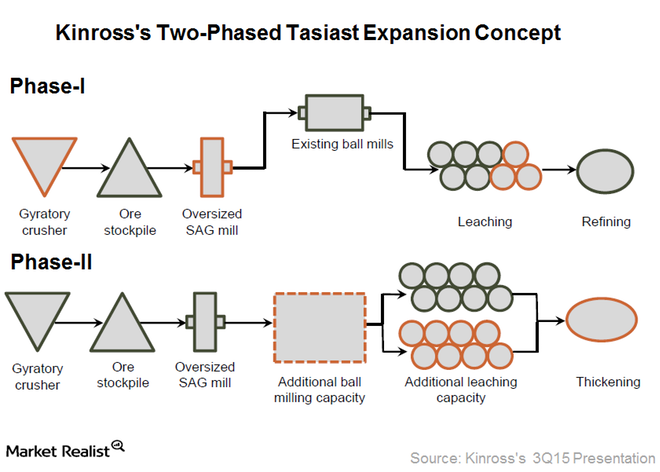

Why the Tasiast Expansion Is Key to Kinross Gold’s Potential

The Tasiast Phase One expansion is expected to increase mill throughput capacity from 8,000 tons per day to 12,000 tons per day.

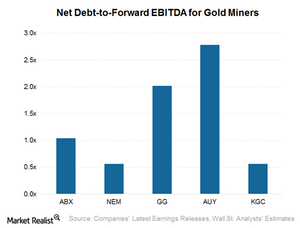

Assessing Gold Miners’ Capacity to Repay Debt through Earnings

Yamana Gold’s (AUY) net-debt-to-forward EBITDA ratio is 2.8x, which is higher than its peers’ ratios.

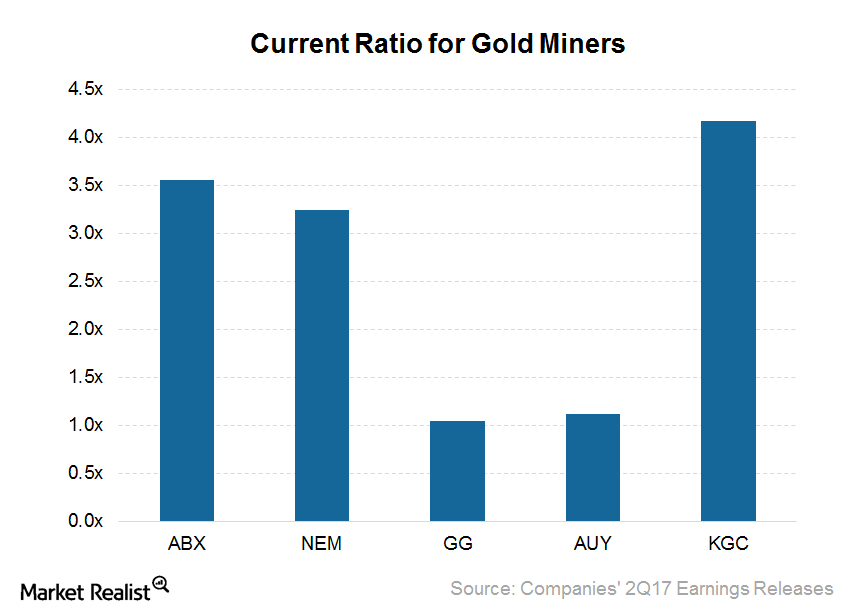

Is Liquidity a Concern for Gold Miners after 2Q17 Earnings?

Newmont Mining had $5.5 billion in liquidity, including $3.1 billion in cash at the end of 2Q17. It has one of the best credit ratings in the sector.

Barrick Gold’s and Other Miners’ Correlation with Gold

Metal stocks As we study the impact of global variables on precious metals and the mining sector, we should also analyze the relationship between mining stocks and gold. Correlational analysis can help us compare price movement in mining stocks and the metal. In this part of our series, we’ll examine New Gold’s (NGD), Newmont’s (NEM), Coeur […]

The Ups and Downs of the Dollar and Gold

On June 6, 2017, the US Dollar Index plunged to its lowest level in seven months, which helped dollar-denominated precious metals regain value.

How Are the Correlations of Mining Stocks Moving?

