How Big Is the US Debt Compared to Other Nations?

Japan leads the nations with its rising debt-to-GDP ratio. The United States is in seventh place.

March 7 2017, Published 3:05 p.m. ET

US debt compared to its GDP

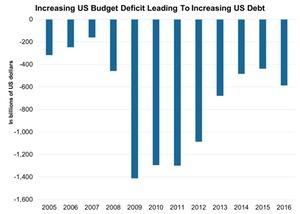

The US debt rose to $19.5 trillion in 2016, a rise of $1.4 trillion compared to 2015. The total debt, which includes intragovernmental debt, rose from $5.1 trillion to $5.5 trillion, and debt held by the public rose about $1.0 trillion to $14.2 trillion.

Let’s look now at the debt levels for other nations compared to their GDPs. The debt-to-GDP ratio compares a country’s debt to its total economic output, measured in terms of gross domestic product.

US debt compared to other nations

The federal debt-to-GDP ratio is dependent on the nation’s fiscal policies and overall economic condition. The United States had a debt-to-GDP ratio of 106.0% as of 2015. As you can see in the above graph, Japan leads the nations with its rising debt-to-GDP ratio. The United States is in seventh place, according to data provided by the OECD (Organisation for Economic Co-operation and Development) as of 2015.

Japan’s estimated gross debt is about twice its GDP held by households and the central bank. If you compare Japan’s debt to the US debt, Japan’s debt is mostly held by its citizens, about 90.0%. However, the US debt is a mixed bag of external creditors and its people. Greece, unlike Japan and the United States, is currently in a vulnerable position since it can print its currency to finance its debt to avoid defaulting on its loans.

Impact of rising deficit

Government debt increases as the demand for credit increases to fund the increasing level of deficits. The cost of borrowing tends to rise in the spiral of rising debt. Higher interest rates make investments in equipment, stock, and other capital goods in the private sector expensive. Big private sector companies tend to be under pressure due to the rising interest rate environment.

The rise in debt is also expected to impact the US dollar. The downside in the US dollar is expected to positively impact gold ETFs such as the VanEck Vectors Gold Miners ETF (GDX) and the SPDR Gold Shares (GLD). Some of the companies to watch in these ETFs include Goldcorp (GG), Newmont Mining (NEM), Barrick Gold (ABX), and Yamana Gold (AUY).

For more information on the US debt, you can read Market Realist’s article How Could Trump Tackle US Debt and the Deficit?