Assessing variables that drive the outlook for gold prices

Physical buying from China and India should support the demand for gold. But a rate hike by the Fed could be the catalyst that could take gold down.

Dec. 4 2020, Updated 10:53 a.m. ET

The strengthening US dollar

As we’ve already seen, the US dollar is strengthening on improved labor market conditions, strong factory activity, and other positive data such as improving consumer sentiment. The divergence in US central banks’ actions and global markets’ economic growth will also likely lead to a stronger US dollar.

The Federal Reserve is poised to hike rates in 2015. It plans to tighten monetary policy. In contrast, the ECB (European Central Bank), the BoJ (Bank of Japan), and the People’s Bank of China (or PBC) are all following expansionary policies to stimulate their slowing economies.

A strengthening US dollar is negative for gold.

US labor market and inflation decide Fed rate hike

US labor market conditions are improving. This is one of the key factors, along with inflation, that the Fed watches to decide on its first interest rate hike. Better-than-expected data on this front could lead to a sooner-than-expected rate hike by the Fed.

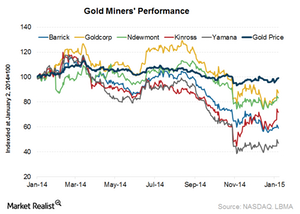

In that scenario, gold as a safe haven commodity is likely to be less preferred compared to other interest-yielding asset classes such as bonds and equities. On the other hand, inflation is staying below the Fed’s target of 2%. If it stays at these levels longer, the Fed could defer its rate hike. That would be positive for gold (GLD) and gold stocks including Barrick Gold Corporation (ABX), Goldcorp (GG), Newmont Mining Corporation (NEM), and Kinross Gold Corporation (KGC). It would also be positive for ETFs such as the Gold Miners ETF (GDX) that invest in these stocks.

Outlook includes pressure on gold prices

The demand for gold is expected to be supported somewhat by physical buying from China and India. But because of lower prices, the Fed’s rate hike is a very big catalyst that could take gold down.

In the short run, speculation over the Greek election results could support gold prices. Any major political and economic uncertainty is positive for safe-haven assets, including gold.