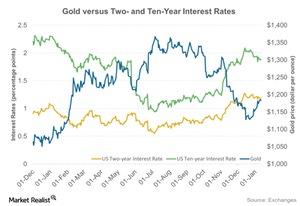

Fears surrounding a potential upcoming interest rate hike took over precious metals recently, and they fell at the beginning of May 2017.

How Silver-Based Funds Plunged Their Way through April 2017

Precious metals were doing considerably well until the first half of April 2017. As investors’ risk appetites revived, haven assets slumped. Among these metals, silver has plummeted the most.

Will the Dollar Get Burned by Another Rate Hike?

While the US dollar has seen a decline in 2017, the increased possibility of a Fed rate hike in June could give the currency some breathing room.

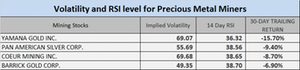

Reading the Mining Stocks’ Falling RSI Numbers

Newmont Mining, Silver Wheaton, Randgold, and Yamana have RSI levels of 45.5, 37.1, 41.2, and 43.0, respectively.

Correlation Trends of Miners to Gold

Among the leveraged mining funds, the Direxion Daily Gold Miners ETF (NUGT) and the Proshares Ultra Silver ETF (AGQ) have seen considerable losses over the past month.

Gauging the Role of the US Dollar in the April 19 Fall of Precious Metals

Another important phenomenon that played on the fall of precious metals on Wednesday, April 19, was the upswing of the US dollar.

Are Miners Rebounding from Last Week’s Slump?

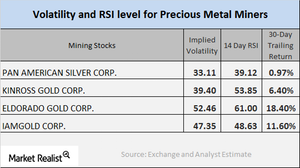

Monitoring the implied volatilities of large mining stocks is important. We should also watch their RSI (relative strength index) levels, particularly in the wake of changing precious metals prices.

What Scenarios Decide How Precious Metals Move?

The directional move of the interest rate is a crucial determinant of the direction precious metals will take.

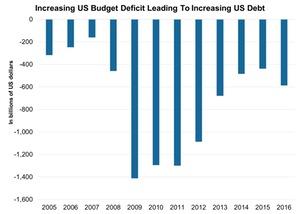

How Big Is the US Debt Compared to Other Nations?

Japan leads the nations with its rising debt-to-GDP ratio. The United States is in seventh place.

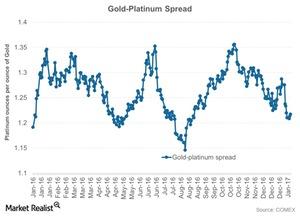

A Look at the Gold-Platinum Ratio

The demand for platinum has been very fragile over the past few years due to concerns about sales of diesel-based vehicles.

Mining Stocks and Gold Prices: Reading the Correlation

It’s important to understand which mining stocks have overperformed and underperformed precious metals.

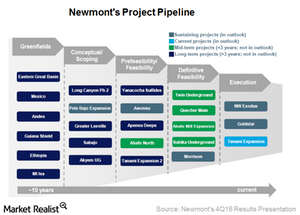

Newmont Mining: How’s the Project Pipeline Looking?

Newmont Mining (NEM) approved funding for its Northwest Exodus project in June 2016, and the project is now under construction.

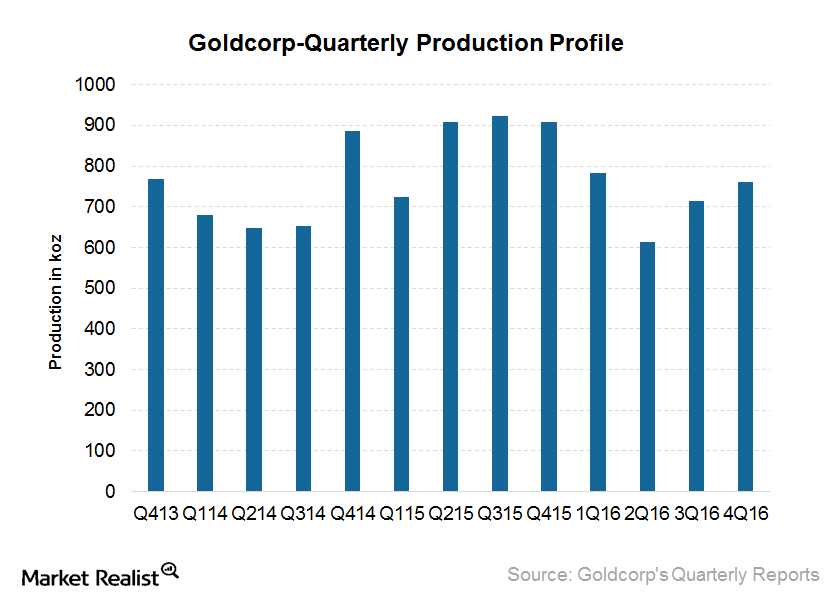

What Are the Drivers of Goldcorp’s Production Growth?

