India’s rising real interest rate is negative for gold

India’s real interest rate has moved up rapidly in the last few months due to declining inflation.

March 29 2015, Updated 2:04 a.m. ET

India’s rising real interest rate

Tracking China’s and India’s inflation figures can give you insight into the future direction of gold prices. The figures also suggest what could happen with gold-backed ETFs such as the SPDR Gold Trust (GLD).

With this insight, you can decide what to do with gold stocks such as Goldcorp (GG), Barrick Gold (ABX), Newmont Mining (NEM), Kinross Gold (KGC), and Yamana Gold (AUY). You can also decide how to invest in ETFs such as the VanEck Vectors Gold Miners ETF (GDX). GG, ABX, NEM, KGC, and AUY make up 10.2%, 8.5%, 7.4%, 3.1%, and 3.5% of GDX holdings, respectively.

Tracking real interest rates

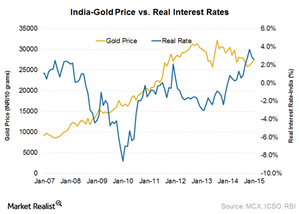

We’ll use the ten-year government bond yield as the nominal interest rate in India. We’ll use the year-over-year change in the consumer price index (or CPI) as India’s inflation.

CPI data are released monthly by India’s Central Statistical Organization. These data measure the average changes in the general price for a basket of consumer goods and services over time.

Low inflation

According to the latest data, India’s inflation in January was 5.1% year-over-year compared to 5.0% year-over-year in December. Growth in the CPI has averaged 8% since 2005. Consumer price inflation has been higher than benchmark interest rates and government bond yields for a long time. This caused negative real interest rates, which discouraged savers. But now, things are changing. Inflation fell rapidly in 2014 and is continuing on a steady path in 2015.

Rising real interest rate

In India, the yield on a ten-year government bond is currently 7.7%. Adjusted for 5.1% inflation, the real return comes in at 2.6%. India’s real interest rate has moved up rapidly in the last few months due to declining inflation.

Gold still popular among the rural population

Increasing real interest rates could motivate some urban gold investors to move to other investments. But the majority of India’s population is rural. They don’t have easy access to banks and other investment options. Gold is an easy and available investment option for them. To an extent, it maintains their purchasing power. This makes gold one of the most popular investments.