Goldcorp’s gold production fell 16% year-over-year in 4Q16 to 761,000 ounces. The company’s management had guided for 2.8 million–3.1 million ounces of gold production in 2016.

How Are Mining Stocks Reacting in 2017?

The rate hike phenomenon in December 2016 played negatively for precious metals.

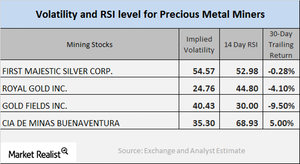

Reading the Volatility and RSI Levels for Miners

Precious metal mining stocks are known to closely track the performance of their respective precious metals. Mining stocks often show more volatility than metals.

How Mining Stocks Reacted to Plummeting Metals

Mining companies that have high correlations to gold include Royal Gold (RGLD), Goldcorp (GG), New Gold (NGD), and Newmont Mining (NEM).

How Are Miners and Gold Correlated?

The substantial returns of most mining companies have been due to safe-haven bids that boosted gold and other precious metals.

Reading the RSI Levels and Volatilities of Mining Companies

Many of the fluctuations in precious metals have been determined by the Federal Reserve’s interest rate stance. These variations play on precious metals funds.

What Tasiast Mine Being Back in Full Swing Means for Kinross Gold

Kinross Gold (KGC) announced in June 2016 that it was temporarily halting its mining and processing activities at the Tasiast mine in Mauritania.

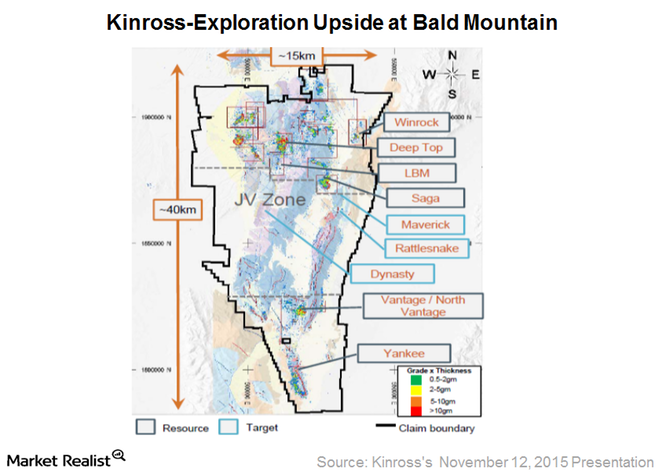

How Bald Mountain Is a Positive for Kinross Gold

Kinross Gold (KGC) acquired 100% of the Bald Mountain gold mine and the remaining 50% of the Round Mountain gold mine in Nevada from Barrick Gold (ABX) in November 2015.

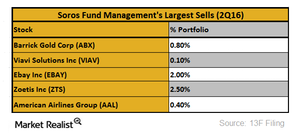

Why Did Soros Fund Management Reduce Its Holdings in Barrick Gold?

Billionaire investor George Soros, who said in April 2016 that gold was the only asset that could outperform in the current market environment, is now getting out of gold.

What Do Analysts Think about Coeur Mining?

Of the ten analysts covering Coeur Mining, 50% have given the stock a “buy” recommendation. The average target price is $14.20 compared to its current price of $15.90.

How Much Can Brexit Affect the Precious Metals?

Brexit could send jitters around the globe, and investors may jump to safe-haven assets such as gold and silver, which have risen 21.2% and 25.6%, respectively, on a YTD (year-to-date) basis.

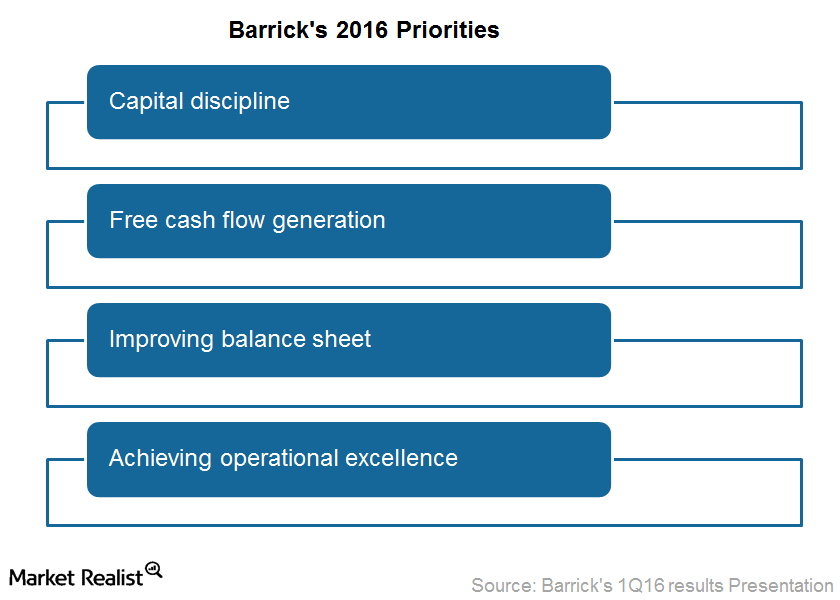

What Will Barrick Gold’s Focus on Its 4 Priorities Achieve?

Barrick Gold (ABX) wants to achieve positive free cash flow even at a gold price of $1,000 per ounce.

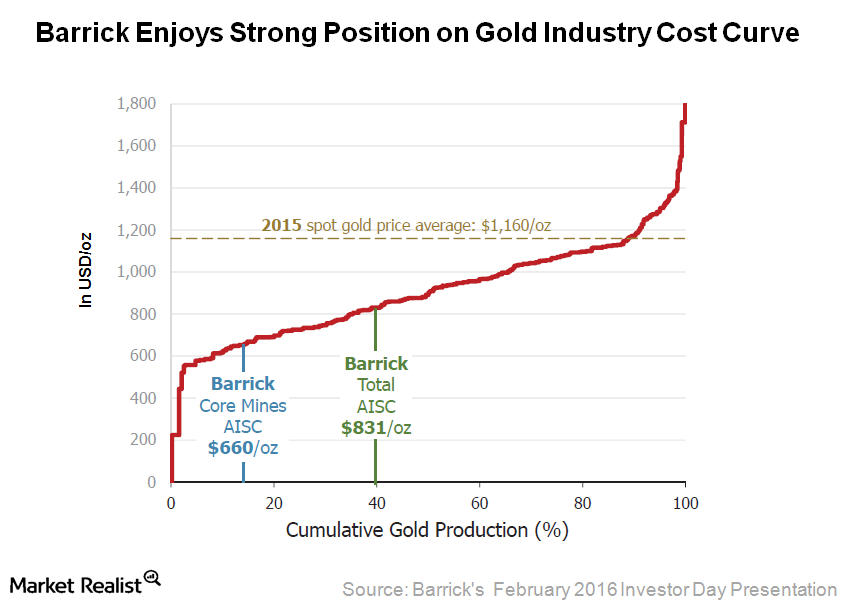

Barrick’s Focus on Costs Places It Favorably on Gold’s Cost Curve

Barrick Gold achieved all-in sustaining costs of $831 per ounce for 2015. This AISC was below the 40th percentile of the global industry cost curve.

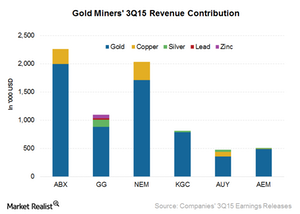

Why You Should Look Out for Gold Miners’ Commodity Exposure

It’s important to understand not only miners’ geography but also their revenue composition in terms of commodity exposure.

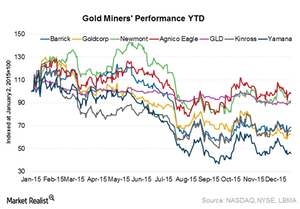

Why Have Newmont and Agnico Outperformed?

In this series, we’ll look at various factors that are affecting gold miners like Barrick Gold, Newmont Mining, Goldcorp, Yamana Gold, Agnico Eagle Mines, and Kinross Gold.